It is never a good idea to have money sitting around. Inflation frequently forces people to change their cash into a valued asset. At the very least, they should think about it. Some individuals invest, while others believe it is too hazardous.

Stocks are often a risky investment that requires extensive topic expertise. Many individuals purchase immovable assets such as real estate to generate passive income via rental. This is a fantastic concept. However, the career entails additional complications in managing these resources.

Crypto culture has not always encouraged early adopters to generate money from their current holdings. Decentralized Finance (Defi) protocols aimed to alter the cryptocurrency environment. It made passive income more profitable and accessible than ever before. These changes enticed many investors.

Let’s take a closer look at every crypto enthusiast’s strategies to generate passive income from their digital assets.

How Is Passive Crypto Income Generated?

There are several options to explore when it comes to earning a passive income from cryptocurrencies. Each offers distinct possibilities as well as problems that must be recognized. Some are more lucrative than others. At the end of the day, if done correctly, each approach may provide you with a sizable crypto return gained with little work.

Lending and yield farming are two of the most common methods to make passive income using cryptocurrency. Both entail donating part of your digital assets to a crypto project for a limited time. In exchange, you will be paid proportionate to the amount loaned.

Staking

Mining is the process of creating various assets (such as Bitcoin, Ethereum, and so on). Some currencies, on the other hand, are generated via a process known as staking.

Staking is a low-energy alternative to mining in its most basic form. It entails storing money in a good wallet and doing specific actions to obtain rewards. These activities might include transaction validation, network stability, and much more.

In contrast to mining, staking networks employ proof-of-stake (PoS) blockchain as its consensus method (PoW). Typically, staking is merely opening a wallet and storing the money. In certain situations, you may be able to contribute your coins to a staking pool. Staking is simple since it requires little effort. Most of the time, you have to deposit the money, and you’re good to go.

Cosmos (ATOM), Tezos (XTZ), and Cardano (ADA) are among the most popular cryptocurrencies that may currently be staked for passive income. All of them are also accessible on popular cryptocurrency exchanges.

How is staking designed?

In essence, validators get rewarded on staked cash in exchange for their contribution to the network’s validity. Proof-of-Stake is the name given to this validation process. It enables holders (those in it for the long haul) to receive passive income.

Several systems choose validators. They may be utilized in a variety of ways. Some blockchain networks require depositors to commit funds. A blockchain selects validators from a pool of users who have staked a specified quantity of their native digital assets.

Crypto staking is an excellent strategy to earn passive income and cryptocurrency rewards. It is also an ideal approach to promoting the underlying value and idea of blockchain technology. Staking is an excellent passive income tactic for long-term crypto enthusiasts. This might be highly beneficial even in 2022.

Staking on Margex

Margex is set to offer staking features on its platform that will enable users to earn fixed income from their investments. The new staking feature will offer up to 13.05% APY and the exclusive ability to use staked assets as collateral for margin trading.

Furthermore users will be able to stake assets like USDT,BTC,ETH,LINK and DAI without any lockup periods or limitations.

Benefits of staking on Margex

- Instant gratification — in the payment passive income, there is no waiting or holdout periods

- The industry’s highest fixed returns. USDT (13.05%), BTC (8.46%), ETH (9.54%), USDC (13.05%), DAI (13.05%), and LINK (8.1%)

- Ability to use staked assets as collateral

- Stake multiple assets

Affiliate Programs

Affiliate programs are not unique to the cryptocurrency industry, but they are a simple method to generate passive income from cryptocurrencies.

Crypto affiliate schemes are appealing in and of themselves, but there are specific challenges you may encounter along the way. In particular, you should grasp how to generate a steady stream of people to lead to your advertising site. Some affiliate program members have their websites, while others construct social media and crypto accounts.

Affiliate Programs: Types

There are three sorts of affiliate programs available on the Internet for passive income generation. They are as follows:

Partnership programs: This campaign enables you to earn a set or variable fee for each referral who completes a particular activity on the website. Before the firm can pay you your commission (passive income), the suggested user must usually register and pay for various services.

