Financial markets are in a constant state of buying and selling, in which supply and demand is established. However, many other intricate factors can influence price action in the short term and long term.

For example, when expectations from speculators are high that prices will move in one direction, prices will instead move in the opposite direction. Fear and greed, news, macro factors, and more, can also impact price action.

In this guide, we are examining a phenomenon called a short squeeze. The guide will cover the short squeeze definition, how to spot a potential setup for a short squeeze, and how to trade the explosive move that results.

What Is A Short Squeeze? Short-Covering Rallies In Crypto Explained

When there is excessively high short interest, the market can move against short positions, forcing short sellers to cover their positions. This combined with an increase in buying pressure can result in a powerful rally called a short squeeze.

Short squeezes are a fairly common occurrence and can be spotted in advance by analyzing important indicators like open interest, bearish sentiment, and short interest ratio. A short squeeze is often characterized by a large increase in average daily trading volume, which represents both shorts-covering and new buyers entering the market in rapid succession.

Short sellers don’t always manually cover their positions to contribute to a short squeeze. More often than not, the move is strong enough to trigger short-side stop loss orders, forcing traders out of their positions.

How Does A Short Squeeze Work? The Mechanics Behind A Short-Selling Showdown

Unlike traditional buy-and-hold investing strategies where investors can only profit when markets are rising, derivatives markets provide a way to profit from both directions of the market, create hedge positions, and be more strategic overall.

Large businesses like energy producers regularly hedge against falling energy prices in this way. Hedging via short positions or options can protect capital and reduce risk. However, like all things in financial markets, short positions do carry risks.

A short position is a type of trading position in the derivatives market where an investor borrows a cryptocurrency from an intermediary and sells it with the intent of purchasing it at a lower price later. A successful short-seller would profit from the difference when the cryptocurrency is later bought back.

Because a short position closing results in a buy order, a large influx of short positions closing at once can push prices of the underlying asset up. When there is heavy short interest in the market, oftentimes a contrarian move will force short-sellers out of their positions, causing a short-covering rally.

Examples Of A Short Squeezes

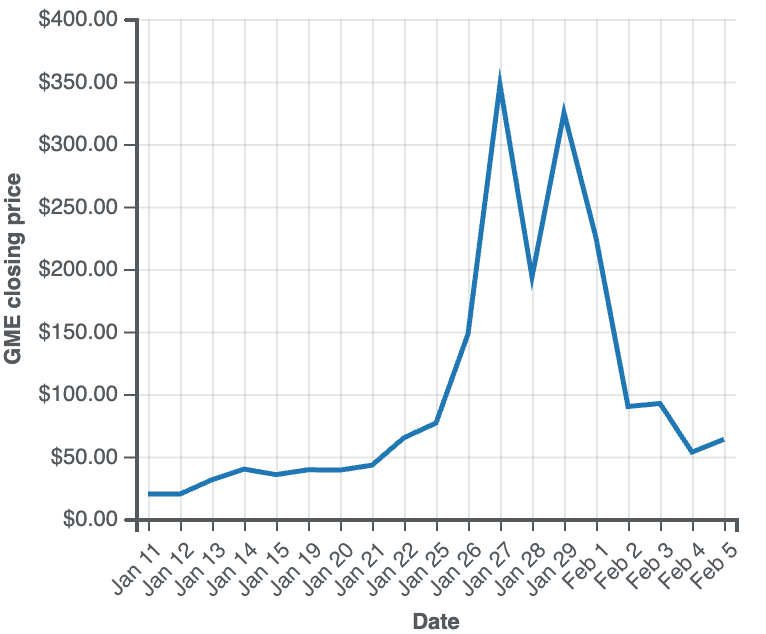

Perhaps the most famous short squeeze in recent times was the GameStop GME situation in January 2021. Reddit users of the WallStreetBets subreddit often searched for stock shares that were most heavily shorted by hedge funds, and as a community filled with gamers, the consensus took to markets in an attempt to collectively squeeze hedge funds out of their positions. And it worked. GME shares climbed by more than 2,000% in a single month and made a spectacle of markets.

