The cryptocurrency industry has seen so much evolution from its pioneers’ Bitcoin and Ethereum, with so much growth and taste to solve a real-life problem that has plagued the financial world through the different blockchain technology aimed at solving and bringing better solutions.

With the constant change found from the inception of Bitcoin, Ethereum, and other altcoin projects, traders and investors have seen that the market has continued to undergo some change as it has noticed the market operates in phases leading many traders and investors seeking the best ways and strategies to best position themselves for a particular market cycle.

Traders and investors have gone as far as learning different techniques of technical analysis, chart patterns, and technical indicators to stay ahead of the market and use strategies that produce the best probable outcomes based on the market conditions with reduced risk.

In this guide, we will focus more on how to short Bitcoin, strategies, and chart patterns you can use to short BTC and stay more profitable in the current bear market cycle.

What Is Bitcoin (BTC)

Bitcoin is the first and most well-known digital cryptocurrency, enabling peer-to-peer value exchange in the crypto space or industry through the use of decentralized protocols, cryptography, and consensus mechanisms to achieve an up-to-date periodic transaction ledger known as a blockchain.

Bitcoin is also known as digital money because it exists independently of the government or financial institutions. It can be transferred globally without the assistance of an intermediary or intermediary organization.

Bitcoin was launched anonymously in January 2009 by a small group of technologists led by Satoshi Nakamoto. Satoshi Nakamoto’s ideas for BTC were based on a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” published in 2008. Satoshi released the first Bitcoin software as open-source software, which users can use to get started with Bitcoin.

The utility of Bitcoin was a major motivator that drove the mass adoption of digital currency to easily and quickly transact value digitally. As political and social change push Bitcoin’s adoption and significant growth, many people are becoming interested in cryptography and privacy-enhancing technologies.

After a few years of learning about this amazing technology, Bitcoin’s price and mass adoption skyrocketed. As a result, many exchanges broke away, making it simple to convert local currency to Bitcoin. Bitcoin is becoming the primary currency of other entities, businesses, and El Salvador.

What Is Bitcoin Shorting

BTC short or short selling BTC or an asset is a strategy used by traders, investors, and institutions to speculate the fall of the price of an asset and make a profit out of it. A trader or investor has the belief that an asset or BTC is falling after conducting technical analysis or some market conditions that prove true for that asset. As a result, the trader takes a short position by opening a futures contract or borrowing an asset from an exchange selling the asset at a price now and buying it back at a later time when the assets have fallen, thereby making some profit out of this trade from the price differences.

Opening a BTC short position has become a common practice and tradition by most traders, investors, and institutions in the cryptocurrency industry as they try to predict the fall of an asset like BTC, making BTC the most shorted asset in the crypto space.

The principle used to short BTC or shorting BTC and any other tradable asset is quite straightforward as a trader needs to sell an asset and then buy it back at a lower or more reduced price, thereby making a profit.

Some several exchanges and platforms allow traders and investors to participate in this type of speculative trading at a small amount; this exchange includes Margex as it allows traders to trade with up to 100X leverage size, either long or short position as a derivative exchange, thereby making it possible for traders to earn from a downtrend market.

There are several ways to short Bitcoin depending on a trader’s risk appetite and knowledge of trading, including technical analysis, chart patterns, margin trading, futures trading, options, and leverage tokens to stay ahead of the market and become more profitable.

Benefits Of Shorting Bitcoin (BTC)

There are so many reasons why traders look for opportunities to short Bitcoin and to make a profit from the market. Let us consider some reasons why traders short BTC.

Hedging Risks

Most traders and investors are unwilling to liquidate their long position during an extreme downtrend, and as a result, most traders in a bear market would open a short Bitcoin position to enable them to upset the losses as they make profits from their short position.

Increase Earning Potential

Like every other asset in the financial market, Bitcoin goes through market cycles in the form of bull and bear markets, where the prices of assets rise and fall extensively. An experienced trader or investor would want to utilize these opportunities to stay profitable in a bull or bear market, thereby taking chances to increase profit potential.

Bitcoin skeptics

Investors who are skeptical of the blockchain revolution’s message. Such individuals believe Bitcoin is a fad and may seek to profit from the asset’s eventual decline. They might even try to influence public perception of cryptocurrencies through the media by spreading misinformation (fear, uncertainty, and doubt). They have previously successfully driven the Bitcoin price down, but not out.

