To answer the question, “what is ethereum?”Instead of relying on a single server, the Ethereum network is decentralized and spread out among thousands of computers worldwide, much like Bitcoin. As a result, the network is not only impenetrable but also decentralized and highly resistant to attacks. If one computer breaks, the web will still function because of the thousands of others.

Ethereum is a distributed computing platform that runs on a unique computer called an Ethereum Virtual Machine (EVM). In a distributed system, where every node maintains an identical copy of the database, all interactions must be validated before making any changes.

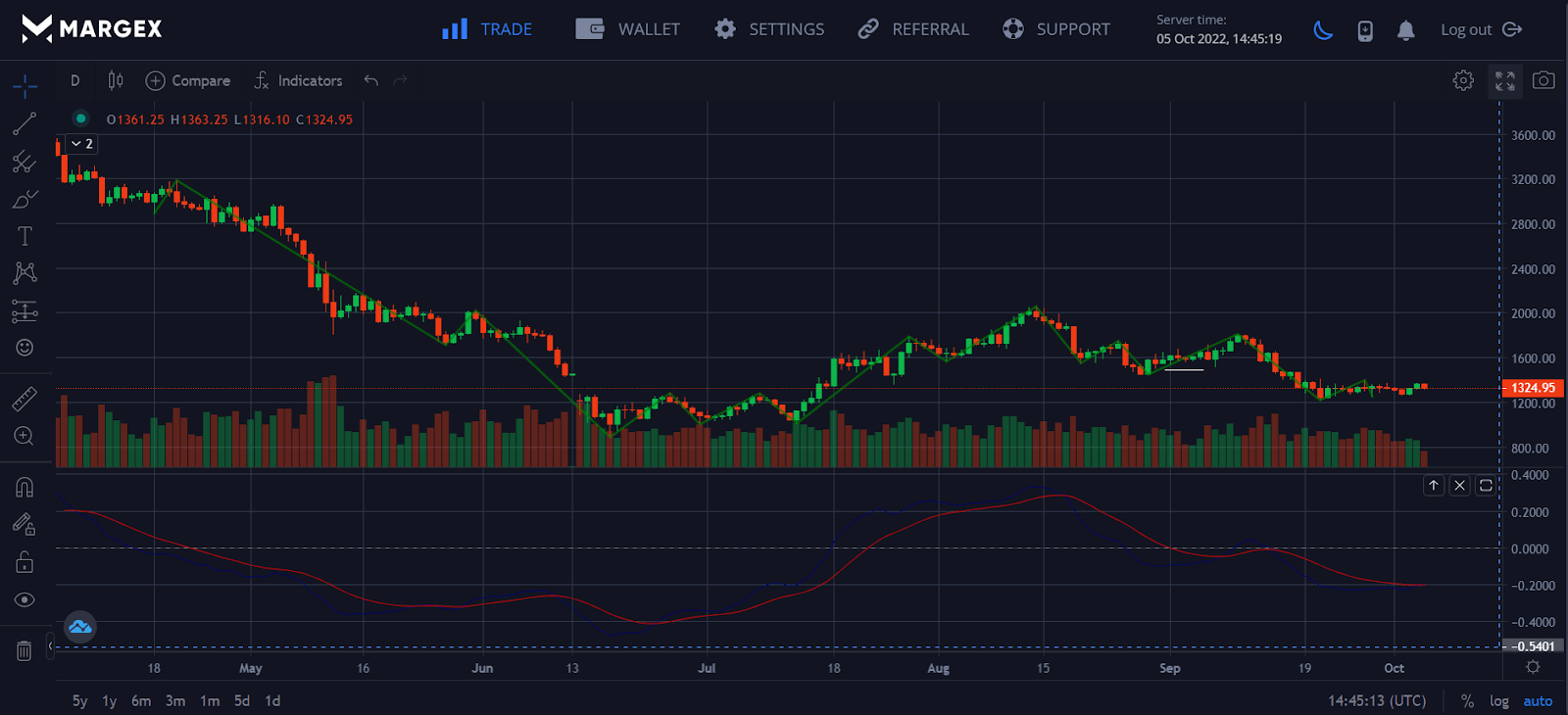

Ethereum Chart Technical Analysis on the Margex Platform for 05-10-2022

The Ethereum blockchain stores “transactions” or network interactions. Miners verify these blocks before they are added to the network and operate as a record of past transactions or a digital ledger. Specifically, transactions are validated via a proof-of-work (PoW) consensus algorithm. Each block is given a one-of-a-kind 64-digit code. Miners use the computer processing power to locate the code and verify its uniqueness. As “proof” of their work, miners’ computers are paid in ETH for their efforts.

Furthermore, all Ethereum transactions are entirely public, just like Bitcoin. When a block is complete, a miner will broadcast it to the network so that everyone can verify the change and add it to their distributed ledger. As confirmed blocks cannot be altered, they permanently document all transactions on the network.

But if miners are paid in ETH, where does the ETH come from? The one who initiates a transaction is responsible for paying a fee called “gas.” Payment of this fee to the miner who verified the transaction promotes further mining and protects the integrity of the network. In practice, gas serves as a cap, restricting the number of activities a user may do in a single transaction. Additionally, it helps prevent spam from spreading across networks.

ETH is issued in an infinite quantity since it is primarily used as a utility rather than as a store of wealth. When the network transitions to proof-of-stake consensus, Ether will again enter circulation due to miner rewards (PoS). In theory, the value of Ether will never fall below its purchasing power due to inflation.

