The crypto industry has many tokens with different value propositions that make them unique. Some of them include Cardano, Solana, Avalanche, Polkadot, etc. But this article focuses on Solana, the number 9 cryptocurrency based on market cap.

By understanding the network, you can utilize it properly. So, what is Solana, and why is it worth your attention? Also, how does Solana work as a network?

Solana is a third-generation blockchain that supports scalable applications such as decentralized finance, decentralized Apps: and smart contracts. Solana: also called “the Ethereum killer,” facilitates faster and cheaper transactions.

With a market capitalization of $11,169,433,833 and a circulating supply of 358,516,633.27 SOL, it is an investor’s delight. Keep reading to find Solana Explained below.

How Does Solana Work As A Crypto Network?

The Solana network uses a hybrid consensus algorithm that combines a proof-of-history algorithm and proof-of-stake. This mechanism makes the network lightning fast with an increased processing speed of up to 50,000 transactions per second.

Solana’s proof-of-history (PoH) mechanism is a computation sequence that keeps records of events on the Solana network. The developers upgraded the network to have a record of all transaction history.

The proof-of-history keeps digital records that record transactions on the network within a particular timeframe. The proof-of-stake mechanism using the Tower Byzantine fault tolerance (BFT) algorithm helps to secure the network and handle transaction validation.

Solana makes use of a 256-bit secure hash algorithm (SHA-256). The network validators use hashes to record specific data on the network. Timestamp for transactions relies on this data. Rather than waiting for Solana validators to verify transactions, all nodes in the network have cryptographic clocks that track events.

Solana History: When Did Solana Launch?

The highly functional open-source project kicked off in 2017. But the official launch came three years later, in March 2020. Anatoly Yakovenko – who had previous experience with Qualcomm and Dropbox, founded Solana.

Yakovenko teamed up with his Qualcomm colleague Greg Fitzgerald (a Solana co-founder) and founded Solana Labs. More colleagues from Qualcomm joined in on the project to create the solana foundation, and in 2020 the SOL token and Solana protocol went live.

Yakovenko started the process with a private codebase in C programming language. He then migrated the codebase to the Rust programming language. When the project attracted more inventors like Stephen Akridge (a Qualcomm colleague) who worked on the “Throughput,” the name changed to Loom.

However, the team later named the project Solana after a small beach town close to San Diego, where the former Qualcomm employees lived. The aim was to prevent people from mistaking the project for a similar project by Ethereum.

The developers later scaled the project to run on cloud-based networks in June 2018. Shortly the company released a 50-node public testnet that could support up to 250,000TPS.

What Are The Unique Attributes Of Solana?

Solana blockchain platform’s main standout feature is its combination of Proof-of-History (PoH) and Proof-of-Stake (PoS) consensus mechanisms. Its founder Anatoly Yakovenko developed the Proof-of-History mechanism. He was an expert in distributed systems and designs.

Yakovenko realized that using a clock made the network easily synchronized and faster. This single innovation eclipsed the Bitcoin and Ethereum networks that operated their blockchain system without clocks. These networks struggled to handle above 15 transactions per second – giving Solana’s new blockchain an edge over them.

Solana’s developers designed its blockchain to solve the blockchain trilemma. This trilemma is the three challenges that developers face when building blockchains. The trilemma is achieving decentralization, security, and scalability together in a blockchain.

The general belief is that blockchain design requires a developer to sacrifice one of the three features in favor of two. Hence, they can only provide two of these three at every time.

So, Solana blockchain developers came up with a hybrid consensus mechanism that sacrificed decentralization to an extent in favor of speed by appointing a leader node. Also, the difference in transaction time has been a major stumbling block to achieving scalability.

But the Solana blockchain reconciled it by creating one leader node in the network, chosen to relay messages between other nodes. Also, the network creates transaction chains by hashing the output of one transaction and imputing it in the next.

What Makes Solana Valuable?

Solana’s value is based on its lightning-speed transactions and low cost. The blockchain can handle over 2000 transactions per second. Each of these transactions costs fractions of a dollar: $0.00025, a modest transaction fee.

More users are migrating to Solana from Ethereum due to ETH’s notoriously high transaction costs. This transaction speed is due to Solana’s proof-of-history mechanism. It also supports DeFi projects and is a forerunner for NFTs.

Despite the bear market and a recent hack in the protocol, Solana is still one of the most used cryptocurrencies. The consensus mechanism of Solana is far superior to the one some crypto projects use.

