Determining when to enter and exit from the crypto market is a strategy that many traders, including beginners and advanced traders, have to deal with, as this issue plays a key role on the overall portfolio and success rate of the crypto trader.

Technical analysis is handy when it comes to applying strategies to create more opportunities and stay ahead of major cryptocurrency players like Whales, investors, and of course, institutions who are always ready to push the market in their favor.

Technical analysis makes it possible to identify trend reversals and continuation chart patterns as this will give traders a better perspective regarding the direction the market is headed. The opening range breakout strategy is a trend reversal and continuation chart pattern that makes it possible for traders to time their entries and exits more professionally.

In this guide, we will dive deep into learning about the opening range breakout strategy, the ORB strategy, and how to use this technical analysis strategy to stay ahead of the crypto market.

Opening Range Breakouts Explained

The opening range describes a crypto asset’s highs and lows over a short period just before the market’s opening price with the trading day. Day traders often become concerned about these day price ranges as they give more indication and a clear picture of the day’s market sentiments, price actions, and price trends.

Due to the market volatility and price actions that come with trading in the crypto market, there are tendencies to have non-random price movements. As a result, the opening range breakout strategy gives traders so many opportunities to define their entry and exit points based on the strategy that has been built. Still, there are no exact points or areas to place stop loss in trading.

Just as the name implies, the opening range breakout strategy is a break in the opening range of the day or a break in the price ranges within a period. This strategy was first tradable within the one-hour (1H) timeframe when it was initially adopted, but as the market and trading strategies evolve, many traders sort to use the opening range more on a shorter timeframe like the 30 minutes, 15 minutes, and even the 1-minute timeframe for really aggressive traders.

Traders use different chart patterns, other technical analysis strategies, and multiple timeframes to track the opening range in the crypto market. Some traders use Bollinger bands which provides dynamic support and resistance band when used to the right standard deviation with a moving average below and above.

When the price breaks out of the opening range band, traders look to open either a breakout or reversion to the mean. Depending on the price action, some traders and investors may follow a few minutes of the opening price range. In contrast, others may prefer to stick to the hourly timeframe depending on the conclusion drawn for the opening range.

