Crypto investment and trading have seen a meteoric rise in popularity during the past few years, primarily because of the market’s numerous opportunities for financial gain. Every day, transactions involving cryptocurrencies worth billions of dollars are conducted without the participation of intermediaries or governmental organizations. Nobody wants to be left behind on the crypto bandwagon, and everyone, from amateurs to institutional traders, is becoming engaged in the cryptocurrency market.

Although showing immense potential, traders are still skeptical about which of the many crypto assets to invest in. Among these many different crypto assets is XRP.

Ripple (XRP) has been one of the few cryptocurrencies that has generated the most controversy on the market for some time now. Supporters praise it for its potential to revolutionize the banking industry, while critics claim that it’s nothing more than a glorified payment system.

So, what’s the truth? Is XRP a good investment? Is Ripple a good investment? In this post, we’ll take a closer look at Ripple and XRP and we’ll try our best to give an honest response to those questions. We’ll also give you a short XRP price prediction.

What is Ripple XRP?

XRP is a digital asset created to help facilitate cross-border payments. Launched in 2012, the cryptocurrency prides itself as one of the top 10 in the crypto market.

XRP is the native token of the Ripple network, a distributed open-source protocol that focuses on digital payment networks for processing financial transactions. Ripple’s purpose is to take transaction power from central databases controlled by financial institutions to a more open infrastructure. So far, Ripple has partnered with over 100 banks and financial institutions to use its technology.

Ripple and the XRP cryptocurrency are not the same thing, despite the fact that some people refer to the XRP coin as Ripple or consider Ripple and XRP to be the same thing. Ripple is a payment protocol created by Ripple Labs Inc., a US-based technology company. XRP is a cryptocurrency on Ripple that allows financial institutions to transfer money quickly with little fees.

How Does XRP Work?

XRP is unlike other cryptocurrencies because it was created to address some of Bitcoin’s shortcomings and to serve a specific purpose with the banking industry.

XRP runs on the XRP Ledger, a blockchain created by David Schwartz, Jed McCaleb, and Arthur Britto. This blockchain works more like a decentralized database and is different from a typical one. It works with the Ripple Protocol to form its own notion of consensus algorithm (RPCA), where only validating members of a unique code list are considered when verifying the authenticity of a transaction.

XRP would later go on to be used to facilitate payments on the Ripple network. It does this work through RippleNet, which is a network consisting of a collection of banks and payment providers who have agreed to use Ripple’s blockchain network for processing international transactions. More on this later.

Environmental Impacts Of XRP

The environmental impacts of cryptocurrencies have been a hot topic for some time now. Consensus mechanisms used in crypto mining consume a lot of energy each year, some using more power than the total annual electricity usage of an entire country. As the crypto market keeps expanding, the issue of adverse environmental impact is expected to increase, especially with cryptocurrencies using Proof-of-Work.

According to its creators, XRP’s environmental friendliness was one of the biggest talking points during its development. When compared to other cryptocurrencies, XRP requires a much lower amount of energy to operate because its consensus mechanism consumes less power. Additionally, every XRP in existence has already been minted, so there is no requirement for any extra energy to create more supply.

XRP and Banking

The first cryptocurrency, Bitcoin, was created to fix the problems of transferring traditional currencies and decentralize money by replacing banks and financial institutions as intermediaries. Since the inception of the industry, many other cryptocurrencies have taken on the same approach. XRP takes a different approach, which is to serve as a hybrid system between both industries.

XRP’s value is closely correlated with the banking industry’s interest in Ripple. Because Ripple is created to help banks process faster and cheaper international payments, banks are the target market for Ripple and its products such asXRP. When banks are interested in Ripple, they also tend to be interested in XRP.

Ripple has since been able to partner with large banks and payment providers and continues to expand its list of partnerships. As Ripple continues to grow and partner with more banks, XRP will likely continue to increase in value.

How XRP Is Used For Banking

XRP can be used as a bridge currency when trading other currencies. Say, for instance, Person A living in the U.S. wants to send $1 to Person B who is based in Germany. Doing this through traditional means like a SWIFT currency transfer can take anywhere between 1 to 5 working days to complete.

Instead, Person A’s bank can convert USD to XRP through RippleNet. Then, validators check if the transaction is valid. If valid, the XRP is converted to Euros which can then be received by Person B’s bank.

