Tether (USDT) is a stablecoin, which is a cryptocurrency that actively seeks to maintain its value through market mechanisms. It’s used by investors who want to protect themselves against the inherent volatility of their cryptocurrency investments while still keeping value in the crypto market and ready to use.

Tether is a fiat-collateralized stablecoin, which means it is backed by a fiat currency such as USD, CAD, AUD, or even Yen (JPY). Tether was created to bridge the gap between fiat currencies and blockchain assets while providing USDT users with transparency, stability, and low fees. Tether is linked to the US dollar, and dollars are exchanged at a 1:1 ratio.

In essence, Tether crypto enables users to “store, send, and receive 1-to-1 backed digital currency across tether-integrated exchanges, platforms, and wallets” by leveraging blockchain technology. The goal is to provide users with the benefits of both blockchain technology and traditional currency, allowing for global, instant, and secure money transfers at a fraction of the cost of any other option.

However, Tether Ltd. makes no guarantees about any right to redeem or exchange Tether for USD. USDT cannot be exchanged for USD directly through the Tether company.

What Makes Tether Unique?

Apart from knowing what Tether is, it is important to also explore what makes it a unique coin. There are numerous stablecoins available, many of which are pegged to the US dollar. Although it effectively provides the same service as its competitors, Tether’s popularity (and that of one of its main competitors, USD Coin (CRYPTO: USDC)), distinguishes it.

Tether has the highest market cap of any stablecoin. More importantly, its daily trading volume is much higher. Tether, in fact, has the highest 24-hour trading volume of any cryptocurrency, so it plays a significant role in the digital token ecosystem.

Stablecoins have an advantage over other types of cryptocurrency in that they have a predictable price range under normal circumstances. Because they are not volatile, they are used differently than cryptocurrencies purchased as an investment. The following are the most common applications for stablecoins like Tether:

- Sending money to another party anywhere in the world via digital means.

- Transferring funds between crypto exchanges.

- Earn high-interest rates by lending out your stablecoins (some lending platforms pay more than 10%).

- Storing funds on an exchange so that they can be quickly exchanged for other cryptocurrencies.

Tether is easier to use than other stablecoins due to its popularity and high trading volume. For example, most of the top cryptocurrency apps allow you to buy, sell, or trade Tether. And, given the trading volume, you should have no trouble using your Tether.

Tether’s largest crypto token is USDT, but it also has tokens tied to the euro, yuan, and gold.

A stable value encourages the use of stablecoins as a medium of exchange, similar to traditional money. As previously stated, stablecoins have made it easier to speculate in cryptocurrency markets. Stablecoins’ rapid popularity is also due to their use as collateral by decentralized finance (DeFi) lending and staking protocols.

Tether’s price briefly fell to $0.96 in May 2022, following the collapse in the value of a different stablecoin, TerraUSD (UST), issued by an issuer unaffiliated with Tether or BitFinex.

Tether tokens quickly recovered to more than $0.99, and Tether announced that it would continue to honor redemption requests that had reached 2 billion tokens on May 12 at a 1-to-1 ratio to the US dollar.

How Tether Works

It is not enough to know what a USDT coin is. You must also understand how it works and how you can benefit from it.

The crypto token Tether is distributed across several significant blockchains. The objective of Tether is for 1 USDT to be equivalent to $1. To support the tokens it issues, Tether Limited keeps reserves on hand to achieve this.

To ensure that buyers can get their money back if they want it, Tether Limited needs $1,000 in reserves to mint 1,000 USDT. Although, in theory, that is how Tether is supposed to operate, things are a little more complicated in practice because Tether Limited has had problems being trusted with its reserves. Initially, the company stated that every USDT was backed one-to-one by $1, which proved false.

According to a lawyer for Tether Limited, 74% of USDT tokens were backed by cash or cash equivalents in 2019. On the other hand, only 2.9% of USDT tokens were backed by cash in 2021, according to a breakdown of Tether Limited’s reserves. Commercial paper, corporate bonds, and secured loans made up the remainder of its reserves.

In conclusion, Tether Limited asserts that the company’s reserves fully back all USDT. These reserves are not all cash; they consist of various assets. The fact that there is no legal assurance that a USDT token will be redeemable for $1 is also important to note.

Who Are The Founders Of Tether? (History of USDT)

Realcoin, which was the predecessor to Tether (USDT), was first introduced on October 6th, 2014, by Brock Pierce, Reeve Collins, and Craig Sellars (a member of the Omni Foundation).

As a result, they were able to develop Tether on the Omni Protocol, which allowed users to create and exchange assets and currencies based on smart contracts on the blockchain of Bitcoin. Reeve Collins, the CEO of Tether, announced the renaming of their token from Realcoin to Tether on November 20th, 2014. (USDT).

The contentious history of Tether began with the product’s release. Tether (USDT) was first able to be traded on Bitfinex’s exchange platform in January 2015. With USD transactions going through Taiwanese banks, who then forwarded the transactions to Wells Fargo, Tether’s volume rose quickly on the blockchain network. That persisted up until 2017.

