Cryptocurrency trading can be used to make a lot of money. Trading methods assist you in putting all of your techniques into a logical, followable framework. This way, you can keep track of your Bitcoin strategy and make adjustments as needed.

Technical analysis (TA) and fundamental analysis (FA) are the two primary schools of thought you should examine while developing a trading strategy. Before we go any further, be sure you grasp the distinctions between these concepts.

The focus of this article is on cryptocurrency trading tactics. Other financial assets, such as currencies, stocks, options, and precious metals like gold, may also be affected.

Do you want to come up with your own trading strategy? This post will teach you the fundamentals of how to approach crypto market speculation. You’re more likely to meet your trading and investment objectives if you have a sound trading plan.

What is a crypto trading strategy?

A trading strategy is a comprehensive plan that covers all aspects of your trade. It’s a structure you design to help you with your trading.

A trading plan can also reduce financial risk by removing many unneeded decisions. While it is not necessary to have a trading plan in order to trade, it can be life-saving at times. If something unexpected occurs in the market (which it will), your trading plan, not your emotions, should determine how you react. To put it another way, having a trading strategy in place prepares you for any eventuality. It keeps you from making fast, rash judgments that can result in significant financial losses.

A complete trading plan, for example, might comprise the following:

- Which asset classes do you want to deal in?

- What kind of setups do you plan to use?

- Which tools and indicators do you employ?

- What causes you to enter and exit (your stop loss placement)?

- What determines the size of your position?

- How do you keep track of and evaluate your portfolio’s performance?

Furthermore, your trading plan may include other broad principles, including minor specifics. You can, for example, specify that you will never trade on Fridays or when you are tired or sleepy. Alternatively, you can set up a trading plan so that you only trade on certain days of the week. Do you monitor the Bitcoin price over the weekend? Before the weekend, always close your positions. This type of personalized advice can also be used in your trading strategy.

Backtesting and forward testing may be used in the development of a trading strategy. As you’ll see momentarily, trading strategy definitions aren’t always strict, and there may be overlap between them. In fact, a hybrid approach integrating different tactics is worth exploring.

Features of cryptocurrency trading

-

Anonymity – Transactions, including personal and company data, are linked to a random sequence of characters rather than the owner’s identity. The popularity of some virtual currencies is a good indicator of supply and demand. Contracts cannot be linked to individuals or businesses.

-

Secure – Cryptocurrencies can be held in virtual wallets that are protected by a private key. This means that the collected funds are exclusively accessible to the possessor. The owner of a virtual currency should use encryption technologies on their storage devices to boost security.

-

Not centralized – Cryptocurrency flow and quotations are not regulated by any government. Virtual currency trade does not take place in a single location. This keeps trading from being disrupted after a hacking attempt. Because transaction data is stored directly by Bitcoin holders, it is spread over the network.

Best crypto trading strategies for a beginner

As a beginner, you need to know that there are two types of crypto trading strategies. They are:

- Active trading strategy

- Passive trading strategy

Active trading strategies

Within this strategy, there are FOUR trading strategies, and they include:

Day trading

The most well-known active trading approach is probably day trading. It’s a popular misperception that all active traders are day traders by definition, but this isn’t the case.

Day trading is when you open and close positions on the same day. As a result, day traders seek to profit on intraday price swings or price changes that occur inside a single trading day.

The phrase "day trading" comes from conventional marketplaces, where trading is limited to certain hours of the day. As a result, when trading is halted, day traders in those markets never stay in positions overnight.

