A Wolfe wave pattern is a chart pattern composed of five price wave patterns that indicate an underlying equilibrium price.

Investors and traders time their entries and exit depending on the channel formed for this pattern, as this channel is bounded by support and resistance lines.

Wolfe Waves are price patterns in technical analysis consisting of five waves that suggest bullish or bearish price and tendencies. To be accurately classified as a Wolfe wave strategy, several characteristics must be satisfied, such as price action in the third and fourth waves being comparable and unique.

Bill Wolfe and his son, Brian, were the first to discover wave patterns. They occur organically in all markets, according to Wolfe. Traders must find a sequence of price oscillations that conform to particular criteria to recognize them.

- The waves must cycle at regular intervals.

- The third and fourth waves must remain inside the channel that the first and second waves have established.

- The third and fourth waves must be symmetrical to the first and second waves.

- The fifth wave bursts out of the channel in a Wolfe wave pattern.

A line drawn from the beginning of the first wave and passing through the beginning of the fourth wave indicates a target price for the end of the fifth wave, according to the theory underlying the pattern. If a trader correctly detects a Wolfe Wave as it develops, the start of the fifth wave provides an opportunity to go long or short. The target price forecasts the end of the wave and, as a result, the point at which the trader intends to benefit from the position.

Wolfe Wave Strategy: Explained

The wolf wave is a natural trading pattern that may appear on any financial instrument. Five alternating waves make up this technical chart arrangement. This is similar to Elliott Waves. It indicates market supply and demand mismatches and probable equilibrium price points.

Wolf waves may be seen on all time frames, ranging from the 5-minute timeframe chart to the weekly chart. Unlike other chart patterns, wolf waves are used to anticipate price movement. Also, how long will it take to get there? Another approach to keep you sane is the weekly trading plan.

In essence, the wolf wave trading approach is an excellent instrument for market timing. Wolfe Wave strategy traders, like many other forms of “wave methods,” search for specific patterns where the asset is expected to undergo a significant shift in value. Traders anticipate a fresh “breakout” once the first four “waves” have formed.

Traders using the Wolfe wave strategy, build a profit target line by drawing a line between the first and fourth points. This is accomplished by projecting the line to the projected breakout point following wave 5. This exercise aims to determine the projected price upon arrival (future value) and estimated arrival time (when this future value will occur).

For a Wolfe Wave strategy to operate, a related set of rules must be followed (listed below). These principles will assist in determining if the pattern is authentic or the result of random price fluctuations.

This will assist you in trading the most acceptable Wolfe wave pattern effectively. You may also learn about our most effective short-term trading approach.

Wolfe Waves Indicator: Explained

Wolfe wave indicator is a technical indicator that recognizes price chart wave patterns using the pine script computer language.

This indicator uses the connection between the waves. It is primarily a script that assists in rapidly identifying countertrend trade setups on the price chart.

The inventor of this indicator determined the chart pattern using a Fibonacci sequence between the waves. The Fibonacci ratio of 127% is used to describe the link between waves 3 and 4. Between waves 3 and 4, there is a 68% Fibonacci ratio sequence.

The wave 3-4 is usually shorter than wave 1-2, as in the Wolfe wave pattern. Because it is a critical requirement for this design, the creator used Fibonacci ratios.

Bullish Wolfe waves

Wolfe waves will often develop in parallel or equidistant channels. That is, the Wolfe wave pattern will be viewed as emerging between two trend lines that are generally parallel. Within the framework of a Bearish Wolfe wave pattern, there will be five price legs of almost comparable length and symmetry.

