Michael Saylor, the founder of MicroStrategy, has just tweeted on December 5 to his 2.8 million followers a chart that shows the percentage of crypto holders in various countries while asserting that “no force on earth can stop Bitcoin when the time has come”. The CEO of MicroStrategy, which holds 130,000 BTC on its balance sheet, has always been an outspoken proponent of Bitcoin and has lately been actively appearing on various interviews to defend his take on Bitcoin even as the value of his investment has fallen by more than $1.5 billion.

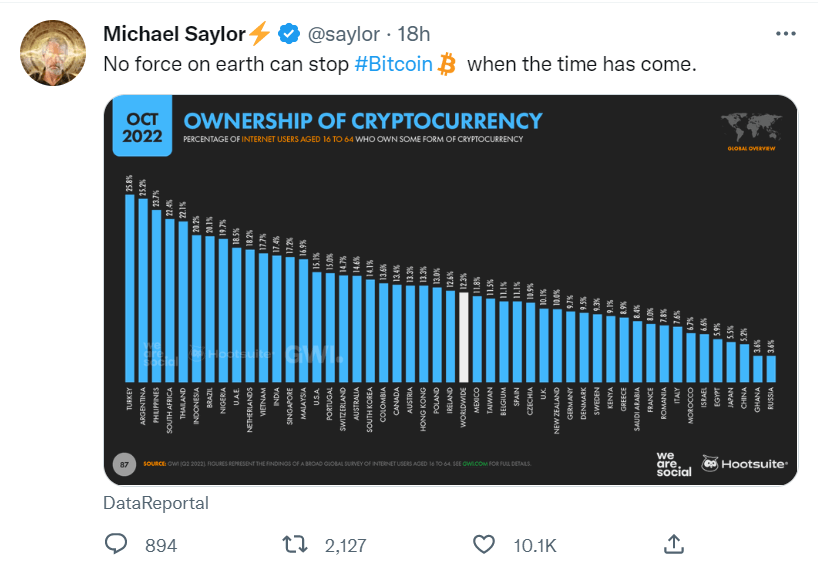

The graph is from the social media marketing and management tool, Hootsuite, that shows the proportion of global internet users as a percentage of their local population who own cryptocurrency. The results were based on a global survey of internet users between the ages of 16 and 64 that market research firm GWI did for the month of October, which means the information is pretty up to date.

Countries with Fast Declining Purchasing Power Owns Most Crypto

What the graph shows is that amongst all nations, Turkey has the highest percentage of crypto adoption, with around 25.8% of its residents owning some sort of cryptocurrency. Argentina is in second place with 25.2% of its population owning cryptocurrency. This is hardly surprising, as the national currencies of both countries, especially that of Turkey, has been declining the most in recent times. Both countries are also plagued with extremely high levels of inflation.

For instance, the Turkish lira lost 44% of its value last year, and a further 20% this year, against the currencies of the G7 nations, and in particular, the US dollar. The annual inflation rate from June 2021 to June 2022 in Turkey is also spiraling out of control, with average price increases from last year to this year reportedly as high as 78.6%, as food prices double and transport costs increase 123%. With a fast depreciating local currency and sky high inflation, it is no wonder that the Turkish people are turning to crypto to protect their purchasing power. Thus, Michael Saylor had his point when he said that “Bitcoin is hope” in a November 3 tweet. Without crypto, these people would have no hope of being able to catch up with the costs of living.

The conclusion we can derive from the graph above is that crypto adoption is gaining traction especially in countries where fiat currency is failing and inflation is rampant, which is hardly surprising.

In third place comes the Philippines, with 23.7% of its population owning cryptocurrency, followed by South Africa with 22.4%. 22.1%, 20.2%, and 20.1% of the population in Thailand, Indonesia, and Brazil, respectively, own some sort of cryptocurrency.

Comparatively, the Netherlands, India, the US, and the UK each have 18.2%, 17.4%, 15.1%, and 10.1% of cryptocurrency owners amongst their population, while China and Russia are in last place with 5.2% and 3.6%, respectively. The low proportion of crypto holders in China shows that the China ban on crypto has been a great success, as China used to have one of the largest proportions of its population investing in crypto. Interestingly, other countries in Asia with a large or predominant Chinese race, like Singapore, Malaysia, and Indonesia, rank higher than its global peers in terms of crypto adoption.

Crypto Adoption Globally Still Very Low

Most readers would be more interested in how much of the global population owns crypto, and we have good news to report. According to the report, which is up to date to October this year, only 12.3% of the world’s population has owned cryptocurrencies, which is a very low ratio. This means we are still early adopters and for readers who have not yet jumped onto the crypto bandwagon, you are not too late as there is still 87.7% of the world population behind you. If crypto prices have gone up more than 100x (some 10,000x) with only 12.3% of the global population invested in it, can you imagine what the upside potential can be if even just another 10% or 20% of the global population gets into crypto? The possibility of greater adoption is high since soaring inflation and declining purchasing power of fiat currencies has been felt more and more in the last couple of years. The advancement of technology and onboarding of crypto by various payment platforms is also making it far easier to get into crypto now than before, thus, the road to adoption could only get easier. While regulations could be a big obstacle towards adoption, they are but speed bumps on the road which will likely only slow down adoption, but they cannot put a stop to what is inevitable. Regulation issues will only plague the sector in the short-term since these issues can be resolved and clarified with the passage of time. As such, crypto investment should be taken with a long-term approach.

Interestingly, Michael Saylor also dished out a similar advice on crypto investment recently at the Los Angeles Pacific Bitcoin Conference. Using Bitcoin as a reference, he said, “If you’re buying Bitcoin and you’ve got less than a four-year time horizon, you’re just speculating. And once you’ve got more than a four-year time horizon, then the obvious thing is your dollar-cost average.” In other words, Bitcoin and crypto are for long-term investors. To reap the benefits, you must have a long-term view and not be a short-term speculator.

The above are the personal opinions of the author and should not be taken as the official view of the Margex platform. They are also not financial advice and are only meant to be informative in nature. Thus, they should not be construed as a solicitation to trade. Readers are strongly encouraged to do your own research, conduct due diligence, and assess your financial abilities before doing any investment or trading as these activities carry risks. Should you be in doubt, kindly speak with your personal financial advisor.