Differences between XRP and other cryptocurrencies

As mentioned earlier, XRP operates differently from your conventional cryptocurrency. Here are some of these differences:

Unique blockchain:

Although XRP is decentralized, it does not operate on a blockchain like Bitcoin and other cryptocurrencies. Instead, it operates on the XRP Ledger, where validating nodes vote on polls to validate transactions. When establishing consensus, only the votes of the members of the unique node list (UNL) are considered (as opposed to every node on the network). This UNL represents a part of the network that is trusted by the network servers.

XRP is pre-mined:

Unlike other major cryptocurrencies, XRP is pre-mined. This means that there’s no way to create new XRP tokens through mining. There are currently more than 48 billion tokens in circulation but the maximum number of XRP that can exist is the 100 billion units pre-mined during its launch. Ripple Labs presently holds the remaining tokens and occasionally releases them to the public through escrow.

Limited number of validating nodes:

Although Ripple uses a decentralized concept to validate transactions, it is still somewhat centralized because of the unique node lists used for validation. This is in contrast to blockchains like Bitcoin and Ethereum where transactions are confirmed by every node on the network.

Relationship with the banking industry:

As we’ve already said, XRP gets along well with the banking industry. Doing so stands in stark contrast to other cryptocurrencies, which aim to eliminate the need for traditional financial institutions.

Private Company:

One further aspect in which XRP stands out from many other famous cryptocurrencies is the fact that it was developed by a privately-held fintech company that operates for financial gain.

Ways To Invest In Ripple XRP

The world of crypto trading can be intimidating for beginners, but it’s definitely not impossible. In fact, Ripple XRP is a great place to start because its price is more stable than other cryptocurrencies.

There are a few different ways you can invest in XRP. You can buy it on exchanges, or you can invest in Ripple through a fund or investment vehicle. If you’re looking to invest in Ripple through a fund or investment vehicle, there are a few different options to choose from. One popular option is the Blockchain Capital Innovation Fund, which has invested in over 100 blockchain companies, including Ripple.

If you’re looking to buy XRP on exchanges, you’ll need to first create an account with a reputable cryptocurrency exchange like Margex. Once you have your account set up, you can then add funds and trade XRP easily.

