The crypto market is a good spot for making huge funds. But before you start the journey, you must know the dangers of cryptocurrency. Many cryptocurrency investors have lost their funds to scams and exploits in the industry.

The major risks lie in price volatility. Cryptocurrencies are unstable, speculative, and high-risk. When getting into this system, it’s crucial to know the possible cryptocurrency risks. Some other must-know risks of cryptocurrency include fake crypto exchanges, storage risks, crypto pump-and-dump, trading risks, etc.

This article provides details on these risks and how to mitigate them. Read on for clearer insights into cryptocurrency risks.

Risks Of Cryptocurrency

Some traders and cryptocurrency investors have become victims of the numerous harms of cryptocurrency. Some of the common risks include:

Storage Risks

Buying cryptocurrencies comes with the added responsibility of storing them properly. Cryptocurrency holders can opt for a digital/hot wallet or a cold offline wallet.

Cold wallets are safe, yes, but if you forget the key to your wallet, your crypto assets are gone forever. This is one of the risks of cryptocurrency to avoid. Some users who lost their keys in the past forfeited their tokens.

Also, using a digital wallet can expose your assets to hack attempts on the exchange storing the wallet. That’s why you must only store small amounts of coins in hot wallets to protect your funds.

Crypto Scams

Crypto pump and dump scams

Every crypto activity with a digital currency on blockchain technology attracts bad actors. These criminals achieve their selfish gains through the pump-and-dump scheme. Creating a new project is easy with proper coding knowledge, making these pump-and-dump schemes successful.

Once the scammers develop a cryptocurrency project, they’ll suddenly create false hype around it to push value. Fear Of Missing Out (FOMO) will make many investors jump on the project without a thorough check.

Once enough people have invested money in the project, the scam organizers quickly sell all their tokens. The sale of many tokens at once will cause the price to crash, leaving investors high and dry. This practice is sometimes called a “rug pull” in crypto circles, which is one deadly risk of owning crypto.

One sign to identify such projects is that the coins mostly have little value and are purchased in large volumes. Also, altcoins are easy for these scammers to influence since it is harder to dump established projects like bitcoin.

Fake cryptocurrency exchanges

These exchanges go the extra mile to prove false legitimacy. They can even have a celebrity endorsement or follow users with aggressive marketing. Then, the operators will encourage cryptocurrency holders to deposit and even deceive them with manipulated trade pages.

These exchanges use advanced techniques like “typosquatting” to get access to users. When a user mistakenly enters a typo or an error, they are directed to their scam site rather than the real exchange.

How to identify fake crypto exchanges

It is advisable to only go for the industry’s popular and registered crypto exchanges. But you can identify the scammers through some features.

- Unreasonably high return on investment: If an exchange promise returns that are too good to be true or guaranteed profits, it is a red flag. Due to price volatility, there are no guarantees in the crypto market. So any “sure profit” scheme is fake.

- Too much contact: an exchange that seems so focused on bombarding you with emails and calls is suspicious. Once you make a deposit the attention will reduce since the mission is complete.

- Unexplained high registration, withdrawal fees, and tax: If it seems like your exchange is bent on fleecing you with charges, it is a sure sign of a scam site.

- The website layout: A website with many pop-ups constantly requesting permission and private information is a sign of a scam site.

Phishing, smishing, and vishing scams

Phishing is correspondence by fraudulent emails seeking to get personal data from the receiving address. . Many crypto users have fallen into this trap and unknowingly released details about their cryptocurrency wallet.

This malicious team sends phishing emails to their targets to fleece them of their coins.

Smishing, on the other hand, is an attempt to carry out phishing activities through SMS on victims.

Vishing scams involve calls that convince users to part with personal information like wallet keys. This information can be used to hack into their account and steal crypto tokens.

To avoid most of these attempts, store large crypto tokens in a cold wallet that is offline and hard to access by malicious people. Then, never open links you do not know. Also, be wary of calls from strangers soliciting you to part with vital personal information.

Ransomware

This is a form of malware used as an extortion device by cybercriminals. It locks your system and requests a specific sum of money or crypto to grant your access to your files. The perpetrators might also engage in blackmail tactics threatening to reveal sensitive content to the general public from your device. These attackers can also infest many computers simultaneously using botnets.

