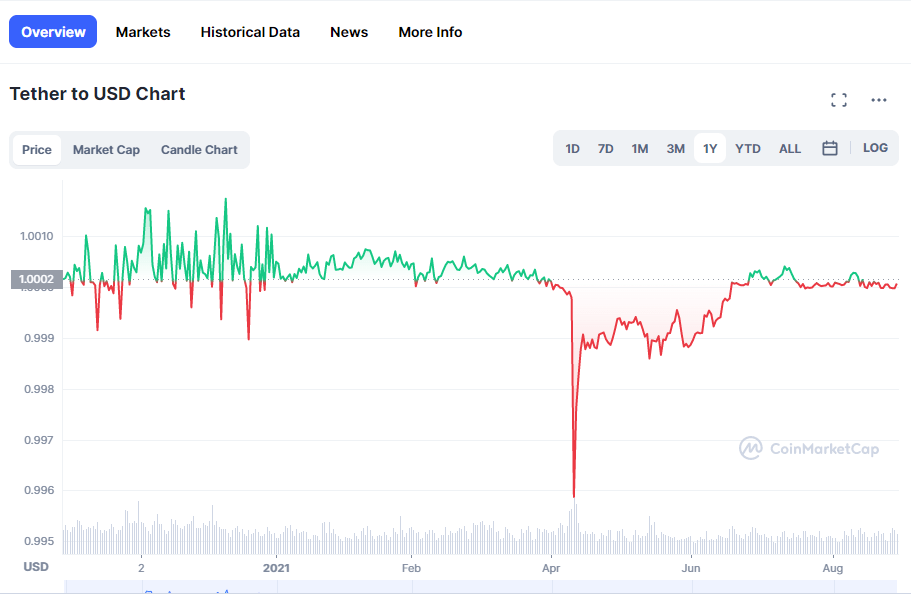

Tether has been the world’s largest stablecoin by market capitalization. But it has suffered a series of volatility and even lost its dollar peg from May to July this year. The two events that plummeted Tether’s depeg were the crash of Terra’s UST stablecoin and the Celsius Network withdrawal freeze.

The digital token, which was supposed to match USD in value, eventually dropped to about $0.9485, pushing the entire market down. The event triggered a series of events that led to losses for investors and traders. Currently, many people are asking, should I buy USDT? Is Tether a good investment in 2022?

This Tether crypto price prediction provides answers to these questions. Read on to discover experts’ predictions on USDT.

What Is TETHER (USDT)?

Tether (USDT) is a fiat-pegged stablecoin that facilitates digital assets trading. Users prefer the coin on Bitcoin and Ethereum blockchain. Notably, Tether is pegged to the US dollar in a 1:1 ratio.

The stablecoin maintains its peg through reserves in banks to keep the USDT equal to one dollar in value. Tether was updated to also work on EOS, Tron, Algorand, and OMG blockchains.

Brock Pierce, Craig Sellars, and Reeve Collins created the stablecoin in July 2014. The developers originally called it “realcoin” since it aimed to maintain a fixed ratio with the U.S. dollar.

What protocol does Tether use?

Tether was built on the Bitcoin Mastercoin (Omni) protocol layer that introduced stablecoins in 2012. It emerged as a solution to the high volatility and convertibility problem between fiat currencies and cryptocurrencies.

On the Ethereum network, USDT is represented as an ERC-20 token using the Omni layer on the bitcoin network. Tether operates on a decentralized network under Tether Ltd. A Hong Kong-based company.

What makes Tether different

USDT has a unique selling point: stability. For every new USDT token issued, the developers allocate the equivalent amount in US dollars to the reserves. This strategy sustains USDT peg to the US dollar.

The stablecoin is designed to operate without the volatility in the crypto space. This stability makes it an ideal project for most investors. It also provides a safe and faster transaction framework for transactions between countries through the blockchain network.

This eliminates the need to rely on middlemen like banks or other financial institutions.

