After a few months of peace just when the community thought the worst was over for Solana, the blockchain ushered in October by yet another stoppage, its 9th one in slightly over a year, on the night of September 30.

What Caused The Stoppage?

According to Stakewiz, a Solana validator operator, the issue was caused by a misconfigured node, which is a computer running the Solana software powering the network.

In layman terms, this meant that a particular computer that was adding to a new block was running two applications of the same software at the same time, which resulted in the same transaction appearing under two different blocks on the blockchain. The validators that came after him saw transactions in varying blocks and thus, were adding new blocks to two different chains; some on chain 1, others on chain 2. This caused the blockchain to fork into two chains and had to restart. The blockchain subsequently synchronized for a successful restart around 7 hours later.

This incident has once again left many crypto investors pondering over Solana’s reliability against its huge potential for growth, unsure which would impact Solana’s investment thesis more.

Solana Holds the Most Promise

The struggle is real, as Solana is indeed one blockchain with the most potential in the current market.

Thus far, adoption and the total number of transactions on Solana has been the highest amongst all blockchains, surpassing even those of Ethereum, which has been around for at least 5 years before Solana did. Crypto investors are fully aware of how important these metrics are for any blockchain, and Solana’s growth has been blistering.

NFTs The Driving Force Behind Solana’s Growth

The rise of NFTs as a viable investment and identification instrument has benefitted Solana greatly, partly due to the low cost of transactions as well as the high speed of the blockchain.

