In the past 24 hours, much has happened in the crypto space which has left even the most seasoned crypto trader in shock as a large crypto exchange has almost become insolvent and had asked for a bailout by a competitor.

One thing to note is that while this incident has more to do with poor corporate governance and possibly fraud with a particular group of companies and is not reflective of the crypto universe in general, the almost collapse of one of the largest crypto firms will surely have its implications, and those ripple effects have been felt in crypto prices even faster than how long it took for investors to figure out what was going on. As many investors could still be unsure as to what led to this market wide selldown, let us give our readers a quick rundown about what happened in the last 48 hours.

How It Started

Late last week, crypto reporter Coindesk wrote an article about crypto exchange FTX’s balance sheet, which had around $14 billion of assets versus $8 billion of liabilities. However, the assets consisted mainly of only its own utility token, FTT, some Solana (SOL) and some Bybit(BIT). The expose caused wide scrutiny within the crypto space, which led to one of FTX’s seed investors, Binance, to decide to sell their remaining investment in the FTT token. Binance had around 23 million FTT tokens that it wanted to get rid of and the news of this impending sale caused traders to front-run the news, selling and shorting the FTT token.

Not only this, the rumour mill was rife with people with knowledge of the inner goings in FTX saying that the firm could be insolvent. This led to a massive bank run on FTX exchange, which subsequently had to halt withdrawals and ask competitor Binance for a bailout. The need to beg a competitor for a bailout has totally shaken market watchers, who had by then, realised the magnitude of the problem.

This caused the price of the FTT token to plunge by 80% overnight, falling from $22 to under $5 on November 8, the large drop prompted market watchers to suspect there is an integrity issue with FTX, which could have used its users’ funds for other purposes when it was not supposed to and was itself selling FTT tokens to raise funds to meet customer withdrawals.

This further led to a market wide fear and panic amongst investors, who had in May, just witnessed the fallout of LUNA, which subsequently led to a series of bankruptcies within the space.

FTT Printed Out of Thin Air to Fund Sister Company

To make matters worse, the majority of the FTT tokens are rumoured to be loaned to its sister company, Alameda Research, which is a crypto hedge fund that lost a huge chunk of money during the LUNA meltdown. The move to “print” FTT to loan to Alameda thus appeared to be a ploy to save Alameda. Rumours further have it that Alameda used that same borrowed FTT tokens from FTX to borrow USDT and USDC stablecoins (no one knows yet who Alameda borrowed from, but Tether and Circle have both denied any dealings with Alameda) which it then sends back to FTX to buy and prop up the price of FTT. Such a ploy is often referred to as a flywheel scheme, which could have legal repercussions.

As trouble mounted at FTX, it likely had to recall loans to Alameda, which would have to dump whatever tokens it had in order to pay back the tokens borrowed, and both FTX and Alameda would have to dump more coins in the market – in the case of Alameda, to raise funds to repay FTX, and in the case of FTX, to dump coins and raise capital so as to be able to meet its customer withdrawals.

Can This Be Next LUNA?

While this case is not playing out the same way as LUNA, the fact that both LUNA and FTT have had values evaporated within a short time span has similar effects in wiping out investor funds. Other than FTT, other FTX related tokens have also fallen sharply. Not far behind is Solana (SOL), a coin not directly related to FTX but is the second largest holding on FTX’s books. The price of SOL has dropped to $16, down 40% in just 24 hours.

However, as there is no stablecoin involved in the case of the FTT debacle and that the market cap of FTT was only slightly above $1 billion before it crashed, far below the $8 billion market cap of LUNA, the contagion may not be as bad. However, it is still too early to tell if this debacle will end up causing more trouble ahead in other crypto lending firms, as the balance sheet of Alameda Research has not yet been made public. We still do not have information about who Alameda has borrowed funds from as at the time of writing. However, we are inclined to think that there may not be a large external lender to Alameda since Alameda had easily devised the above flywheel scheme to raise funds through FTX. If there is no other big lender to Alameda, the worst case scenario of a contagion the size of LUNA may not materialise. That said, while we think that a large contagion is not likely to happen, it is still too early to tell.