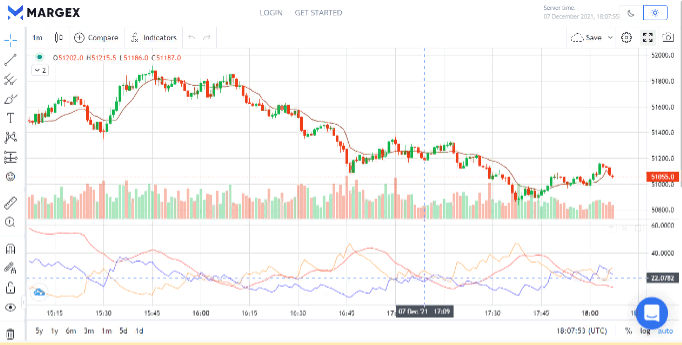

The majority of digital currency trading platforms are available 24/7, 365 days a year. When it comes to the crypto markets, day trading is applied in a somewhat different way. It usually refers to a short-term trading strategy in which traders enter and exit positions within a 24-hour timeframe or less.

Price action and technical analysis are commonly used by day traders to generate trade ideas. They may also use a variety of different strategies to identify market inefficiencies.

Intraday trading is best for trading crypto derivatives because trading inside the funding interval exempts you from paying funding fees

Swing trading

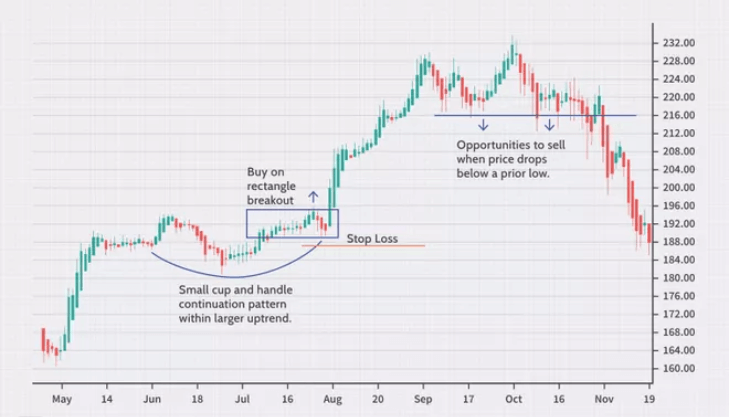

Swing trading is a form of longer-term trading technique that entails holding positions for more than a day but no more than a few weeks or months. Swing trading is a hybrid of day and trend trading in several ways.

Swing traders try to profit on volatility waves that last several days or weeks. Swing traders may formulate their trading ideas by combining technical and fundamental factors. Fundamental changes, by their very nature, may take longer to manifest, which is where fundamental analysis comes in. Nonetheless, chart patterns and technical indicators can play a significant role in swing trading.

Swing trading may be the most practical active trading method for novice traders. Swing traders take longer to complete than day transactions, which is a considerable advantage. Still, they’re short enough that keeping track of the trade isn’t too difficult.

This gives traders additional time to think about their choices. They usually have adequate time to react to how the trade is progressing. Swing trading allows you to make more reasonable selections with less haste. Day trading, on the other hand, frequently necessitates quick judgments and execution, which isn’t ideal for a novice.

Trend trading

Trend trading, which is also known as position trading, is a strategy that entails holding positions over a longer period of time, usually at least a few months. Trend traders, as the name implies, strive to profit from directional trends. In an uptrend, trend traders can take a long position, while in a downtrend, they can take a short one.

Fundamental analysis is generally used by trend traders, however, this is not always the case. Nonetheless, fundamental analysis takes into account events that may take a long time to unfold, and these are the moves that trend traders seek to profit from.

A trend trading strategy is based on the assumption that the underlying asset will continue to move in the trend’s direction. Trend traders must, however, consider the likelihood of a trend reversal. As a result, they might use moving averages, trend lines, and other technical indicators in their approach to try to boost their success rate and reduce financial risks.

Beginner traders can benefit from trend trading, provided they do their homework and manage their risk.

Scalping

Scalping is one of the most rapid trading tactics available. Scalpers don’t aim to profit from major moves or long-term trends. It’s a strategy that focuses on repeatedly exploiting tiny moves: profiting from bid-ask spreads, liquidity gaps, and other market inefficiencies, for example.