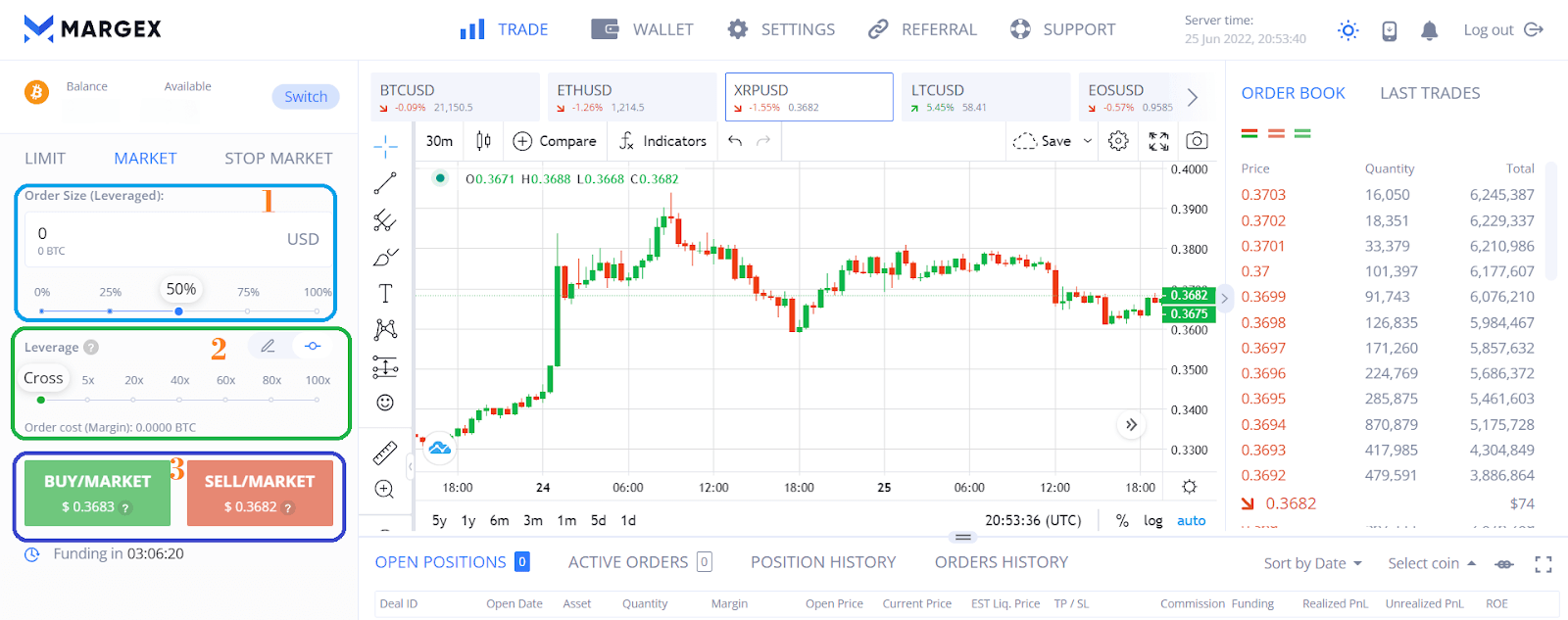

How To Trade XRP On Margex

With a modern friendly and the easiest-to-use user interface in the industry, Margex is the right platform for those interested in trading XRP. With Margex’s 100X leverage, traders can start trading with as little as $10 and make profits faster.

1. Sign up for a live trading account at Margex.com by clicking on “Start Trading.”

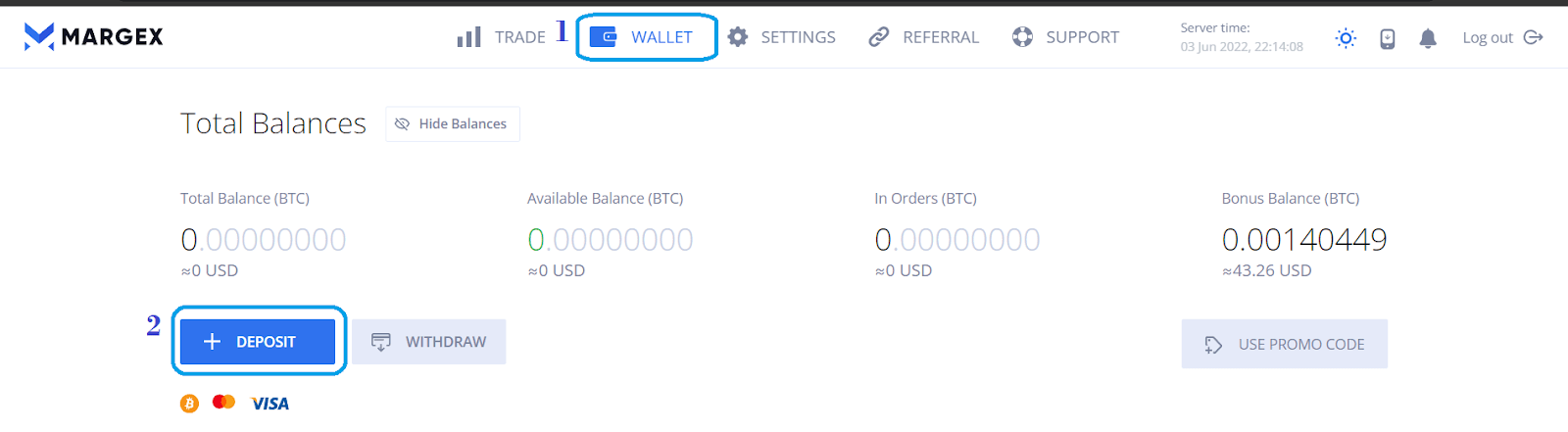

2. You need to deposit to begin trading. Click on the “Wallet page” and select “+Deposit” to buy crypto through Changelly/ChangeNow or by transferring crypto to your Margex wallet.

