CeFi is an acronym for “centralized finance.” CeFi’s core concept is to create crypto investment opportunities that combine some of the yield benefits of DeFi with the ease of use and security of traditional financial-services products (sometimes referred to as TradFi).

Since the dawn of civilization, we have relied on central authorities or other third parties to process our financial transactions. This practice is known as “centralized finance” or “CeFi.”

Traditional financial services, for instance, were initially only available at reputable financial institutions like central banks and credit unions. Only a few services were offered, including investing and obtaining personal and business loans.

However, this has changed a little in recent years due to the creation of financial technology (FinTech), which includes tools like robo-advisors and digital lending to help with personal and business finance. The development of blockchain technology and cryptocurrencies are other topics of growing interest. People want to understand the current debate between centralized finance (CeFi) and decentralized finance as the world of cryptocurrencies grows (DeFi).

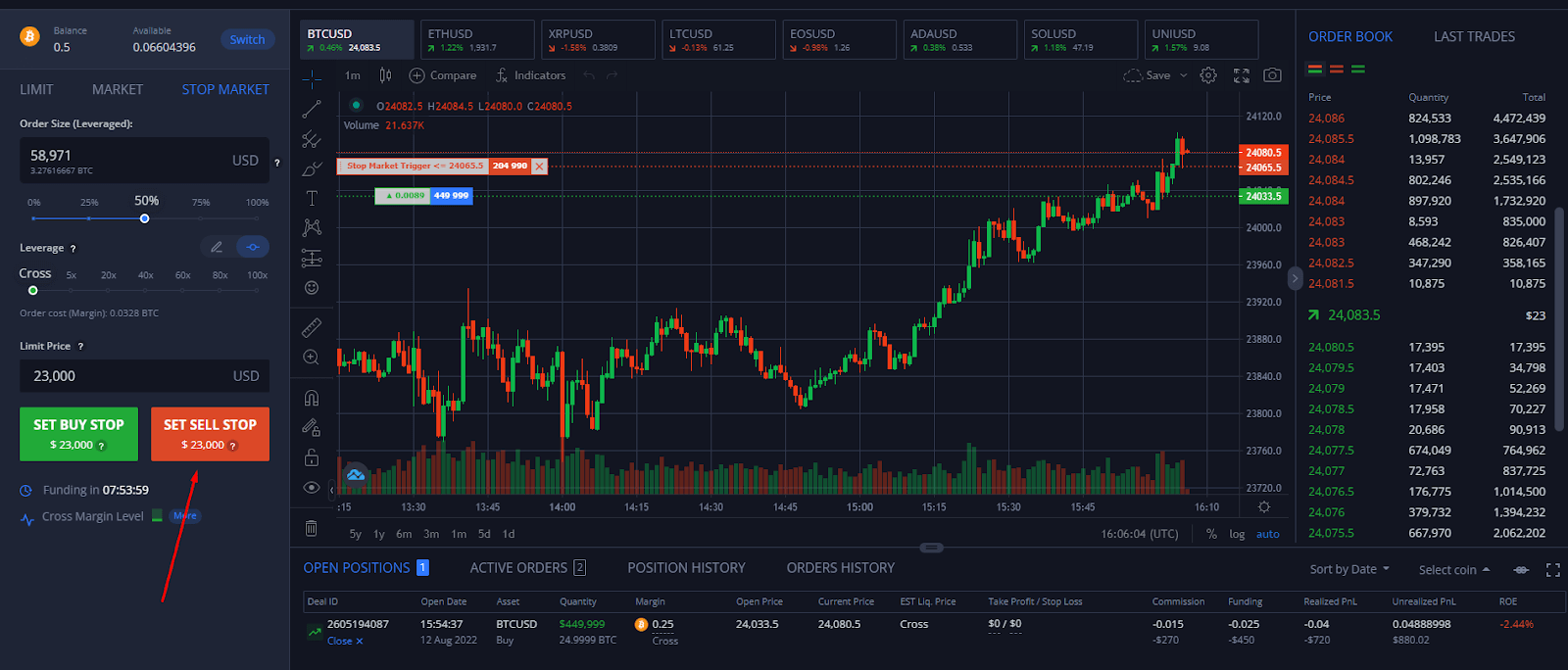

Centralized finance, or CeFi in the context of cryptocurrencies, refers to exchanges that act as central authorities and regulators for cryptocurrency transactions and activities. In a Centralized Exchange (CEX) in CeFi, all cryptocurrency trading orders are filled automatically through the Order book. Any cryptocurrency with a low volume of transactions is removed from CEX, ensuring liquidity in cryptocurrency tokens or coins for easy trading.

The financial world has discovered a new way of trading with the advancement of blockchain and the emergence of cryptocurrencies in technology. Cryptocurrencies were designed to decentralize the financial trading system, but they have only been used for cryptocurrency trading.

So, in addition to crypto trading, centralized and decentralized finance (DeFi) was introduced, which included other aspects such as providing crypto loans, trading crypto derivatives such as Bitcoin Futures, and tokenizing digital assets.

