Litecoin is a cryptocurrency altcoin that was extremely popular and dominant prior to the 2020 bull market in crypto. Despite the coin falling out of the top ten cryptocurrencies by market capitalization, it remains a blockchain network with a rising number of transactions.

Will the trend change for Litecoin and the coin once again become one of the most bullish in the space? Or will the altcoin never quite make it as a payment currency and continue to drop out of favor for higher ROI digital assets?

The following Litecoin price prediction guide will help the average investor understand if LTC is a buy at this time and how high or low the price might go in the future. Keep reading to learn if now is the time to invest in Litecoin.

What Is Litecoin? (LTC)

Litecoin (LTC) is a popular cryptocurrency, first launched in October 2011. It is a decentralized peer-to-peer cryptocurrency and open source blockchain protocol. Litecoin was created to share many similar traits with Bitcoin and runs on a modified version of the Bitcoin source code.

Further similarities include a scarce supply, a comparative unit of measurement system, and proof-of-work timestamping scheme. Litecoin also features a supply halving that occurs roughly every fours years much like Bitcoin does. Any changes in the Litecoin codebase were done to achieve faster transaction times at lower fees. Mining difficulty adjustments also occur at a faster pace.

Litecoin Launch And Origin Story

Founded in 2011 by former Google engineer and Coinbase director Charlie Lee, Litecoin was one of the earliest altcoins ever to be released. Due to the many similarities between the two cryptocurrencies, Litecoin is affectionately referred to as the silver to Bitcoin as digital gold.

The story of Litecoin’s creation was of course inspired by Bitcoin in more than one way. In early 2011, CPUs were no longer capable of mining BTC and mining was largely performed by GPUs. The crypto community at the time feared that the cost associated with GPUs would limit those who could get involved in crypto mining.

As such another cryptocurrency was created using Bitcoin’s code, called Tenebrix (TBX). Tenebrix swapped the SHA-256 in Bitcoin’s mining algorithm with a scrypt hash function. The founder and creator of Litecoin, Charlie Lee, built an alternate version of Tenebrix called Fairbrix. Lee used his work on Fairbrix to adapt the scrypt function to the Litecoin project.

At the time realizing that many altcoin projects failed due to a lack of a fair distribution model, Lee chose to create Litecoin as the “silver to Bitcoin’s gold” and avoided things like premining and other issues plaguing early altcoins. Lee later uploaded the Litecoin open-source client in early October, with the Litecoin network going live just one week later.

Within the first years of adoption, Litecoin soared to the top of the cryptocurrency top ten and eventually into the top five. It stayed there for many years, up until the 2020 bull run in crypto when it fell out of the top ten cryptocurrencies by market capitalization for the first time.

Litecoin Similarities With Bitcoin

Litecoin is commonly used as a testnet for Bitcoin. For example, Litecoin was the first to adopt Segretaged Witness and the first to make a Lightning Network transaction. The transaction is said to have transferred 0.00000001 LTC from Zürich to San Francisco in under a second. The Mimblewimble extension block upgrade was activated on the Litecoin network recently, giving users the option of obfuscating transaction details to remain anonymous.

Litecoin has a maximum supply of 84,000,000 LTC, four times that of the supply of BTC. However, there is currently only 70,000,000 LTC in circulation. Litecoin’s 2.5-minute transactions are four times faster than Bitcoin’s ten-minute block confirmation times. Litecoin utilizes a less energy intensive proof-of-work algorithm called scrypt, which includes something called a memory-hard function.

Litecoin difficulty adjustments occur four times more rapidly, at every 3.5 days compared to Bitcoin’s every 14 days. However, both occur every 2016 blocks. Litecoin block clearing times are four times as fast as Bitcoin’s, reaching the difficulty adjustment four times faster and more frequently. Litecoin’s halving matches Bitcoin’s at every four years. However, they take place at different times. The initial Litecoin block reward was 50 LTC. Later, it was slashed in half to 25 LTC. Currently, the block reward is set at 12.5 LTC. The next Litecoin halving is scheduled for August 2023 and will reduce the block reward to 6.25 LTC.