Opening Range Trading Example

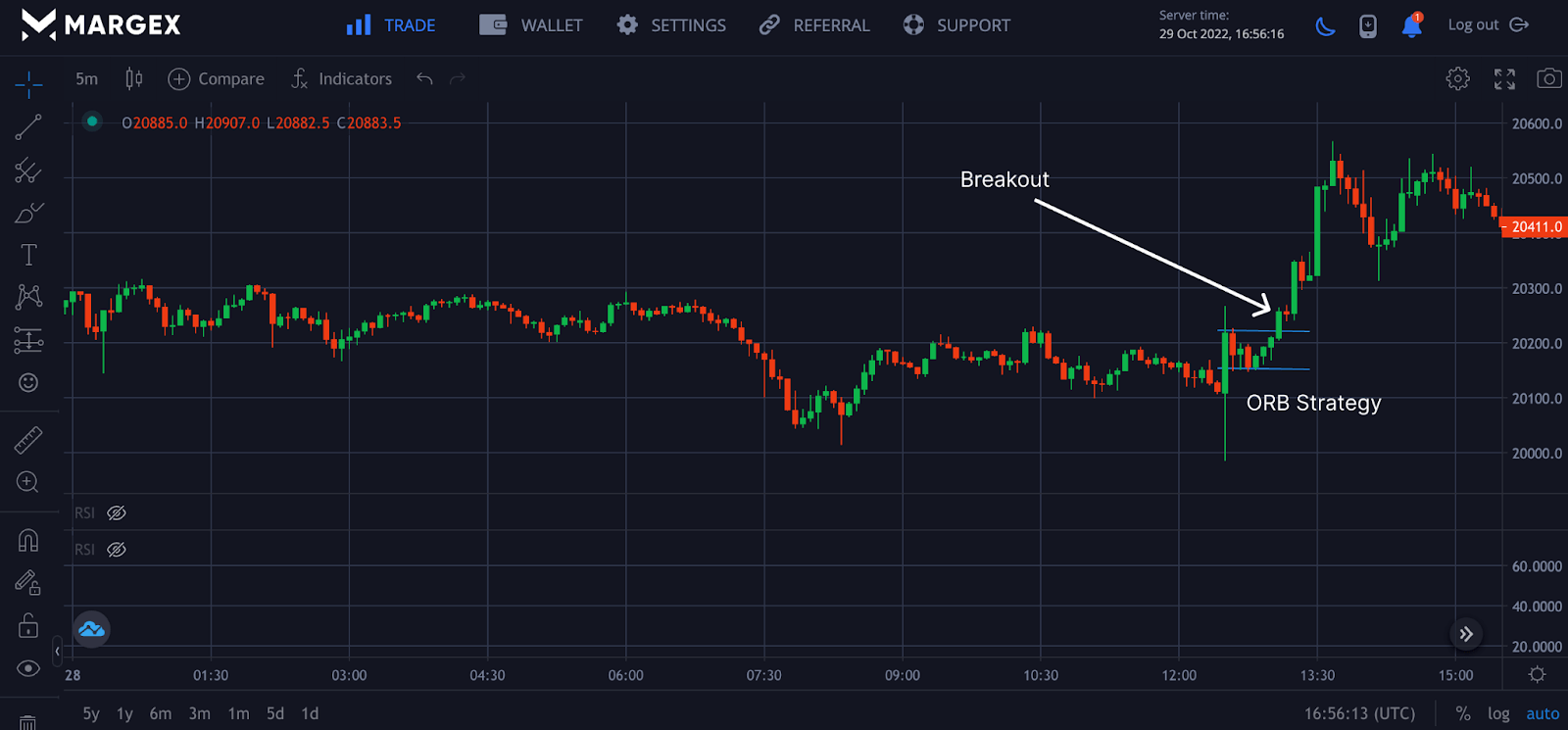

The example above shows the opening range breakout with the BTCUSD pair with so much price action in place. The sellers had an opening day price pushing the price of BTC to the lower side of the chart; the candlestick indicates domination by the buyers forcing the price to be closed slightly upward as the price was locked up in a range between buyers and sellers with a potential breakout from the range with more buy orders indicating a change in direction as the price broke out from the region of $20,200 rallying to a high of $20,500. A trader with good experience in the opening range breakout could open a long position for this trade and close with a good profit margin.