Who Are Solana Investors?

Every cryptocurrency network has top investors pushing its token’s growth, and the Solana network is no exception. The value of the SOL token will keep rising due to the size and reputation of its investors. Moreover, they’re the main reason for the token’s popularity in the crypto industry.

Solana investors are well-known venture capital companies, including CoinFund, ParaFi Capital, a16z, Alameda Research, and CoinShares.

CoinFund

CoinFund is a private company committed to crypto asset investments. It is also a blockchain advisory and research firm. Its investments center on blockchain and digital currencies.

- Founder: Jake Brukhman

- Location: Brooklyn, New York City, USA

- Date founded: 2015

ParaFi capital

ParaFi Capital is a U.S.-based company that focuses on managing crypto assets. But it uses a private equity system to invest in firms operating in the blockchain and fintech sectors.

- Founder: Benjamin Forman

- Location: San Francisco, California, United States

- Date founded: 2018

a16z

The a16z company is known for its commitment to companies building processes. It aims to bring together different investors, entrepreneurs, executives, academics, and engineers in the crypto industry.

- Founder: Marc Andreessen and Ben Horowitz

- Location: Menlo Park in California, USA

- Date founded: July 2009

Alameda research

Alameda Research is a recognized cryptocurrency company in Hong Kong. Its ultimate function is to provide liquidity in digital assets and cryptocurrency markets.

- Founder: Sam Bankman-Fried

- Location: Hong Kong

- Date founded: 2017

CoinShares

CoinShares is one of the largest cryptocurrency trading and investment firms in Europe. The company ensures transparency for crypto investors by pioneering the creation of financial products and services.

- Founder: Ryan Radloff

- Location: Paris, Jersey, and London

- Date founded: 2013

Comparing Ethereum (ETH) And Solana (SOL)

Launch date

The Ethereum network created its genesis block in 2015 and launched on July 30, 2015. Solana, on the other hand, emerged on March 16, 2020. However, it took another five months before its first block creation on August 3, 2022.

Transaction speed

The Ethereum network can process just around 15 transactions per second. But the transaction speed of the SOL token is about 4,000 higher than that of Ethereum. The Solana blockchain completes approximately 65,000 transactions in a second.

Number of decentralized applications (DApps)

There are more than 2,700 decentralized applications on the Ethereum network. Presently, Ethereum is the most commonly used network for creating such applications.

On the other hand, Solana’s open-source blockchain supports over 350 decentralized apps. But it is cost-effective in terms of developing these DApps.

Maximum supply

Ethereum has no limits to its maximum supply. Also, Solana developers haven’t shared any data about its max supply yet based on CoinMarketCap statistics.

What Is SOL’s Circulating Supply?

According to data from CoinMarketCap, the total circulating supply of the SOL token is 358,515,756.84 as of October 27, 2022. But its total supply is around 511,616,946 SOL.

As of October 25, about 67.4% of the token’s total supply is in circulation. However, data from Solana Explorer shows that approximately 408.9 million of the available tokens are already staked, which is about 77%.

How Can Crypto Investors Use Solana?

Solana investors can trade, mine, and stake Solana to make a profit. Trading is the most lucrative of these methods since the price movement gives more profit opportunities.

Here are a few methods investors can profit from the sol token.

Mining

This method can be profitable if the investor does quality research. It is difficult as Solana uses a Proof-of-Stake mechanism. ASIC computers are vital for the mining process.

These supercomputers consist of a motherboard, an ASIC chip, and a cooling system. This hardware solves complex puzzles while confirming blocks of transactions and rewarding miners with tokens.

However, they produce heat and noise and consume electrical power.

NFTs

Investing in Solana NFTs can yield investors profit without paying gas fees. An investor can purchase an NFT and re-sell the digital Art once the price goes up. NFTs are growing in popularity, and the gaming community uses them as a reward system.

Staking

Solana runs on the proof of stake mechanism. So it’s a better option than mining. Staking SOL tokens help to secure the network while earning rewards. The process involves delegating your token to Solana validators that process transactions and maintain the network.

To stake your SOL tokens, you can move them to a wallet that supports the staking feature. Most staking wallets provide step-by-step guides for staking Solana.

Contract for difference (CFDs)

You can easily purchase Solana CFDs using a brokerage. You get rewards for a price increase and lose if the price crashes. This method is not very reliable since the crypto market is volatile.

