Many cryptocurrency projects have emerged since 2009. Ripple is amongst the first entrants into the crypto space. Even though the network has been battling with the United States Securities and Exchange Commission (SEC) since 2020, Ripple’s value proposition is outstanding. So, what is Ripple, and how does Ripple work?

The major purpose of the Ripple network is to facilitate asset exchange, remittance systems, and global payment settlement. The crypto is prominent amongst financial institutions, banks, and individuals for global transactions at low cost.

To answer the question, what is XRP? This article contains everything about the money transfer network and its native token. Read on to understand more.

How Does Ripple Cryptocurrency Work?

Reoccurring questions like what is ripple cryptocurrency and what does XRP stand for are major concerns for crypto newbies. Let’s consider the working process of the transfer network to understand it better.

The XRP token verifies transactions through a consensus system involving the servers of various banks. Every transaction proposal must pass through validators, who decide whether they’re accurate.

Afterward, they compare them to the current XRP Ledger version. For these transactions to be verified, most validators must sign them off.

The Ripple network provides financial institutions and businesses with many solutions regarding cross-border payments. They’re as follows:

- xRapid – This solution helps many financial organizations mitigate the cost of liquidity. The network achieves this goal through the XRP digital asset since it serves as a link to different fiat currencies.

- xCurrent – The xCurrent is simply a bank payment processing system.

- xVia – This solution system works similarly to the xRapid. But with xVia, businesses can easily make payment transactions through the Ripple network.

Ripple provides very interesting benefits for international transactions through its digital asset. Some notable ones include:

- A fast transaction processing time of about 5 seconds per XRP transaction.

- The XRP token is accepted across borders, which makes it useful for such transactions.

- The transaction cost with this token is less than a cent. Even at its all-time high, each transaction costs only 0.00001 XRP.

A Brief Ripple (XRP) History And Past Performance

Ripple is the brainchild of Jed McCaleb, an American Programmer and businessman. He came up with the idea in 2011 and founded his company in 2012. This company was known as OpenCoin.

Mr.McCaleb involved some other developers: Authur Britto and David Schwartz, to help him achieve his goal. The Authur Britto and Davis Schwartz team engaged Ryan Fugger to complete the project.

Ryan Fugger was able to transform Jed McCaleb’s OpenCoin system into Ripple. Eventually, the adoption of the network grew massive, and by 2018, over 100 banks were lined up to use its token.

For most of the banks, their area of interest at first was Ripple’s infrastructural messaging ability and not the cryptocurrency.

In December 2020, the Security Exchange Commission filed a lawsuit alleging that Ripple XRP was sold as unregistered securities. They classified the project as security and not a commodity.

In April 2021, the value of XRP spiked despite its legal battles, and its popularity increased among individuals.

Fast-forward to 2022, recent updates on the case between SEC and Ripple show the latter is winning.

Brief price performance history

XRP achieved an all-time high of $3.84 on January 4, 2018. By 2020 XRP had lost over 90% of its value. The token is currently trading at $0.48 with a market capitalization of $23,940,465,932.77.

What Makes XRP Network And Token Unique?

The project was created to facilitate faster and cheaper transactions. Holders of XRP tokens can exchange them for fiat currency or commodities like gold. It also attracts minimal commission rates as an added advantage.

The network uses its XRP Ledger to process payments efficiently. It finds a wide range of applications in decentralized finance (DeFi), and NFTs are on the horizon. XRP is also regarded as a good investment that will yield future results in certain quarters.

What Drives XRP Digital Asset Value?

Several factors contribute to the value of the XRP digital asset, like being accepted by many financial institutions. Another key factor is the possibility of users exchanging it for any other digital asset or currency fast and at a low cost.

Most of the discussions about the crypto industry center on the price of digital assets. Notably, the value of the XRP token is a function of the value institutions places on it through its regular application.

XRP is the only digital asset specially built for value transfer across enterprises. This operation is in line with one of the primary objectives of Ripple – developing a worldwide Internet of Value. To achieve this, the company acts as an on-demand and reliable option to send cross-border payments and source liquidity.

