A stablecoin is a digital currency run on a blockchain whose value is pegged, or tied, to that of another fiat currency, commodity, or asset. Most stablecoins are pegged to national currencies like the USD or EUR, although there are some which are pegged to hard assets like gold or real estate.

However, when someone mentions stablecoin in the crypto world, he most likely refers to one that is pegged to the US dollar. Such stablecoins are designed to combat the volatility of traditional cryptocurrencies like Bitcoin and Ethereum, which make them unsuitable for transactional and valuing purposes.

How Do Stablecoins Work?

As mentioned above, stablecoins can be backed, or collateralized by various physical assets, this means that the value of the stablecoin follows the value of the specific asset. If the backed asset value goes up, so would the value of the stablecoin, and vice versa.

Many types of assets have been used as the asset backing of stablecoins. These include fiat currency, i.e. traditional currencies like the US dollar or Euro dollars in your bank account, other cryptocurrencies like Bitcoin, precious metals like gold, real estate, and even algorithmic functions.

A fiat-collateralized stablecoin is usually more stable in value because fiat currencies are inherently stable assets. The value of fiat currencies are maintained by regulatory bodies to ensure price stability and thus have a fixed value, while a crypto-collateralized stablecoin’s value could fluctuate more because its backing asset, being a cryptocurrency, is subject to high price volatility in itself.

Types of Stablecoins

After learning the basic definition of what is a stablecoin, now let us go through in greater detail what the common types of stablecoins are.

Fiat-Collateralized Stablecoins

Fiat-collateralized stablecoins have the equivalent of cash reserves in fiat currency as a backup to their supply, and these reserves are maintained by independent financial institutions that act as custodians. Most fiat-backed stablecoins are audited regularly to ensure that they really do have the equivalent amount of reserves to back up their stablecoin supply to ensure there is no uncontrolled minting of unaccounted for coins.

There are many examples of fiat-backed stablecoins. USDT, USDC, BUSD, are all examples of popular stablecoins that are pegged to the US dollar. These US dollar backed stablecoins are being used in the crypto world just like the US dollar.

Commodity-Collateralized Stablecoins

Commodities, in particular, Gold, has long been touted as a safe haven that hedges against stock market volatility and inflation. Hence, it is only natural that stablecoins with commodity backing such as gold have been invented. Commodity-backed stablecoins like those backed by gold can help investors protect against the fluctuations of the crypto market.

One example of a gold-backed stablecoin is Digix, which can even be considered as a proxy to investing in gold bars, but without the hassle of having to transport and store the precious metal.

Crypto-Collateralized Stablecoins

Crypto-collateralized stablecoins are backed up by other cryptocurrencies. Due to the volatile nature of cryptocurrencies, crypto-backed stablecoins are often overcollateralized, meaning there is more underlying collateral than the market capitalization of the entire circulating supply of the stablecoin to ensure the stablecoin holds its value.

For instance, a $1 crypto-backed stablecoin is usually tied to an underlying crypto asset worth more than $1, often $2 or more, so that in the event of the underlying crypto losing its value, the stablecoin will still have a cushion and can remain valued at $1.

Non-Collateralized Stablecoins

Non-Collateralized Stablecoins are not backed by any asset, but instead, are backed by a computer algorithm and as such, they are often referred to as algorithmic stablecoins. This type of stablecoin uses a mathematical formula to balance the demand and supply of the stablecoin under varying market conditions to ensure that it stays at $1. These control mechanisms are programmed into smart contracts which will automatically execute different commands under varying market conditions to balance the demand and supply so as to keep the stablecoin valued at $1.

Often known as rebalancing, a typical demand-supply adjustment of an algorithmic stablecoin system goes like this:

The price of the stablecoin is pegged to $1 US dollar, but when demand rises and causes its price to rise higher than $1, the algorithm would automatically release more tokens to increase the supply so as to bring the demand and supply back in balance and have the price trade back down to $1. Conversely, if the market price falls below $1, it would reduce the supply to bring the price back up to $1. While it sounds good on paper, there are high risks associated with algorithmic stablecoins, which we will show in a case study in a later part of this article.

How Are Stablecoins Different From Traditional Cryptocurrencies?

The key way that stablecoins are different from traditional cryptocurrencies is their price stability. A stablecoin token maintains most of the traits of a traditional cryptocurrency like being censorship resistant and not geographically constrained, but without the price volatility, since its value is pegged to that of a fiat currency, which holds its value very well with much less fluctuation when compared with the more volatile cryptocurrencies.

What Are the Risks of Stablecoins?