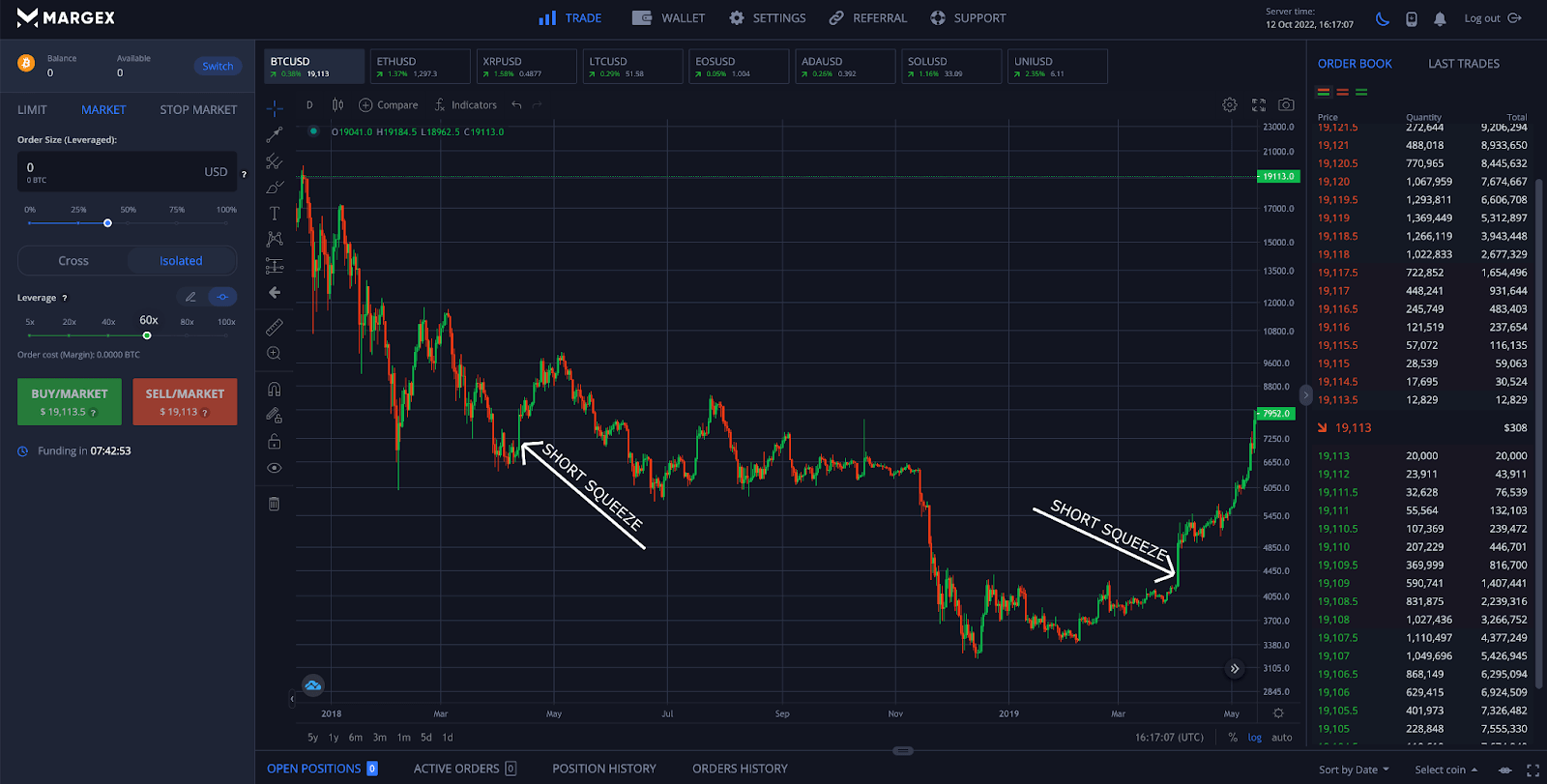

Other important short squeezes have happened all throughout cryptocurrency history. The entire 2017 bull rally in crypto was said to be a heavily shorted rally, as most people expected Bitcoin to correct starting at $5,000 per coin, when it climbed all the way to $20,000. After the eventual peak of that bull market, the next largest short squeeze happened on April 12, 2018, when Bitcoin price climbed 17% in a single day due to an abundance of short positions expecting new lows.

The next massive short squeeze happened on April 2, 2019, when Bitcoin price broke upward out of its downtrend resistance for a 22% move in just one day. Again in late 2019, heavy short interest after Bitcoin broke down from $10,000 resulted in a 42% move within 48 hours as short positions were squeezed rapidly on positive news coming out of China. The cryptocurrency community affectionately called the two-day short squeeze the China pump or Xi pump –– named after the Chinese president Xi Jinping.

