Analyzing chart patterns, trading volume, and Japanese candlesticks are only individual aspects of the study of technical analysis. Another important puzzle piece in terms of putting together successful technical trading systems is by using technical indicators like the MACD, Stochastic, Bollinger Bands, and the Relative Strength Index.

In fact, the Relative Strength Index (RSI) is one of the most popular tools used by crypto traders to generate buy and sell signals. It is considered a reliable indicator and a cornerstone of technical trading systems.

Read the following in-depth RSI crypto trading guide, complete with details on the tool’s definition, how RSI works, its calculation, and how to use it to trade crypto.

RSI Indicator Definition

The Relative Strength Index (RSI) is a popular technical indicator developed in the 1970s by J. Welles Wilder, Jr. Wilder first introduced the momentum oscillator in his 1978 book New Concepts In Technical Trading Systems. He is also the creator of other leading technical indicators such as the Average True Range, Parabolic SAR, and Average Directional Index.

The RSI indicator is a bounded oscillator with readings between 0 and 100. In addition to helping to measure the speed and magnitude of recent price action, the RSI can tell traders when the market is overbought or oversold.

Crypto traders can use these overbought signals and oversold signals to get an early read on when a trend might be due for a reversal. The RSI can be a tricky tool, however. Trending crypto assets can remain overbought or oversold for extended periods, and divergences are common.

How Does The Relative Strength Index Work? RSI Indicator Explained

The RSI measures the velocity of price action by comparing the strength of an asset during positive price movements versus the strength of an asset during negative price movements. The result is displayed as a line chart within a bounded indicator with a gauge between 0 to 100.

Using the RSI, readings of over 70 is overbought territory while readings below 30 represent oversold territory. The higher or lower the reading, the stronger the momentum behind the rate of change in price action on that particular asset. But it also represents a possible turning point in a prevailing trend where the underlying strength of the trend becomes exhausted due to overbought or oversold conditions.

RSI Formula: What Is RSI Indicator Calculation

The formula to calculate RSI indicator is:

RS = average gain / average loss

RSI = 100 – 100 / (1 + RS)

Where:

RS = Relative Strength

RSI = Relative Strength Index

The RSI indicator uses the average gains and average losses in a crypto’s price within a specific timeframe. The RSI is typically set to 14 periods when trading crypto, stocks, forex, commodities or other assets. The first calculation provides the data, while the second calculation in the formula smooths the results to create the RSI indicator.

RSI Settings For Crypto Trading

The RSI indicator like many other technical indicators can be customized further to work better with cryptocurrencies. For example, more advanced trading techniques recommend changing the boundaries to generate trade signals at 80 and 20, for greater accuracy and less risk.

Some versions of the RSI indicator will come with an optional RSI-based moving average. The moving average is an SMA set at 14-periods, much like the RSI itself. Crypto traders can also tinker with the length of the moving average period to find more reliable trading signals.

How To Interpret RSI Signals And How To Read RSI Charts

Reading RSI crypto price charts can become second nature with some familiarity and practice using the tool.

The RSI is a trend-following momentum indicator that can help traders validate strengthening trends, predict possible trend reversals, and gauge buying momentum or selling momentum during an uptrend or downtrend.

Based on the tool’s design, readings above 70 indicate overbought conditions during an upward price movement and suggest a pullback and possible reversal is coming. In contrast, readings below 30 indicate oversold conditions during a downward trend, and a rally over reversal could materialize.

In addition to readings of 70 and 30, some trading strategies involve adding a horizontal trendline at a reading of 50 – passing through this is a signal that price momentum is increasing. Trendlines can also be drawn across RSI peaks and troughs, and passing through them can provide buy or sell signals for more aggressive traders.

The more extreme the RSI value, the higher the probability of a reversal. However, powerful crypto trends can overextend and the RSI indicator can remain oversold or overbought for a long timeframe. Because of this, false signals are possible and the RSI is more effective to use during trading ranges versus trending markets.

What Is RSI Divergence? How To Use Relative Strength Index To Trade Divergences

A RSI divergence appears when the price action is making a higher high or lower low, yet the RSI makes a lower high or higher low. This “divergence” in price action can indicate a possible trend reversal and move in the opposite direction.

A bearish divergence occurs in a bullish trend when price action makes a higher high, but the RSI indicator makes a lower high.

A bullish divergence occurs in a bearish trend when price action makes a lower low, yet the RSI indicator makes a higher low.

Most traders will avoid taking a trade based on a divergence alone, and instead look for confirmation using chart patterns, volume, candlestick patterns, and other technical indicators.

