Swing trading is a type of trading technique in which traders hold positions for a brief to medium length period. It may be used for any asset (stocks, forex, crypto, etc.).

There are typically two distinct tactics for investing: Day trading or long-term investing. Every day, day traders will purchase into and sell out of various cryptocurrencies. They do this hoping to make money from the coin’s daily swings. Technical analysis is often used substantially in day trading.

Long-term investors are on the opposite end of the spectrum. These investors invest in cryptocurrencies they find appealing to hold for a long time. Let’s take the case of a long-term investor who purchases Bitcoin today. They wouldn’t sell even if the price changed by 40% in the next month. Before making a new choice, they will probably hold onto their Bitcoin for three to five years.

Fundamental analysis is often preferred by long-term investors when appraising assets. Swing trading in crypto often combines these two methods (fundamental analysis and technical analysis). Swing traders often hang onto their holdings for a few days to many months. They do this to profit from price patterns for the assets.

Let’s consider the case of a stock swing trader who wishes to profit from an impending earnings announcement. A few weeks before the publication of the earnings report, they could buy a stock. The day after the information is made public, they would then sell the shares. A combination of technical and fundamental analysis is used in swing trading.

Differences Between Day Trading Crypto And Swing Trading Crypto

The significant distinction between day trading and swing trading in cryptocurrency is the time period. Day traders seek to benefit from short-term market movements within a single day. Consequently, they are more active than swing traders and seldom hold positions for more than one day.

Day trading often places a more significant focus on technical analysis. Swing traders, on the other hand, are more concerned with fundamentals. In reality, some crypto investors may rely their research exclusively on news events and corporate pronouncements, as when Binance suspended Bitcoin withdrawals in June 2022 due to a market collapse.

Individual investment styles and objectives ultimately determine whether to day trade or swing trade cryptocurrency. While some prefer to trade only during the day, others are unfazed by the thought of holding holdings overnight. Furthermore, some investors thrive in high-pressure circumstances, whilst others prefer a more passive approach.

Testing alternative tactics in a sample account before incorporating them into your trading strategy is brilliant.

Swing Trading As A Strategy In The Crypto Space

Various swing trading strategies are available, but it will take some time to find the one that best suits your needs.

Catch the wave

As soon as the trend is in consolidation or correction, you want to wait for a strong price action reversal or chart pattern to reverse.

For example, in swing trading, wait for a bullish price rejection of lower levels (a rebound) in a bullish trend. Once that happens, a LONG trade may be launched. With the stop loss below the recent low and the first profit target at the most recent swing high, it is possible to benefit from a trading pattern.

You may start a trade based on swing analysis and strive for more significant gains if the transaction is in the direction of the primary trend, which usually has a considerably greater potential than the next swing high. It can benefit from a possible continuation of the movement and more extraordinary highs by placing further goals above it. It’s also worth noting that the SELL trade chances appear the same except the other direction.

Buy the pullback

While taking a position immediately after receiving a buy or sell signal is possible, this is not the best method for swing trading or day trading. When a buy or sell call is received, the price moves swiftly, so there is a concern that the price may retrace. As a result, the trader sits on the sidelines and watches for a pullback before entering the market and increasing his risk-to-reward ratio. There’s always the chance that the retreat won’t take place. As a result, if a trader is looking to enhance their RRR (risk-to-reward ratio), they should wait for a decline before placing their stop loss order.

Follow the crowd

Traders identify the coin’s support and resistance levels with this approach over a specific time period. There is no hard and fast rule on how long this period should be.

The price at which a coin will not break past the resistance level is known as the price ceiling. The support level is the price at which the currency will fall before reversing course. Bowling alley bumpers are up on the coin’s pricing. Price will fluctuate between the support and resistance levels. It’s essential to keep in mind that these values might change over time.

In swing trading, following the pattern is as simple as identifying these stages. You may take winnings or start a short trade when the currency reaches a higher resistance level. When the coin comes to this point, it should turn the other way. It is only then that you begin to enter a lengthy posture.