Unfortunately, Ethereum gas costs may be prohibitively high for many users, depending on network congestion. Because the amount of gas included in a block varies with the kind and size of the transaction, this is the case. As a result, miners will focus on transactions with the highest gas costs, suggesting that users would race to validate transactions first. In addition to raising prices, this increased competition also causes congestion at peak times.

Ethereum 2.0, a complete redesign discussed elsewhere, aims to alleviate the problem of network congestion.

What Is ETH History?

In the past, Ethereum wasn’t the world’s second-largest blockchain project. Vitalik Buterin co-created the initiative to address Bitcoin’s flaws. In 2013, Buterin released the Ethereum white paper, wherein he outlined the concept of smart contracts (i.e., automated immutable “if-then” statements), which would later pave the way for the creation of decentralized apps. Although there was prior DApp development in the blockchain realm, there was no interoperability across the various ethereum platforms. Buterin hoped that Ethereum would bring everyone together. He believed that the best way to ensure the longevity of DApps was to standardize their operation and interaction.

As a result, version 1.0 of Ethereum was created. Imagine something like Apple’s App Store, where thousands of programs that adhere to the same standards can be found in a single location. Since developers may impose their own rules inside DApps, only that ruleset is hardcoded into the network and enforced autonomously. There isn’t a single entity making and enforcing laws as Apple does. Community members have absolute power.

Creating a network of this magnitude does not come cheap. To support Ethereum’s ongoing and future development, Buterin and his co-founders Gavin Wood, Jeffrey Wilcke, Charles Hoskinson, Mihai Alisie, Anthony Di Iorio, and Amir Chetrit organized a cryptographic tokens presale. They raised a total of $18,439,086 in Ether.

In addition, they established the Ethereum Foundation in Switzerland to manage and advance the network. Some original co-founders left once Buterin revealed that the foundation would be operated as a charity.

Over time, programmers brought their decentralized concepts to Ethereum. This group of internet users established “The DAO” in 2016 to serve as a decentralized governing body for the network, whereby members may vote on various ideas and modifications. With a smart contract as its foundation, the company sidestepped the requirement for a single person to wield all Ethereum’s authority. In contrast, alterations could only be made if supported by a majority of voters.

