Different skills and methods make trading easier and more favorable to crypto traders. These methods can come to the rescue when it seems like all is over, and the best option is to liquidate due to excess margin; however, if a trader knows how to leverage them, it will serve as a protective hedge for his portfolio.

In this article, we will discuss cross-margin trading, how traders use it to remain profitable, step-by-step guide on how to use it on the Margex platform.

What Is Margin Trading?

This trading strategy is also called leverage trading, as it allows traders to speculate on the condition of the market using borrowed funds or leverage, but it also involves investing a little capital. The total amount of crypto tokens needed to enter a leverage position is known as the margin. There are currently two margin trading positions that can be utilized, A short position, whereby a trader speculates on a price drop, and a Long position, where the speculation is on price spiking.

To further explain both positions, a trader who enters a short position borrows cryptocurrency at a specific price and aims to repurchase it when the prices drop, resulting in a profit. For example, John is a trader who enters a short position by borrowing 10 BTC when it was still valued at 60,000 per one. Currently, BTC has dropped in price and trades around $16,872.9.

Now he has made a lot of profit because when buying to pay back, he will spend less than the value from which he borrowed it. However, there is the risk that instead of dropping cryptocurrencies, prices can continue to rise. If this happens, John may eventually pay up to double the price he borrowed, depending on how high the increase was when he borrowed the BTC, resulting in a massive loss.

For a trader who enters a long position, however they buy low to sell high, this type of trading can be carried out without leverage; however, there is the risk that instead of rising, prices could drop drastically and never rise past the price which they bought, resulting in loss of funds. Let’s retake the example of John, let’s say he buys BTC at its current price of $16,872.96 with the hope that it would rise, but unfortunately, it continued to drop down, reaching almost $30, and refused to rise again, that is a loss of more than $16,000 per one BTC. He bought 10, recording over $160,000 loss.

However, both positions, if calculated well, bring huge rewards. Still, for massive yield using a little capital based on betting, there is always the risk factor, coupled with the fact that cryptocurrencies are a very volatile market.

What Is Cross-Margin Trading?

Cross-margin trading is the ingenious method whereby a trader uses their balanced margin accounts to save another one with an excess margin by transferring the excess margin to the latter to stay in line with margin maintenance requirements.

The method was introduced toward the last quarter of the 1980s during a period of extreme volatility in the market; firms could leverage this feature to increase their liquidity and prevent unnecessary liquidations that could lead to heavy loss in funds.

Before cross-margin trading, a trader or firm is at the risk of liquidation whenever they receive a margin call from a clearing house that is unable to offset positions at another clearing house, cross margining however made it possible to link accounts, enabling a fair distribution of margins across all the accounts so that none is weighed down with excessive margins to the point of liquidation.

To illustrate, let’s say a trader, Joe opens a short cross-margin position on ETH/USD with 0.1 ETH at the current price of $1,217 for ETH; the margin required to enter that position is usually calculated using the max allowable leverage for the trading pair, let’s say the margin requirements falls at 1% of ETH current price, Joe will need to stake his 0.01 of his ETH as margin to open the position. However, there is the risk factor that ETH can drop in price. If it does, the initial margin, too, will drop in price value. To prevent liquidation, the cross margin will withdraw $0.1 ETH from the total balance of Joe’s portfolio as an additional margin.

In that example, we see how cross-margin works; it simply ensures the safety of the trader’s funds with the rest of his portfolio.

Pros And Cons Of Cross Margin Trading

Like all trading methods, cross-margin has its risks and rewards; in this section, we will briefly discuss a few.

Pros

The benefits of cross-margin trading are numerous, but some are

- Cross Margin Trading complements Margin Trading supporting long and short positions.

- Cross Margin helps prevent Unnecessary Liquidation by sharing excessive margins across other accounts of the trader.

- Cross Margin Allows traders to borrow more with the purpose of magnifying profits.

Cons

Cross-margin trading is not without risks, as it deals with a highly volatile market, which is cryptocurrencies. In this part, we will also list three disadvantages of cross-margin trading.

- Cross Margin Trading puts the whole portfolio of a trader at risk if the whole trading operation goes sideways due to extreme market conditions.

- Cross Margin Trading snatches Control from the trader in certain positions and restricts some additional trading techniques like copy trading.