RSI Swing Rejections In Crypto Trading: What Are Crypto RSI Swing Rejections

The most conservative buy or sell signals using the RSI indicator are called swing rejections. Here is how a market analyst would find bullish and bearish swing rejections.

How To Identify A Bullish Swing Rejection

- A bullish swing rejection occurs when the RSI reaches oversold conditions.

- The RSI must next return above a reading of 30

- The RSI then retraces, but fails to cross back below a reading of 30

- Once the RSI is surpasses its most recent high, a bullish swing rejection is confirmed

How To Identify A Bearish Swing Rejection

- A bearish swing rejection occurs when the RSI reaches overbought conditions.

- The RSI must next return below a reading of 70

- The RSI then retraces, but fails to cross back above a reading of 70

- Once the RSI is surpasses its most recent low, a bearish swing rejection is confirmed

RSI Indicator Swing Rejection Example

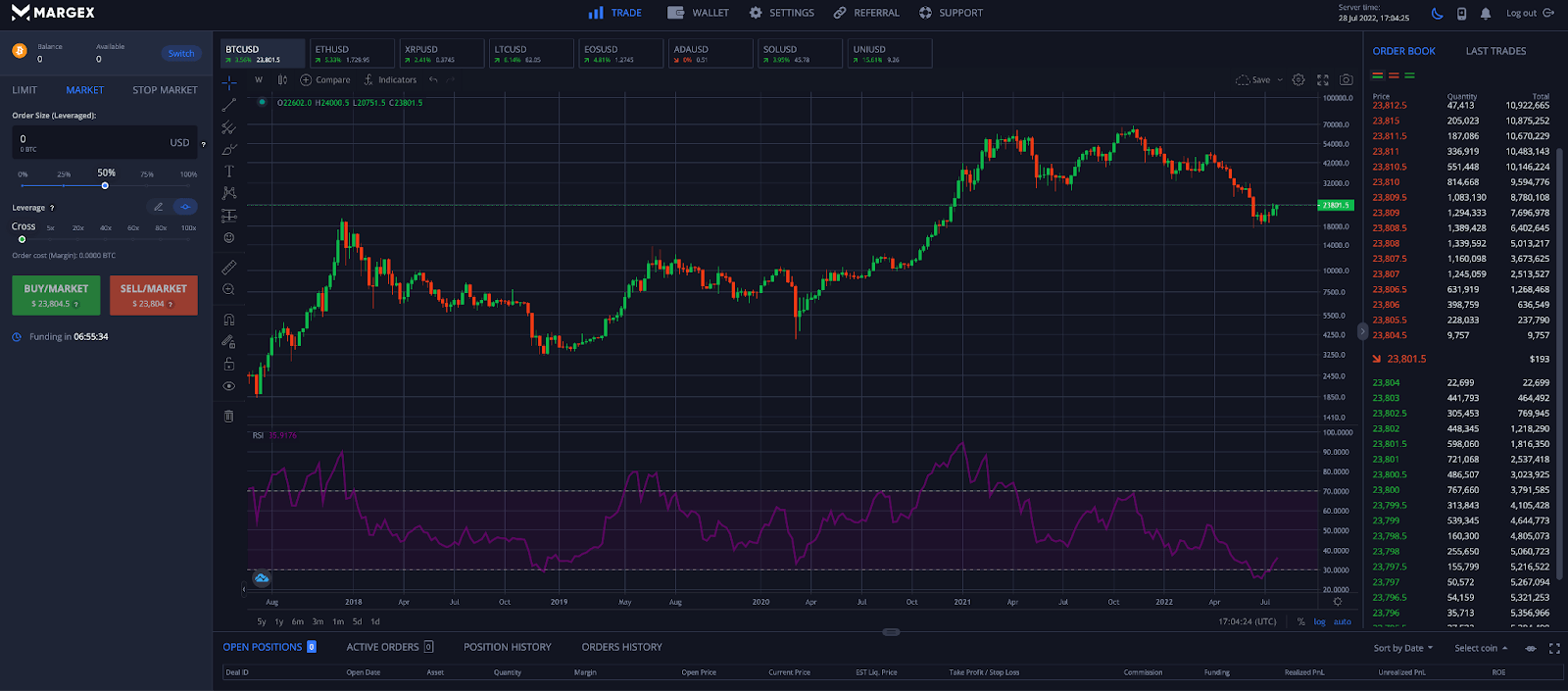

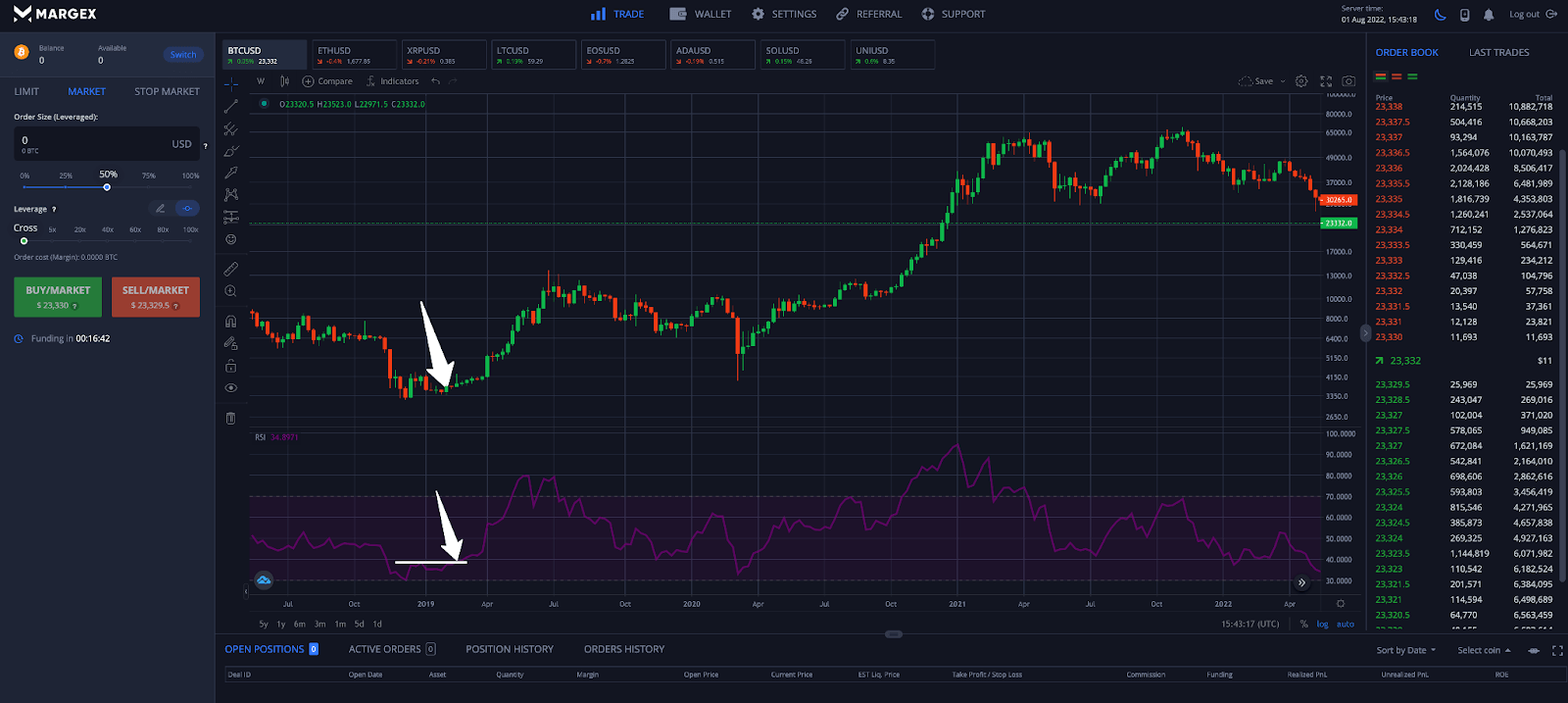

In the below example, Bitcoin price made a bear market low in late 2018. At the same time, the weekly RSI reached oversold conditions.

After returning above a reading of 30, the RSI retraced, but held above the boundary of 30. Once surpassing the most recent high, a buy signal was generated.

Bitcoin price climbed by more than 1,500% in the following years.

Example Of How To Use RSI In The Crypto Market

Here is an example of how to use the RSI to trade cryptocurrencies like Bitcoin, Ethereum, Litecoin, XRP, and other altcoins.