Comparing Bitcoin BTC Vs. Ripple XRP

XRP was programmed with a maximum XRP supply of 100 billion tokens on the XRP network. 55 billion of these tokens were locked in escrow accounts by Ripple in December 2017. On September 30, 2022, the estimate of XRP in circulation was 49.9 billion tokens.

More than 10.7 million XRP coins have been burned since the coin’s creation. Burning is to prevent inflation and preserve the source liquidity of XRP.

How Can Cryptocurrency Investors Use XRP?

Investors can use XRP tokens to carry out transactions and global payments due to its fast transaction confirmation time. Also, there are potential cryptocurrency investment opportunities. The Ripple network supports currency exchange between fiat and cryptocurrencies.

There are other channels to make a profit from XRP tokens. They include:

XRP cryptocurrency mining

XRP, unlike the bitcoin blockchain, doesn’t rely on mining to add transaction blocks to the blockchain technology. XRP has 100 billion pre-mined tokens, and the team releases them periodically. XRP uses validators and organizations like financial institutions that control a large token volume.

Investing in XRP

As an investor, you can easily buy and hold the XRP token for the long term until it increases in value. You can achieve more with this method by following technical and fundamental analysis of price data. But sometimes, the data is not too reliable since the volatile nature of the crypto market can make it crash suddenly.

XRP faucets

These are platforms where users gain small token amounts for performing various tasks. The rewards from these faucets are small, like droplets, and take a while to become something substantial.

These tasks might include clicking on links, playing games, posting on social media, and many more activities.

Predicting the next bull run

This requires a lot of proper analysis so you do not lose your assets. Cryptocurrencies go on bull runs periodically. Buying XRP just before a bull run will greatly increase your chances of making a profit.

Margex offers you free educational articles and videos to make you a better trader.

XRP trading

Trading is the best way to profit from XRP. With Margex, placing your trades and making a profit is much easier. With the option to trade with up to 100x leverage on your lot size Margex is ideal for traders and organizations alike.

Margex offers users various top cryptocurrencies and pairs to trade with. The top options are BTC, XRP, ETH, ADA, UNI, SOL, LTC, EOS, and SOL.

Also, Margex supports staking for Oracle’s followers. This feature supports trading with staked assets, yielding 5.5% APY for bitcoin and 8.8% for stablecoins.

With multiple deposit options, including bank transfer and direct deposit of cryptocurrency, Margex gives users various options. A trader on this platform has a higher chance of breaking even with the support materials and options available.