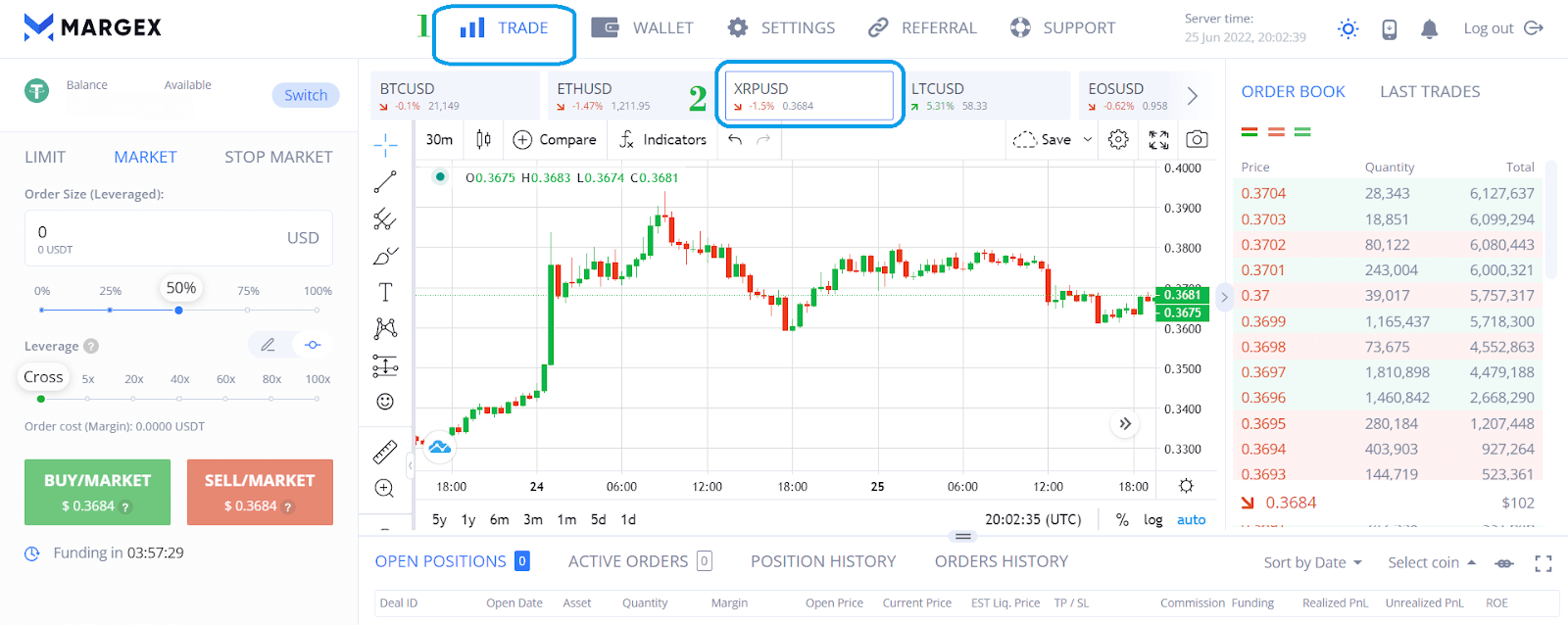

3. Return to the “Trade” page to start trading. Select XRP/USD to trade XRP.

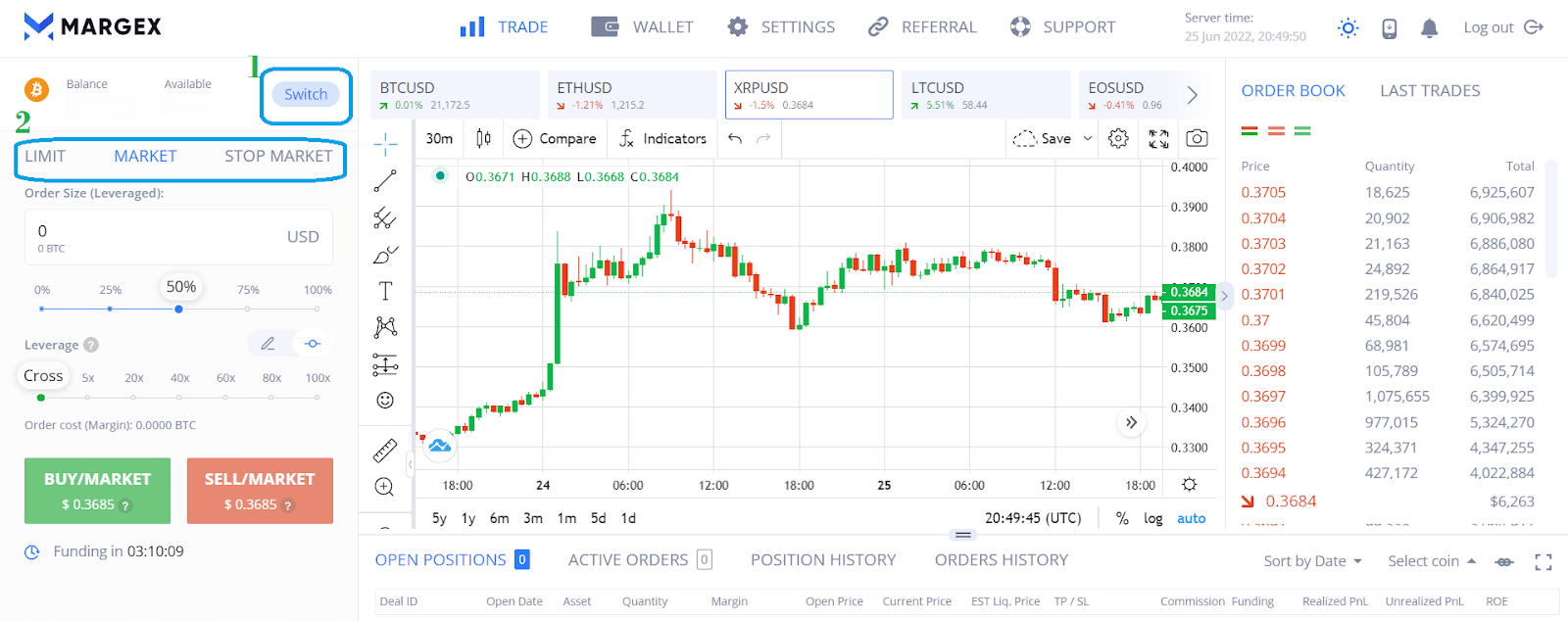

4. Click on “Switch” to switch between the various assets available. You have the option to execute a market order immediately or a limit order at the price you specify.

