Polkadot and Cardano are two of the most popular crypto projects marked as alternatives to Ethereum. They both have a common root as their founders Charles Hoskinson, and Dr Gavin Wood were both parts of the Ethereum project.

Both projects’ success and unique approaches have resulted in several debates about the similarities and differences. We’ll be exploring some of the key features of these blockchain platforms and highlighting their strengths and weakness

Comparison Table: Polkadot Vs Cardano

Here’s a comparison table that compares the differences between Polkadot and Cardano blockchains.

Cardano: An Overview

Cardano is one of the most established open-source and proof-of-stake blockchain networks ever since its launch in 2015 by Charles Hoskinson. Viewed as the next Ethereum, the platform offers smart contracts and allows users to develop decentralised applications, DeFi and other blockchain services with lower transaction fees.

So far, this blockchain technology stands out from other networks because, as a third-generation platform, Cardano adopts a unique protocol within the Proof-of-Stake consensus mechanism called the Ouroboros protocol. Ouroboros consensus mechanism favours the environment compared to the Proof-of-Work protocol. As a result, the network can process over 250 transactions per second.

Another reason Cardano remains a leading blockchain network is that it effectively connects security, decentralisation, scalability, flexibility and sustainability. While Bitcoin and Ethereum had their lapses in terms of scalability and limited transaction capabilities as first and second-generation blockchains, respectively, Cardano, as a third-generation blockchain, has provided an effective means of operation compared to other blockchains.

Cardano’s technology

Interestingly, the Cardano blockchain works effectively with two layers: Cardano Settlement Layer and Cardano Computation Layer.

The CSL is the first layer that runs peer-to-peer transactions on the blockchain, while the CCL is the second layer that helps scale specific protocols. As a result, the combination of both layers allows smart contracts to run independently without being hindered by transaction verification requirements.

