Cryptocurrency trading attracts some costs. Cryptocurrency exchanges are the platforms that match orders between customers who want to buy and sell crypto.

All centralized exchange trading platforms collect a fraction of your liquidity as profits. Fees in cryptocurrency exchange are calculated based on the order type. The exchange deducts the fees after matching and executing the orders. That’s why fee maker and fee taker concepts exist on trade types.

Maker and taker fees are the two types of fees traders face on exchanges. The fee percentage depends on your trading volume in a specific time frame, the trading pair, and your order type. A fee maker arises for maker orders not executed immediately, thereby increasing liquidity. On the other hand, a fee taker is for taker or limit orders executed instantly.

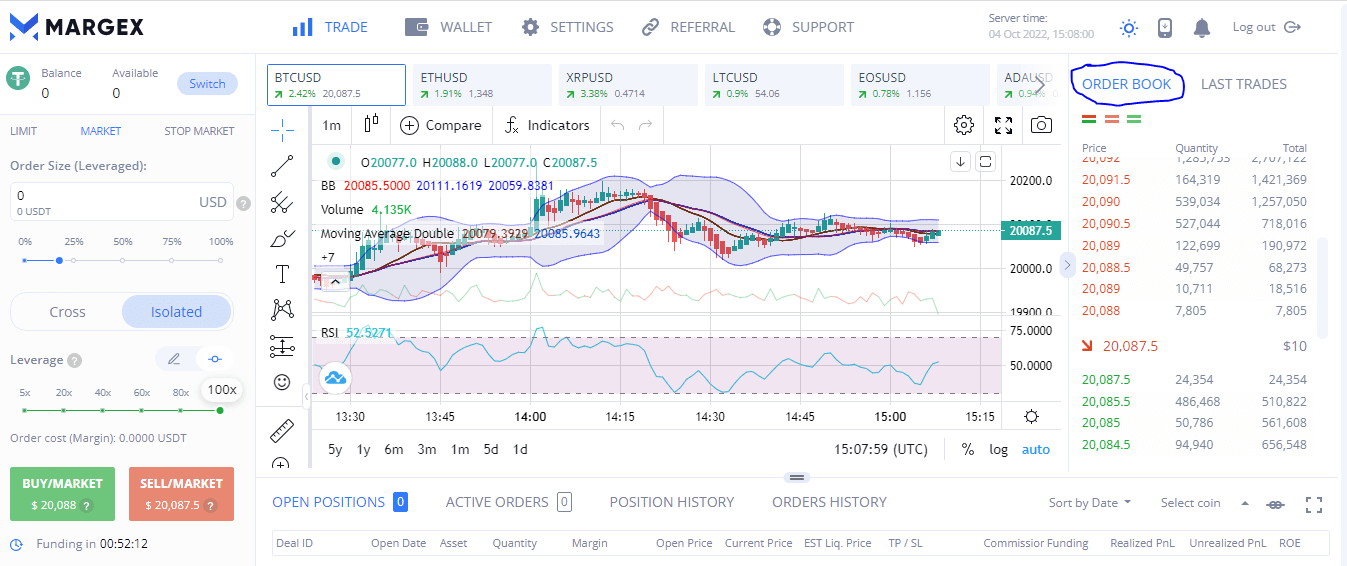

Generally, maker fees are lower than taker fees since they add liquidity to the order books. An order book shows the payment for order flow.

Overview Of Maker Fee In Cryptocurrency

The buying and selling of cryptocurrency on Exchange platforms accrue trading fees. Understanding the fees and how they work is key to successful crypto trading. Different type of trading fees is based on the order or order flow.

Generally, orders come in two categories:

• Pending orders relating to fee makers

• Instant orders relating to fee takers

The maker and taker fees are forms of transaction rebates given to liquidity providers, otherwise known as market makers. Rebates aim to incentivize the market. Market makers charge customers for receiving their services. The rebate system facilitates trading on an exchange platform by encouraging firms to accrue incentives.

The maker-taker rebate system started in the 1990s but started gaining traction with the emergence of high-frequency and algorithmic trading. The maker-taker model provides a means of separating orders that remove liquidity and those that add it.