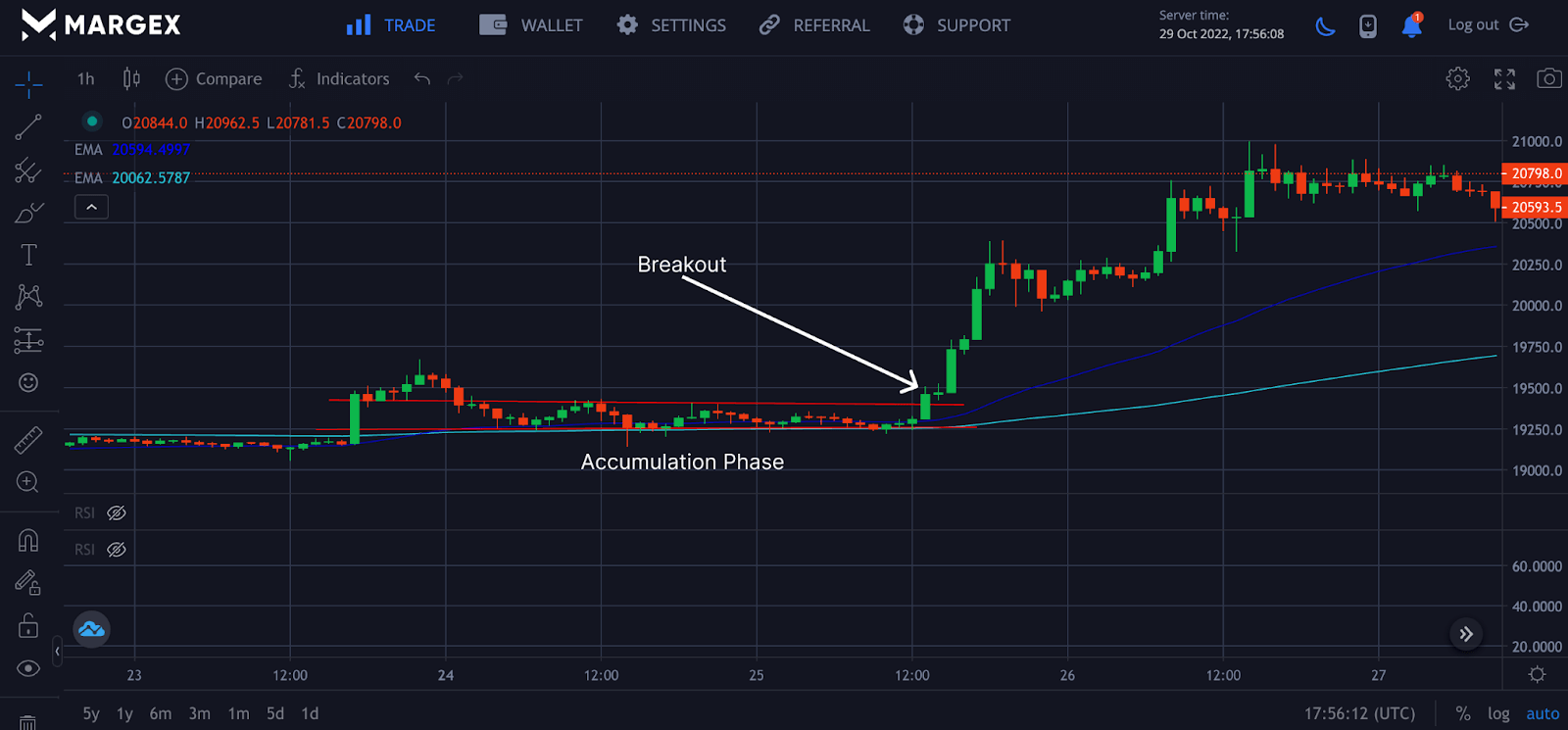

Another example of the opening range breakout strategy is that many institutions and investors look for the accumulation phase of the crypto market to build up their positions.

The large institutions that move and manipulate the market accumulate massive trading positions within a narrow range. They initiate strong and aggressive buying or selling activity to move the price after fully entering their positions. They are attempting to move the price toward their newly acquired positions.

The accumulation phase provides so many opportunities to build on a position and anticipate a breakout either in an uptrend or downtrend with high trading volume in the form of a bull breakout in the case of the chart above or a bear breakout as a trader would anticipate either movement for a potential position. In the case above, a trader could enter a long position on a breakout of the opening range to sell at a good profit while setting up a stop loss to avoid over-exposing oneself.

Trading this opening range breakout strategy requires good trading experience and guidance. You can get comfortable on the Margex platform with many technical analysis tools to learn and practice.

Margex is a Bitcoin-based derivatives platform that allows traders to trade with over 100X leverage size, and you can access the Margex unique staking features available at your disposal. The Margex unique staking features allow advanced traders and beginners to trade and stake the same assets on the go, making it possible to earn extra income trading and staking the same crypto assets.

There are no lockup periods for these crypto assets, and you can earn up to 13% APY on your staked assets with daily staking rewards sent to your staking balance with the help of the Margex automated system.

Finding these opening range breakouts within a trading session of your choice is not an issue; applying this strategy for good profit return is what matters. Everyone has a different trading session that fits the type of trader they have become.

How To Trade Opening Range Breakout

Trading the opening range breakout strategy as a technical analyst makes trading easier especially sticking to the strategy and executing it with the help of other trading tools. The opening range breakout helps traders define entry and exit points when trading. The trading sessions and timeframe don’t matter when using this strategy as long as you are following the right way of trading and all traders have different preferences and timeframes the trade best.

Let us discuss some key steps to trade the opening range breakout and how you can best position yourself for better setups.

Step 1: Select A Timeframe

There is no best trading timeframe for traders; it all boils down to preferences and what works best for each trader over time as they learn to develop their skills in range trading and other aspects of trading. Some traders, called scalpers, prefer to use a 5mins chart pattern, 15mins, or even a 30mins chart; it all goes down to making a profit and having a stop loss order in place to reduce risk exposures. Whatever timeframe you wish to use works perfectly, as this does not change the ORB strategy.

Step 2: Decide On The Criteria

Decide on what you should look out for as a good reason or bias for a particular opening range breakout that’s forming. Traders sometimes look for range high, range low, size of the range, and high or high relative volume. These criteria will good you a good reason to enter a trade on a potential breakout in either direction.

Step 3: Identify Strong Breakout

Identifying strong, successful breakouts when trading the ORB strategy comes in handy. This will lead to successful trade and separate the novice traders from the matured traders struggling to identify entry and exit points using the opening range breakout, but rest assured is very simple to identify.

