Cryptocurrencies have been around for quite a while now and, without a doubt, look like the next generation of Finance. No industry has been spared the might of blockchain because it has skillfully intertwined itself as a major offset of the traditional financial system and a part of our daily lives as humans.

Nevertheless, factors like high volatility have made cryptocurrency very unpredictable, and those who hold it are uncertain about how things could play out.

Market declines and bearish seasons are one of the worst things to happen to a cryptocurrency. The recent one that has continued to drag for several months after it started in December of 2021 has brought with it turbulent times for all crypto assets.

This has led to an important question: is this the end for crypto assets? Will crypto recover? In this article, we will briefly talk about the present condition of cryptocurrencies before moving forward to answer those questions.

Where Is The Crypto Sector At Right Now?

The severe bearish condition of the crypto market, which has been the order of the day for some time, has continued till now. Many crypto enthusiasts have had their hopes cut short in the crypto industry as there seems to be little or no hope for the crypto market.

The major assets, namely Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB), have continued to stray far away from their known all-time high (ATH) with several short-term rises and falls. Currently, the crypto market cap amounts to $1.01T, representing a 5.79% decrease in the last 24 hrs, according to the crypto assets tracking website Coin Market Cap.

The DeFi space accumulates about $7.54 billion in total volume, 7.52% of the total 24 hr volume of the crypto market. Stablecoins, on the other hand, hold the lion’s share of the market 24 hr volume with a total volume of $93.39 billion, representing 93.09% of the market volume.

However, Bitcoin, the largest crypto asset, has continued to dwindle in price and market dominance. Its current market dominance is down to 39.79%, which is a 0.11% decrease.

