Fundamental analysis is a method of study that is used to determine the intrinsic value of an asset. Likewise, fundamental analysis in crypto is a suite of valuation metrics that helps an investor assess whether a cryptocurrency is overpriced or underpriced so that he can make an informed investment decision about whether to buy or sell the crypto asset.

How to Make Fundamental Analysis

Investors can use fundamental analysis tools to determine if an asset is overvalued so they can make a decision to sell, or if an asset is undervalued, to buy. Fundamental analysis for cryptocurrency works in the same way, except that the metrics that crypto fundamental analysis looks at are quite different from those used in traditional finance.

While traditional fundamental analysis looks into business metrics like price-to-earnings ratio or net asset value to construe what they think is its real value, crypto fundamental analysis uses a set of metrics that is vastly different. Please read on below to find out how the usage of some useful crypto fundamental analysis tools can help you find prospective investments that can potentially yield you good long-term profitability.

With a solid foundation in crypto fundamental analysis, non-technical investors that are not good at reading charts will still be able to time their entries and exits from their crypto investments with confidence. One thing that traders need to take note of, is that the result from fundamental analysis is often seen over a longer time period as opposed to the instant gratification of technical analysis. The results of fundamental analysis are however, often more long lasting and are more suited for longer time frame trading rather than intra-day trading.

As we are going to see below, crypto fundamental analysis is an important qualitative investment tool that prospective crypto investors, especially the ones that have a longer investment horizon, need to at least know something about.

Generally, fundamental analysis for cryptocurrencies can be broadly classified into three main categories. These are financial metrics, blockchain metrics, and product metrics. We shall start looking into the details of each. Please do note that these metrics are non-exhaustive and there may be other fundamental analysis tools that we may not have been able to cover in this article.