Try to identify breakouts with a strong candle on the chart followed by strong buy or sell signals or volume, as this will help you come to a better conclusion as to where the market is headed.

Using the high-volume node strategy is a good way to identify a successful breakout when trading the opening range breakout, with statistics confirming that there is 50% price reconsolidation happening around the high-volume node which can lead to a successful breakout.

Step 4: Step-by-step Trade Execution

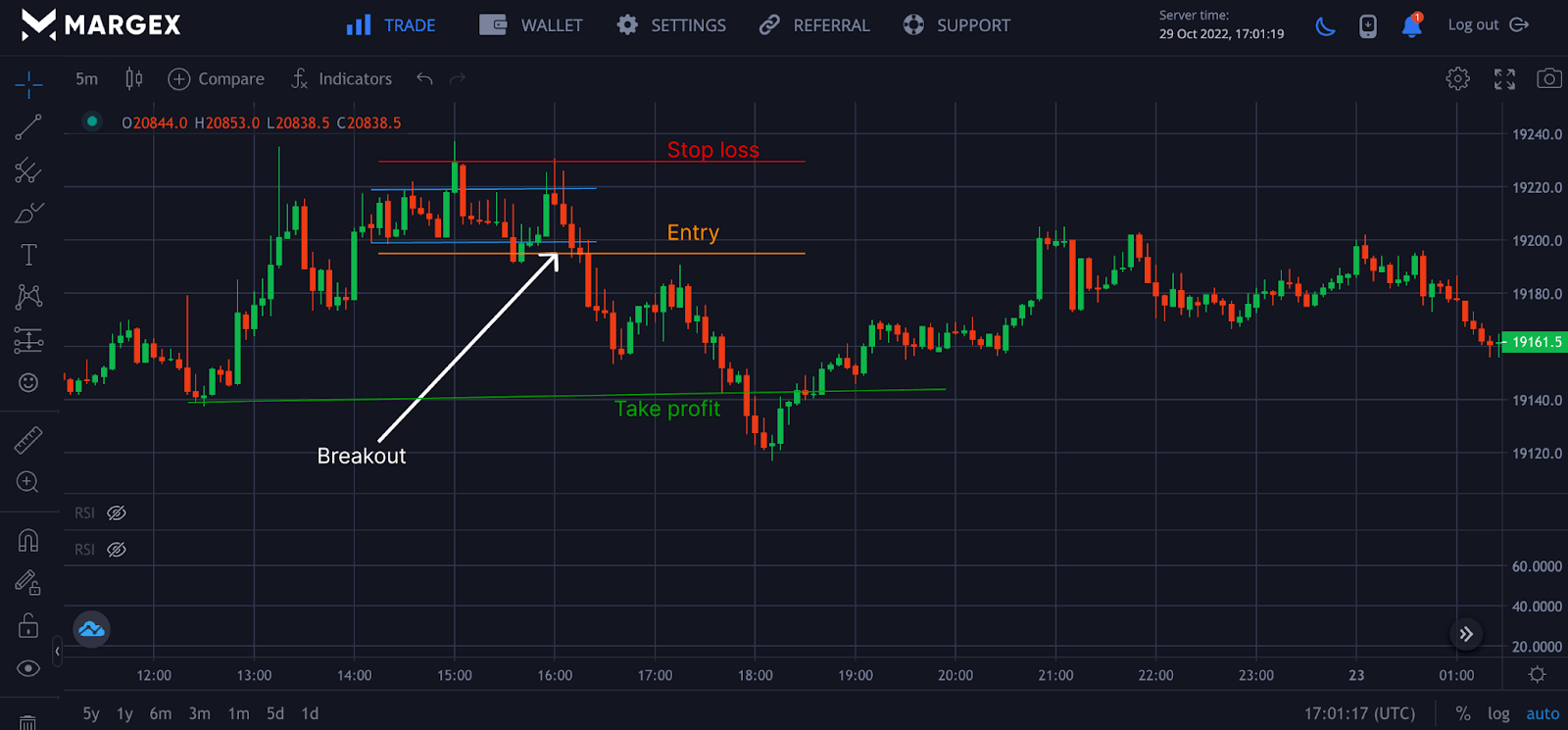

After following all the steps above to identify a high probable opening range breakout, we want to identify our entry points. This will give us a good opportunity to weigh our risk-to-reward ratio.