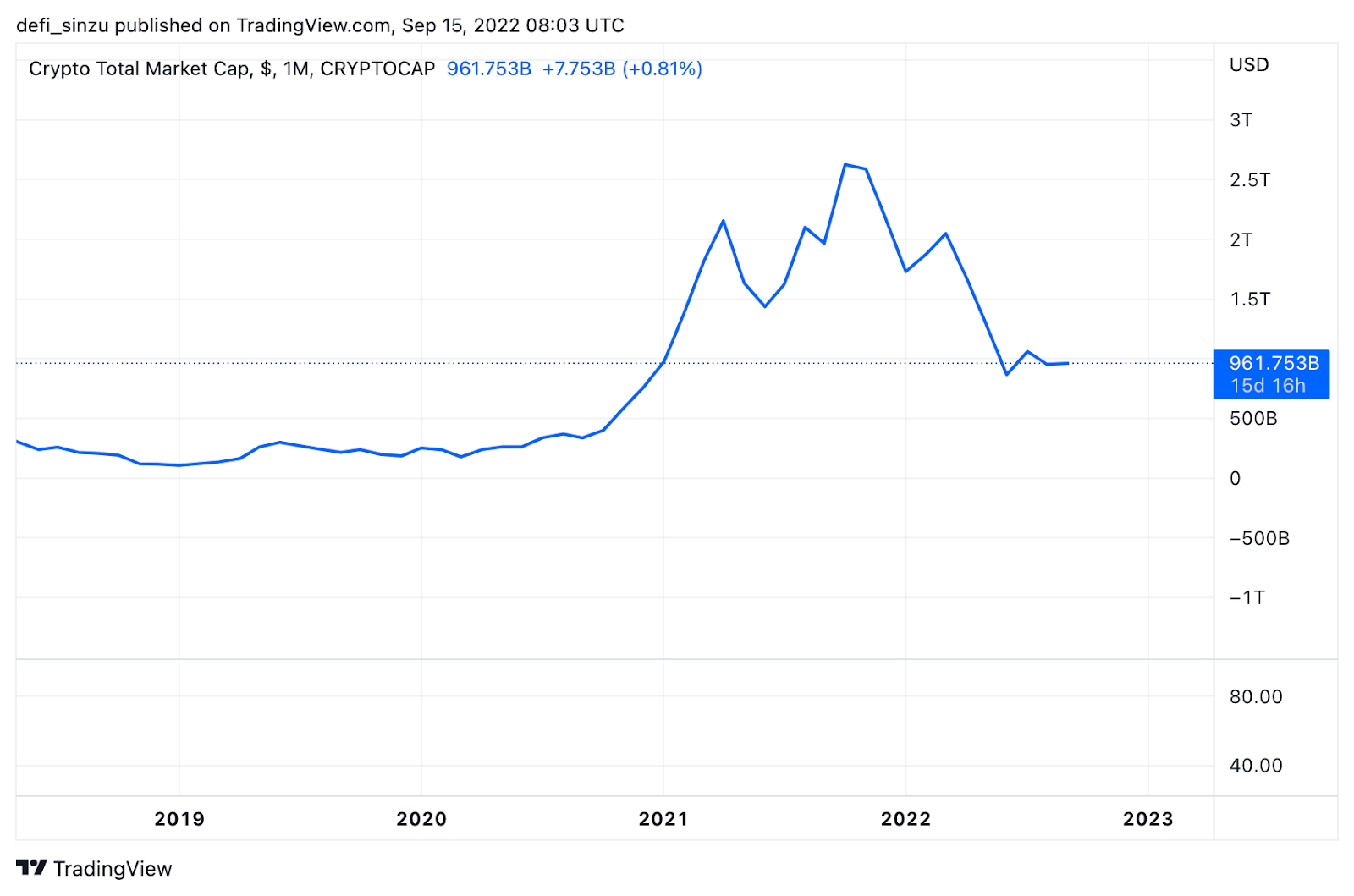

From the chart, the crypto market has seen a fall of over 60% from November 2021, from a market cap of 2.62 Trillion to 959.3 Billion, affecting the market sentiment.

However, some crypto assets have continued to stand their ground against this current crypto winter and have remained within the range of their last Known all-time high.

In addition, several platforms in the blockchain industry have partnered with many organizations in and outside the finance sector during this bear market.

An excellent example is that of the FTX exchange; in just eight months, they’ve partnered with the significant league Baseball Team Miami Heat, popular social media and news platform Reddit, and four other organizations.

Another notable partnership is that of crypto trading platform WhaleFin with Spanish soccer giant Atletico Madrid as the main shirt sponsor for the 2022-23 campaign and a five-year deal worth $42 million.

With the current state of the crypto market, trading without good market knowledge can be frustrating and exposes you to many risks. But you can make use of Margex trading and staking offers. This is one of its kind, as you can trade and stake your tokens to earn returns from Margex APY with up to 13% rewards. There are no lockup periods, and all staking rewards are sent to your staking balance daily with the help of the Margex automated system.

How Long Have Past Crypto Winters Lasted?

Since the inception of cryptocurrencies, their price value has always been ups and downs. Bear markets disrupt the stability of cryptocurrencies and cause a significant fall in price. Crypto winter results from a prolonged bear market that continues to cause a substantial downturn in market prices and a negative impact on crypto investors lasting several weeks and months.

It is also similar to a bear market in the stock market. The first time the term was used in the crypto industry was in late 2017 when Bitcoin and a large swath of digital currencies experienced a crash in price and continued to stay down for about three years before a shoot-up in price occurred in December 2020 and all assets flourished.

2017 was known as the ICO (Initial Coin Offering) era. Several crypto startups emerged with the promise of financial breakthroughs to their users; however, many failed due to a lack of regulations and excessive capital thrown at under-growing projects. Coupled with that were the multiple scams and rug pulls that also came onboard.

Massive loss of funds due to either failed projects or scams created high tension and doubts in the industry, leading to a gruesome crypto winter that lasted three years.

However, before 2018 some crypto winters affected the crypto market even though the term was not yet known. In 2011 Bitcoin, then valued at $1.06, lost over 40% of its value, spiraling down to $0.67, causing a crypto crash that made some people think crypto was dead, but it surged back to life before year-end and attained a new all-time high of $30.

There continued to rise and fall until 2013 when Bitcoin hit it big and rose to a whopping $1200 in value. Still, it suffered a massive crash by year-end, losing more than 80% of its value and violently dropping to $180. Prices continued to be in a downturn until January 2015, representing the first extremely long winter spanning 410 days.

Even though crypto winters cause significant damage like loss of funds, jobs, and company bankruptcy, some crypto analysts like Jake Weiner, founder of uncommon, believe that long-term crypto winters strengthen the industry by weeding crypto startups that can’t face the test of time and allowing genuine projects to build a sustainable community.

When Will Crypto Recover?

Cryptocurrencies are highly volatile assets, hence unpredictable, so no one can say precisely when crypto prices will rise or dump. But we can take a cue from the last crypto winter market, looking precisely into when the market started to surge back to life and the factors that influenced it.

Close to the time when crypto assets started to show signs of recovery, a chain of events played a major role in the impressive comeback. One of the major factors that influenced crypto recovery was the Covid-19 pandemic that struck the whole world in early 2020.

It came as a shock, and its aftereffects strained world economies due to the loss of jobs and properties and rising inflation. With so many uncertainties in the economy, people began to find other means of income that won’t warrant them to leave their homes, and this led to a high surge and demand for cryptocurrencies, including BTC and ETH. The price of BTC moved from a region of $3,000 to a high of $10,000 in just a few months, coupled with the fact that BTC had its halving at that time.