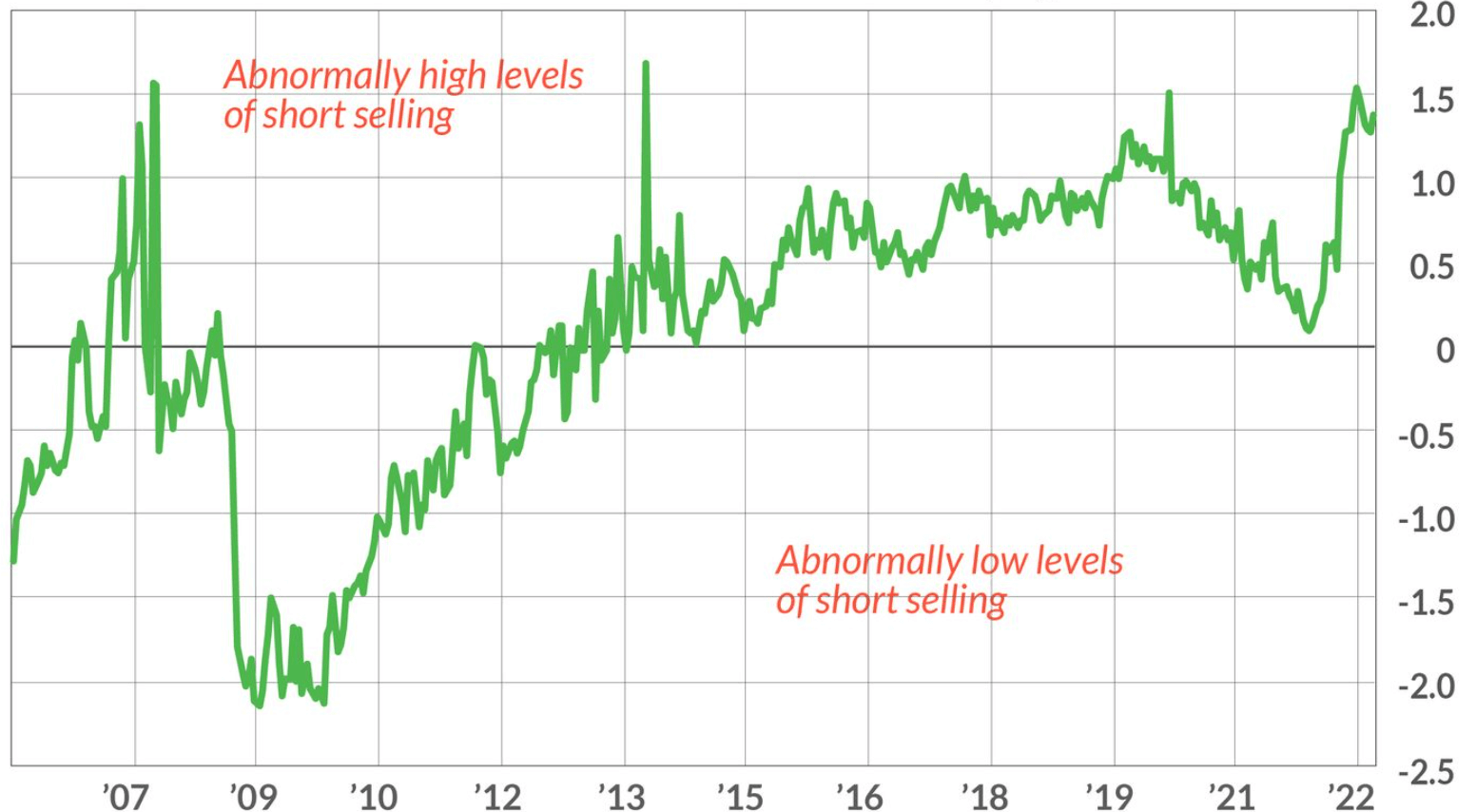

Short interest is currently the highest ever in the S&P 500 and across most global assets as investors hedge against a possible recession. However, as the situations have proven above, the current massive increase in short interest while markets are oversold, could lead to a short squeeze setup of epic proportions.

Why Do Short Squeeze Happen? How To Avoid Mistakes When Shorting

Short squeezes can happen for a variety of reasons, but in all scenarios, there must be high short interest and strong bearish sentiment that prompts market participants to believe the price of a cryptocurrency is going lower.

These events trigger at market bottoms, as trend followers and recency bias can cause a large herd of traders to become greedy. Other times, a short squeeze can be caused by a rapid rise triggered by sudden positive news. This can make for a very bad day for short sellers in an instant.

Short interest is highest when investors and traders believe an asset is overvalued and will soon drop in price. While not investment advice, a contrarian investor would look for a long position counter to the dominant short selling side of the trade.