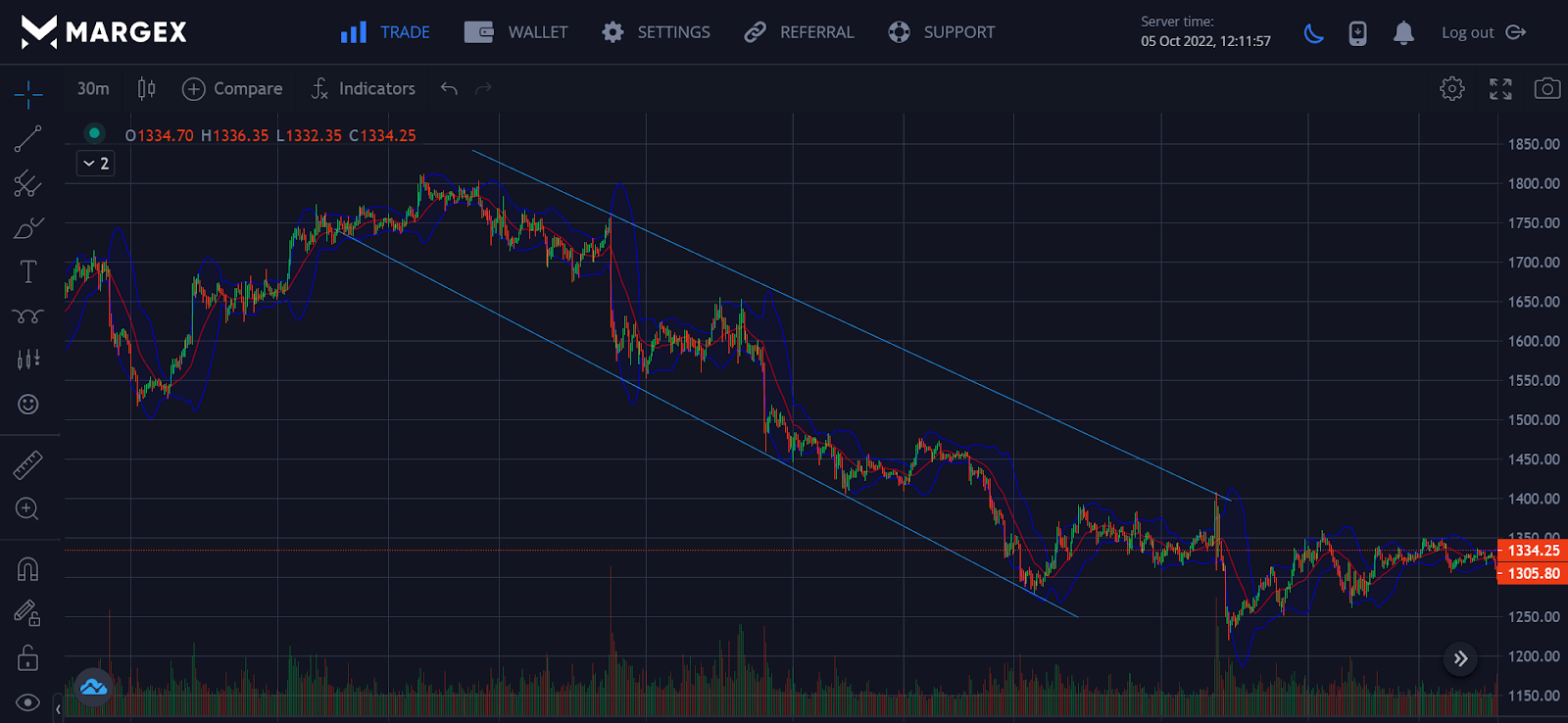

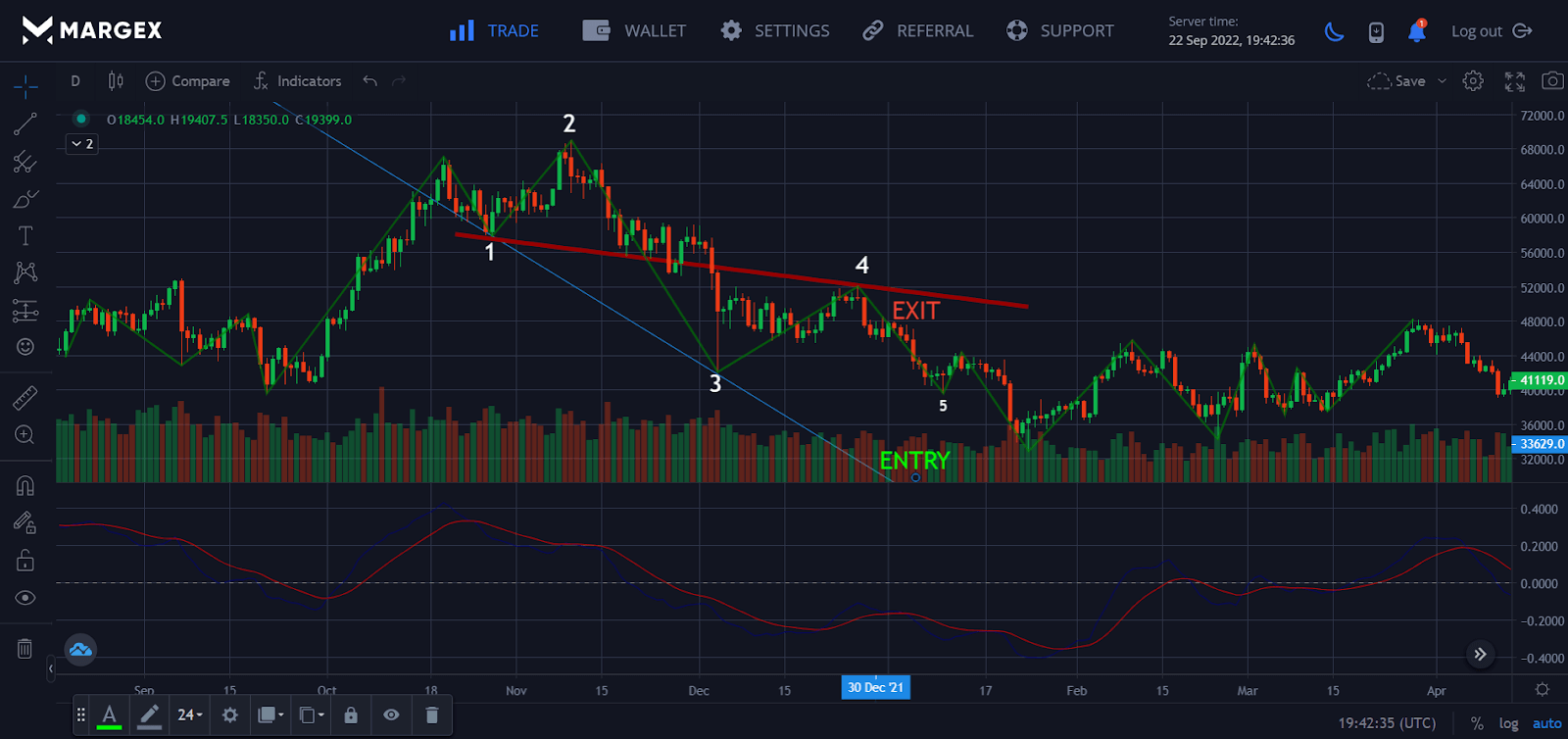

The bullish Wolfe wave pattern is seen in the figure below.

Leg one of the bullish Wolfe wave rule/formation swings downward. Wave one will eventually produce a swing low, and prices will begin to rise in wave two. Following the completion of wave two, wave three will begin to travel lower and end below the start of wave one, followed by wave four, which will rise higher and generate a swing high below wave two.

After identifying the endpoints of waves 1 and 3, we can now build the 1-3 trend line. At the same time, we will draw the 2–4 trendline, connecting the apexes of waves 2 and 4. Once again, please note that trends in the ranges 1-3 and 2–4 are parallel. Wave five should finally break through the 1-3 trendline’s bottom section and go below wave 3’s swing low.

When prices move back within the 1-3 trendline channel, a buy entry signal will be created. If the price eventually finds its way back within the channel, we will have strong evidence that this formation is a good bullish Wolfe wave pattern.

The bullish Wolfe wave pattern is a contrarian trading setup in which we wish to trade against the current downtrending market environment in the hope of an upward turnaround. The 1-4 trendline generates a target point for the bullish Wolfe wave pattern. As prices reach this level , we anticipate resistance, presenting an excellent chance to exit our long position.