Cost-per-action programs, or CPA: The commission (passive income) is paid when a user does a particular activity on your advertising platform, as the name implies. CPA is often paid for deposits made by traders and investors on exchanges.

Promoting affiliate programs: You may also make extra money by just introducing new individuals to the world of cryptocurrency. You will supply exclusive resources to your target audience and earn commissions (passive income) when they purchase this instructive stuff.

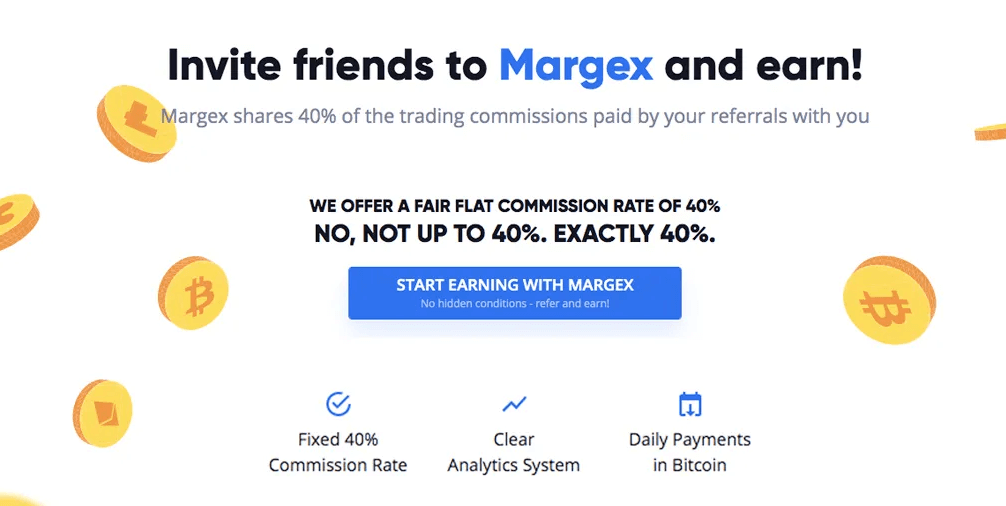

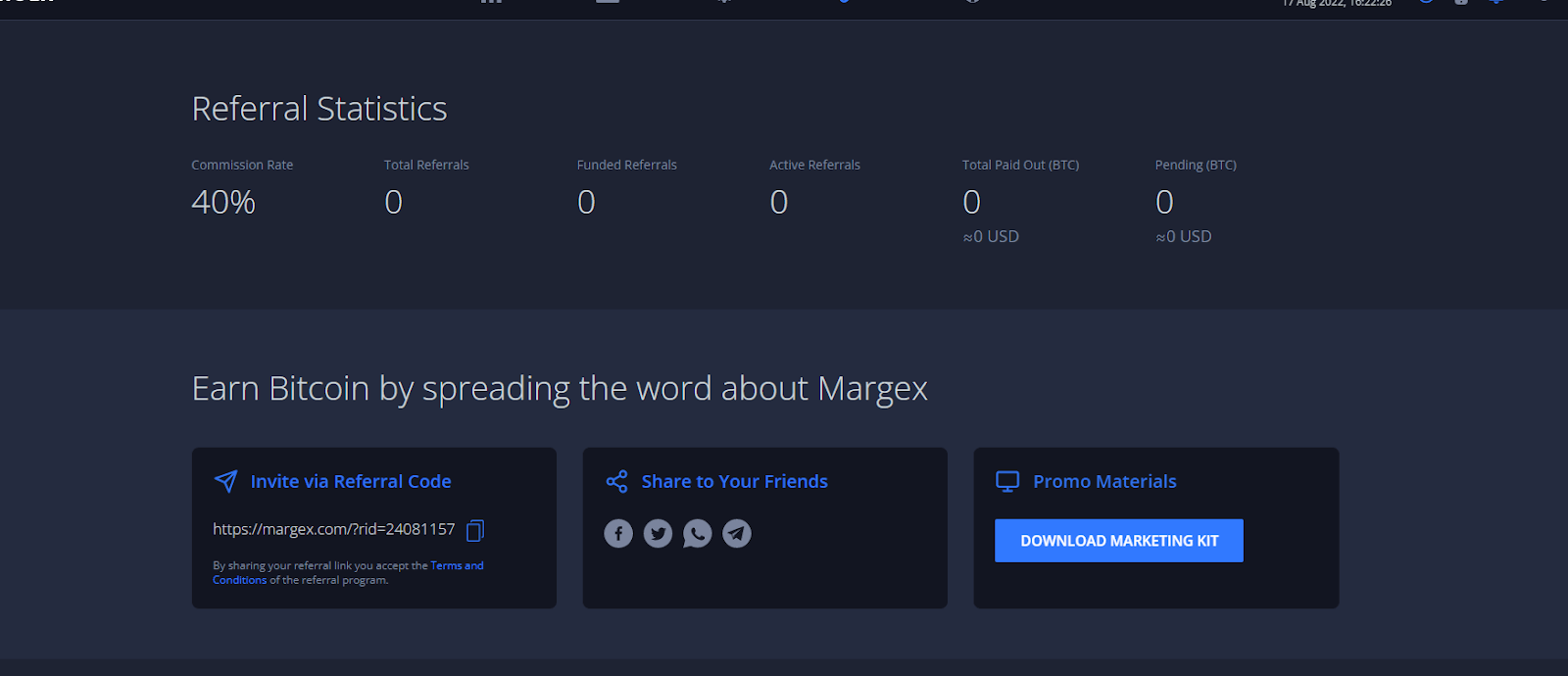

Margex provides one of the best crypto affiliate programs where users can earn Bitcoin by spreading the word about Margex. The affiliate program has a high commission rate of 40% and users get paid automatically.

Lending

Lending has grown in popularity in both the controlled and decentralized portions of the passive income generation and overall cryptocurrency business. You may earn money by lending your digital assets to borrowers as an investor. To earn passive income, you have four primary lending techniques to choose from:

Peer-to-peer lending: These platforms enable systems that allow users to create their conditions, select how much they want to lend, and how much interest they want to earn on loans. The platform connects lenders, and borrowers like P2P (peer-to-peer) trading platforms connect buyers and sellers. Regarding crypto lending, such lending platforms give customers a certain amount of control. However, it would help if you first put your digital asset into the lending platform’s custodial wallet and non-custodial wallet.

Centralized lending: In this technique of passive income generation, you depend entirely on third-party lending infrastructure. Interest-bearing rates and lock-up periods are set in this country. To begin earning interest money (passive income), you must first send your cryptocurrency to the lending platform, similar to P2P lending.

Decentralized lending, often called Defi lending: This enables users to conduct loan services directly on the blockchain. In contrast to the P2P and centralized lending models, Defi lending does not involve intermediaries. Instead, lenders and borrowers engage with programmable and self-executing contracts (also known as smart contracts), which determine interest rates autonomously and regularly.

Margin lending: Finally, you might lend your crypto assets to traders who want to trade with borrowed cash. These traders leverage their trading position by borrowing money and repaying it with interest. In this instance, cryptocurrency exchanges do most of the job on your behalf. It would help if you made your digital item accessible.

