Earlier this Monday, Federal Reserve Governor Christopher Waller, one of the voting members to decide on rate increase at the Fed, voiced his view on the US economic outlook before the Australasia Conference in Sydney, Australia. Waller also gave his opinion on the latest October CPI print which came in tamer than what market participants had anticipated, dismissing it as just one data point which may not make a trend. Waller further commented that markets were behaving ‘way out in front’ of the Fed, which still had a lot more tightening to do.

The Fed Has Reason to Be Cautious

Indeed, the Fed has reasons to be cautious, especially after an exceptionally strong rally in stocks, and together with it, an out-of-norm huge drop in the dollar post the CPI release. The crash in the dollar’s value would make imports more expensive going forward, and this could again send prices higher and drive up inflation in the following months. Thus, Waller saying that one data point cannot prove anything is prudent and being responsible. It is the trend that matters and more proof needs to be seen in order for the Fed to ease up on tightening.

Furthermore, according to another market expert, Gordon Johnson of GLJ Research, there are reasons to suspect that the October CPI reading was an unusually low fluke reading. Why did he say so? Let us check it out below.

CPI Readings Could Be Lower Than PCE Reading

Johnson noted over his twitter postings that there was a record “periodic adjustment” to Health Care Inflation CPI that artificially lowered the October Services Inflation, and this adjustment has distorted the October reading to the downside. Most importantly, this adjustment will not be reflected in the December 1 release of the PCE price index, the Fed’s preferred inflation gauge, which means that the PCE data could shock the markets by reporting a much higher than anticipated rate of increase.

With regards to Johnson’s argument, other experts have pointed out that the Health Care adjustment would continue to be applied in subsequent months until September 2023, which would mean that the adjustment would lower the CPI reading every month for the next 12 months, and this was not a one-off distortion. That said, this adjustment may cause the CPI and PCE data readings to differ, with the CPI ending up with a consistently lower reading than the PCE. For those in the know, the Fed prefers to use the core PCE number as reference instead of the core CPI number. Up to this point, the markets could use the CPI reading as an early indication for the PCE because the CPI produced more or less the same results as the PCE reading historically. However, in the coming 12 months, with this adjustment starting to take effect for the coming 12 months, this could make the CPI reading lower than the PCE reading and hence, not be an accurate gauge of the actual PCE result.

This thus begs the question, has inflation really eased, or is the CPI index simply a misrepresentation now? The markets will only find this out after the PCE price index is released on December 1. Regardless of what actually happens in the real world, traders’ attention will be on the data that the Fed looks at, and the Fed takes reference from the PCE rather than the CPI. Hence, it may be too soon to rejoice indeed.

Energy Prices Are Rising Again

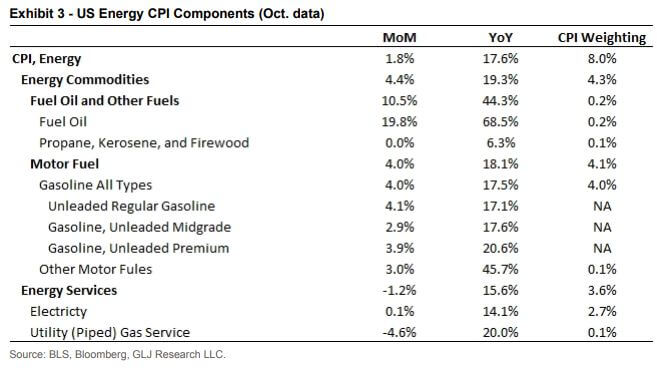

Johnson also looked deeper into the inflation report which showed that energy inflation, which has a 8% weightage in the CPI reading, is rising again after easing for the last couple of months.

While 8% may not be a very high weightage, the fact that energy prices would affect other spending and consumer behavior could be a cause of concern. Expectation of higher prices ahead could alter spending habits and consumers may bring forward large spendings to the foreground rather than wait till later, which could cause consumer prices to move up in the short-term, this may again, drive inflation higher in the coming months.

Even stripping away energy inflation, core services CPI is running at 6.7% year-over-year, its fastest pace of increase in over 40 years. This reading is still very far away from the Fed’s target core inflation rate of 2%, which means the Fed may still want to keep rates elevated for much longer.

Impact on Crypto Prices

The markets may have over-reacted to the CPI numbers by excessive bearishness on the dollar at the moment. This could return to bite crypto prices later when traders start to buy dollars again at the expense of crypto. Due to various rumours of contagion related to the FTX and Alameda bankruptcy, crypto prices did not even move higher when the stock markets put in a very strong relief rally last week. Thus, should the dollar strength return, crypto prices could dip further.

Even if the PCE price index eventually also shows that inflation has eased, any positive impact on crypto prices could be limited as the fate of crypto prices now depends more on the contagion from the FTX fallout rather than on any macro-economic event.