While stablecoins sound like a dream, they are not without risks. For one, they are not well regulated since there is no central regulatory body to govern them. Hence, users are using them at their own risks. One common problem investors fear is the lack of transparency regarding the reserve asset. Some stablecoin issuers may not hold a 100% equivalent in reserve asset to fully back the stablecoin, raising concerns of under collateralization and an inability for users to redeem their funds should there be a mass redemption event. To ease user concerns, stablecoin issuers are engaging independent third-party auditors to audit their reserves holdings and publish the reserve reports regularly on their websites.

Furthermore, to safeguard consumers in their countries, financial institution regulatory bodies in different jurisdictions are currently reviewing and scrutinizing laws to regulate stablecoins. This could be both a boon and a bane, depending on how the regulations eventually take shape.

The second risk of stablecoins lies with the inherent risk of using cryptocurrencies. As with all new technologies, there is a high possibility of bugs or other vulnerabilities that can be exploited. Using your own private keys could result in you losing or forgetting your keys, or they could be subject to hacks where they could get stolen by cyber criminals.

Another risk with stablecoins, especially algorithmic ones, is that their formulas may have vulnerabilities that cause the balancing to not turn out the way they were supposed to work. This is due to the fact that algorithmic stablecoins were all hypothesis-based and birthed out of theoretical scenarios instead of having real market trials. This could make them prone to errors when dealing with real-life market situations.

What Can You Do with a Stablecoin?

You can use a stablecoin to make transactions with others via smartphones or your computers without having to have a bank account. By and large, due to their nature of having no centralized system of control, holders of stablecoins get full control of their funds when compared with putting it in a bank, traditional financial products, or brokerage services who are custodians of your funds that can override your decisions. Holding stablecoins puts you in full control of your financial decisions.

Holding a stablecoin that has the fiat backing of another currency that has a more stable value can also help to protect the purchasing power of someone that lives in a country where inflation is rampant and prevents his wealth from being eroded away by inflation.

Further to these, a holder of stablecoin can also use it to earn interest. There are many avenues for stablecoin holders to lend, borrow or simply stake their stablecoins to earn a steady interest from them.

Stablecoins also open the way into decentralized finance (DeFi), where one is able to do investments and transact with others without having to disclose their identity. This allows them to keep their financial and other personal data private and not privy to hackers or cyber criminals.

Depending on the blockchain that you choose to transaction on, the cost of using a stablecoin can be much lower than using the traditional banking system. This is a big cost saver to the consumer, especially if you are a frequent cross-border fund transfer user.

How Do Stablecoin Companies Make Money?

Stablecoin issuers make money through earning part of the transaction fees when users send and receive these stablecoins on the blockchain. Other than transfer fees, stablecoin issuers also earn returns by reinvesting those currency reserves, mainly dollar reserves, in other dollar denominated assets like US commercial paper or other financial products like short term corporate debt or collateralized debt position.

As such, since these investments are not 100% safe; there is counterparty risk and market risk associated when holding stablecoins that are issued by central entities like the USDT or USDC. That said, as we have mentioned above, these issuers have been making risk reduction a key priority and are keeping as much stablecoin reserves in cash as possible to assure investors that they can meet all redemptions in the event of a run. Impending regulation on stablecoins to ensure that they meet certain regulatory reserve thresholds could also give more comfort to stablecoin owners who wish to hold them for a longer period of time.

What Are The Most Popular Stablecoins?

Now that we know the rationale behind and uses of stablecoins, let us get to know some of the most popular stablecoins in the market right now.

Diem

Diem is the renamed version of the controversial Facebook stablecoin that used to be called Libra. Libra came under fire by regulators across the US and EU for trying to create a stablecoin backed by a basket of different fiat currencies.

Under the new name and with Facebook now rebranded as Meta, the Diem stablecoin looked to work hand in hand with the new Metaverse that Meta was creating, until it got the marching orders by US regulators to stop the project. The intellectual property and assets of the Diem project had since been sold to Silvergate Bank in January 2022. It is still not publicly known what plans Silvergate Bank has for the assets.

Tether

Tether, more commonly known as USDT, is the first and most used fiat-backed stablecoin issued by a private entity. It has a market cap of around $68 billion and is the largest stablecoin in circulation. Most crypto assets are priced and traded in USDT as it is the stablecoin with the longest history and highest turnover. USDT is accepted by almost all crypto establishments and can be used to stake for interest, trade, or simply as a means of value transfer.

USD Coin

USD Coin, commonly known as USDC, is issued by Circle, a licensed money transmitter in the USA, and is the second largest fiat-back stablecoin issued by a private entity. It has a market cap of around $50 billion and is hot on the heels of USDT to become the largest stablecoin in circulation. However, as not many exchanges list USDC pairs for trading, its trading volume still pales in comparison to USDT. Most users of USDC are long-term holders, using it for staking to earn returns, or as an electronic way to store the US dollar.