Unfortunately, everything went sideways when an unnamed hacker stole $40 million from The DAO’s assets via a security flaw. The theft was undone when the DAO opted to “hard fork” Ethereum, splitting off from the original network and adopting a new protocol. Despite the existence of Ethereum Classic, the name Ethereum has been preserved in this new split.

Why Is ETH So Unique, Exactly?

Instead of utilizing a large company’s computer system (a centralized system), Ethereum allows software programs to operate on a network of numerous private computers (a decentralized system).

Company computers and cloud servers have been replaced with a vast, decentralized network of numerous tiny computers managed by volunteers from all over the globe.

The core concept of Ethereum is that anybody may utilize this new, decentralized network to construct and operate decentralized apps. Because third parties are no longer necessary, no consent is required. Surprisingly, Vitalik and his team do not influence Ethereum or any other individual, corporation, or government. Its user community operates it. It’s vital to read that twice!

Ethereum’s ambition is to build a “World Computer” – a massive network of many private computers that will execute all future internet applications without the involvement of any third parties (like Google and Microsoft). Ethereum is revolutionizing the way the Internet operates. It takes power and control away from major tech firms and puts it in your hands.

Where Does ETH’s Value Come From?

Ether (ETH), Ethereum’s asset, offers a unique value proposition that is arguably useful for various reasons.

Ethereum’s value is derived from various elements, including gas costs, use as collateral, the ability to lend and borrow, use as a means of crypto exchange for trade and NFTs [non fungible tokens], and the capacity to be staked for interest. It also has speculative potential and draws institutional investors’ attention and interest.

When a project is built on Ethereum, it may include an asset for usage inside the Ethereum ecosystem. That asset is most likely an ERC-20 token. However, it is relatively rare for projects to migrate to their mainnet blockchain after originally debuting on Ethereum’s blockchain.

Much of the cryptocurrency’s decentralized financial sector also emerged on Ethereum, with decentralized exchanges built on Ethereum’s blockchain networks allowing trade for various tokens connected with the speciality. Defi members may borrow and lend crypto assets, among other things. As Melker said, ETH may play a role in this ecosystem.

Gas fees are Ethereum transaction expenses; gas fees account for a portion of ETH’s value. When someone transmits ETH, they must pay a set amount of the currency to pay for the transaction, comparable to the fees people pay when transferring Bitcoin (BTC).

The main distinction between ERC-20 tokens and ETH is that transmitting ERC-20 tokens incurs gas costs. To send an ERC-20 token, the sender must also have ETH in the same wallet to complete the transaction. Trading on DEXs also incurs gas costs. Someone may purchase and retain ETH for gas costs, providing the currency with a basic level of market demand.

During the Defi boom of 2020, Ethereum’s network had tremendous traffic, causing gas costs to skyrocket. Transaction costs remained high in 2021. According to YCharts statistics, an average ETH transaction cost $39.49 in February 2021, much more than values observed in previous years. A cost of roughly $1-$2 is considered standard. Ethereum Average Transaction Cost calculates the average fee in USD charged when an Ethereum transaction is processed and validated by a miner.

A Comparison Between Bitcoin (BTC) And Ethereum (ETH)

While Bitcoin is the most widely used cryptocurrency, the Ethereum community hopes to grow the project. The former is intended to be digital money and performs well. However, Bitcoin has restrictions. It’s a PoW network that’s having difficulty scaling, prompting some to feel it’s more of a store of value, akin to gold. Bitcoin also includes a hard maximum of 21 million coins, which lends credence to that claim.

Ethereum, on the other hand, aims to replace our present internet infrastructure. It intends to automate numerous activities that now need the involvement of other parties, such as accessing an app store or collaborating with fund managers. ETH is used to engage with the network rather than to send money. However, it may do both.

Developers may use Ethereum to produce each app’s unique Ether-compatible ERC-20 token. While the method is far from flawless, it does imply that all Ethereum-based currencies are theoretically compatible. The Bitcoin network is just for Bitcoin.

How Many ETH Coins Are Currently In Circulation?