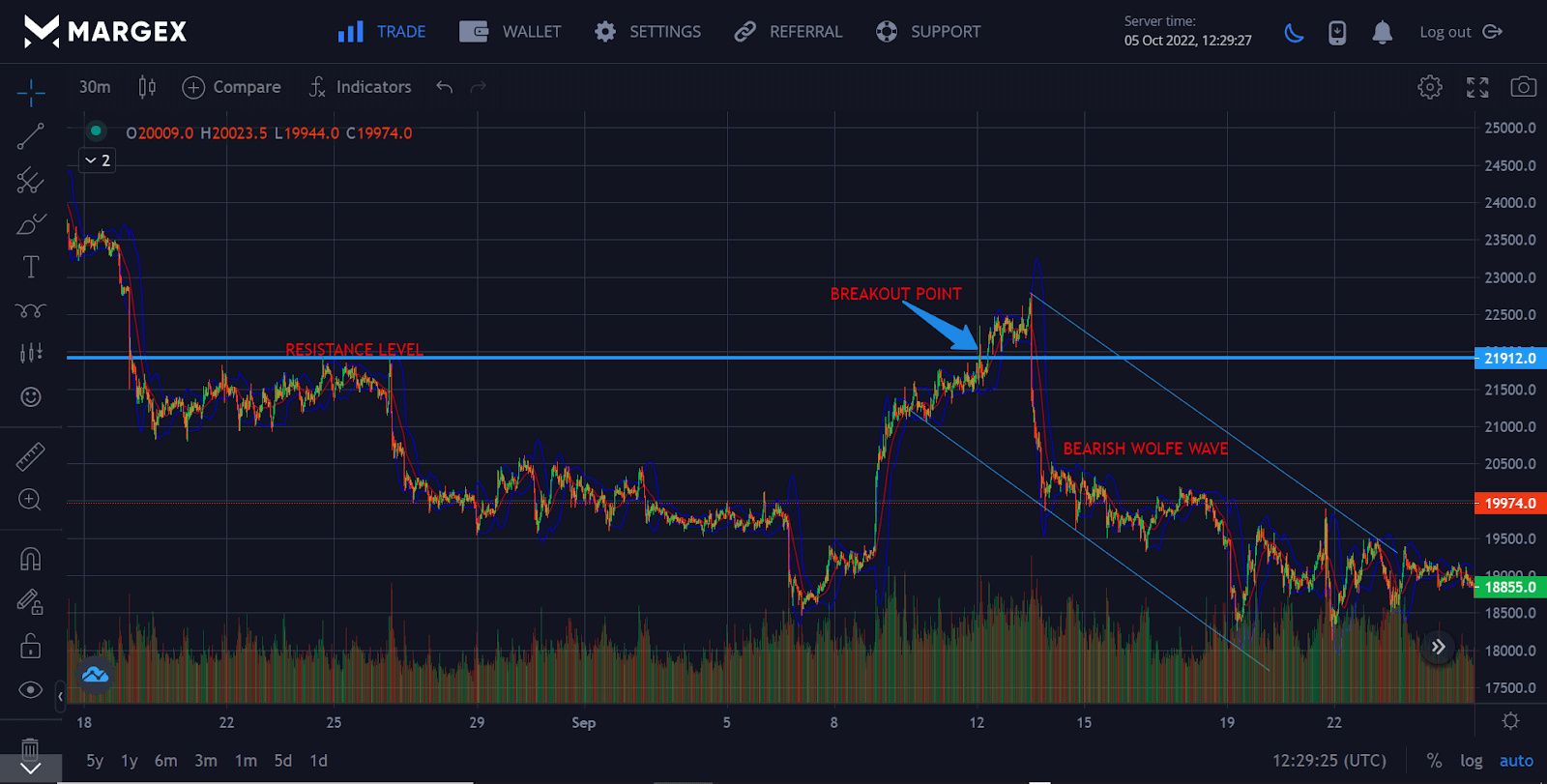

Bearish Wolfe waves: explained

Wolfe waves will often develop in parallel or equidistant channels. That is, the Wolfe wave pattern will be viewed as emerging between two trend lines that are generally parallel. Within the framework of a Bearish Wolfe wave pattern, there will be five price legs of almost comparable length and symmetry.

The bullish Wolfe wave pattern is seen in the figure below

Leg one of the bullish Wolfe wave formation swings downward. Wave one will eventually produce a swing low, and prices will begin to rise in wave two. Following the completion of wave two, wave three will begin to travel lower and end below the start of wave one, followed by wave four, which will rise higher and generate a swing high below wave two.

