Like Cardano blockchain, Ethereum, Bitcoin, and many others, Polkadot is likely to play a significant role in the future of cryptocurrencies. Since this technology is still in its infancy, there will inevitably be winners and losers.

Solana’s robust scalability makes it a reliable, future-proof platform option. Since SOL is this blockchain’s native currency, investing in it is an up-and-coming prospect due to the blockchain’s resilience and efficiency. Similar to Ethereum, both are essentially utility tokens.

Over 12,000 distinct cryptocurrencies exist, with almost 1,000 particular blockchain systems supporting them in the rapidly expanding blockchain sector. Having so many seemingly unrelated initiatives to choose from might make it challenging to decide where to put your money, particularly if many projects seem to address the same issues.

This essay will examine the similarities and differences between the two blockchains. Which is the superior option? Read on to find out!

Overview Of Solana

Solana is a programmable blockchain that seeks high-speed transactions while maintaining its vital decentralization characteristic. The network employs a revolutionary technology known as proof-of-history. SOL, the native coin of the blockchain, is used for transaction fees and may also be staked. Solana is predicted to outperform Ethereum in the foreseeable future.

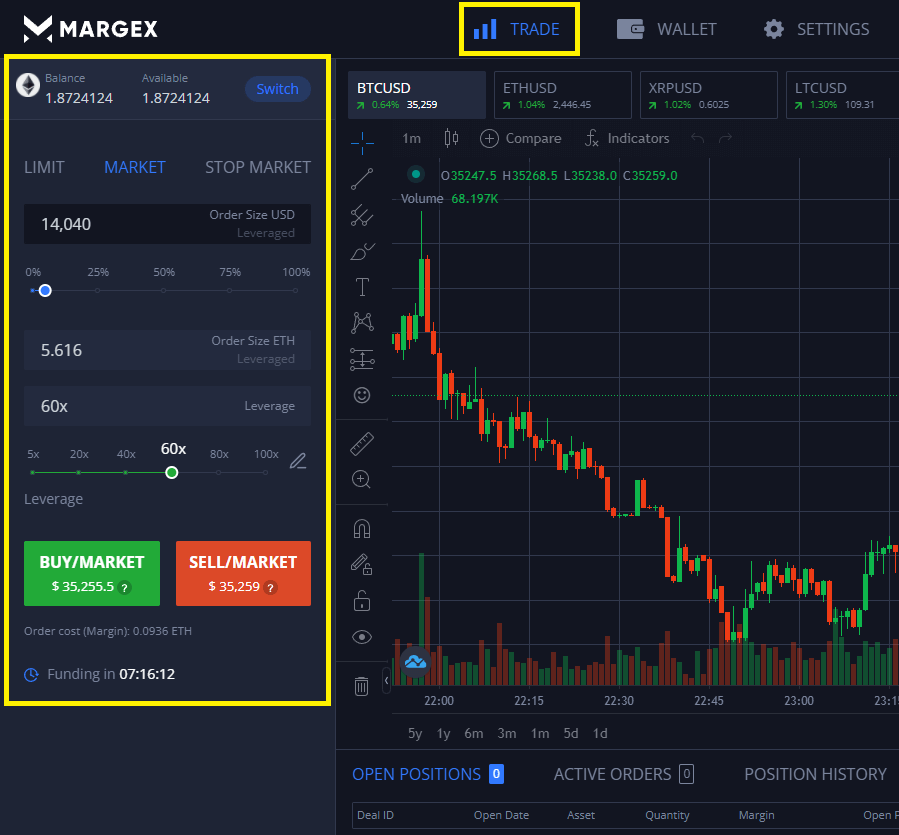

An illustration of Solana’s daily chart on the Margex platform

Solana was developed to offer excellent scalability and developer freedom. The protocol incorporates an open infrastructure and minimal gas prices to encourage developers to create more engaging and practical Dapps. The average transaction fee is around $0.00025, making this network significantly quicker and cheaper than Ethereum.

Anatoly Yakovenko conceptualized Solana. The network launched in 2017—the breakthrough year for cryptocurrencies. Due to its high transaction throughput and competent engineers like Greg Fitzgerald and Eric Williams, the network gained prompt notice. These two execs have worked at Dropbox and Qualcomm in the past.

