Is trading strategy important when trading in the cryptocurrency market? Successful traders understand the need to strategise before making trading decisions. However, crypto trading is a skill that requires time to study and understand, which is why you need to strategise your move in an irregular market.

So far, there are various types of trading styles. But these strategies are unique to the kind of investors, especially when emotions are involved in trading.

As an active trader, you can day-trade, swing, trend, and scalp. On the other hand, passive investors prefer to buy and hold their assets for long periods. While each crypto trading technique has risks, they provide a level of guarantee for you.

Nevertheless, there is one unique trading strategy that this article aims to explore. Do you want to learn more about touch trading and its advantages and disadvantages? Keep reading to learn more.

Definition Of Touch Trading

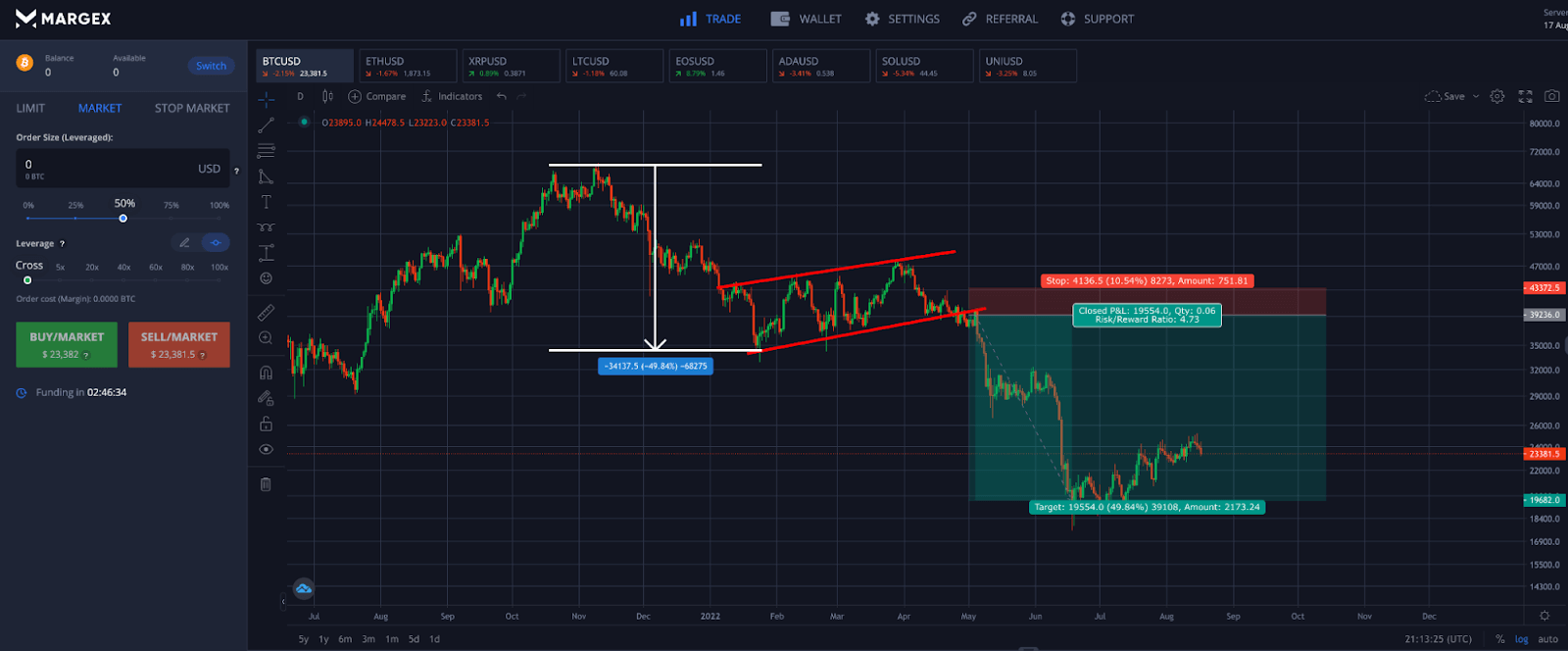

Touch trading is a strategy that allows traders to venture into the market after observing their areas of interest on the chart, leading them to potential trading opportunities. It requires a trader to make a move based on their prediction of a selected market asset within a timeframe.

As a result, traders can only trade at horizontal support and resistance level that is within ‘touch’ of the level without waiting for added price action confirmations. In most cases, touch trading has two major outcomes that can emerge within a trade. A profit occurs when the trader can accurately predict the strike price hitting the target price, while a loss occurs when the opposite occurs.