At this point, we’ll draw a trend line connecting the ends of waves one and three, establishing the 1-3 trend line. Simultaneously, we will construct a trendline linking the end of wave two and four, resulting in the 2-4 trendline. Again, we want to observe that the 1-3 and 2-4 trendlines are roughly parallel. Finally, wave five should break through the bottom portion of the 1-3 trendline and proceed down past the swing low of wave three.

The buy entry signal will be generated when prices reject the region outside the 1-3 trendline and move back within the channel. We may undoubtedly describe the structure as a legitimate bullish Wolfe wave pattern after the price successfully returns to the channel.

To trade against the current downtrending market environment in the hopes of a reversal, we look to the bullish Wolfe wave pattern as a contrarian trading strategy. The bullish Wolfe wave structure has a destination provided by the 1-4 trendline. We expect resistance when prices approach this level, signaling a great time to close our long position.

Wolfe Waves: A Step By Step Guide To Speculative Trading

Margex continues to provide the best trading tools for users to analyze different patterns in the crypto market. Margex also offers traders the opportunity to trade up to 100x leverage size while staking the same tradable crypto assets to earn up to 13% APY return with no lockup periods. Margex unique trade and stake feature make it one of a kind in the crypto industry.

You can trade Wolfe wave pattern on Margex by following this requirement and guide.