Several power outages in January lasted for more than 8 hours in Solana. These disruptions occurred because automated programs were racing to cash in on arbitrage chances so they could increase the profits they made from their leveraged investments. The token used to access the network saw a temporary decline in value due to these outages, leading some investors to doubt the enterprise’s long-term viability. Despite the setbacks, Solana remains a favorite with programmers and investors.

Solana was created to give developers greater scalability and flexibility than Ethereum. Because of its technical nature, the network removes scalability difficulties. To match network bandwidth, the protocol may grow accordingly. Solana had a 29,171 tps on the bench test.

Solana developers use several technologies to achieve its objective of being the quickest blockchain on the market. To split and transport data between the network’s nodes, the web uses a protocol known as a turbine. This information is subsequently delivered to a feature known as the Gulf Stream.

Golf Stream eliminates the requirement for a mempool, as Bitcoin uses, which speeds up the transaction process. The Gulf Stream protocol is capable of handling 50,000 tps. One of the most distinctive features of this strategy is that the system sends packets to nodes before the final batch has completed confirmation.

Transaction speed

The project’s capacity to process millions of transactions per second is highlighted in the Solana documentation. “The design defines a potential top limit of 710 thousand transactions per second (tps) over a normal gigabit network and 28.4 million tps on 40 gigabits,” the Solana documents indicate.

The network “can grow incredibly fast since it is only restricted by hardware limits (i.e., CPU/GPU, RAM & bandwidth),” according to a post on the Solana Blog. Solana’s lightning-fast confirmation timings come from the network’s usage of Proof-of-History (POH), a consensus technique that stamps each transaction with a timestamp to facilitate faster verification.

Lower costs

Not only may transactions be processed quickly on Solana, but they also only cost an average of US$0.00025 per. Most alternative networks have far more significant pricing increases. In 2021, for instance, one Ethereum (ETH) transaction cost more than USD 70.00.

Emerging demand

Solana’s high exposure and large bandwidth have contributed to the network’s popularity. In particular, the Solana network has over 5 million non-fungible tokens (NFTs) and over US$11 billion in value tied to Defi projects.

Complications with technology

Despite this revolutionary technology and its associated capabilities, the Solana network has often slowed or gone entirely down, raising questions about its dependability.

The Solana network was down for the first time in September 2021 for 17 hours. “The reason for the network slowdown was, in fact, a denial of service assault,” according to a study published on the Solana website. The network got overburdened with transactions, being slow initially and eventually shutting down.

According to a Twitter account with the handle twitter.com/@SolanaStatus, Solana’s mainnet beta also experienced “severe levels of network congestion.” The situation was caused by “many duplicate transactions,” according to the report.

Now that you know what Solana is, you may ask what kinds of decentralized applications can use it. Like the Ethereum network, Solana can communicate with smart contracts, making it a programmable blockchain. The use of smart contracts facilitates the development of DApps like NFT marketplaces, Defi games, and DEXs.

Solana’s most used applications are DEXs and lending platforms. Wrapped assets and stablecoins like USD Coin are also compatible with the network. The whole Solana biome is right here.

SOL token

Solana employs tokenomics using the SOL token. This native token may be used by users to engage with smart contracts on the network or to pay transaction fees.

The network started with 500 million SOL tokens. However, this quantity has altered over time as the network burnt SOL units, and fresh supply was introduced under a specified Inflation Schedule. According to Solana Docs, the “main token burning method is the burning of a part of each transaction fee.” The network burns every transaction charge.

At the time of writing, around 315 million SOL tokens were circulated. Users may also stake their SOL tokens to assist in the confirmation of network transactions in return for incentives.

Overview Of Polkadot

Polkadot ($DOT) bills itself as a next-generation blockchain technology that integrates numerous blockchains into a single network. Polkadot and its Co-creator Gavin Wood are highly recognized by the Chinese cryptocurrency community, who are actively involved in this project, as we saw in a recent post on the top blockchain projects in China. Polkadot is also gaining popularity in the West due to its placement on meaningful exchanges, including Margex.

Polkadot is another blockchain environment that can be programmed using smart contracts. The protocol is distinct from Solana since it supports a multi-chain application ecosystem. So that it can communicate with other blockchains. Polkadot’s purpose is to facilitate safe and seamless data transfers across blockchains, increasing the number of users and the number of applications that may use blockchain technology.