The Litecoin halving is periodical and programmed into Litecoin’s code. Halvings will conclude and all LTC will be distributed by the year 2142. Governments over the centuries have debased currencies to the point of extreme inflation. The Litecoin halving and distribution model ensures that no further LTC can be made and the supply cannot be debased. The idea first emerged with Bitcoin, which sought to create a form of digital gold with a similarly scarce supply.

The Litecoin blockchain is as active, if not more active than the Bitcoin blockchain. Litecoin is often used as a medium of exchange and is one of the fastest cryptocurrencies to use for sending assets from one exchange to another. If the goal is sending funds from one exchange to another as quickly as possible, converting even BTC to LTC first would be faster than the four-times longer transaction times of Bitcoin. In addition to speed, Litecoin fees are much lower when compared to Bitcoin.

Litecoin Adoption And Controversy

Litecoin is a popular cryptocurrency in the online merchant world. It is among the cryptocurrencies offered and accepted at PayPal, Venmo, and other popular finance apps and services. Litecoin also accounts for roughly 21% of all BitPay transactions. The coin’s creator never intended for it to compete with Bitcoin, but rather be used for smaller payment transactions.

The popular altcoin is no stranger to controversy or confusion. In September 2021, a fake press release was distributed stating that Wal-Mart had planned to accept Litecoin as part of a partnership. Despite the fake news regarding a partnership with Wal-Mart, Litecoin has inked several high profile partnership deals with other brands, even becoming the official cryptocurrency of the Ultimate Fighting Championship.

Prior to this, the biggest controversy to surround the coin was due to the Litecoin’s creator, Charlie Lee, selling his position of LTC at the peak of the 2017 bull market. Lee cited his decision as an attempt to remove any potential allegations of personal conflict and to focus on development only. By removing his personal stake in Litecoin, the supply has become more decentralized ultimately.

Charlie Lee is a computer science master graduate of MIT and worked at both Google and Coinbase in high level specialist positions. He helped write the code for Chrome OS for Google. While working at Coinbase, Lee was able to get Litecoin launched on the exchange. Today, Charlie Lee serves as the Managing Director of The Litecoin Foundation – a non-profit focused on furthering the development and adoption of Litecoin globally. The Litecoin Foundation has established several high-profile partnerships since its inception, keeping the outlook for LTC optimistic.

Factors Behind Litecoin Price Action: How They Influence LTC Price Predictions

Every cryptocurrency’s price action is driven by a variety of factors, but these important influences aren’t shared across the board. For example, the demand for ETH to use to pay for gas fees related to NFT minting, DeFi apps, and more doesn’t quite exist in the same capacity with Litecoin. Here are the unique factors influencing Litecoin price predictions.

Demand

The demand for Litecoin has not been as high as it has been in the past. This is visible through relative strength comparison with other altcoins and even Bitcoin. This can also be clearly seen on LTCBTC and LTCETH trading pairs, with Litecoin on the losing side of the pair for some time.

The emergence of smart contracts and the rapid growth of layer 1 and 2 blockchains has put payment coins like Litecoin in the background of the crypto market. Older altcoins successful in the 2017 bull market such as LTC and XRP, haven’t yet made new all-time highs due to a lack of demand.

Demand for LTC is turning around, since the rollout of the Mimblewimble upgrade, which makes Litecoin transactions more anonymous by design.

Supply

The primary factor in any market is a strict balance of supply versus demand. Although demand has been diminished in Litecoin recently, supply is still constrained and at any point could fall out of the delicate balance in favor of further price appreciation.

Only 84,000,000 LTC will ever exist, much like Bitcoin’s 21 million BTC. It is among these reasons that Litecoin is often called silver to Bitcoin as the crypto version of gold. Interestingly, silver demand has also been low in comparison to gold. Could the trend change for both Litecoin and silver at the same time?

Litecoin’s available supply in theory is further reduced with each subsequent block reward halving. The max supply will not reduce, but the amount of LTC miners receive for each block reward will decrease in half every four years. The lower rate of supply available for miners to sell could lead to further price growth over time.

Macro

The Ned Davis Research has a set of rules for successful investing. Among them is “don’t fight the Fed.” The recent macro environment in markets has been cruel to risk assets like crypto, making it even more challenging for Litecoin to regain traction.

