The study of technical analysis is broad and has hundreds of years of practice behind it. Several legendary investors, traders, and analysts have contributed to the field by creating trading indicators and outlining unique principles that govern the market.

Some of the more prominent methods of examining markets include Dow Theory, Elliott Wave Theory, and the Wyckoff method. In this guide, we are specifically looking at the Wyckoff method, Wyckoff price cycles, and more. Keep reading to learn how to trade using Wyckoff patterns.

What Is The Wyckoff Method? All About About The Composite Man And Understanding Smart Money

The Wyckoff method is a type of technical analysis methodology and trading method that helps investors and traders understand at which point an asset is in a market cycle and therefore when to open a long position or a short position. The theory’s creator, Richard Wyckoff noticed that retail traders were regularly being taken advantage of by large professional interests he referred to as “smart money.”

Wyckoff proposed that the market as a whole should be thought of as being controlled by a mysterious figure called the “Composite Man.” Wyckoff theory seeks to interpret the motives behind the price action on a price chart, essentially getting in the mind of the Composite Man and acting accordingly to profit from the Composite Man’s behavior.

Understanding the Composite Man and its behaviors is the core basis of Wyckoff theory. In one of his teachings, he explained:

“…all the fluctuations in the market and in all the various stocks should be studied as if they were the result of one man’s operations. Let us call him the Composite Man, who, in theory, sits behind the scenes and manipulates the stocks to your disadvantage if you do not understand the game as he plays it; and to your great profit if you do understand it.”

To become successful in markets, Wyckoff suggested that retail traders should attempt to outsmart the Composite Man. Wyckoff studied market greats of the time, like Jesse Livermore and JP Morgan, and took the learnings to create certain laws and techniques that still today apply to the cryptocurrency market nearly 100 years later.

According to Wyckoff, here are some of the common characteristics of the large operators he referred to as the Composite Man:

- The Composite Man is strategic, carefully planning ahead, and follows through any plans until the very end.

- The Composite Man kicks off trends only after they have sufficiently accumulated a sizable position in the market.

- The Composite Man places large transactions to attract the public to the market in which a position is taken.

Who Is Richard D. Wyckoff? All About The Creator Of The Wyckoff Law Of Market Cycles

The Wyckoff method is named after the creator of the popular technical analysis methodology, Richard Demille Wyckoff. Wyckoff is considered one of the five “titans” of technical analysis. These titans include Charles Dow, Ralph Nelson Elliott, Charles Merrill, William Delbert Gann, and Richard Wyckoff. Each made a major contribution to the financial market.

Charles Dow established Dow Theory and his name is represented in part with the Dow Jones Industrial Average. Ralph Nelson Elliott created Elliott Wave Principle and was fascinated with Fibonacci-based growth. Charles Merrill went on to partner with his friend Edmund C. Lynch to found Merrill Lynch. Merrill also famously anticipated the 1929 Wall Street panic and sold his assets ahead of the Great Depression. W.D. Gann today is a legend, remembered for his unorthodox strategies that consisted of geometry, astrology, and more.

Wyckoff was an investing and trading enthusiast, and avid tape reader. At the age of 15, he took a job as a stock runner for a New York brokerage. In his 20s, he launched his own firm. He was also the founder and editor for The Magazine of Wall Street.

In the 1930s, he founded a school which would later become The Stock Market Institute. In the sections below, you will learn some of the strategies, trading techniques, and market approaches that Wyckoff taught in his school.

A Five-Step Approach To Markets

In Chapter 6 of Hank Pruden’s The Three Skills of Top Trading, the author outlines the five-step approach that Wyckoff relied on for market analysis:

- Determine the current trend and anticipate the probable future trend of the market. Form your decisions from that starting point. Wyckoff was an advocate of bar charts and point-and-figure charts. However, the Wyckoff method was developed in the 1930s. Japanese candlesticks weren’t introduced to the Western world until the 1990s though Steve Nison.

- Select only assets that are in harmony with the currency trend. In the crypto market, Bitcoin and Ethereum are the primary market drivers. Look for cryptocurrencies that are stronger than the rest of the market and outperform Bitcoin and Ethereum. Wyckoff advocated using bar charts to determine this. A comparative analysis of relative strength can also help an investor or trader determine an asset’s performance against another.

- Select only assets with cause that equals or exceeds minimum objective. Specifically, look for assets in the accumulation or reaccumulation phase. To do this, Wyckoff suggested utilizing point-and-figure charts. Point-and-figure charts do not plot price against time as time-based charts do and instead plots price against changes in direction utilizing a column of Xs and Os. An X is recorded if price rises, and an O is recorded if price falls. An X or O is only added if price surpasses the associated box size. If the price of an asset doesn’t set a new high or low above or below the box size, no X or O is recorded.

- Time your positions with turns in a major market index. In terms of cryptocurrencies, like the first approach above, look to Bitcoin and Ethereum for a confirmation of a trend change. Other cryptocurrencies will follow. Set a stop loss, then be patient, following through on the plan. Once again, bar charts are recommended to find important turning points.

- Determine an asset’s readiness to move and rank them in an order of preference. Look for cryptocurrencies that have begun to show signs of a momentum shift and accumulation after reaching extreme oversold conditions. Hank Pruden’s Wyckoff teachings include nine tests for buying and selling that can be applied using bar charts and point-and-figure charts.