Scalpers don’t intend to keep their positions for an extended period of time. Scalpers are known for opening and closing positions in a couple of seconds. As a result, scalping is frequently associated with High-Frequency Trading (HFT).

If a trader discovers a market inefficiency that occurs frequently and that they can exploit, scalping can be a very profitable approach. They can benefit in little increments each time this occurs. Scalping works best in markets with significant liquidity, when entering and exiting positions is reasonably easy and predictable.

Scalping is a more advanced trading strategy that, due to its intricacy, is not suggested for newcomers. It also necessitates a thorough knowledge of market dynamics. Also, it is often better suited to larger traders (whales). Trading larger holdings makes more sense because the profit percentage targets are typically smaller.

Passive investment strategies

Buy and hold

"Buy and hold" is a passive investment strategy in which traders purchase an asset with the intention of holding it for an extended period of time, regardless of market movements.

This method is most commonly used in long-term investment portfolios, where the goal is to just get in the market and not worry about timing. The concept behind this method is that over a long enough time frame, timing and entry price are irrelevant.

The purchase and hold approach is virtually always focused on fundamental analysis, while technical indicators are rarely used. The method is also unlikely to include assessing the portfolio’s performance only once in a while, not on a regular basis.

The hold-on for dear life (HODL) phenomenon can be linked to the buy and hold approach, despite the fact that Bitcoin and cryptocurrencies have only been around for a little more than a decade. Cryptocurrencies, however, are a dangerous and volatile asset class. While buying and keeping Bitcoin is a well-known cryptocurrency strategy, the purchase and hold strategy may not be appropriate for other cryptocurrencies.

Index investing

In most cases, index investing entails purchasing ETFs and indices on regular stock exchanges. However, in the cryptocurrency marketplaces, this type of goods is also available, both within the Decentralized Finance (DeFi) movement and on controlled Bitcoin exchanges.

The aim of a crypto index is to construct a token that measures the performance of a group of crypto assets. This basket can contain coins from the same industry, such as privacy coins or utility tokens. It might even be something completely different, as long as it provides a consistent pricing feed. As you may expect, the majority of these tokens rely largely on blockchain oracles.

What are the benefits of crypto indexes for investors? Instead of purchasing a single privacy coin, users might invest in a privacy coin index. This way, they can gamble on privacy coins as a sector rather than a single coin, reducing the danger of a single coin bet.

Over the next few years, tokenized index investing is likely to become increasingly popular. It allows for a more hands-off approach to investing in the blockchain and cryptocurrency industries.

Which strategy to use to trade Bitcoin futures

Swing trading is one of the best trading strategies to use when trading Bitcoin futures or any cryptocurrency. Crypto swing trading is popular with traders of all levels of experience. In order to detect daily and weekly trends, successful crypto swing traders generally utilize technical analysis to examine short to medium-time frame charts. Fundamental analysis is also necessary because economic events might take days or weeks to unfold.

Swing trading is a simple approach to learn and is less demanding than other crypto trading strategies. You also get the following benefits:

- Long-term strategy – Swing trading, unlike other forms of trading, does not necessitate spending hours watching deals because trades might span days or even weeks.

- Lower intensity – Due to the longer timeline and lower frequency of trades, many traders believe swing trading cryptos to be less stressful than day trading.

- Trade part-time – As a result of the above, it is possible to trade around your lifestyle while still working full-time.

- Volatility – Volatility is essential when swing trading cryptos like Bitcoin. The cryptocurrency market is extremely volatile, making it appealing to skilled swing traders.

Beginner tips from professionals

-

Have a strategy for crypto trading – Examine the project with a critical eye. What is the total number of users? What problem is it supposed to solve? Does it have any ties to the business world? Avoid coins that claim to be from the Earth but haven’t been delivered.