Risk of a possible recession has sent panic through the investing community, and top analysts all fear the worst. The fear-riddled macro environment has caused Litecoin to crash by as much as 90%. At the same time, this means that Litecoin is ripe with new opportunities for investors who missed the early crypto rallies.

Litecoin Past Performance: A Complete Price History Of LTCUSD

Like all other cryptocurrencies, Litecoin experiences a large amount of volatility when compared to other asset classes like stocks, commodities, or forex currencies. This fluctuation in price can be exploited by trading.

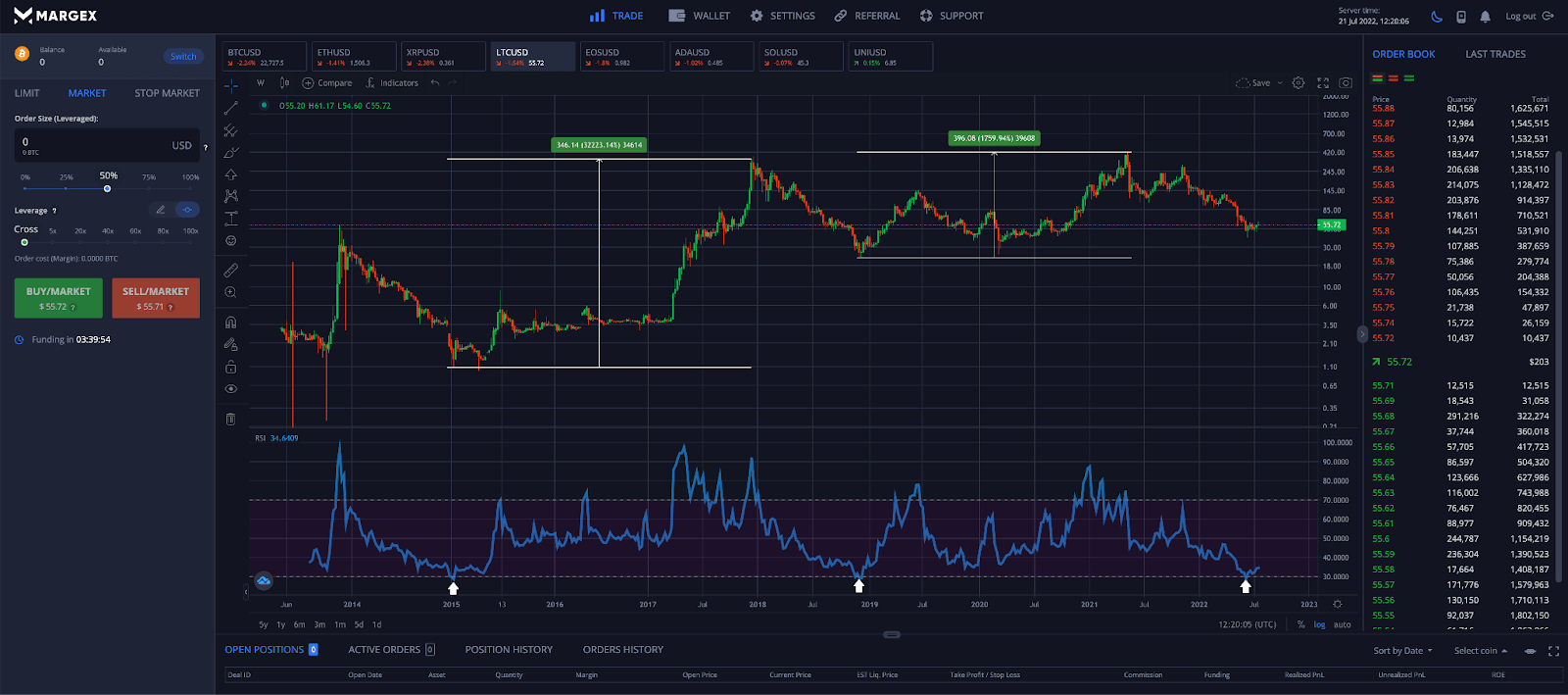

Although Litecoin price history first began in late 2011, the coin was virtually worthless. The earliest price action begins to appear is in 2013. At the end of 2013 Litecoin rallied more than 3,000% just ahead of the crypto market peaking and experiencing its longest bear market yet from 2014 to 2015. From a high of around $56 in late 2013, Litecoin plummeted to as low as $1.