- Traders who use cross-margin modes cannot make changes to the amount of margin for each position.

How To Trade With Cross-margin (Step-By-Step Guide With Screenshots From Margex)

Margex is a bitcoin-based derivatives exchange that allows traders to open leverage size of up to 100x for either cross or isolated margin. Margex also has a unique staking feature that allows traders to stake the same tradable assets to earn up to 13% APY returns with no lockup periods.

Margex has been designed to help traders trade easily with the help of different trading tools and techniques like cross and isolated-margin trading. Let us discuss how to access and use the cross and isolated-margin trading on Margex.

Step 1: Access Your Margex Account

For a new user on Margex, you can create a Margex account to allow you access to cross-margin trading and other features accessible on Margex. An existing user needs to login to access the Margex trading interface.

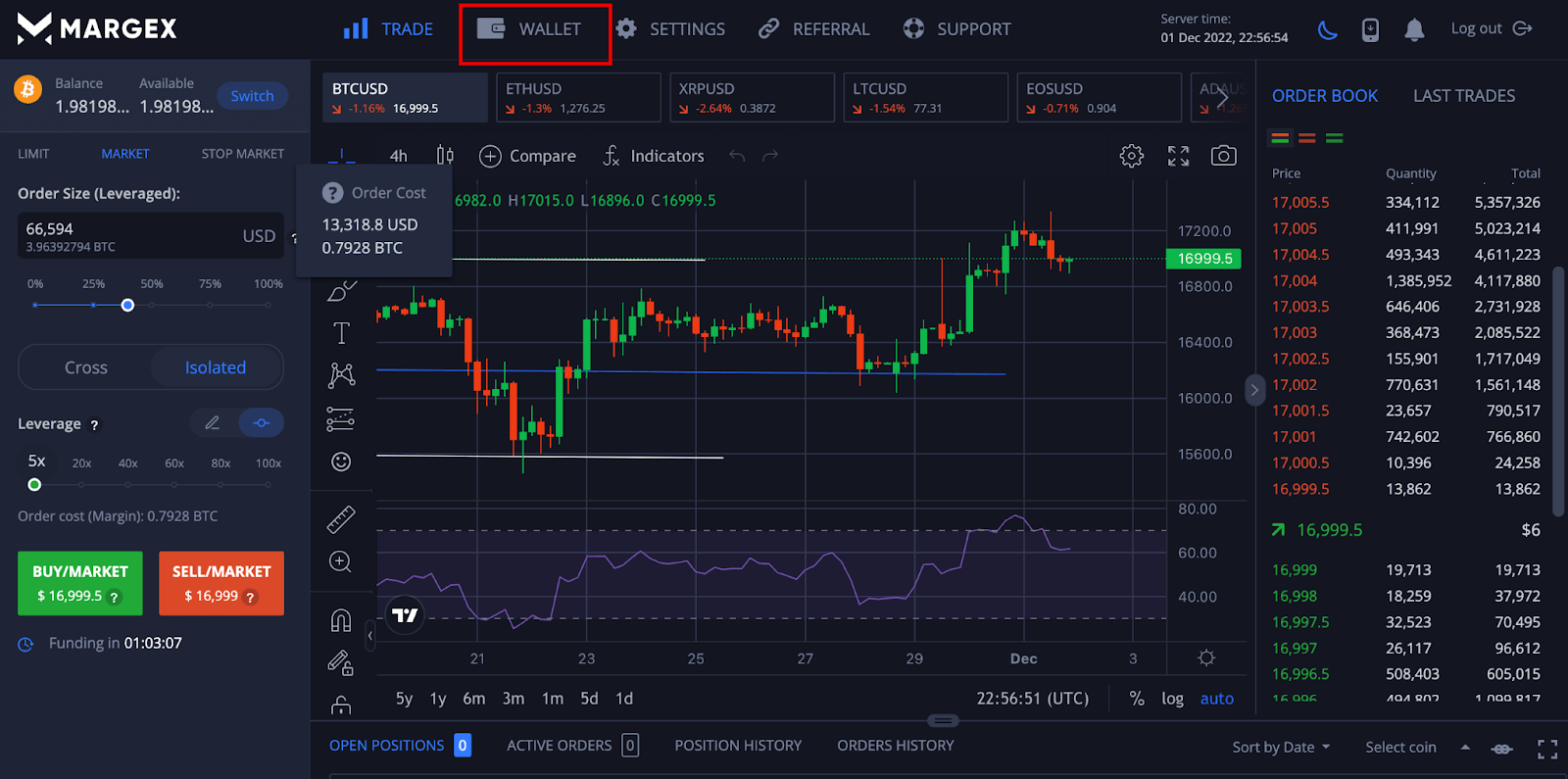

Step 2: Click On Wallet To Fund Account

After logging in to your account, click on the wallet to enable you to fund your account, as this will allow you to try using cross and isolated-margin trading.

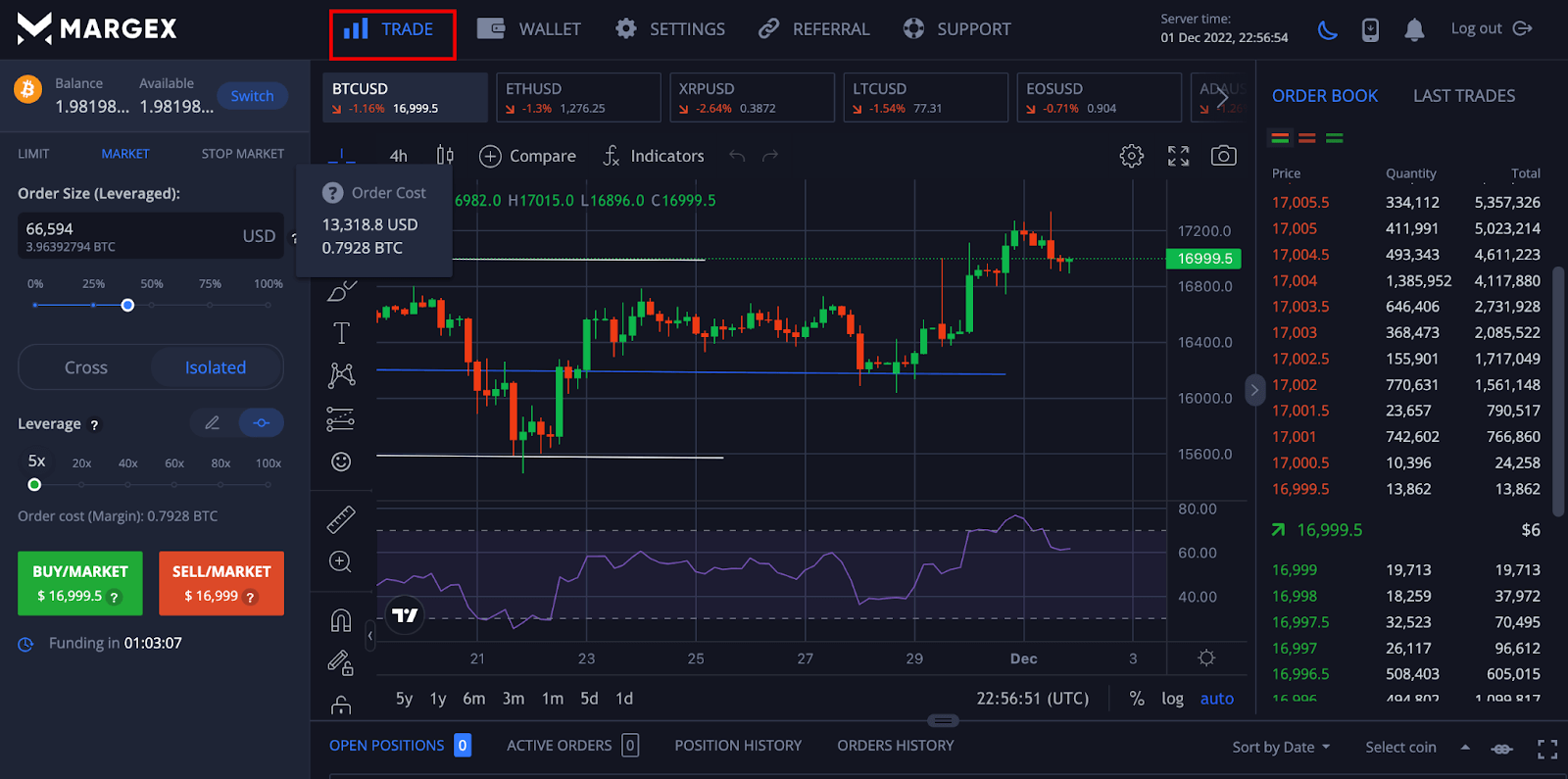

Step 3: Click On Trade

Click on the trade tab to access all of the Margex trading features, including the future interface that contains the cross and isolated-margin tab.