Financial Metrics

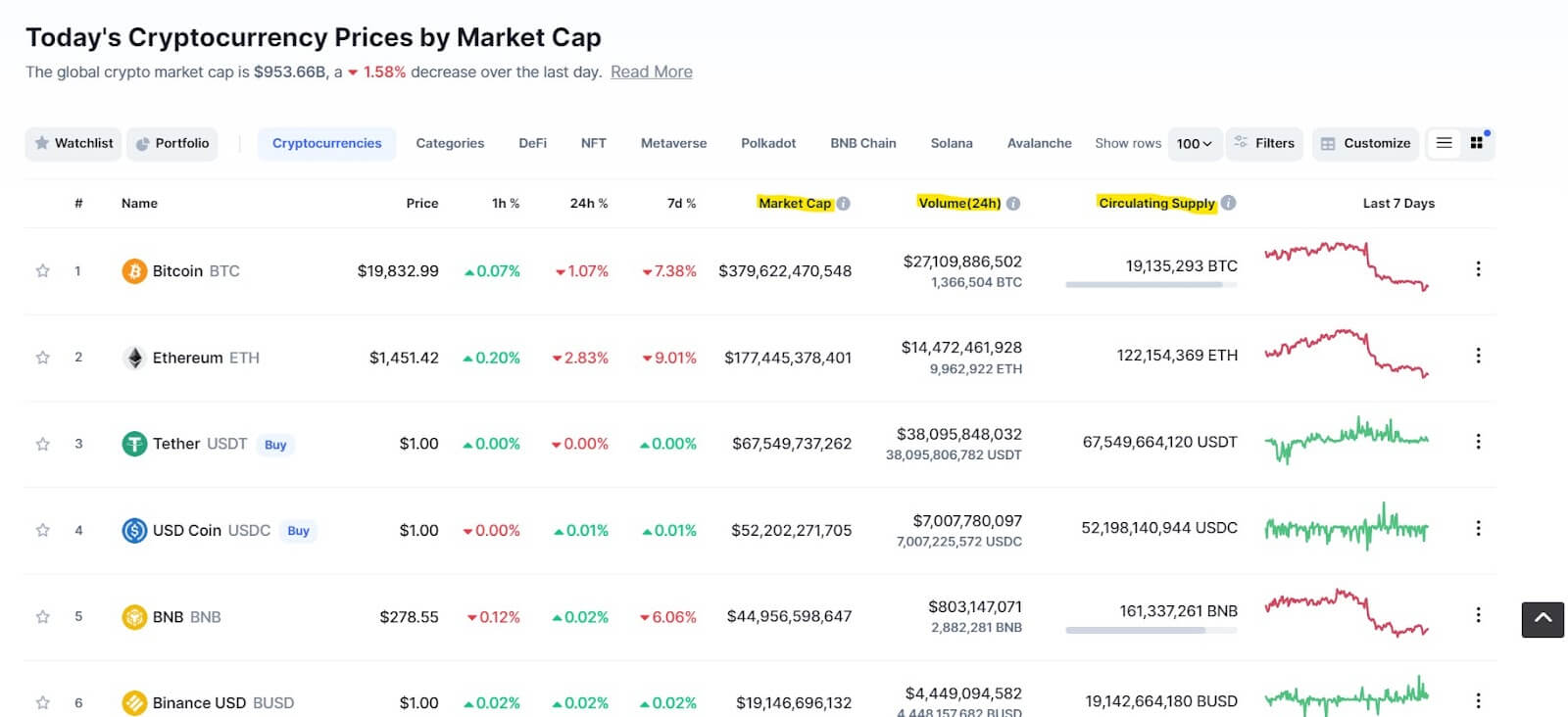

Financial metrics are indicators that include raw users’ data on a cryptocurrency asset, its liquidity profile, as well as external variables and market reaction to that particular crypto project, all of which can help provide useful information to anyone doing the financial analysis of the crypto in question. Examples of financial metrics are market cap, liquidity and volume, as well as supply mechanics of the crypto (highlighted in yellow in diagram below).

Market Capitalisation

First of all, market capitalization is one of the most significant metrics in evaluating cryptocurrencies, as the market cap is the first representation of a crypto network’s value.

To calculate a crypto token’s market cap, simply multiply its current price by the circulating supply of its coins. A high market cap coin is definitely more desired by investors. This is why Bitcoin, being a large-cap coin, holds a far higher premium than all other small-cap and relatively unknown altcoins.

However, using market capitalisation alone in fundamental analysis can often be misleading if one fails to look at it in conjunction with other metrics, such as liquidity.

Liquidity and Volume

The liquidity of an asset is the ease with which it can be acquired or sold in the market without impacting its overall market cap to a large extent. An illiquid market often has a wide bid-ask spread, while a liquid token can be bought or sold with very little loss in spread, as well as not affecting its orderbook very much, thus allowing a crypto to maintain its market cap.

One good way of assessing the liquidity of a crypto token is to watch its trading volume. A crypto with a higher daily trading volume is seen as being more liquid as it shows that money is flowing into and out of the crypto asset easily.

Other than Bitcoin, many top cryptos like Ethereum, Cardano, XLM, are coins with good liquidity within the cryptocurrency market.

Supply Mechanisms

Another area of financial analysis that is important to crypto investors is supply mechanics.

Under the law of supply and demand, when the supply of something is low and its demand is high, its price rises. Bitcoin is a good example to illustrate this due to its limited total supply. There are about 19 million BTCs in circulation right now, and only 2 million more BTCs are still to be released through crypto miners in the form of block subsidies or block rewards. This is because BTC has a maximum supply cap of only 21 million units. This means there will only ever be a maximum of 21 million units of BTC to ever be created. From this statistic, we can calculate the number of BTCs that will be produced everyday, which is around 900 units. Should the average demand for BTC exceed 900 units per day, the price of BTC will rise. Conversely, a crypto with a huge indefinite supply could be less attractive to long-term investors due to its unlimited supply possibly outstripping demand.

Analytical Tools on Margex

On the Margex platform, a user will be able to easily and clearly view the fundamental analysis metrics described above all on one screen. Such information, on top of a suite of technical charting tools, is provided free to all Margex users to equip them with a best-in-class package to give them the best possible trading and investing experience.

Next, we shall dive into the second category of fundamental analysis tools – blockchain metrics.

Blockchain Metrics

Blockchain metrics are on-chain raw data extracted from APIs that shows the activities on a blockchain. Due to the transparent nature of transactions on a blockchain, movements are trackable and can reveal a lot about the state of the blockchain, e.g. how much activity there is, whether users are sending coins to cryptocurrency exchanges, etc.

On-chain metrics used to be difficult for the average investor to gain access to. However, with the maturity of this investment class, more crypto service providers are now offering a slew of such valuable information. Useful metrics like the number of active users, total transactions, and transaction value, are thus made available to the investing public.

There are four crucial blockchain metrics in cryptocurrency and blockchain evaluation. These are, hash rate, active addresses, transaction values, and fees.