During 2016 the coin traded mostly sideways, until in Q1 2017 the crypto market went on an explosive rally and the first major alt season occurred. Altcoins outperformed BTC across the board just as Bitcoin began to top out. Litecoin was among the bunch and peaked ahead of BTC.

Once again, crypto fell into a painfu bear market and Litecoin collapsed from $360 to around $23 per LTC. Litecoin’s halving in 2019 kickstarted a short-lived rally in crypto, which saw Litecoin rise by 500% before retesting bear market lows at $24 per coin.

In the 2020 to 2021 bull market in crypto, Litecoin underperformed the rest of the market and fell out of the top ten cryptocurrencies by market cap. Litecoin still managed to produce as much as 1,500% returns from lows set on Black Thursday in 2020 to the highs of 2021.

Towards the end of 2021 to 2022 the price of LTC suffered more losses to a region of $45 as the price of LTC hovered in a range movement before rallying high to a region of $60. The price found more buy orders in this region as price rallied to $80 before facing more resistance to break higher.

How Is Litecoin Doing Now?

2022 started off with a lower high in Litecoin, but a higher high in Bitcoin, bringing mass confusion to the crypto market. The Federal Reserve hiking interest rates and beginning quantitative tightening has caused risky assets like crypto to sell off. Litecoin was caught in the storm and crashed back to around $42 per LTC. The 90% crash brought prices below highs set in 2013, creating another potential buy opportunity for crypto investors who missed Litecoin on the way up.

According to the Relative Strength Index, Litecoin might have seen its bottom after reaching historical oversold levels on weekly timeframes. A strategy using the RSI would involve a buy signal triggering after the indicator has reclaimed the lower threshold of the gauge at a reading of 30. In all other instances that the weekly RSI behaved in this manner, a long-term Litecoin bottom was in, and an explosive rally ensued.

Past rallies that resulted from such a low RSI weekly reading brought returns of over 30,000% and 1,700% respectively. What will the next Litecoin rally produce for a return on investment? Keep reading for a series of Litecoin price predictions that will help provide an answer.

Short-Term Litecoin Price Prediction 2023

Litecoin has struggled throughout 2022 thus far, but the worst could be over. The below chart displays automated Litecoin price predictions month-by-month for 2023.

Long-term Litecoin Price Prediction 2023, 2024, & 2025

Litecoin at this point could have a resurgence and crypto could return to growth. The below chart displays automated Litecoin price predictions quarter-by-quarter for 2023, 2024, & 2025.

Long-Term Litecoin Price Prediction 2026 – 2030

The future is bright for cryptocurrencies and in another five to ten years, anything is possible for Litecoin and other altcoins. The below chart displays automated Litecoin price predictions year-by-year for the years 2026, 2027, 2028, 2029, & 2030.

Long-Term LTC Price Predictions From Experts

Litecoin price predictions are a prominent discussion point across top media outlets, leading industry experts, technical analysts, and many others. The below aggregation of Litecoin price predictions from other experts will help provide a wider range of opinions to consider.

Changelly

The price predicting experts over at Changelly see a bright future in Litecoin, calling for a maximum peak by the year 2030 at around $1,933.41 per LTC. The minimum price they expect is “at least $1,572.50” according to their long-term Litecoin price forecasts. Short-term forecasts from Changelly aren’t as positive, with the company predicting only a high of $295 per LTC by the year 2025. This number is well below its former all-time high, but anything is possible in the volatile world of cryptocurrencies.

Coinpedia

Ouch. The pros at Coinpedia see a bleak near-term future for Litecoin. According to the Coinpedia price prediction report on Litecoin, the cryptocurrency expects a maximum high of $326 per coin in 2025, and a minimum of $167.

WalletInvestor

The five-year max Litecoin forecast via WalletInvestor suggests a high of LTC at only $148 per coin, or significantly lower than past all-time highs. This would result in Litecoin seeing no growth for several years and is among the more negative price predictions available today.