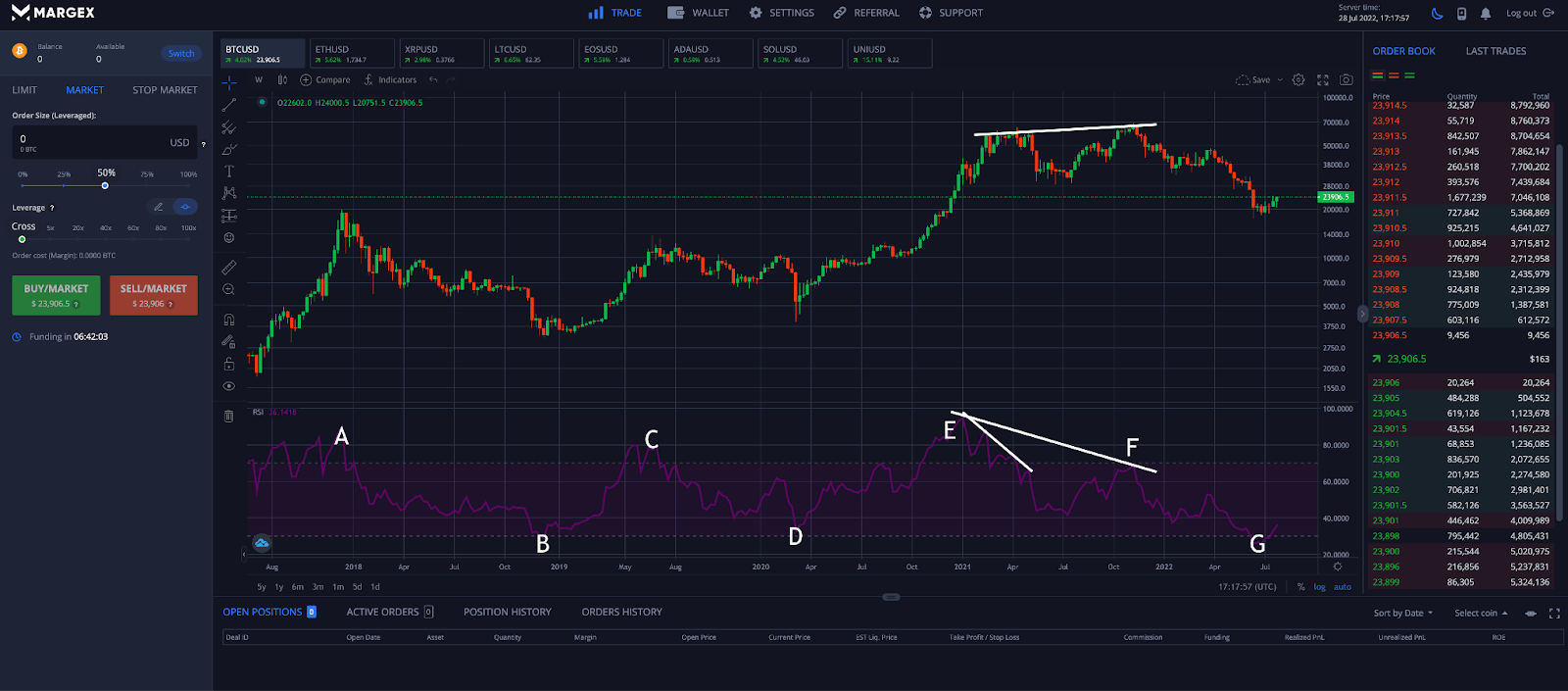

In the above BTC weekly chart, we’ll walk you through a variety of signals issued by the weekly Relative Strength Index.

Point A – At point A, the RSI became oversold with a reading of above 70, putting in the 2017 bull market peak.

Point B – Highlighting the effectiveness of the tool, the top cryptocurrency asset didn’t reach oversold conditions until the exact bear market bottom.

Point C – Bitcoin still remained in a trading range, resulting in a lower high on weekly timeframes and a failure to break resistance. The RSI signaled this failure when the price reached oversold conditions for the first time since the 2017 bull market peak.

Point D – In March 2020 during the onset of the pandemic, panic took Bitcoin back down to lows, but the RSI failed to reach oversold territory, suggesting the underlying trend was strong and bought up.

Point E – At point E, a bearish divergence developed that put in the 2021 peak at around $65,000 per coin.

Point F – By point F, Bitcoin price made a higher high, but the RSI put in a lower low, creating a pronounced bearish divergence. Following this signal, Bitcoin fell by more than 70%.

Point G – Bitcoin has once again reached oversold territory on the RSI indicator. If Bitcoin can complete a bullish swing pattern rejection, a new bullish trend could begin.

Advantages And Disadvantages Of Using RSI Indicator

Like any tool, there are always upsides and downsides to using them. Some indicators give false positive signals, lag behind trend changes, or create other issues.

Here are some of the most common advantages and disadvantages of using the RSI indicator:

RSI Indicator Crypto Trading Pros

✔️Measures momentum

✔️Easy to read

✔️Follows the trend

✔️Clear overbought or oversold signals

RSI Indicator Crypto Trading Cons

❌Can remain overbought and oversold for extended periods

❌False signals

❌Less valuable during trending markets

How To Trade With RSI Indicator On Margex

The Margex trading platform offers built-in technical analysis tools that the pros rely on, like the MACD, Ichimoku, Bollinger Bands, Fibonacci tools, and the Relative Strength Index. Here is a step-by-step guide on how to use the RSI indicator to trade crypto with Margex.