These are some of the most frequently asked topics about Ethereum and are often argued on various platforms. As of the time of writing, there are around 114.3 million Ethereum in circulation. This may change over time, and you can check the circulating supply on Ethereum block explorers and websites like CoinMarketCap.

How Can Cryptocurrency Investors Utilize ETH?

There are various ways for cryptocurrency investors to utilize Ethereum; here are some of the most popular.

Mining

Mining is the process of producing a block of transactions to be added to the Ethereum blockchain. Ethereum presently employs a proof-of-work blockchain, but with Ethereum 2.0, it will transition to a proof-of-stake (PoS) blockchain for scalability and a more ecologically friendly method.

Ethereum miners are machines that run the software and utilize their processing power and validation time to process transactions and produce blocks. In decentralized systems like Ethereum, network members must verify that everyone agrees on transaction sequencing. Miners help create blocks by solving computationally tricky puzzles, protecting the network from attackers.

Automated trading

By creating a bot to follow precise trading rules, users may make passive income with their Ethereum.

Users of automated trading software may create their own trading rules; they can also choose from prepared templates that utilize various trading approaches depending on the user’s risk tolerance.

Hodling

If you believe in the future of Ethereum, buying and hodling the cryptocurrency might provide an acceptable passive income stream. Hardware wallets are the most excellent location to save your cash. While we’re on wallets, here’s a list of the finest Ethereum wallets.

From March 2020 to March 2021, the price of Ethereum increased from $141 to nearly $1800. This implies that if you put $5000 into Ethereum in March 2020, you would have earned more than $50,000 in a year.

Many Ethereum holders are unaware that they may maximize their earnings by using various passive income sources like staking, lending, and yield farming; let’s look at a few passive income techniques.

Staking

Staking enables anybody to earn bitcoin by validating transactions on a proof-of-stake (POS) algorithm. The Ethereum blockchain is migrating from PoW to PoS, allowing anybody with 32 ETH to participate in the Ethereum 2.0 staking infrastructure.

To stake Ether directly, you must deposit at least 32 ETH to activate the validator software. You will be in charge of storing data, processing transactions and adding new blocks to the blockchain as a validator. This procedure contributes to the security of Ethereum while also allowing you to earn ETH.

Lending

Cryptocurrency loans have grown in popularity in recent years. Investors may generate passive revenue by lending their bitcoin to borrowers at a high-interest rate.

There are two kinds of lending services: centralized and completely decentralized.

Lending: Centralized vs. Decentralized

Centralized lending systems handle all technological concerns for the user. They enable investors to enhance the productivity of their investments. In contrast to decentralized crypto lending, centralized platforms often offer higher interest rates.

Defi systems are often non-custodial and exclusively concentrate on cryptocurrency. Interest rates may fluctuate based on market supply and demand. Interest rates are often lower than those given by centralized platforms; nevertheless, Defi is more transparent since the protocols are accessible to anybody. The transactions may be seen on public blockchains.

How to trade ETH with Margex

By trading Ethereum ETH, you are effectively purchasing the currency when you feel it is “undervalued” and selling it when you believe it is overpriced. You then wait for its price to decline before repeating the procedure, aiming for a bit of profit with each closed position. Advanced traders, particularly ETH derivative traders, may trade in either direction, going long (buying) when they feel ETH prices will increase and short (selling) when they believe ETH prices will fall.

Trading ETH on Margex and most crypto has low entry hurdles. To get started, follow these instructions;

