The cryptocurrency industry has advanced from mere hodling of assets to making profits traders, investors, and institutions look for ways to stay ahead of the market or drive things to favor them using different instruments due to their huge portfolio or money size.

In a way to buy things cheaply or drive the market to favor them, traders and investors, through their extraordinary capital and portfolio size in the crypto space, put up buy walls and sell walls to push the market in a particular direction, either upward price movement or downward price movement and as a result, usually lead to market manipulation.

Buy and sell walls can be interpreted as indicators of a cryptocurrency’s health and the overall market trend. As a result, they can be beneficial to traders and potential investors.

In the course of this guide, we will delve in-depth to understand buy wall sell wall, order book, sell order, buy order, market depth, particular price, depth chart, and market manipulation, as this would be key in making better trading decisions.

What Is A Buy Wall In Crypto?

A buy wall is a big buy order created by a trader, investor, or an institution at a particular price level. These volumes are so big that they influence the market and drive prices upward where the trader wants the price to go. When these orders are fulfilled at a particular price, this tends to push the price of an asset because its supply becomes limited as the price of the asset activates the buy wall. This buy wall gives more belief in the bullish price action on the part of other traders who wish to open a long position for this asset.

A buy wall happens due to multiple buy orders more than sell orders for a particular asset. For example, the buy wall for Bitcoin is bigger than the sell wall for Bitcoin; this will most probably drive the price of Bitcoin upward. Most times, buy walls are created by whales or institutions looking to buy a huge amount of an asset, thereby manipulating the price.

How Do I Find Walls To Buy?

Most traders who look to make smart money learn to trade buy walls for a possible entry, as these buy walls are initiated by big crypto players like whales and institutions. Traders set their buy orders a few prices away from the buy walls created to get their hands on the cryptocurrency asset for a potential profit before a potential profit, as the price would potentially be driven up with these huge buyer orders.

It’s important to recognize that buy walls represent the sentiment of the trader or investor, and as such, a buy wall is added manually. It can be removed, making it very possible for the market to be manipulated. A trader buying an asset at this particular price would be exposed to false signals and suffer losses. Using stop losses at most times gives the trader an advantage to protect profit and stay consistent in trading.

What Is A Sell Wall In Crypto?

A sell wall is the opposite of a buy wall, as discussed above, as this refers to a big sell order or orders created by whales or institutions to dispose of an asset at a particular price, as this is seen in the financial market, including crypto.

These sell orders overwhelm buy orders leading to a rapid price decline of an asset indicating this region has become a supply zone as more sellers are willing to sell the assets compared to buyers willing to buy the asset.

The greater the size of the wall, the greater the number of sellers. This also implies that the asset’s price will most likely fall. Sell walls, like buy walls, can be formed by multiple orders at the same price or by a whale manipulating the price.

How Do I Find Walls To Sell?

Traders wishing to sell their crypto assets look for sell walls and, as such, are aware that if they need to sell off their assets, they need to set their sell orders before the sell wall price to avoid their price not being activated. Traders, therefore, set their sell orders below the wall to allow their sell order price to be activated. As the sell orders of traders are activated, this lowers the price.

Sell walls, like buy walls, can be manipulated by whales or traders who own a large portion of the cryptocurrency or stocks available.

Pros And Cons Of Buy Walls And Sell Walls

Just like every trading strategy has its pros and cons, it is with the buy and sells wall strategy employed by many traders to spot a good entry and exit or gauge the market conditions.

The pros of buy walls and sell walls include good trading decisions, helping the trader to spot possible entries and exits for crypto assets, and to know the possible direction the market could be heading.

The cons of using the buy walls and sell walls are that this strategy is not for a beginner trader and requires time coupled with good trading skills to harness this system of trading and, as such, exposes one to false signals if not properly followed.

