One interesting observation in the aftermath of the FTX scandal is an increase in small Bitcoin holders. Many would have expected that a scandal of such a large proportion would drive away retail investors who would be selling their coins and leaving the crypto scene. However, the data is speaking otherwise, as there has been an increase in the number of small Bitcoin wallets in recent days post the FTX bankruptcy.

Small Buyers Nibbling at Bitcoin

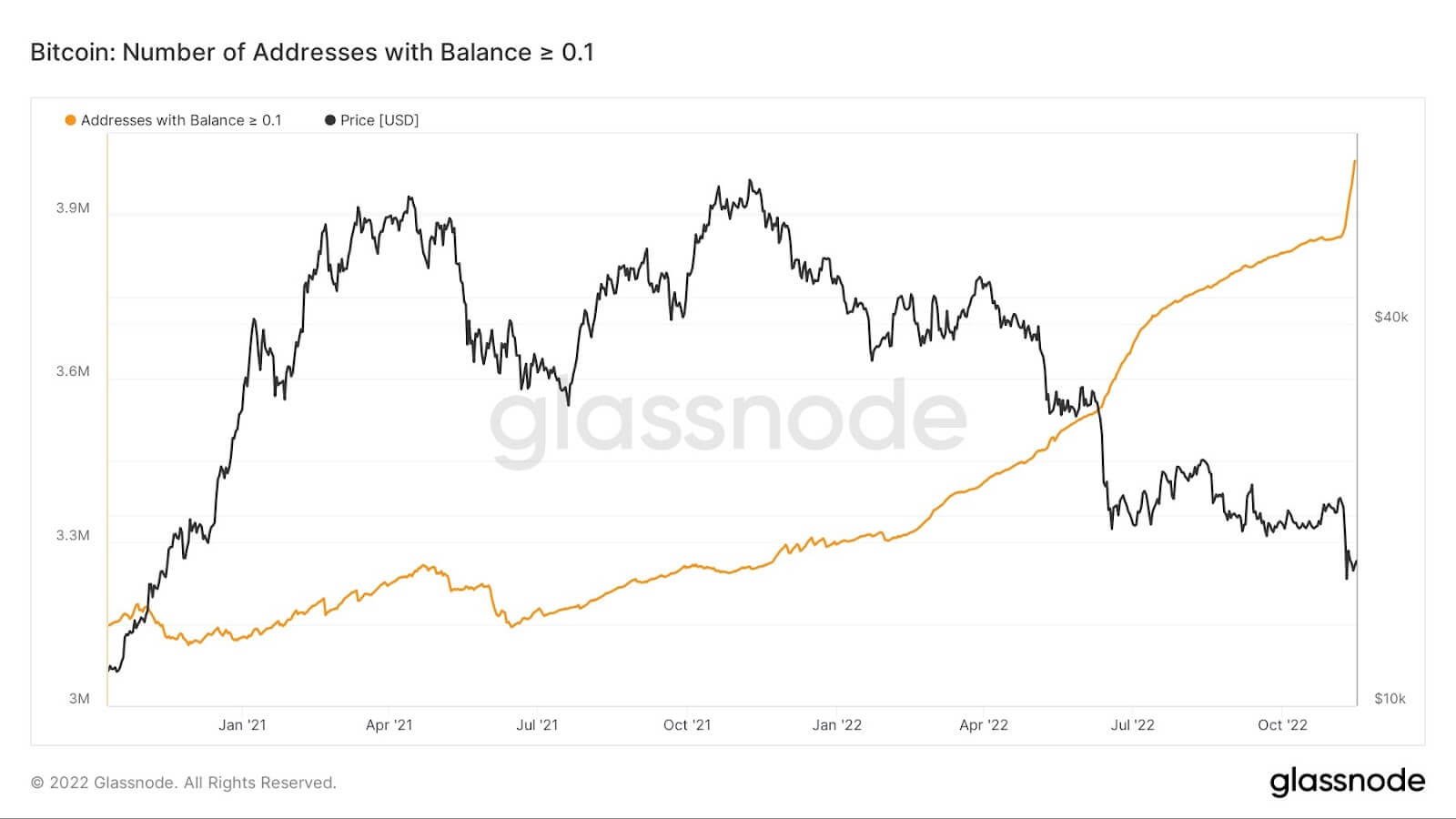

As can be seen from onchain data provider Glassnode’s chart below, the number of small Bitcoin holders with less than 0.1 BTC has spiked up almost vertically after the price of Bitcoin started crashing in the selloff caused by the FTX bankruptcy. The total number of wallets containing at least 0.1 BTC has now passed 4 million, up from around 3.8 million before the FTX incident. To put things into perspective, if one thinks that 200,000 new wallets in two weeks is not a large number, bear in mind that it took Bitcoin 14 years, or 784 weeks to hit 3.8 million wallets, which translates to around 9,694 wallets every two weeks. Compare 9,694 wallets to 200,000 wallets.

While it can be argued that these could be users withdrawing funds from exchanges into self custody, the size of the amount of Bitcoin held hints that these may not be users who simply withdrew from exchanges for a variety of reasons.

First, the dollar value of 0.1 BTC is less by $1,700 at today’s price, which implies that the absolute amount of each wallet is less than $1,700. With Bitcoin’s network fee of almost $20, it would not make much sense for users to feel incentivized to withdraw coins they have kept at exchanges because the cost of transferring to and fro makes it not worthwhile.

Secondly, holders of such an amount of Bitcoin may not feel the pinch if they were to lose their Bitcoins to an unfortunate event like an exchange bankruptcy as much as larger holders. While it is not a nice thing to be saying, it is a fact that most crypto investors would not be severely impacted by a loss of $1,700 or less. If a person has difficulty living if he loses $1,700, it is unlikely that he will be invested in crypto in the first place as crypto is well-known to be an extremely high risk investment not for the faint hearted.

Hence, for the reasons above, these wallet addresses would seem more likely to be new buyers of Bitcoin who are taking advantage of the current dip to enter the market and start accumulating Bitcoin on the cheap.