Hash Rate

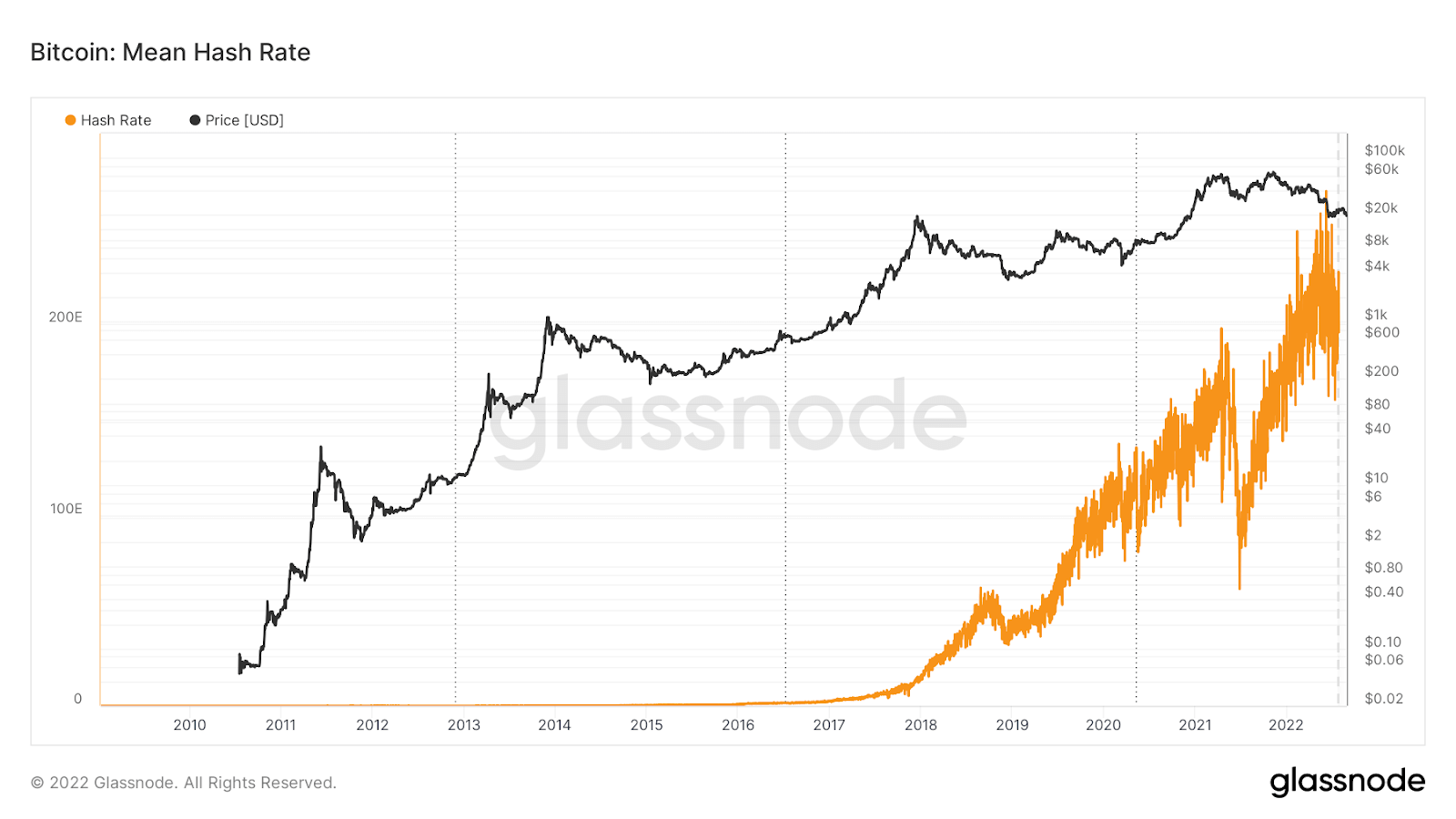

The hash rate of a blockchain is the combined computational power that crypto miners have used to perform calculations on a Proof-of-Work (PoW) blockchain in order to produce new blocks, i.e. mine new tokens. Bitcoin and Litecoin are examples of a PoW network.

Hash rates are an important fundamental analysis tool as this computing power shows the state of health of the blockchain network in question. The higher the hash rate, the more miners are incentivized to mine for profits, and the more secure the network.

