A derivative form of Bitcoin that is run on the Ethereum blockchain, known as wrapped Bitcoin (wBTC), recently depegged from its value of one Bitcoin, showing that investors could be rushing to get out of the asset into the safety of owning an actual Bitcoin. A depeg is unsettling news to holders of the wBTC token as the depeg could mean that they would be getting back less than one Bitcoin for every wBTC that they hold. Furthermore, this depeg opened up another can of worms as crypto experts have found that the biggest possible holder of wBTC could be none other than the few infamous crypto firms that have filed for bankruptcy recently. This revelation raised the fear level amongst the crypto community – that these firms could one day dump their redeemed Bitcoins to pay creditors. Depending on how much Bitcoin they still have to redeem and sell, it may drag down the price of Bitcoin. Furthermore, should wBTC’s discount to Bitcoin’s price go deeper, it could send more shockwaves to the crypto space as holders of wBTC will not be able to get their promised one-for-one Bitcoin exchange from its issuer, BitGo. Read on as we dive into the details so our readers can find out what exactly happened and decide for yourself if you should be concerned.

What is Wrapped Bitcoin?

Wrapped Bitcoin, popularly referred to as just wBTC by most crypto DeFi users, is a token run on the Ethereum blockchain that is supposed to represent one Bitcoin. Its issuer, BitGo, has provided onchain proof that it has the backing of one Bitcoin for every wBTC minted. While wBTC is used by many DeFi traders, it is in no way a decentralized product and its soundness still depends a lot on its issuer, BitGo. wBTC has been very popular and in fact, instrumental to the growth of DeFi in the 2021 bull market because it allows holders to capitalize on the price appreciation of Bitcoin without having to hold one actual Bitcoin. It is simply an erc-20 token that its issuer promises to exchange for one Bitcoin whenever the holder redeems it. In other words, the exchangeability of this Bitcoin representative depends on the credibility of the issuer, BitGo. The token has been popular amongst DeFi degenerate traders because being built on Ethereum allows the wBTC token to be able to interact with smart contracts and other DeFi applications run on the Ethereum blockchain to generate yields, something that holding an actual Bitcoin is not able to do.

The product had been operating without much issues until after the implosion of FTX, where everything that is centralized within the crypto space has come under intense scrutiny, from lending firms to crypto exchanges, to issuers of all other crypto related products like stablecoins and derivatives. Needless to say, wBTC has naturally come into the spotlight also, as industry insiders attempt to suss out other operators that could be at risk of default. The findings by some people revealed something unsettling, which caused the token to depeg

Wrapped Bitcoin Worked with the Most Notorious Names

As fate would have it, data tracked by Dune analytics, a blockchain data provider, revealed that the largest user of wBTC is none other than Alameda Research, the bankrupt trading arm of FTX. While scary to know, this is not the worst news as the second largest holder is Coinlist, which has also suspended withdrawals on its platform and is rumored to be filing for bankruptcy. Three Arrows Capital, a crypto hedge fund that has filed for bankruptcy after the implosion of LUNA, is its fourth largest holder.