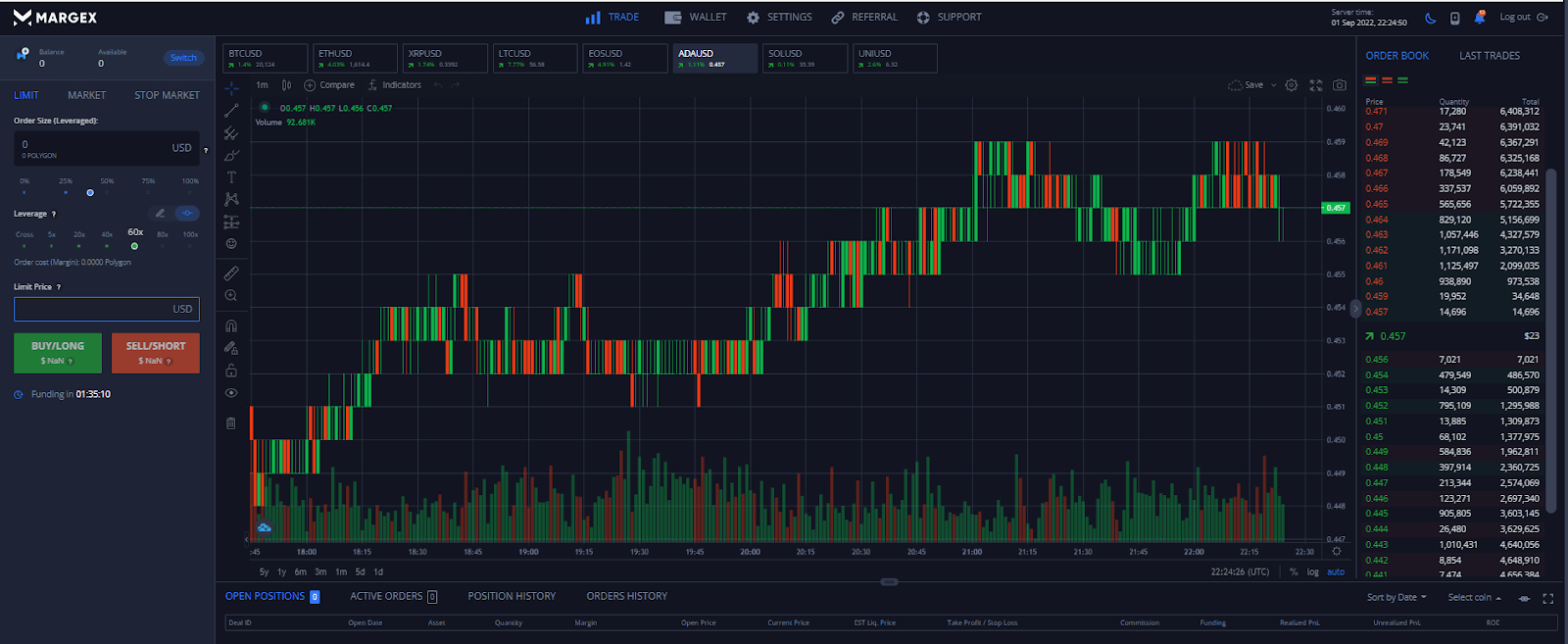

ADA’s price history

ADA token, the native cryptocurrency of the Cardano blockchain named after Ada Lovelace, a renowned mathematician, can be staked to earn more income and rights to vote and governance within the ecosystem.

After Cardano’s launch in 2017, ADA exchanged hands at $0.02 till the end of that year. However, the price was boosted by 260% in 2018 due to the bullish crypto market situation. This run saw the ADA move from $0.367 to $1.33 on January 4, 2018. The value increase did not last long as it fell back to $0.08. Nevertheless, the asset stood out in the market with its potential.

By 2021, ADA experienced exponential growth in January. The token started trading at $0.1814 on January 1, which moved to $0.3654 by January 16. The month that followed was even more interesting for the asset.

On February 5th, the token surged by 25% within hours from $0.4396 to $0.556. Following this gain, ADA began trading at $0.9439 on February 10, boosting the asset by 70% in five days. It did not take long before ADA broke through to $1 as the token rose to $1.12 ten days after.

Between March 13th and April 14th, Cardano’s price continued to move inconsistently in the crypto market as it hung around $0.9931 to $1.56. By April 23 2021, the asset fell to $0.9352 before closing at $1.16 at the end of that day. ADA hit $1.55 on May 12th and reached $2.46 four days after.

The price rally did not last long as the crypto market collapsed on May 19th, 2021, causing ADA to lose half its value to $1.48. The dip did not last long as the token reached an all-time high of $3.10 on September 2nd, 2021. Nevertheless, the token’s price fell to $2.64 after the Alonzo Fork launch on September 12th.

By October, ADA’s price moved between $2.10 to $2.23 as it maintained the $2 mark. The following month did not look suitable for Cardano as eToro, a leading crypto exchange platform, announced delisting many crypto assets, including ADA. By December, the token closed for the year at $1.31.

The token finally surged to $1.63 on January 18, 2022, after Cardano organised a campaign to plant and record a million trees on the blockchain to show the platform’s commitment to transparency and land preservation. However, the coin ended the month at $1.01.

The next month, Cardano celebrated a significant milestone of surpassing 30 million transactions on its blockchain. However, the crises between Russia and Ukraine negatively affected the token’s price as it drastically fell to $0.7528 on February 24th, 2022. Nevertheless, the asset’s price recovered and settled at $1 on March 1st.

Cardano gained support from Greyscale, a crypto investment company, as its stocks boosted, and the price rose between $0.96 to $0.98 on March 22. In the following days, ADA enjoyed a price rally that took its value to $1.24 on March 28th and 29th, 2022.

China’s ban on crypto trading affected prominent cryptocurrencies, including ADA, on April 11 as its price dipped to $0.9201. Furthermore, the ongoing bear run saw the asset close the month underwhelmingly at $0.7567, but it rose to $0.79 on May 6th. Terra’s collapse saw the market fall under the pressure of the heavy bear waves as ADA started trading at $0.535 before moving slightly to $0.585 by June 1st.

Cardano is currently ranked as the 8th most-valuable token in the crypto market, with a market capitalisation of $15,461,951,694. As of the time of writing, ADA is exchanging hands at $0.4552.

Cardano’s scalability

For a blockchain to be effective for global users who are constantly making transactions daily, it has to be scalable. Scalability allows the Cardano platform to process many transactions irrespective of the number of participants.

