A dead cat bounce is a technical indicator that was primarily used for predicting stock prices. It is defined by a period of temporary rise in prices that deceives most investors to think that the rally is sustainable, before the main downward trend resumes, and prices start to decline again. Even though the idea of a dead cat bounce was initiated to predict share price movements, traders of other assets like commodities, precious metals, and the crypto market have also benefited hugely from using the dead cat bounce phenomenon to help in their trading. A dead cat bounce is also known as a sucker’s rally, a bull trap, a fake out, or simply as a false rally or a short-lived rally.

Why is It Called Dead Cat Bounce?

The term “dead cat bounce” came about in the late 1980s from Wall Street to describe a stock market movement that was not sustainable and bound to fail because the rally was backed by no real fundamental reason. Pundits referred to such assets as “dead cats”, while the “bounce” was derived from the notion that even a dead cat will bounce if it falls from a high enough height. However, despite being able to bounce, a dead cat nonetheless, is still dead.

What Does a Dead Cat Bounce Tell You?

A dead cat bounce can tell investors several things that they can make use of to help in their investing. These are:

A dead cat bounce is not sustainable: a dead cat bounce is only a temporary rebound from the downward trend after a prolonged period of decline and is not sustainable.

A dead cat bounce can be deceiving: a dead cat bounce can give unwary investors the false impression that the price increase is sustainable and the asset is on the road to recovery.

A dead cat bounce can provide good trading opportunities: While a dead cat bounce is not a sustainable trend, a nimble trader can still profit from the temporary period of gains, or even use a dead cat bounce reliably to open a short position once other chart indicators signal that the price is about to do a reversal and resume its downtrend.

How to Spot a Dead Cat Bounce on Margex

Even though it is almost impossible to confirm a dead cat bounce before it happens, there are several telltale signs that would strongly hint of one. At the following signs, a trader should be cautious of a potential dead cat bounce and not get caught. These are:

- A prevailing downtrend: A prevailing downtrend must be present in order for any relief rally to be classified as a dead cat bounce.

- A lack of volume: One key telltale sign of a dead cat bounce is a lack of volume during the price recovery stage. This is because there is not enough buying interest.

- A lower high: While a dead cat bounce is a rise in price, it does not rise as high as the previous peak. This indicates that the downtrend is still in place.

- The rally is short-lived: A dead cat bounce is usually short-lived, it is not able to sustain the price increase for a long time before falling again.

After knowing what signs to look out for, let us go through with an example on how to identify a dead cat bounce in the crypto market.

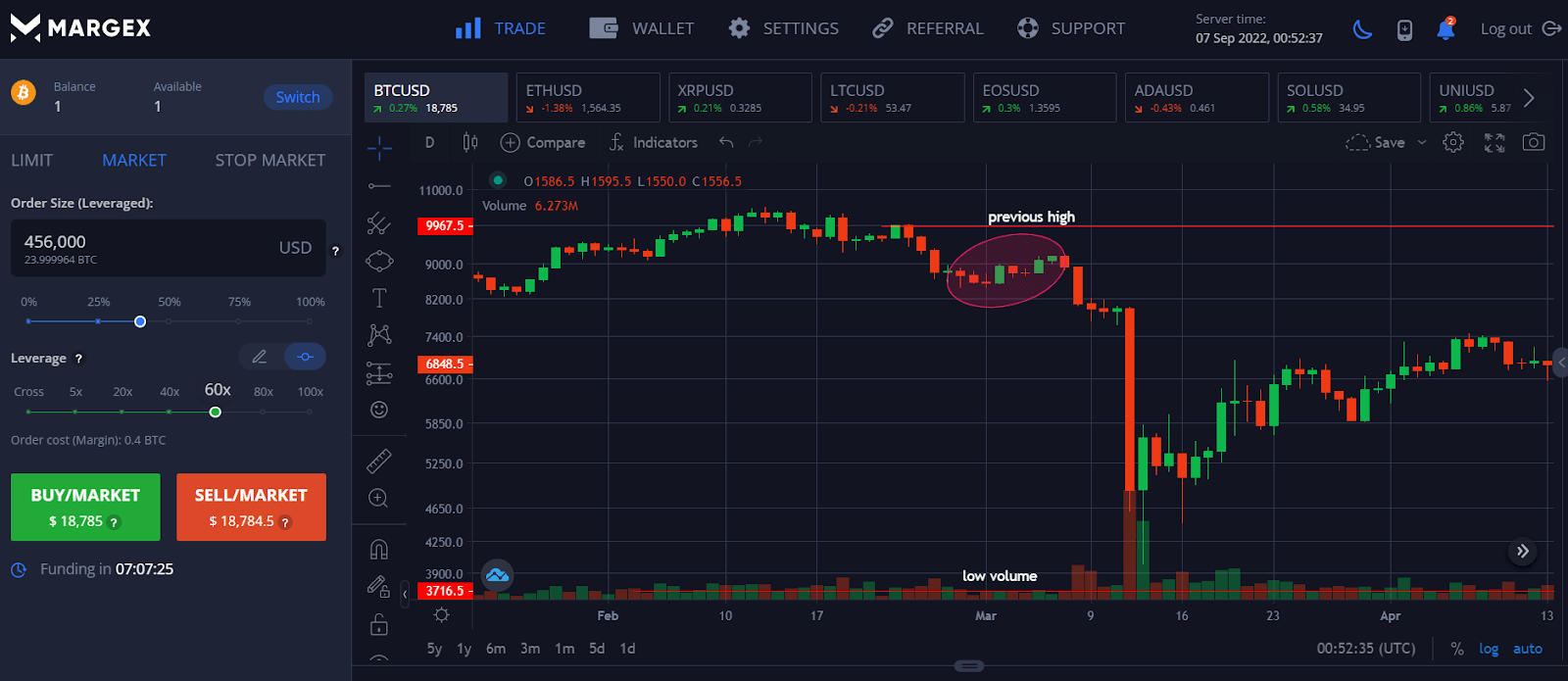

One classic example of a dead cat bounce in investing was the temporary recovery in the crypto market when news of the COVID pandemic was first made public. Please refer to the BTCUSD chart below as we run through the illustration.