Drawbacks Of Shorting Bitcoin (BTC)

A major drawback associated with shorting BTC is unlimited losses due to the trade going against the trader’s position, with the price not returning to an entry position or breakeven for the trader. When a trader’s losses are reduced to zero from a short position, a trader’s losses can increase infinitely.

Since the price of BTC can never go to zero, this limits the gains associated with shorting BTC.

Ways Of Shorting Bitcoin (BTC)

With a basic understanding of what shorting BTC is and the benefits of shorting Bitcoin. Let us dive deep into how to short BTC in different ways as traders utilize these means to stay profitable in a bear market. Although the list is exhaustive, we would consider the common ones.

Spot Margin Trading

Spot margin trading is a form of trading offered by different trading exchanges and platforms that involve buying and selling crypto assets using spot leverage positions offered by exchanges like Margex.

A trader that participates in stop-margin trading for a short BTC usually borrows assets from an exchange by selling the asset and rebuying this asset at a reduced price when the asset’s price has fallen, thereby making a profit from the asset’s price differences. Margin trading is the most straightforward method of shorting Bitcoin. Compared to the other methods available, it is the most straightforward implementation of the short-selling concept.

Crypto Options

This type of crypto trading is not well adopted like other forms. A crypto option is a non-obligatory contract between parties transacting and allowing settlement within a period. There are two forms of options trading used to trade BTC. We have the call options and the put options. The call option allows the trader to buy BTC at a strike price and make profits when the price of BTC rises. The put options give the trader a chance to sell BTC at a strike price; when the price falls, the trader makes more gains.

Futures Trading

A futures contract allows two parties to get into a contract agreement in which either party will buy or sell BTC or any other assets at a decided time of the contract, and this contract is usually settled based on the terms of the agreement.

A trader who wants to short BTC will open a sell futures contract and agree to sell BTC to the buyer at a lower price, thereby making money from the price differences as the price of BTC goes lower.

Margex allows traders to open a futures contract for either a long or sell position, and traders can benefit from the different market conditions. Assets on Margex are protected from pumps and dumps, so you do not need to worry about shilling coins, as this will improve your trading experience on Margex.

How To Short Bitcoin On Margex (Step-By-Step Guide With Screenshots)

Margex is a Bitcoin-based derivatives exchange that allows traders to open a futures contract for buy or sell positions with up to 100X leverage size. Traders can also stake their tradable assets with the help of Margex’s unique staking features, allowing traders to earn from both earns trading and staking simultaneously.

Traders can make up to 13% APY on staked assets; there are no lockup periods and withdrawals of staking rewards as sent daily to the staking balance.

With the help of Margex MP shield and price manipulation protection, this sets the platform apart from other exchanges and protects your funds from the excessive rise and dumps of coins due to shilling.

Shorting bitcoin is straightforward; we will focus in this section on how to short Bitcoin using step-by-step guides and methods with the help of futures trading or margin trading, as others may call it.

We would be using Margex.com for this section as our exchange because of the following reasons:

- Margex is trustworthy and reliable.

- It has insured its trader’s and investors’ assets

- With the help of Margex MP and a price protection system, traders are free from pumps and dumps of assets.

- Traders can stake and trade the same assets on Margex with the help of its unique staking features.

- Traders can open a leverage position with as little as $10 and up to 100X leverage size.

Let us discuss how to short Bitcoin using screenshots with easy steps.