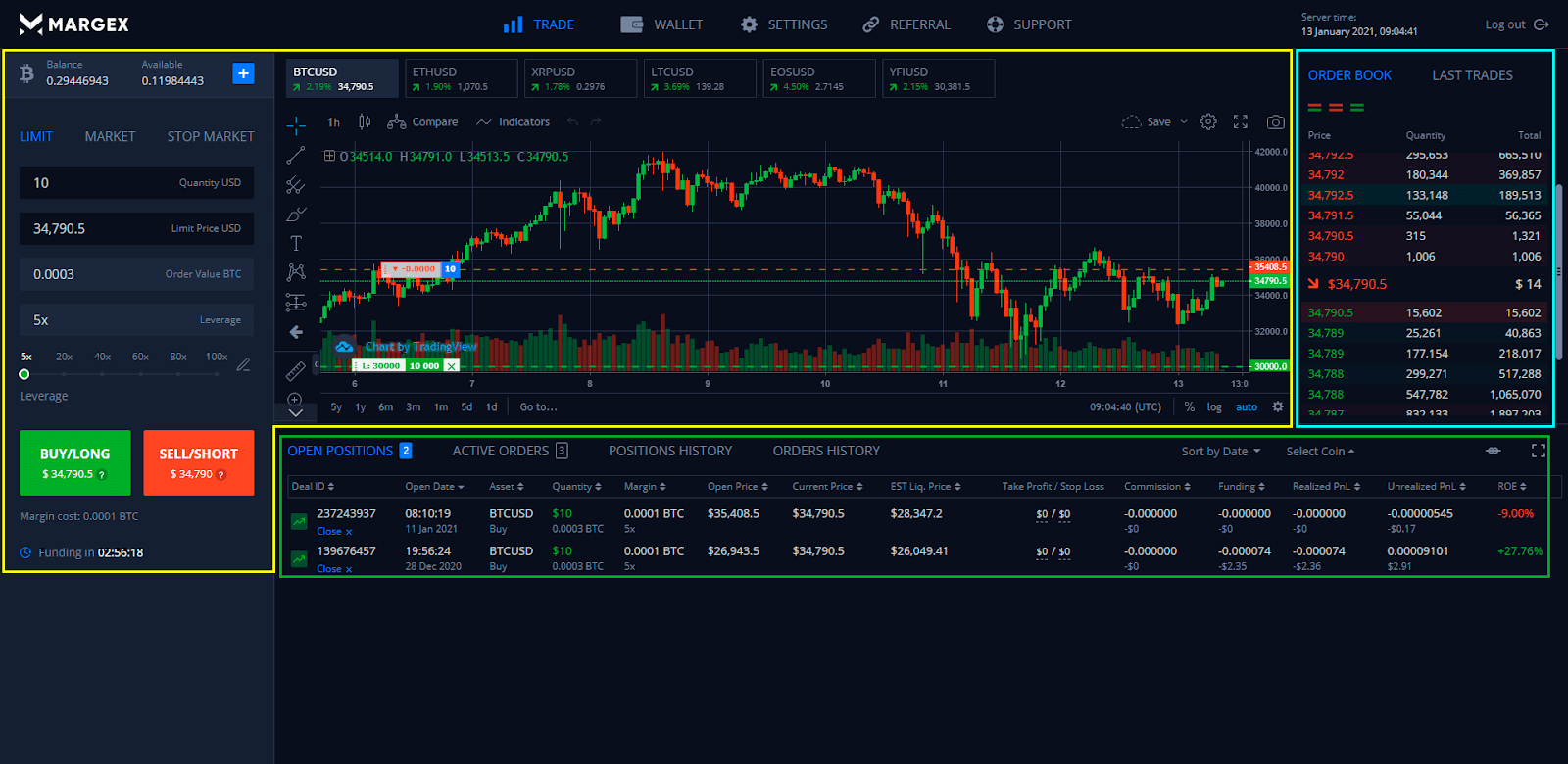

Swing Trading Crypto Tools

Using numerous tools may improve your swing trading approach and give you confidence when things become complicated, regardless of whether you’re investing in Bitcoin or other altcoins.