However, a concentrated amount of hash rate in the hands of only a few miners is not a good sign since this could subject the blockchain from being “taken over” by this group of miners, which defeats the purpose of having a decentralised blockchain. This attack is known as a 51% attack and many crypto market watchers routinely assess a metric such as hash rate to see how well decentralized a blockchain is, and what amount of computing power is involved in securing the network. The higher and more distributed the hash rate, the greater the value of the blockchain is. Conversely, a decrease in hash rate is often seen as a deteriorating health warning as to the security of a blockchain.

Active Addresses

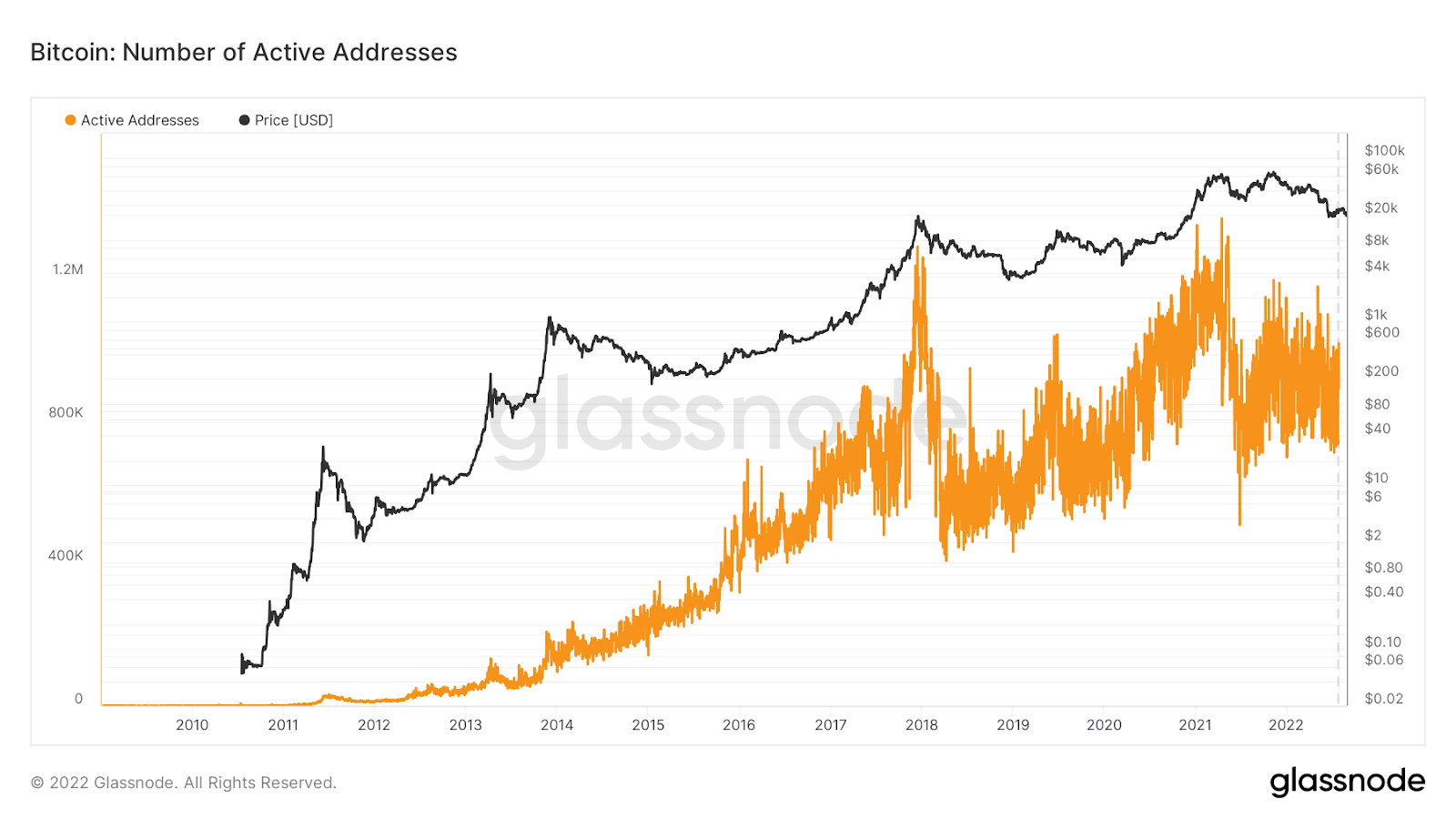

Active addresses monitor the number of active blockchain addresses over a specific period. The easiest way of calculating the number of active addresses on a blockchain is to get the total number of unique addresses that are sending and receiving on the blockchain over time and see if they are increasing or falling. An active blockchain definitely has higher value than one that is unused. Thus, an increasing number of active addresses implies that demand on the blockchain is increasing, and with that, its value.