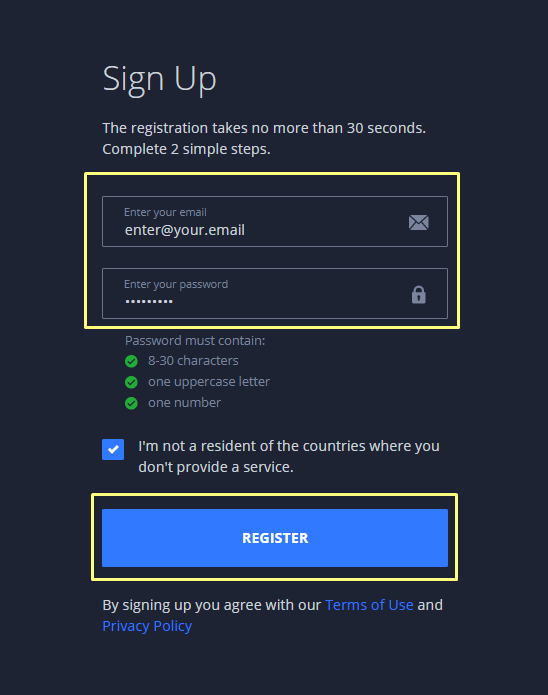

Create a user profile;

Fill out the needed information on the Sign-up page. “Register” is the only option. You’ll get an email to confirm your registration. To finish account registration, open this email and click on the confirmation link.