Additionally, the network has executed various updates that provide easy data management on the blockchain. As a result, Cardano is introducing Hydra, an off-chain mini-ledger between limited users, which works similarly to the on-chain central ledger. Hydra helps to reduce the challenges of high transaction fees and insufficient storage.

Notably, Cardano founder Charles Hoskinson created a system a system called Epoch. This system shares validators into blocks where a slot leader is nominated. These leaders oversee the network’s activities, including mining, validation, and posting transactions in the right blocks.

Therefore, the growth of the network validators boosts Cardano’s scalability.

Cardano’s governance

Cardano network is a fully decentralised ecosystem focusing on true democracy. This governance model focuses on individuals who have the right to vote and make vital decisions in the ecosystem. Furthermore, the blockchain’s governance mechanism is off-chain, where Charles Hoskinson is the CEO of Input Output Global, the research and development team of the Cardano blockchain technology.

Is Cardano the next Ethereum blockchain?

As a third-generation blockchain solution, Cardano is often known as the “Ethereum Killer” because it was built to solve the challenges of the Ethereum blockchain. One of the downsides of the Ethereum network is transaction congestion due to its lack of scalability.

While both blockchains offer the necessary tools to their users, Cardano provides better scalability, advanced security, and a layer-2 network that speeds up transactions irrespective of the high amount of participants. Additionally, Cardano’s consensus mechanism boosts transactions per second compared to Ethereum.

Therefore, anyone could assume that Cardano could surpass Ethereum in the future. After all, Charles Hoskinson, a co-founder and former developer of Ethereum, established the Cardano blockchain with more facts, leaving room for no assumptions. As a result, the network became the first blockchain hinged on peer-reviewed research and is evidence-based, making Cardano more credible than Ethereum.

Another means by which Cardano could surpass Ethereum is through its implementation and development approach. While Ethereum focuses on building speed at the expense of a more fragile set of software implementations, Cardano takes time to access developments through peer reviews to ensure reliability and efficiency.

Polkadot: An Overview

The “Polkadot vs Cardano” review cannot be complete without laying the foundation of the Polkadot blockchain. This blockchain project belongs to the class of “Ethereum Killers”, and its currently handling the challenge of latency, transaction speed and costs without compromising the decentralised ecosystem.

The self-proclaimed third-generation protocol was established by Gavin Wood, another co-founder of the Ethereum blockchain. Unsurprisingly, in the battle of Cardano vs Polkadot, the latter aims to overtake Ethereum’s present TPS rate, making it a worthy choice for fintech companies and other prominent industries.

Polkadot stands out from the crowd for many reasons. Firstly, the protocol is built on a decentralised internet, also known as Web 3.0, that allows it to host applications from other blockchain platforms. Furthermore, the blockchain’s infrastructure transforms complex programmes into simple means to enable developers to create decentralised apps on the network. Additionally, the network handles over 1,000 transactions per second and could be better than Ethereum 2.0.

Polkadot is a layer-1, open-source platform built to hold other specialised networks in the blockchain sector. The platform is a bridge between other private blockchains by transferring tokens and arbitrary data from one network to another, making it interoperable. Therefore, Polkadot is an excellent environment for cross-chain transactions.

Aside from its interoperability feature, it is also scalable, allowing blockchain developers to build smart contracts and decentralised finance projects and games effectively and at a lower cost. Polkadot adopts a scalable Proof-of-Stake consensus mechanism that involves four key network participants: validators, nominators, collators, and fishermen.

Each of these actors has roles to play on the blockchain. Firstly. The validators are responsible for mining on the network. Secondly, the collators and fishermen inform the validators of the para chain, while the fishermen observe and report any errors in the ecosystem. Therefore, these significant participants ensure that the network is immune to attack and corruption.