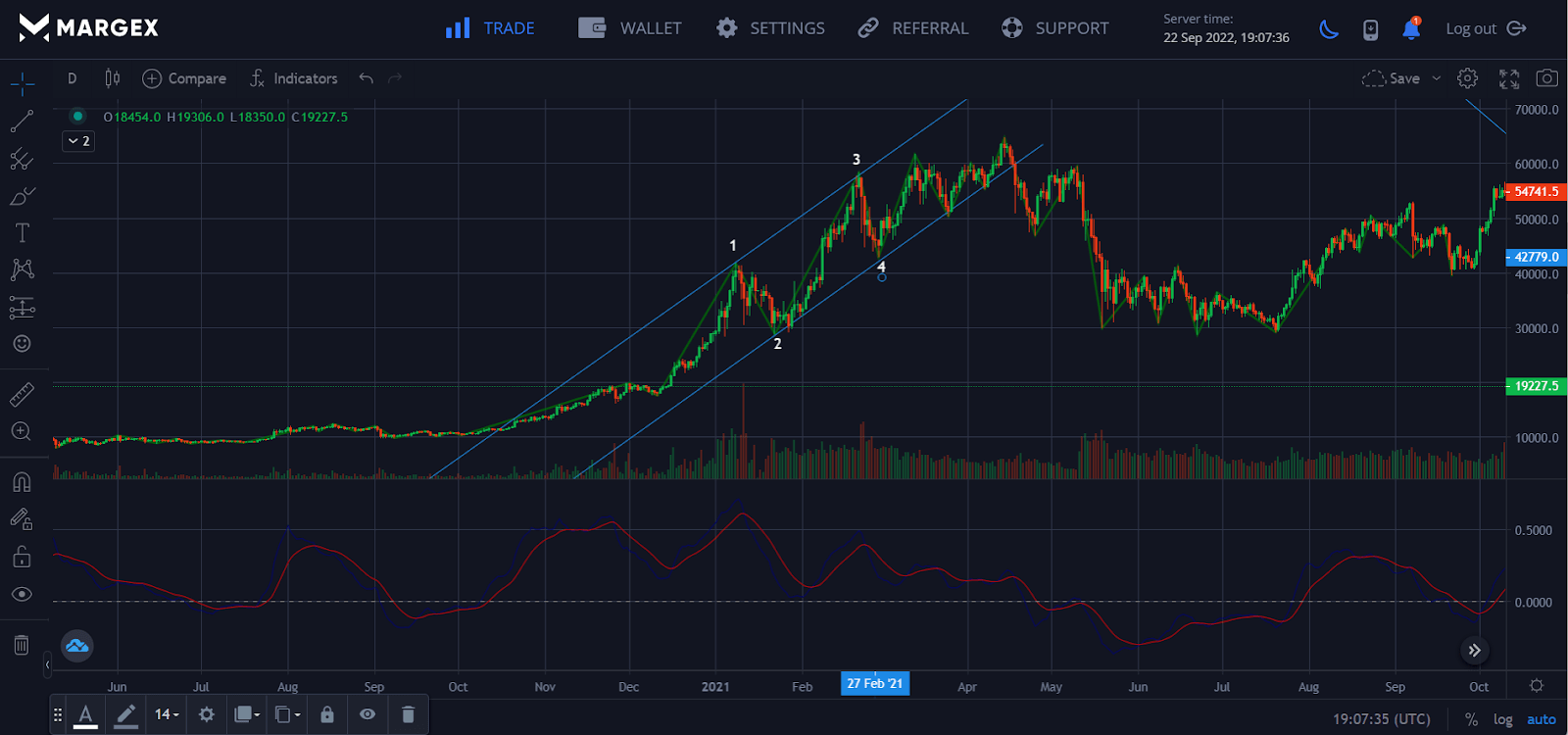

Once a parallel price channel has been found, traders may spot a Wolfe waves pattern readily.

The Wolfe waves pattern should develop inside an Equidistant Channel, according to the first rule of thumb;

- Remember that even if the channel’s two trend lines are not entirely parallel, they should not stray too much from each other. The more parallel and symmetric the trend lines are to one another, the better.

- Second, we need to observe that the third and fourth waves of the pattern remain inside the channel formed by the first and second waves of the pattern.

- Third, the waves’ time horizons should be consistent with one another, which implies the trend line’s angles should be in harmony and seem symmetric.

- The fourth criterion is that during an uptrend, the fifth wave should break above the channel’s top trend line by a little margin. Similarly, if the channel represents a downtrend, the fifth wave should break below the channel’s lower trend line to qualify for a false breakout.

- The last guideline that completes a Wolfe waves pattern is when the price returns to the channel following a false breakout.