Trading

Cryptocurrency trading has recently become more relevant since they find applications across more sectors. But to benefit from trading, you must sign up for a platform – and do proper analysis before trading.

You can profit from your SOL tokens by trading them on a reliable platform like Margex.

How to trade Solana on Margex

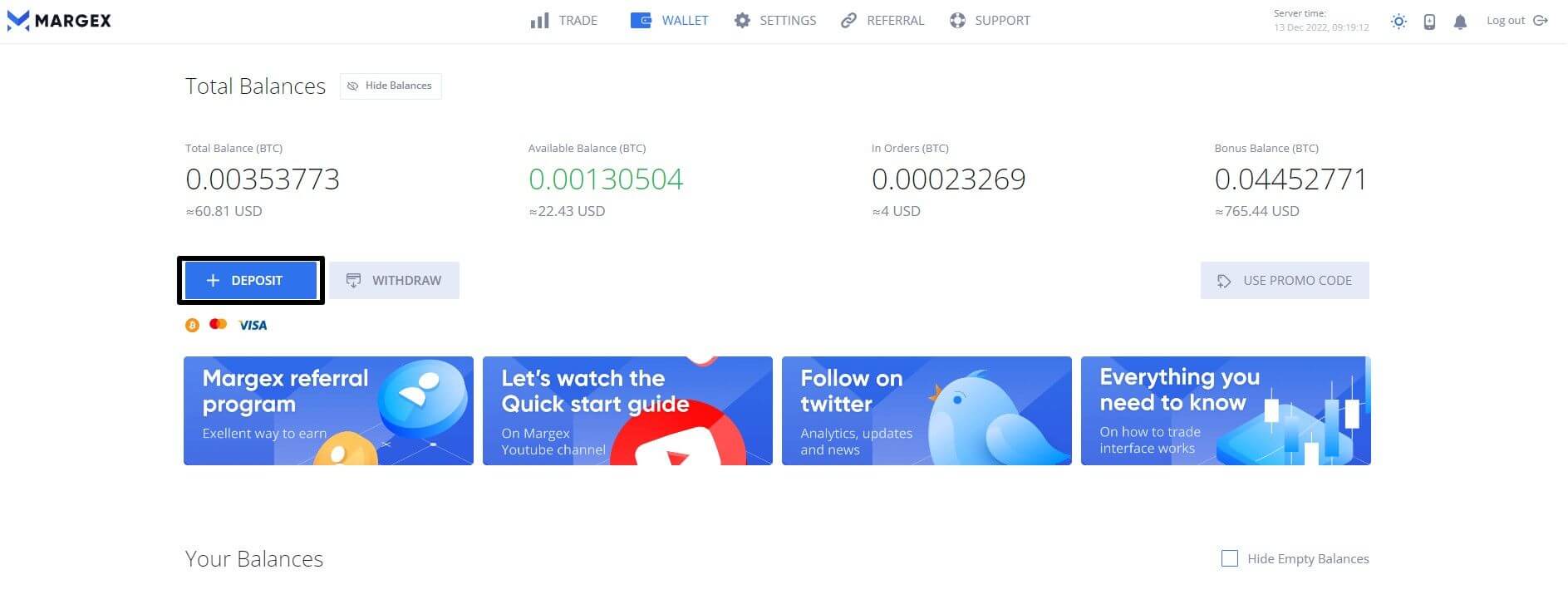

Start trading on Margex in the following steps:

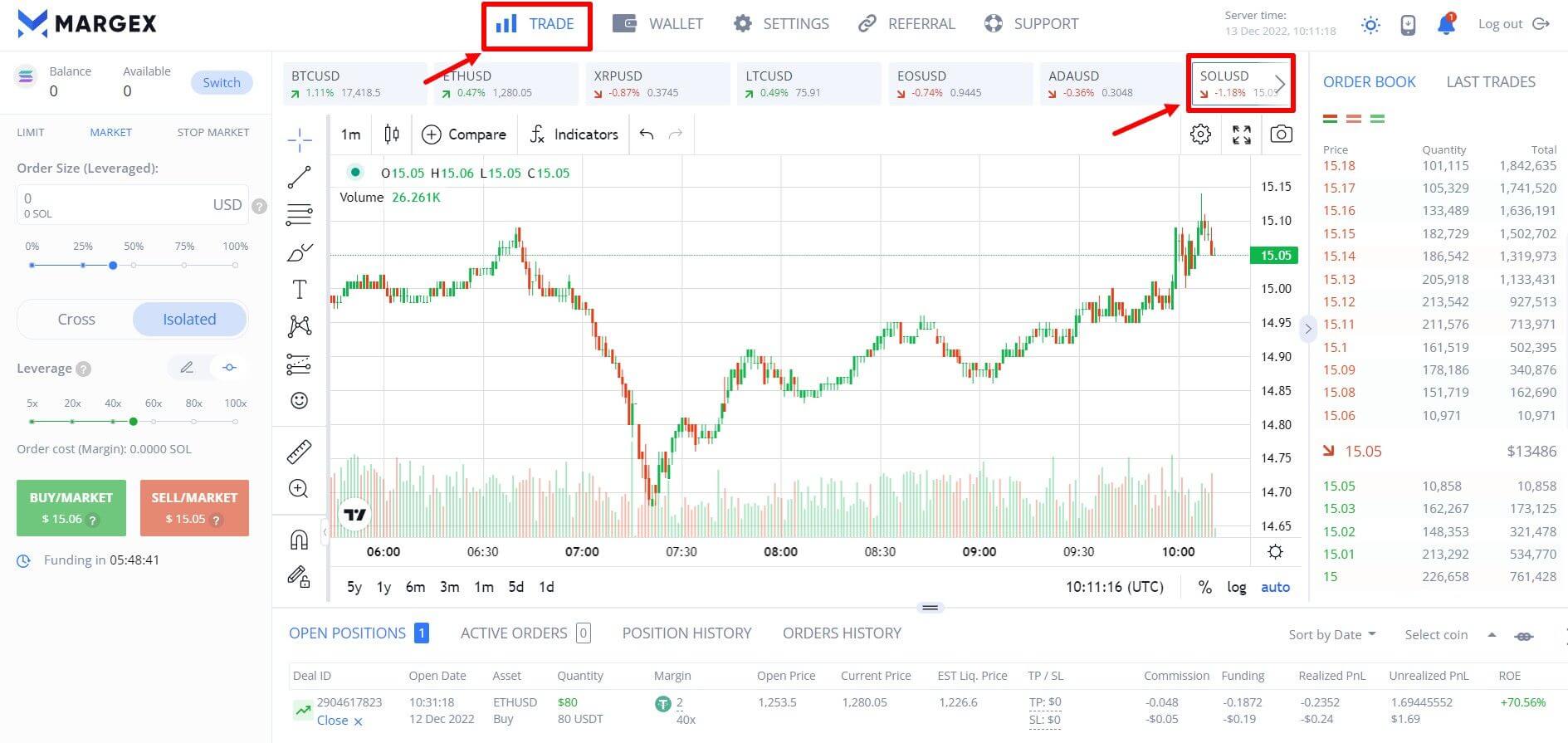

- Signup or login to your Margex account.

