It might be challenging to trade and invest in cryptocurrencies without thorough research and wise decision-making. Make sure you are aware of the performance of your current investments before making any future investment-related decisions. Calculating ROI is an excellent place to start when evaluating a project’s success.

When estimating crypto ROI, there are a few aspects to remember. Calculating crypto ROI has been described in this beginner’s tutorial, along with a quick explanation of why ROI is paramount.

What Does Getting A Return On Your Investment (ROI) Mean In Crypto?

Return on Investment (ROI) is one of the metrics used to assess the market performance of an asset. Because the market is all about purchasing when the price is low and selling when the price rises, ROI informs us if a market strategy is working or not. If the ROI of a project is insufficient, it implies that the investment-related plan must be changed.

Although ROI does not consider as many elements as other market analysis tools, it highlights how your asset performs compared to previous performances. For example, a Technical Analysis of an investment would investigate how it has responded to various market movements over time. ROI, on the other hand, considers the tangible profit generated by the asset over time.

Of course, crypto ROI cannot be used as the primary guidance to design your investment strategy. The volatility of the market and the risks associated with it must be considered. However, ROI is a reliable metric for determining whether or not an asset is operating as expected. Best of all, you can utilize ROI to examine conventional assets like real estate property and crypto-asset performance.

In the above crypto ROI example, ROI gives us an idea of how successful a trade or a trend is, in terms of overall profitability. ROI can be measured by trade, by trend, by asset, or across an entire portfolio.

Crypto Return On Investment (ROI) Calculator

Crypto ROI calculator is a popular way traders and investors calculate the performance of their assets. It provides an ideal way to know whether the asset has brought about profits or losses over a period of time.

The profitability of an investment needs to be properly gauged by using an ROI calculator. There are cases when it could seem that the investor is in profit when his overall ROI returns may be negative.

Therefore crypto ROI calculators are an important part of any investment management firm and there are a few formulas that exist that we’ll be addressing below.

ROI Calculation Formula

The most popular crypto ROI calculator formula used by many investors is as follows:

ROI = (FVI – IVI) / (FVI – IVI) * 100%

Where:

- FVI stands for the final value (cost) of the investment.

- IVI stands for the initial value of the investment or original/actual cost of the investment.

Assume you put $1,000 into Bitcoin a year ago and during this period it rises by 25%. Then you decide to sell it at $1,250. According to the calculator your investment has yielded the following returns.

(1,250 – 1,000) / 1,000 * 100% = 0.25 = 25%

No extra fees or charges are included when using this primary ROI calculation method. Knowing how to calculate return on cryptocurrency or for any other asset and stock is a breeze with this basic formula!

While preserving your investment without incurring new costs is possible, this is impractical. If you purchased $1,000 worth of Bitcoin, for example, you would have had to pay transaction fees. The brokerage may also charge annual account fees as well. Finally, certain expenses will be associated with the sale of your investment.

There are a lot of costs that eat away at returns, particularly for little investments. Therefore a better way to determine your return on investment is by accounting for all of these extra costs:

ROI = (FVI – Expenses – IVI) / IVI * 100%

As a result of its simplicity, this formula is a handy metric for swiftly assessing the effectiveness of your investment. However, there are several limits that must be considered partly because of its simplicity.

How Does Annualized ROI Work?

Annualized returns on investment are returns that have been adjusted for a year. There are various occasions when we make investments for a few years, months, or even days. Because of the differences in maturity durations, it is impossible to evaluate various investment avenues based on their returns in such instances.

The notion of annualized ROI aids in addressing the issue mentioned above. Returns on Investment from numerous investment alternatives over various periods may be combined into a single format in the form of annualized ROI. Using the findings, an investor may quickly determine the best investment choice. Furthermore, if an investor does not want to depend on the outcomes of a single year, he might find out the annualized returns of an investment over several years.

In other words, annualized ROI is the compounded annual growth rate (CAGR) that considers compounding.

The annualized ROI formula is as follows:

((1 + ROI) 1/n – 1) * 100% = Annualized ROI

Where:

- n = the number of investment years

An investment that grows from $100 to $150 over ten years has an annualized ROI of 4.14%, but the same investment that increases by the same dollar amount over one year has an annualized ROI of 50%.

The typical ROI would show the same return for these two investments, but the annualized ROI shows a significant variation in performance.

What Is The Difference Between The Traditional Market And Crypto ROI?

