With the US midterm elections happening on the 8 November and the stock market coincidentally recovering in October and posting impressive returns in the final week of October after a certain Fed official surprisingly recommended an easing of the rate hiking cycle, one would be not blamed for thinking that the US midterm elections could have a part to play in all of these.

We examined the history of US midterm elections as well as their impact on past stock market performance below and noted that they do have a favourable impact on stock price performance. Some market experts are also noting the trend and have been speaking to the media about this. Let us take a look below.

History Suggests 2022 Is a Typical Inflation Year

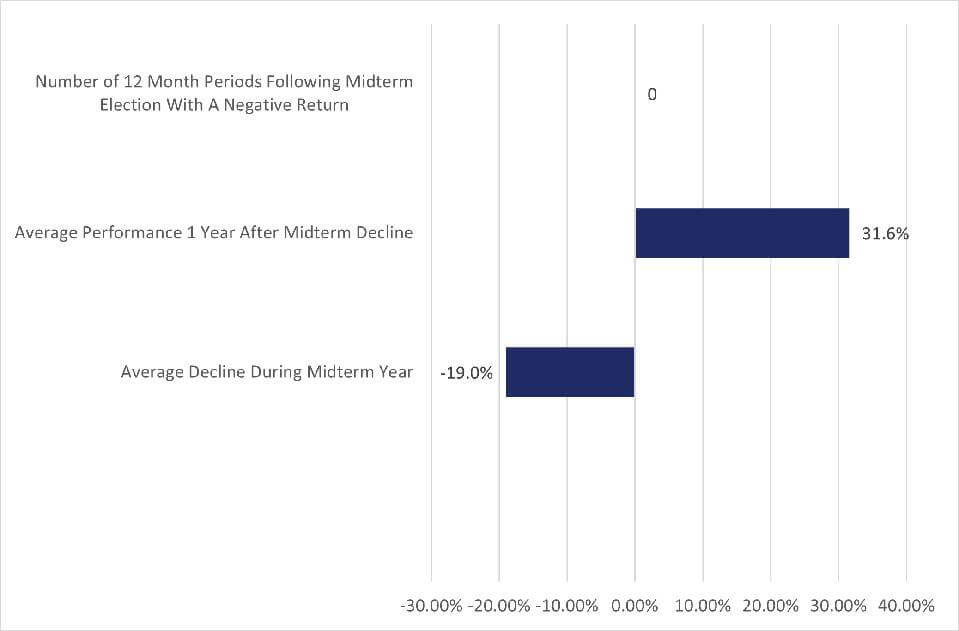

According to Dan Clifton at Strategas, ever since 1942, US stocks have traditionally fallen by an average of around 19% in a midterm election year, only to bottom in October and would subsequently rally by an average of almost 32% in the ensuing 12 months. Clifton further noted that this trend of stocks gaining in the twelve months following a midterm election has been unbroken since 1942. In other words, this means that there has been no post midterm election year where stocks have recorded a negative return since 1942, which is an impressive record.

Another market expert, Philip Orlando, senior vice president and chief equity market strategist at Pittsburgh-based Federated Hermes, also voiced the same opinion. In a recent interview with CNBC, Orlando said that based on history, the market has a very distinct trading pattern in midterm election years, in which the first six to nine months tends to be very rocky, but the following six months after the elections tend to do much better. Orlando further explained that the party that controls the White House typically loses seats in a midterm election, and if we get a similar result this year and there is a divided government, the stock market could stage a 15% to 20% rally into spring.

Thus far this year, US stocks have followed the historical trend like clockwork, albeit falling by more than the 19% average, but have also since recovered off their lows in October. Could this uncanny similar pattern also translate into a stock market rally in the coming months? If we were to go by Mark Twain’s famous saying, “History doesn’t repeat itself, but it does rhyme,” the chances are good.

Midterm Elections And S&P 500 Performance (1962-2020)GLENVIEW TRUST, STRATEGAS

Time will eventually tell, but the promising signs are already there.

Clifton also noted that a recession has not begun in the third year of a presidential cycle back to 1929, which in our case, would mean the year 2023. The US latest 3Q2022 GDP numbers have already come in better-than-expected, recording a surprise positive growth and showing that the US economy is out of a recession. Recent data from the US labour department also shows that the labour market is still strong.

US Economy in Better Shape Than Expected

Even though at the November Fed meeting, investors were treated with a surprise hawkishness from Fed Chair Powell, who squashed hopes of a rate hike pause, the Fed made this decision based on stronger economic numbers. The labour market in particular, has still been strong, while the economy had already bounced back from the technical recession that it fell into at the beginning of 2022 when the latest GDP reading came in at +0.2% growth in 3Q from a negative reading in 2Q. This means that the economy is not as bad as what market watchers are anticipating in spite of higher rates. The ADP employment change for October came in almost 50% higher than the number expected, coming in at 239,000 versus expectation of only 178,000, while the number of job openings released on 1 November had 10.72 million job openings against expectation of 9.75 million.

The ISM Manufacturing PMI for October had also declined by less than expected, falling from September’s 50.9 to 50.2 in October, while consensus expectation was for a reading of 50.

These are actually positive news that the markets will have to eventually adjust upwards to when they get over the disappointment of not getting a more dovish Fed, which could be anytime.

Narrative Could Quickly Become Bullish Again

As the more observant trader may have noticed, trading themes this year have been influenced by narratives more than they are by actual data. This means that just as fast as how the markets decided to rally due to a couple of remarks made by one certain Fed speaker on the 21 October, they can easily rally again when another person says something bullish or dovish in the coming days, as a market focused on narratives rather than facts can change direction very fast. With the midterm elections barely a week away, politicians could come out to make promises to boost the economy or they could promise stimulus checks that could eventually find their way into the stock markets again. Carrot dangling is but a natural process in an election and while they may not eventually materialise, they are good enough to act as a market catalyst in a trigger happy market. Thus, it may be too soon to discount this market just because the Fed is not giving it what it wants at the moment. In the face of an upcoming midterm election, positive surprises could spring forth.