Buy/Sell Signals

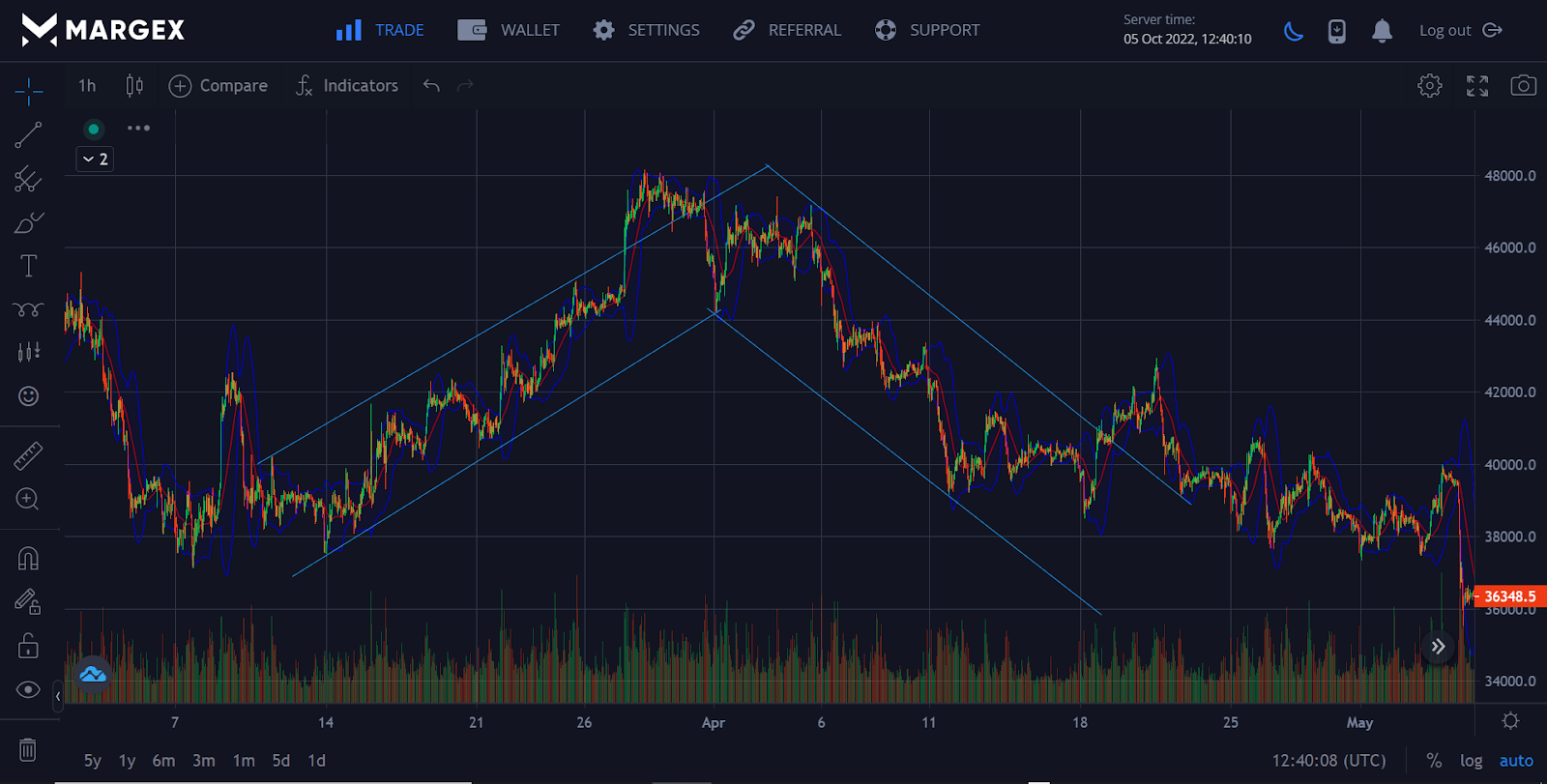

The Wolfe Waves indicator is simple to use. However, it takes a lot of patience. When the fourth waveforms, it indicates an impending price reversal.

Wait for the first, second, third, and fourth waves to be drawn by the indicator. Now enter the trade in the fifth wave direction. For example, if the fourth wave were trending, the fifth wave would be downtrending. As a result, you should try to initiate a bearish trade. If the fourth wave is bearish, you should try to create a bullish position.

Set the stop loss below the most recent swing low for an uptrend and above the most recent swing high for a downtrend. The take profit strategy should be near the channel’s trend line produced by the prior waves.

FAQs

Here are some frequently asked questions about Wolfe waves.

How do the Wolfe waves trade work?

The fifth wave bursts out of the channel in a Wolfe Wave pattern. A line drawn from the beginning of the first wave and passing through the beginning of the fourth wave indicates a target price for the end of the fifth wave, according to the theory underlying the pattern. If a trader correctly detects a Wolfe Wave as it develops, the start of the fifth wave provides an opportunity to go long or short. The target price forecasts the end of the wave and, as a result, the point at which the trader intends to benefit from the position.

How to trade with Wolfe waves?

The concept behind trading the bullish Wolfe waves pattern is to purchase at point 5 and place a take-profit order at point 6.

The fifth point might be above or below the 1-3 line. In this scenario, draw an auxiliary line between points 2 and 4 and shift it parallel to point 3. A “sweet zone” is the area between lines 1-3 and the projection of lines 2-4 from point 3. This is where you should seek a buying opportunity. There is no sweet zone if the 2-4 line is parallel to the 1-3 line. If the angle between lines 1-3 and the projection of lines 2-4 is too large, there is an error, and the pattern is not a Wolfe wave pattern.

How is it possible to draw a Wolfe wave?

The Wolfe Wave pattern may be drawn in technical analysis by drawing a price channel around the first four waves. First, draw a parallel trend line connecting waves one and three and another parallel trend line connecting waves two and four. These parallel lines are projected into the future to determine where wave five could conclude.

Wolf wave patterns are not difficult to observe and distinguish. Some trading platforms include the Wolfe wave indicator as a default feature, making your work even more straightforward.

If your trading platform does not provide the Wolfe wave indicator, you may use the channel indicator. This will assist you in visualizing the Wolfe wave pattern. Thankfully, Margex offers trading tools that help you draw the Wolfe Wave, and all you need is to register to utilize this important trading tool.