Transaction Values

Transaction values is one interesting metric in fundamental analysis that is the most similar in nature to technical analysis. Transaction count or daily transaction volume are also other names that transaction value can be referred to.

Having a high transaction value typically implies that a particular cryptocurrency is in healthy circulation, which is a good assessment of the network. Each blockchain’s native token, e.g. in units of BTC, or in units of a fiat currency like the USD, EUR or GBP, can be used to represent transaction values quite effectively.

Fees

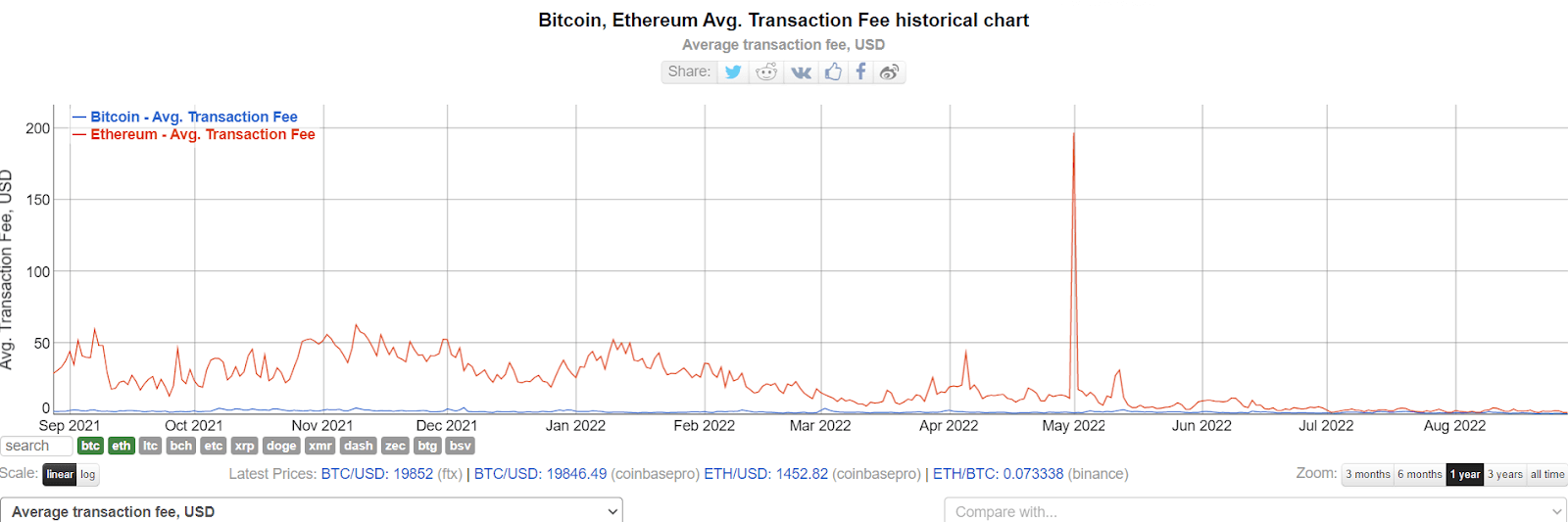

Just like active addresses, its fees show the demand on a particular blockchain, or how many transactions are paying fees to be added to blockchains as quickly as possible. While every blockchain has their own inherent fee structure (some are higher than others), monitoring the changes in the fees of a particular blockchain over time can help investors see user behaviour on a blockchain to deduce if demand is rising or falling for that blockchain.

Furthermore, with block rewards decreasing in relation to mining difficulty, transaction costs are supposed to naturally rise over time. Thus, watching the amount of transaction fees paid over a period of time on a blockchain can provide an investor with a rough gauge of how secure the crypto is.

Product Metrics

While blockchain metrics are concerned with observable quantitative data points, product metrics, or project metrics as it is more commonly known as, is a more qualitative approach which considers factors like team performance, the whitepaper of the project, the project roadmap and what is in the project pipeline.

Product metrics also consider the amount of developer activity as well as the number of github commits a project gets on a regular basis to show how alive the project is. An active developer community shows that a crypto project is being consistently worked on.

Crypto White Paper

The white paper of a crypto project is a technical document that outlines its purpose and operational goals. It is the most important document detailing the conception and objective of any crypto project and includes a forward-looking statement to enlighten its potential investors of why they should invest in the project.