Traders in binary markets favour this form of trading as it provides faster trade resolutions since it does not require a trading contract to expire. All that is needed is for the price to hit a preset strike mark within the trading duration.

Trading is set to be complete when the price of an asset touches the target price predicted within a timeframe. Once this is achieved, the trader can receive his profit and execute the trade contract.

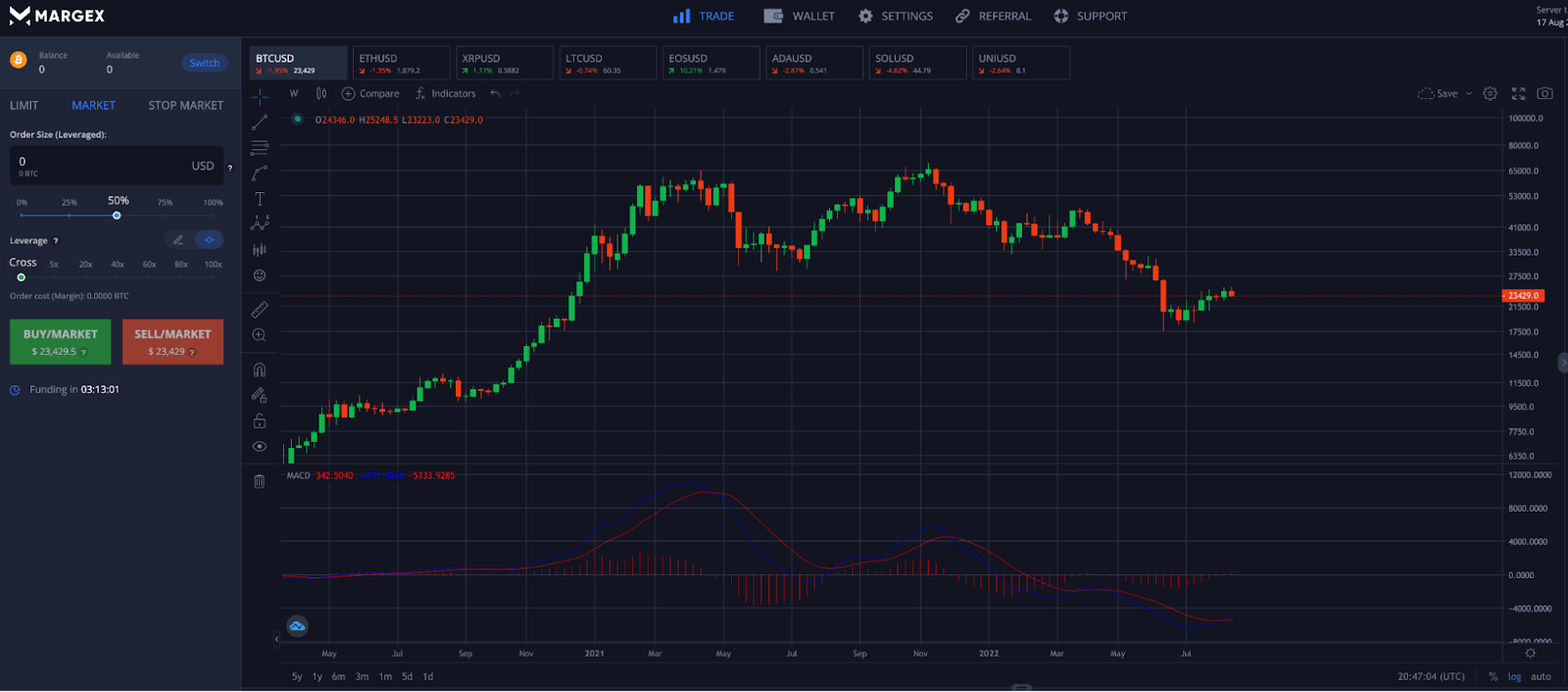

Traders who want to utilize the touch trading techniques must be well versed in studying market trends and price action dynamics in their respective markets. Therefore, they must be familiar with analytics tools and monitor price changes before entering the market.

Furthermore, they must identify major trading factors that affect the asset they desire, including the trading frame, strike price and fundamental analysis. The crypto market, for one, is volatile and, compared to other markets, swings widely, making touch trading a highly technical strategy.

Finally, as a novice who wants to utilise this strategy in real market situations, you should conduct extensive testing on the technique.