A step-by-step guide to trading XRP on Margex’s

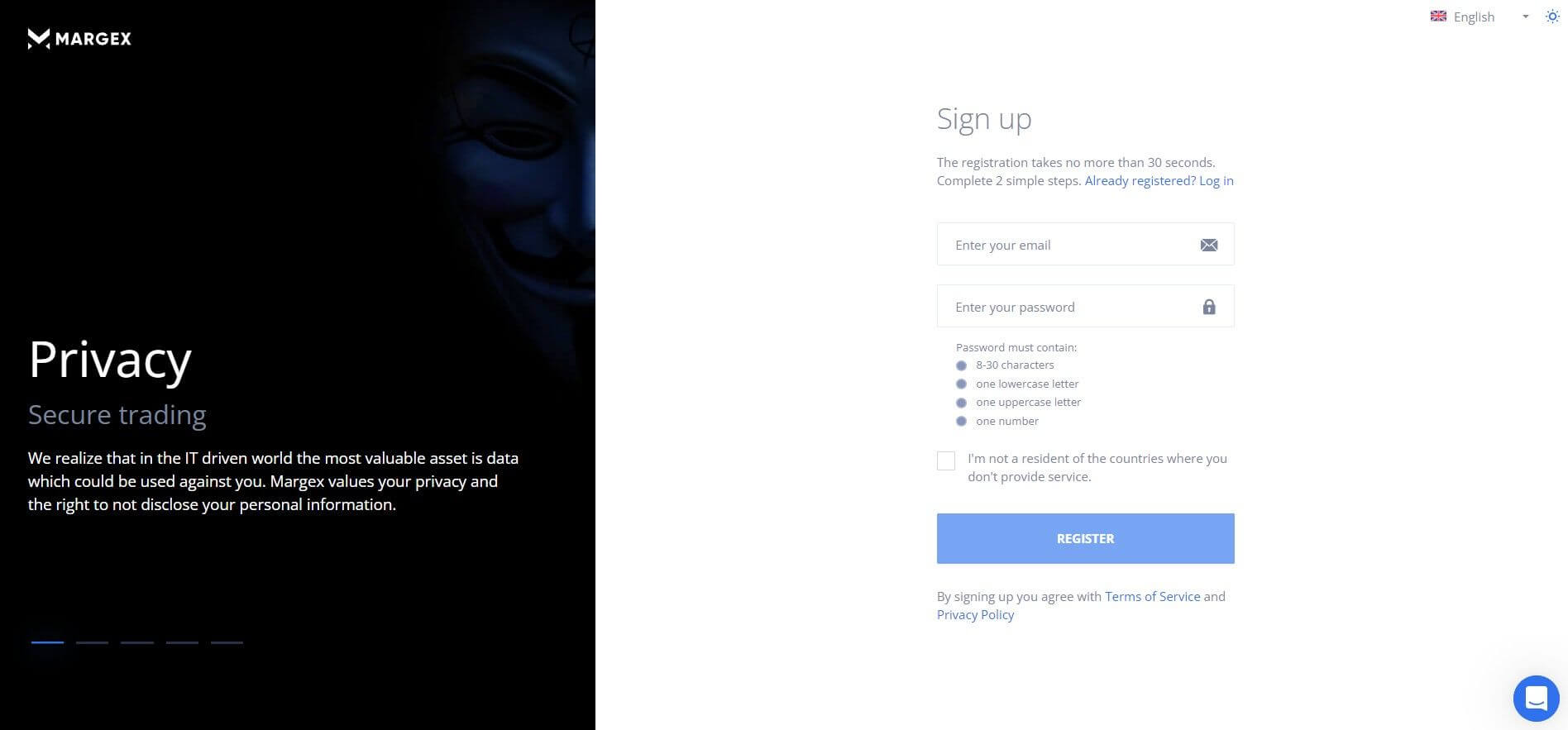

Step 1: Create an account on Margex. Simply visit this site and fill in your details to create an account on Margex.