Copy & social trading

Here are some examples if you’re a newbie who wants to watch swing trading in action. Alternatively, you may seek a broker that allows you to duplicate trades. This is an excellent tool for investors still learning the ropes since it enables you to discuss trading ideas and imitates successful transactions.

Swing traders who have honed their craft on the site may also be found searching for copy-trading suppliers.

Automated systems and signaling

With automated tools like crypto bots and signals, you’ll be able to take on more positions in less time. When certain pre-set conditions are satisfied, trading bots acquire and sell assets independently without human intervention.

You may choose from various robots to fit your swing trading strategy. Depending on volume, orders, time, and pricing, bots may be programmed to do multiple tasks.

There are a variety of signal sources that may either be maintained by another trader or completely automated on specific platforms. These are great for swing trading crypto methods since they may run overnight while open positions.

Furthermore, robots may perform transactions outside of usual trading hours in any time zone since cryptocurrency exchanges are open 24/7, 365 days a year. Even on the weekends, this is true.

Technical analysis

For crypto swing traders, support and resistance levels, Relative Strength Index (RSI), Bollinger Bands, Fibonacci Retracement Volume, Stochastic oscillator, and moving averages are used to evaluate price movement and candlestick chart patterns.

In technical analysis, bullish and bearish areas on a chart are identified by using techniques that assist investors purchase and sell stocks when the trend is in their favor. Trends and breakouts are the two main kinds of trading opportunities that traders will be looking for. Short-term oscillations describe long-term market trends. A breakout signals the beginning of a new trend.

Swing traders rely heavily on moving averages as a critical tool. It is calculated by averaging a crypto asset’s price movements over time. There is a possibility of bullish or bearish momentum when a crossing is found. Moving averages may also be used as a support and resistance level for your strategy.

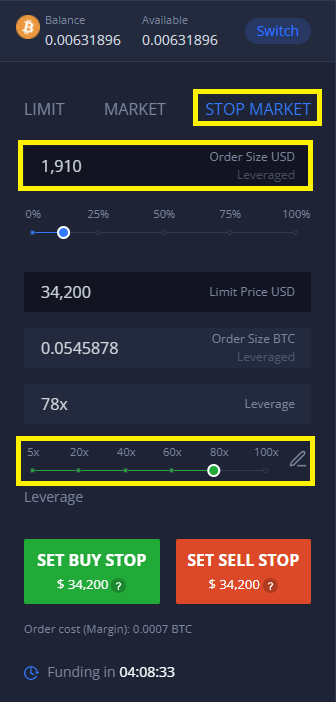

Risk tools

With any swing trading crypto method, you should never risk more than you can afford to lose. Stop-loss criteria are the most excellent way to reduce risk after entering a deal. Stop losses might be used to safeguard your assets while you’re away from your computer since swing trading in crypto often necessitates keeping positions open overnight.

These help you save your account from being wiped out in the event of a loss while allowing you to make a decent profit. The goal is to limit your losses to a modest amount so that your coin profits may eventually exceed your losses.

Risk management features, profit calculators, and live streaming from official news sites are all examples of additional beneficial resources. Swing trading tactics on crypto goods may be practiced using simulators or demo accounts provided by certain brokers.

Risk Management In Swing Trading In Crypto: Storage And Safety

Hot wallets

The term “hot wallet” refers to a cryptocurrency wallet that is constantly online and linked to the cryptocurrency and blockchain. It is possible to see how many tokens you have available for usage and to transfer and receive cryptocurrencies using a hot wallet.

When it comes to the decentralized blockchain ledger for any cryptocurrency you’re using, the cryptocurrency network enables any modifications to the transaction record to keep it accurate.