Centralized exchanges have control over both the trading fees and which cryptocurrencies are added to or removed from their exchanges. CeFi is well known for being custodial, and CEX manages and controls a user’s cryptocurrency. To stop money laundering and other financial crimes, the government has established strict guidelines and regulations for CEX. For example, when an account is flagged as fraudulent in CeFi, centralized exchanges have the authority to freeze that user’s funds.

How Does Centralized Finance Work?

In contrast to decentralization, centralization refers to the concentration of an organization’s planning and decision-making processes to a single leader or location. The head office retains decision-making authority in a centralized organization, while all subordinate offices receive orders from the main office. The executives and specialists who make critical decisions are housed in the headquarters.

In centralized finance, all crypto trading orders are routed through a central exchange (CeFi). Individuals in charge of this exchange manage the money. This implies that they cannot access their wallet because they lack a private key. Furthermore, the exchange decides which currencies can be traded and how much users must pay in fees to trade on their platform.

CeFi provides the opportunity to generate income through crypto-based accounts practically comparable to traditional bank savings accounts but may yield significantly higher profits.

Unlike traditional savings accounts, crypto deposits are not yet insured by government regulations, so users should be cautious. The basic idea is to keep a portion of the cryptocurrency on one of the numerous websites that offer this service.

Features Of CeFi (How Does CeFi Work?)

Interoperability

Trading in cryptocurrencies only takes place between tokens from the same blockchain in decentralized finance. Only tokens created on the ERC20 (Ethereum blockchain) protocol can be traded; this protocol is also allied with the BEP20 (BNB blockchain), TRC20 (Tron blockchain), and all other blockchains. Without regard to the blockchain of the crypto token, CeFi allows for trading, crypto lending, staking, and all other financial activities involving cryptocurrencies. In CeFi, ERC20 tokens can be exchanged for BEP20 tokens and any other tokens that are available for purchase on a centralized exchange on a different blockchain. The ease and simplicity with which traditional fiat money can be changed into cryptocurrencies on CeFi exchanges demonstrate the interoperability of CeFi’s cryptocurrency.

Centralized exchanges (CEX)

CeFi also has centralized exchanges as a feature (CEX). Online exchanges called CEX to allow users to buy and sell cryptocurrencies. Users trust these “middlemen” to carry out trading operations on CEX. The duties and responsibilities carried out by CEX include lending and borrowing services, trading in cryptocurrency futures, and staking. Government regulations and policies govern CEX’s trading practices; assets of fraudulent users are seized, and trading profits are taxed following the user’s country of residence. Although CEX has benefits and drawbacks, they offer many features that decentralized exchanges (DEX) do not. This is because trading crypto relies solely on centralized finance.

Fees

Centralized exchanges have very small and negligible trading fees compared to DEX exchanges. However, fees are imposed on transactions such as trading and withdrawals.

The majority of cryptocurrency investors are concerned about trading fees. A white-label DEX operates similarly to a CEX in that it charges a percentage of the transaction cost, but a centralized exchange operates on a per-trade fee!

As a result, when a transaction is ready to be placed on a decentralized exchange, you must pay a gas cost for your trade to be confirmed via blockchain, which can be costly depending on the chain.

Usability

The user interface is the first thing users notice when interacting with a platform. So naturally, an easy-to-use interface will encourage users to return to the platform, and the user experience will keep them coming back. The user experience extends from the onboarding processes to users’ interactions with their assets.

Trading on Margex

Margex and other centralized exchanges excel at making their platforms and services as user-friendly as possible. It has a simple interface that takes only a few minutes to learn. CEXs also entice users with the availability of fiat-crypto trading pairs, which adds a familiar element. As a result, they provide newer crypto investors with direct access to the market.

Speed

Centralized exchanges employ order-book trading technology, in which bots are programmed to buy and sell the token that a trader wishes to trade. As a result, centralized exchanges are typically faster than decentralized cryptocurrency exchanges. Security

This gives it the advantage of being quicker in order execution than decentralized exchanges. For example, a centralized exchange typically takes 10 seconds to complete a transaction, whereas a decentralized exchange takes 15 seconds to match and execute the order.

Security

On CEX, there are hardly any cryptocurrency scams. Since CEX is a residual exchange, the user’s private key is owned by the exchange, tightening security even further. In DEX, a user’s private key or seed phrase might get lost, making it impossible to access their cryptocurrency wallet. Additionally, a hacker may be able to access the location where a user stores their private key and take that user’s belongings. People are “rug-pulled” by scammers who create and persuade them to purchase fraudulent and fake cryptocurrencies.

The name was inspired by the expression “pulling the rug out,” which describes how a developer can draw money to a new cryptocurrency project by controlling most of the tokens. After obtaining sufficient investors, the developer withdraws the project’s liquidity. The investors are then left with worthless cryptocurrency.

Custody

In a centralized exchange, the exchange is in charge of the user’s assets and is in charge of their private key. Before using the CEX, a user must accept the exchange’s terms and conditions. If a user’s activity is deemed fraudulent, a CEX has the authority to freeze that user’s assets. When CEX flags an account for cryptocurrency laundering, it is frozen until the user can show proof of funds and the transaction’s justification. In this sense, CEX performs the role of our traditional bank.

