Turtle Trading strategy emerged as a response to a debate. This strategy relies on rigid mechanisms that traders must strictly adhere to for profits. The basis of turtle trading is following the prevailing market trend.

This strategy focuses on markets traded, position sizing, entry and exit, position limit, correlations, and tactics. It was largely successful during its inception period. However, it has lost its potency in a new market like the crypto market.

Turtle trading was mainly for the commodity and stock markets. However, with some slight modifications, this method can help traders profit in the crypto market.

Keep reading to find more facts and applications of this dynamic trading strategy.

A Brief History Of Turtle Trading Method

The Turtle trading strategy emerged in 1983 following an experiment by commodity traders Richard Dennis and William Eckhardt. Dennis aimed to prove that anyone can become a successful trader by following principles. On the other hand, Eckhardt believed that trading was an inborn gift Dennis, his trading partner, had.

Dennis then sets off on a quest to prove his point to Eckhardt. He screened a group of students who he referred to as “Turtles.” The farm-grown turtles he saw on his visit to Singapore inspired the name. He felt he could mentor total strangers into becoming successful traders quickly.

The training for the students was slated for two weeks. He placed an Ad in the Wall Street Journal that drew massive interest from the public. After a thorough selection process from thousands of applicants, he got only 14 students for the first Turtle strategy trading training.

The two “Turtle” classes by Dennis in his turtle experiment realized more than $175 million in just five years. This proved that his earlier conviction was true and that people could master turtle strategy trading with the proper rules.

Turtle trading has become a market legend since traders apply it to this day. Proper knowledge of this strategy’s rules and entry and exit points is essential.

What Does Turtle Trading Mean?

This is a trend-following strategy that utilizes sustained momentum for profit. With this system, traders buy futures breaking out of the upside in a trading range and sell short downside breakouts.

The goal of this strategy is for traders to follow the rules meticulously and not rely on emotions or feelings.

Turtle Trading Rules

Turtles must strictly adhere to this set of rules to record success.

Markets traded

The pioneer Turtles traded several future contracts, commodities, metals, bonds, S&P 500 FX, and energy. The main aim is to trade in markets with high liquidity. Traders with this method can move the market without making a large order. Higher liquidity increases the depth of the market, which is favorable for traders.

This strategy in turtle trading rules significantly decreases the trading risks for traders. Using this method for cryptocurrency trades implies traders must focus on highly liquid assets like bitcoin.

Position Sizing

This system automatically adjusts the position size to the Market Dollar Volatility of a specific market. It adjusts the trade size based on the dollar volatility in the current market.

The system encourages diversity by ensuring that all positions maintain the same size in each market. Markets with higher liquidity will trade fewer contracts, and those with lower liquidity will trade more.

The volatility of the market was studied by observing the 20-day exponential moving average of the True Range.

N or ATR represents the 20-day exponential average of the True Range.

The daily true range is calculated as follows:

True Range = MAXIMUM (H-L, H-PDC, PDC-L)

H = Current High

PDC = Previous Day’s Close

L = Current Low

Formula for N = (19 x PDN +TR)20

Where:

N = 20-day exponential moving average of the true range.

PDN = Previous Day’s N

TR = Current day’s true range

Entry and pyramiding

The entry point of a position is vital to the success of a trade in the turtle trading rules. Turtle traders use two entry systems.

System 1: Short-term entry based on 20-day breakout

The turtles buy one unit when the price is above the high of the last twenty days. Also, they sell one unit if it drops below the low of the last twenty days. Turtles would ignore the trade if the former signal was a winner, meaning the price went 2 N against the current position.

The turtles can engage in a ten-day profitable exit with the winning signals.

System 2: long-term 55-day breakout strategy

Traders entered buy positions of one unit when the price moved above the high of the last 55 days. They entered sell positions of one unit when the trade dropped below the low of the previous 55 days.

Traders used this method in cases where they skipped the 20-day breakout due to winning trades. The trades ended on a breakout before the market’s daily close. When the price of an asset exceeds its high or low, a breakout occurs.

Pyramiding (adding to positions)

Turtles apply the pyramiding strategy as part of the turtle trading rules. It involves increasing your position size when a trade is moving favorably. One unit is added to the position whenever the price moves ½ N in a Turtle’s favor. They will add based on the transaction price since it could differ from the breakout price.