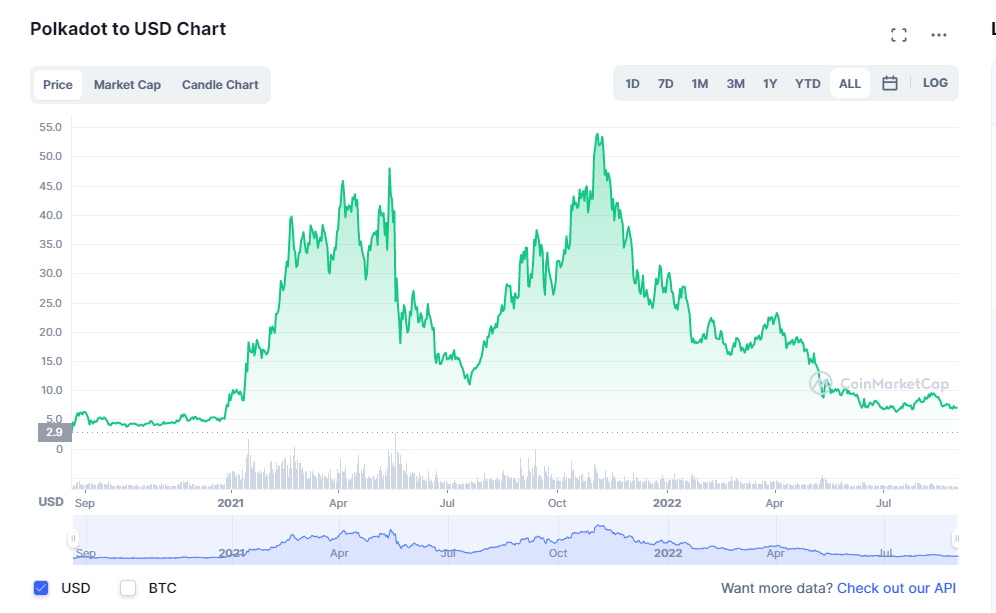

DOT’s price history

Between March and June 2021, Polkadot’s currency, DOT, remained inconsistent in the crypto market. However, the digital asset’s value surged due to a market bull run at the end of March. As a result, DOT hit $45 on April 5, but it consistently traded between $40-$42.

On May 14, Polkadot hit its highest mark by reaching $47.9, a reflection of the market’s bullish run. But the surge did not last for long as the token dropped by almost 50% to $25, after four days of reaching its all-time high, thanks to the sudden crypto market flip. DOT continued to trade between $20 to $25 for the next month till it finally collapsed to $14.65 at the end of June.

By July, the crypto token maintained its value before recovering by the middle of the month. At the end of September, the digital asset began to exchange hands at $37.3 but settled at a resistance level of $26 after a long period of price correction.

Fortunes quickly changed for Polkadot’s DOT as the market bull run saw the token hit another all-time high of $53.88 on November 4. However, the value crashed again after four days because of the bearish nature of the inconsistent crypto market.

The crypto token’s value reached $24 at the end of 2021 before recovering for a while in January 2022. The recovery did not last long as DOT sank to $18.8. This development saw the cryptocurrency struggle to break free from the bear market throughout February, keeping its price at $22.6.

At the start of March 2022, Ukraine stated that it would accept donations in DOT, but the announcement did not impact the token’s value as it remained at $18.

Nevertheless, the digital currency increased by 10%, standing around $20, after the launch of the Polkadot Parachains Fund. At the start of the next month, the asset started trading at $23.77.

By April, China stepped up its strict regulations on crypto transactions which saw DOT dip to $17. While there was much back and forth with the token’s price, the value further dipped to $14.40 by the start of May.

Matters became worse for DOT after Terra’s collapse, leading cryptocurrency to sink to $7.32 on May 12, 2022. The token fought back and regained its price at $10 on May 18th. However, the market’s inconsistencies say DOT fell to $861 on May 27 before fighting the bear price and hitting $10.37 at the end of the month.

June witnessed the token fall to $6.43, but it recovered by ending the month at $7.04. DOT has seen a turbulent July as the token failed to rally even after maintaining its usage despite the bear market. The crypto asset sank to $6.09 on July 13 before closing the month at $8.65 and still dropped to $7.70 at the start of August.

Polkadot’s value increased to $8.95 when Bitbank, a Japanese-based crypto exchange, announced DOT’s listing on August 8, 2022. At the time of writing, Polkadot is trading at $7.19, with a market capitalisation of $7,998,349,840, making it the 11th most traded crypto asset.

Does Polkadot have a future?