CoinPriceForecast

CoinPriceForecast continues the bearish trend of Litecoin price predictions, giving the cryptocurrency a range of $218.90 to $352.00 between the years 2029 and 2033. This means that very little Litecoin adoption will have taken place between now and the next decade.

Trader’s Union

Trader’s Union expects Litecoin price to reach somewhere between $1,090 and $1,226 by early 2030. This represents more than a 20x return from prices around $50 per LTC.

LTC Price Prediction By Margex Technical Analysts

The Margex platform provides all the tools necessary to perform detailed technical analysis and potentially predict future market outcomes. Using the same tools featured by Margex, a team of expert analysts have provided some Litecoin forecasts of their own. Please note, this is not investment advice and price predictions are subject to change. Always do your own research and never invest more than you can comfortably afford to lose.

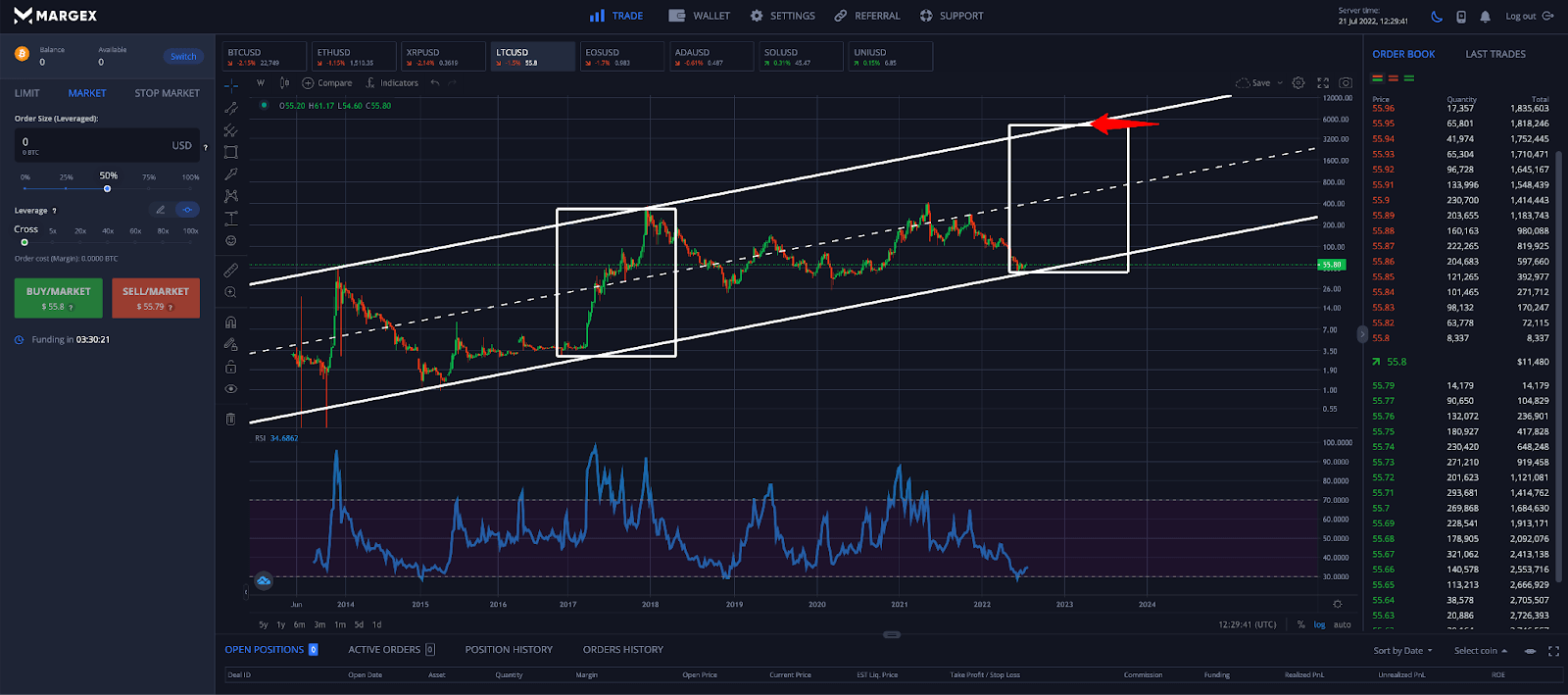

Over the years, Litecoin has begun to form a parallel channel, where price travels along the channel making peaks and troughs at the upper and lower trend lines. Mid-term peaks appear each time price action approaches the median. The 2021 Litecoin peak and resulting lower high both found resistance at this upward traveling median.