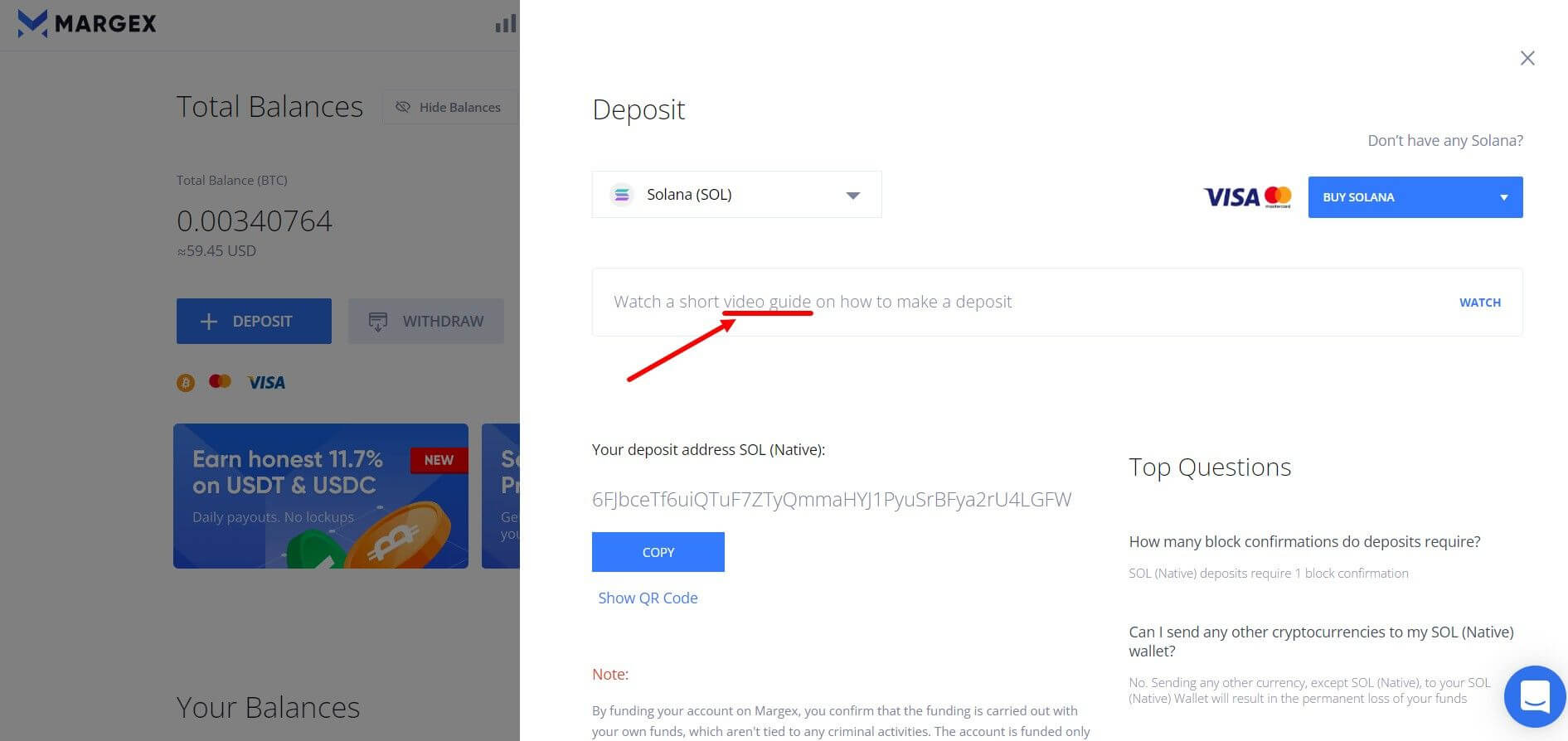

- Next, you click on the wallet and go to deposit: you can purchase SOL tokens directly from your bank.

- Select Solana from the drop-down menu: you can watch a short video guide on how to make a deposit, especially for new traders.

- Next, return to the Margex trading view and click on trade.