Buy And Hold On Margex

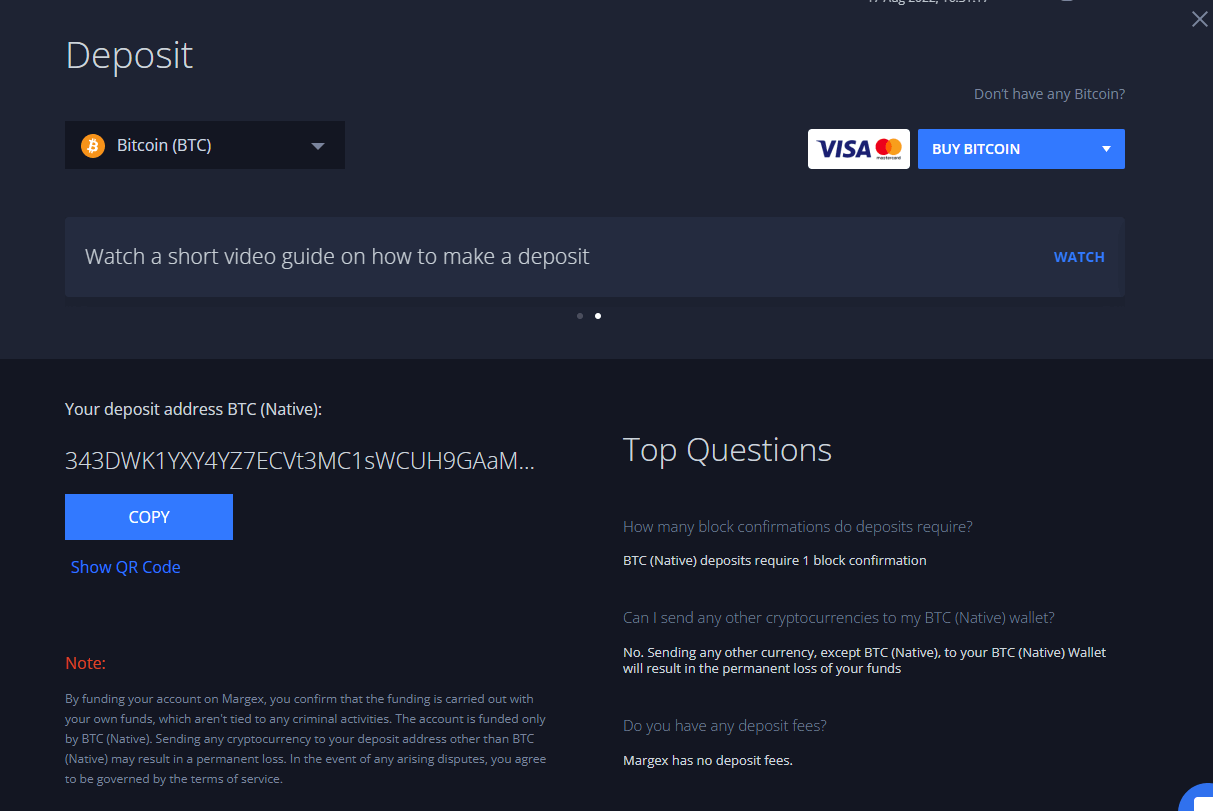

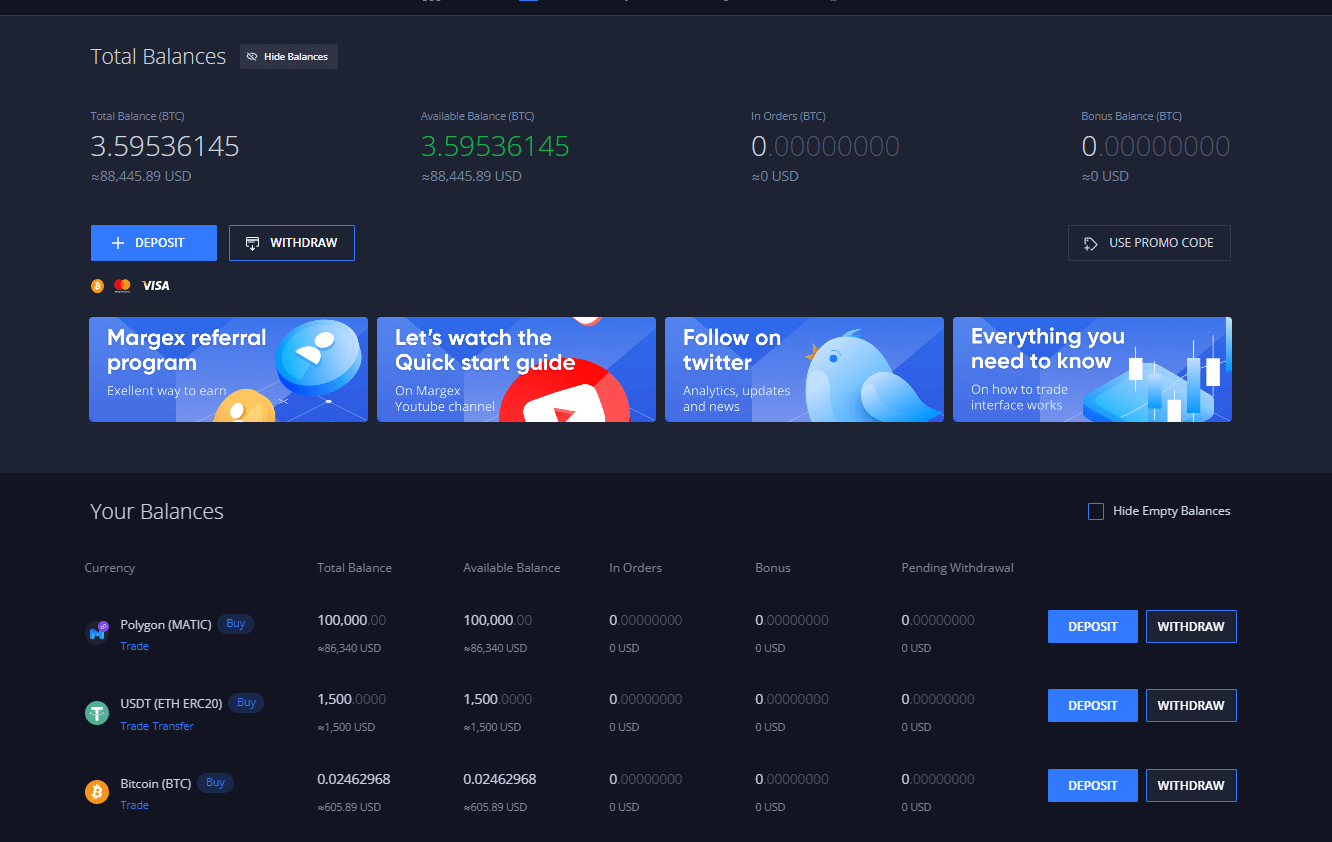

Margex offers a great platform for crypto investors to buy and hold their assets without difficulties. Users can easily register on the platform and deposit any of the supported tokens or buy Bitcoin using their debit cards.