Wyckoff’s Nine Buying Tests

- Downside price objective accomplished – P&F chart

- Activity bullish (volume increases on rallies and diminishes during reactions) – Bar chart

- Preliminary support, selling climax, secondary test – Bar and P&F charts

- Downward stride broken (that is, supply line or downtrend line penetrated) – Bar or P&F chart

- Higher lows – Bar or P&F chart

- Higher highs – Bar or P&F chart

- Asset stronger than the market (that is, stock more responsive on rallies and more resistant to reactions than the market index) – Bar chart

- Base forming (horizontal price line) – Bar or P&F chart

- Estimated upside profit potential is at least three times the loss if the initial stop-loss were hit – P&F and bar charts

Wyckoff’s Nine Selling Tests

- Upside objective accomplished – P&F chart

- Activity bearish (volume decreases on rallies and increases on reactions) – Bar and P&F charts

- Preliminary supply, buying climax – Bar and P&F charts

- Asset weaker than the market (that is, more responsive than the market on reactions and sluggish on rallies) – Bar chart

- Upward stride broken (that is, support line or uptrend line penetrated) – Bar or P&F chart

- Lower highs – Bar or P&F chart

- Lower lows – Bar or P&F chart

- Crown forming (lateral movement) – P&F chart

- Estimated downside profit potential is at least three times the risk for if the initial stop-order were hit – P&F and bar charts

What Are Wyckoff Patterns? The Three Wyckoff Laws Explained

The Wyckoff charts follow three core tenets or laws to determine a high-probability trading setup. These laws include: The Law of Supply and Demand, The Law of Cause and Effect, and The Law of Effort vs. Result.

Here is a breakdown of each Wyckoff law:

The Law of Supply and Demand

The Wyckoff law of supply and demand is what determines the direction of price movement. When demand grows beyond available supply, prices move up. When supply outweighs demand, prices fall instead. The Wyckoff method advises studying the delicate balance between supply and demand by examining the price-volume relationship. Wyckoff believed that an increase in trading volume was indicative of large interests taking positions early. A low-volume environment typically suggests a lack of demand.

The Law of Cause and Effect

The Wyckoff law of cause and effect finds potential price targets by estimating the potential strength of a price trend emerging from a trading range breakout. Again, Wyckoff relied on point-and-figure charts for this type of analysis. The concept of cause is measured by the horizontal point count in a point and figure chart. The effect is the distance price moves in relation to the point count. Wyckoff methodology viewed the cause as accumulation or distribution, and the resulting markup or markdown as the effect of those phases.

The Law of Effort Vs. Result

The Wyckoff law of effort versus result is how the Wyckoff method anticipates a possible trend reversal, specifically using the price-volume relationship. Divergences between trading volume and price can potentially predict a change in trend in advance. Analysts can look for high-volume bar charts or candles within a narrow price range following a large uptrend or downtrend, which could indicate that large interests are accumulating or distributing ahead of a possible reversal. Increasing volume suggests increasing effort, but the tight trading range indicates little to no result from the effort.

What Do Wyckoff Chart Patterns Tell The Market? Understanding Wyckoff Schematics

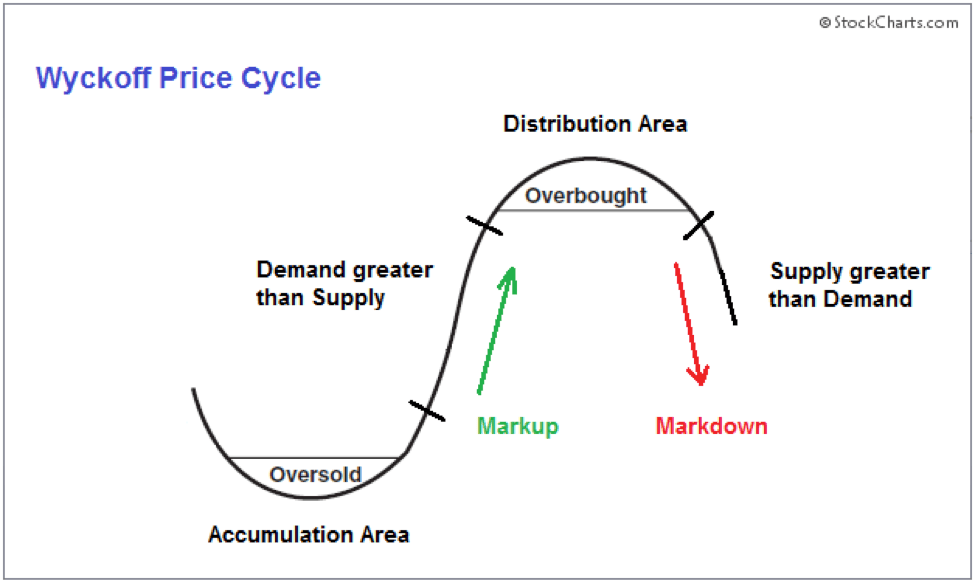

The image above depicts the ideal Wyckoff market cycle. Wyckoff cycles have several distinct events and phases, which we’ll outline in the Wyckoff schematics below. Within each Wyckoff price cycle, there is an accumulation phase, markup phase, distribution phase, and a markdown phase. Within the markup phase re-accumulation can take place during consolidation, and during the markdown re-distribution can take place when prices are consolidating.