One key to successful pyramiding is keeping the risk-to-reward ratio low since the market fluctuates regularly. Never risk more than half your possible reward if it is a winning trade. Pyramiding uses leverage to increase the size of the stake and can increase your gains and losses.

It is advisable to use this strategy only during a strong market trend and work with your exit strategy. Do not exceed your risk-to-reward ratio.

Exiting

Having a definite exit strategy is fundamental to turtle strategy trading. System 1’s exit is a 10-day low for long positions and a 10-day high for short positions. All units in the position will be exited if the price eventually goes against the position in a 10-day breakout.

System 2’s exit strategy is a 20-day low for long positions and a 20-day high for short positions. All units will also exit if the price is against the position concerning a 20-day breakout.

The stop loss of turtle trading is placed based on risk assessment. No trade must draw down the account by more than 2% of the value. A stop loss is placed 2N belong to the entry price in a long position or 2 N above the entry in a short position. This protects the account from total liquidation if the market becomes unfavorable.

If new positions are added at each ½ N favorable move, the previous stop loss will also be moved by ½ N. The general rule is that the stop loss is always 2N away from the last entry. There could be slight variations in the stop loss position based on slippage.

The Whipsaw is also another stop-loss method turtle use. Here, the stop loss is placed ½ N away from the entry point. If the price of the assets does not hit the stop loss, system 1 and 2 exit methods are used. Turtles depend on an N-based system to exit positions.

Tactics

Turtle trading is a mechanical system of trading that trend follows signals. The strategy believes in “buying strength and selling liabilities or weaknesses.” These traders diversify their trades and share the risk across different investments to avoid certain risks.

Turtle traders also deal with a fast-paced market and trend-following. They also wait for a bit of calmness before placing their order. They do not rush in for the best price. Turtle traders strictly adhere to all the trading rules, either in losing or winning positions, as part of turtle strategy trading.

Position Limits And Correlations

Most markets Turtles traded are correlated, and trades occur with striking similarities. To avoid unnecessary exposure, turtles set limits to the number of units or contracts they can buy or sell.

Due to these correlations, position limits serve as risk management tools deployed as follows:

- Single Market: Maximum of 4 Units

- Closely Correlated markets, Maximum of 6 Units

- Loosely correlated Markets Maximum of 10 Units

- Single Direction (Long or Short) Maximum of 12 Units

Does Turtle Strategy Work In Cryptocurrency Market?

Cryptocurrency is still a relatively new market for investors. Turtle trading works in the cryptocurrency market; however, the success rate is not as high as the original experiment. This is because as the market matures, it changes and becomes more volatile.

Also, more traders are now knowledgeable of market trends and will seek to take advantage of them.

Margex offers users access to top-performing cryptocurrencies such as Bitcoin, Ethereum, Solana, and many more.

Turtle trading can still give traders a decent return when used in the crypto market. However, a trader must stick to a proper risk management strategy to protect his investment and make the best trading decisions.

Turtle trading on Margex

To enjoy the benefits of Margex, you must sign up for the platform before you can trade.

