The crypto industry has seen constant growth over the years with the emergence of Ethereum and other great DeFi projects looking to upset the industry and Bitcoin. Many traders and investors seek to hold Ethereum and other assets as a store of value but have yet to think of how to short Ethereum to make profitable returns.

Not until the GameStop Saga that led many traders and investors looking for opportunities to short an asset exploring different trading techniques ranging from fundamental analysis to technical analysis, chart pattern, and use of indicators to profit from the price differences when a short opportunity opens up for an asset.

This has led many traders and investors to look for ways to short Ethereum, given that it is a digital asset and can be traded with both upward and downward price movement. This guide focuses on how to short Ethereum on exchanges like Margex.

What Is Ethereum

Bitcoin, from its inception, has been considered the future of money, with many assuming that Ethereum is a direct competitor of Bitcoin, especially for those new to the cryptocurrency industry. However, this is not the case as many would assume it to be.

Bitcoin and Ethereum are never into a competition based on the technology, features, and goals they both have as regards their make gives a clear-cut reason that although they were the first pioneers of the industry, they have different goals set out for them.

Ethereum is a decentralized blockchain network powered by the Ether token, which allows users to make transactions, earn interest on their holdings through staking, use and store nonfungible tokens (NFTs), trade cryptocurrencies, play games, use social media, and do a variety of other things.

Many consider Ethereum as the next big internet to happen to the blockchain, considering how it powers and offers solutions to many applications such as decentralized applications (DApps), decentralized finance (DeFi), and decentralized exchanges (DEXs).

Ethereum provides solutions for so many applications looking to provide services and solutions to real-world problems on the blockchain and tackling some shortcomings of Bitcoin based on the Ethereum whitepaper as outlined by its co-founder Vitalik in 2013.

With the price of Ethereum growing over the years and facing some downside as a result of the market cycles, traders look for opportunities to make profits from shorting ETH price differences.

What Is Ethereum Shorting

A strategy and techniques many traders and investors have adopted in the cryptocurrency to stay profitable, especially in a constant downtrend or a bear market when assets such as Ethereum experience more downtrend than an uptrend, is Ethereum short (ETH short) or short selling ETH.

Traders, investors, and institutions speculate an asset’s rise and fall through technical analysis understanding and other forms such as chart patterns, candlesticks patterns, price actions, technical indicators, and fundamental news that affects the market and price of assets.

Short-selling Ethereum is a speculative way of trading Ethereum; after predicting the price of ETH, a trader or investor opens a short position in other to profit from the price differences of ETH; when the price falls, the trader or investor profits as a result. This means a trader or investor opens a short position for ETH and buys it back later at a lower price using different means, such as a futures contract with the help of an Exchange like Margex.

The principle behind shorting Ethereum or ETH and any other tradable asset is simple: a trader must sell an asset and then buy it back at a lower or more reduced price, thereby profiting.

Several exchanges and platforms allow traders and investors to participate in this type of speculative trading for a small fee; this exchange includes Margex, which allows traders to trade with up to 100X leverage size, either long or short position as a derivative exchange, allowing traders to profit from a downtrend market.

Depending on a trader’s risk tolerance and trading knowledge, there are several ways to short Ethereum, including technical analysis, chart patterns, margin trading, futures trading, options, and leverage tokens, to stay ahead of the market and become more profitable.

Benefits Of Shorting Ethereum

Shorting ETH requires good trading knowledge using technical analysis for a trader to predict the next market action and open a short position. We will outline the many benefits associated with shorting ETH below.

Hedge Risk

Traders engage in the hedge due to offsetting big portfolio losses due to a downtrend. This means a trader would open a short position to short ETH, and if the speculation goes right, the trader will make profitable returns from the price differences.

Volatility

Throughout history, there has been more volume of trading from leverage or margin trading as compared to other forms of trading, and as such, the risk appetite of the trader to trade using leverage position as this provides the opportunity to make huge gains using small capital with a considerable leverage size to trade. Traders reap huge rewards when the price of an asset goes in their favor based on their trading experience.