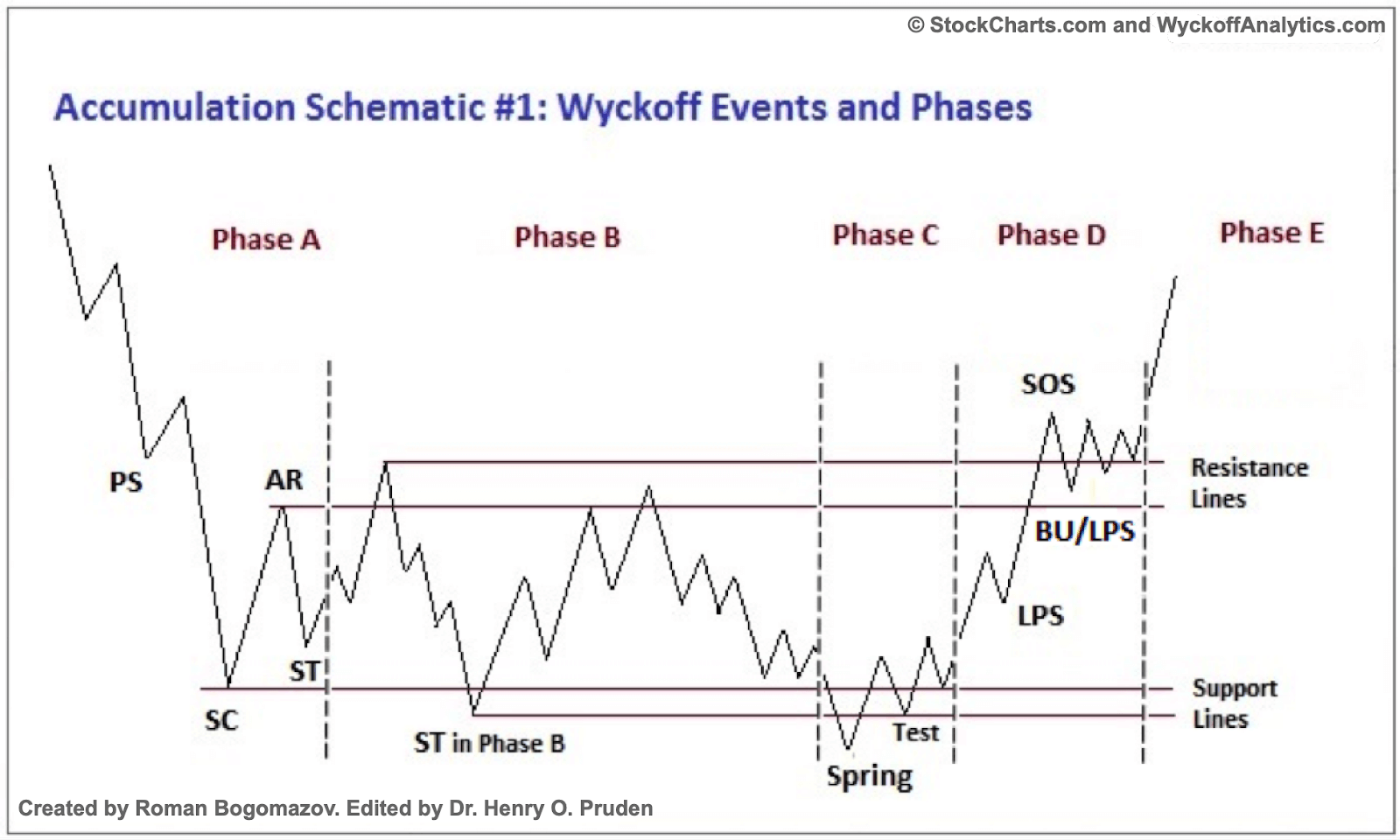

Accumulation Schematic

Here is an explanation of the events and phases that occur within the Wyckoff accumulation schematic. Note: TR refers to trading ranges.

PS (Preliminary Support)

Preliminary support is where buying begins to establish a base following an extended down-move. Typically, price spread starts widening and trading volume increases. This is the first sign that the downswing may be ready to end.

SC (Selling Climax)

The selling climax is when selling pressure reaches its climactic conclusion. Characteristics of a selling climax include panic-selling by retail investors which is bought by smart money without causing a price increase.

AR (Automatic Rally)

An automatic rally will occur once the intense selling has ended and any buying pressure leads to a quick move. The automatic rally is typically a short-covering rally due to retail investors turning short after the selling climax. The high of the automatic rally defines the upper resistance level of an accumulation TR.

ST (Secondary Test)

A secondary test follows, where there is a pullback to retest demand at the previous support level. If the bottom support holds, volume should decline with each subsequent test.

Spring

A spring is a final shakeout that can occur toward the end of a TR allowing a more aggressive retest of support to hold and demonstrate its strength ahead of a new uptrend. The spring sweeps the lows of support in an attempt to once again mislead retail traders. The deceptive move is orchestrated by the “composite man” who takes advantage of cheap crypto prices. A spring is not required as part of Wyckoff accumulation theory.

Test

A retest will follow but create a higher low and reestablish the TR. Successful retests are a sign to the market that price could soon increase and a new uptrend could begin.

SOS (Sign Of Strength)

The sign of a strength confirms to the market that the prior tests held were positive and caused other market participants to act. Volume and price spread will increase as prices climb higher.