As news first spread that a new transmissible virus later to be known as COVID was spreading throughout the world in mid February 2020, the price of BTCUSD already started to decline. However, in early March, the price of BTCUSD began to rise slightly for about a week. This rise was a dead cat bounce as not only did the market have no fundamental reason to rise due to the devastating impact COVID would have on global economies, the move met all the key signs of a dead cat bounce, namely,

- Existing downtrend present.

- Low volume: This rise was of lower volume than usual.

- Lower high: The highest point of the rally could not reach its previous high as shown in the diagram. In fact, it was quite some distance lower.

- The rally was short-lived and lasted only about a week before volume came in on 08 March 2020 to crash the price far lower after news broke that the COVID pandemic had spread to the USA.

More Examples of Dead Cat Bounce on Margex

Let us look at more examples of dead cat bounce on the Margex trading platform to help you familiarise how to spot them. Margex offers clear and easy to use charts that will be a powerful arsenal of analytical tools that even a beginner trader with no trading experience will have no trouble using.

Example 1: BTCUSD Dead Cat Bounce Between February and April 2022.

In this textbook example, one can see clearly that the price of BTCUSD was in a clear downtrend before the short-term rally took place. Furthermore, even though the price rallied quite significantly in its dead cat bounce, its highest peak was still far lower than the previous peak, and the trading volume during the price increase period was lower than its previous norm. Price subsequently broke lower.

Example 2: SOLUSD Dead Cat Bounce Between 15 and 27 December 2021.

Another example of a dead cat bounce in crypto is SOL. From November 2021, SOLUSD was already in a period of decline. However, in the middle of December, price started to creep up, giving SOL fans false hopes that its price would recover sustainably and recapture its all-time-high. The prospect that the recovery would not be sustainable could already be seen in its trading volume, which was significantly lower than its then usual trading volume. This showed that there were not enough buyers to keep the price of SOL going up. Eventually, its price broke lower as the number of buyers dried up and SOLUSD began a second decline and even had a third similar decline as shown by the smaller red circle.

After looking at three examples of dead cat bounces, you should be confident enough to spot the warning signs and prevent yourself from getting fooled the next time you come across similar moves.

How Long Can a Dead Cat Bounce Last?

A dead cat bounce can last between a couple of hours and up to a few weeks or even months. The exact duration of each dead cat bounce is difficult to determine, which is why investors who are conditioned to “buy the dip” usually end up getting sucked into one.

What Causes a Dead Cat Bounce?

There could be a variety of reasons for a dead cat bounce. Some could be driven by loyal fans of a particular stock or crypto who keep buying the dips. Other times, investors could have been led to believe that prices have bottomed out, or that a fundamental reason for recovery was forthcoming, which in the end, did not materialise.

Typically, a dead cat bounce is a result of severely oversold market conditions as in most cases, a dead cat bounce occurs after an asset experiences a lengthy period of price decline in a bear market.

What Is the Opposite of a Dead Cat Bounce?

The opposite of a dead cat bounce is a bear trap, which is a price decrease after a lengthy bull market action to fool bears into believing that the bullish trend is over. After the bears have sold, the price rises again, thereby trapping these bears.

FAQ

Now that we have learnt about what is dead cat bounce, and also seen a few examples, it is time for a revision before our article ends.

What Happens After a Dead Cat Bounce?

After a dead cat bounce, the asset price resumes its main bear market trend and price declines again.

How Do You Know If It’s a Dead Cat Bounce?

According to The Motley Fool advisors, dead cat bounce is a term used in technical stock analysis which they are not fans of. The newsletter analysts at The Motley Fool commentary think that understanding the fundamentals of an asset is a better way to produce consistent market-beating returns and thus, the best way to spot a dead cat bounce is to look at market fundamentals.

For instance, to know the latest news of any company, a trader could set a breaking news alert to know the latest market insights or disclosures of that company. In the event that a stock price is rallying from a low point, the trader will be able to know if it is because the company has significant news that is improving its business fundamentals, or if the rise is simply because it is too oversold and thus, not a sustainable trend change.

Where Did The Term Dead Cat Bounce Come From?

The term dead cat bounce came from Wall Street to describe the false rallies of stocks that have no strong underlying reasons to go up.

What is The Opposite of Dead Cat Bounce?

The opposite of a dead cat bounce is a bear trap. Just like how a dead cat bounce is also known as a bull trap which traps bulls, a bear trap is the exact opposite of a dead cat bounce in that it is used to trap bears.

How Long is a Dead Cat Bounce?

There is no fixed defined period for a dead cat bounce. They can vary from within a day to up to a couple of months.