Drawbacks Of Shorting Ethereum (ETH)

Since the price of Ethereum can not go to zero, there is a limit to the profit that can be made from shorting ETH and a high possibility of the trade going against your opened short position, thereby exposing a trader to uncapped losses. The losses associated with shorting ETH are hypothetical and could be endless, and as such, a stop loss in place would be an idea when shorting ETH.

Ways Of Shorting Ethereum (ETH)

There ar several ways to short Ethereum but we would consider just one of them that is popularly used in shorting an asset.

Ethereum Futures Trading

A futures contract allows two parties to enter into a contract agreement in which either party will buy or sell ETH or any other assets at a predetermined time during the contract. The contract is typically settled based on the terms of the agreement.

A trader who wishes to short ETH will open a sell futures contract and agree to sell ETH to the buyer at a lower price, profiting from price differences as the price of BTC falls.

Margex allows traders to open a futures contract for either a long or short position, allowing them to profit from changing market conditions. Margex assets are protected from pumps and dumps, so you don’t have to worry about shilling coins, which will improve your Margex trading experience.

How To Short Ethereum On Margex (Step-By-Step Guide With Screenshots)

Margex is a Bitcoin-based derivatives exchange that allows traders to open futures contracts for buy or sell positions with leverage of up to 100X. Traders can also stake their tradable assets using Margex’s unique staking features, allowing them to earn from both trading and staking at the same time with up to 13% APY on their staking returns, including stablecoins.

This distinguishes the platform from other exchanges and protects your funds from the excessive rise and dumps of coins caused by shilling, thanks to the Margex MP shield and price manipulation protection.

Shorting ETH is simple; in this section, we will walk you through the process.

We would be using Margex.com for this section as our exchange because of the following reasons:

- Margex is dependable and trustworthy.

- Traders can avoid asset pump and dumps with the help of Margex MP and a price protection system.

- Using Margex’s unique staking features, traders can stake and trade the same assets.