LPS (Last Point Of Support)

The last point of support is the pullback to a former resistance level turned support level, prior to the breakout of the TR.

BU (Back Up)

The back up to the creek is a short-term profit-taking opportunity resulting in an additional retest/LPS, or a new TR. The back up appears prior to a more substantial price movement.

Phase A

Phase A is where the sell-off stops and a TR forms. After losing preliminary support, a sell climax is reached. The sudden demand causes an automatic rally. The low of the SC and high of the AR form the upper and lower boundary of the TR.

Phase B

Phase B serves as the “cause” for a new uptrend and is where the bulk of accumulation takes place from large players and institutional investors. Phase B can include multiple STs and fails to move outside the upper portion of the TR.

Phase C

Phase C is where the cryptocurrency performs a strong test and shakeout to flush out remaining supply while smart money buys at a low cost. A spring sweeps below the trading range prompting additional selling, but large interests buying pushes prices back into the trading range.

Phase D

Phase D is where the trend begins to reverse and prices begin to rally. There are often several LPS retests to establish higher lows and confirm the trend to the rest of the market. During Phase D, price moves to the top of the TR in anticipation of a breakout.

Phase E

It is in Phase E that the cryptocurrency exits the TR. Demand has taken over and markup begins to become apparent. During the markup phase, reaccumulation phases can act as stepping stones to much higher prices.