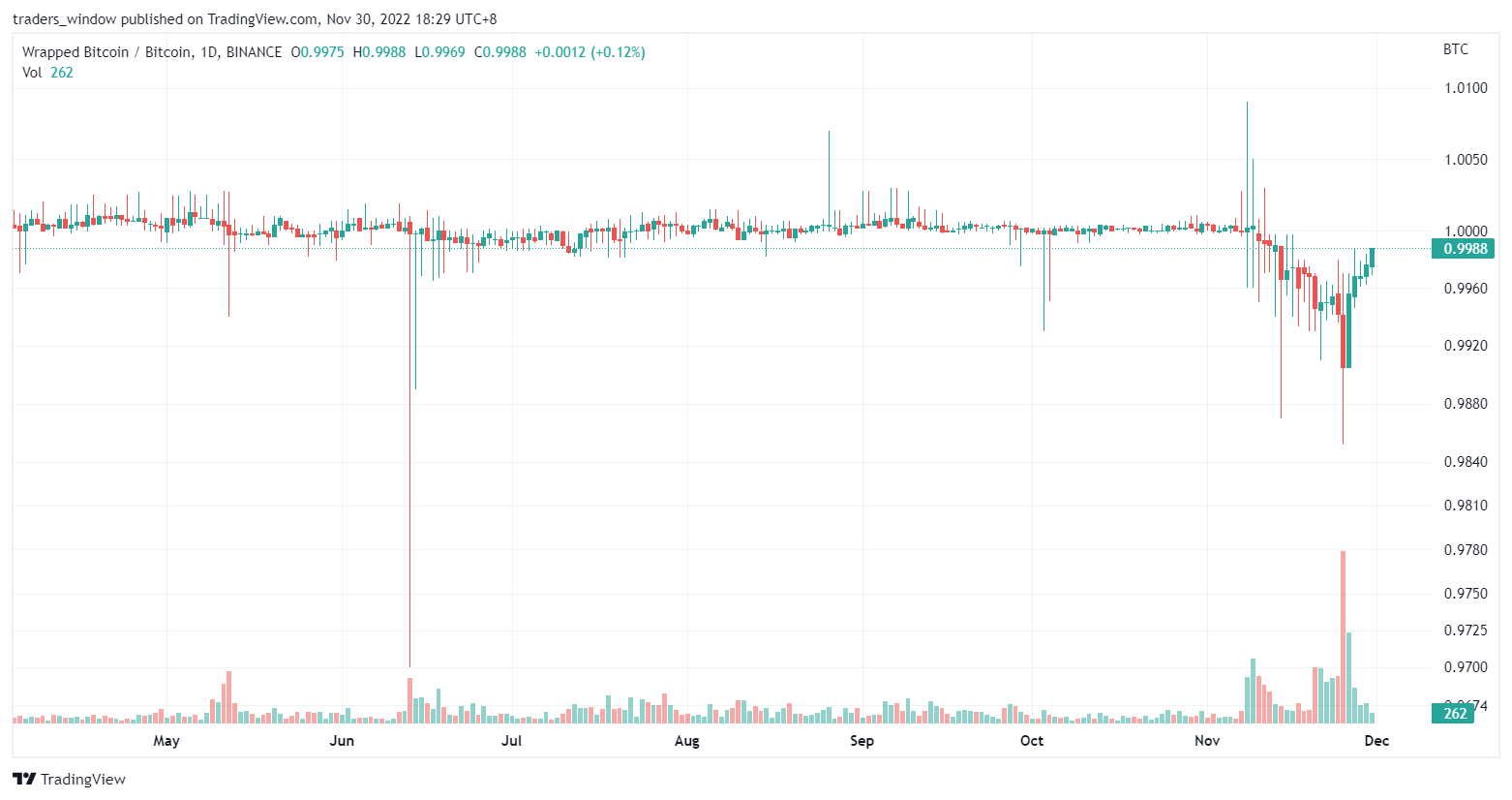

This information may shed light on why wBTC has depegged since mid-November after the implosion of FTX – Alameda may have been redeeming them for Bitcoin for sale. The amount of redemption has been too big, while new buyers too little, resulting in a price discount. Market data showed that there has been an 8.82% decrease in wBTC supply from 238,000 on November 12 down to 217,000 on November 26 when its price discrepancy was the largest, trading at a 1.3% discount to Bitcoin.

Lost of Faith in Centralized Entities Exacerbated the Depeg

While Alameda and Coinlist were only merchants that assisted their customers to mint wBTC, there has been no information about how much of these wBTC Alameda was still holding at the point they filed for bankruptcy, nor has it been revealed if Alameda was still holding on to any of these wBTC on behalf of its customers at its point of default. This could have led to uncertainty amongst traders, which caused arbitrageurs to not want to step in to bring the peg back to parity, resulting in the depeg to last for more than one week. To make things worse, there was some FUD among the crypto community that the reserves of BitGo could be insufficient to meet redemptions, or that there was financial issues with BitGo, before a clarification by BitGo’s COO on November 27 managed to restore some confidence and send the peg recovering to about 0.9988 BTC as at the time of writing.

While the situation appears to have been contained at this point in time, holders of wBTC may still wish to be wary and keep monitoring the price of wBTC just in case a larger and more sustained period of depeg occurs, as the identity of the largest holders of wBTC has not yet been made known.

Should the depeg happen again and remain for a long period of time, more uncertainty could blanket the already fragile crypto market.

The above are the personal opinions of the author and should not be taken as the official view of the Margex platform. They are also not financial advice and are only meant to be educational in nature. Thus, they should not be construed as a solicitation to trade. Readers are strongly encouraged to do your own research, conduct due diligence, and assess your financial abilities before doing any investment or trading as these activities carry risks. Should you be in doubt, kindly speak with your personal financial advisor.