Examples Of Buy Walls And Sell Walls

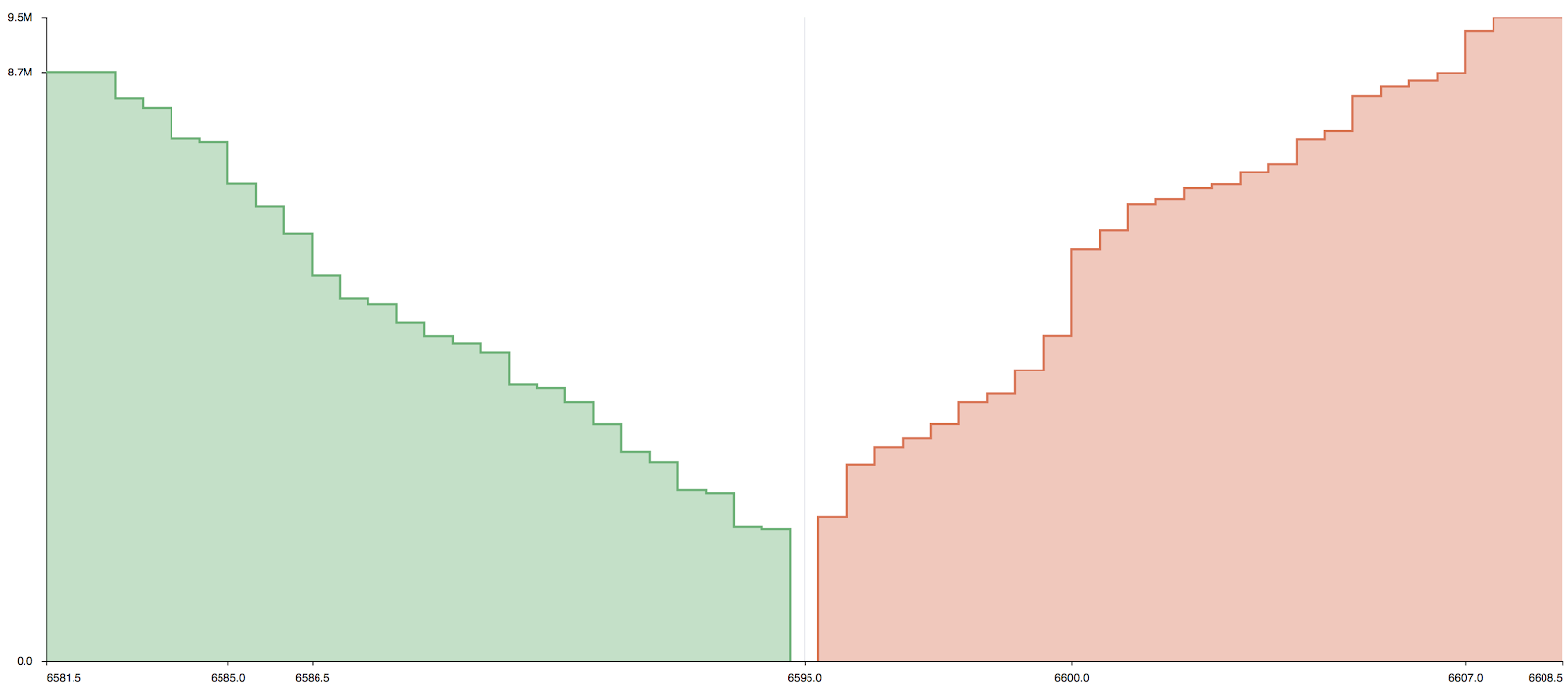

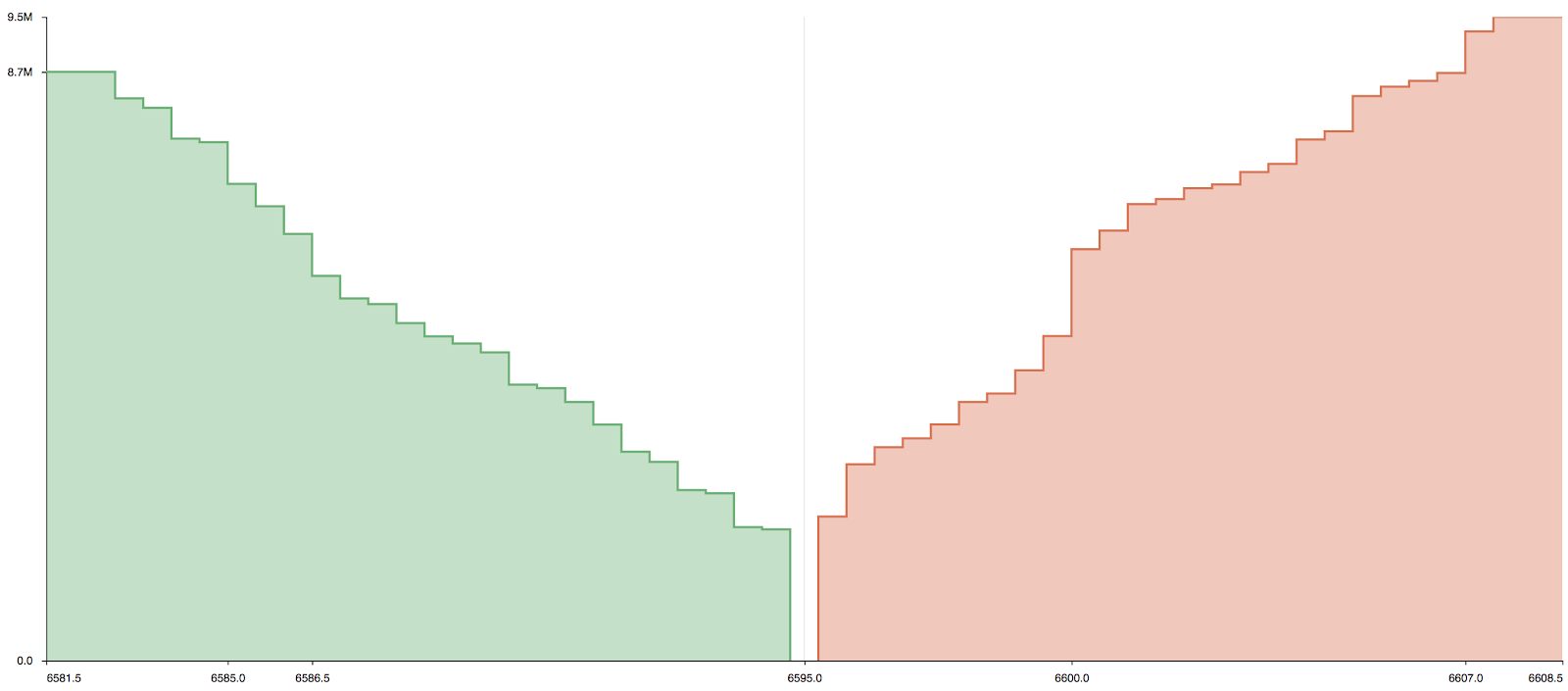

The Image above shows a typical example of buy and sell walls on some crypto exchanges; the Image shows the green wall indicating more buy orders have been placed at a particular price compared to others, while on the right-hand side, we can see the sell wall in red showing the volume of sellers willing to let go of an asset at a particular price.