Digital hygiene practices are the best way to prevent such attacks. Mind what you click on and who has access to your crypto wallet. Note this malware is normally embedded in emails to disguise its vicious nature.

Trading Risks

The crypto market is uncertain, and price volatility is a given. People carry out different crypto activities during the day. But cryptocurrency trading is foremost.

Unfortunately, the cryptocurrency market sometimes records sudden dips and swings that could turn a profitable trade into a losing one. Therefore, you must understand trading and its instruments to avoid certain losses.

Thankfully, some crypto investors have ventured into holding cryptocurrency on exchanges through staking. Many wallet providers are also centralized exchanges serving as cryptocurrency holders for users to avoid certain trading risks.

CFDs and spread bet risks

Contracts for difference (CFDs) also carry an amount of risk for investors. Here a trader takes a position regarding the future value of a crypto asset. Spread betting lets an investor speculate if the market will rise or fall.

However, there are also risks with this type of crypto trading.

- They are affected by gapping: The volatile market can cause a price jump where the market does not pass through the predicted level of the trader. Slippage (gapping) occurs when the market is in a highly volatile phase. This could lead to a poorly executed stop-loss, especially when the market trend changes.

- Variations in pricing: The prices of cryptocurrency vary compared to fiat currencies. This can cause variations in spread bets and CFDs.

- Highly speculative: In this trade, you can open a position with a fraction of the full trade value. This is referred to as leverage. However, if the market becomes unfavourable, your losses will also increase.

Legal Risks

Understanding the legal risks of cryptocurrencies is crucial to investors. Some notable ones include:

Foreign bank accounts and cryptocurrency

A foreign crypto bank account is not reportable, according to federal law. So, it’s impossible to file disclosures of such accounts to FinCEN (Financial Crimes Enforcement Network).

But, FinCEN is aiming to amend the filing requirement to include crypto wallets. In such a scenario, investors must file a FATCA, FBAR, or both for wallet owners. Failure to adhere to the demands attracts criminal penalties and fines.

Decentralization issues

The decentralized nature of cryptocurrencies is advantageous to investors, but there’s also a caveat. The term decentralized means these coins are not physically present, so they have no backup from a central authority. So, there’s a limit to their usability.

Attraction of taxes

The United States IRS doesn’t see cryptocurrencies as currencies but as properties. As a result, they ascribe high taxes to holders of these digital tokens. Therefore, as a crypto investor, you are liable for such fees.

Fraud cases

Traditional victims of fraudulence cases have the right to report such issues to a central authority. However, crypto investors don’t have the same rights, which leaves them helpless in such situations.