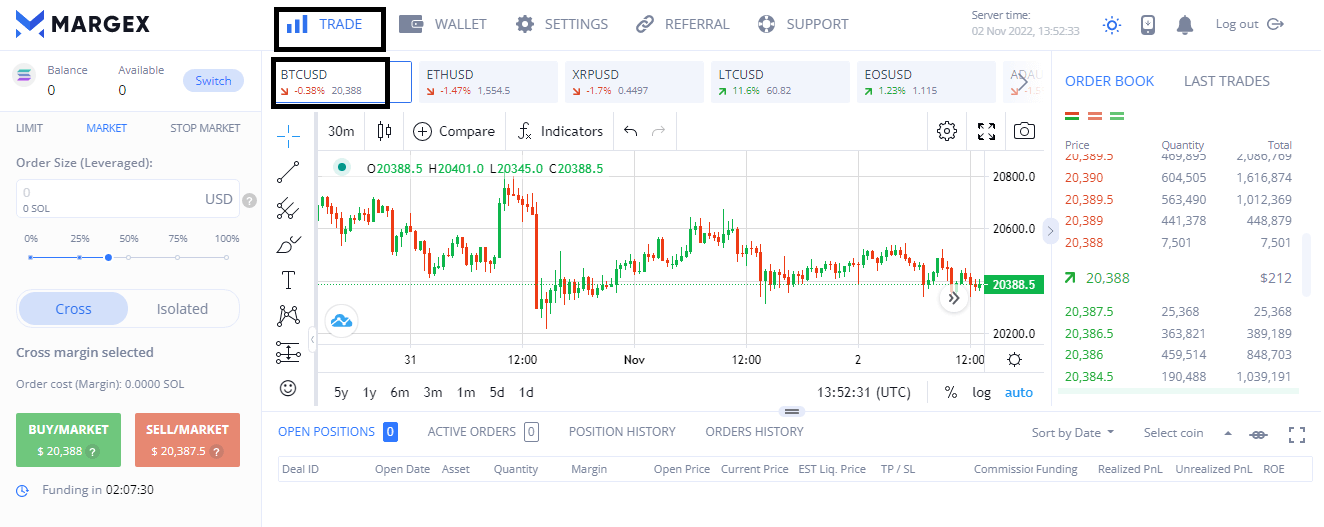

Once the process is complete, log in and go to your trade page. Next, you deposit into your account and return to the trade view.

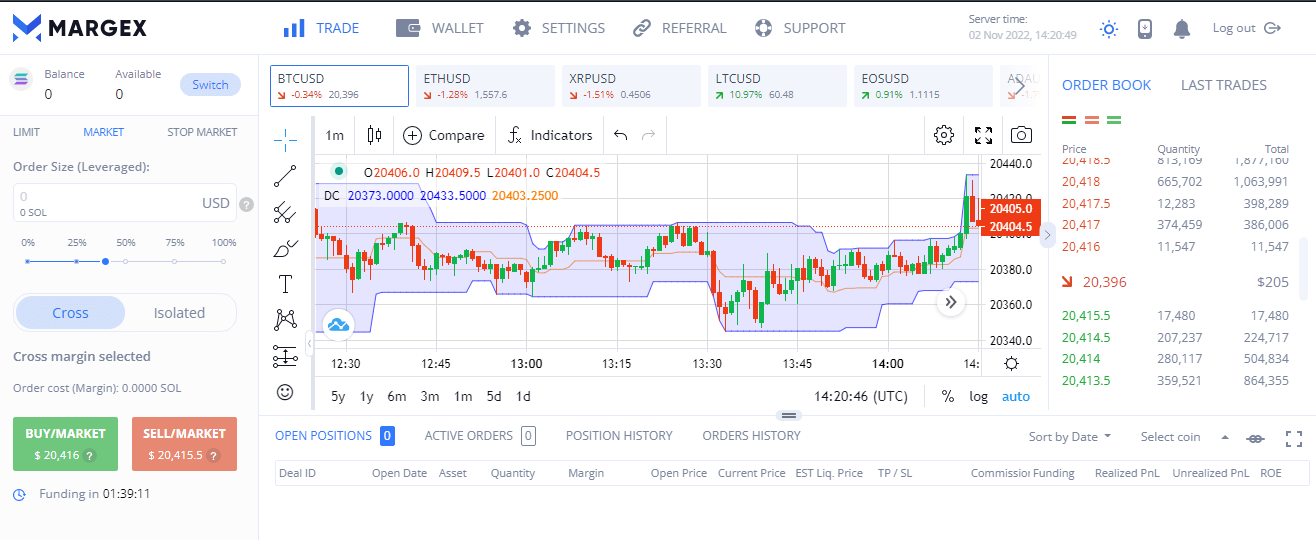

Click on trade and select the BTC/USD pair for this turtle trade test.