However, the image also shows that Litecoin didn’t touch the lower boundary at any point during the last bear market – until now. With the lower boundary now tapped, and with the RSI rising out of oversold conditions, if Litecoin can produce another rally like the one in 2017, the price per LTC could rise above the median to anywhere from $1,000 per LTC to as high as $4,500 per coin.

Several years of bearish sentiment in Litecoin could provide potential for a powerful short squeeze. If buyers begin to also jump on board, an explosive move from one channel boundary to the other could result.

Litecoin Crypto FAQ: Commonly Asked Questions About LTC Cryptocurrency

Litecoin is a breakthrough payment technology and early cryptocurrency based on the Bitcoin core code. Because Litecoin has many similarities with Bitcoin, yet hasn’t performed as well in recent years, many questions about the future of LTC remain.

This FAQ is designed to answer commonly asked questions related to Litecoin price predictions.

Will Litecoin go up in 2022?

The consensus among experts is that after such a strong consistent selloff in Litecoin and other cryptocurrencies, LTC is expected to rise into a new uptrend. Litecoin and other cryptocurrencies continue to correlate with the stock market, so a rally might not form until the stock market recovers. Refer to the many Litecoin price predictions above for direct answers related to the year 2022.

What was Litecoin’s all-time high?

It depends on where you look, but most exchanges have Litecoin’s all-time high at above $400 in 2021. Litecoin could set a new all-time high in the years ahead according to the expert predictions above.

Is Litecoin worth investing in 2022?

Given the impressive Litecoin forecast ahead, investing in Litecoin this year could prove to be very profitable. Litecoin recently experienced a 90% drawdown. In the past, such events were in hindsight a long term bottom and an incredible investment opportunity. Litecoin currently presents a high reward, low risk setup for those who missed the crypto rally the first time around.

What will Litecoin be worth in 2025?

Litecoin could be worth considering the parallel price channel anywhere from $150 per LTC to nearly $10,000 per coin. There is no guarantee that Litecoin ever returns to the upper boundary of the well-defined price channel. Refer to the many Litecoin price predictions above for direct answers related to the year 2025.

What will be the value of Litecoin in 2030?

Anything is possible with that long of a time horizon. 2030 is a full eight years from now. In Litecoin’s first eight years on the market, it rose from $1 per LTC to more than $360 per coin, representing more than a 30,000% ROI. Even with the law of diminishing returns, Litecoin could theoretically experience another massive rally in the same time period. Refer to the many Litecoin price predictions above for direct answers related to the year 2030.

Will Litecoin be the next Bitcoin?

Litecoin will never be “the next Bitcoin” and nothing ever will be. Litecoin, however, is built using modified Bitcoin code and features many similarities with the top cryptocurrency. Litecoin is often considered the silver to Bitcoin as digital gold. Both have a scarce supply and a halving model that reduces the block reward miners receive over time. Litecoin is four times faster to send than Bitcoin, and has four times the supply of coins,

Can Litecoin overtake Bitcoin?

Anything is possible, so never say never regarding Litecoin overtaking Bitcoin. However, it is very improbable for many reasons, not limited to the fact Bitcoin had early mover advantage and much wider adoption. Billions of dollars of capital would have to come into Litecoin for it to have a chance to take on Bitcoin. There is also a difference of Litecoin overtaking Bitcoin in price versus its rank in market cap. Because Litecoin has a supply of 84 million LTC versus a supply of 21 million BTC, the price per LTC is unlikely to ever surpass the price per BTC.

What is the Mimblewimble upgrade?

The Mimblewimble upgrade has finally gone live on Litecoin and enables anonymous privacy features for the popular altcoin. It also includes other Litecoin network improvements, such as reduced transaction clutter. The increase in privacy has caused some exchanges to delist Litecoin in Asia.