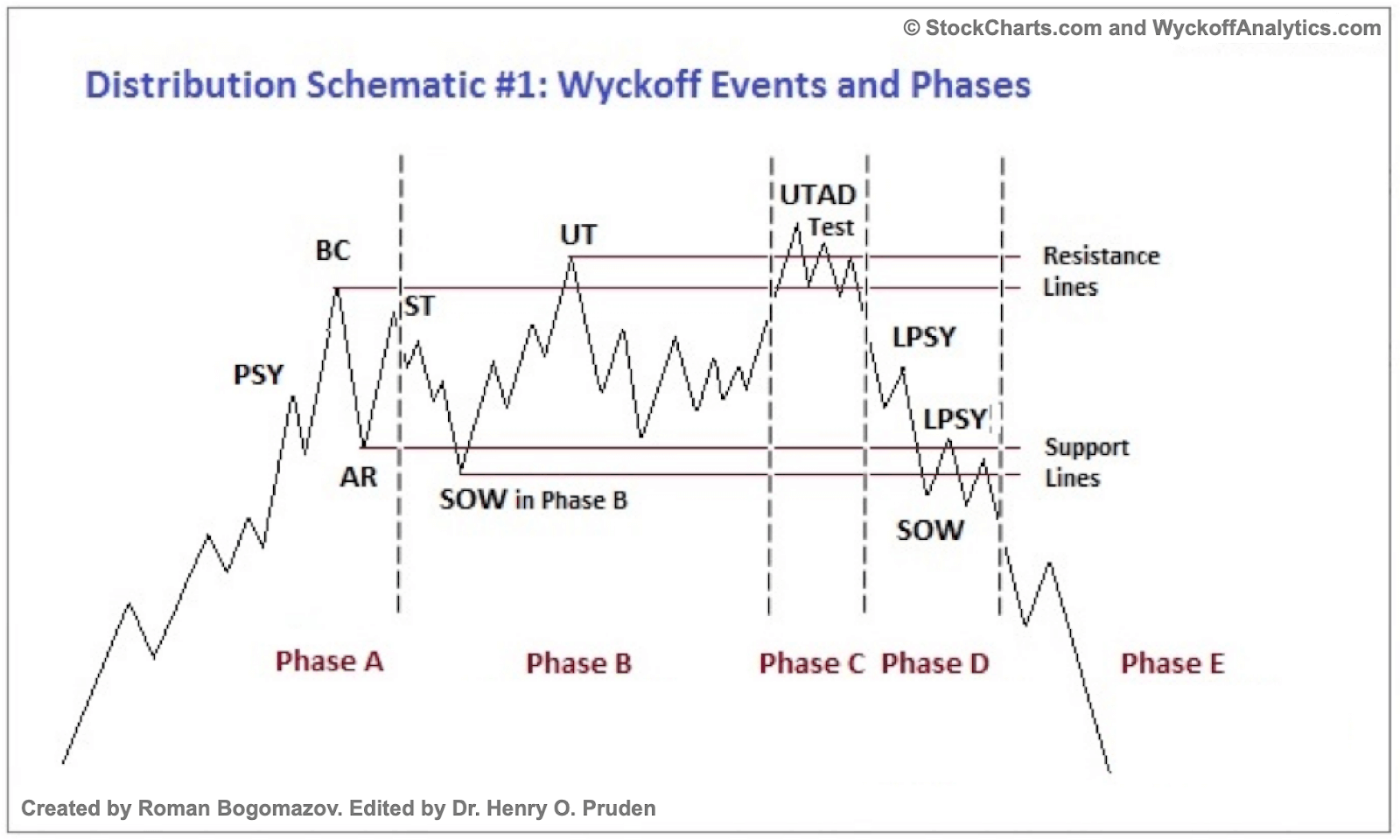

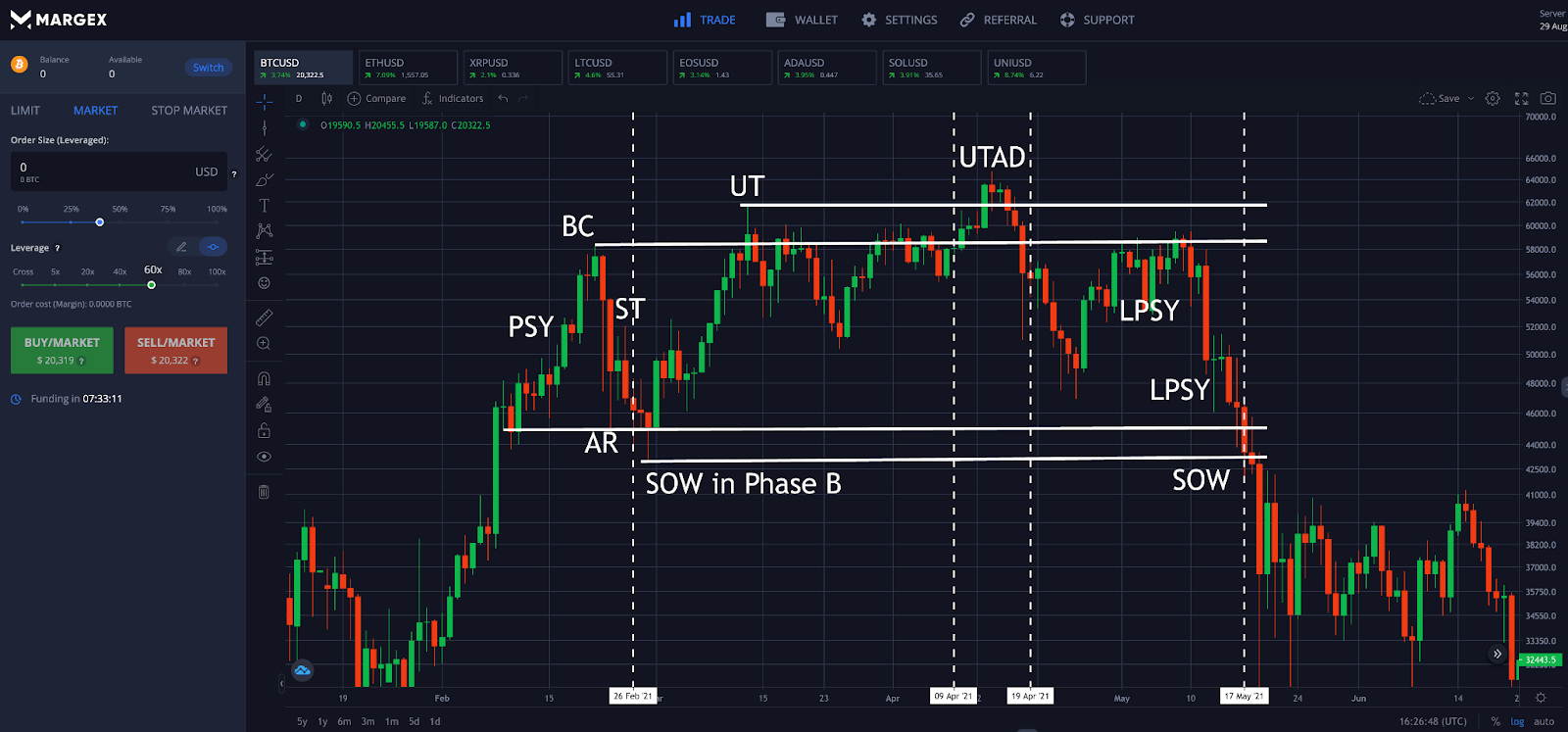

Distribution Schematic

Here is an explanation of the events and phases that occur within the Wyckoff distribution schematic. Note: TRs represent trading ranges.

PSY (Preliminary Supply)

Preliminary supply is where large players begin to sell coins after an impulsive uptrend. Typically, price spread widens and trading volume increases. This is the first sign that the upswing may be ready to end and a bearish trend is about to start.

BC (Buying Climax)

The buying climax is when buying pressure reaches its climactic conclusion. Characteristics of a buying climax include FOMO by retail investors which is sold into by smart money without causing a price decrease.

AR (Automatic Reaction)

An automatic reaction will occur once the intense buying has ended and any selling pressure leads to a quick move. The automatic reaction is due to heavy supply reaching the market suddenly outweighing demand. The low of the automatic reaction defines the lower support level of a distribution TR.

ST (Secondary Test)

A secondary test follows, where there is a throwback to retest supply at the previous resistance level. If the top resistance holds, volume should decline with each subsequent test.

UT (Upthrust)

A ST may take the form of a more aggressive upthrust (UT), in which price moves above the resistance level set by the BC. Following a UT, price often retests the other side of the TR.

SOW (Sign Of Weakness)

The sign of a weakness confirms to the market that supply has begun to outpace demand. Volume and price spread will increase as prices fall lower.

LPSY (Last Point Of Supply)

The last point of supply is the throwback to a former support level turned resistance, prior to a breakdown of the TR. It tells the market that prices are struggling to advance.

UTAD (Upthrust After Distribution)

A UTAD is the distribution schematic version of the spring resulting in a shakeout before the reversal. The UTAD sweeps the highs in an attempt to once again mislead retail traders. The deceptive move can accompany important news or a launch. A UTAD is not required as part of Wyckoff distribution methodology.