5. Enter your order size. Adjust leverage to your preference and click on “Buy” or “Sell” to enter your trade.

Price History and Analysis of XRP

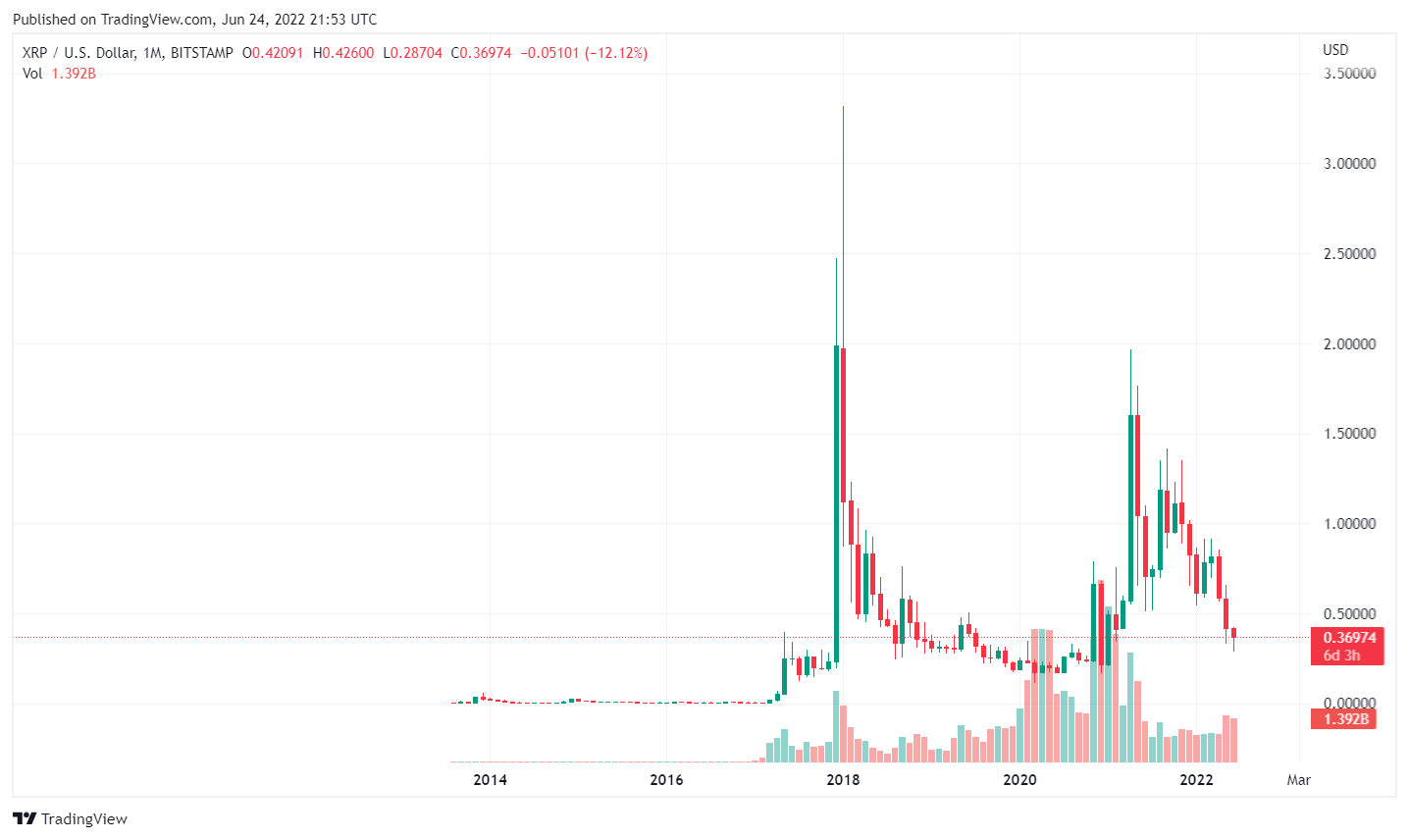

Since its inception in 2012, Ripple has been one of the most polarizing cryptocurrencies on the market. Some consider it a promising investment, while others claim it is a scam. Regardless of where you stand, one thing is certain: the price of XRP has experienced some serious ups and downs.

As with all altcoins, its price movement is closely associated with Bitcoin. However, due to the close relationship of its parent company with financial institutions, XRP’s price movement is also known to be widely affected by events surrounding Ripple Labs Inc.

Prior to the major crypto market hype in 2017, XRP was mostly trading below $0.01 in the early years after its launch. The cryptocurrency didn’t stay on the sidelines in 2017, when the market experienced a major upswing, reaching an annual high of $0.39. Yet, this price surge was modest compared to the 2018 bull run.

On January 4, 2018, as the whole cryptocurrency market continued to grow in popularity, XRP hit an all-time high of $3.84. This bull run was short-lived though, as the price collapsed in less than a month and ended the year below $0.50.

The next two years were fairly quiet although XRP’s value continued to decline, eventually hitting $0.12 sometime around March 2020. Later in the year, it went on another bullish trend to reach nearly $0.80, but then crashed to $0.19 in December due to the uncertainty over the SEC lawsuit.

