Presently, more than 10,000 cryptocurrencies are circulating in the market. Each of these cryptocurrency projects offers diverse value propositions. One of such unique projects is Tecoin.

Telcoin is a project that combines telecommunications and blockchain technology. It aims to boost security, efficiency, and privacy for crypto users in transactions and transfers by leveraging the simplicity of mobile devices.

Since its launch in 2017, Telcoin price has recorded bullish and bearish movements, just like other cryptos in the space. But what’s the latest Telcoin price forecast saying about the cryptocurrency? Will investing in the decentralized blockchain wise, or should you be wary of it?

Find these answers below as we explore the movements of Telcoin price since inception. We also gathered forecasts from an advanced technical analysis tool on TEL token price. Keep reading to learn more.

What Is Telcoin? (TEL)

Telcoin is an Ethereum-based decentralized financial platform that supports seamless transactions on mobile devices. The Telcoin blockchain is powered by Mobile Network Operators, Telcoin users, and Mobile Financial Service Providers.

The project aims to ensure that mobile device users can seamlessly access digital assets and transact with them. In 2020, the developers launched mobile apps for Android and iOS users to make digital payments from anywhere in the world. By February 2022, the developers launched trading on the V3.1 featuring 11 crypto assets.

Some features of Telcoin blockchain include SwiftTX, Obfuscation, and Decentralized Blockchain Voting. SwiftTX is a feature that ensures instant transactions on Telcoin. All it takes is a few seconds for the masternodes network to validate the transaction in a decentralized and trustless manner.

To be in their network, a user must stake 1000 Telcoin as collateral for the duration of the service. Masternodes are rewarded more than other staking activities since they are the network’s backbone.

Obsfucation takes care of concealing the coins through MasterNode mixing, while the DBV is the way of establishing consensus for updates and future advancements on the network.

Telcoin Launch and Origin History

Singaporean-based Telcoin Pte. Ltd. is the company behind Telcoin crypto. The company was established in July 2017. The founders of Telcoin are Paul Neuner, a cybersecurity and telecommunications expert with 12 years of experience, and Claude Eguienta.

Telcoin ICO took place in December 2017 and ended on February 11, 2018. A bounty campaign lasted from December 7, 2017, to January 31, 2018. The first product Telcoin launched was Telcoin remittances focusing on providing low-cost, high-speed digital money transfers to e-wallets and mobile money platforms. Afterward, Telcoin launched its V3, introducing two user-owned products, TELxchange and SMS (Send Money Smarter Network).

TELxchange is a decentralized cryptocurrency exchange, while SMS is a global remittance network. These projects were developed in 2020 and launched in 2021. Also, by August 2020, Telcoin launched its liquidity mining pool on Uniswap V2.

Regarding regulations, Telcoin operates with Singapore licenses. Also, it acquired other licenses from Australia and Canada to operate as a payment institution.

What protocol does Telcoin use?

Telcoin uses the Proof-of-Work consensus mechanism to validate transactions. The network is based on the Ethereum blockchain. It completes the validation and execution of smart contracts through its PoW mechanism. But before validating transactions, Telcoin verifies whether it has real-world feasibility through a proof-of-concept mechanism.

What makes it different from other cryptocurrencies

Telcoin provides global mobile remittances at a low cost. But aside from simplifying transactions, other features make the cryptocurrency unique from others in the space.

- Mobile access to financial products: Telcoin is focused on ensuring that billions of mobile devices can interact with financial products through their phones without intermediary institutions.

- Wallet Agnostic; the network integrates seamlessly with the existing telecom mobile money wallet and owns a proprietary wallet.

- Incentivized adoption; it is easy to fit Telcoin into existing models for connecting to mobile money platforms and direct carrier billing (DCB). But fees are deducted from Tel issuance, profiting both the end-users and the network.

- Flexible Telecom Application Programming Interface; the exchange of API and pricing of Telcoin interacts directly with mobile money platforms and carrier billing through SMS, USSD, and REST APIs.

Telecoin Network at a glance

Factors Influencing Telcoin price

Like other cryptocurrencies, many factors are vital in moving Telcoin Price Prediction. Check some of the factors affecting Telcoin price below.

Supply

Supply is one of the cryptocurrency market forces that could drive Telcoin prices upwards or downwards. If supply exceeds demand, a token price falls due to saturation. But a coin’s price will spike when the supply is lower than the demand.

Telcoin has a supply cap of 100,000 000,000 TEL, and the number in circulation now is 61,728,700,558 TEL. New TEL tokens won’t be released when the max supply is reached.