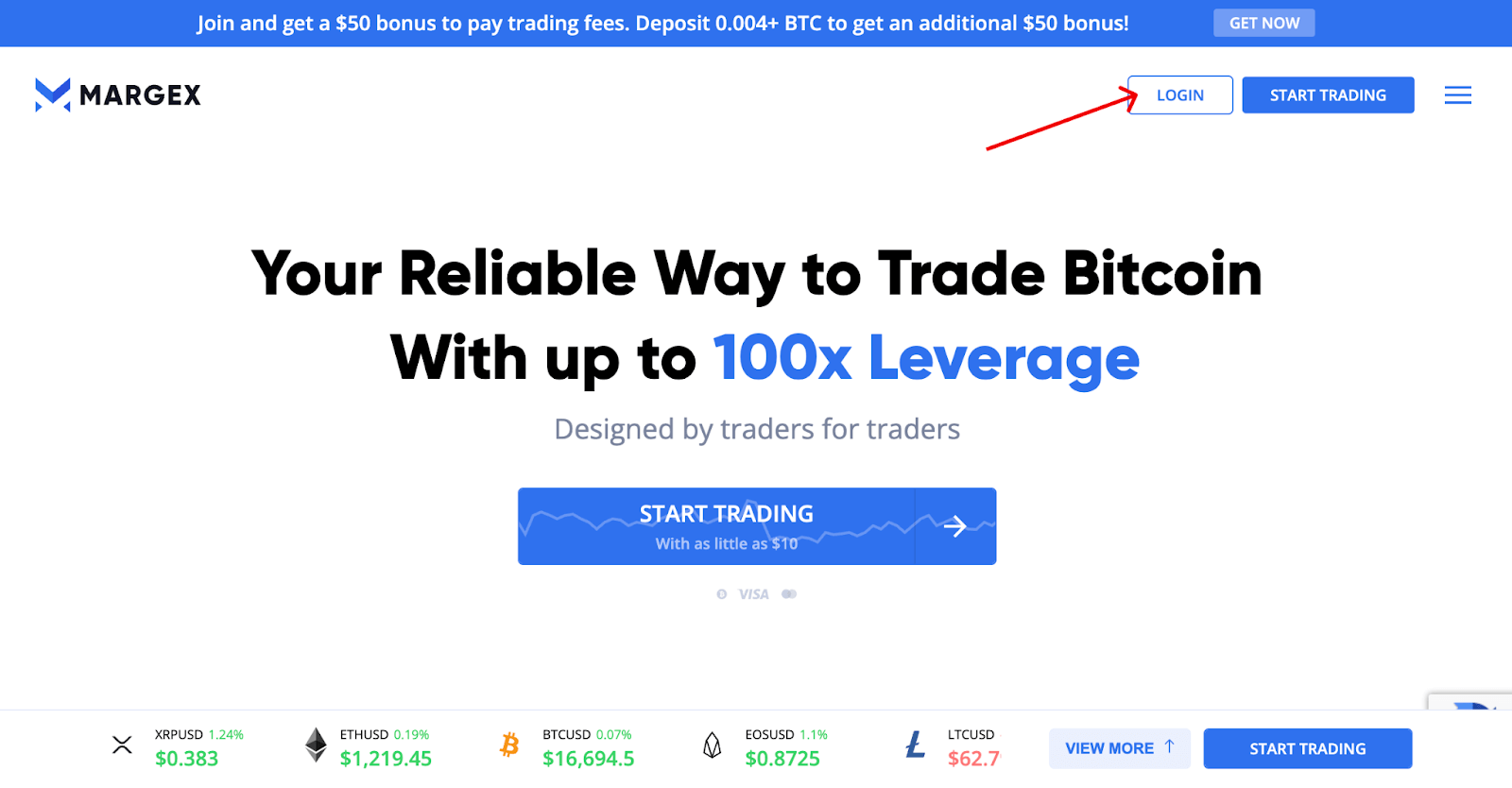

Step 1: Create A Margex Account Or Login

To access all Margex features and enjoy the best experience trading, you need to create an account as a new user or login with your credentials as an existing user.