Although there is no way to know a squeeze target, depending on how heavy the short interest is, how high open interest is in general, and how oversold an asset is can lead to an explosive move in the opposite direction. The combination of intense buying and shorts covering results in a large climb in price in a short amount of time.

The most important prevention technique related to reducing the risk associated with short squeezes, to ensure the use of stop loss protection and placement. Without a stop loss, the powerful move can cause short positions to quickly plunge underwater and eat up any available margin and create a risk of liquidation or margin call.

A stop loss will still lead to some incremental loss (unless the stop loss is set to trigger in profit) but it will protect from a maximum drawdown and complete capital loss. Traders can also open a long position counter to a short position to get hedged in case of a reversal.

In this scenario, the stop loss on the short order would trigger, closing it out in a minor loss. Meanwhile, the long position would become profitable, offsetting the incremental loss from the short being stopped out.

How To Prepare For And Find A Short Squeeze About To Happen?

Bearish sentiment is a key indicator related to a short squeeze. However, several other important metrics can be measured and analyzed which can tip traders off that a short squeeze is possible. A heavily dominant short-side of the market, combined with soaring open interest, and prices at potential lows are all factors in any short squeeze setup.

Below we will explore the many short indicators that can be used to prepare for a short squeeze effectively.

Short Squeeze Indicators

Here are the key short squeeze indicators to consider so you can make a financial decision with confidence.

Short Interest

Short interest is the percentage of total short positions when dividing the number of shorts versus the number of cryptocurrencies in circulation. Heavy short interest implies a crowded trade and a potential setup for a short squeeze.

Short Interest Ratio

Rather than dividing the total number of shorts by the total supply, the short interest ratio divides the total number of shorts by the average daily trading volume. This tool also helps indicate how many days it would take for shorts to cover.

Open Interest

Although short interest is the more important factor, how high open interest is as a whole matters. If open interest is low, there may not be enough short positions for a meaningful short squeeze. Short squeezes occur most frequently when open interest is rising, suggesting that more market participants are entering positions in anticipation of a breakout.

High Funding Rates

When it begins to become expensive to hold a short position, it often is a sign of a crowded trade and could start a domino effect of shorts closing which can lead to a larger short squeeze depending on how much interest is currently in the market. Not only is a sharp rise a potential indicator of a short squeeze setup, a sudden decline in borrowing costs could indicate the same thing.

Long Downtrend

Short squeezes tend to occur after a long downtrend and after most of the selling has been exhausted. Short interest continues to rise due to recency bias and expecting the trend to continue indefinitely, which blinds traders to the potential reversal at the bottom of a downtrend.

How To Use Technical Indicators With Margex To Find A Short Squeeze Setup

The Margex margin trading platform provides traders with long and short positions and built-in charting tools, In addition to using the external market data listed under short squeeze indicators, many technical analysis indicators can also be used effectively to find signals that help to support a short squeeze setup.

Margex also offers custom crypto price alerts that can be used to be notified when prices pass a certain threshold. When used in conjunction with Margex margin trading tools, traders can be ready for when a short squeeze happens and can react accordingly.