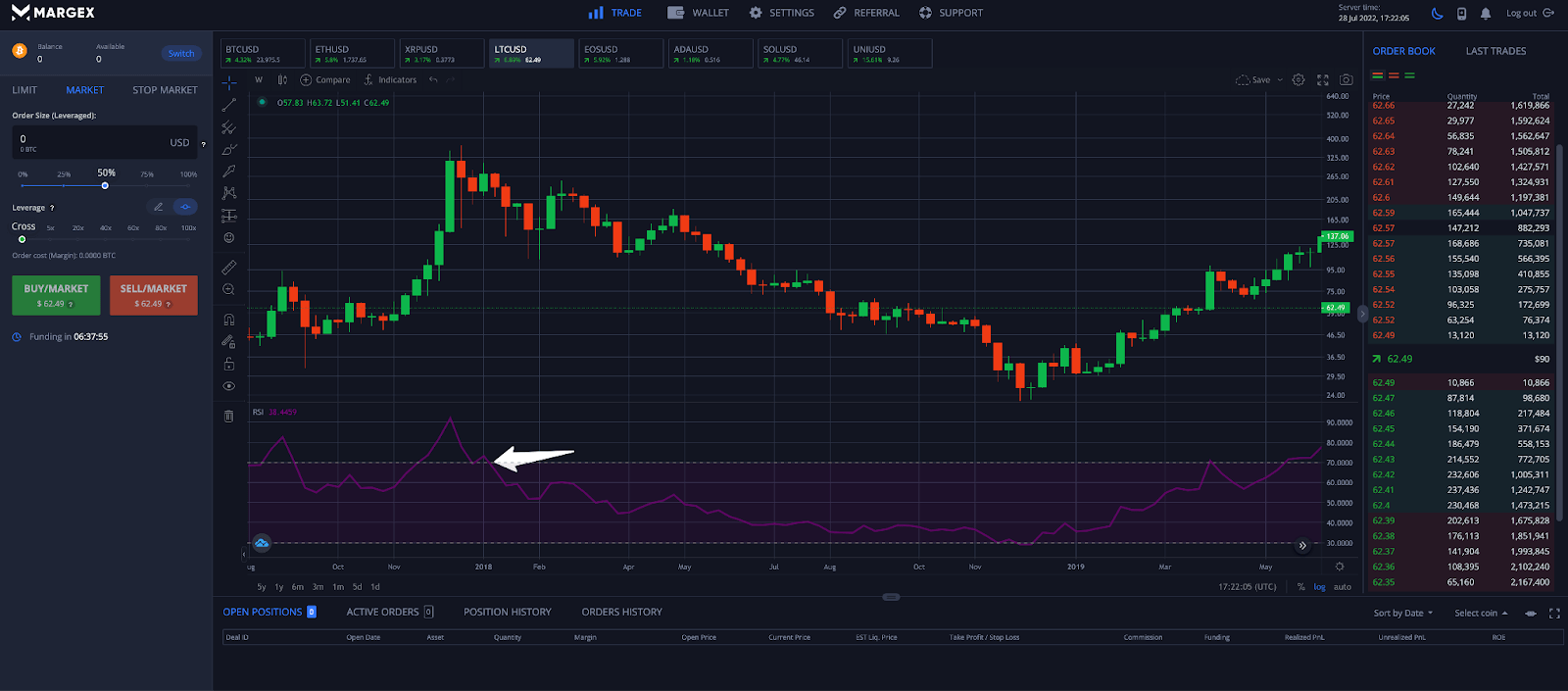

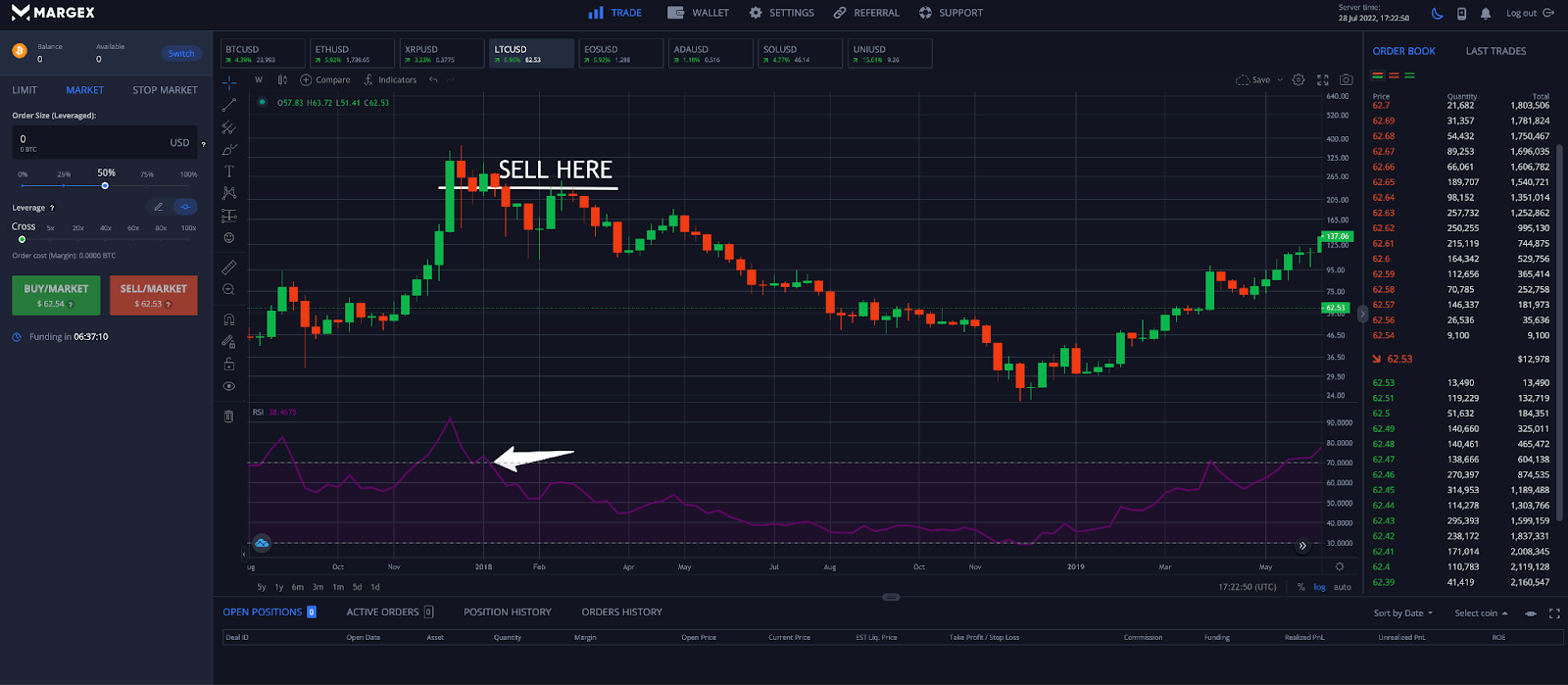

Step 1 – Turn on the RSI indicator and scan the price chart for overbought or oversold conditions. In the above LTCUSD example, Litecoin peaked when the RSI reached above 70.

Step 2 – A sell order would be placed once the RSI fell below the reading of 70. A more conservative entry would involve waiting for the RSI to surpass the most recent peak after retracing and holding below 70.