Sometimes some exchanges separate the buy walls and sell walls from the order book, while in some cases, the buy and sell wall is embedded with the order book.

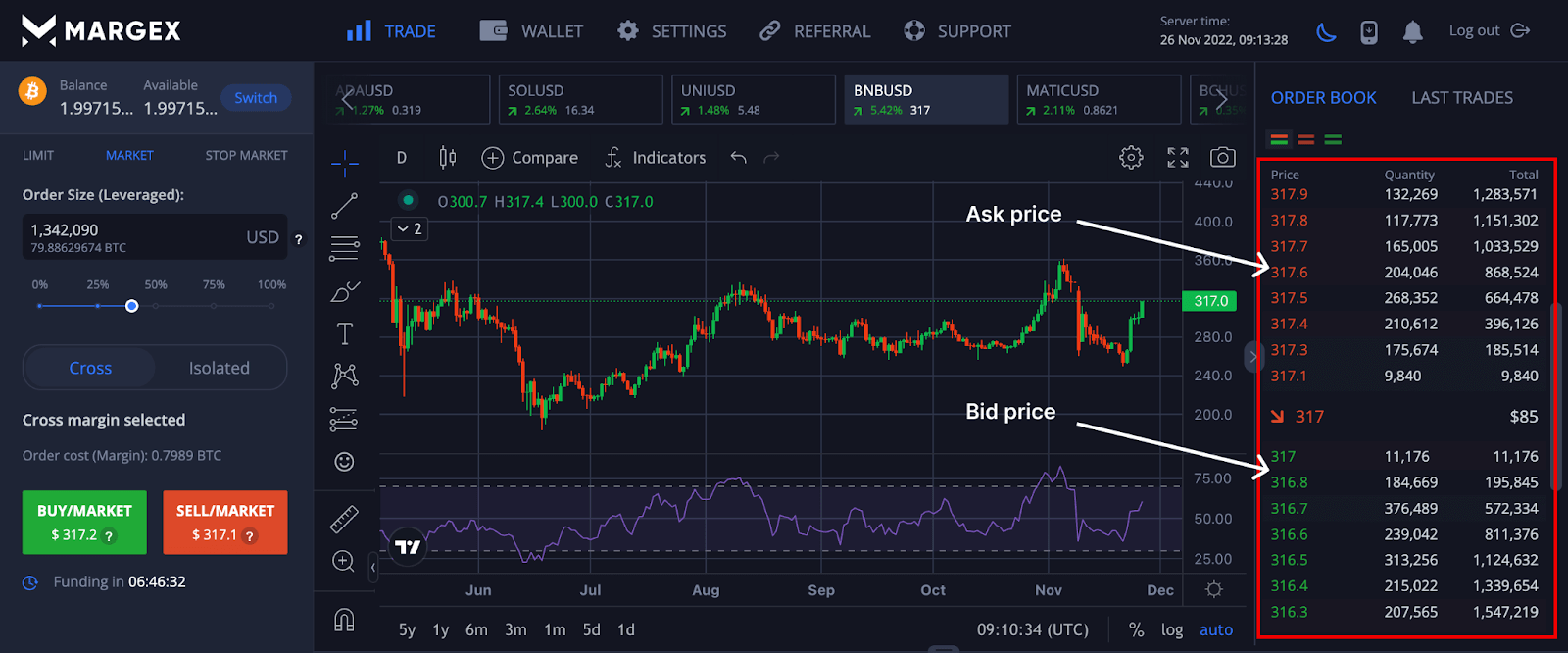

The image above shows the order book and the buy walls and sell wall. The buy walls and sell walls shows more of an image of who controls the market or a possible direction the market could be headed.