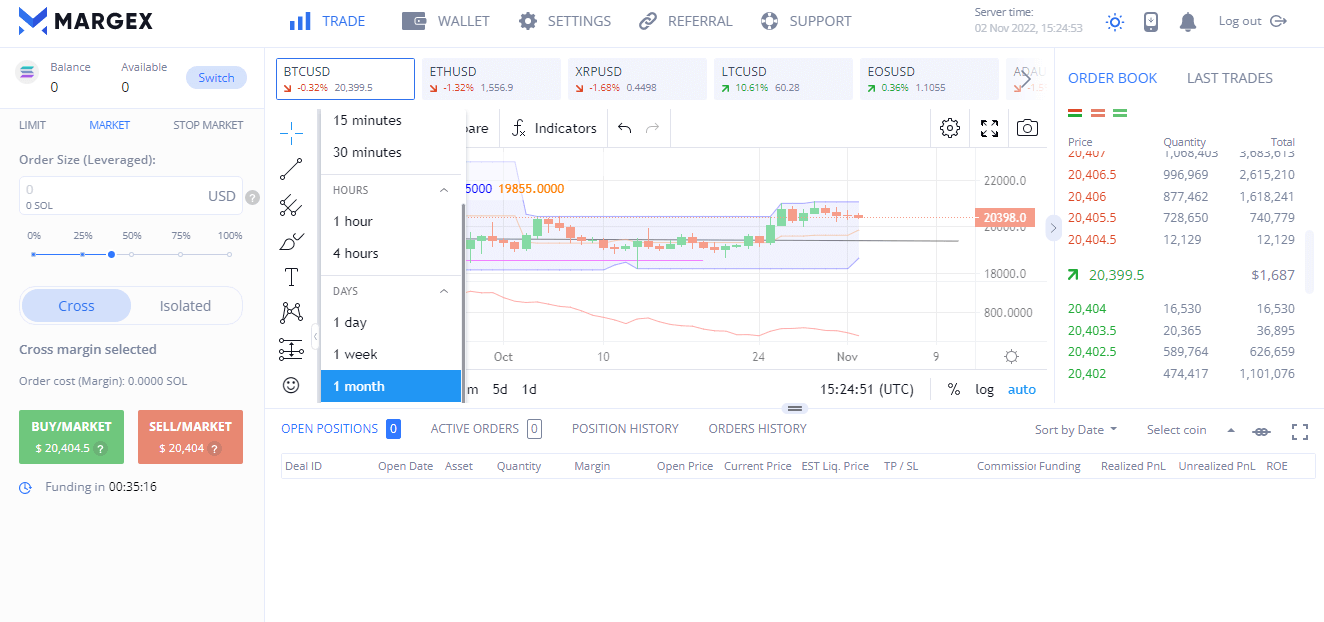

Next, click on the time frame and select one day since you need 20 days for this particular strategy. You can zoom in on your chart if the candles appear small on your screen.