Dai

The Dai stablecoin, simply referred to as DAI, is a stablecoin issued by DeFi protocol MakerDAO. DAI is pegged to the US dollar but is backed by Ethereum and other cryptocurrencies that are worth minimally 150% of the Dai stablecoin total market cap. DAI is a type of crypto-collateralized stablecoin.

What Happened with UST?

UST is one example of an algorithmic stablecoin that has gone massively wrong. Its value plunged by 99.9% within a span of 5 days beginning 9 May 2022, vaporizing about $18 billion worth of investor funds who held the UST stablecoin.

UST has a dual coin system where a token named LUNA was the balancing mechanism that ensured that UST would be pegged to $1. LUNA was the native token that was used to run the blockchain that UST was built on (Terra blockchain) and the modus operandi was that more LUNA would be minted to buy UST when its price fell below $1, and the circulating supply of LUNA would be burned to keep UST at $1 in the event that there was too much demand to send UST beyond $1.

During the heyday of DeFi, a continuous stream of demand for both UST and LUNA caused the price of LUNA to surge, which the team could sell easily to maintain the $1 peg for UST. However, as the crypto market downturn started, the price of LUNA started wavering as with the rest of the market and not enough new demand was created to support the redemption of UST. As a wave of redemption hit UST, a lot more LUNA tokens were minted to help try to keep UST pegged at $1 peg, but there was no buyer for the team to sell their LUNA tokens to. Eventually, both LUNA and UST collapsed under their own weight and both tokens fell to zero, causing massive casualties within the crypto space. A large crypto hedge fund was even bankrupted due to an overly large position in both failed tokens.

Stablecoin FAQ

Now that we have gone through quite a bit of information, let us do a simple revision on what is a stablecoin before our article ends.

What is The Point of a Stablecoin?

The point of a stablecoin is to provide crypto investors with a means of an asset within the crypto ecosystem that can offer price stability. A stablecoin also helps crypto investors trade peer to peer by offering a low cost and efficient method of value transfer. Please refer to our article above for more information about what is a stablecoin and what is a stablecoin used for.

What is An Example of a Stablecoin?

An example of a stablecoin is USDT.

How is Stablecoin Different from Cryptocurrency?

The difference between a stablecoin and a cryptocurrency is price stability. While a stablecoin always has a value of $1, a cryptocurrency’s value fluctuates according to market conditions and has a lot more price volatility.

How Do You Profit From Stablecoins?