Next, we want to determine the stop loss order to avoid exposing your portfolio to excessive risk while maximizing profit potential by setting up the take profit based on your calculations or the next supply zone for either a long or short position.

ORB Trading Strategy Key Takeaways

Trading the opening range breakout can be rewarding for a trader with good knowledge of the crypto market and can put the right strategy into practice. With the above discussion on opening range breakout, let us look at some key takeaways you should pay attention to.

- To determine the size of the range, measure the distance between the high or low of the previous trading session’s closing candle and the high or low of the new trading session’s opening candle.

- When a breakout is identified when trading the opening range breakout strategy, a potential breakout takes place in the direction of the chart. A breakout in an upward direction will lead to a bullish price trend in the direction of the breakout, while a breakdown will lead to a bearish price trend in the direction of the breakout.

- During an early range breakout, enter a trade when the price action breaks out of the opening range. Always trade in the direction of the breakout, whether an uptrend or a downtrend, to avoid counter-trading a breakout, as this could lead to a loss of funds. Set a stop loss in the middle of the initial range and keep the trade open for a minimum price move.

Frequently Asked Questions (FAQ) On Open Range Breakout

Here are the frequently asked questions as regards trading an opening range breakout strategy.

How Do I Find My Opening Range Breakout?

The opening range breakout is one of the many trade strategies employed by traders in leveraging opportunities presented in the financial and cryptocurrency markets.

Traders may be able to identify and spot opening range breakouts by analyzing short timeframes of a new daily candle, opening below or above the previous day candle close.

To successfully verify an opening range breakout, a trader may need to look out for a price breakout below or above the close of the previous day’s candle and use multiple technical indicators for confirmations and determining price momentum.

Traders may be advised to conduct personal research on trading strategies and employ multiple technical indicators in addition to trading the opening range breakout.

Is Opening Range Breakout Profitable?

Trading in the cryptocurrency and financial markets using the opening range breakout strategy may or may not be profitable, depending on several trade factors.

To become profitable as a trader trading the opening range breakout or any other technical indicators and strategy, a good knowledge of technical analysis must be acquired and applied appropriately.

Traders may also need to understand market sentiments at every moment before trading and verify the validity of strategies using multiple trading tools and indicators.

The opening range breakout strategy may be profitable and effective for traders if used resourcefully and understood adequately.

What Is Considered An Opening Range?

An opening range is understood and considered a range between the price highs and lows of a digital asset or cryptocurrency traded in a short time frame after the market opens.

Traders spot the Open Range of a trading day as an opportunity to enter into long or short positions depending on its breakout below or above the previous day’s candle close.

Skilled traders may also gain insight into market sentiments and price trends of a digital asset just by technically analyzing its opening range breakout.

It is important for traders to gain ample knowledge of technical analysis and its applications and stick to strategies that work best for them individually.

How Do Intraday Traders Use The Opening Range Breakout Strategy?

Intraday traders may use the opening range breakout strategy to inform their trade setups and directions of the markets for a particular day.

Intraday traders take advantage of clear trade setups and opportunities for making short-term trades in the financial and cryptocurrency markets.

The opening range breakout strategy may be effective for intraday traders, combining it with different trading tools and technical indicators for multiple confirmations on price movements.

Traders may need to identify a trading style and strategy that suits their personality, and this can only be achieved through personal assessments and research on trading styles and strategies.

How Do I Learn Opening Range Breakout Strategy?

Traders looking to learn trading strategies, including the opening range breakout strategy, may need to conduct personal research into each strategy.

Globally recognized cryptocurrency exchanges and trading platforms, such as the Margex cryptocurrency exchange, offer new and skilled traders a learning environment to learn new and improved trading strategies.

Traders subjecting themselves to consistent learning and applications of the opening range breakout strategy may become skilled in its usage over time.

Continuous learning and development are paramount for traders looking to be consistent in trading the cryptocurrency and financial markets profitably.

Which Indicator Is Best For Trading Opening Range Breakouts?

Cryptocurrency exchanges and trading platforms such as Margex offer traders a wide range of trading tools and technical indicators to aid traders in becoming profitable.

There are a variety of effective technical indicators that traders can use alongside the opening range breakout strategy.

While many trading tools and technical indicators exist, traders may need to subject themselves to learning and applying each technical indicator and its relevance to the opening range breakout strategy.