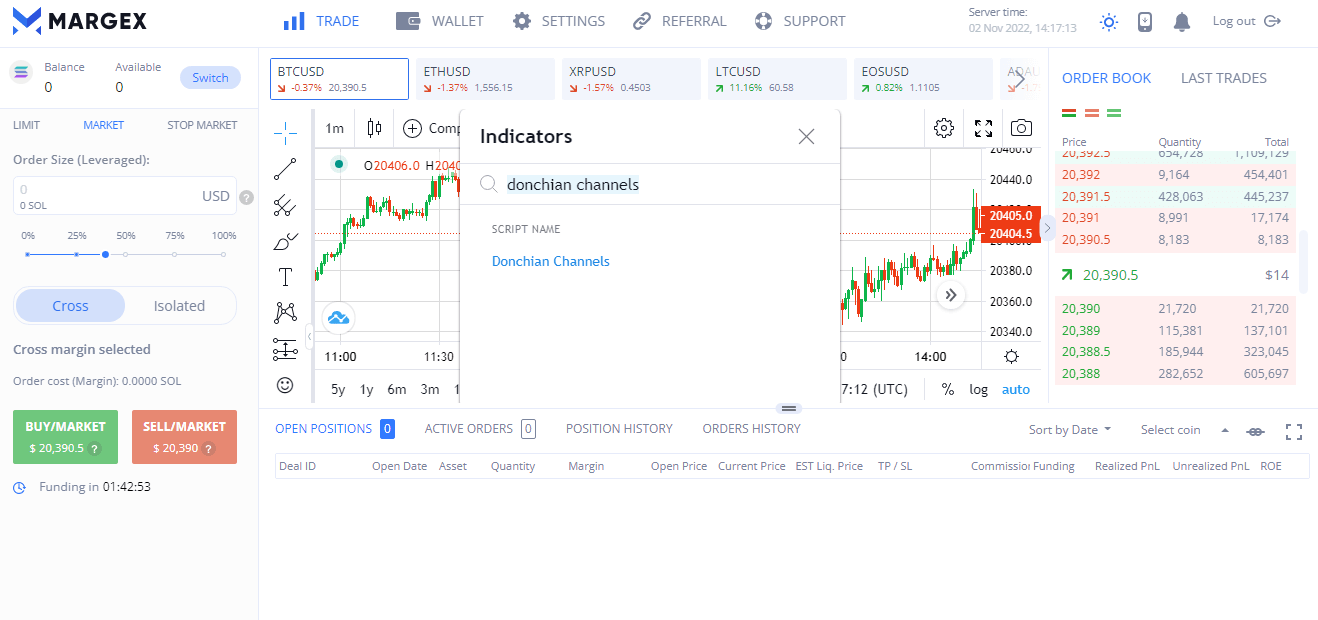

After doing that, go to indicators and search for Donchian channels. This is one of the best indicators for the Turtle strategy.

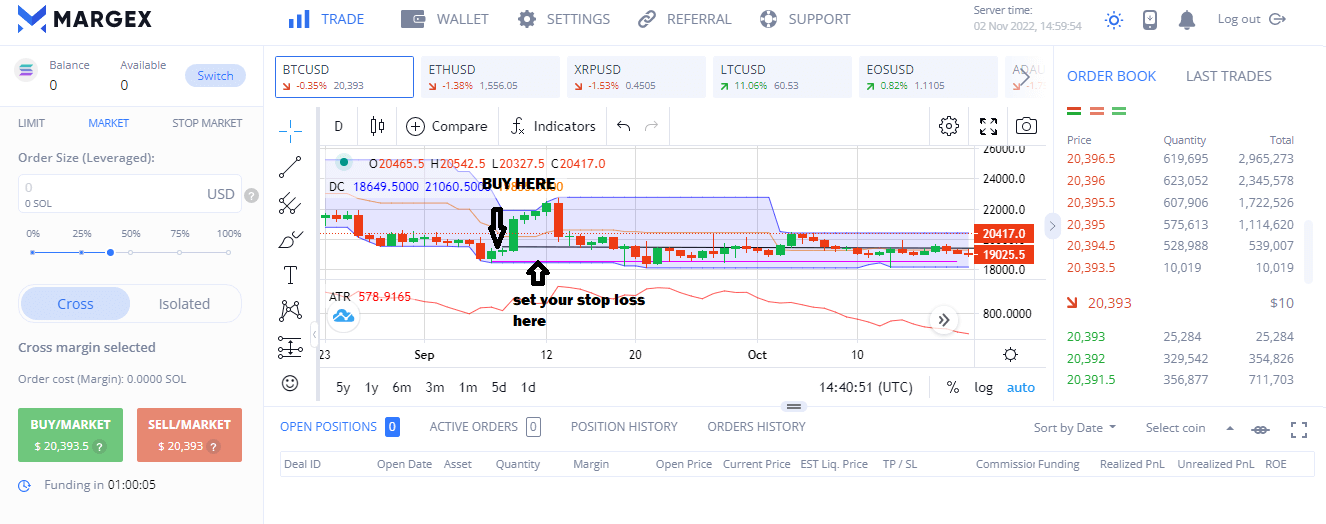

Your chart should look like this. The upper band rising shows a price increase, while the lower band falling shows a price decrease.