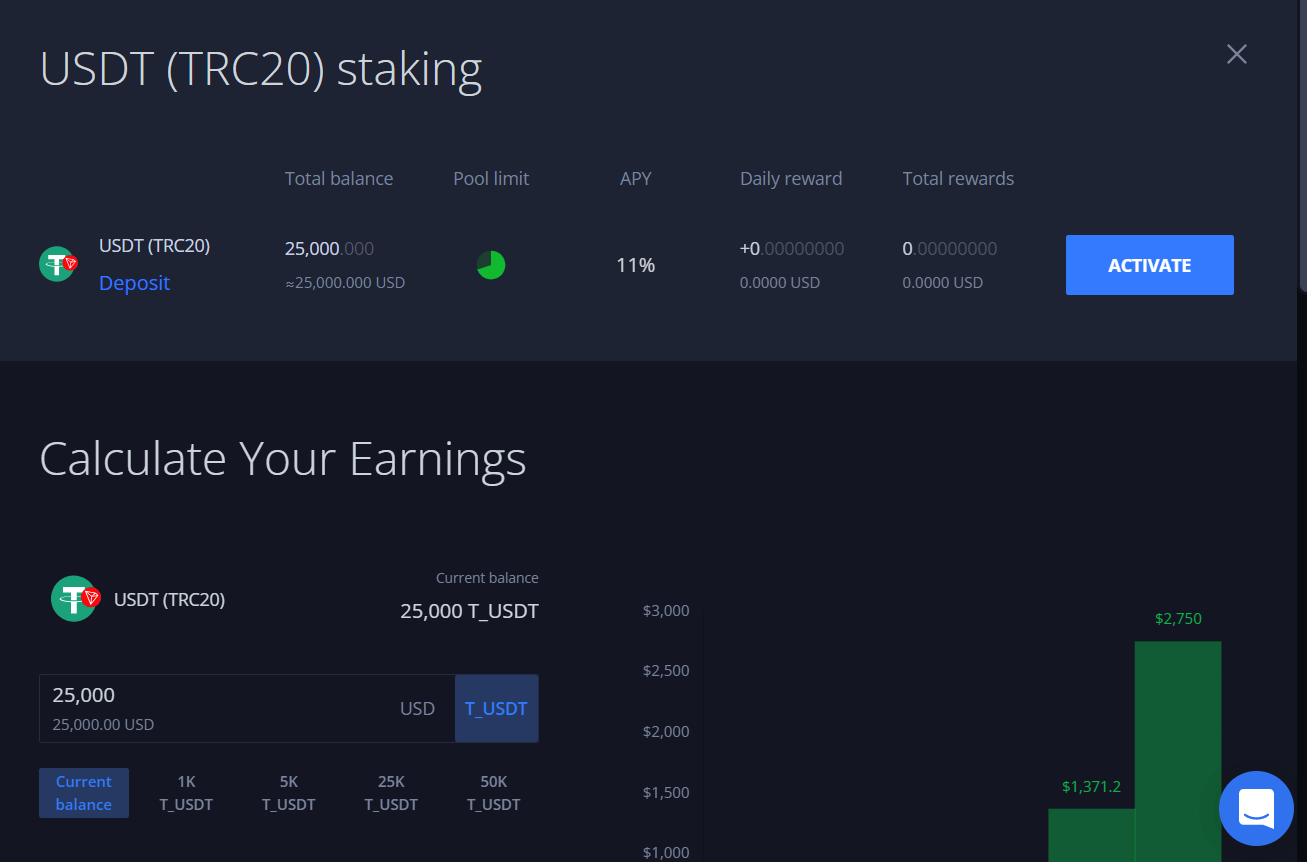

You can stake your stablecoins to earn regular returns in the form of getting interest paid on the amount of stablecoin you stake. One platform that offers very good staking returns on stablecoins is Margex, which offers an annual return of more than 10% on stablecoin staking.

Simply go to margex.com to sign up for an account and start staking!

Which is The Safest Stablecoin?

There is no safest stablecoin. Each type of stablecoin comes with their associated risks. For instance, a company issued stablecoin pegged to a fiat currency may have counterparty risk, while the algorithmic stablecoin technology is still a works-in-progress and comes with a high risk of design flaw. Please refer to our article above for more information regarding the safety of stablecoins.

What is The Best Stablecoin?

There is no best stablecoin. A user should assess his own risk profile and needs to determine which is the stablecoin most suited for his use. Please refer to our article above to find out the merits and flaws of each type of stablecoin.

Can Stablecoins Lose Value?

While stablecoins are supposed to hold their price at $1, it is possible for stablecoins to lose value, especially seigniorage style stablecoins that are non-collateralized and based on algorithms. Such stablecoins are at the highest risk of losing their values due to design flaws. Please refer to our article above regarding the collapse of the UST stablecoin for more information.

Is Shiba Inu a Stablecoin?

No. Shiba Inu is not a stablecoin. Shiba Inu is a traditional cryptocurrency that has very high price volatility. Please refer to our article above for more information regarding the definition of stablecoins.

Is Dogecoin a Stablecoin?

No. Dogecoin is not a stablecoin. Dogecoin is a traditional cryptocurrency that has high price volatility. Please refer to our article above for more information regarding the definition of stablecoins.

Why is stablecoin interest so high?

The way of explaining why stablecoin interest is so high is via the law of demand and supply. The demand of stablecoins far exceeding the supply is why stablecoin interest is so high.

Stablecoin issuers are not able to increase the supply of stablecoins at will even when the demand increases because they need to be fully backed by its specific asset, unlike a fiat currency which can be issued by central banks at will.

The demand for stablecoin constantly exceeds its supply due to various reasons, some of which are below:

The importance of stablecoins used as the base currency to value most crypto assets. The trading of cryptocurrencies at exchanges is done using stablecoins, this results in almost all crypto transactions needing to use stablecoins.

Not only are stablecoins the backbone of crypto trading, they are also the backbone of decentralized finance, the lending, borrowing, and investment ecosystem of the crypto universe. Stablecoins are the most used crypto asset as collateral for lending and borrowing due to its relatively fixed value, which makes valuation less of a headache compared with using traditional cryptocurrencies whose value could change every minute. An asset used as a collateral is typically locked up, which automatically reduces its supply in circulation. Thus, the prevalent use of stablecoins as a collateral in the crypto space is causing its active supply to be shrinking even as demand continues to increase.

Another reason why the demand for stablecoins is so high is the increasing use of stablecoins as a cheaper means for the transfer of value across borders. Compared with the traditional banking system which charges an exorbitant amount of fees, using stablecoins to make international transfer of funds is much more economical.

Thus, with the supply of stablecoins not being able to expand as fast as the increase in demand, the net result is a high interest that borrowers will be willing to pay for them.