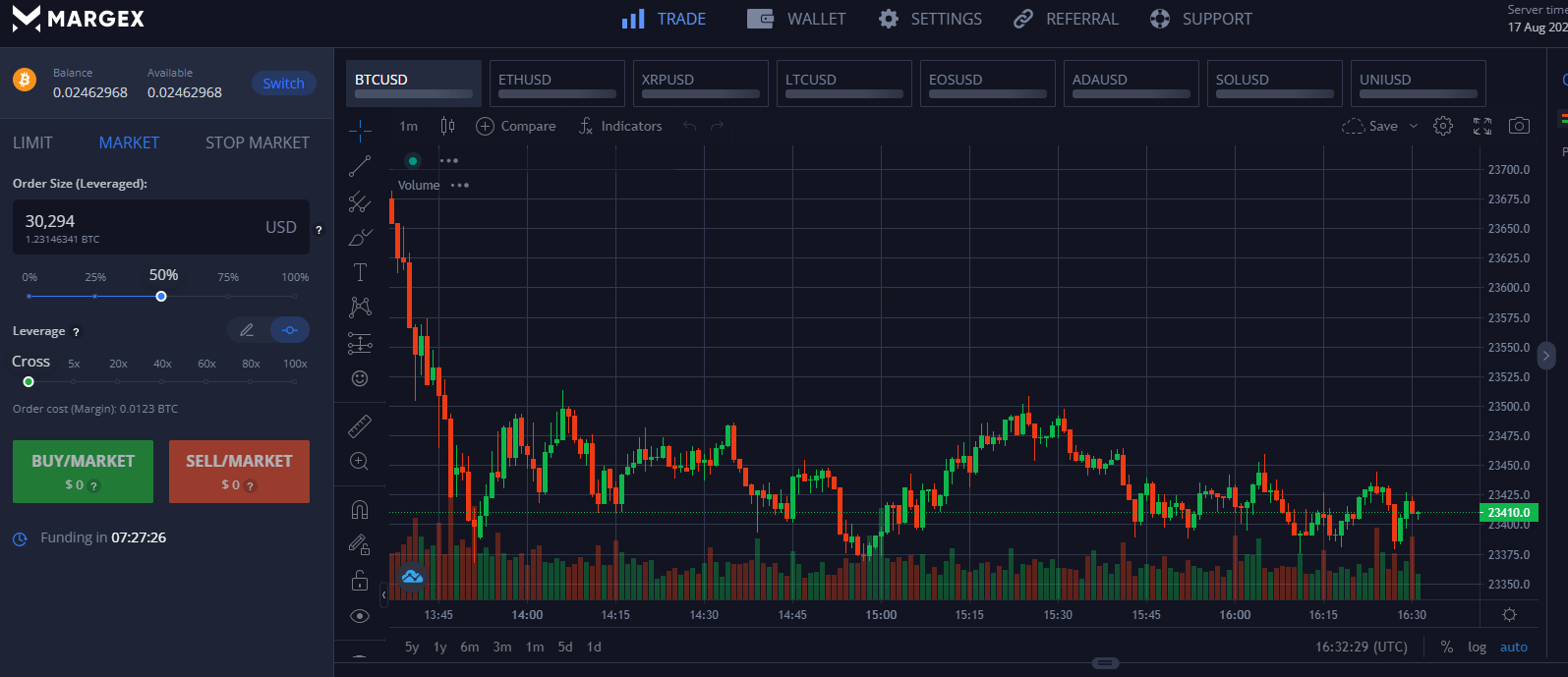

On receiving the tokens, users can trade on Margex using its interactive and user-friendly trading platform or swap to other tokens.

They also have the option of holding long term via the secure wallets provided on the Margex exchange. The wallets are well protected and users can store as many as 14 tokens in their portfolio.

Cloud Mining

Unlike the proof-of-stake system described previously, other blockchains, notably Bitcoin (BTC), take a more computer-intensive approach in which users compete against one another to solve complicated mathematical problems to become validators (also known as miners). This is known as crypto mining. Miners must invest in powerful computers and pay excessive energy rates because of the competitiveness of this consensus method.

This endeavor is undeniably time-consuming and complicated to earn passive income. As a result, investors often use a different lending strategy for passive income known as cloud mining. You may use this to pay other companies to handle the technical aspects of crypto mining on your behalf. In essence, you pay a single fee to a platform that provides such services to rent or acquire mining equipment from their facility. Following this initial payment, you may be required to pay a daily maintenance charge so that the cloud mining service provider can assist you in managing your mining rigs.

As exhilarating as this sounds, it is fraught with danger. Since its widespread use, cloud mining has been a source of contention in passive income. Due to the distant location of this mining enterprise, there have been multiple examples of fraud. As a result, you should exercise caution when selecting this choice.

Yield Farming

Another decentralized (or Defi) strategy for obtaining cryptocurrency passive income is yield farming. The fluid operations of decentralized exchanges make this feasible; these are essentially trading platforms where users may get the liquidity required to complete deals using a mix of smart contracts (programmable and self-executing computer contracts) and investors. Users are not competing with brokers or other users. Instead, they do business using the fiat currency or money put by investors, or “liquidity providers,” into smart contracts explicitly designed for this purpose. Liquidity providers have then reimbursed a share of the trading fees collected.

One must become a liquidity provider (LP) on a Defi exchange like Uniswap or PancakeSwap before beginning to generate passive income via this consensus mechanism. To start collecting these fees, you’ll need to put a certain number of digital assets in a liquidity pool. If you want to contribute to the liquidity of an ETH/USDT pool, for instance, you’ll have to put in both ETH and USDT and other crypto tokens.

After a liquidity deposit is made, the decentralized exchange will provide you with LP tokens that are proportional to your part in the entire liquidity pool. After that, you may use these LP tokens to generate passive income by staking them on decentralized lending sites that support them. Using this method, you may receive two different interest rates on the same deposit.