- Select SOLUSD by clicking on the arrow at the top right corner of your screen

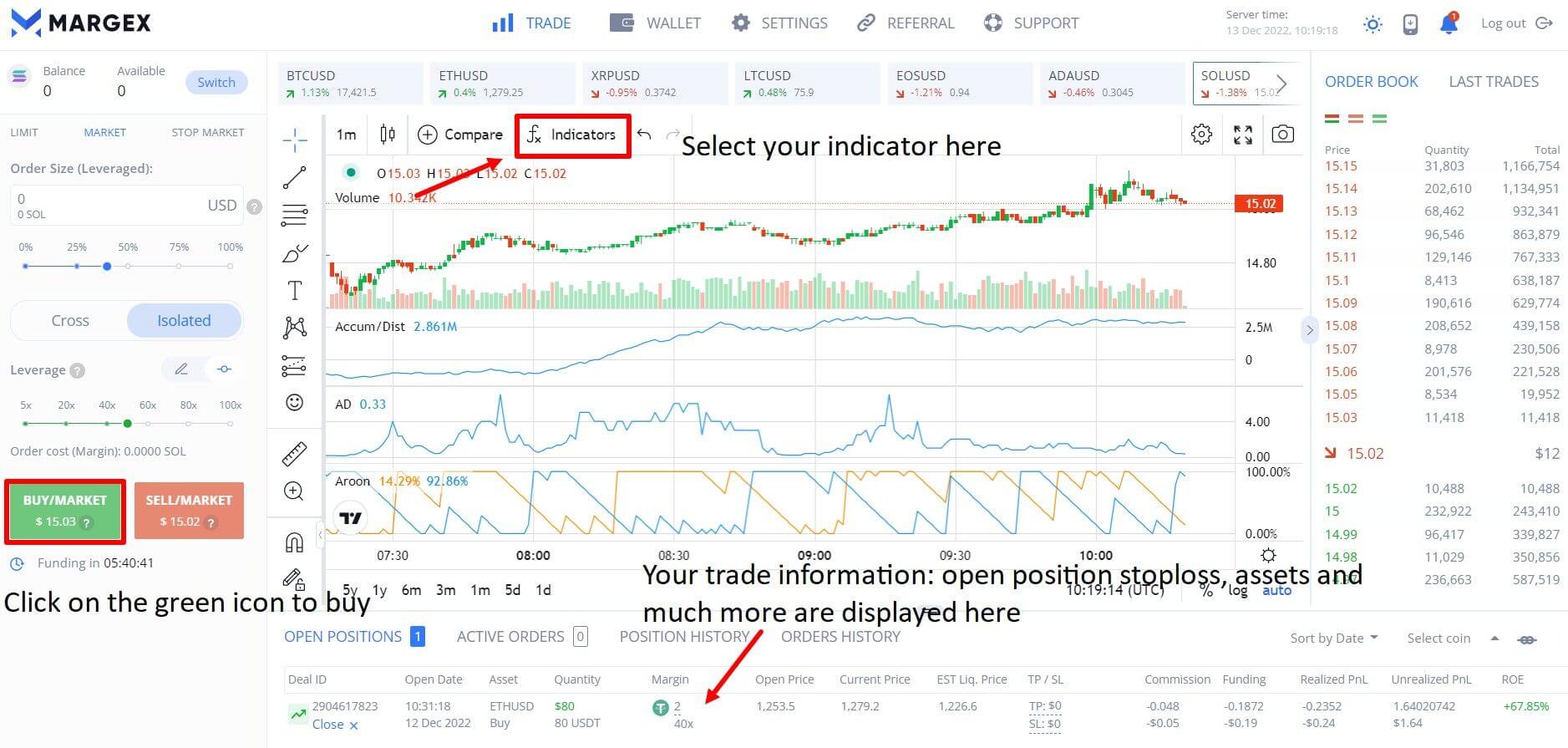

- Select and use Margex quality trading tools and indicators to trade your SOL tokens.

- For instance, applying the Stochastic RSI indicator below and studying the candlesticks show that the market will likely continue the buying trend. This trend is visible in the parallel channel drawn on the chart.

- Click on the green icon to buy and take your profits.

Margex also provides a blog to educate users on trading and ensure you end up with more winning trades.

FAQs-Common Questions About Solana

Find more details about this cryptocurrency and how it works.

What is Solana, and what does it do?

Solana is an open-source blockchain that supports decentralized finance projects, decentralized applications (DApps), and other scalable solutions. It combined consensus mechanisms of Proof-of-Stake (PoS) and Proof-of-History (PoH) to enhance scalability. One of the basic attractive features of Solana is its lightning speed in transaction executions.

Is Sol worth investing in?

Solana tops the line in high scalability, enhanced speed, and growing ecosystem. The project is a good investment option due to low transaction fees, faster processes, and security. However, every investment comes with a risk. So, consider your risk tolerance and conduct proper research on the token.

Is Solana a token or a coin?

Solana is a blockchain network that supports $SOL coins and other tokens. Audius (Audio) and Serum (SRM) are supported tokens on the Solana network. Raydium (RAY) and Mango (MNGO) tokens.

A blockchain can have only one coin but support numerous tokens. SOL is the native coin of the Solana network.

Will Solana work like Ethereum?

Solana competes favourably over Ethereum with high scalability, lower fees, and faster transaction speed. Also, Solana has gained collaborations with top firms such as Google, Microsoft, IBM, Samsung, and others. These contribute to the robust ecosystem of Solana, positioning it to be the next Ethereum.

Who is the owner of Solana crypto?

The major brain behind Solana and the CEO of the protocol is Anatoly Yakovenko. He co-founded the Solana project with Greg Fitzgerald, one of his Qualcomm colleagues.

Is SOL token good crypto?

Solana is one of the best-performing cryptocurrencies in the crypto industry. Solana competes with Ethereum in scalability and transaction costs as a smart contract protocol. Also, its processing speed of 65,000 TPS distinguishes it positively.

How does the Solana network make money?

Solana makes money through its community’s votes for staking rewards. Though the transaction fees are low, increasing the number of transactions increases earnings. Also, there are high earnings in holding the token and its appreciation over time.