Cold wallets

Cold wallets are the final and safest form of wallet to use. In the simplest terms, a “cold wallet” is a wallet that isn’t linked to the internet and has a lower chance of getting hacked. Offline wallets and hardware wallets may also be used to describe these wallets.

It is possible to access your portfolio without risking the security of your private key by using these wallets, which keep a user’s address and private key on a non-internet-connected device.

A paper wallet is one of the safest ways to keep bitcoin offline. Using specific websites, you may build a cold wallet known as a “paper wallet.” On a sheet of paper, it generates both public and private keys. Using the bitcoin stored at these addresses is only feasible if you have the relevant piece of paper. In addition to keeping them in their bank’s safety deposit box or even at home in a safe, many individuals laminate and save these paper wallets. You can only access your paper wallet with a piece of paper and the blockchain.

USB drives are often used to store private keys in a hardware wallet. Because your private keys never come into touch with your network-connected machine or possibly susceptible software, this offers significant benefits over hot wallets.

Security

Investing in digital currencies necessitates ensuring the safety of your accounts and valuables. Systems that make it easier to identify potential risks while validating user login credentials should include features for risk management and two-factor authentication (2FA).

Regulations & rules guiding swing trading in crypto

There are fewer regulations and procedures for crypto trading than for FX or stock and share trading.

As a result, decentralized finance (Defi) is precisely what it sounds like. Thus, no authority has the power to track, control, or prohibit bitcoin purchases (unless you use regulated derivatives brokers). As a result, the officials are scrambling to catch up and impose regulations and restrictions.

Swing Trading Crypto Tips

Watch Bitcoin’s movement

Most altcoins are strongly tied to Bitcoin’s movement. Other cryptocurrencies may plummet in value if the price of BTC soars. As a result of this, the altcoin market has seen a drop. BTC’s quick drop in value is frequently followed by a drop in value in the other crypto marketplaces.

Education

Swing trading in crypto is a popular entry point for traders new to the medium- to the long-term investing process. You’ll still need access to high-quality educational materials and other resources for furthering your education.

A crypto training course, a community forum, or a swing trading e-book might all fall under this category. Consider this before selecting a cryptocurrency broker. Investing academies are a feature of some of the most reputable online marketplaces.

Analysis

Swing trading crypto methods rely on technical and fundamental research to succeed. You’ll be well on your way if you’re familiar with daily candlestick charts and the most basic indicators. Although actual events and financial data might influence market volatility, it is still crucial to keep an eye on them.

Identify the appropriate token

At a quick rate, the cryptocurrency market is gaining in popularity. Approximately 10,000 tokens are available. This does not mean, however, that all cryptocurrencies are the same. If you’re a novice to investing, stick to digital currencies with high market capitalizations. Numerous exchanges and marketplaces provide access to these commonly traded digital assets. You may start with Bitcoin (BTC), the Tether virtual currency (USDT), and Ethereum (ETH).

Stay updated with the news

Keep a watch on announcements, events, and news since they may influence the value of cryptocurrencies. Take note of the opinions expressed by prominent cryptocurrency traders, celebrities, businesses, and limited liability firms.

Also, keep an eye out for companies, towns, and even countries to accept tokens as a form of payment. Bitcoin was recognised as legal cash when it came to paying municipal fees in Zug, Switzerland.

Advantages And Disadvantages Of Swing Trading

Advantages Of Swing Trading

A practical approach to mastering swing trading is not as complex as other crypto investment tactics. In addition, the following advantages are available:

- Longer-term strategy: Unlike other kinds of trading, transactions might last days or weeks, so there is no need to spend hours monitoring holdings.

- A lower level of intensity: Because of the longer time horizons and lower frequency of investments, many traders believe swing trading cryptocurrencies to be less stressful than day trading.

- Side hustle: Because of the preceding, it is conceivable to trade part-time while maintaining a full-time career.