Tether Blockchain At A Glance

Factors Influencing Tether (USDT) Price

Some key factors usually influence the price action on all the assets in the cryptocurrency market. Although Tether is a stablecoin, these factors also affect it.

Supply

This is one of the strongest determinants of price in any market structure. If the supply of USDT exceeds the demand, it could create a bearish price movement for the token. USDT has a market cap of $67,959,923,695.

The current circulating supply of Tether is 67,956,206,762.891 USDT. Tether is unique because, unlike other cryptocurrencies, there is no expected maximum supply since a private company controls it.

Demand

A spike in demand for USDT will naturally drive the prices up for a possible bullish run in the market. Despite the bearish trend in the current crypto market that has seen giants like Bitcoin dip, USDT retains stability.

This fight to remain stable has prompted investors to add USDT to their investment portfolios.

Market sentiments

Investors always seek general market sentiments and crypto predictions to protect their portfolios. Since USDT is pegged to the USD, it feels most of the effects of the market on the dollar.

For instance, investors could move their holdings to a commodity like gold if the market is in a downtrend. Such moves will devalue the US dollar and reduce the price of USDT proportionally.

Technical and fundamental analysis

Many analysts and experts keep an eye out for even slight movements in the market. Experts use past price data to monitor and predict possible price development and changes for cryptocurrencies.

They monitor the economy using vital statistics which could affect the price of USDT. If the economy is booming, assets also boom, and vice versa.

Gross Domestic Product (GDP)

GDP figures portray the monetary value of goods and services produced in a country within a period. A high GDP is an indicator of a country growing economically.

In the US, for instance, a high GDP will further strengthen the dollar and affect the price of USDT and vice versa.

Tether Price Performance In The Past

Tether has experienced several fluctuations since its launch in July 2014. The developers failed to provide audited financial statements of its reserve, raising doubts in investors. The controversies altered the original 1:1 ratio of the token, with the USD bringing its price to $0.85 in May 2015. Months and years building up to 2022 were unfavorable for the Tether token. Its price was mostly under the $1 price mark.

It regained stability to the United States dollar in 2020 but witnessed a few up-and-down trends between 2021 and 2022.

The controversy behind Tether

Many economists and investors opined that Tether didn’t have enough dollar reserves to affirm its peg to the USD. This was one of the major factors that affected and is still affecting the possible price development of Tether.

The controversy arose because 2.9% of Tether’s holdings were cash as of 2021. Moreover, many believe that Tether crypto is a tool for manipulating the prices of Bitcoin.

In early 2021, the attorney general’s office in New York concluded that Tether and Bitfinex were involved in a theft case. It reported that both parties moved hundreds of millions of dollars to regain a loss of $850 million.

The event at the time affected the value of the token, bringing it to a price of $0.9187

Market moves

Negative sentiments and psychology about Tether and the broader crypto sector also affected the price of the token, resulting in its fluctuations. For instance, the 2022 crypto winter caused Tether USDT to depeg from USD.

From May 8 to July 19, Tether’s price was below $1, causing a lot of panic in the market. Thankfully, by July 20, 2022, Tether reclaimed its peg to USD.

How Is Tether Doing Now? Current Tether Price

The current price of the Tether token is $1.0000453, equating to the 1:1 USD value ratio. Its market cap is now $67.96 billion, with a 24-hour trading volume of $54.67 billion. Its price change rate has been +0.01% in the past 24 hours.

It appears that the bearish crypto market is not affecting the price of Tether. The minimum price of the Tether token since September 2021 was $0.9959.

Chances are that it will maintain the $1 price level provided there are no further controversies to drive investors away from the token.

Tether Crypto Price Prediction Today

Currently, the value of the Tether token stands at $1, according to the market watch. Its minimum and average price on the remaining day of September is $1.00 but has an expected maximum price of $1.01.

Tether Price Prediction For February 2023

In February 2022, Tether is predicted to begin at $1.072 and end at $0.9282 during the end of the month. Below is Tether Price Prediction for February.