The term “Polkadot” (DOT) entered into use in 2016. During that time, Ethereum’s co-developer Gavin Wood published the network’s whitepaper. As the creator of the Solidity innovative contract programming language, which is at the heart of Ethereum, Wood is widely regarded as one of the industry’s most influential figures.

Polkadot’s record-breaking initial coin offering (ICO) caught everyone’s attention. Unfortunately, the ICO’s $150 million in cryptocurrency was lost after the Parity wallet holding the cash was hacked. Even though these obstacles slowed the project, Polkadot is now among the best-performing networks available.

Polkadot aims to allow blockchain networks to enhance scalability, optimize for particular use cases, collaborate and communicate, self-govern, and update without the need for hard forks. This article examines Polkadot’s present state, its position in Decentralized Finance (DeFi), the $DOT coin, and other topics.

Polkadot relay chain

Polkadot’s principal chain is called the Relay Chain, while other chains are called parachains. Different blockchains may link to the Relay Chain as parachains and exchange data with one another provided they satisfy specific standards.

Polkadot’s architecture allows parachains to communicate in a safe, trustless, and private setting. It will enable parachains to collaborate on blocks and validate them by the Relay Chain’s validators. The supplied blocks are verified and added to the chain if they pass.

Polkadot was created to allow private and public blockchains to interact freely. The project’s creators regard this cooperation as a critical step toward increasing blockchain usage. Polkadot also provides developers with other advantages, like the opportunity to incorporate the most remarkable features from various blockchain networks into their Dapps.

Polkadot simplifies programming duties related to Dapp development. It has scalability comparable to top-performing blockchains. Furthermore, the network’s multi-chain structure facilitates the establishment of sub-networks, tokens, and other assets.

Polkadot functions as a multi-chain ecosystem. The network may be divided into levels, with the Polkadot relay chain serving as the primary communication layer. This layer is in charge of network consensus. Polkadot uses a new consensus style called GRANDPA (GHOST-based Recursive Ancestor Deriving Prefix Agreement). GRANDPA allows the network to share security. It’s also very scalable, with near-instant confirmation speeds.

The network incorporates sovereign blockchains called Parachains that developers may establish. Polkadot may be used to secure these sub-networks, or they can combine unique technological frameworks. Polkadot parachains may have their governance, consensus mechanisms, and currency.

On the other hand, Polkadot provides a more economical solution for developers that need a little amount of blockchain exposure to run their Dapps. The Parathreads functionality allows developers to build networks on a pay-as-you-go basis. This technique makes much more sense and saves money for Dapps that do not need continual blockchain access.

Polkadot’s DOT token

The DOT coin, used on the Polkadot network, is a multipurpose digital asset. An example of the first is leadership. Users can vote on important decisions like platform updates and fee structures by holding DOT tokens.

Users may also create parachains by temporarily making their tokens inaccessible (a process known as “bonding”). To back up Polkadot’s consensus method, users may now stake their DOT. Nominated Proof-of-Stake is the precise method used by Polkadot, which incentivizes token holders to stake a portion of their holdings in the network for a limited time.

DOT uses an inflationary model

An inflationary mechanism underpins the DOT token’s supply. It had 10,000,000 tokens initially, but after the redenomination, it currently has 1,000,000,000. [21] As of January 2022, the system is set up to generate a yearly inflation rate of 10%.

According to PolkaStats, there were around 1.16 billion DOT tokens in circulation as of this writing.

Solana Vs. Polkadot: What Are The Similarities Between Both Tokens?

Polkadot and Solana are two blockchain initiatives that have gained much attention and become trending topics on various social media platforms. With speeds that are so comparable, they save a lot of time and effort. You may send anything to both of them at once, and it will arrive at their addresses at no cost in a matter of seconds.

They’re comparable to smart contracts, too. They both expand in scope greatly when you start making your creations with them. We all know that ETH’s rise was not due only to chance. Due to the many large and impressive projects built on the Ethereum blockchain, ETH might be used to pay for network resources such as gas.

Token appreciation

It’s worth noting that tokens for both Solana and Polkadot have also seen substantial price increases. From less than $0.90 in April 2020 to about $260 in November 2021, the price of SOL more than doubled. DOT has increased significantly from less than US$3.00 in August 2020 to more than US$50.00 in November 2021.

Staking

Staking is used for consensus in both of these projects. In addition to Proof-of-Work (POH), Solana uses Proof-of-Stake (POS) to ensure the robustness of the network. Polkadot employs an NPOS system for its POS needs.