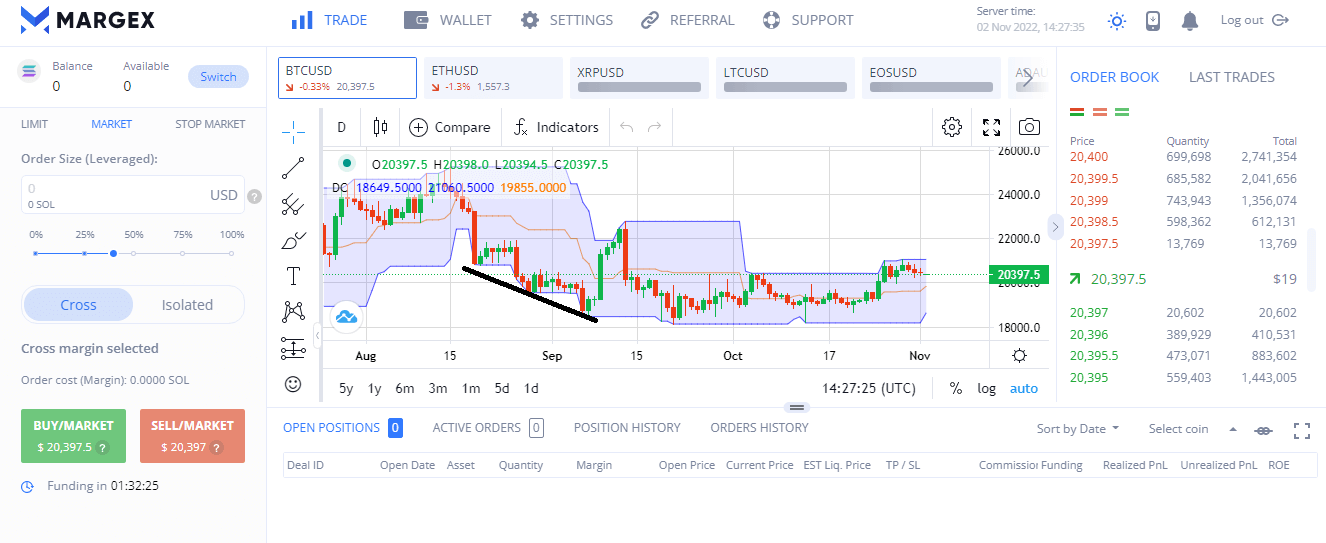

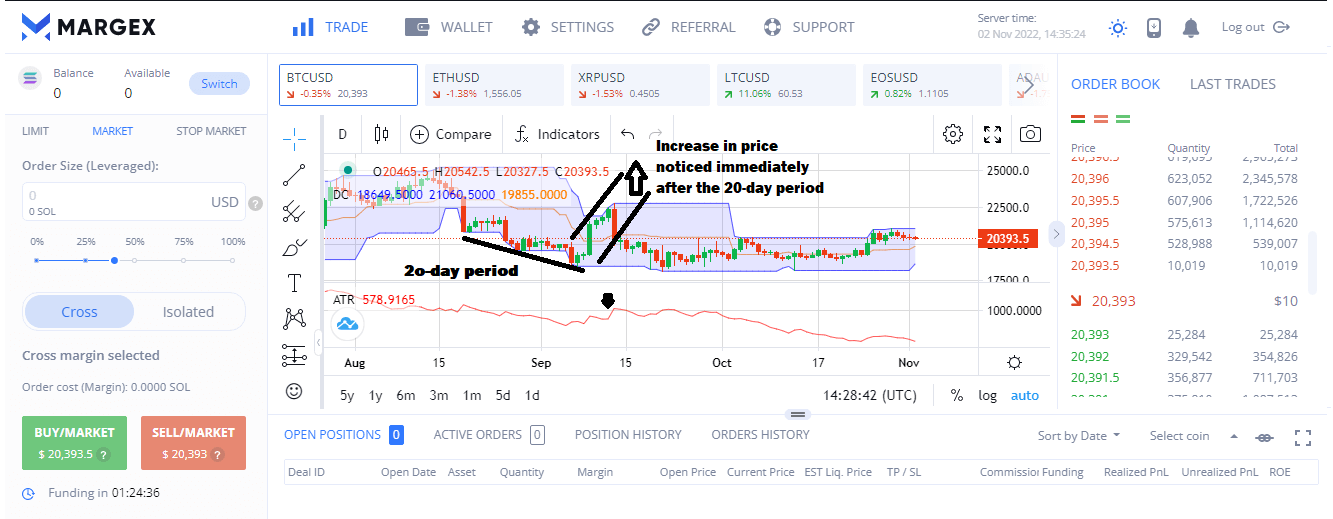

The region marked with the dark line on the chart is a 20-day view. Notice that the upper band of the Donchian channel is horizontal at the end of the 20 days. That is a signal for a possible uptrend.

