DeFi has attracted the attention of many ever since its inception because the idea of being able to have a bank where you can withdraw funds anytime and without the involvement of any third party has fascinated many people.

However, DeFi has seen many upgrades and advancements compared to its formative years; several DeFi platforms have emerged with innovative ideas to make DeFi more effective and secure. One such platform is Wanchain.

Wanchain is a crypto platform keen on driving the worldwide adoption of Blockchain services by harnessing the power of cross-chain interoperability by building decentralized bridges to connect all blockchain networks.

Recently the platform’s native token Wanchain has gained traction and ground in the blockchain industry, attracting the attention of long-term and intraday traders due to its growth potential.

It has also attracted the attention of coin experts and crypto analysts who are keenly interested in the token and speculating its price in the future. This article will provide the data for long-term WAN price predictions by several experts.

What Is WanChain (WAN)

Wanchain is a blockchain platform that leverages cross-chain interoperability to carry out a single transaction on multiple blockchains. This platform is not limited to only public chains, but the transactions carried on the chain also occur between private chains.

Wanchain is a fork of the Ethereum network, encompassing some functionalities and properties of the network, like EVM compatibility for all Ethereum-based tokens. In addition, developers can easily build cross-chain dApps on the wanchain ecosystem.

Another exciting thing on Wanchain is the bridge storeman nodes which are decentralized and permissionless, giving everyone access to run nodes on the blockchain.

Wanchain coin, the native token of the platform, currently ranks 433rd in the crypto market and is worth $0.187 with a market capitalization of over $34 million and a maximum supply of $210 million WAN tokens.

Brief History Of Wanchain (WAN)

The platform launched in 2017 with Jack Lu as founder and CEO placing its headquarters in Beijing, China, and Austin, Texas.

Before founding Wanchain, Jack was co-founder and CTO of Factom, a blockchain platform based on storing sensitive information on Blockchain 2014.

Aside from that, he also founded Wanglutech, a distributed ledger protocol that focuses on digital asset and data deposit certificates.

In January 2018 Wanchain mainnet test went live, and the Wanchain crypto token was available for purchase on the Binance exchange in March 2018, just two months later.

However, their ICO had already taken place five months earlier. In October 2017, at that time, WAN was worth $0.34, making over $35 million at the end of the presale that lasted just 12 minutes.

The Protocol Wanchain Uses

Wanchain operates on a proof-of-stake consensus mechanism, which is faster, transparent, and more scalable than its predecessor, Proof of Work.

Because instead of mining to create new blocks, it uses a random selection of individuals who make their cryptocurrency available to the platform through staking validators. These selected individuals validate new blocks, and they get rewarded for doing so.

One interesting thing about Wanchain is that validators are selected through a fair selection and rotated every month so everyone qualified can have a share in validating blocks and getting rewards.

There are three categories of validation nodes on these platforms, and each of them has a specific function. The first is storemen in charge of locked accounts, Vouchers verify cross-chain transactions, and Validators manage regular verifications on the blockchain.

What Makes Wanchain Unique Among Other Cryptocurrencies?

Wanchain is the first cryptocurrency platform to carry out full-scale decentralized cross-chain interoperable transactions involving multiple chains simultaneously autonomously managing all accounts without the help of a third party.

They achieved this feat through multiparty computing and threshold secret sharing technology. Most cross-chain platforms need the help of third parties to execute cross-chain transactions, but with this tool, Wanchain can handle and manage all transactions directly.

In addition, Wanchain has three major cross-chain functionalities; which are the registration module, data transmission module, and transaction status query module; all three are involved in a transaction from its beginning till when it’s executed

Major Factors Influencing The Price Of Wanchain

As volatile assets, cryptocurrencies respond to external factors that affect their prices both negatively and positively. Some of these factors are common phenomena we encounter daily, while some are extremely rare and come by chance. In this section, we will discuss three major factors affecting the price of Wanchain.

Demand

Naturally, the higher the demand for a particular commodity gets, the higher its prices become; therefore, we can’t downplay the role of demand in the factors affecting the price of cryptocurrencies. The lower the demand for a cryptocurrency gets, the more it loses value.

That had proven true for Wanchain; when it became available for purchase on the Binance exchange in March 2018, there was much demand for it due to Fomo (Fear of missing out), and its floor price of $0.34 rose to $9.92 in just two months in May.