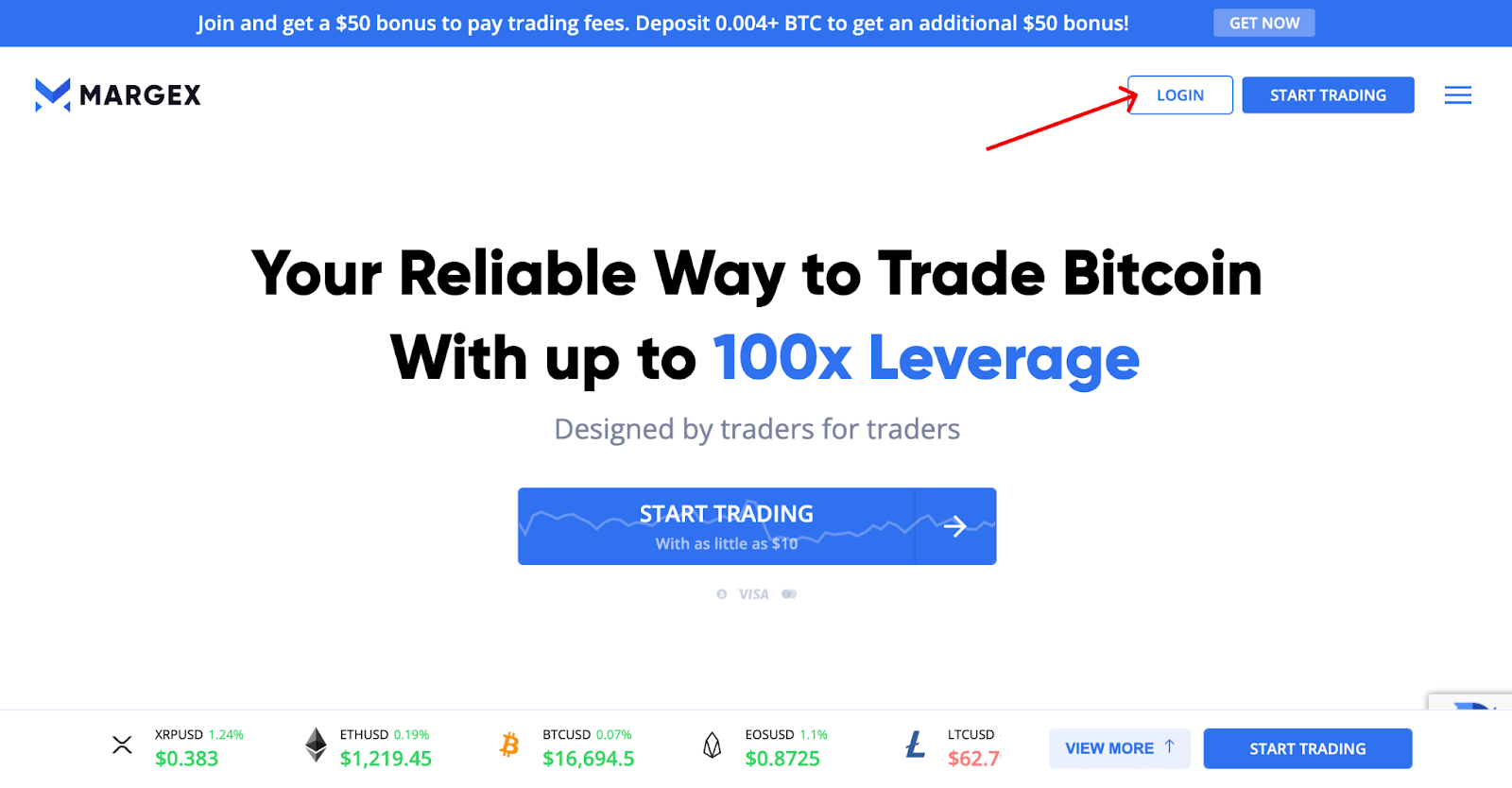

Step 1: Create A Margex Account Or Login

To access all Margex features you need to own an account and for existing users you only need to login to access all of the best trading experience.