Short-Term Tether Price Prediction For 2023

The crypto market has been facing rises and falls due to macros. So, it’s important to understand the price prediction for the end of 2023. Below is the experts’ month-by-month price prediction of Tether.

The year 2022 was an intense year leading to the collapse of many projects and other stable tokens like UST, the stablecoin for the LUNA ecosystem, as the price of the token depegged to less than $1 as many began speculation for the price of Tether to follow the decline in the price of UST. Despite the rumors and fear surrounding the event, the price of USDT remained strong above $0.95.

Long-Term Tether Price Prediction For 2023

Tether price prediction for 2023 shows that it will grow up to $1.40 by December 31, 2023. Investors will like this forecast, indicating that Tether will stabilize and have a potential investment value.

Long-Term Tether Price Prediction For 2023 – 2030

Given how closely Tether is tied to the world’s financial system, it’s challenging to anticipate its future price. Check the Long-term Tether price prediction for 2023 -2030 below.

Long-Term Tether Crypto Price Prediction by Experts

Price Prediction by WalletInvestor

According to WalletInvestor, the expected maximum price of Tether in 2025 could get up to $1.039. Its minimum price will be around $1.010 based on the expert’s forecast, with an average Tether price of $1.027.

Prediction by DigitalCoinPrice

DigitalCoinPrice prediction for the end of 2025 reveals a minimum price of $1.780. Its expected maximum price can get up to $1.860, having an average price of $1.571.

Prediction by TradingBeasts

According to TradingBeasts, Tether will likely get above an average price of $1.384 from 2026 to 2027. Based on its prediction, the maximum price of Tether in the same period should be around $1.705 and a minimum price of $1.191.

Price Prediction By Margex

Margex provides you with more details and an expert overview. With the recent Tether price trend, USDT is currently worth $1.00. The price in September was relatively volatile, as with other cryptocurrencies. Between August 1 and September 28, the price deviated slightly from $1. For instance, on September 26, the minimum price recorded was 0.9999, which was the low of the day.

Between May and July 2022, Tether recorded great volatility due to the bearish turn of the crypto market. For October, Tether crypto might see lower deviations from the $1 peg. It is important to note that these predictions are based on past price data and can change anytime.

Margex provides a platform for trading cryptocurrencies. On the platform, you can trade Bitcoin and stablecoins like Tether with 100x leverage on the value of your tokens. The platform also supports cryptocurrency staking, which is the best bet for Tether.

It is important to note that USDT and USDC are low volatile stablecoins. This means that there are no opportunities to make a profit trading them. We suggest staking your stablecoins to preserve their value over time.

The price difference in USDT rates always floats by a few cents. This is a great arbitrage opportunity to capitalize on price differences and make profits. But the rate can also be affected by a depeg from the dollar and panic due to a lack of stable support.

Therefore, only invest what you can afford to lose on any crypto asset.

FAQ

Is Tether USDT a good investment option?

As long as the Tether can sustain its peg to the dollar, it is a worthwhile investment. While the cryptocurrency market is experiencing a bearish trend, Tether is still a great choice for investors. Tether is a lot more stable and offers investors easy transactions at cheaper rates.

Will Tether price increase?

Tether is pegged to the dollar at a ratio of 1:1. This means that the value of the stablecoin will not deviate a lot from $1. Experts have predicted a slight percentage increase in the coming years for Tether.

However, most predictions are highly speculative since the market is volatile. Forecasters always differ on their prognosis of price movements.

Why is Tether better for investors?

Investing in Tether is somehow secure from market forces due to its USD reserves. Even bitcoin recorded a major drop in value in 2022, while Tether remained in the one-dollar range. One added benefit is that you can easily swap Tether for other cryptocurrencies and vice-versa.

What platform should I use to invest in Tether?

Margex is the most reliable platform for investors. It offers many interesting features and educational materials for beginner and experienced traders. The platform gives traders leverage of up to 100x of their assets. It also supports multiple order types and is highly interactive. There are also bonuses and other incentives for traders and investors.