Phase A

Phase A is where the pump stops and a TR forms. After reaching preliminary supply, a buying climax is reached. The sudden resistance causes an automatic reaction to the downside. The high of the BC and low of the AR form the upper and lower boundary of the TR.

Phase B

Phase B serves as the “cause” for a new downtrend and is where the bulk of distribution takes place from large players and institutional investors. Phase B can include multiple STs and fails to move outside to the lower portion of the TR.

Phase C

Phase C is where the cryptocurrency performs an upthrust after distribution and shakeout to flush out remaining demand while smart money sells at a high prices. A UTAD sweeps above the trading range prompting additional buying, but large interests selling pushes prices back into the trading range.

Phase D

Phase D is where the trend begins to reverse and prices begin to plummet. There are often several LPSY retests to establish lower highs and confirm the trend to the rest of the market. During Phase D, price moves to the bottom of the TR in anticipation of a breakout.

Phase E

It is in Phase E that the cryptocurrency exits the TR. Supply has taken over and markdown begins to become apparent. During the markdown phase, redistribution phases can create a stair-stepping action to much lower prices.

Trading Ranges, Breakouts, And Shakeouts

Wyckoff also believed that the time to open a position was when timing offered the most favorable setup. Trading ranges provide clear boundaries forming resistance and support that tell the market a move is coming once violated. Trading ranges form when the prevailing trend has taken a pause for consolidation. A trading range represents supply and demand coming closer into balance.

The most profitable trade takes place when there is a confirmed breakout of a trading range on high volume. Springs and UTAD are shakeouts that can deceive retail traders into thinking the prior trend will continue. Typically, the more pronounced and lengthy the trading range, the larger the move that results from the accumulation or distribution. In some cases, the prior trend can continue after reaccumulation or redistribution. This is why stop-loss orders are crucial at all times.

How To Identify And Trade Wyckoff Chart Patterns On Margex? A Step-By-Step Guide

The innovative Margex margin trading platform offers built-in technical analysis tools to help crypto traders chart and trade Wyckoff patterns. The platform also includes access to powerful technical indicators like the Relative Strength Index, Bollinger Bands, Ichimoku Cloud, MACD, Fibonacci retracement, and more. It also lets the user toggle between Japanese candlesticks and bar charts as Wyckoff recommends.

Follow these 4 simple steps:

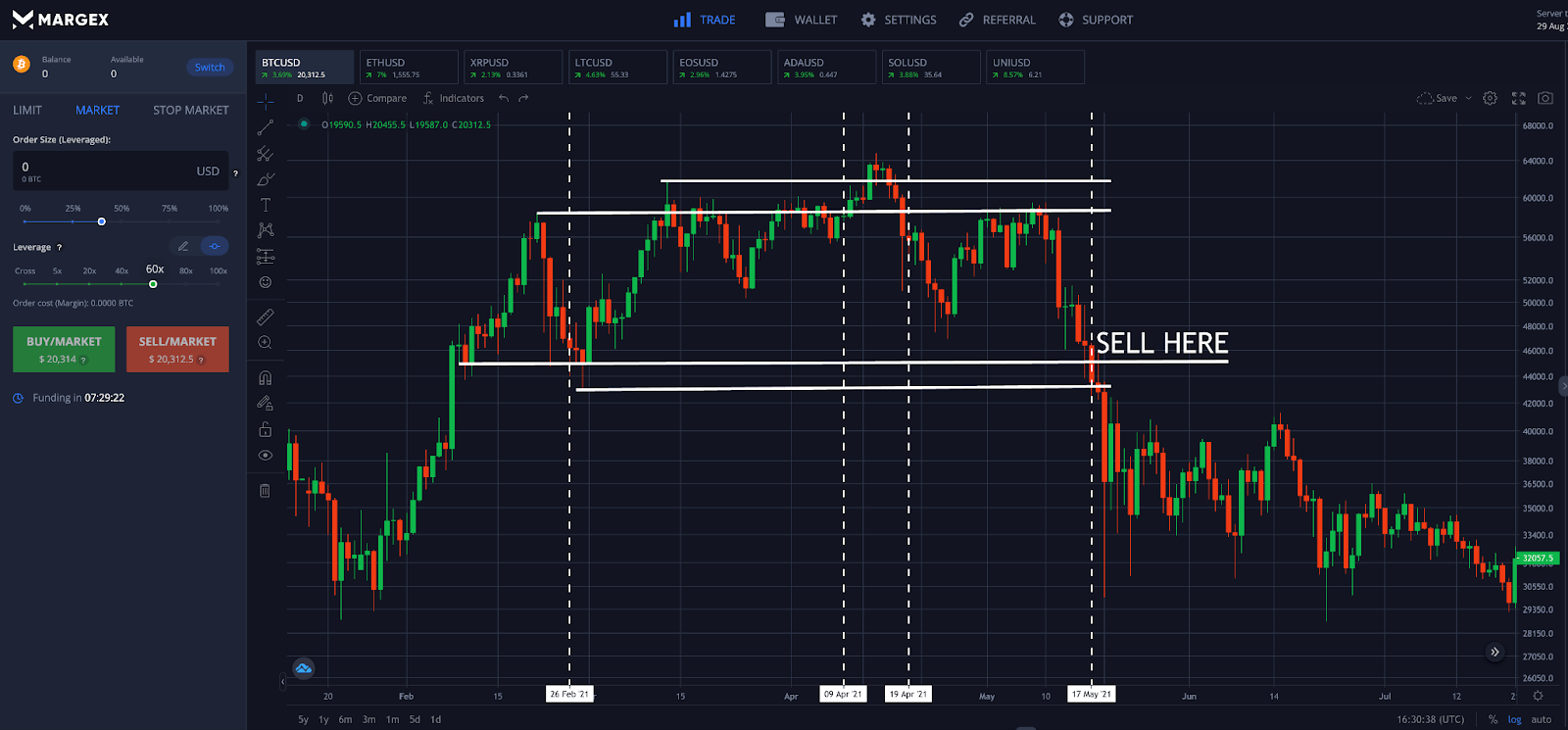

Step 1 – Open the Bitcoin (BTC) chart, and scan the price action for Wyckoff distribution patterns. Be sure to follow the selling tests outlined above to confirm the pattern.

Step 2 – After finding the pattern according to the above image, patiently wait for confirmation of the trend-reversal on high volume. The pattern is valid once price moves below the trading range. At this point, place a sell order.

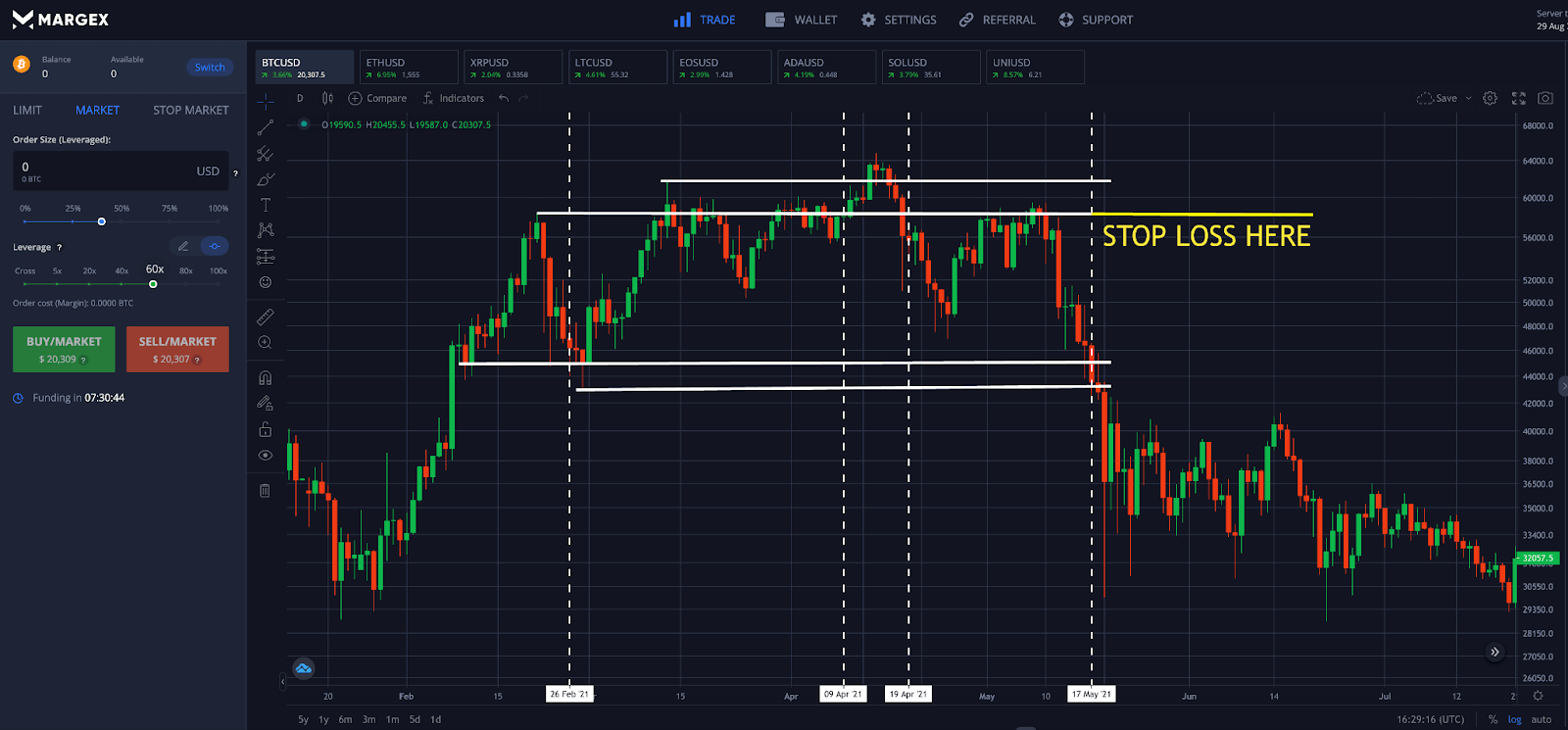

Step 3 – Place a stop loss order above the UTAD in the distribution pattern to prevent loss in case the market moves against your position and the distribution pattern ends up being invalid.