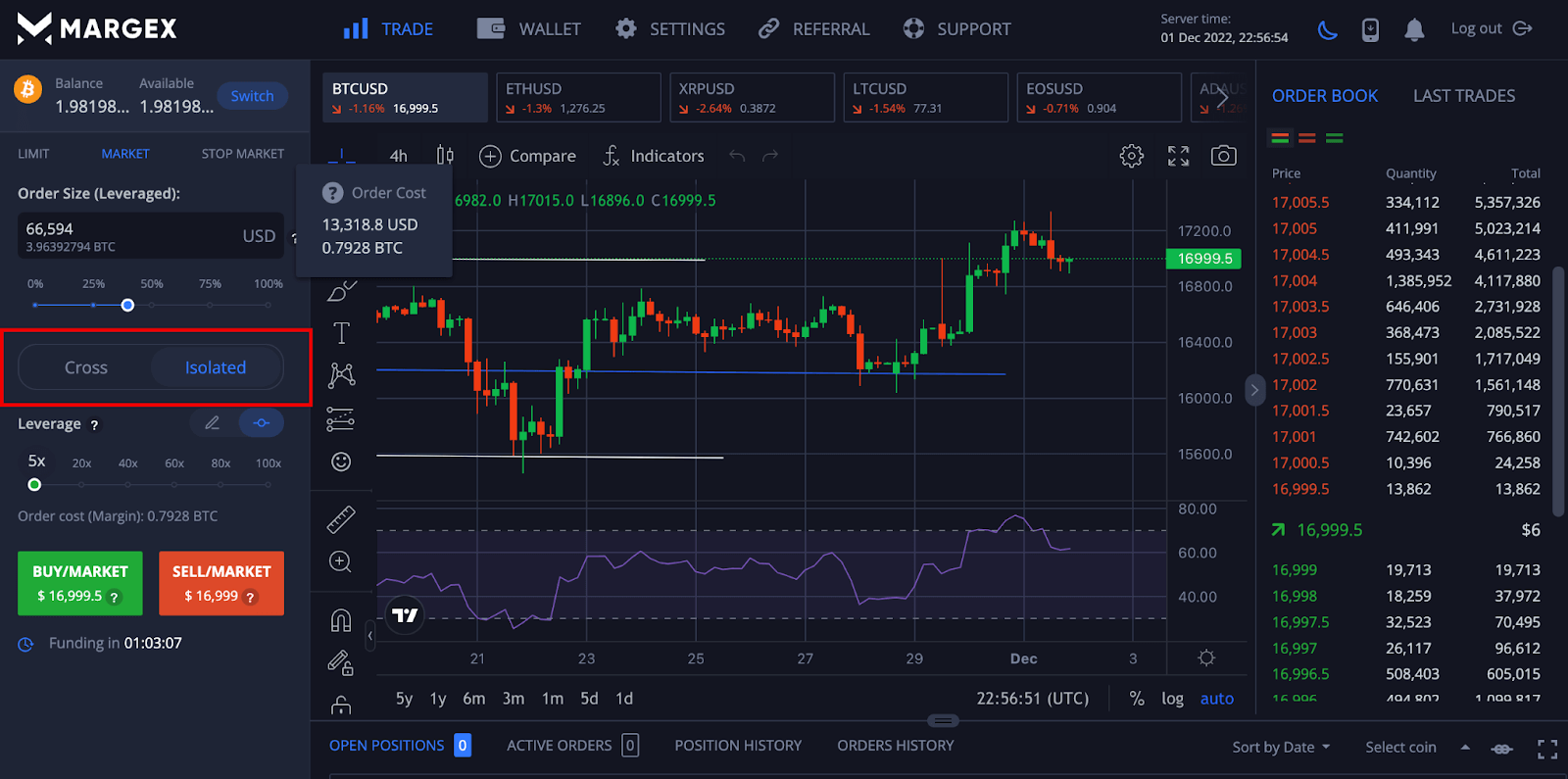

Step 4: Choose Either Cross or Isolated-margin Trading

The left side of the image above shows the cross and isolated-margin tab that can be toggled to any preferred technique. A trader needs a good understanding of these techniques before opting for the desired one to avoid losing funds.