This piece only scratches how your new cryptocurrency holdings might bring in passive income for you. Keep in mind that there is an inherent danger in pursuing any of these options. Therefore, you should do your study, consult with a competent financial counselor, and choose an investment strategy that is tailored to your own needs and objectives to generate passive income.

Airdrops

Airdrops are a kind of free cryptocurrency distribution that rewards early adopters and long-term holders with passive income. New projects, bug bounties, voting incentives, and promotional events are all examples of appropriate times and places for airdrops to be distributed.

Typically, the creators or developers of a project will do an airdrop. For the sake of openness, tokens designated for airdrops are often published in advance, along with the quantity and percentage of tickets that will be distributed.

When a new coin launch is imminent, it is common practice for the project to announce an airdrop for early users to generate interest in and excitement about the launch. While Defi protocols reward liquidity suppliers with Airdrops, they also utilize Airdrops to attract users of other Defi protocols.

The process entails depositing bitcoins or tokens into the wallets of active cryptocurrency traders for no cost or a nominal promotional charge.

It is used as a marketing strategy and provides a way of generating passive income to early community stakeholders. Additionally, airdrops can be used to foster early community development, and establish an early market value for the token. Hunting airdrops is a way crypto enthusiasts with little or no holdings build wealth for the future by taking part in activities that promote a project.

Some projects distribute their airdrops in tiers that could include college investors and cryptocurrency investors who took part in presale programs. Furthermore airdrop distributions could take days or months depending on the project.

Liquidity Pools

In their most basic form, liquidity pools are token reserves protected by a smart contract. Large liquidity pools are created with their help, which improves liquidity. Because of this, trading and generating passive income is made simpler by using liquidity pools. So, they are heavily used by specific decentralized markets. Although Hodlnaut was one of the first advocates for the implementation of liquidity pools, Uniswap made them mainstream.

Together, buyers and sellers submit orders to the order book models. Buyers, often called bids, submit offers to acquire an asset at the best feasible trading price. On the other side, sellers want to get the most excellent possible price for their goods.

Buyers and sellers need to agree on a price for the transaction. Either the purchasers raise their bid prices, or the vendors drop their asking prices to accomplish this and generate passive income.

In certain transactions, however, neither the buyers nor the sellers are interested in increasing the price. Sometimes there isn’t enough of a desirable item for potential purchasers to pull the trigger. This is when market makers step in to make a move.

Trading is simplified by market makers who are always prepared to purchase or sell a particular item. That’s why there are market makers: to ensure that transactions may occur at any time, regardless of whether or not the counterparty is present.

This has attracted interest from those who believe it is possible to implement such a system with decentralized banking and generate passive income

Key Takeaway

- Using cryptocurrencies is one way to generate a passive income for yourself.

- Staking, mining, lending, interest-earning deposits, gambling, dividend-earning digital tokens, yield farming, and other forms of yield farming are all passive income-generating activities.

Margex is the most progressive crypto platform that allows for generating passive income (money), and here’s why;

- A Wide Range of Coins & Ease of Use: To begin with, Margex is easy to use and supports over a hundred different staking currencies.

- Sign-up is quick and straightforward, with no KYC required.

- Trading on margin with up to 100x leverage.