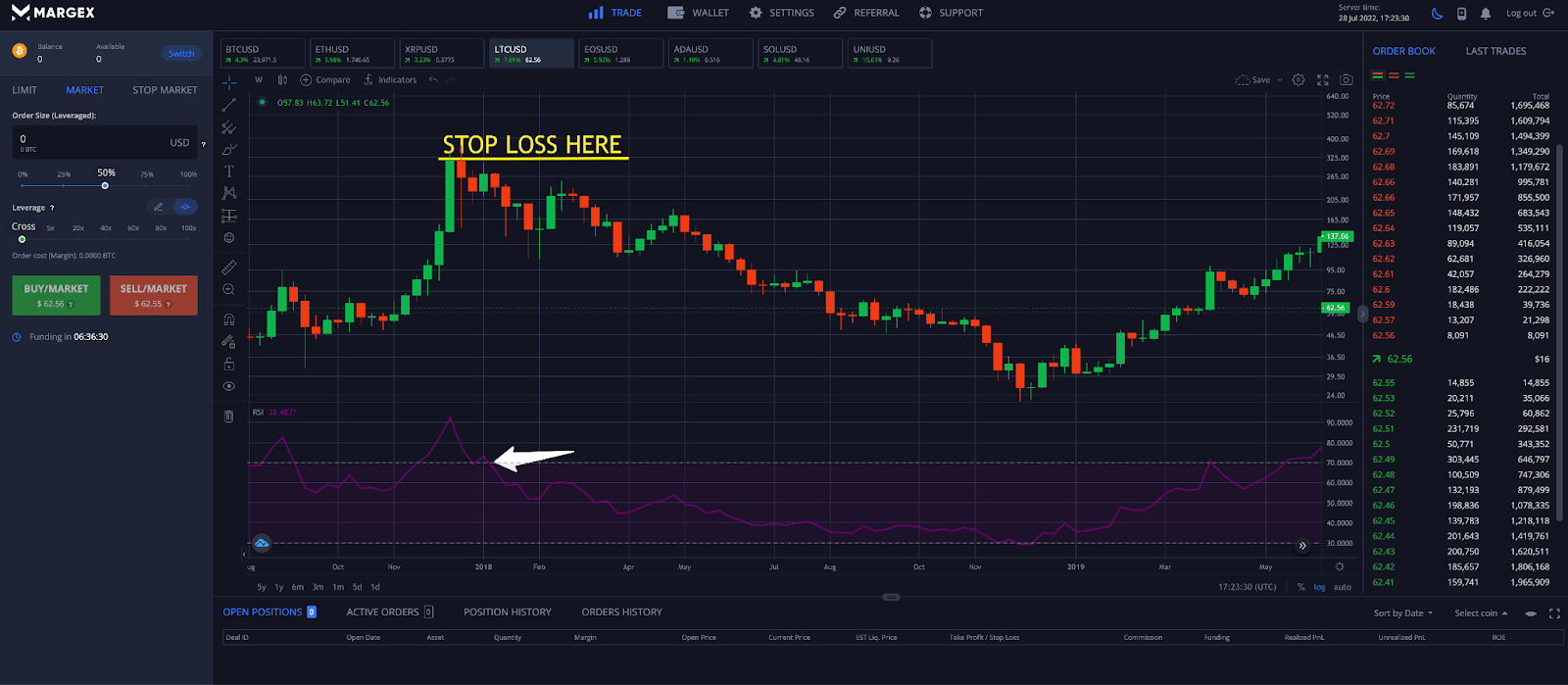

Step 3 – A stop loss order would be placed above the high of the first RSI peak.

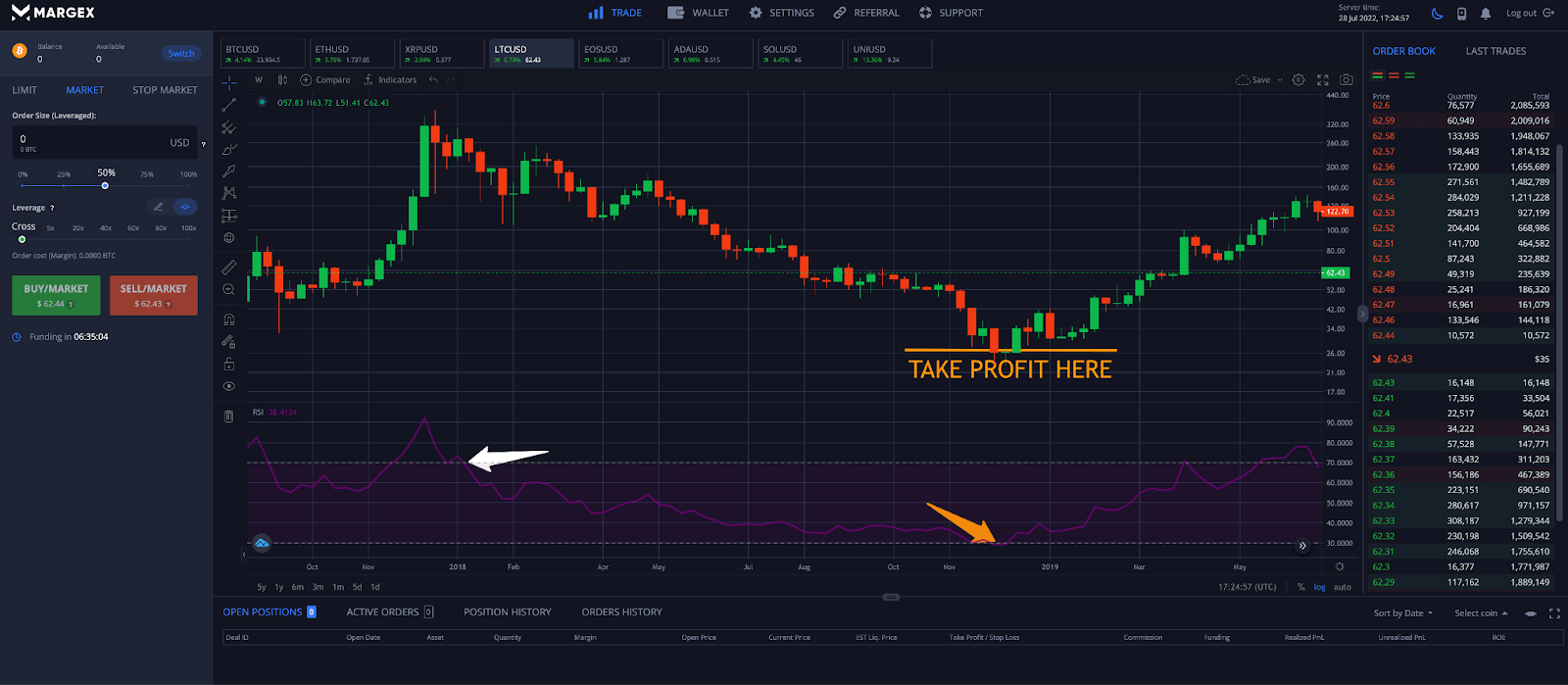

Step 4 – Finally, the trade would be closed when the RSI reached oversold conditions. The market price of Litecoin declined by more than 90% during this timeframe.