Demand

An increasing demand affects Telcoin price prediction. When more investors pick interest in TEL tokens, demand will increase. But this force can drive value if the supply of Tel remains controlled and does not saturate the market.

The crypto market is not very appealing to investors due to the continuing bear market. This situation affects Telcoin price just like others in the space. But if the tide turns, the cryptocurrency might stabilize.

Network developments

Another factor that pushes crypto networks is development. For instance, the announcement of Ethereum Merge pushed ETH prices up, and investors expect more spikes after the upgrade.

Telcoin price could follow the same momentum with future developments. For instance, a recent Nebraska Legislation favoring DeFi and crypto, in general, helped to improve Telcoin price after its announcement.

Mass adoption

Since its launch, Telcoin hasn’t significantly grown as the team focused more on developing the network. One of the fruits of their effort was achieving its remittance service operations to facilitate funds transfer between the Philippines and Canada. Mass adoption might become possible if such projects continue, thereby driving value higher.

Exchange listing

Achieving more listings on top exchanges can propel TEL tokens upward. Telcoin tokens can be bought, sold, or traded on KuCoin, Sushiswap, Balancer, Uniswap, Bilaxy, Sushiswap, and Quickswap polygon and 1inch Exchange. As more exchanges list TEL coins, demand will spike Telcoin price too.

Regulation

Many people in the crypto community are skeptical about regulations. But cryptocurrencies like Telcoin are already regulated and won’t be affected by new rules that might emerge in the future. For instance, Telcoin added KYC to its wallet to comply with regulations on the ground in most countries, such as the US. Such developments could boost its adoption as an efficient mobile funds transfer option.

Telcoin Price Performance In The Past: Detailed TEL Price Movement From Launch

Telcoin hasn’t recorded many price movements since its launch. But there have been some slight price changes. Let’s discuss them below.

TEL ICO and price

CoinMarketcap started tracking Telcoin price in January 2018 during the ICO and bounty campaign. Then 1 TEL was $0.004678, and the team raised $25,000,000.

Bear market and Telcoin price

The 2018 crypto bear market also affected Telcoin price. Before the downwards trends in 2018, TEL price recorded a price surge to $0.01113. But by August 14, 2018, the coin price fell flat to $0.0005563. The downward trends continued until February 15, 2019, when they plummeted to $0.0002626. By March 30 and August 2, 2019, the token price rose to $0.0007373 and $0.0007595. After the brief surge, it continued the downward trend until 2020.

Global pandemic and Telcoin price

The global pandemic affected the crypto market in early 2020. Telcoin price didn’t fare well, even with the expansion of its network. By March 13, 2020, TEL average trading price was again low at $0.0006474 after losing the previous year’s increase.

Launch of products and Telcoin price

Telcoin development team launched two new products in January 2021. This achievement led to a price increase from $0.0001708 on January 1 to $0.05987 on April 10, 2021. But the coin couldn’t sustain its price value. By December 31, 2021, the token price plummeted to $0.01179.

Crypto winter and Telcoin price

Telecoin price Prediction for 2022 has been difficult to achieve. The token stood at $0.005882 at the beginning of February 2022. But since the May/June crypto winter, TEL tokens have fallen. On June 14, Telcoin average trading price was $0.001341, and after sideways trading closed the month at $0.001506. But as of July 14, 1 TEL fell to $0.001336. Even till August 23, the crypto market is still bearish.

How Is Telcoin Doing Now? Is Telcoin price Bullish Or Bearish?