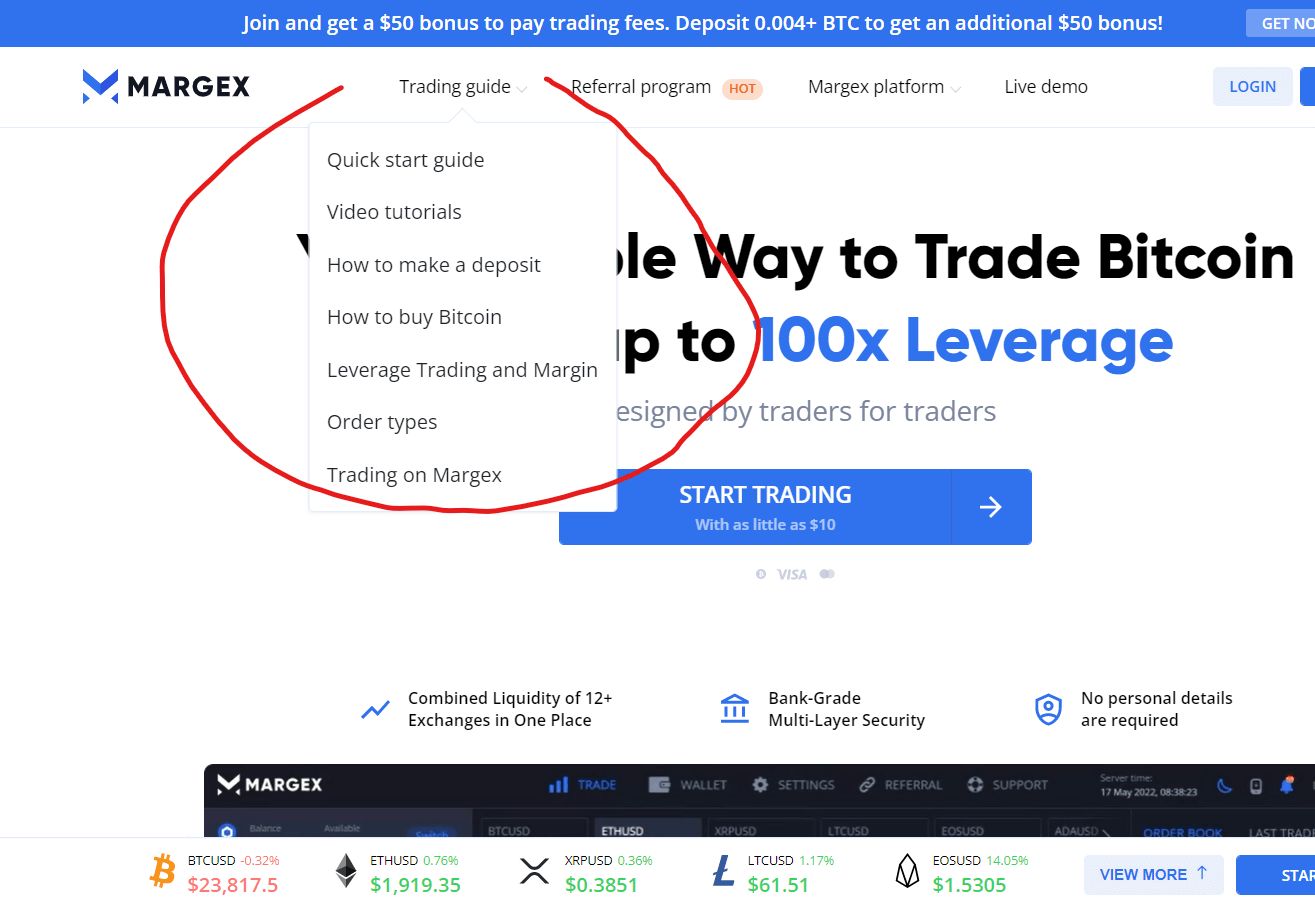

- A complete trading guide with lessons.

- New and improved staking feature

FAQ

In 2022, how can you set up a passive crypto income revenue stream?

Several programs provide crypto users with the opportunity to generate passive income. Crypto users will receive altcoins as a reward for staking, yield farming, or lending. The program and the currency itself will determine the value of their awards.

The degree of incentives is determined by numerous aspects linked to the project providing the prizes and the awarded currency.

Which ideas for passive income are there?

As a Crypto aficionado taking a cue from the likes of Andrey Sergeenkov, you may generate a passive income from your digital assets. Staking service, yield farming, cloud mining, and crypto lending are all successful strategies. Best of all, they do not need active asset management to create profit.

How can I get a monthly passive income from Cryptocurrency?

Defi users may benefit significantly from strategies such as staking and yield farming. Their benefits will be determined by the program and the crypto assets in which they participate. Checking the market might help you make $100 daily from your current crypto investment or conventional investments.