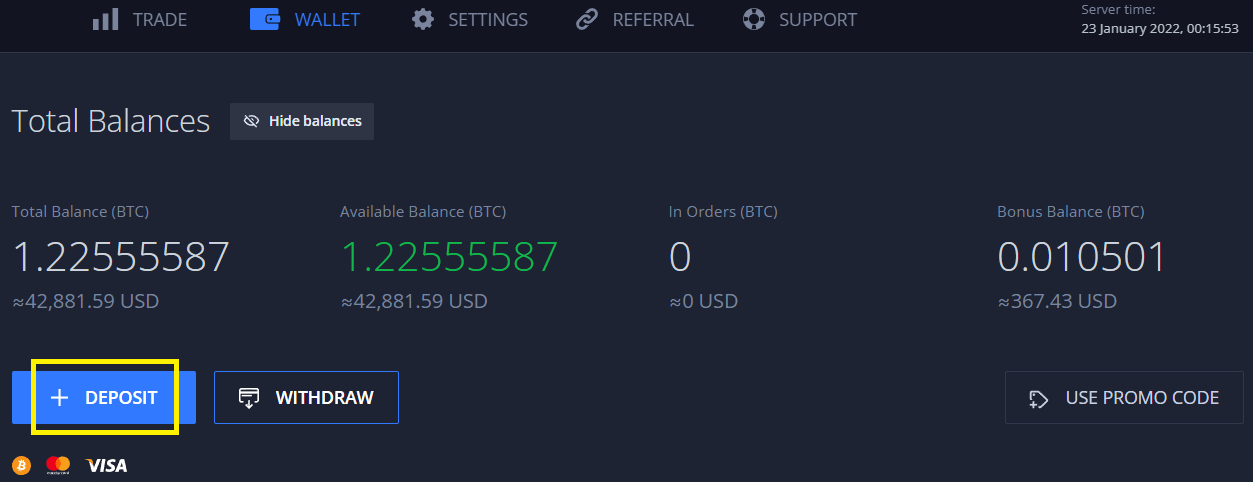

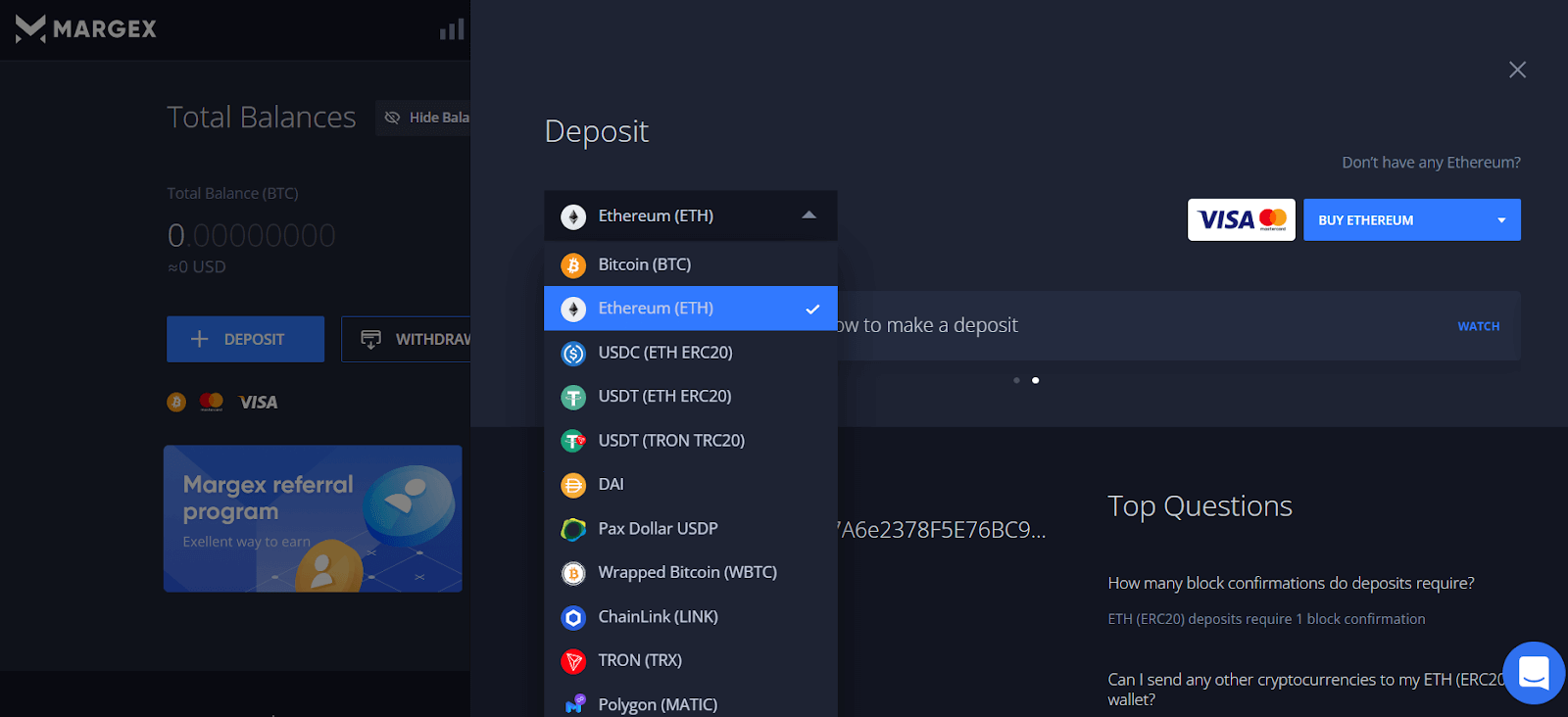

Deposit

Margex accepts the following payment options at this time:

- Directly transfer cryptocurrency to your Margex wallet from another address.

- Use Changelly or Changenow to buy cryptocurrency using a bank card.

- Making a deposit is as easy as the following:

Add a deposit to your Wallet by clicking +Deposit:

