Over the weekend, a rumor that went rife around the crypto community that Vitalik Buterin, the founder of Ethereum, had sold 3,000 ETH tokens, sent the price of ETH, which had already been negatively impacted by the FTX bankruptcy drama, to fall even lower, worrying some ETH holders.

The wallet moves were made very early last Saturday morning, less than 24 hours after news broke that FTX and its affiliates had filed for Chapter 11 bankruptcy protection.

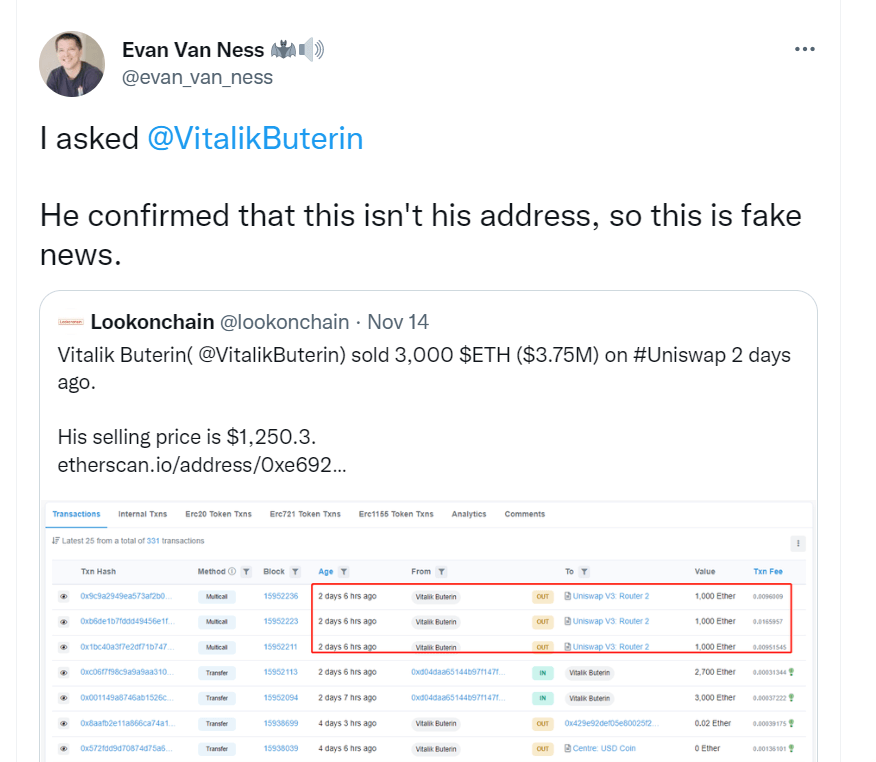

The “news” was started by onchain data provider LookOnChain, which posted on twitter rather convincingly that Vitalik had sold 3,000 ETH in 3 transactions of 1,000 each at an average price of $1,250.30 via Uniswap, further split the proceeds into denominations of different stablecoins, before ultimately converted into the USDC stablecoin.

The crypto community quickly picked up on this news and it was spreading like wildfire even up to this day, as different investors are hearing the same rumor at different times from different sources. The result has been confusion and fear, which caused the price of ETH to drop around 8% over the weekend.

This situation was made worse after it was revealed that a hacker stole up to $660 million worth of crypto and converted them into ETH. Investors were worried that the hacker would eventually sell off his newly acquired ETH and send its price falling further. However, as at the point of writing, the hacker has not sold his ETH yet.

Vitalik had been said to have denied that the wallet that sold 3,000 ETH belonged to him. Evan Van Ness, a high profile and long-time developer in the Ethereum ecosystem, responded to reports of those transactions by saying that Buterin told him the wallet in question is not his, dismissing those reports that had been spreading far and wide as fake news.

Vitalik himself however, has not yet publicly denied those rumours. Hence, it is still unknown if Vitalik really sold that 3,000 ETH.

Other crypto experts beg to differ from Evan Van Ness however, with one market watcher noting that the wallet had received many transactions from a known address of Buterin’s before, and another person citing transactions on Etherscan with a wallet known as “vb2”, who he claimed to be indeed Vitalik’s wallet. As a result, this could imply that this could indeed be one of Vitalik’s many wallets.

After the transfer, the wallet that sent out the 3,000 ETH still has nearly $3.3 million worth of ETH in it. According to its OpenSea profile, this wallet also owns the Ethereum Name Service (ENS) domain name iiiiiiii.eth. It received the ENS domain name via transfer back in May from a wallet that may also belong to Vitalik. This further gives credit to the idea that Vitalik indeed sold those ETH.

Another wallet connected to Vitalik.eth, which has the same name as Vitalik’s twitter account handle, recently moved 180 ETH ($286,000 at the time) and about $8,500 of USDT to another wallet and then to a Kraken exchange account last week. While many speculate that the purpose of sending the 180 ETH to Kraken was to sell, it was hard to explain the $8,500 USDT that was also sent to Kraken. Why would Vitalik send $8,500 to an exchange when he would be receiving USDT for selling the 180 ETH anyway?

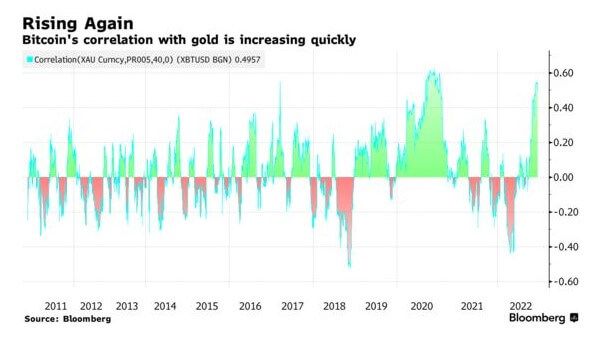

While the media has tried to get the man himself to clarify the confusing situation, no one has yet managed to speak to Vitalik to get a definitive answer. As a result, investors’ outlook on ETH has been affected in the short-term, with the price of ETH underperforming many other altcoins and even Bitcoin as the market consolidates after a week of terrible shock from FTX.

While a founder selling his stake is certainly not good publicity, it has to be said that Vitalik still holds 290,000 ETH. Selling 3,000 ETH out of 290,000 ETH should not be something investors should be alarmed about, it could just mean that Vitalik was in need of some cash.

If there is anything about ETH that investors need to be concerned about, it will be the FTX hacker, who now has around 228,523 ETH that he can potentially dump. This could become the main pressure point for ETH going forward.

Other than the above real and possible threat to the price of ETH, there are also unfounded and absurd rumors that Ethereum Foundation could be bankrupt because stakers could not withdraw their staked ETH. It has to be clarified that staked ETH on ETH 2.0 has not yet opened for withdrawal as the coins need to be staked for 2 years.

Hence, these baseless FUD by uninformed people trying to create more panic amongst the crypto community to make the market tank further should be taken with a grain of salt. Readers are strongly advised to do your own research and conduct your own due diligence instead of being influenced by the tonnes of FUD flying out there in the aftermath of the FTX scandal.