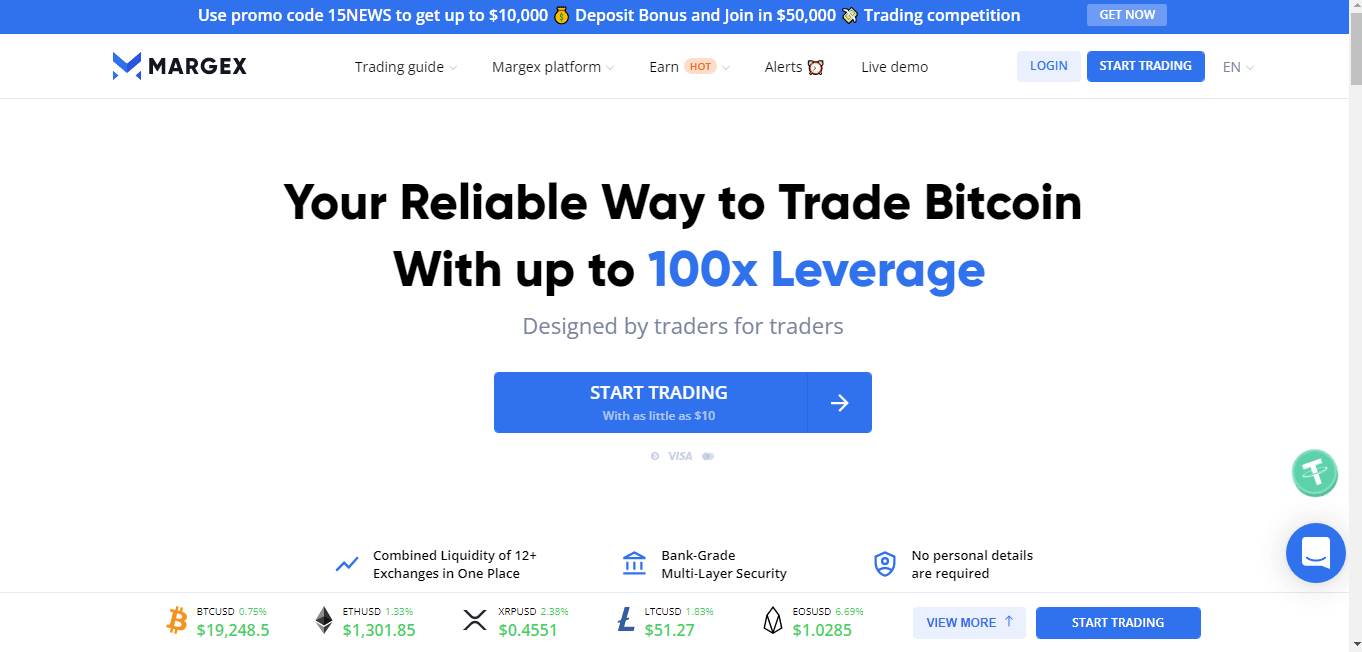

How Does Margex Help You Minimize Crypto Risk

Cryptocurrency investment comes with some risks. As a forward-thinking platform, Margex has measures that secure and protects users’ trading capital. Some of these features are:

MP shield

Price manipulation is a challenge that exists even in the global financial markets. Margex MP shield protects traders from setbacks that can easily liquidate their assets.

How it works

On the Margex platform, the price of an asset depends on combined liquidity from over 12 different providers. Also, Margex does not offer assets with no liquidity but with artificially inflated prices.

These practices protect users from pump-and-dump scams where fake projects are promoted. With AI-based algorithmic technology, Margex keeps a close watch on price data from each liquidity provider.

The platform offers a level playing field for all traders and monitors all suspicious trading activities.

Stop loss

The platform offers a stop-loss feature that enables traders set their trades on autopilot. With this feature, you can determine how much draw-down your trading account can take in a particular section.

Responsive customer support

Margex customer service team is readily available to serve your needs. You can immediately reach out to the team if you have concerns regarding suspicious activities on your account.

Margex supports a live chat feature that allows instant access to lay out your complaints or observations.

Cutting-edge security framework

User privacy and security are the topmost priority on the Margex platform. The following features are used to ensure this:

2FA: With the two-factor authentication feature supported by google, your account is secured even if your email or password is compromised.

SSL encryption: This feature encrypts your data with deep coding to ensure that there is no breach between your browser and Margex.

Email notifications/alerts: These notifications keep you updated on all activities on your account.

Withdrawal limit: withdrawals can be processed only once per day by the treasury department of Margex. This makes it more difficult for your funds to be transferred without your knowledge.

FAQ-Common Questions And Answers On Crypto Risks.

The answers below will help you understand more of the common risks of a cryptocurrency holder in investments.

What is the biggest cryptocurrency risk?

The major risk with digital currencies is price volatility. Cryptocurrency prices drop based on market sentiments, news, and crypto activities. Sometimes, these price changes could rise to hundreds and thousands of dollars.

Are crypto assets high-risk?

Cryptocurrencies are high-risk investments. The market can sometimes be very volatile, dropping the price of the coins rapidly within a short period. For investors, such price actions result in huge losses.

Between crypto and stocks, which is riskier?

The cryptocurrency market is riskier than stock. While the stock market maintains a steadier price movement, cryptocurrencies remain volatile – the centre of its riskiness.

Which crypto is the safest?

One of the safest cryptocurrencies in terms of volatility is the Aleph.in USD (ALEPH-USD) tokens. At the time of writing, the coin trades at $0.1122 with a market cap of $27,793,953.11. ALEPH-USD has a total supply of 500 million tokens and a circulating supply of 247,220,482.

Other stable cryptocurrencies are Venus ETH USD (VETH-USD) and Portion USD (PRT-USD). Both tokens are trading at $11.33 and $0.003295, respectively.