Naturally, it is more common to find big traders and organizations acting as market makers. These organizations specialize in a high-frequency model of trading. Small traders can also become market makers by placing certain order types not designed, for instance, execution.

The fee makers are the traders that trade with pending orders.

Makers VS takers

Makers (market makers) are trading firms that employ special strategies to receive payments. Takers (market takers) are large investment firms that buy or sell large stocks betting on short-term price movement.

Makers provide two-sided markets, while takers depend on prices set by the makers. Market makers generate limit orders and only execute the best offer after waiting for the exchange to fill their orders. Market takers operate opposite to the makers; the exchange fills their orders immediately. Liquidity is very important to market takers, and they work with time.

Makers ensure constant liquidity in a market. They pay transaction fees when exchanges execute their orders but receive transaction rebates for adding liquidity to the system. Some trades can incur both maker-taker payments if they are fulfilled in part.

A fee maker depends on pending orders, while a fee taker relies on instantly executed orders.

Maker fees

These are fees on pending orders on a trading platform. Exchanges charge maker fees on pending orders. Maker orders have two distinct characteristics:

- A sell order is placed at a higher price than the highest buy order.

- A buy order has to sit at a lower price than the lowest sell order.

Exchanges monitor and place these orders on the order book. When traders fulfill two criteria, your order is included in the order book. The makers add liquidity to the order book and provide the market for the takers to thrive.

Exchanges apply the maker fee to your order after its execution on a trading platform. The fees are always lower than taker fees, although trade volume is also a huge factor.

A limit order is a maker order

A limit order that is pending and not executed immediately is a maker order. It is an order that a trader places to buy and sell an asset at a specified price on a trading platform.

If you place an order for 1ETH, for instance, at $1200, and Ethereum is currently trading at $1350.20, the order will be pending in the order book.

The exchange will not execute it until a price drops to the $1200 level. Placing this order gives you the tag “maker ‘since no market existed yet at $1200 until you created it. You have also added liquidity to the market.

Makers dictate the liquidity of the market. They patiently hold onto their positions till the market falls or rises to its price levels. A buy limit order is an example of a limit order.

An Overview Of Taker Fee In Cryptocurrency Trading

An exchange charges a taker fee for taker orders executed on a trading platform. The exchange matches the taker order instantly with a buyer or seller’s order already in its book. A buy order must be placed at the lowest sell order in the order book for these types.

Takers are traders holding positions that exchange can fill and match with an available order instantly using market orders. They place buy and sell commands filling trade orders on the order book. These traders pay taker fees when the exchange executes their orders.

This fee taker action is to remove liquidity from the market. Taker fees depend on the speed of order execution. When liquidity decreases, exchanges charge fees to discourage the removal of existing pending orders.

As a rule, the taker fees are usually higher than the maker fees. The takers remove liquidity while the makers add to it.

A sell order must be set at the highest buy or bid order in the order book. For taker orders, they remove pre-existing orders from orders on the order book and pay fees.

A market order is a taker order

Since a market order is executed instantly, it is considered a taker order. If Ethereum currently trades at $1349.35, exchanges will instantly execute a market order for 1ETH at that price. These orders are taker orders since they leave the order book.

But note that if the market’s liquidity is insufficient, an exchange can reject or partially fulfill a market order.

Placing such an order makes you a “taker” since you have taken liquidity from the market. For takers to succeed, there must be enough liquidity in the order.

An exchange will use the fee taker metrics to deduct their percentage. Without placing your order, a sell market will still be pending in the order book.

Maker And Taker Fees Examples

Leveraged platforms like Margex use a fee model that gives users fee rebates, competitive rebate pricing, and discounts. Our platform offers deposit and referral bonuses which give you unlimited earning opportunities. There is also enough liquidity to keep your trades profitable.

Traders should be careful to ensure enough liquidity from the exchange they choose. This ensures profits from your crypto assets.

Example of maker fee

To understand fee maker metrics, check this example. If you buy 200 BTC at $16,000 with a 30-day trading volume of $20,000,000 based on the crypto exchange schedule, you will pay either:

A taker fee of 0.10% or a maker fee of 0.02%.