Relative Strength Index (RSI) Versus Other Technical Indicators

Because the Relative Strength Index is among the most popular technical indicators, it is often compared to or used in conjunction with other indicators such as the MACD, Stochastic RSI, and Bollinger Bands.

RSI Vs MACD

The Moving Average Convergence Divergence indicator is another trend-following momentum indicator like the RSI, but uses unique calculations involving an MACD line and a signal line. The distance between these two lines is represented by a histogram.

Because the RSI and MACD use different methods to come up with their calculations, unique signals can be generated that when used in conjunction provide an analyst with a better read on the market.

RSI Vs Stochastic RSI

Stochastic RSI uses RSI values in a Stochastic instead of price data, creating a much more sensitive technical indicator. The Relative Strength Index itself is a derivative of price action, while the Stochastic RSI is a second derivative of price.

The Stochastic RSI can provide more frequent signals. However, with greater sensitivity traders run the risk of generating false signals. When used in conjunction, a trader can decipher which signals to take action on.

RSI Vs Bollinger Bands

The Bollinger Bands are a 20-period SMA set at two standard deviations to create an upper and lower band. When price action is trading at the upper or lower band, prices are overvalued and undervalued respectively.

When combined with the RSI which tells a trader when markets are overbought or oversold, signals are more effective. Both price passing through the mid-BB while the RSI passes through 50 can tell a trader that a trend is strengthening.

FAQ

The Relative Strength indicator can give false signals during trending markets and is more effective during trading ranges. Therefore, there is often a lot of confusion surrounding how to effectively use the RSI.

We have created this RSI crypto trading FAQ to answer any remaining questions about the RSI indicator.

Which RSI is best for crypto?

RSI settings can be adjusted for cryptocurrencies by setting the boundaries for overbought and oversold conditions to over 80 and below 20 respectively. This can make signals more accurate and lower risk in the highly volatile asset class of cryptocurrencies.

What RSI means crypto?

The RSI in crypto stands for the Relative Strength Index, and is a popular trend-following momentum indicator that most traders in crypto use.

What are the RSI calculations?

The RSI indicator uses the average gains and average losses within a specific timeframe. It consists of two calculations. The first calculation provides the data, while the second calculation in the formula smooths the results to create the RSI indicator.

What is a good RSI to buy?

A good RSI reading to buy is anything that falls below a reading of 30. However, for more conservative entries, traders can set this to below 20, or wait for a confirmed bullish swing rejection before taking a long position.

How to read RSI signals?

The RSI provides trading signals when the asset has reached overbought or oversold levels. Readings of over 70 are considered overbought, while RSI readings below 30 represent oversold conditions. Passing above or below 50 suggests a trend is strengthening.

Is 14 RSI good?

“14 RSI” refers to the default time period the RSI is set to before further customization. However, crypto traders are advised to try altering other settings before experimenting with the default time period. The RSI-based moving average is also set to 14 periods by default, which can be further customized for interesting results.

What does RSI of 50 mean?

Because the RSI indicator is a bounded oscillator with readings between 0 and 100, readings of 50 are essentially a midway point and passing above or below this line can indicate a trend is getting stronger.

Is RSI under 30 good?

An RSI reading under 30 is often a good place to buy an asset as it represents extremely oversold conditions and higher probability for a reversal. However, like any RSI reading, during trending markets readings can remain elevated for an extended period of time. Therefore, the RSI is more effective in trading ranges.

How does the Relative Strength Index compare to other indicators?

The RSI indicator is a momentum indicator that is even more effective when used in conjunction with other technical indicators, such as the Stochastic RSI, MACD, or the Bollinger Bands, Combined, these tools confirm signals with one another, or tell a trader when there may be false signals to consider. These tools can be even more effective when used with chart patterns, Japanese candlesticks, and volume for further confirmation.

Who created the RSI indicator?

The Relative Strength Index was created in the 1970s by J. Welles Wilder, Jr. Wilder is often considered the father of technical analysis indicators, and also developed the Average Directional Index, the Average True Range, and the Parabolic SAR.