Lately, when you look into social media, or even the mainstream media for that matter, almost everyone is talking about how the Fed is late to the curve or overly tightening and these could lead us into a Lehman-like recession by next year.

Seeing how interest rates have not risen by a similar magnitude for a long time and that Fed Fund rates have not been at such levels since 2007, these concerns are understandable. Experts are predicting Fed Fund rates to be between 4 to 5% in 2023 and many traders are extremely fearful of interest rates at such levels perhaps because they have not experienced such high rates before and fear the economy would crumble.

History Suggests US Economy Could Handle Higher Rates

A look back at history however, suggests that the US had survived and in fact, thrived under periods of even higher interest rates.

Hence, why would the US going back to normalized rates inevitably lead to a disaster this time? Traders forgot that the composition of the US economy now is very different from that in 2008 – the system now is much more resistant to shocks.

We examine below two troubling sectors that experts have been worried about to see the kind of improvements that have been put forth by lawmakers to prevent the same situation from happening again.

Housing Market Situation

The housing market crisis that led to 2008 was actually brewing for many years before it imploded. The only similarity with 2022 is that it started with ultra-low borrowing costs. However, the 2008 bubble burst because of structural problems, not with interest rates. In the lead up to 2008, subprime loans where borrowers with very poor credit history and affordability were given loans to purchase housing. These toxic debts were subsequently repackaged as low-risk financial products and sold to unbeknownst investors and investment banks. The borrowers of these debts were unable to repay them anyway, regardless of what happened to interest rates because they were not credit worthy, interest rates going up in 2005 was just one part of the whole picture.

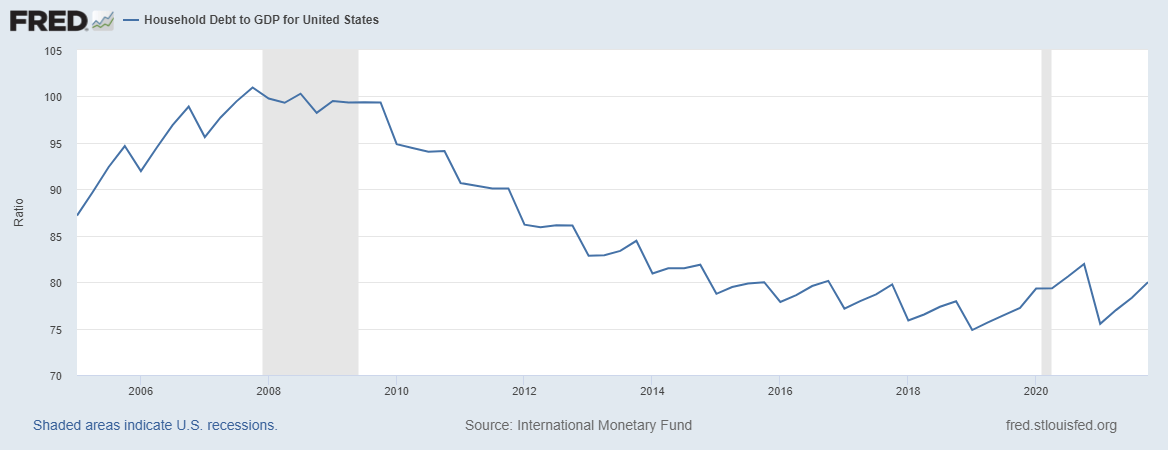

However, US households are much more creditworthy now compared with 2005. According to Federal Reserve data, the debt of American households in 2007 was around 100% of GDP, currently, that figure is only around 77% of GDP.

The current day housing market in the USA is also very different from that in 2005.

According to the US Census Bureau data, the supply of homes currently is much less than 10 years ago. Between 2000 and 2010, US homebuilders produced 27 million homes, but in the past 10 years, only 5.8 million homes have been built. This means the supply of homes in the market is at least 4 times lesser, which means housing prices could be much more well-supported now than in 2008. In 2008, the housing market was in oversupply, which meant that prices could spiral downwards very fast as each seller tried to outdo the other by lowering their selling prices, leading to a self destructive cycle.

Banking Sector Reform

The banking sector is also much more resilient now than in 2008. Notice how in the recent 3Q earnings releases, that banks surprised with earnings beat from not just one, but from all American banks that have reported. Bank of America, Bank of New York Mellon, and Goldman Sachs, all reported better-than-expected earnings last week.

The banks are in much better shape today due to a series of painstaking reforms that have been initiated after the Lehman crisis so that banks will be better able to withstand financial shocks.

One such major reform was the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010. The act restricts the types and amount of high risk activities that banks can undertake, and allows for increased government oversight of banking activities.

The introduction of the Basel III requirement also forced banks on a global scale, to maintain larger cash reserves and reduce leverage. Basel III has been in effect since 2009 to prevent the irrational credit over-extension in the 2000s that led to Lehman fallout. In other words, the banks have not been able to do the monkey businesses that led to the Lehman crisis and are thus not going to experience the same magnitude nor type of losses.

What is Basel III

Basel III comes in three parts – Capital Requirement, Leverage Ratio, and Liquidity Requirements.

Capital Requirement

Basel III raised the minimum capital requirements for banks from 2% in Basel II to 4.5% of common equity, as a percentage of the bank’s risk-weighted assets. There is also an additional 2.5% buffer capital requirement that brings the total minimum requirement to 7%.

Leverage Ratio

Basel III introduced the usage of two liquidity ratios – the Liquidity Coverage Ratio and the Net Stable Funding Ratio. The Liquidity Coverage Ratio requires banks to hold sufficient highly liquid assets that can withstand a 30-day stressed funding scenario as specified by the supervisors. The Liquidity Coverage Ratio (LCR) currently is 70% of required liquid assets.

Liquidity Requirements

On top of the LCR, there is also the Net Stable Funding Ratio (NSFR), which requires banks to maintain stable funding above the required amount of stable funding for a period of one year of extended stress. The banks have been regularly performing such stress tests since 2009 and have passed with flying colors each time.

We can thus see that the banks are now operating under more stringent regulations that make them more resistant to counterparty risks. When banks are safe, the contagion effect that would trickle to other sectors and impact the economy is greatly reduced.

The above analysis does not imply that we will not see a fall in asset prices or a recession. It simply means that we are not likely to end up with the big housing market crash or the financial system failure that was 2008.

With rates expected to be around 4% by the end of 2022, the Fed actually will have a lot more room to cut rates should there be a need to later on. The QE tool will still be available to them anytime they wish to also when problems start manifesting. Hence, the grapevine talk about the Fed hiking us to hit a brick wall does seem a little overly simplistic and pessimistic. We are not likely to end up like 2008.

The above is the personal opinion of the author and should not be construed as the official view of Margex.