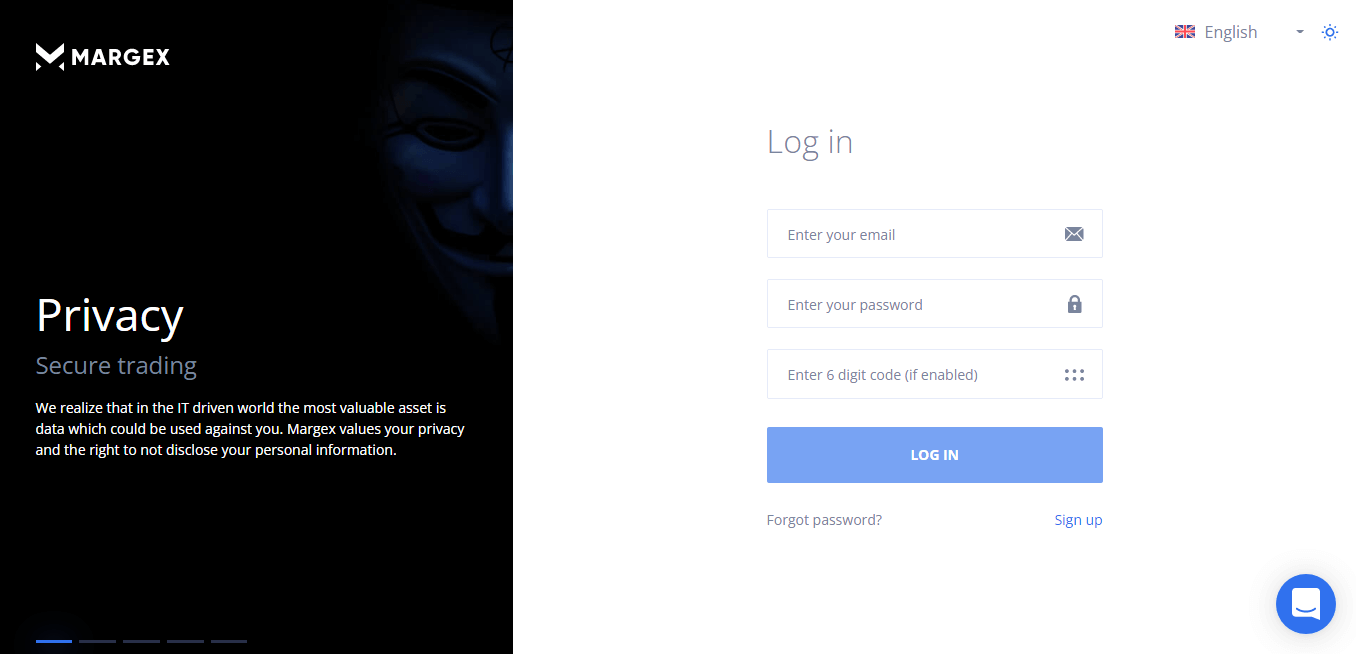

Step 2: After signing up, log in to your account.

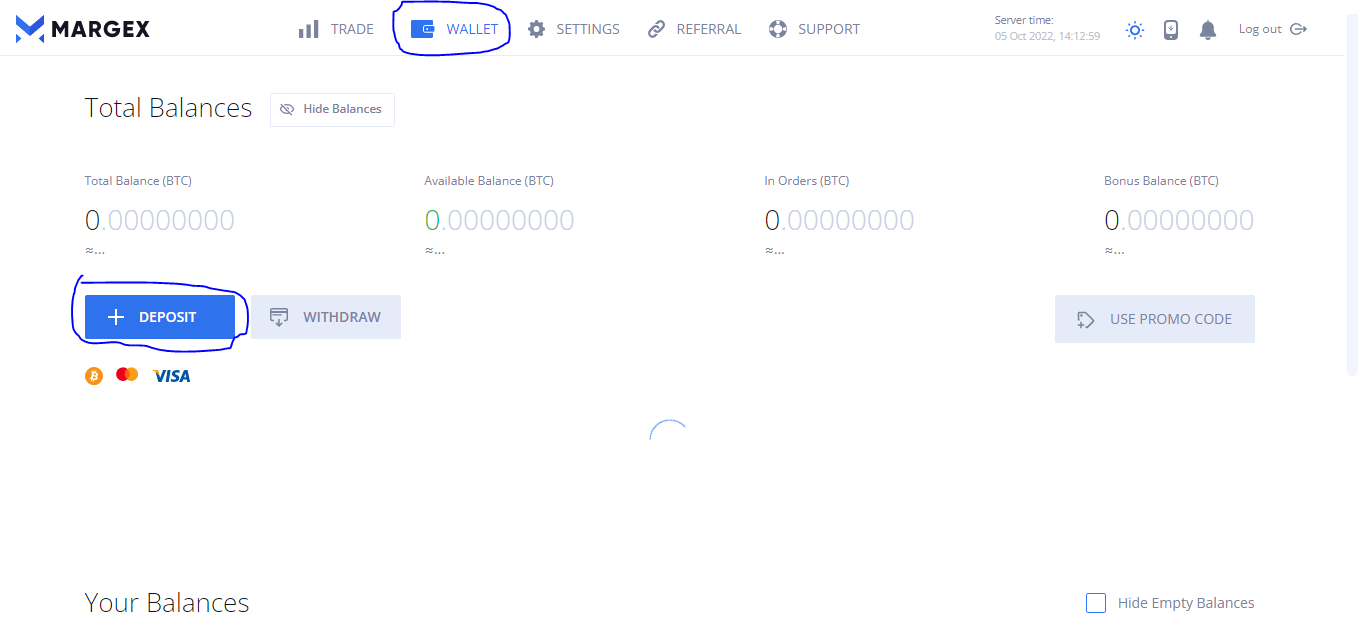

Step 3: Next, click on the wallet and select deposit. Select your payment method and deposit at least $10. Go for a higher amount to increase your potential trade volume.