Overall, 2021 was a strong year for XRP, largely due to a newly discovered excitement around cryptocurrencies and NFTs. Fears over the SEC lawsuit had subsided and investors began to have more confidence in the asset. XRP kept the uptrend and reached an intraday high of $1.96 on 14 April after breaking the $1 mark again the same month. It seemed like the asset found a new range, as it spent the following several months close to the $1 level and ended the year at $0.80.

2022 has been sort of a bearish run for the asset. February looked pretty positive, with XRP hitting a high of $0.91 on 8 February. However, things haven’t been rosy for the entire crypto market since then. China’s continued crackdown on the crypto industry, Russia’s invasion of Ukraine, and the collapse of LUNA and the TerraUSD stablecoin have all had adverse effects and XRP hasn’t been left out. Currently, as of late June, XRP is trading around $0.36 as the crypto market looks to bounce back from its most recent bearish trend.

XRP Price Prediction By Experts

Although the future is always difficult to predict, some experts have offered their thoughts on what they believe XRP’s price could be in 2022.

According to a recent study conducted by Finder.com on a panel of 36 industry professionals about XRP’s performance over the next decade, the majority of respondents anticipate the price to reach $2.55 by the end of December 2022. Obviously, this depends on the outcome of the SEC lawsuit.

Changelly.com also predicts that the price of XRP in 2022 will range between $0.47 and $0.56, with an average price of $0.47.

Taking into account crypto market volatility, it’s difficult to say where the price of XRP will go in the short term. Although we believe that the long-term prospects for XRP are bright, a more realistic maximum price in 2022 is $0.60. However, the SEC lawsuit remains a big factor. If Ripple wins, XRP might surpass $1 this year. If they lose, a bear run should be expected.