By and large, a crypto white paper should contain at least the following information:

- What solution the blockchain project is offering

- Details on the technology’s open-source code

- The native cryptocurrency use in the project

- Planned features and upgrades

- Token economics and sale information, also known as tokenomics

- Token distribution scheme

- Team Information

- Product Roadmap

Product Road Map

Every crypto project should have a product roadmap that shows the timeline for future milestones like when the expected upgrades, releases, planned features, or any scheduled mainnet launches will be. Each milestone of the project should be clearly laid out in the product roadmap. An investor should follow and observe if the milestones and timelines are being adhered to so as to see how effective and trustworthy the crypto project team is.

Fundamental vs Technical Analysis

Technical analysis is the study of price statistics gathered from a trading marketplace like a stock brokerage or a cryptocurrency exchange. TA indicators like the MACD, RSI, and bollinger bands are influenced by factors such as price movement and trading volume.

Fundamental analysis, on the other hand, is the study of factors other than the price statistics defined above. It is the study of everything else other than the effect of price action on assets. An investor using fundamental analysis would likely combine both quantitative and qualitative approaches to derive the intrinsic value of an asset, and then use this information to compare it against whatever is the realized price of the asset in the market to determine if the asset should be bought or sold.

A seasoned trader could also use both technical and fundamental analysis strategies to construct his own indicator that is best suited for his style of trading or investing. The Margex platform offers the convenience of both technical and fundamental analysis tools readily available to all users to equip them with the necessary tools to help them achieve their investment goals. The Margex platform offers both basic and advanced tools that are suited for both levels of users.

Beginner traders will find the Margex toolkit easy to pick up, while the more experienced traders will find the tools sophisticated enough to help them construct more bespoke trading solutions.

FAQ

Now that we have seen how the usage of fundamental analysis tools can help you assess the potential of a cryptocurrency as well as value it correctly, let us do some revision exercises to refresh what we have learnt so far.

Why is Fundamental Analysis Important in Crypto?

Fundamental analysis is important in crypto because it provides potential investors with a systematic way to value crypto assets apart from their regular price fluctuations to know if they should buy or sell.

How Do You Analyze Cryptocurrency Value?

Various fundamental analysis tools can be used to analyse the value of a cryptocurrency. Other than the methods mentioned above, some commonly used FA indicators for crypto includes but are not limited to, the NVT ratio, the MVRV, MRVR, stock-to-flow ratio, etc. Many of these metrics can be found on Glassnode Studio, one out of many platforms that provide on-chain crypto metrics.

To understand more in depth about how to analyse cryptocurrency value, please kindly read our article above which provides valuable information that will be useful to you.

Which Crypto is Fundamentally Strong?

A crypto that has a large market cap, has high trading volume with good liquidity and an active developer and user community is generally considered strong according to fundamental analysis. In this regard, most of crypto’s top ten coins like Bitcoin and Ethereum are considered fundamentally strong.

What Fundamentals Affect Cryptocurrency?

Fundamental factors that affect cryptocurrency are generally classified into three broad categories. These are, financial metrics, blockchain metrics, as well as product metrics.

Financial metrics includes statistical information of the crypto like market cap, liquidity, volume, and its supply mechanism.

Blockchain metrics are on-chain data that can be used to plot usage trends. These are, changes in a blockchain’s hash rate, changes in the number of active blockchain addresses, changes in transaction value, and changes in transaction fees.

Product metrics are things associated with the products of a crypto project. These include a detailed white paper that outlines the project’s objective, use case, features and upgrades. The founding team of the project should preferably be introduced, while a timetable that displays how the native token is to be distributed is very crucial. A good crypto project should also have a clearly defined roadmap and the team should keep to their scheduled milestones as much as possible. Regular updates to their community is also an important factor to show that the project team is not slacking. A high number of developer activity is another good way to show how alive a project is.

Even though the factors mentioned above seem like a long list, these are not exhaustive and with the maturity of the crypto investing market, more indicators may become relevant. Hence, a crypto investor is advised to keep abreast of the new developments within the crypto space as often as possible to know how to apply new FA metrics to improve his investment acumen. Understanding fundamental analysis tailored for crypto can greatly help any investor improve his chances of making better investment decisions and is a worthwhile skill to learn if he wants to thrive in the crypto space.

How Do You Find The Fundamentals of a Coin?

The fundamentals of a coin can be found in most crypto exchanges and on-chain service providers. Kindly have a look at some suggestions we have mentioned above in our article.