Benefits of touch trading

Getting it at the source

In the commodity market, buyers with a direct link to the product or service manufacturers usually benefit more than when they trade with intermediaries. This benefit also applies to cryptocurrency trading. Aggressive touch traders enjoy getting in at the source, leading to early entry and a potentially high-profit margin.

Extra trade setups

In any form of business, fortune favours risk takers compared to conservative investors who are unwilling to take their chances. In application to cryptocurrency, touch trading is a form of aggressive technique that delivers much profit.

Consequently, trading without price action confirmations can remove the extra filters related to conservative trading techniques. You are left with a more flexible and adaptive trading strategy that guarantees better transaction opportunities.

Therefore, touch trading favours risk-averse traders capable of identifying trade-able opportunities and can leverage market movements for quick profits.

Tighter trade management

The touch trading technique also allows you to avert losses during the bear market wave. Because you are trading at the source, you can bail out when the market counters at the interest point and go sideways.

Touch trading employs a trade management technique that leads to floating stop loss or tight fixed placements, relying on the market’s sharp reversal of the resistance area. Therefore, a stricter stop increases the risk-to-reward ratio, not to add that early market entry brings more profit.

Traders can easily get out of trades in time, limiting losses on their capital. On the other hand, conventional price action trading strategies require more in-depth stop loss placements because traders enter the market far away from the entry point. This can be detrimental to traders as they can easily fall into deep losses during an extended bearish period.

Therefore touch trading allows traders to have flexibility as they can quickly adjust based on the market condition. This ensures that traders can test different entries into the market and get more opportunities to make profits on their capital.

Setbacks of touch trading

Lower hit rate

One of the major cons of touch trading is a lower hit rate. High trading opportunities do not guarantee a high hit rate. As a touch trader, you could get more trading opportunities, leading to your hit rate for profitable trades being lower than that of a conservative investor who likes to wait for apparent price action confirmations.

While in theory, a combination of a higher hit rate with a lower trading frequency should be equivalent to a strategy that uses a lower hit rate but higher trading frequency. This does not apply in real-life cryptocurrency trading. This reason is that every trader has a different personality, and most cannot seem to maintain the balance between aggressive and conservative trading.

Furthermore, conservative trading strategies are regarded as generally safer as it requires stacking assets for the long-term. Therefore many traders gravitate towards that than touch trading, which is a hit-or-miss strategy that requires a large sample size to make a significant profit.

Not for Beginners

Touch trading works better for experienced investors because it is more aggressive and subjective. Because of the nature of this strategy, successful touch traders would have understood the market dynamics and price actions. Therefore, beginners may find it challenging to excel using touch trading techniques.

It is not enough to understand the market’s vital support and resistance points, place stop or limit orders, and fish for trading opportunities. Additionally, touch trading is synonymous with

“Blind” trading, but traders cannot make successful investments with closed eyes. It requires discipline and the ability to concentrate while adjusting to different market conditions.

This can be overwhelming for beginners who typically have the urge to chase losses and are too emotional to have the patience to change their trading models. This could lead to significant losses to their portfolio.

Subjective trade management

While touch trading involves an aggressive nature that has its advantage, it also has its weakness, especially for new and intermediate investors. This is because emotions play a part in every investment decision, and it may be hard for some traders to make subjective judgments that require a quick response to the market’s performance.

Most traders often use crypto trading techniques that suit their objective nature, going against an aggressive trading method like touch trading. Unsurprisingly, expert investors have little to lose when they take the bull by the horn because of the higher risk-to-reward ratio.

FAQ

What is touch trading?

In a nutshell, touch trading is a form of trading when you predict that the price of an asset would ‘touch’ or ‘not touch’ the set price within the duration of a certain time frame, based on a trader’s technical analysis of the price movement.

Is touch trading profitable?

Touch trading strategy is considered a high risk-to-reward strategy. While it allows to gain some good returns in a short time, it is also very hard for a beginner to get a hold of as it requires a good understanding of market trends and basics of chart analysis.

What are the drawbacks of touch trading?

For the most forestanding drawbacks there are:

- Low hit rate – being an aggresive trading strategy, touch trading involves higher trading frequency and a lower hit rate;

- Not beginner friendly – touch trading requires good knowledge of basic technical analysis and market trends, which could be hard for novice traders to get a grasp on, subsequently leading to a very long learning curve and thus delayed profit earnings;

- Emotionally draining – touch trading, as was already pointed out, is a very aggressive trading strategy and would require a trader to make split-second decisions on the market movement, which is not suitable for more passive and conservative traders to be involved in.