They also provide incentives to token holders who participate in the betting pool. Users may earn prizes in the form of more SOL tokens for locking up their tokens while supporting the network simultaneously. Users will not be able to utilize tokens while bound in this way.

Similarly, on Polkadot, users may “stake” or tie up their DOT tokens for a short period to help verify blocks on the network and gain rewards.

Assets do not pay dividends

It’s vital to remember that buying SOL or DOT is not like buying a stock, despite these extraordinary returns. In particular, SOL and DOT do not provide permission to profit-making businesses. This category of assets does not give dividends either. Therefore, they may be classified as highly speculative investments advice.

Solana Vs. Polkadot: What Are The Differences Both Tokens?

Although both the Solana Vs. Polkadot tokens are blockchain initiatives, they serve pretty distinct ends.

Different purposes

Polkadot offers blockchain scalability, interoperability, and governance, whereas the Solana blockchain can handle thousands of transactions per second. Solana employs a Proof of History consensus mechanism, whereas Polkadot employs a Proof of Stake algorithm. In addition, Polkadot supports scalability over several chains, whereas Solana only supports scaling across a single chain.

Consensus mechanisms

Consensus processes are another area where the two systems diverge. Solana uses POH and POS. In the Solana network, validators vote on which blocks should be added to the blockchain, validating the transactions inside them.

Instead, Polkadot employs NPOS, which draws upon the efforts of both nominators and validators. Tokens issued by nominators go toward funding-specific validators. In turn, it is up to the validators to choose new blocks for the Relay Chain.

Solana Vs. Polkadot: Which Is Better?

Since the two projects are so dissimilar, comparing their merits is pointless. While Solana is fast and low-cost, Polkadot addresses blockchain technology’s scalability and interoperability issues. While the two initiatives are distinct, they have a common goal of advancing the state of the crypto world. If these initiatives succeed in their aims and provide distinctive practical benefits, they may become crucial to the blockchain ecosystem.

Until their ecosystems expand, there isn’t much of a way to compare them. However, the market capitalization may make it seem that SOL is now in the lead.

How To Trade Crypto On Margex

Here’s a quick guide to trade crypto on Margex, a crypto exchange platform that offers world class services.

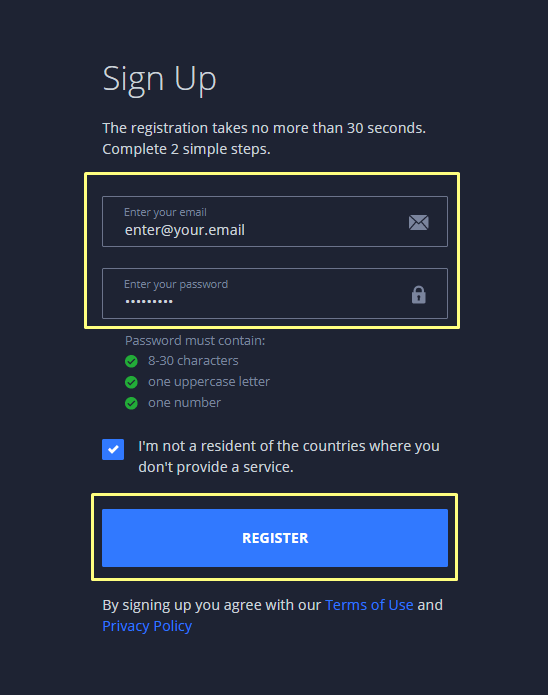

Create a user profile;

Fill out the needed information on the Sign-up page. “Register” is the only option. You’ll get an email to confirm your registration. To finish account registration, open this email and click on the confirmation link.