Long Term Holders Profit Ratio Lowest in Two Years

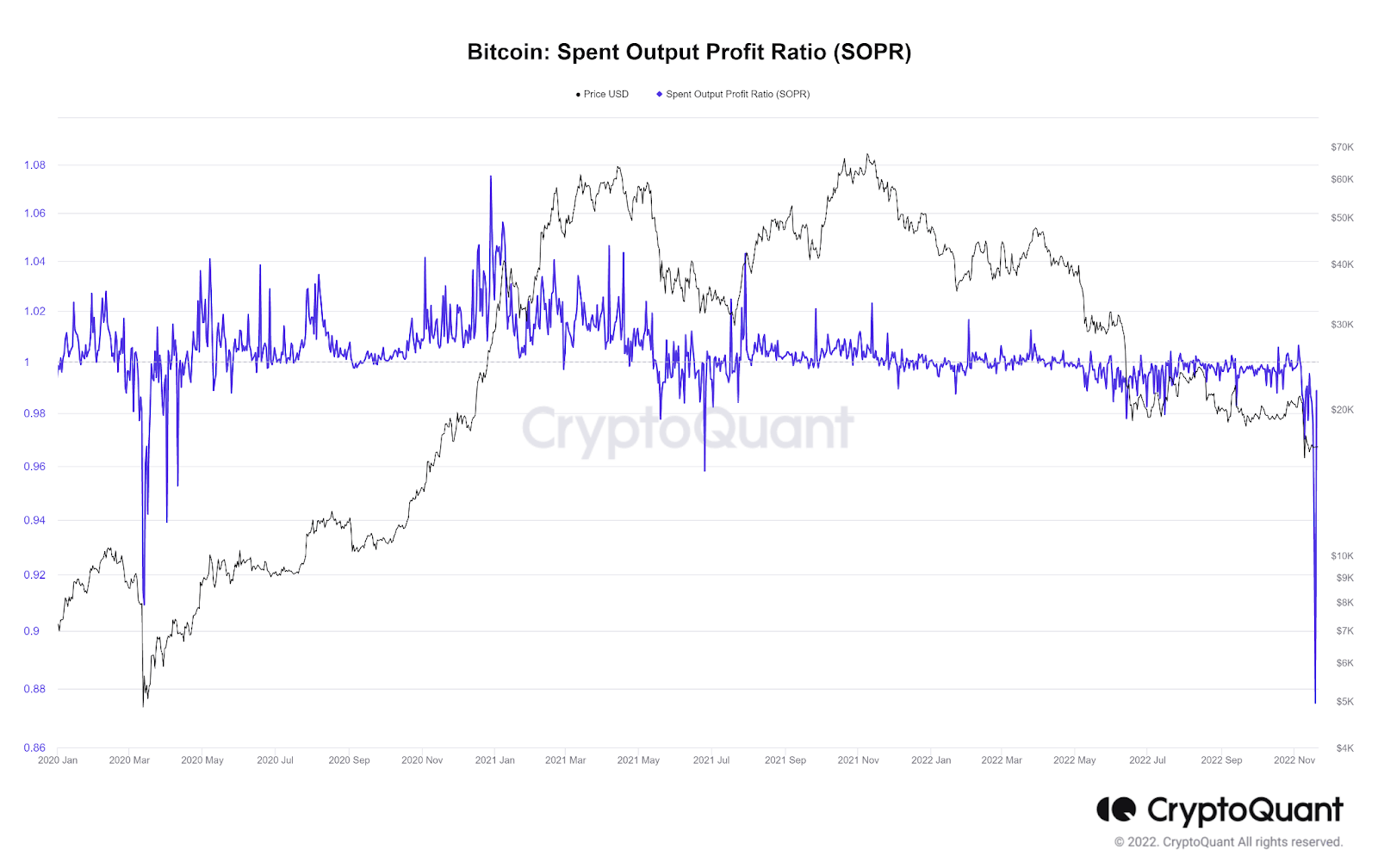

Meanwhile, while new buyers are swooping in to buy the dip, old Bitcoin holders are feeling the pinch from the market drawdown. According to data from CryptoQuant, Bitcoin’s long-term holders’ spent output profit ratio (LTH-SOPR) has now fallen to two-year lows.

SOPR divides the realized value of coins in a spent output by their value at creation. In other words, its value is derived by dividing a Bitcoin transaction’s average selling price over its average purchase price, and is used to gauge the profitability of coins sold.

SOPR usually fluctuates around 1 and tends to be below this level during bear markets and above it in bull markets, implying that in bull markets, holders on average, are selling at a loss.

The Bitcoin LTH-SOPR as of mid-November is 0.9847, its lowest since the March 2020 COVID crash. During that crash, the Bitcoin SOPR dipped to a low of 0.9486. However, it was still not as low as the end of the 2018 bear market, which clocked a reading of 0.9416. This may imply that Bitcoin could still have some room to roam lower before it finally hits the bear market bottom.