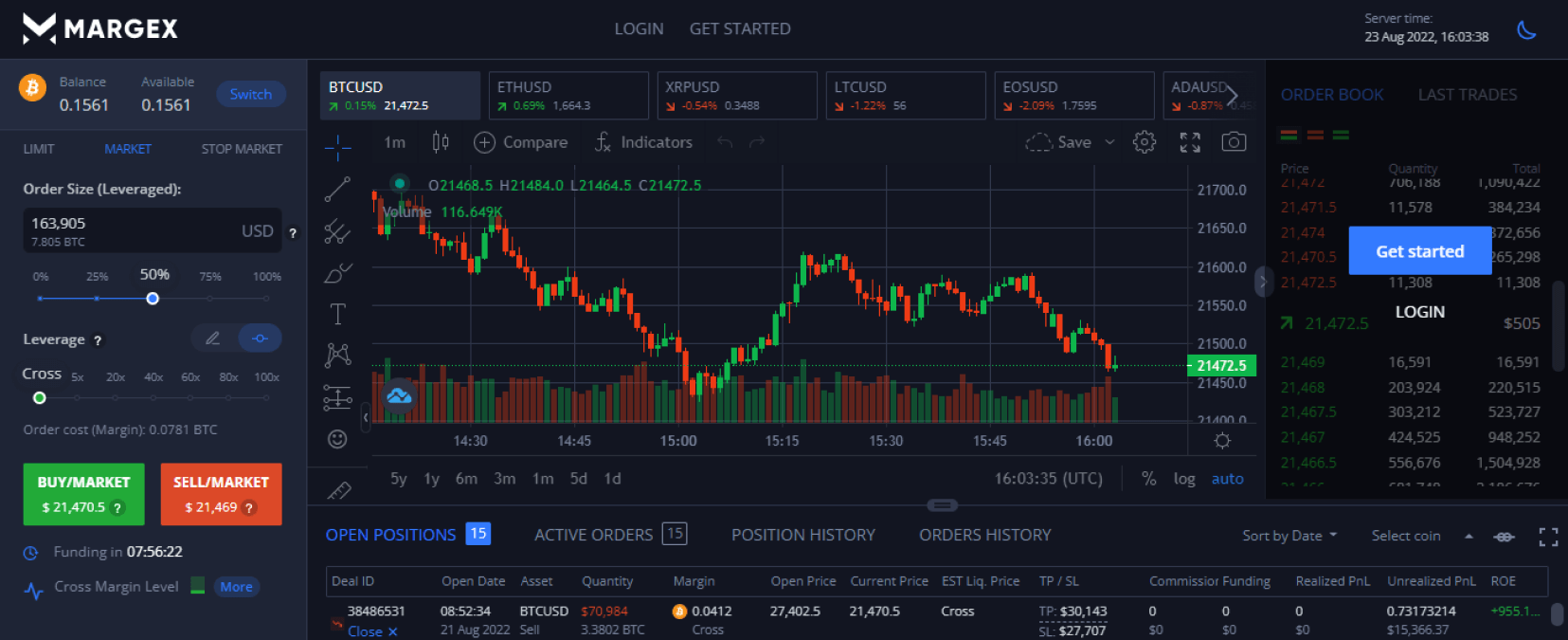

Telcoin price has been trading more on the greens than the reds since the market started recovering slightly. The token price as of August 23 stands at $0.001603, indicating a price gain of 1.47% from August 22.

The chart above shows a price movement of Telcoin, indicating a more favorable price trend. Also, Telcoin trading volume has added 45.19%, while its market cap also gained 1.54% in 24 hours.

While we can’t say that Telcoin price is bullish, there is an encouraging move towards price rallies. But the general crypto market hasn’t overcome the bear market trend yet.

Telcoin Price Prediction Today

According to an advanced technical analysis tool, Telcoin price on December 26, 2022, will stand at a minimum value of $0.002. The maximum price of TEL will be $0.0023, while the average price is expected to be $0.0021.

The next day, December 27, Telcoin price Prediction shows the token will hit $0.0021 as its minimum price. The maximum trading price will reach $0.0021. But the average price forecast stands at $0.0022.

Long-Term Telcoin price Prediction For 2023

Experts present Telcoin price Prediction because, by 2023, the network may have more competition, affecting its coin price.

Long-term Telcoin price Prediction For 2023 – 2030

The long-term Telcoin price Prediction indicates a gradual price increase. Expert analysts believe that more adoption and recognition of the industry might also push Telcoin price up. Find their forecasts below.

Long-Term Telcoin price Prediction By Experts

To invest wisely, check experts’ Telcoin price predictions from 2022 to 2027 below to gauge their take on TEL in the next 5 years.

Prediction by PricePrediction.net

There seem to be diverse thoughts regarding the Telcoin price forecast in the remaining part of 2022. Telcoin Price Prediction, according to PricePrediction.net, states that the digital token will hit $0.002 toward the end of this year.

Prediction by TradingBeast

TradingBeast predicted that Telcoin price in December 2023 would be $0.0028386 at maximum. But TradingBeast believes that the crypto will keep rising in 2023. However, some others foresee a downtrend in its price.

Prediction by WalletInvestor

According to the Prediction from WalletInvestor, Telcoin price will still fluctuate below $0.0002 in that year. Its price Prediction for the digital currency cited that it will get to the $0.000170 price mark toward the end of 2024.

Prediction by DigitalCoinPrice

Advanced technical analysis and price forecast of the Telcoin digital token from DigitalCoinPrice display a positive movement of the token. From its data, there’s a tendency that Telcoin will hit a price mark of $0.00312 before the end of 2025.