US banks blocked tether’s international transfers on April 18, 2017. Many users speculated if the Tether currency reserves actually existed or if the entire stablecoin would collapse due to a lack of transparency leading up to and during these events, followed by leaks such as the Paradise Papers amid accusations of market manipulation.

This was made worse in 2017 when withdrawals were temporarily halted. These news events resulted in significant volatility for USDT holders.

Tether’s (USDT) outstanding has increased from $10 million in January 2017 to nearly $2.8 billion in September 2018. In April of 2019, New York Attorney General Letitia James filed a lawsuit accusing Bitfinex and Tether of misappropriating reserves funds to cover an 850 million dollar deficit.

Bitfinex and Tether agreed to pay an $18.5 million penalty in 2021. Tether remains the focus of speculation in cryptocurrency markets and blockchain networks, with many users concerned about its liquidity and stability risks.

How Many Tether (USDT) Coins Are In Circulation?

There is no hard-coded limit on the total supply of USDT — because it belongs to a private company, its issuance is theoretically limited only by Tether’s own policies. However, because Tether claims that each USDT is backed by one US dollar, the number of tokens is limited by the company’s actual cash reserves.

Furthermore, Tether needs to disclose its issuance schedules in advance. Instead, they issue daily transparency reports outlining the total value of tether asset reserves and liabilities, the latter corresponding to the amount of USDT in circulation.

According to Tether, there are over 14.4 billion USDT tokens in circulation as of September 2020, backed by $14.6 billion in assets.

Tether’s price is currently $0.999074, with a 24-hour trading volume of $177,851,222,258. Our USDT to USD price is updated in real-time.

Tether has fallen by 0.11% in the last 24 hours. With a live market cap of $69,798,189,590 on CoinMarketCap, it currently ranks third-biggest cryptocurrency. The circulating supply is 69,862,912,743 USDT coins, and the maximum supply is unknown.

How To Use Tether (USDT)

Tether is valued for its stability in comparison to other cryptocurrencies, which are much more volatile and prone to erratic price movements and this is what Tether crypto is about. Furthermore, some users prefer that tethers avoid the banking system and can instead be transferred between cryptocurrency exchanges or other platforms.

Tether’s USDT is also available as a trading pair on some exchanges, allowing users to purchase cryptocurrency tokens with a coin that is pegged to the US dollar (i.e., mirrors its value). Given bitcoin’s volatile price, this can be extremely useful.

Tether is valued by businesses such as exchanges, wallets, payment processors, financial services, and ATMs because it allows them to easily use traditional currencies on blockchains. The digital coin also provides liquidity to exchanges that are unable to deal in dollars (e.g. Margrex).

Rather than holding traders’ balances in dollars, many exchanges hold them in UTSD. Maintaining banking relationships in the crypto space is especially difficult, so exchanges use Tether to price crypto assets in USD without the need for USD-denominated bank accounts.

How To Choose A Tether (USDT) Wallet

The type of Tether (USDT) wallet you select will most likely be determined by what you intend to use it for and how much money you need to store.

Hardware wallets, also known as cold wallets, are the most secure option, as they allow for offline storage and backup. The hardware wallets Ledger and Trezor both support USDT storage. On the other hand, hardware wallets have a higher learning curve and are more expensive. As a result, more experienced users may be better suited to storing larger amounts of USDT.

Software wallets are another option that is both free and simple to use. They can be custodial or non-custodial and can be downloaded as smartphone or desktop apps. The service provider manages and backs up your private keys when you use custodial wallets.

Non-custodial wallets store private keys on your device using secure elements. While they are more convenient, they are regarded as less secure than hardware wallets and may be better suited to smaller amounts of Tether (USDT) or more inexperienced users.

Online wallets, also known as web wallets, are free and simple to use and can be accessed from various devices via a web browser. However, they are considered hot wallets and are less secure than hardware or software alternatives. You should choose a reputable service with a track record in security and custody because you are likely entrusting the platform with your USDT. As a result, they are best suited for smaller amounts or more experienced frequent traders.

Kriptomat provides a secure storage solution, allowing you to store and trade your Tether (USDT) tokens easily. You get enterprise-grade security and user-friendly functionality when you store your USDT with Kriptomat.

Selling and buying USDT and exchanging them for other cryptocurrencies can be done on cryptocurrency exchanges such as Margrex.

Tether (USDT) Staking

Tether staking is a popular way traders use to increase their holdings. There are several platforms that offer staking options for users. Margex is one of the most popular and allows users to gain 11% APY from staking USDT.

In addition, the staked assets can be used as collateral for margin trading enabling investors to increase their earning capabilities. Margex staking is also flexible as users can unstake their assets with any penalties or holding period. There is also a staking calculator that provides a means for users to calculate their potential rewards on Margex.

FAQ

How is Tether (USDT) secured?