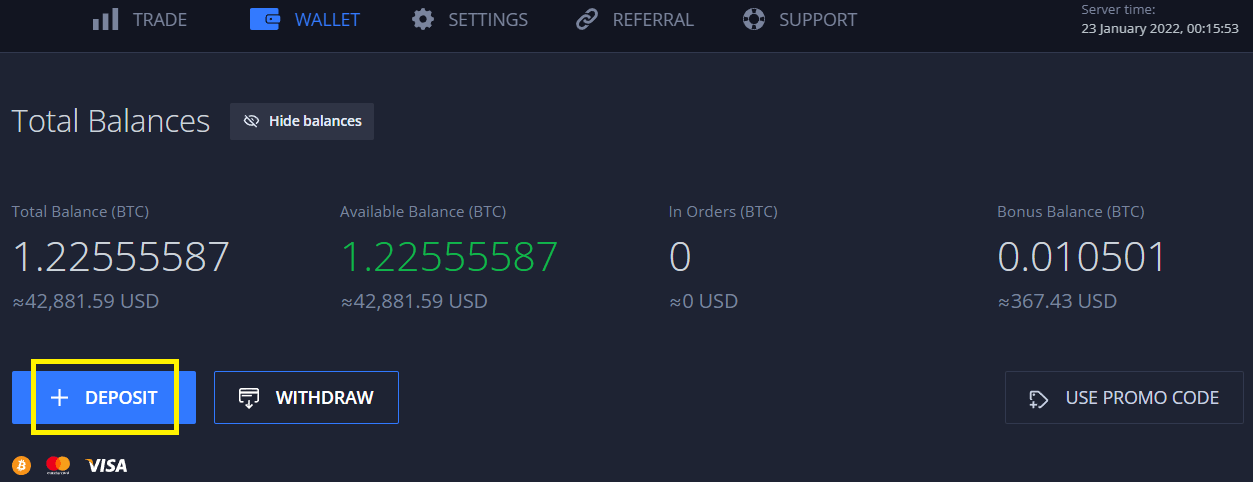

Deposit

Margex accepts the following payment options at this time:

- Directly transfer cryptocurrency to your Margex wallet from another address.

- Use Changelly or Changenow to buy cryptocurrency using a bank card.

- Making a deposit is as easy as the following:

Add a deposit to your Wallet by clicking +Deposit:

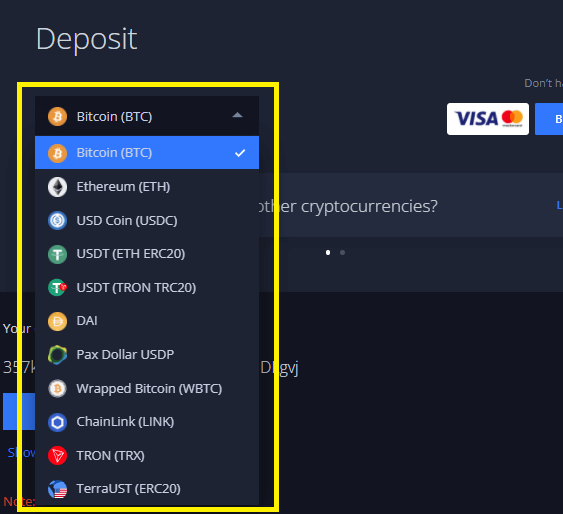

Select the currency you want to deposit from the drop-down menu:

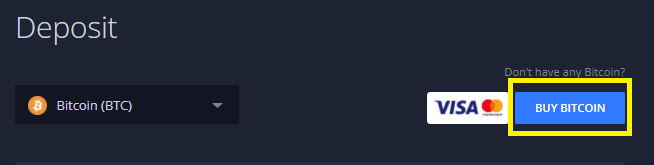

Simply copy the Margex deposit address and paste it into the site/destination wallet’s box.

Once you’ve clicked the “Buy Crypto” button, follow the steps given by Changelly to complete the transaction.

Navigate to the Trade page in order to begin trading

When placing an order, choose your preferred criteria;

- Collateral currency

- Trading pair

- Order type

- Order size

- Leverage

To make a Buy or Sell order, click the appropriate button.

TL/DR

- To understand “Solana Vs. Polkadot”, you must first understand that Solana and Polkadot have distinguished themselves as blockchain projects. They have distinguished themselves via compelling use cases. Solana has characterized itself by its capacity to manage many transactions. On the other hand, Polkadot has made a name for itself via its unique and practical value offer.

- As at the time of writing, they were ranked in the top 20 cryptocurrencies by capitalizing on CoinMarketCap. Solana has seen spectacular increases, from less than US$0.90 to about US$260, a gain of more than 25,000%. Polkadot has likewise surged, rising from less than $3 to more than $50, an increase of more than 1,000%.

It is hard to predict how well any of these projects will perform or how much their tokens will be appreciated in the future. However, investors have access to a lot of data, including technical documentation, Solana Vs. Polkadot performance, and third-party appraisals of these two projects.