But it could not maintain the price due to sellers toppling buyers leading to a downtrend.

Supply

One of the major causes of inflation in the mainstream economy is because fiat currencies have an unlimited supply, hence the reason why it is so quick to lose value.

When a currency has infinite supply so much that it overshadows demand, it tends to lead to devaluation and possible total loss of value.

Wanchain crypto, on the other hand, has a fixed supply of tokens so that it does not become excessive and lose value in the future.

Blackswan Events

The unexpected pandemic that shook the world to its root is a perfect example of how unforeseen occurrences can majorly affect the price of cryptocurrencies.

During the pandemic, several economies suffered due to restricted mobility, people could not go to work, and many companies shut down totally or took a long break. This affected money circulation, and many started to turn to cryptocurrencies as a source of income and investment as it requires only a mobile device and data connection.

This singular act made the price of all cryptocurrencies spike and tremendously increased in value.

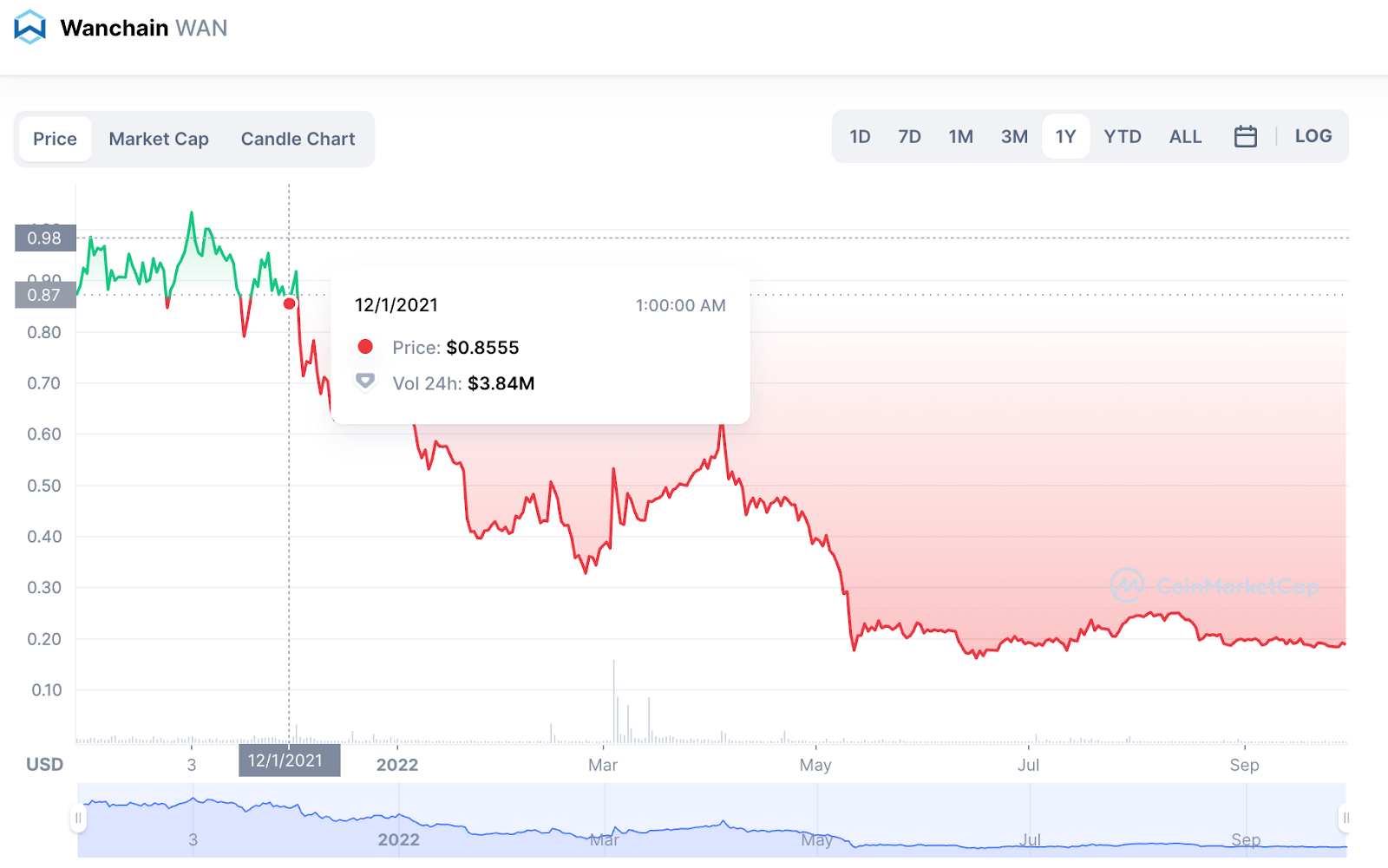

Wanchain Past Price Performance: A Complete History Of Wanchain

Wanchain held an ICO for the WAN coin in October 2017, and the opening price for the public presale was $0.34, with a total token of $210 million. The purpose was to raise Ethereum, and they raised over $35 million worth of ETH in a presale that lasted only 12min.

Three months later, in January, the Wanchain mainnet went live, and by March 2018, the WAN coin was listed on the Binance exchange, making it available for purchase and trading. By May 2018, the token hit an all-time high of $9.92 but crashed back a few months later.

However, in March 2020, just two years after Wanchain’s mainnet launch, its price dropped severely, taking it to its first all-time low of $0.07575.

After seeing its price rally to an all-time high of $9.9, WAN has experienced a tough time seeing its price drop by over 90% due to the current run in the bear market. This bear market has proven to be a tough one for most crypto projects, including WAN. With so many expectations regarding the next bull market, crypto assets like WAN would do well considering their use case and partnerships. Always do your due diligence before investing in crypto assets, and don’t invest more than what you can afford to lose.

How Is Wanchain Doing Now?

Currently, Wanchain is valued at $0.1711 with a market dominance of 0.00%, having a daily high of $0.1815 and a low of $0.1782. It has strayed from its all-time high of May 2018 by a 98.17% decrease in value and a $95.85 ROI (return on investment).

However, it has continued to soar high above its all-time low of March 2020 with 139.09%, which is quite commendable due to the ongoing bearish trend that has brought several crypto assets to their all-time low.