Shortly after the pandemic started, Bitcoin and some other notable assets were the first to recover, rising from 2.71% to 3.37% in a short time; other assets, like litecoin, too, experienced growth by increasing from 3.20% to 3.84%.

Nevertheless, crypto assets recovered during the pandemic doesn’t mean the pandemic itself gave crypto its relief; instead, it was the demand for more of these assets and the positive outlook of the majority of people on digital assets during that time that created the shoot-up in price and rise in value.

Therefore it’s possible that, like the previous crypto winter market, crypto assets may recover from the present one with so many hopes and sentiments focused on the next BTC halving that is to come in December 2023.

But once again, it’s important to remember that it’s all speculation. No one can be so sure in predicting these volatile assets; however, the bottom line is cryptocurrencies have recovered from a 3-year-long winter market. There is a high probability that they will survive and soar again.

However, recent developments like the Ethereum network’s long-awaited mainnet merge, the Cardano Blockchain Vasil upgrade, and the Monero Hardfork release have brought about a slight increase in momentum for the respective blockchains’ trading volume.

What Investors Need To Know About Investing In Crypto

The first and most important is always to do your research before giving out your funds for any cryptocurrency because despite offering financial freedom that comes from big returns on investment, there are many pitfalls to make you lose money. Without proper research, it won’t be easy to spot them.

It is also crucial to understand how the mechanism behind buying, exchanging, and selling cryptocurrencies works before the thoughts of being an investor in the crypto space.

When investing, it will be wise not to put all hopes into a particular crypto asset; diversifying your portfolio in popular sectors of the industry like NFTs, Stablecoins, DeFi, blockchain gaming, and so on would reduce the risk and exposure of the market volatility and would be rewarding on the long run.

Before purchasing any cryptocurrency or investing in a crypto exchange, it is essential to conduct quick research on the macroeconomic factors influencing a particular project. Other factors to consider include partnerships, community, tokenomics, and comparing and contrasting the platform’s roadmap and developer activity to ascertain how far and successful they have been in accomplishing goals they set for the platform.

This will also give you an edge, and a measure of protection against rug pulls and scam projects which make it their aim to milk unsuspecting crypto traders through deceit skillfully. Going through a project’s whitepaper and use cases helps a short-term or long-term investor avoid falling prey to fake projects.

It is important to invest; only what you can afford to lose. Going above one’s means to invest in a crypto startup or project could lead to disaster and is not a wise call in most cases.

Finally, going as a long-term investor helps concentrate on searching for a stabilized project or platform. However, having the mindset of quick, fast money in crypto may lead to making bad investment decisions.

FAQ: Frequently Asked Questions Regarding Crypto Recovery

Many people have developed a negative view of cryptocurrencies due to the current crypto winter market, and they ask several questions regarding the foreseeable future of crypto. This section will discuss some frequently asked questions about cryptocurrencies and the bear market.

Will Crypto Rise Again 2022?

Crypto has faced several tests over time and overcome; However, crypto analysts say that this present crypto winter is very different from all bearish markets that have preceded it; with only a few months left to the year-end, there is a high chance that buyers may topple sellers resulting in another price uptrend in 2022.

However, no one can tell if it will follow the same pattern as the last crypto winter, last for three years, or even take longer.

Will 2022 Be A Good Year For Crypto?

So far, 2022 has been a very gloomy year for cryptocurrencies. The bear market that struck in May has extended into a crypto winter, leaving digital assets utterly helpless, with much-losing value each day.

But cryptocurrencies are highly volatile assets; therefore, the market may dance to a good tune towards the end of the year and turn out to be the most extensive bull run ever in the crypto industry.

Which Crypto Will Rise By 2022?

NFT projects and blockchain gaming are currently holding the attention of crypto investors due to the promising potential for growth they exhibit. Fun aspects of blockchain gaming have made it stay on top even during this crypto winter. NFTs have also developed more practical uses with the emergence of dynamic NFTs.

They may continue their massive uptrend till the end of 2022 and beyond. Top assets like ETH, XRP, and ADA may also recover following the slight price uptrends that resulted from their respective upgrades scheduled for sometime this year.

Will Crypto Ever Go Back Up?

After winter comes summer, so there is a high chance that this present crypto winter, like the one preceding it, will leave, giving all digital assets a big break; they need to regain their composure and attain their present all-time high or set new ones.

Industry experts have drawn a point of reference from Bitcoins’ all-time high of 2021, when the coin rose to over $64,000 in value; they believe that after this winter, cryptos will recover, and Bitcoin will reach $100,000 in value.