Margex does not charge any deposit fees, making the process easy.

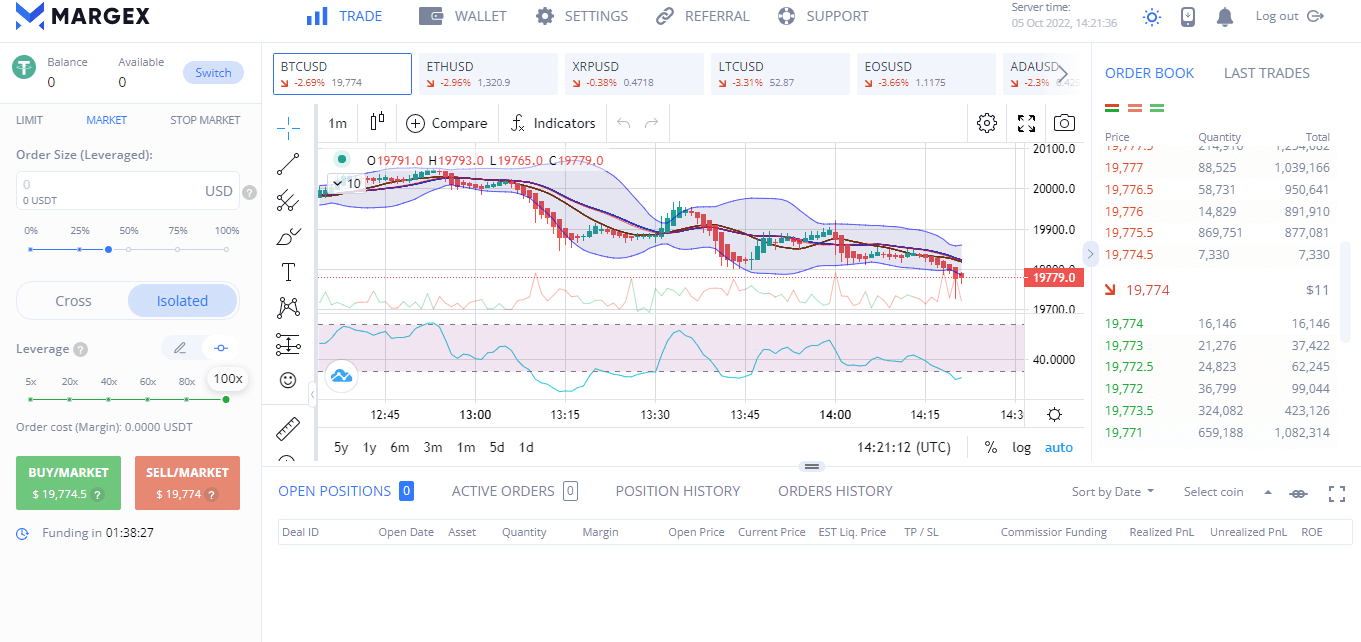

Step 4: Next, you click on trade view and get familiar with the tools and all you need.