Like all winter seasons, this, too, will come and go. Some skilled traders depend on bearish signals to invest because they will be able to buy at a low price and sell at a higher price when the market is favorable; however, it is accompanied by risks; therefore, always do your research before purchasing any cryptocurrency now or later in the future. On where to buy Wanchain, it’s currently available on the Binance Exchange, Kucoin, and Huobi global.

Current Wanchain Price Prediction

Currently, Wanchain is worth $0.189 with a 24h high of $0.194 and a low of $0.1812. In the last 24 hours, there was a 4.47% increase in its price level. It has experienced some increase and a slight decrease in the previous 7 days but has remained far away from its ATH with a 98.10% decrease.

There is a 182.21% increase in its trading volume compared to the last 24 hours and a 2.36% in its market cap. All these statistics show that Wanchain is doing all it can to stay afloat during this winter market and may well soar in future times.

Short-Term Wanchain Price Prediction For February 2023

February 2023 is looking good for Wanchain crypto as it’s showing signs of a slight recovery in the first quarter of the month. Suppose it continues like this; no doubt, the months that follow till the end of 2023 will be great for Wanchain. However, there is no way to know for sure if it will continue to rise or if it will lose value in the following months. Nevertheless, some price prediction experts have speculated on the price of WAN for February. The table below shows the short-term Wanchain price prediction

Despite suffering so many losses in the previous year of 2022, the price of WAN has continued to hold during this turbulent bear market that has affected many crypto projects. With the market showing some relief bounce in January, it is yet to be determined if such a bounce will be sustained as the price of WAN aims to go higher.

Long Term Wanchain Price Prediction For 2023

Cryptocurrencies could see an uptrend in 2023, but it’s not all certain because the current bearish condition of the crypto market has harmed several assets, even causing some of them to lose value. Top assets like Bitcoin, for instance, are close to their last resistance level and have strayed far from their ATH with no hopes of recovering anytime soon.

However, like all bearish seasons, this time too will pass, opening the way for another bullish run. Price prediction experts have made a long-term WAN price prediction for 2023. The table below shows the figures

Long Term Wanchain Price Prediction:2023-2030

Cryptocurrency must have transitioned to the next level by 2030 due to widespread adoption into mainstream economy that will result from surviving the test of time. Bitcoin will have been around for 21 years and Ethereum for 15 years. Experts have made a long-term Wanchain price prediction that spans 7 years, 2023-2030.