What Are Some CeFi risks?

Risk of compromised privacy

Giving private information like your legal documents and home address is part of the initial process of opening an account with a centralized exchange. By confirming that the users are real, this procedure, known as KYC (Know Your Customer), helps to stop illegal activities like money laundering. However, your personal information could end up in the wrong hands if the exchange is subject to a cyber intrusion.

Risk of losing funds

In CeFi, you entrust your funds to your preferred centralized exchanges and have no control over the funds. Essentially, we are relying on the people in charge of the businesses to maintain a high level of security and safeguard the assets. If the exchange is hacked, they are very likely to be lost.

Regardless of these risks, you should not be concerned about CeFi because almost all exchanges use blockchain forensics and have companies on the lookout for any fraudulent activity. In addition, they strive to minimise risks and protect their customers by providing a dependable environment.

Advantages And Disadvantages Of CeFi

Advantages Of CeFi

For beginners, the user interfaces are simple to grasp, and the methods can be quickly absorbed. In addition, access to the various cryptocurrency trading platforms is straightforward, with a high level of functionality and a wide range of trading options available.

The cryptocurrency expert advisors believe that CEX has a higher cash flow due to its large trading volume. As a result, the trades can complete their payment obligations smoothly and quickly.In addition, the high volume of activity on centralized trading platforms ensures many buyers and sellers, resulting in market-friendly trade.

Furthermore, centralized services provide more flexibility than decentralized services when converting cash to bitcoin and vice versa. In most cases, converting bitcoin to money necessitates using a centralized organization; however, DeFi services do not provide cash in such a flexible manner. Clients can be easily onboarded into the Centralized Finance (CeFi) ecosystem, which can improve the customer experience.

CEX also utilize structures that allows for real-time transactions. As a result, they are algorithmically capable of processing several orders per second in order to gain strategic competitive advantages. As a result, market participants can make quick decisions and respond to changing market conditions.

Traditional exchanges offer a diverse range of virtual currencies and trading pairs. At the same time, withdrawals and deposits in fiat currency are possible.

For example, you can use CeFi cryptocurrency services to trade LTC, XRP, BTC, and other coins created by independent blockchain platforms. However, due to the latency and complexity of executing cross-chain exchanges, DeFi services do not support these coins. CeFi can avoid this issue by obtaining custody of assets from multiple chains. CeFi benefits greatly from this because many of the most commonly traded and highest-market-cap currencies are on separate blockchains that do not adhere to interoperability standards.

Disadvantages Of CeFi

Each CeFi service and provider is unique, and your cryptocurrency investment may be used in various ways with varying degrees of uncertainty. As a result, it’s critical to research and gains knowledge about how your cryptocurrency is being used, how the return you’re receiving is generated, and what risks are involved.

Transaction fees are unavoidably higher in a Ce-fi because multiple intermediaries are available. This is one of the primary reasons why millions worldwide are moving to a decentralized platform.

The most serious issue is that centralized systems are constantly appealing to hackers. The latter intends to profit from the networks’ high liquidity. As a result, they use illegal computer technologies to breach information and steal money from customers.

CeFi users relinquish ownership of their crypto assets to the exchangers. They also reveal personal information during these conversations. As a result, there is a significant risk of losing funds if the transfer is breached or subjected to a cyberattack. Even if your funds are secure, there is still the possibility that your confidentiality will be compromised.

Keep in mind that crypto investments are no longer covered by the government-backed insurance available for regular bank accounts. In addition, certain CeFi operators may temporarily freeze your account.

FAQ

Here are some frequently asked questions about centralized finance.

What is Cefi in crypto

The traditional form of finance, centralized finance (CeFi), is how most people are used to dealing with money. CeFi involves a central authority controlling the financial system and processing all crypto trade orders through a central exchange.

A government, a bank, or financial institution can serve as the central authority. CeFi typically uses fiat currency, or money not backed by a physical commodity. Prior to the invention of DeFi, this was the most popular method of trading cryptos, and it had a firm grip on the cryptocurrency market.

A central exchange manages funds and decides which coins are traded and what fees must be paid.

Is it safe?

CeFi is extremely safe because it guarantees the security and fairness of such payments. Crypto trading is also available to traditional money traders. Furthermore, unlike DeFi services, CeFi exchanges offer customer support which leads to the development of trust along the way. It guarantees fund security and good deals on those assets. Every approach has advantages and disadvantages. The investment and their needs reveal it.

What does CeFi offer?

CeFi is one of the few game-changing technologies that combines some of DeFi’s yield advantages with the simplicity and dependability of traditional financial-services products. As a result, CeFi enables you to earn savings interest, obtain funds, spend with a cryptocurrency debit card, and do various other things.

While the main idea behind CeFi is to create cryptocurrency investment options that combine some of the benefits of DeFi with the ease of use and security of traditional investment instruments (sometimes called TradFi). CeFi allows you to borrow money, buy and sell cryptocurrency, spend and earn rewards with a cryptocurrency debit card, and much more.