The USDT token can currently be issued on the following cryptocurrency networks: Bitcoin, Ethereum, EOS, Tron, Algorand, and OMG Network. Because smart contracts and tokens are hosted on these blockchain networks, the nodes and miners who keep these networks secure using Proof-of-Work or Proof-of-Stake are also in charge of the base security.

These platforms perform regular audits to ensure that the code is current, secure, and compliant with the current framework, and Tether ensures that USDT remains compliant with each network.

How to buy Tether (USDT)

Margrex is the place to go if you want to know where to buy Tether. They provide a safe and secure way to purchase cryptocurrencies via a user-friendly platform. Their mission is to make crypto and stablecoins more accessible, and with a variety of payment methods, you could buy USDT in seconds!

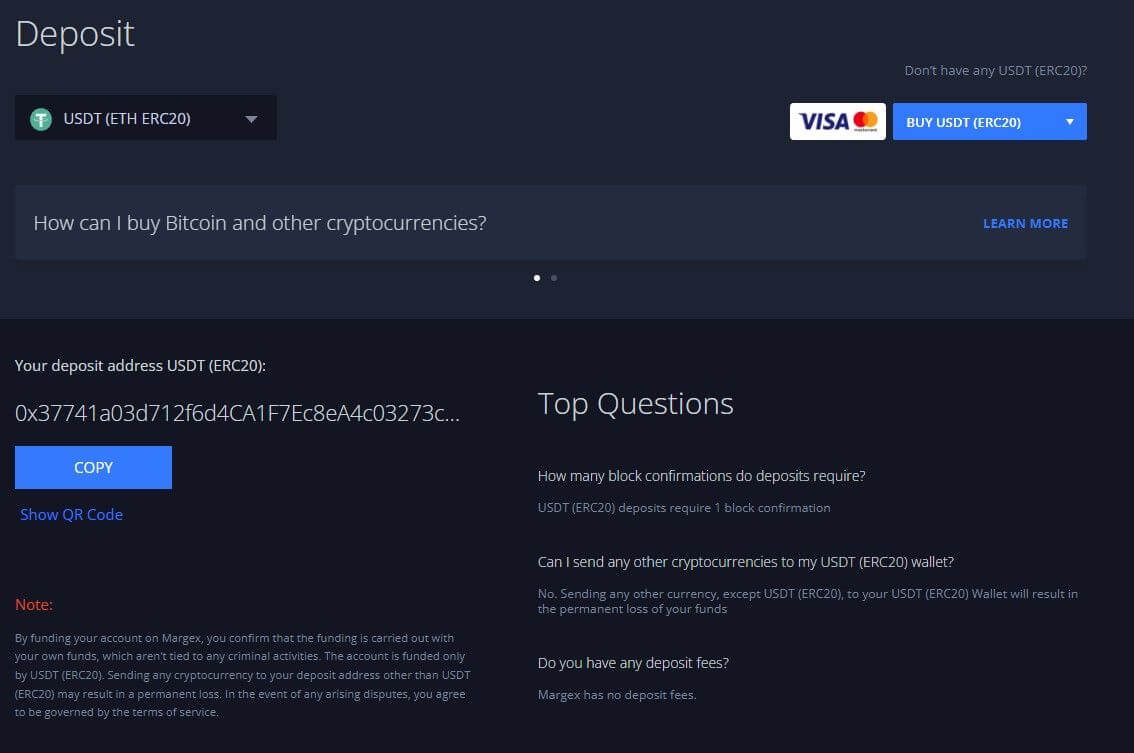

At Margex, it only takes a few clicks to buy USDT quickly and securely. USDT is a stablecoin that is pegged to the US dollar, so its current price should not fluctuate significantly.

But first, you must create an account by following the steps outlined below.

Step 1

Create a user profile

Fill out the needed information on the Sign-up page. “Register” is the only option. You’ll get an email to confirm your registration.

Step 2

Deposit USDT

Fund your USDT account or deposit from the different payment options on Margex.

- Directly transfer cryptocurrency to your Margex wallet from another address.

- Use Changelly or Changenow to buy cryptocurrency using a bank card.

Once you’ve bought the desired amount, you can leverage your USDT by staking, trading or saving on Margex for rewards.

Is Tether a good investment?

Tether isn’t exactly an investment because it’s intended to keep its price at $1. The value will not rise like that of other cryptocurrencies and cryptocurrency stocks.

As previously stated, Tether can be used to generate passive income. There are numerous crypto lending platforms that will offer you competitive interest rates for your Tether. It’s one way to earn more interest than a traditional savings account.

Keep in mind that this is not without risk. Tether is not insured or guaranteed in the same way that money in a bank account is. Although Tether USDT coin value has generally remained constant at $1, this could change in the future.

How does Tether stay at $1?

Tether has fallen below $1 on occasion (and risen above its peg on others), but it can stay close to that level as long as it continues to redeem USDT tokens for $1 each, and as long as investors believe issuance proceeds are fully reserved with liquid collateral assets.