You can also add the average true range (ATR) from Margex’s list of indicators for better analysis. The ATR will appear just below your chart.

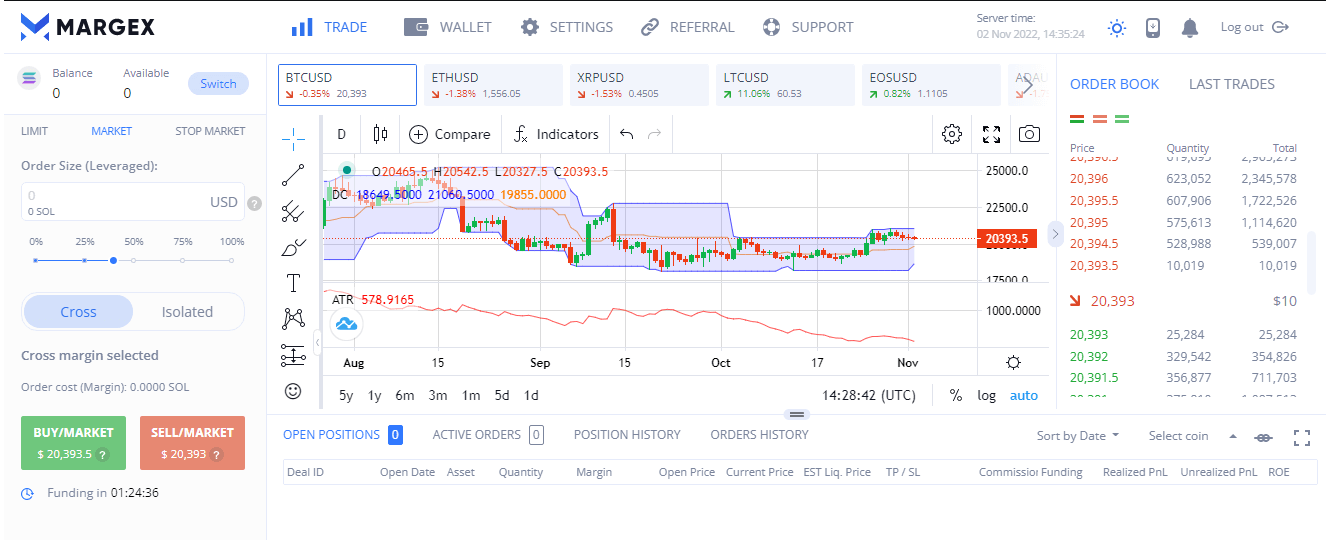

The chart above shows that the price of BTC went on an uptrend after 20 days. This shows that the turtle trading pattern can be used to make a profit.

The ATR also showed a rising trend. This is the exact point when a turtle trader takes advantage of the market.

This method is also applicable in both an uptrend and a downtrend.

Place your buy and stop loss at the right points since the market is going high.

Turtle Trading Rules – Modification

Turtle trading was an effective trading strategy in the 1980s recording outstanding success. However, several backtest results using the strategy on the price of Bitcoin show that the profit margin is low.

Several factors are responsible for this, with the major one being the volatile nature of cryptocurrency. Also, traders now use different methods that work to secure winning trades. The only way to overcome this challenge is to modify the turtle trading strategy.

Discarding it is not ideal since the method has advantages, like encouraging trader discipline. Remember, this whole strategy is hinged on following the trend.

Modified turtle trading has also yielded fantastic results and allayed fears of underperformance.

Here are the basic principles of trend following:

- Buy high and sell higher.

- Only risk a small fraction of your capital per trade.

- Diversify your trades.

- Trail your stop loss and ride the trend.

- Don’t predict or react to market trends.

Turtle trading rules modification

Buy when the price breaks the 200-day-high. Go for a higher time frame than the traditional 20-day breakout.