Blockchain projects, elite crypto performers like Bitcoin and Ethereum and other top cryptocurrencies have surpassed the stock market and commodity markets in terms of return on investment (ROI). In the short-term (one year), medium-term (two years), and long-term (five years), as long as we examine a time following Bitcoin’s introduction in 2009, this remains true.

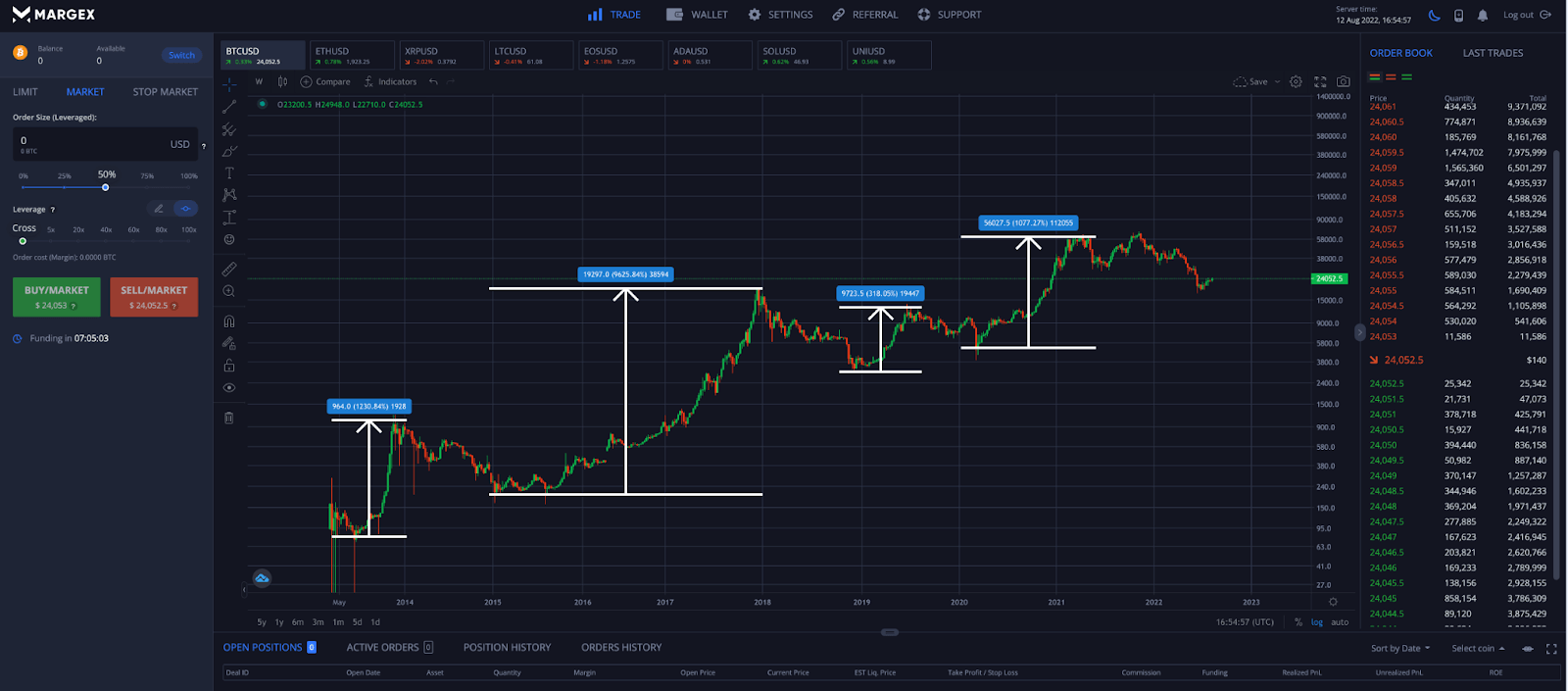

Case in point; In comparison to the more conventional assets and stock market, Bitcoin (BTC) has had an extremely significant ROI since its inception in 2009. Here is a deeper look at how volatile Bitcoin’s ROI is in order so that we can examine it in more detail.

If we look at Bitcoin, Ethereum and other crypto coins against the S&P 500 and gold, it’s easy to see that crypto ROI is higher than the traditional market. In the example above, Bitcoin shows more than 100,000% ROI. Margex provides measuring tools that make determining the ROI of each price movement possible.