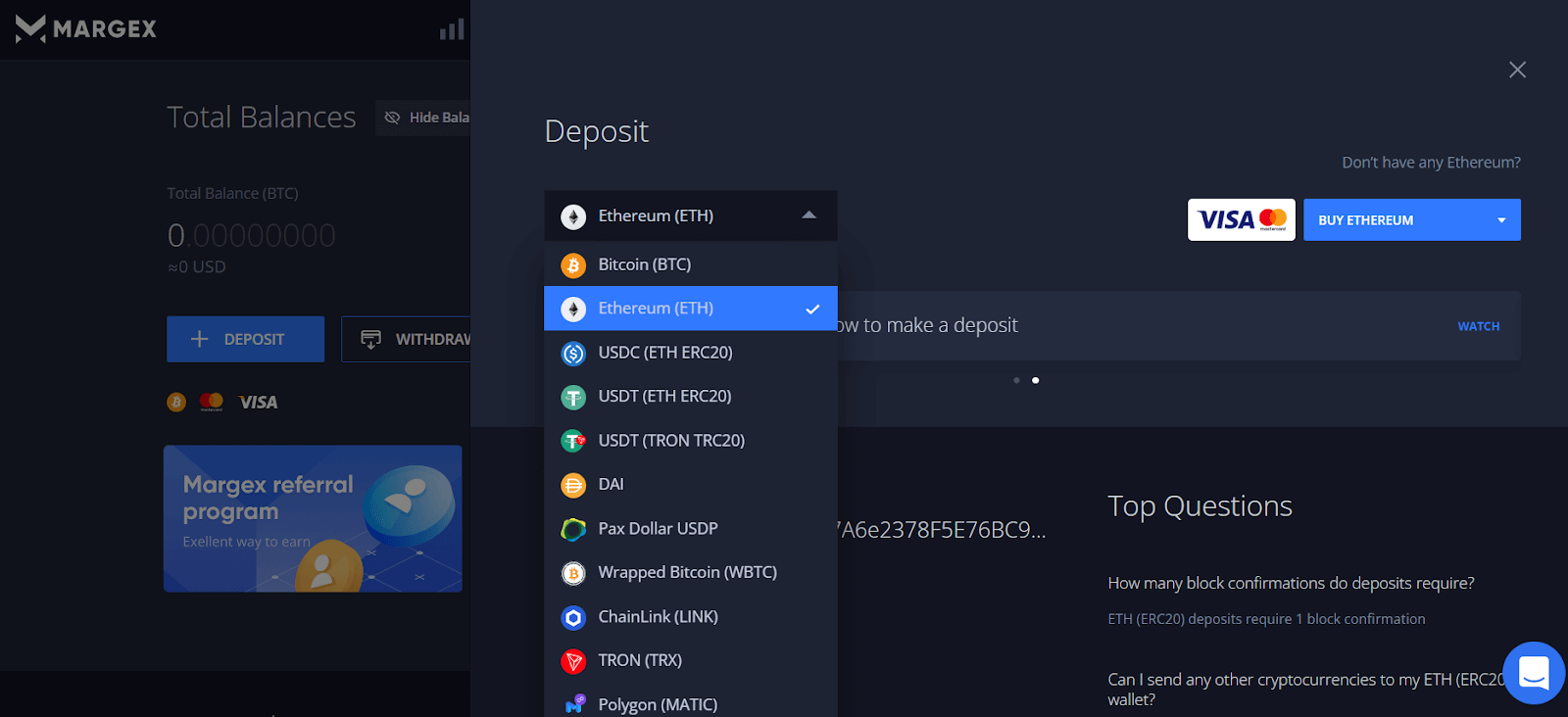

Select the Ethereum as the currency that you want to deposit from the drop-down menu:

Simply copy the Margex deposit address and paste it into the site/destination wallet’s box.

Once you’ve clicked the “Buy Crypto” button, follow the steps given to complete the transaction.