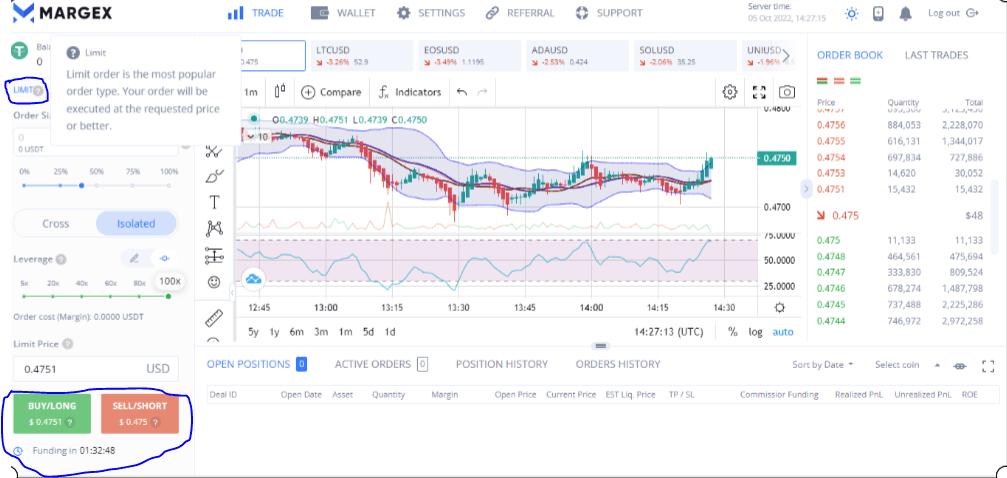

Step 5: To place a maker order in the order book, click on the limit, then select if you want to go long or short. Also, change your chart view to XRP/USD.

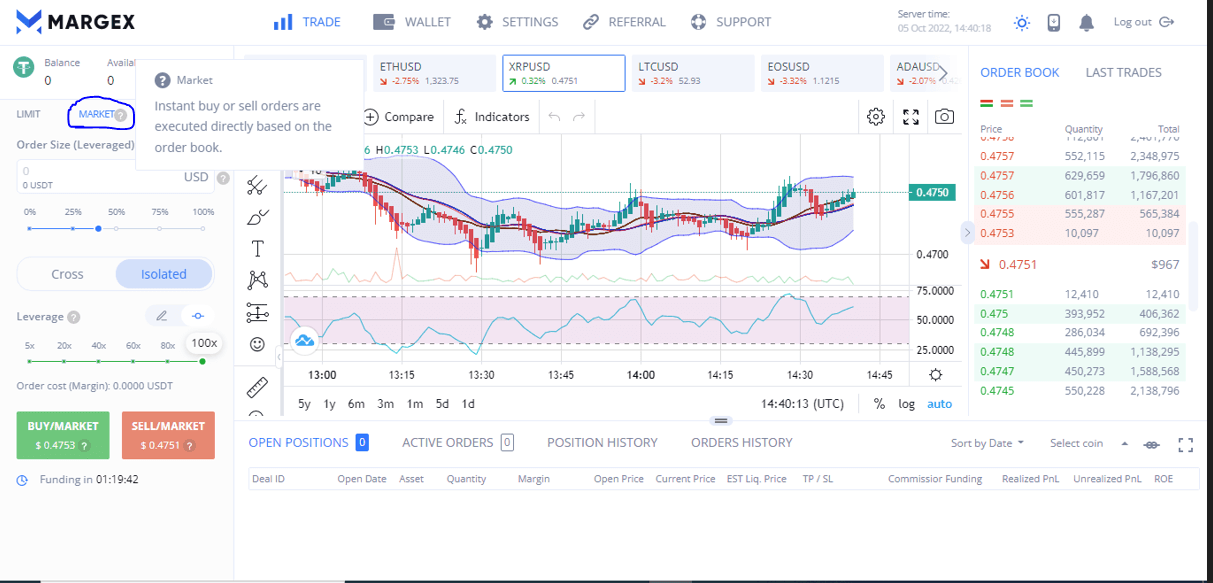

Step 6: To place a Taker order click on market and select if you are going long or short for your trade. Here your order will be executed instantly.