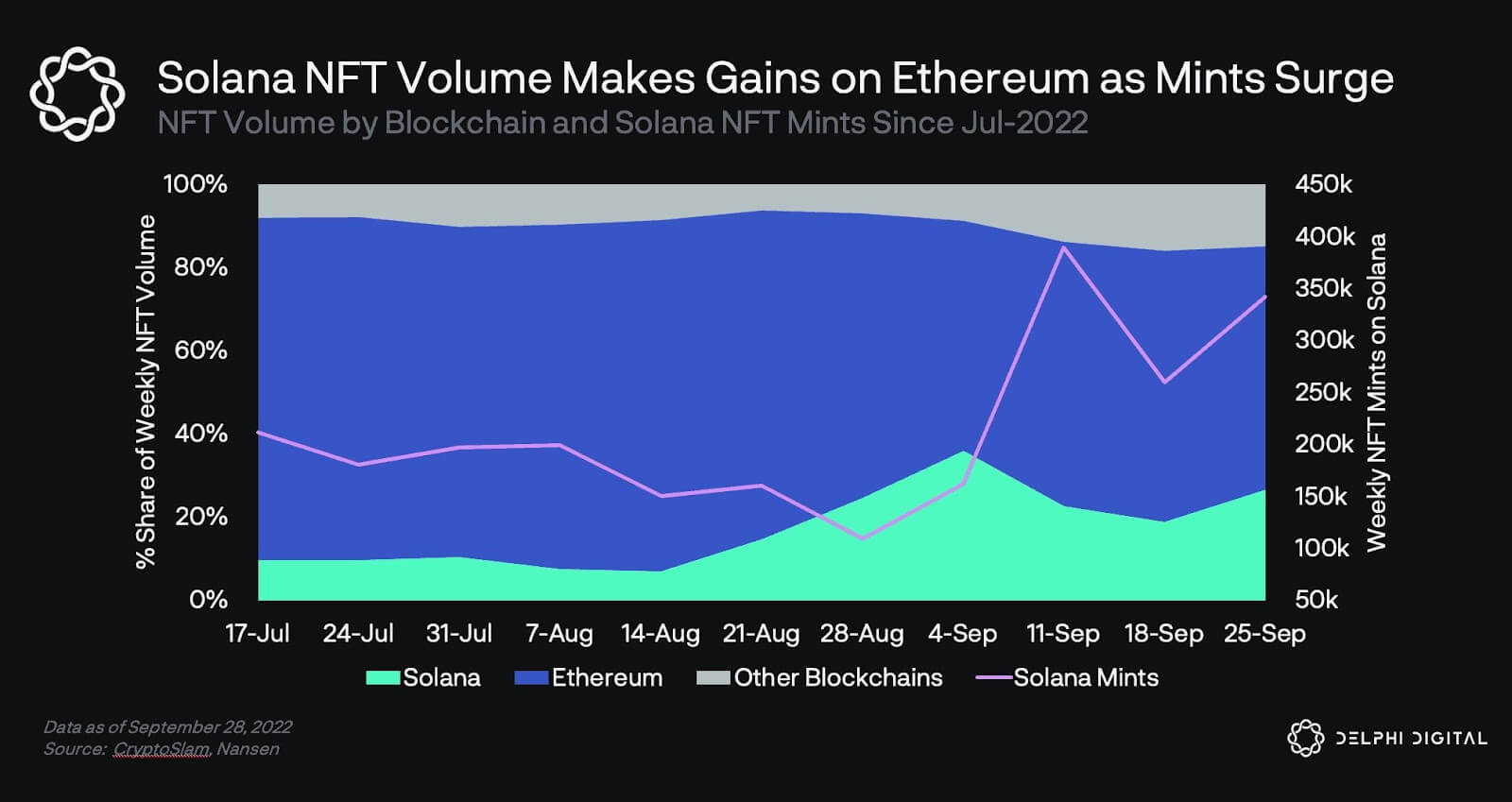

Recently, up to the day of its 9th stoppage, Solana’s market share in the total NFT trading market has surged from under 7% to 24% in a span of just six weeks, the fastest growth of any blockchain, and fast eating into the market share of NFT leader Ethereum, who is the original blockchain that gave birth to the concept of NFT in the first place.

Despite the crypto market downturn and an overall drop in NFT sales since 1Q2022, NFT sales remained stable in 3Q2022, maintaining at around $920 million in average sales monthly. According to DappRadar, in spite of the stagnant market, Solana NFT sales almost doubled in the month of September, growing from August’s $68.5 million to $133 million, led by high-profile projects like yoots and ABC.

Hence, if one is bullish on the future of NFTs, one cannot rule out Solana. The popularity and value of Solana NFT projects is second only to Ethereum’s, and there is no other competitor blockchain that comes even close to Solana and Ethereum in terms of market share and prestige. Prestige is an important value determinant in NFTs as these digital art pieces are valued based on the crypto public’s perception of how valuable they are. Ethereum and Solana pieces command a higher premium to NFT collectors in the same way savvy investors prefer Bitcoin and not another crypto as a store of value. Such perceptions are difficult, if not, impossible to change.

Should We Ignore The Problem Then?

Despite all its promises and potential, one cannot help but wonder how a decentralized blockchain that processes the highest number of transactions can be this vulnerable and be brought to a halt due to the mistake of a single node.

However, to give merit to Solana, it has managed to restart and get back online within seven hours this time, which is a great improvement from last September when it was down for eighteen hours.

How much and whether you should be concerned could depend on whether you are a regular user who invests a large portion of your funds in Solana, or if you are a well-diversified investor.

Also, what you use Solana for is also a key to determine if or how you should be concerned about its persistent stoppage problem.

Use Solana Where It Would Hurt Less

For users, knowing what product you can use Solana for is crucial, especially when dealing with a blockchain that may not be able to execute your transaction when it breaks down, meaning you cannot get your funds out nor save your trade nor deposit funds into a DeFi platform that runs on Solana.

However, using Solana for NFTs should be fine since trading NFTs is not as time sensitive as trading on DeFi, the ill-effects of a failed NFT transaction, while inconvenient, is relatively benign compared with losing money on DeFi – your NFT receiving party can always wait for the blockchain to come back online to complete a transaction, but market conditions and pricing of trades may change with time – the blockchain may stop, but market prices do not stop with the blockchain.

For investors, diversification is key. The phrase, to never put all your eggs into one basket, rings especially true for Solana. It would not be wise to put all your investment funds into just one crypto regardless of how dependable and reliable it is, much less one that could see angry users or traders take its outage incidents as excuses to dump its token. Most recently when Solana stopped, the SOL token fell 6% when the crypto market was holding firm. Had you needed to liquidate your SOL for personal reasons at that time, you would have had to sell your SOL at a bad time. Hence, holding a few other cryptocurrencies together with SOL in your crypto portfolio would be able to at least shield you from the dumping action of angry users until its price recovers, which it has always done.

Not Much Long Term Impact on SOL Price

While being an embarrassment to the Solana team, the regular outages thus far do not appear to have had a disproportionate negative effect on the price of SOL. This may be due to the profile of most crypto investors, who are aware of the pitfalls of crypto investments and the fact that the technology is in a nascent stage and needs time to improve. Hence, unless the outage problem is persistent and worsening even after a number of years down the road, it may not pose as a big problem to Solana over the long-term as some market watchers fear.