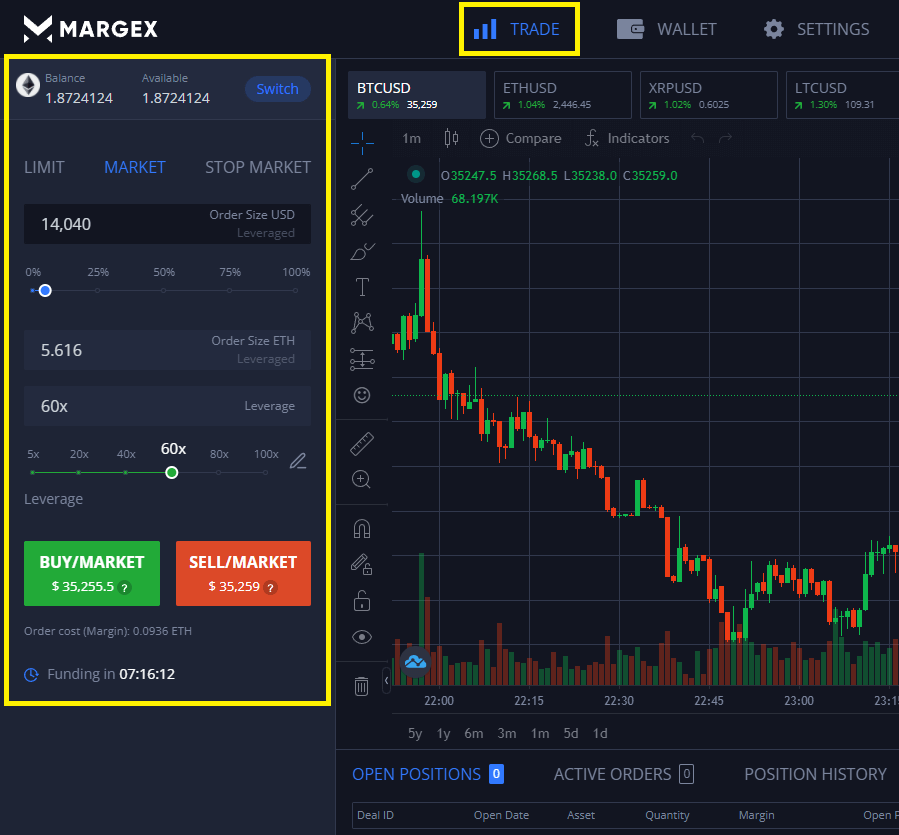

Navigate to the Trade page in order to begin trading

When placing an order, choose your preferred criteria;

- Collateral currency

- Trading pair

- Order type

- Order size

- Leverage

To make a Buy or Sell order, click the appropriate button

FAQs

How does Ethereum function and what is it?

Ethereum is a blockchain-based distributed computing platform that facilitates the execution and verification of smart contracts on a trustless, peer-to-peer network. The use of smart contracts eliminates the need for a reliable third party in commercial transactions.

Is Ethereum a reliable investment?

Like any investment, the answer depends on your financial aspirations, ambitions, and risk tolerance. The cryptocurrency ETH may be volatile, putting investors’ money at risk. However, it is undoubtedly worth investigating as an investment since the numerous present, and new creative Ethereum-based technologies may play more significant roles in our society in the future.

What distinguishes Ethereum from Bitcoin?

The distinction between Ethereum and Bitcoin is that Bitcoin is only money, but Ethereum is a ledger technology that businesses use to create new applications. Bitcoin and Ethereum rely on “blockchain” technology, while Ethereum’s is significantly more robust.

Is there a future for Ethereum?

The Ethereum blockchain has grown in popularity recently, with developers using it to build a host of decentralized financial projects, including NFTs. According to supporters, the advent of new apps like these — among the first to operate on a public blockchain — has already produced a massive network effect as increasing activity pulls more and more developers to Ethereum.

Is Ethereum poised to become the next Bitcoin?

Of course, there’s no guarantee that Ethereum will achieve the same value as Bitcoin, but there are numerous compelling reasons why this cryptocurrency and its underlying technology might be just as essential to the crypto industry as Bitcoin, if not more so.

How come Ethereum is so valuable?

The biggest blockchain that uses smart contracts for programmability is Ethereum. This makes it feasible for people to trade digital assets in ways that are not conceivable with physical goods. The coin’s value is derived from a variety of various sources. It serves a variety of purposes on the Ethereum network, including: used to pay for transactions on the Ethereum blockchain (as “gas”), it is also used as a means of exchange to buy Ethereum-based tokens (via ICOs or exchanges).

How does Ethereum earn money?

To conduct a transaction on the Ethereum network, the user must pay gas, which goes toward compensating the miners and developers that keep the network running. The more computing necessary for an activity, the more money will be required to reward those who do it. This is how Ether generates revenue.