Relative Strength Index

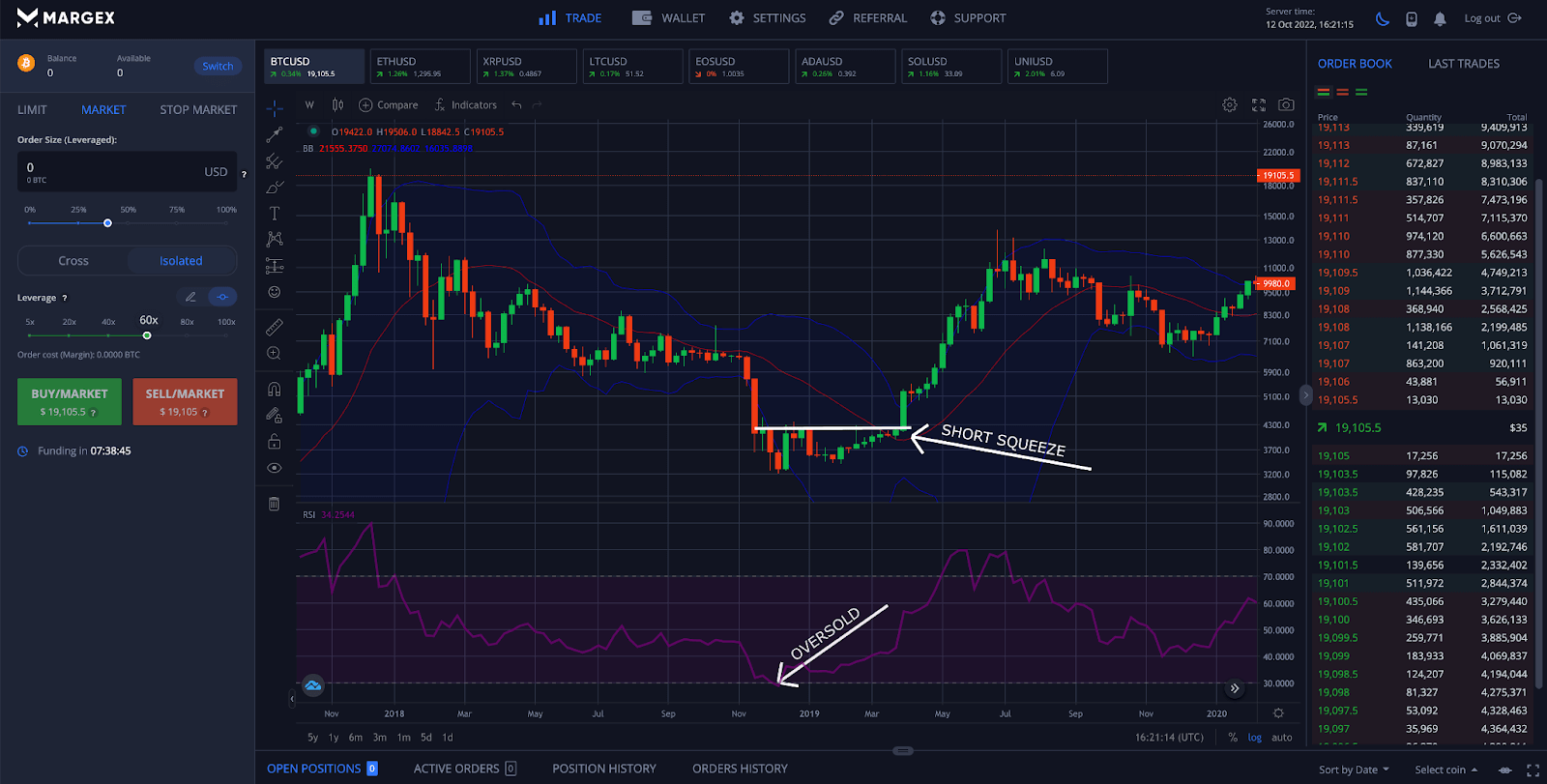

The Relative Strength Index or RSI, is a momentum indicator that helps to measure overbought and oversold conditions. A short squeeze setup would occur for different reasons depending on the readings. For example, a short squeeze is more likely to happen when the RSI shows extreme oversold conditions. However, a short squeeze can also appear when trending assets are overbought and short sellers have stepped in too early and ultimately were used to help squeeze prices higher.

Bollinger Bands

The Bollinger Bands are a volatility measuring tool based on a simple moving average and an upper and lower band set at two standard deviations of the SMA. When prices are at the upper or lower band, they are high or low in respect to historical price action. This makes any price action at the lower bands a possible place where a short squeeze could occur. If the lower bands were touched multiple times without a breakdown, and the two bands begin to tighten, a short squeeze could result when volatility is ultimately released to the upside instead.

FAQ

What Is A Short Squeeze In Crypto?

The short squeeze meaning is the same in crypto as in all other markets, and results from a rapid price increase that causes short sellers to cover positions in succession, which helps to drive up prices even faster and with greater momentum. The sudden change in positioning can kick off a new short or long term trend change and is an important sign to the market.

What Are The Main Indicators Of A Short Squeeze?

The primary indicators investors and traders can watch for include short interest, short interest ratio, open interest, funding rates, and much more. Plenty of technical indicators can also help support the setup of a potential short squeeze. For example, traders can also look for oversold conditions which could create an environment ripe for a short squeeze.

How Does A Short Squeeze Work In Crypto?

When a trader goes short in crypto, they are borrowing the asset from a trading platform and selling it preemptively with an expectation that the price will decline. It is essentially a bet that the price will fall in the near future. If correct, the trader closes out the position to take profit, which buys the asset back at a lower price. Since there is a buy order associated with each short closing, a short squeeze is the result of a price surge that prompts shorts to cover in fast succession and helps to propel prices even higher than from natural buying alone.

What Is Naked Shorting?

Naked short selling is the practice of shorting an asset without first borrowing the asset from someone else. This happens when an asset is in short supply, and receives a failed to deliver status. Companies in the past have been accused of naked shorting as part of price manipulation to push prices lower than normally possible.