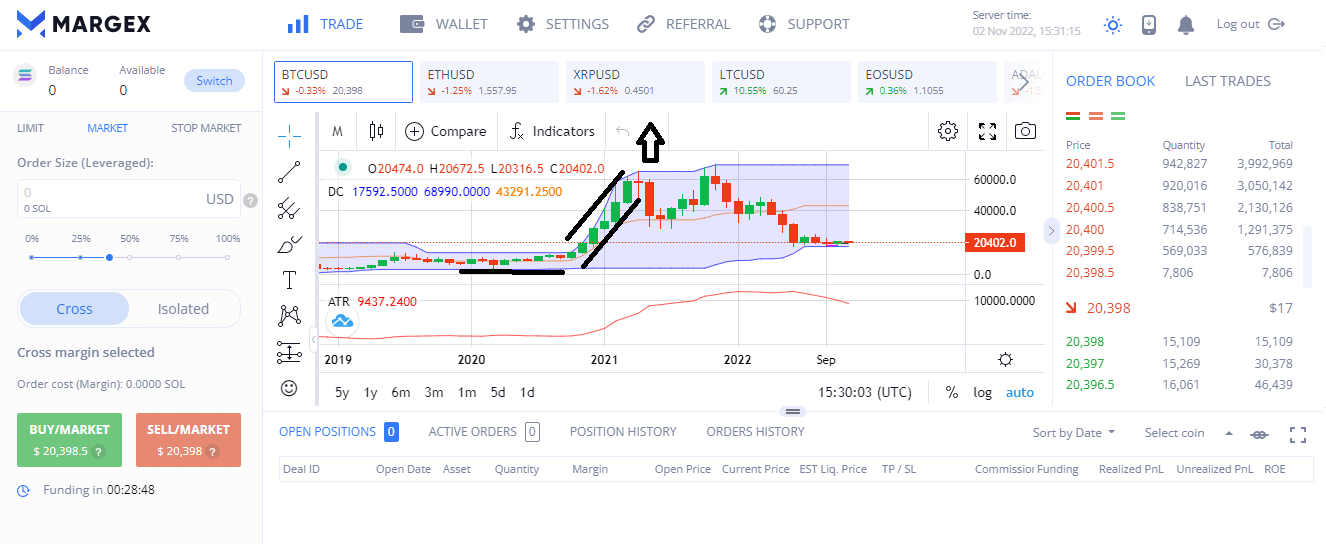

For a 200-day breakout, go to your chart and select at least a one-month view. You still need Your Donchian channel and ATR indicator.

The 200-day breakout is observed on this chart; this time, the trend is stronger than on the 20-day view. A strong and long-lasting trend will be more profitable for the trader.

Set your stop loss at 2 ATR from the initial price, and only risk 1% of your account rather than 2%. Apply the same principle for short (sell) trades.

The Bottom Line

The turtle trading strategy tested by Richard and William was an outstanding success in the 1980s. The technique aimed to help traders make rational decisions and not emotional ones. The strategy has, over the year, seemed to have lost its touch.

However, with a little modification from the 20-day breakout to the 200-day breakout and stop loss trailing, it is still effective. This strategy is also effective for cryptocurrencies with this modification since the markets are highly liquid.

Traders can adopt this method on a robust platform like Margex with the right indicators. Above all, it is crucial to have a sound risk management strategy.

FAQ: Common Questions And Answers On Turtle Trading Strategy.

Please find the answers to common questions about this trading strategy and how to make profits.

Can the turtle trading strategy help you make a profit?

This trading system is still effective with the right modifications to the procedure. Risk management and riding on trends are common features of modern trading strategies. It helps to minimize the maximum drawdown on accounts.

Traders need to combine turtle trading with sound technical and fundamental analysis. Also, the profitability is relative to the type of market where this technique is applied.

What happened, to turtle strategy inventor?

Richard Dennis, the inventor of the turtle trading experiment, recorded stellar success in trading. He believed that his wins would always outweigh his losses. However, Dennis lost above 50% of the assets he managed between 1987 and 1988 when his Turtles were rounding up the experiment.

After this major loss, he retired from trading, but is remembered for the success of his trading experiment. Some of his turtles also became successful traders in their own right.

What advantages does the Turtle Trading method offer?

The Turtle trading method help traders make rational decisions and protect their accounts from drawdown. Risking only 2% of your portfolio will rarely harm your finances.

It also helps traders identify the beginning of a trend to enter it early and have an exit plan. Its diversification mantra in various investments ensures traders know when to cut ties with losing positions. The method was largely successful and is still used for trading more volatile markets like cryptocurrencies.