What Is An Order Book?

The order book is found on cryptocurrency exchanges like Margex; a trader needs to understand the order book before opening a long or short position for an asset.

The order book is a list of buy orders and sell orders on the marketplace that is being updated electronically to keep an asset’s price organized. Order books are dynamic and, as such, are constantly being updated in real time.

The order book is made up of buy orders, sell orders, and market order history. In most exchanges, you will see the bid price and ask price for the order books.

From the Image above, the asking price is labeled red while the bid price is labeled green; when the asking price matches, the bid price trade is initiated for that particular asset price. Sometimes due to high demand for particular crypto assets, the asking price changes rapidly and increases with the sellers or bidders struggling to match the exact price to initiate a trade. In this case, the trader uses the market price to initiate a trade matching the exact ask price or even higher.

Order books give traders more information about the market and how to determine their entries and exit from an asset; bigger players like whales and institutions tend to manipulate the order books and use it for their advantage and depend solely on the order book as a strategy is not advisable.

What Is A Market Depth Chart?

A market depth chart is a graphical representation of the sentiments shared by traders and investors regarding bid/ask orders and who controls the market or a possible direction the market could be headed.

The market depth chart is created by graphing the price point at which the bid/ask is placed on the X-axis and the total volume of orders on the Y-axis.

How Do I Read A Depth Chart To Identify Buy Walls And Sell Walls In Crypto?

A depth chart is a tool for determining the supply and demand for a cryptocurrency at any given point in time (for a range of prices). It is a more graphical representation of the information in the order book. A depth chart is made up of several key elements:

- The bid line displays the total value of buy orders, or demand, at any given price point. This is represented by a green line on the chart’s left side.

- The ask line displays the total value of sell orders, or supply, at any given price point. A red line on the right side of the chart depicts this.

- The horizontal axis is usually expressed in dollars. It displays the various price points at which buy and sell orders are placed.

- The vertical axis is typically found in the cryptocurrency that you are trading, such as Bitcoin. It denotes the number of orders placed at each price point.

What Is A Whale Wall?

A whale is a trader, investor, or institution with a huge quantity of a crypto asset, allowing them to impact and drive prices in the market. Examples of such whales include Micheal Saylor, Grayscale, and others; if these individuals and organizations decide to sell their crypto asset at t particular price, the market will suffer losses, sending the price of an asset lower.

Because of their huge assets, whale tends to influence the market prices of an asset to favor them, and as such, it is not advisable to trade the buy and sell walls in isolation as this could lead to false signals.

Margex exchange, with the help of its MP price protection, gives traders an edge over price manipulation, pumps, and dumps, making them an to trade with.

Margex unique features also include the ability for a trader to trade and stake the same crypto assets helping them to earn up to 13% APY in the current market state with no lockup periods for assets. Withdrawals are made daily into your staking balance with the help of the Margex automated system.

Conclusion

Trading cryptocurrency comes with high risk and high returns enabling traders to be profitable if they have all the necessary tools and knowledge. As a speculative market, sometimes it tends to be manipulated, but staying ahead of the game requires you to continue to update your knowledge of technical analysis and other profitable strategies to help you spot opportunities in this volatile market.

Frequently Asked Questions (FAQ) About Buy And Sell Walls

What Are Buy And Sell Walls?

Buy walls are big buy orders created for a particular price level for an asset, indicating more buyers are willing to buy than the sellers at that point. Sell walls are massive seller orders created for a particular price level for an asset.

How Do You Read Buy And Sell Walls In Crypto?

Buy walls and sell walls are sometimes embedded in the order book and a trader needs good experience trading and using the order book to read these buy walls and sell walls.

The buy walls and sell walls give traders a good sentiment of where the market could be headed.

How Do You Know If Crypto Sells Walls?

The sell walls are found on the red side of the order book for a crypto exchange like Margex that embeds its buy and sell walls with its order book.

Do People Manipulate The Crypto Market?

Crypto whales, such as big crypto traders and institutions with large amounts of crypto assets, sometimes manipulate the market to have the upper hand during trading and for their trades to get filled or sell a particular asset.

Is Market Manipulation Illegal In Crypto?

Crypto is a speculative market, and it is difficult to regulate market manipulation. Still, the Margex MP system helps protect traders from price volatility, dumps, and dumps from shilling a particular crypto asset.