Despite its inconsistencies, the Polkadot project has developed into one of the leading crypto assets in the market, and many investors believe the token has enough potential to maintain its value growth. As a result, many experts expect DOT to take the bull by the horn.

While Wallet Investor’s AI algorithm expects the token to remain bearish for a while, the price will increase by almost 50% before the year runs out. On the other hand, Crowd Wisdom experts estimate that Polkadot will surpass $25 in 2022. This development will be because of the large following on social media and increased trading volume.

Another expert, DigitalCoin, expects DOT to reach $25 by the end of the year. However, they stated that the token will maintain $12.40 in 2022 before improving to $13.26 in 2023 and $14.08 in 2024. Long Forecast also provided an odd prediction, stating that Polkadot will end 2022 at $9.37 and decline further to $4.92 in 2023.

Polkadot relay chain

This architectural structure serves as the main chain of the ecosystem that ensures smooth interaction between Polkadot and other blockchain networks. Therefore, the relay chain controls the system by providing security and consensus, including overseeing the activities of the para-chains, decentralised apps, and other blockchain services.

Notably, the Polkadot validators are attached to the relay chain, allowing them to interact with the governance mechanism and auctions and participate in the Nominated Proof-of-Stake. However, the function does not support smart contracts.

In summary, Polkadot’s relay chain maintains the para-chains and para-threads, enabling the blockchain to provide flexibility and interoperability for developers to explore and build without undergoing technical challenges.

Polkadot ecosystem’s governance

Another thing to note about the Polkadot vs Cardano review is that Polkadot focuses on an on-chain governance mechanism, unlike Cardano. This government allows the community to participate in decision-making when they stake DOT. The key participants include DOT holders and the council.

DOT holders

The DOT holders use their tokens to vote for proposals, and the more they stake, the heavier the weight of their votes. Ways in which these holders can use their DOTs are:

- Propose a public referendum.

- Prioritise public referenda.

- Vote on all active referenda.

- Vote for council members.

- Become a council member.

The council

One of the challenges blockchains face during the voting process is the low turnout of voters, which is not strange to traditional voting exercises. However, Polkadot created a means to carry everyone on the network by introducing the Council.

The Council is a group of 6 to 24 members who have prioritised voting power in the ecosystem. This leadership team will push for sensible referenda and contribute to developing and maintaining the networks attached to Polkadot.

How does the council election work?

The leaders are chosen in rolling elections. Candidates will nominate themselves, and one member will be up for election every fortnight from the list of nominees. Additionally, the council size influences the term of each council member. Therefore, as a council member, your term length equals two weeks times the number of council members. So if we have ten candidates, a term will be 20 weeks (10×2).

Polkadot vs Cardano – Which is better?

In the Polkadot vs Cardano debate, this review shows that these blockchain technologies share the same similarities. Aside from being an upgraded network that aims to overtake Ethereum, they utilise the PoS consensus mechanism and push for total decentralisation. Additionally, their native tokens are among the top-rated crypto space, making them a force to reckon with in the future.

However, Cardano edges Polkadot in terms of cryptocurrency process layers. While the latter operates on a layer-1 network, Cardano thrives better with layer-2, which allows the blockchain to maintain its speed and security despite having a higher number of transactions running over the network per second.

Additionally, Polkadot’s supply of native tokens is not distributed equally compared to Cardano’s ADA supply. Interestingly, ADA is relatively cheaper than DOT and can be easily accessible to new investors with lesser risk than Polkadot’s DOT.

Is Polkadot better than Cardano?

Polkadot and Cardano could be tomorrow’s blockchain technology because of their strengths. While the former focuses on flexibility, speed and interoperability, Cardano prefers to go slow and steady as long as security and decentralisation are not compromised.

Nevertheless, if you want a platform that allows you to integrate your blockchain services seamlessly without going through technical challenges, Polkadot offers the proper infrastructure to meet those needs. In addition, Polkadot supports cross-chain interoperability, which means that other blockchain activities can run effectively on Polkadot. Therefore, Polkadot offers more flexibility than Cardano.

Moreover, Polkadot has hosted more projects on its blockchain network than Cardano. While Cardano provides a friendly environment, especially for new investors, Polkadot is the link to other blockchain protocols, automatically increasing the number of projects on the platform.