Implications for Crypto

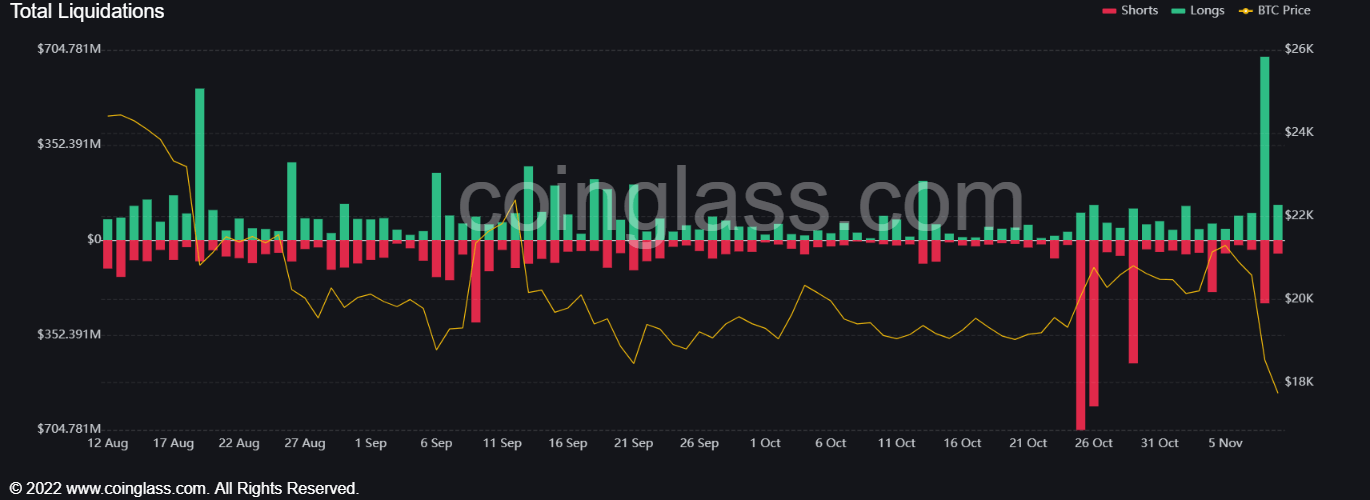

With such a massive shock again, the immediate impact would be for crypto prices to dump. Other than FTX and Alameda who had to dump FTT to raise funds, other worried crypto investors would also likely be dumping every crypto they have out of panic. Traders would take this opportunity to short the market in hopes of a quick profit. Forced margin liquidations are also happening, as traders who have positions in FTT, SOL and even other tokens get liquidated of their leveraged positions, which have sent crypto prices spiralling downwards as an immediate effect. The 24-hour long liquidations as of today have surpassed $800 million at the time of writing.

However, funding rates have turned deeper negative in sharp contrast to where they were at the end of last week, which means that most traders are now holding short positions. As average crypto prices have already crashed more than 20% and funding rates are negative, the chance of a technical bounce is there. However, in the mid-term, how crypto prices perform may depend on whether there is a larger contagion from this fallout.

In the wake of this debacle, some investor confidence has definitely been shakened. However, something good has also emerged from this saga. In an encouraging move, many other crypto exchanges, fearing a complete loss of faith in crypto exchanges, have taken their own initiative to start reporting attestations of their customer funds regularly. Most of the larger exchanges have agreed to this arrangement, which is an important move to salvage faith in crypto exchanges and in the overall crypto industry. While a painful experience for everyone involved, such weeding out of bad actors is important for the healthy growth of a nascent industry that still has a lot to offer.

The above is the personal opinion of the author and should not be taken as the official view of Margex. It is also not financial advice, nor is it a solicitation to trade. Readers are advised to conduct your own research and due diligence before doing any trading or investment. Should you be in doubt, please speak with your personal financial advisor.