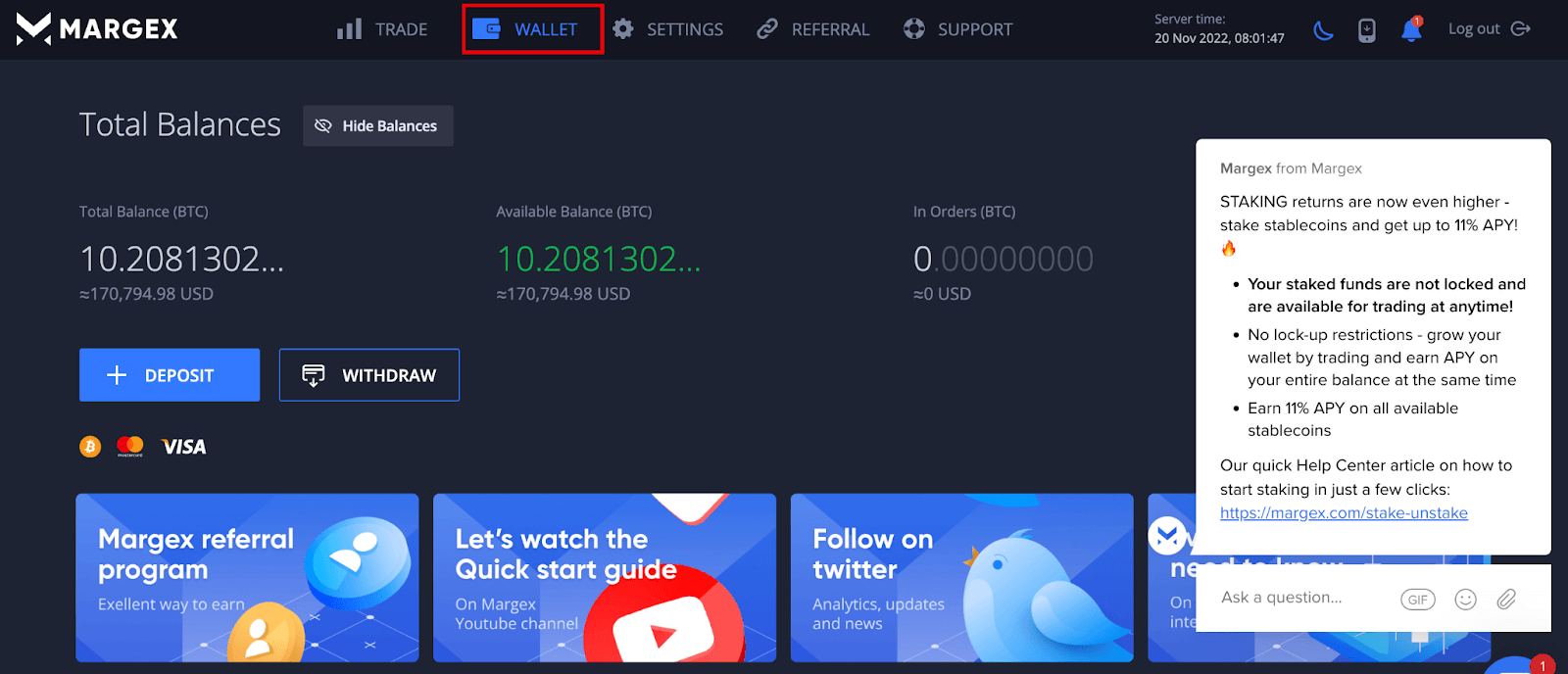

Step 2: Fund Your Wallet

To enable you to try your hands at all the trading features, such as the isolated and cross futures, you need to fund your wallet by clicking on the wallet; you can fund with a crypto asset or use your debit card to buy any crypto asset to enable you to trade.

Step 3: Visit The Futures Trading Section

After a successful deposit, visit the futures trading section by clicking on the trade button at the top of the interface to access all trading experiences, including isolated trading and cross-margin trading. Isolated trading involves the risk shared between the trading pair or the amount in question for that trade, while cross-margin trading involves risk across all funds.

The slider shows the leverage size to be used for trading; a trader selects the desired leverage size. After selecting cross or isolated margin, you can click the buy or sell button depending on the direction you are speculating the asset to move.

Frequently Asked Questions (FAQ) About How To Short BTC

Shorting BTC, especially in a bear market, has been lucrative for experienced traders who know how to trade using the futures trading platform on Margex. Here are the common questions on how to short Bitcoin.

Can Bitcoin Be Shorted?

Yes, Bitcoin can be shorted when the market is downtrend and traders are looking for opportunities to make money from the market. The different ways to short BTC include spot margin trading, Bitcoin options trading, Bitcoin futures trading, and Inverse Bitcoin exchange-traded products (ETPs).

What Is The Best Way To Short Bitcoin?

There is no best way how to short BTC; most traders prefer to use the futures contract where leverage will give them an edge to make more return on their investment using trading platforms like Margex.

Should I Short BTC With leverage?

Shorting BTC using leverage allows traders to make more profit returns with a small margin size or fund at their disposal. Still, the trader must decide whether to use leverage or not based on trading experience and preference.

What Happens If You Short A Crypto And It Goes To Zero?

A cryptocurrency could effectively go to zero only after it was delisted by every exchange where it could be traded. In short, while the price of a cryptocurrency cannot technically reach zero, the trading volume can. If the price of a cryptocurrency falls to zero, it means it has been passed on to someone else without receiving any value in return. Margex MP shield and price manipulation protection have been designed to protect traders from such events and exposure to price manipulations.