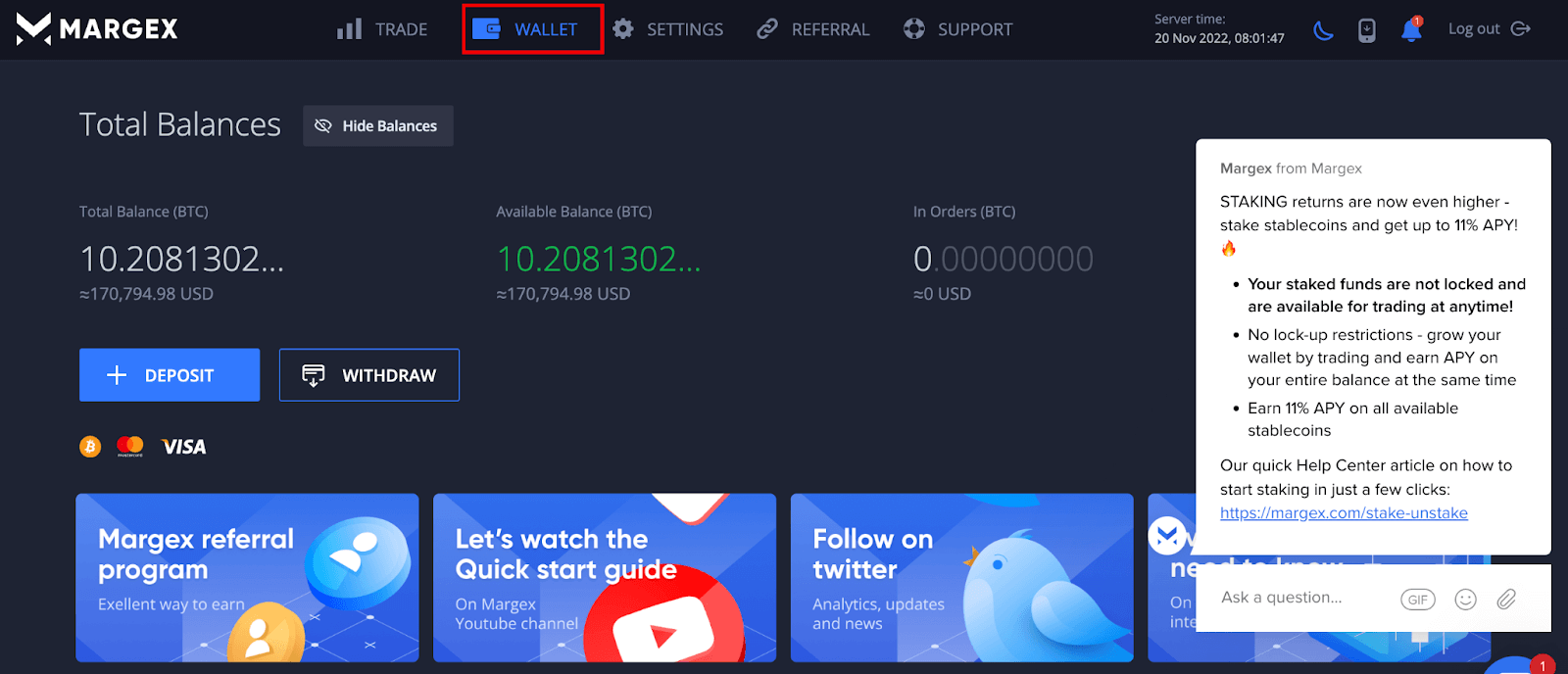

Step 2: Fund Your Wallet

To enable you have a good feel of all that we have discussed on shorting ETH you need to fund your wallet so as to enable you open positions for either isolated or cross-margin call.

Step 3: Visit The Futures Trading Section

Following a successful deposit, navigate to the futures trading section by clicking on the trade button at the top of the interface to gain access to all trading experiences, including isolated trading and cross-margin trading. Isolated trading entails risk shared by the trading pair or the amount in question for that trade, whereas cross-margin trading entails risk shared by all funds.

The slider displays the trading leverage size; the trader selects the desired leverage size. After selecting cross or isolated margin, you can click the buy or sell button to speculate on the asset’s direction.

Frequently Asked Questions (FAQ) About How To Short ETH

Shorting ETH, particularly in a downtrend market, has proven profitable for advanced traders with a strong understanding of technical analysis and who understand how to trade using the futures trading platform on Margex. Here are some frequently asked questions about how to short Ethereum.

Can Ethereum Be Shorted?

Yes, when the market is in a downtrend and traders are looking for ways to profit from it, ETH can be shorted. Shorting ETH can be done through spot margin trading, Bitcoin options trading, Bitcoin futures trading, and Inverse Bitcoin exchange-traded products.

What Is The Best Way To Short Ethereum?

There is no particular order or the best way to short ETH; most traders prefer to use futures contracts where leverage gives them the advantage to make a higher return on their investment using trading platforms such as Margex.

Should I Short ETH With leverage?

Shorting ETH using leverage allows traders to make more profit returns with a small margin size or fund at their disposal. Still, the trader must decide whether to use leverage based on trading experience and preference.

What Happens If You Short A Crypto And It Goes To Zero?

Only after being delisted by every exchange where it could be traded could a cryptocurrency effectively go to zero. To summarize, while a cryptocurrency’s price cannot technically reach zero, its trading volume can. If the price of a cryptocurrency falls to zero, it indicates that it has been transferred to someone else without receiving any value in return. Margex MP shield and price manipulation protection were created to shield traders from such events and price manipulation exposure.