Prediction by Coin Price Forecast

Telcoin Price Prediction from Coin price Forecast cited a continuous growth in the token price. In 2026, Coin price forecast predicts that Telcoin’s lowest price will be approximately $0.0053. However, before the year ends, it would have reached the $0.0058 price mark as its maximum price.

Prediction by Gov Capital

Gov Capital has predicted that Telcoin might be worth about $0.0975 in 2027. This Prediction indicates that in 2027 Telcoin price would have increased by over 1800% from today.

Price Prediction By Margex

Margex is a go-to platform to trade crypto derivatives. The on-chain and technical analysts provided a detailed Telcoin forecast which you can compare to other Telcoin price Predictions. But always do more research, as this is not investment advice. Many factors drive crypto price movements, negating advanced technical analysis.

Based on the recent Telcoin price trend, the token regularly records spikes and pullbacks. On August 11, 2022, the TEL token stood at $0.001638. The next day, it jumped to $0.00171 and continued climbing until it reached $0.001976 on August 14.

From August 14, it fell to $0.001535 on August 21. Later it gained on August 22 and climbed to $0.001592. Currently, on August 23, Telcoin price jumped to $0.001608 after gaining 0.95% in 24 hours.

These fluctuations indicate uncertainty on TEL year-end maximum average price. If it continues gaining, Telcoin price might remain within the $0.0016 and $0.0017 maximum level in the short term. The long-term forecast price for Telcoins might be encouraging, with some improvements in the ecosystem as the team continues expansion. The goal is to reach billions of phone users globally. These developments will undoubtedly attract investors, pushing the coin price even higher to $0.0975 by 2027n and more by 2030.

Crypto As A Financial Instrument Today

To make your crypto assets profitable, start investing and trading. Telcoin and other digital assets are unimaginably volatile, leading to unpredictable price movements. That’s why you should trade with them to earn rewards faster.

But many cryptocurrencies are prone to pump-and-dump scams. So, to protect your investment funds, trade derivatives on Margex with 100x leverage. The assets on the platform are reliable and not manipulated.

Margex has launched a stablecoins staking feature to allow users to trade staked assets and earn high rewards. Trading staked assets offer 8.8% APY on stablecoins and 5.5% APY on Bitcoin.

Also, making deposits on Margex has become easier. You can now use credit/debit cards, BTC, ETH, USDC, DAI, LINK, USDP, wBTC – ERC20, USDT – ERC20, and TRC20. Moreover, all assets on Margex, including BTC, USDT, USDC, DAI, ETH, Link, wBTC, USDP, can be used as trading collaterals.

You can start the journey by downloading the fast and scalable Margex mobile app. The interface offers innovative features and trading tools to support your efforts. The fees on Margex are low, and you can even start with a minimum deposit of $10.

So, what are you waiting for? Open an account, deposit into your Margex wallet and start trading now.

FAQ, Common Questions, And Answers On Telcoin Price Trend

Find more valuable information about Telcoin price movements to aid your research.

How much can 1 TEL be worth?

Most of the Telcoin price forecasts are highly speculative. TradingBeast, predicts Telcoin to reach a minimum level of $0.0155094 and a maximum of $0.0228079 by the end of 2022. According to cryptonewz.com, Telcoin will reach a minimum price level of $0.0047 and a maximum of $0.0087 in 2022. However, these figures are projections and can be affected by other factors.

Is Telcoin growing?

The crypto market is highly speculative. Many popular news sites have predicted slow and measured growth for the asset. With market volatility and other factors, experts don’t believe it might gain much. However, it might increase by the end of 2022.

What is the state of Telcoin?

Currently, Telcoin is down as the cryptocurrency market is generally bearish. Notwithstanding, the project is ideal for long-term investors as the price forecast for the next few years is positive.

What is TEL’s all-time high?

The all-time high of Telcoin is $0.0649, achieved on May 10, 2021, after a healthy market rally. The current price is $0.001564, showing a significant price correction from the previous uptrend. It ranks 200 on marketcap currently.

Can 1 Tel token reach $1?

With the Telcoin price Predictions, there is no certainty if it can break the $1 ceiling in the nearest future. It will be a while until Telcom achieves this price range. Also, based on past price datum, there is a possibility that the average trading price might never reach $1.

Is Telcoin a Decentralized finance project?

Telcoin is a decentralized finance project on Ethereum. It supports peer-to-peer token exchange for mobile phone users and an e-commerce solution for seamless transactions. Telcoin is available on top cryptocurrency exchange platforms like Uniswap.

Can I mine Tel tokens?

You can mine TEL tokens by first providing liquidity to support automated market makers and receive Liquidity Provider Tokens. With the LP tokens, you can mine more TEL tokens.