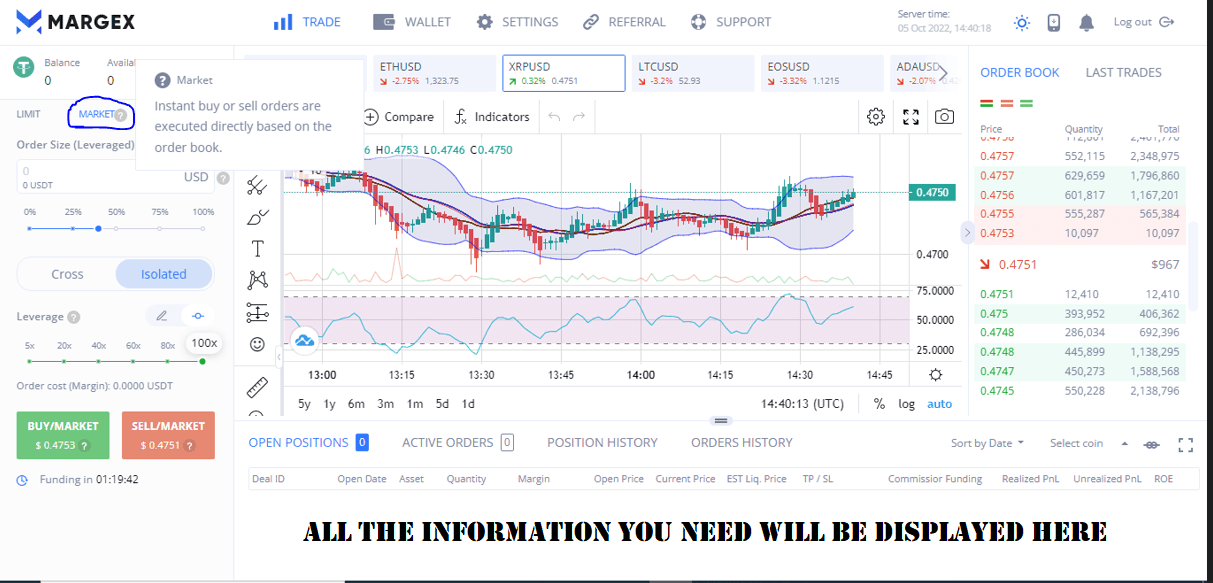

Step 7: Monitor your trade activity from the taskbar at the bottom of the Margex trade view page.

FAQs: Common Questions On What is XRP And Its Future

Find more answers below to help you understand Ripple crypto more.

What is XRP?

Ripple is a cryptocurrency that provides financial payment solutions to financial institutions, businesses, governments, and developers. Ripple was designed as a remittance system and to function like the SWIFT network facilitating the transfer of money and securities globally.

How does ripple work?

Transactions on ripple run through a Protocol Consensus Algorithm. The Consensus protocol validates transactions, including account balances, on the system. Several validators are responsible for updating transaction ledgers.

Any institution can run a node on the Ripples network through the RippleNet. Nevertheless, Ripple’s validator system maintains a unique code list that enables users to verify transaction fraud tendencies.

How Does Ripple Differ from Bitcoin?

The Ripple consensus protocol is nothing like the proof-of-work system of Bitcoin. It maintains the system’s integrity by preventing double-spending. XRP transaction validations take a few seconds. Therefore, the cost of running a transaction is minimal compared to Bitcoin.

Unlike Bitcoin, Ripple is a global payment network and majorly renders services to banks and financial institutions.

Ripple has one billion XRP pre-mined and released into the market, but Bitcoin supply is capped at only 21 million. In other words, only 21 million Bitcoin would ever exist.

Why drives the value of Ripple?

Transactions on Ripple are very fast and generally take only a few seconds, eliminating the several days most banks take to complete transfers. It costs only about 0.00001 XRP to perform a transaction on Ripple.

How does the XRP network make money?

Ripple makes money by charging payment fees, selling XRP, investing profits, and loan interest fees.

Can XRP grow like Bitcoin?

Experts believe XRP’s functionality can avail it of the same level of adoption as Bitcoin. The low transaction fees and fast processing speed, including Ripple’s increasing customer base, contribute to XRP’s popularity and favor in the market.

Is the future bright for XRP?

The XRP digital asset already has the trust of many investors and financial institutions. This gives the token a place among the digital currencies with positive futures. Moreover, Ripple is unlike some other digital assets that constantly generate new tokens through mining. This is because it has a finite number of XRP supplies that it distributes on a pre-determined schedule.