Lawsuit Against XRP

On December 22, 2020, the United States Securities and Exchanges Commission (SEC) filed a complaint against Ripple Labs, Inc. As the firm behind XRP, the news of the lawsuit surprised the whole crypto industry. According to the lawsuit, Ripple generated over $1.3 billion by selling unregistered securities to investors in the United States and across the world. The SEC asserts, however, that it has no issues with the operation of other cryptocurrencies like Bitcoin and Ethereum.

Ripple claims that it has never conducted an Initial Coin Offering (ICO). It maintains that XRP should be seen as a digital currency and not as an investment or a means of raising capital. The company also blames the lack of clarity in the U.S. crypto industry.

After the announcement, the price of XRP fell to a low of USD 0.17, although it has since recovered. U.S. crypto exchanges have also delisted XRP, but its expansion into overseas markets remains strong.

Most of the crypto community is strongly in support of Ripple as the outcome of the lawsuit will determine how the industry moves forward in the United States. A win for Ripple would be a win for all cryptocurrencies as it increases the likelihood that they would be regarded as non-securities and subject to less scrutiny from the SEC. It is also important to note that the case will most likely result in a settlement.

Pros And Cons Of Investing In XRP

Trading XRP comes with its own set of pros and cons, just like any other cryptocurrency does. Here are some of them to consider:

Pros:

- Fast Transaction Speed:

XRP is known for having one of the fastest transfer speeds out there. Not only can XRP process 1,500 transactions per second, but it also does it with an average time of 3 to 5 seconds.

- Bridge Currency:

XRP is known for being a bridge currency between the crypto and banking industries. It addresses issues for huge financial institutions and accelerates capital movement, which is why it’s so popular in Asian markets.

- Cheap and Affordable:

Since XRP is still trading below $1, if you were to invest now, you can get a lot for a small investment if the price surges.

- Strong Backing:

Since XRP was developed by Ripple, it has a strong backing and promotion in the form of the company. XRP will prosper if Ripple keeps performing well. That’s why investing in XRP is tantamount to investing in Ripple.

- Positive Price Prediction:

A lot of market analysts think XRP will do well in the near future. Technical analysis also points to growth and a lot of bull runs.

Cons:

- Ripple has control:

Ripple Labs retains a significant amount of influence over XRP, which continues to generate controversy. What happens to XRP if the company makes some wrong decisions?

- Pre-mined:

Mining is recognized to bring about price stability in the market. Because XRP is pre-mined, the only method to obtain more is through a periodical release by Ripple Labs.

- Close relationship with the banking industry:

XRP’s value is closely correlated with the banking industry’s interest in Ripple but many banks try to avoid XRP due to market volatility.

- Consensus Protocol:

Ripple’s consensus protocol is potentially less secure than your typical blockchain.

Is it better to buy Bitcoin or XRP?

So, is it better to buy Bitcoin or XRP? The answer to this question is a little more complicated than a simple yes or no. It ultimately boils down to what works for each investor’s investment goals.

Bitcoin is the original cryptocurrency and has the highest market cap of any digital currency. This makes it a more stable option for investors.

XRP is an altcoin and has a lower market cap than Bitcoin. This makes it a more volatile option, but also means that there is greater potential for growth.

Conclusion: Is Ripple (XRP) a good investment?

It can be tough to figure out which cryptocurrency to invest in, but XRP is definitely one of the best to look out for. If you’re willing to hold onto XRP for a few years and believe in Ripple’s long-term potential, then it could be a good investment. It is also still cheap, so it’s perfect for beginners who wish to start small.

Cryptocurrencies can be very volatile, but even though XRP is an altcoin, it is stable enough to be a good choice for trading. Therefore, to get started investing in XRP, buy XRP on Margex today to protect yourself from price manipulations and unfair liquidation.

Is XRP a good long-term investment?

Yes, XRP is a good long-term investment. Although its parent company, Ripple Labs, is currently in a tricky situation with the SEC, it has shown that it can still do well. XRP is also on the lower side at the moment, meaning investors can look forward to profiting from a future price surge.

Will XRP ever reach $10?

If XRP and the entire crypto market as a whole continue to do well, XRP should be able to cross the $10 level at some point in the future. However, a more realistic price range is between $1 and $2 in the coming years.

Will banks use XRP?

XRP is recognized for its close ties to the banking industry. Many multinational banks presently use the XRP payment system, and other banks are anticipated to join soon. With XRP, banks can get liquidity on-demand and in real-time without using pre-funded Nostro accounts.