-

Manage risk – Set boundaries on how much you invest in a particular digital currency, and don’t risk more money than you can afford to lose by trading with it. Cryptocurrency trading is a high-risk endeavor, with the majority of traders losing money.

-

Diversify your crypto portfolio – It’s not a good idea to put too much money into a single cryptocurrency. Spread your money among multiple digital currencies, just like you would with equities and shares. This means you won’t be over-exposed if one of them loses value, which is especially important given how volatile these investments’ market prices are. There are thousands of options, so do your homework.

-

Be in it for the long term – Prices fluctuate rapidly from day to day, and inexperienced traders are sometimes fooled into panic selling when prices are low. Cryptocurrencies aren’t going away anytime soon, and investing in them for months or years at a time could yield the best results.

Pitfalls of crypto trading

Because of the high volatility and low predictability, there are higher risks associated with crypto trading than with trading fiat currencies and other traditional assets. Crypto traders should not allocate a major part of their portfolio to crypto, ideally having 5-10% of the portfolio for risky operations such as crypto trading.

Conclusion

It’s not easy to come up with a crypto trading strategy that fits your financial goals and personality. In this article, we went over some of the most common cryptocurrency trading techniques so you can find out which one is right for you. You should follow and track each trading strategy to see what works and what doesn’t while adhering to the rules you set. It’s also a good idea to keep a trading log or sheet so you can track the results of each approach.

However, you don’t have to stick to the same techniques indefinitely. You should be able to change and adapt your tactics after you have adequate data and trading history. To put it another way, as you acquire trading expertise, your trading tactics should evolve as well. It’s also a good idea to divide your portfolio into distinct strategies. This way, you can keep track of each strategy’s performance while also managing risks.

FAQ

When should I buy and sell crypto?

Some analysts believe that you should think about more than the current value of cryptocurrencies. After all, the value of Bitcoin fluctuates significantly more in connection to the USD and other currencies than the relative exchange rate relationships that exist between numerous fiat currencies, so it’s not the same as exchanging two traditional currencies.

When demand is high, so are prices. Consider when demand isn’t as high.

- Because more individuals are trading during business hours, this is the worst time to acquire Bitcoin.

- Consider business hours in countries other than the United States.

- The media’s coverage of cryptocurrencies could have a significant impact on Bitcoin’s value in the near future.

What is the best way to buy and sell cryptocurrency?

You should use an exchange to purchase and sell cryptocurrencies. For example, Margex.com allows you to buy a wide range of cryptocurrencies via credit card and many other options.

What are the strategies for crypto trading?

Here are 5 cryptocurrency trading strategies:

Technical analysis (TA) is the process of predicting how prices will move in the future by applying mathematical indicators and chart patterns.

- Sentiment and news analysis

- Trading in the ranges

- Scalping

- Swing trading

Can you buy and sell crypto as often as you want?

Throughout the year, the cryptocurrency markets are open 24 hours a day, seven days a week. Because crypto markets are open 24 hours a day, traders can purchase and sell without restrictions. The convenience of being able to trade whenever you want is one of the benefits of having 24/7 market access.

Can you get rich by crypto trading?

Cryptocurrency can be used to make money. Because of the inherent volatility of crypto assets, the majority of them carry a significant level of risk, while some necessitate subject knowledge or skill. Despite the fact that the cryptocurrency business is still small, it has a lot of room to develop.

What are the best strategies for crypto trading?

When it comes to finding the greatest crypto trading method to make a career, swing traders (also known as position traders) have the most success. Any of the strategies mentioned in this article can also be implemented using exchange-traded funds, or ETFs.

Any strategy, however, can be lucrative, therefore the optimal strategy is the one that best fits your circumstances. Margex offers you an opportunity to set minimum leverage of x5 to a maximum of x100. Margex strongly believes that everyone should be given equal opportunities for building wealth without any restrictions. The goal is to make complex trading systems simple to use and understand by anyone.