Therefore, Total cost of order = 200 x $16,000 = $3,200,000

If BTC/USD pair is currently trading at $19,200, and you place your buy limit order at $16,000, your order will be listed in the exchange’s order book.

If the price of Bitcoin suddenly falls to $16,000as the current price in the market, the exchange will fill your order.

Since your order was executed as a maker order, you then calculate the total maker fee using this formula.

The total cost of order x (maker fee of exchange / 100)

$3,200,000 x (0.02 /100) = $640

Sometimes filling maker orders can take a bit of time. Your order can be pending in the order book if there are few participants in the market. Fee makers are conservative across trading sites.

Example of taker fee

A fee taker total will always be higher than a fee maker total since the execution is instantaneous and completed with immediacy. This means that there’ll be no allowance for price adjustments, and the exchange will match your order with sellers instantly.

For instance, if you want to purchase 200 BTC at $19,200, you place a market order for instant execution at a trading volume of $20,000,000 in thirty days, then:

You will pay a taker fee of 0.1 instead of a maker fee of 0.02.

Total cost of order = 200 x $19,200 = $3,840,000.

Since your order was executed as a taker order, it can be calculated using the formula:

The total cost of order x (Taker fee of exchange / 100)

Using the formula for this example:

$3,840,000 x (0.1 /100) = $3840

Overall, trading volume and the platform influence the fee maker and fee taker total. The trading volume over a particular period is also a major determinant. The more trades you engage in overtime, the lower your fees on a platform.

Understanding Maker-Taker Fees With Margex Exchange

At Margex, we know that profit is our customer’s priority. So, we provide the right platform to place orders on numerous cryptocurrencies and trading pairs.

Here is our take on Maker-taker fees:

When you execute trade orders, you will incur two types of fees.

Maker fee: The exchange charges this fee on traders that add liquidity to the order book by placing a pending order. These are limit orders set below the current price for a buy order or above the current price for a sell order.

Conditional take-profit orders are also inclusive. Margex offers you low-rate maker fees at 0.019%

Taker fee: These fees apply on orders that remove liquidity from order books. The exchange matches them immediately with pre-existing orders. These orders are market orders or conditional orders converted to market orders after execution.

These conditional orders include a stop loss and stop market order. Whenever a trader opens or closes a position in the market, they incur a trade fee.

A complete market for a trading pair consists of makers and takers. Makers pay fees for pending orders, while takers pay fees for instant orders. Note, if the exchange executes an order partially, it may accrue maker and taker fees.

Markets with high trading volume can undergo rapid trading that reduces liquidity and disrupts prices. Maker-taker fees are a means of containing crazy market price situations. Limit orders also help with price stability.

Funding

If a trading position is carried into a new 8-hour period on the Margex platform, it will be charged. These periods are past 00:00, 8:00, and 16:00 UTC. However, the exchange will not charge if the trader closes the position before the next funding period.

An active countdown timer for funding is available on the traders’ page of Margex. To access the current funding rates for a particular crypto pair, click on the funding timer available on the page. Also, Margex does not charge fees for deposits.

However, there are minimum deposit amounts for each asset on the platform.

Margex also offers you up to 100x leverage on your positions for assets making it quite easy to profit. With Margex, your assets are fully secured and encrypted. Entering and holding trade positions is as easy as clicking on a button.

FAQ – Common Questions On Makers And Takers On Crypto Trading

Some of the questions and answers below provide more clarity on the fee maker and fee taker concepts.

What are maker fees pros and cons?

The low rate of maker fees encourages traders to add liquidity to the market. Higher liquidity in the order books will lead to lower spreads between the bid and ask prices. Positions can then be executed with minimum slippage.

But it will take more time for buyers to fill an order. Your order might get stuck to the order book and never get to the predicted level for a particular trading pair.

What are taker fees pros and cons?

With a taker order, there is instant execution at the current market price. One disadvantage is the higher fee it attracts on many exchanges since it reduces liquidity.

The order might also get executed at a lower sell price, or you will pay a higher buy price than the market order.

Why the name maker vs. taker?

The makers make the market by adding liquidity to it and encouraging trade activity. The takers take from the liquidity pool created by the makers. Makers and takers are like two sides of a coin. They are both vital for the progress of the market.