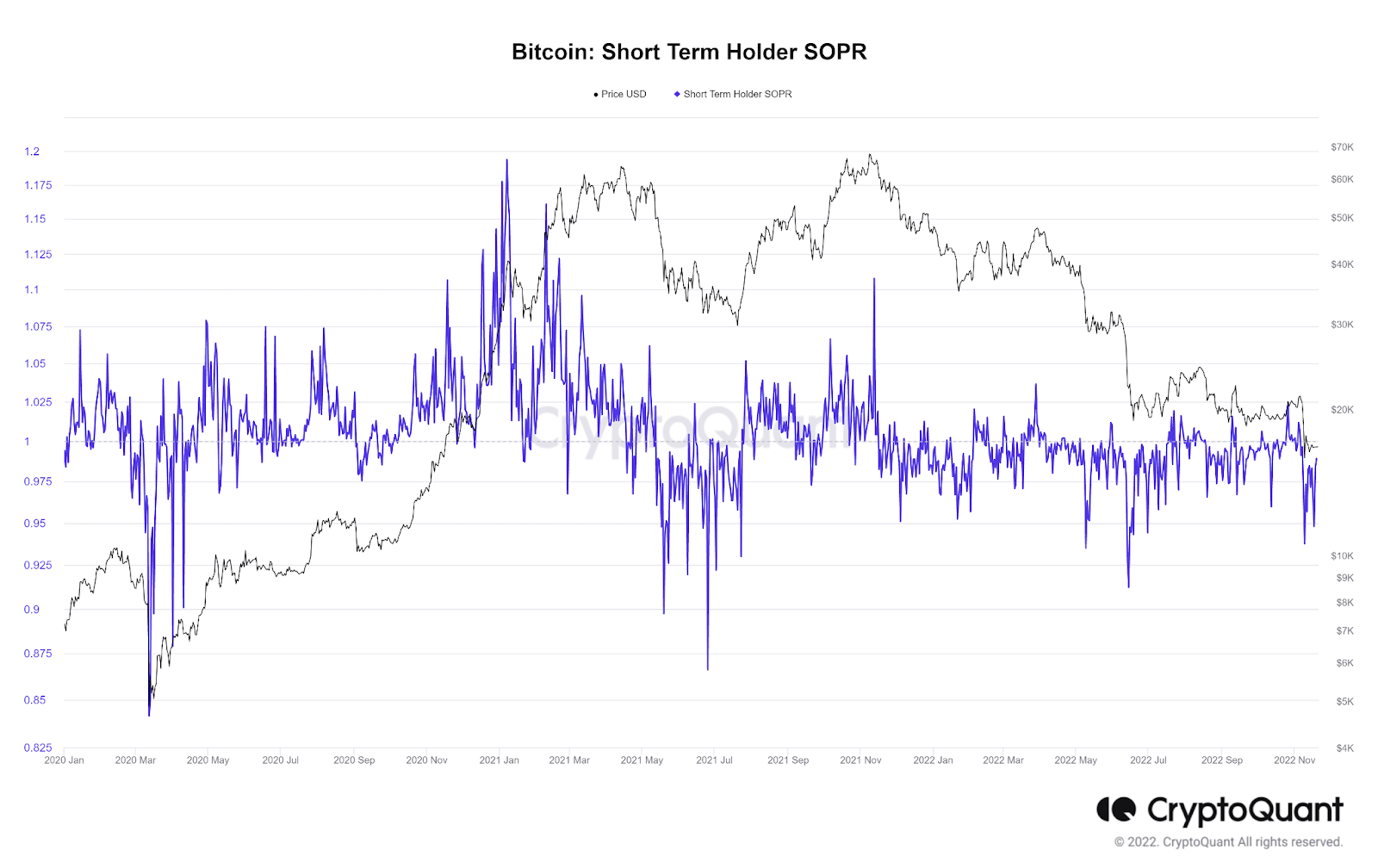

Short Term Holders Are In Minimal Losses

New buyers however, are still feeling relative ease, with the Bitcoin short-term holders’ SOPR (STH-SOPR) as of mid-November at 0.9891, only slightly below 1. The better performance of short-term holders could be one reason why small nibblers have been in accumulation mode as they are currently not seeing significant losses.

With long-term holders hit with the largest drawdown in two years, they may not have the capacity to support the price of Bitcoin. As such, the short-term fate of Bitcoin could lay in the hands of “no-coiners”, as more first time buyers may be required to keep the price of Bitcoin supported.

With institutional investors possibly very wary of the space with the mainstream media misreporting on some facts about the FTX collapse, this class of investor could be hard to come by in the near-term, and as more negative news about companies impacted by the FTX bankruptcy come forth in the coming days and weeks, the chances of institutional support is even more remote. It could take at least until more regulations are being put in place before any institutional investor would come back into the crypto scene.

This leaves us with only the retail players, which may not be such a bad idea. The crypto market did well and saw 3 bull runs up to 2018 before the first institutional investors came onto the scene anyway, and with them now gone, the lack of institutional influence may end up serving the crypto community better than what we expect, and crypto could go back to its basics and finally grow in true decentralized ways, which is what crypto have been made for in the first place – to serve the common people and not the institutions.