Early November, MoneyGram, a leader in digital P2P payments, announced the launch of a new service that will allow users of the MoneyGram mobile app to buy, trade and store cryptocurrencies. This service will be immediately available to users in America, while the service would be expanded to users in other countries later on. The service will start off with three cryptocurrencies, namely, Bitcoin, Ethereum and Litecoin.

Adding Bitcoin and Ethereum is Expected

Supporting Bitcoin and Ethereum is to be expected since these two are the most well-known cryptos and are the two largest market cap coins. Thus, the announcement did not have a material impact on the price of the two top coins. Another reason for the lack of response could be that these two coins are already quite commonly held and so, the addition by MoneyGram would not make much of a difference in their adoption.

Adding Litecoin is a Vote of Confidence

However, the case with Litecoin is a bit different. The addition of Litecoin has made the price of LTC jump by more than 20%. There could be various reasons why so let us discuss them below.

Litecoin has been out of the limelight and out of favour due to the rise of smart contract platforms and NFTs in the 2021 bull run, which has left payment networks like Litecoin largely forgotten by the crypto investing public.

However, applications and merchants are still very keen on payment tokens, since payment networks are more likely to be the link between crypto and the real-world than smart contracts or DeFi or NFT. We need to send payments on our day-to-day lives many times a day, and while the hype in the last bull run has been on smart contracts, the consistent adoption of Litecoin has made investors sit up and realise that a payment token like Litecoin could have more real life usage and be preferred by merchants, than say, a DeFi token.

As Charlie Lee, the founder of Litecoin has always mentioned, real life adoption is key for Litecoin, and the man has very excitedly also tweeted about the MoneyGram good news to his followers.

This tweet by Charlie Lee is significant in that it shows that the man is still very much involved in Litecoin and has not abandoned the project. Many investors had dumped their Litecoins after Charlie Lee sold all his LTC tokens a couple of years ago, thinking that he may be abandoning the blockchain. However, as non-Litecoin followers may not be aware, Charlie is still there working on Litecoin and the latest Litecoin Summit where he gave a keynote speech is evidence.

New Publicity for Long Forgotten Litecoin

Charlie Lee has reasons to be excited. The positive news flow from MoneyGram may lead crypto investors to rethink their investment portfolios, as many have been lured by the hype of newer DeFi and NFT concept tokens in the summer of 2021 and lost substantial amounts of their investments after these tokens dropped to almost zero value in the current bear market. Litecoin, in comparison, has been around since 2011 and is still surviving well today and is slowly but surely gaining acceptance in mainstream businesses, as can be seen where MoneyGram and almost every other crypto accepting platform supports Litecoin. This makes Litecoin a good candidate to be a mainstay crypto asset just like Bitcoin and Ethereum.