Wanchain Long-Term Price Forecast By Experts

Several crypto analysts like Tradingbeasts, PricePrediction, Swapspace, WalletInvestor, and CaptainAltcoin have all made long-term price forecasts of Wanchain after a deep technical analysis of the token and past behavioral patterns.

However, their analysis is still based on calculated guesses, which could turn out to be incorrect because of the high price volatility of crypto assets, making it impossible for anyone to say for sure how their prices will turn out certainly. Therefore, always do your research before investing in any cryptocurrency.

Wanchain Long Term Price Forecast by TradingBeast

After carefully analyzing Wanchain past price history, Coin expert TradingBeast has made a long-term forecast of the token spanning 4 years, 2022-2025. The growth prediction of WAN by these analysts expects it to be valued at $0.250, having a max price of $0.313 and a minimum of $0.213 by the end of 2022

By the early part of 2023, WAN coin price level is to experience a slight increase that will take its price value to $0.251, and finally, by the end of the year, it will rise to $0.300.

2024 will see it rise to $0.326 as the average price signifying a 76.49%, while by the final part of 2025, it will shoot up to $0.395, completing the Wanchain price forecast by Trading beast.

Long Term Wanchain Price Prediction Of By PricePrediction

The Price forecast of wanchain by PricePrediction, another coin expert, spans 9 years, 2022-2030. They expect that by the end of 2022, WAN price should be around $0.21 and should experience a significant increase by 2023, worth $0.28.

2024 should see it continue its bullish trend and increase close to twice its value in the previous year. From 2025-31 it should have risen to $5.81 in price value.

Long-Term Wanchain Price Prediction By Digital Coin

Expert in coin price prediction Digitalcoin has quite an optimistic view of WAN and developed a long-term price forecast of the token from 2022-31. According to their, Wanchain forecast, the token is expected to reach a maximum price of $0.23 by 2022, and in 2023, it will cascade the slope to get to a max price of $0.45.

2024-27 will see it climb to a high of $0.97 as the maximum price, $0.93 as average, and $0.90 as the minimum. It will continue to increase through the years and finally reach a peak of $3.64 in 2031 as the closing price.

Long-Term WAN Price Prediction By CaptainAltcoin

The forecast of CaptainAltcoin focuses on some specific years, 2022-25 and 2030-40. According to their analysis, the estimated WAN price for 2022 is $0.14 but will continue to increase gradually and eventually reach $0.24 in the last quarter of 2023.

2025 will see it increase to $0.39, but for some reason, its price action will drop to zero by 2030 until 2040.

In effect, they are saying Wanchain will crash and fail to recover. It may seem unrealistic, but cryptocurrencies are volatile assets and could turn out in unimaginable ways; therefore, always do your research before making any investment decisions.

Price Prediction By Margex Technical Analysis

Margex is a bitcoin-based derivative crypto trading platform that leverages AI technology to provide one of the best trading tools for intraday and long-term traders.

Margex offers traders the opportunity to trade up to 100x leverage size and, simultaneously, stake their leverage tokens to earn more. Margex staking and trading feature is one of a kind and the first in the crypto industry, helping new and advanced traders to stay profitable in the current bear market.

Another important feature of Margex is enhanced security and regular audits that ensure all users’ funds are safe. They also always vet any crypto listed on their platform through thorough research to prevent the traders from falling victim to pump and dump schemes.

From the chart above, the price of WAN has been affected by the current bear market as price, volume, dominance, and circulating market cap have all seen more of a downtrend. The use case and past price set the WAN coin aside, and experts on Margex believe the coin would do well when the market shifts from its bearish sentiments to bullish sentiment.

Frequently Asked Questions About Wanchain Explained

There are several questions that people ask regarding the wanchain platform and WAN coin. In this section, we will provide answers to a few of these questions

Is Wanchain Coin A Good Investment?

WAN price prediction by Coin prediction expert trading Beast expects the token to rise to $0.39 in 2025; if this happens, it will prove to be an excellent investment, especially for long-term traders.

What Is Wanchain Coin?

Wanchain coin is the native token of the Wanchain platform, it was designed to serve as a means of utility and governance on the platform, but more importantly, it serves as a trading investment for traders.

Will Wanchain Go Up In 2023?

Several coin experts, in their long-term price forecast of Wanchain, expect it to go up. DigitalCoin speculated that WAN coins’ future price could go as high as $0.45 in 2023.