Difference Between Cross Margin And Isolated Margin

Isolated Margin is a trading technique that allows a trader to control the amount used as initial margin when entering a trading position or multiple trading positions; this is quite different from Cross margin, which uses the total balance of an individual trader to cover his excess margin, in turn avoiding liquidation of their position.

However, the trader has no control over the number of funds in their portfolio that will be used to cover the loss, and in extreme market conditions, they could lose all the money in their portfolio. In Isolated margin mode, however, a trader can efficiently allocate the funds they desire as initial margin, minimizing loss even in the face of extreme market volatility.

In addition, when a trader’s position is liquidated in isolated margin mode, the loss is only on the isolated margin balance, not the whole margin account balance.

To illustrate, let’s say Patricia enters a long position with 10x leverage and 1000 EUR, her total margin balance is 2000 EUR, but due to volatility and risk management, she only wants to risk a small portion of the balance for the position; Patricia can easily set her margin at 100 EUR, which is a fraction, of her total margin balance of 2000 EUR. If for some reason, maybe due to market volatility or bad trades, her position was liquidated, she will only lose 100 EUR.

However, if she utilized Cross margin mode, she could lose much more than that cause she can’t control the loss, and her margin balance is at risk of liquidation if the position gets liquidated.

In addition, if a trader’s position is at risk of liquidation, they can efficiently allocate more margin to the position to prevent it.

Nevertheless, most platforms use cross-margin as the default technique due to its ease of use. Therefore, it’s advisable to cross-check and ensure that you are using your preferred margin mode because once there is an open position, the margin mode is irreversible.

The critical point now is both cross margin and isolated margin are beneficial techniques in successful trading; however, for institutional traders, cross trading is a very effective hedging tool, as it can help prevent liquidation by spreading the excessive margin across their portfolio; isolated margin is more like a risk management tool for those who want to cut their losses and direct more margin toward a specific position.

The Margex platform allows traders to trade these two techniques, and for more information regarding cross-margin vs isolated-margin trading, visit the link for more info.

Conclusion

Sometimes it’s hard to know which technique to go for, especially novice traders without much knowledge about how positions and margin work; this article was designed to help such traders know how the two most used margin modes in trading platforms function, highlighting the key differences, It highlights the pros and cons of one of the trading techniques cross margin so that they can make well-informed decisions before trading.

Frequently Asked Questions – The Most Asked Questions About Cross-margin Trading

We have discussed how cross-margin trading works and the difference between it and Isolated margin mode. Advantages and possible risks. In this section, we will focus on questions people ask about cross-margin trading and Isolated Margin trading.

What Is Cross-Margin Leverage?

Cross-margin uses all a trader’s margins as available balance, drawing from any amount it feels is sufficient to cover the margin loss of a position or multiple positions from the available balance. To avoid liquidation, a trader needs to have a substantial amount of funds in their balance to cover the leverage drawn.

What Are The Features Of Cross-margin?

Cross margin utilizes the whole portfolio of a trader to prevent the liquidation of positions by spreading the entire balance across all open positions.

Is Cross-margin Safer?

Many trading platforms use cross-margin mode as default because it is straightforward to use; also, it is an essential hedging tool for institutional traders with multiple positions, as it can spread their entire balance to cover the margin loss. However, it does come with the risk of potential loss of total balance due to specific factors.

What Is the Benefit Of Cross Margin?

Cross margin prevents unnecessary liquidation of positions by fairly distributing the available balance to cover margin loss. In addition, it allows traders to borrow more to increase their yield.

Can You Get Liquidated On Cross Margin?

A trader’s position can be liquidated if there are not enough funds in their available balance to cover the margin loss. However, with enough funds as an existing balance, the chances are slim for a position to be liquidated.