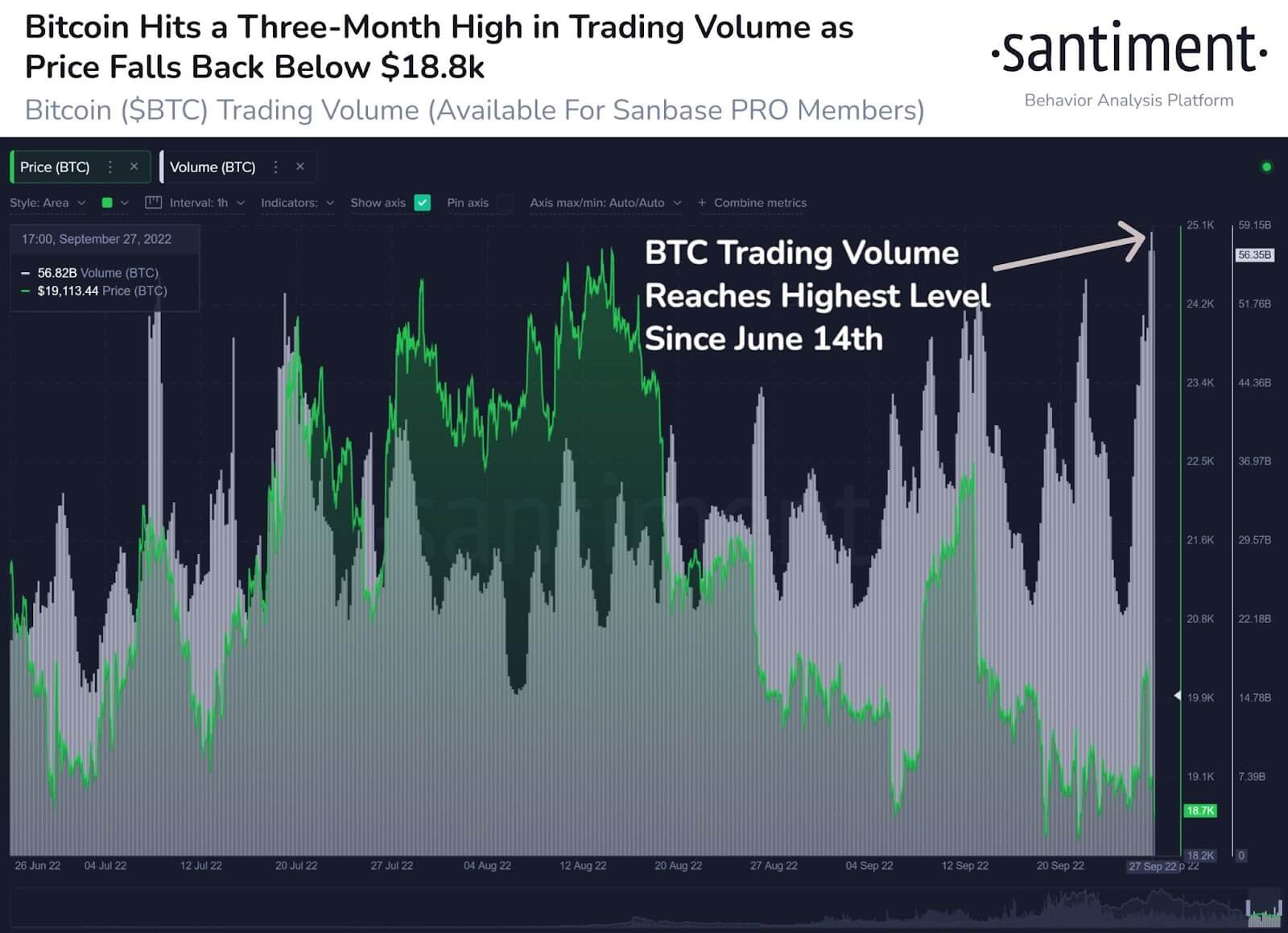

Blockchain analytics firm Santiment has noticed this change in sentiment towards Litecoin, reporting that the LTC token had jumped by 7.5% within three hours after the MoneyGram news was announced.

The firm further noted that since May 27, the number of addresses holding more than 1,000 LTC had grown by 8.2%, signalling that whales have been accumulating the payments token when the crypto market was undergoing a correction.

Santiment also noted that LTC’s jump was in contrast with the rest of the market, which had been rather quiet in early November, and led them to opine that Litecoin had decoupled from the other coins. As evidence, Sanitment pointed out that Litecoin had outperformed Bitcoin by 51% since June 12.

Could this outperformance be a result of people with knowledge of the MoneyGram addition front running the news, or could it signify something bigger, like a shift in holder interest in Litecoin? Time will tell after the impact of the MoneyGram news dies off in about a week.

Lower Price Point Gives Litecoin an Edge

MoneyGram supporting two other more highly priced cryptocurrencies also benefits Litecoin. It is a proven fact that new entrants to crypto investment like to purchase lower priced coins because they see it as better “value”. While this may sound strange to the seasoned investor, it is a psychological effect that cannot be ignored. Litecoin thus has a huge advantage over Bitcoin which is $20,000 and Ethereum which is 1,500, when it is a “wallet-friendly” $64.

Should Litecoin be able to hold on to its recent gains, it could be a sign of better times to come. The signs are already showing, as the number of new addresses created for Litecoin has been increasing at a higher percentage than Bitcoin.

In the past 11 months, LTC added 45 million new addresses, equalling to around 28% of all LTC addresses created. While Bitcoin had a higher number of new addresses created, at 122 million, this amount is only 11.7% of all BTC addresses created, which means that in relative terms, LTC addresses are growing at a historically faster rate than BTC addresses. This development can only mean good things for the growth of Litecoin.

Lower Popularity a Plus for Litecoin

Furthermore, since Litecoin is not a crypto popularly held by institutional investors yet, there is room for growth once they realise its potential. At the same time, there is not a lot of derivative products on Litecoin due to a general lack of hype, which serves it well in a bear market where the unwinding of leveraged positions could cause prices of popular cryptos to plummet, just like what we have seen happening to Bitcoin when LUNA Foundation liquidated its BTC and when Three Arrows Capital liquidated their ETH. This is not likely to happen to LTC as LTC does not have any single large volume investor.

With Litecoin’s halving set to occur early next August, the number of LTC that miners will receive as block reward will be halved. Just like how the halving always led to a rise in Bitcoin’s price, the Litecoin halving next year could be another driving force for the price of Litecoin, while Bitcoins’s halving is still two years away. Thus, interest in Litecoin could start to grow in the lead up to Litecoin’s halving, and this endorsement in Litecoin by MoneyGram could not have come at a better time to renew interest and generate buzz for the coin that has been touted as the silver to Bitcoin’s gold.