- Volatility: When it comes to swing trading cryptos like Bitcoin (or other cryptocurrencies), volatile markets are essential. Since the cryptocurrency market is so unpredictable, it’s possible to make a lot of money.

Disadvantages Of Swing Trading

Unsurprisingly, swing trading cryptocurrency may provide difficulties for both novice and expert investors:

- Overnight risk: Swing trading may result in significant losses since you hold positions for a more extended period than day traders. It would help if you also accounted for any overnight swap costs.

- Price disparities: Some investors may encounter price disparities while holding holdings overnight or at weekends. This might occur when events and news arise after-hours in the market.

- Market timing: Even for seasoned investors, timing market swings may be difficult, particularly in the famously volatile cryptocurrency field.

How To Swing Trade Crypto

Using the procedures outlined below, one may locate a few solid stocks. This will almost certainly assist you:

Chart Patterns

- On daily and weekly periods, look for continuation patterns. Pattern breakouts are most effective when used just once.

- Discover wedges, poles and flags, cups and handles, symmetrical rectangles, and ascending and descending patterns.

Structure

- Begin by watching stock trends on a weekly timeframe; if you trade on significant trends, your chances of winning rise.

Analysis

- Always note main supply and demand zones (support and resistance) on higher TF and critical response points while evaluating stocks.

Stop Loss/Entry

- Wait for a close above your highlighted levels, and resistance on the 1 Hr and 30 Min charts, before entering.

- You also place your stop loss below the swing lows/support level/powerful bullish candle.

Targets

- You may set objectives based on prior swing highs. Your goal zone should be located next to the resistance zones.It would be best if you had practice and execution to acquire trust in your approach.

FAQ

Here are some common questions on swing trading.

Which crypto is best for swing trading?

As previously said, any cryptocurrency in the top 50 or that has previously been there is a contender for swing trading; however, some are consistently better than others.

In no particular order, these are our top cryptocurrencies for swing trading: Chainlink, Cardano, Shiba Inu, Dogecoin, Decentraland, Monero, Ethereum, Ripple, among others.

How much do cryptocurrency swing traders earn?

A swing trader is a person who holds a position in any market sector (cash, futures, or options) for a short period and exits when the profit objective is met. Swing trades are simple to execute and provide traders with a leg up on market volatility.

To get started, swing traders might buy stocks predicted to rise between 5% and 10% if the outcomes are good. Before any upcoming government announcement, you may also take positions by looking at the charts and watching for potential breakouts.

A swing trader may earn anywhere from 40% to 50% ROI in a single month.

Can swing trading crypto make you rich?

Yes, swing trading may lead to financial success. No trading strategy in the world consistently delivers an income. Therefore we must warn you. There will be some losses. Even the most successful traders have been wiped out on occasion. Most individuals should avoid trading unless they have no other options. It’s not complicated at all.

Is it better to swing trade or day trade crypto?

Because swing trading takes longer to play out, keeping track of the deal is not difficult. It is an excellent technique for novices since it allows them to take their time thinking through their transactions instead of day trading, which involves rapid judgments and fast executions.

Which coin is best for day trading?

Currency day trading is a very profitable investment strategy. Many investors take profit via intraday price fluctuations in cryptocurrencies by initiating positions.

To succeed in day trading, you need to select the right moment to buy or sell and the ideal cryptocurrency to trade.

Who is the richest swing trader?

Identifying the wealthiest Swing trader is difficult. However, Mark Minervini has often been mentioned as one. In addition to being included in a Market Wizards book, he has been an elite swing trader for over 30 years. When you look at Mark’s audited returns, you see just how much you can accomplish when you put in the time and effort.

Why do swing traders fail?

Due to a lack of funds, traders often fail. You may earn money straight now when trading the market is simpler. However, there is always a learning curve, and as a result, you may lose part of your initial investment. To minimize risk on a single deal, you must have sufficient funds.