For short-term, medium-term, and long-term ROI analysis, many financial analysts utilize a set of defined periods. The definition of short-, medium-, and long-term is, of course, a matter of opinion. We’ll utilize one-year, two-year, and five-year periods to show Bitcoin’s return on investment (ROI).

Here is a table showing the return on investment (ROI) for Bitcoin (BTC):

Over the previous year, all of the top ten cryptocurrencies (excluding stablecoin) have seen remarkable returns on their initial investments. Since many of these cryptocurrencies didn’t exist two years ago and the majority weren’t even on the market five years ago, estimating their longer-term crypto ROI is either impossible or misleading because many of them had low coin prices two to three years ago and only recently began to appreciate.

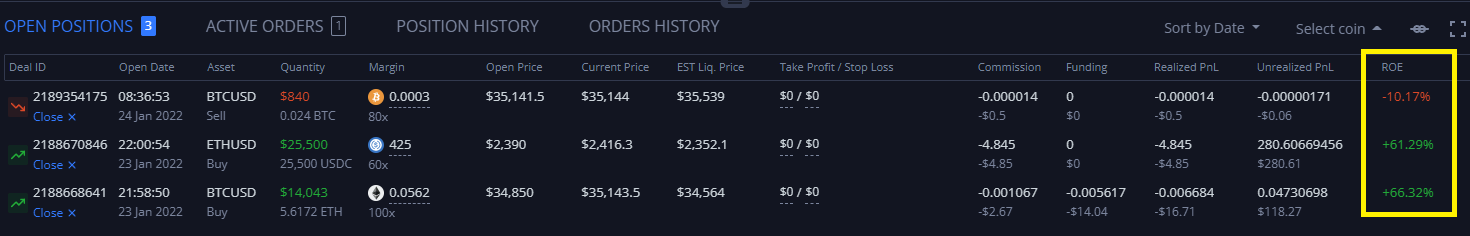

How To Calculate Return On Equity (ROE) On Margex

Return on Equity (ROE) is a metric that measures the current NET performance of an open deal. Positive ROE indicates that the transaction is profitable, whilst negative ROE means that the value is presently losing money after accounting for the price (of the crypto) movement of the item being traded and the trade costs and financing.

Margex, a highly reputable crypto platform, provides an ideal platform to calculate ROE using a unique formula based on trader’s margin set aside for a trade.

- ROE% is equal to Margin / (Unrealized PnL + Realized PnL – CloseOrderCommission)

For example, if a trader uses $100 as a Margin for a position, an ROE of +20% indicates that the deal is effectively profitable by $20.

When you first initiate a trade, the ROE% indication will be negative. This is due to the ROE% indicator accounting for the position’s opening and closing transaction costs, offering a more accurate depiction of the current situation of the trade.

Users on margex always see their ROE and PNL. It’s even possible to set stop loss and take profit depending on the desired ROE

FAQ

Here are some of the most asked questions about ROI in crypto.

What is a reasonable crypto ROI?

Several aspects must be considered to have the best return on investment, such as the industry, benefits, and costs. Investors’ investment objectives are as unique as their fingerprints, and they take into account both the risks and the rewards of their choices. Trading in cryptocurrency involves very high levels of risk.

In the context of equities indexes, a 7% ROI is considered a decent rate of return.

Crypto projects like BTC, ETH, and Polkadot have had gains in the cryptocurrency world’s thousands of per cent range. Cryptocurrency’s ROI success in the 2010s is not sure to repeat (or for any past returns to recur, for that matter).

It is reasonable to assume that many cryptocurrency projects will fail and that a well-diversified crypto portfolio should demand returns far greater than the “7% rule” to compensate for this potential market risk.

It’s ultimately up to you to determine the best objectives for your scenario and the potential benefits of the technology you’ve researched.

What does crypto ROI stand for?

ROI, an acronym for Return on Investment, is an attribute cryptocurrency traders use to assess and compare the high-performance of numerous volatility in crypto-assets in a portfolio. It is critical for cryptocurrency traders to monitor the ROI number and adjust their bitcoin holdings appropriately. A positive ROI number indicates that the crypto investment is profitable, while a negative ROI value suggests that the initiative is losing money.

What does 100% ROI mean?

If your crypto ROI is 100%, you have effectively twice your original investment. Using a real-life-friendly example, if you invest $1,000 and gain $1,000, your return on this investment is 100%: ($1,000 + $1000) / $1,000 = 2x, or 100%.

With this type of crypto ROI, the investor can smile all the way to the bank.