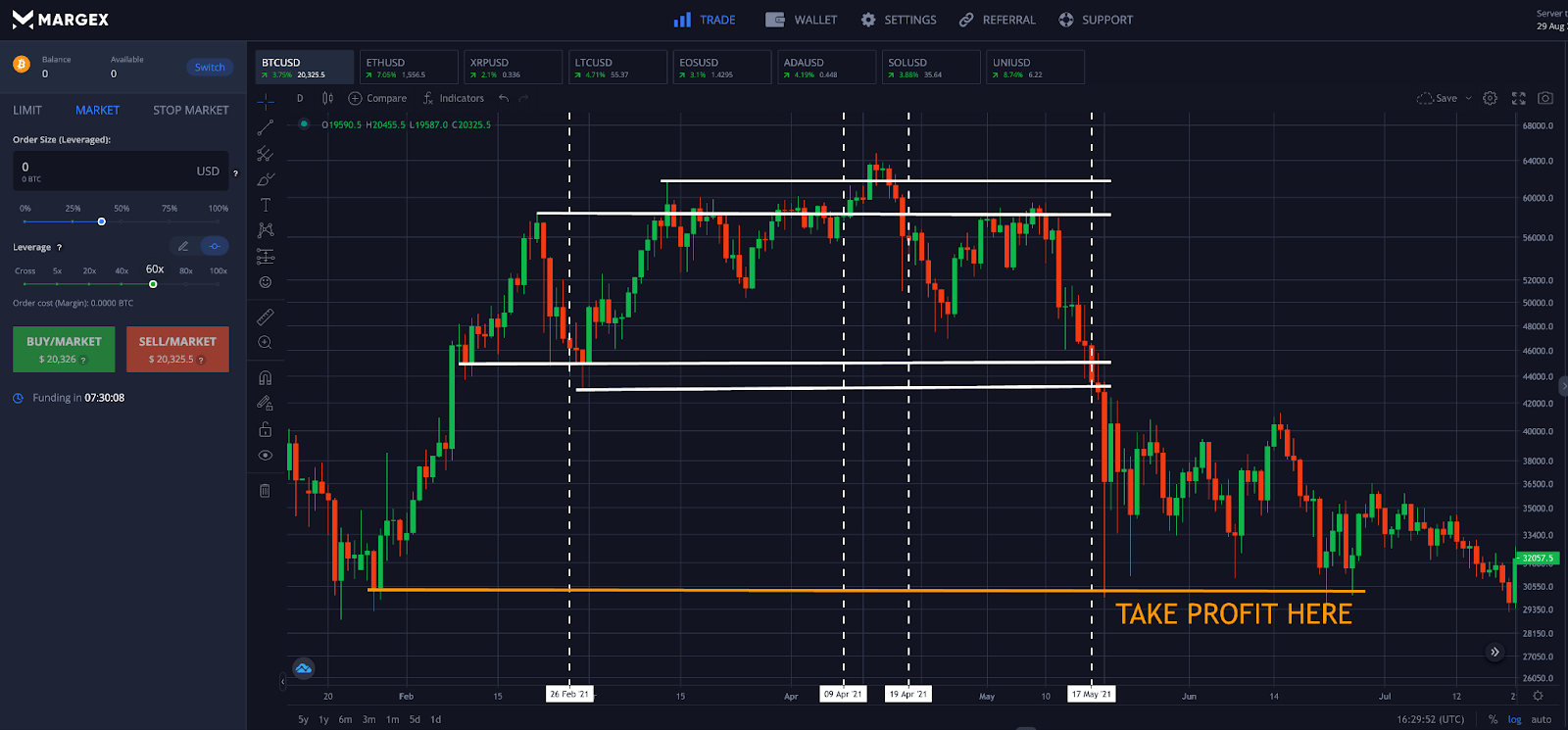

Step 4 – Plan ahead to take profit at key support zones, based on previous price action or Fibonacci retracement levels. You can also use Wyckoff’s guidelines for estimating price objectives once price leaves the trading range.

Congratulations, you have traded a Wyckoff candle pattern!

FAQ

The Wyckoff method is an entire technical analysis principle that uses concepts like accumulation, distribution, and a large operator defined as the composite man. Because of the confusing concepts covered, we have created this list of commonly asked questions in case there are any remaining questions after reading the above guide.

What is the Wyckoff Method used for?

The Wyckoff method is used to determine when to buy or sell a cryptocurrency depending on where it is within its market cycle. Wyckoff method believes in four primary market phases which include accumulation, distribution, markup, and markdown.

Is the Wyckoff method effective?

The Wyckoff method is an effective practice for approaching markets when all guidelines and laws are followed. The practice also works best when using bar charts and point and figure charts.

How reliable Is Wyckoff theory?

Wyckoff theory is very reliable and has been in practice since the 1930s. It was so effective it earned its creator, Richard Wyckoff, a spot among the five titans of technical analysis including Gann, Elliott, Dow, and Merrill.

Is a Wyckoff pattern bullish or bearish?

Wyckoff patterns can be both bullish and bearish depending on if the schematic is accumulation or distribution. Accumulation is a bullish sign after a downtrend and distribution is a bearish sign after an uptrend.

How do I learn Wyckoff?

You can learn Wyckoff by reading this guide and other educational sources.

The Three Skills of Top Trading: Behavioral Systems Building, Pattern Recognition, and Mental State Management, by Hank Pruden is among the best resources for Wyckoff theory.

Is trading Wyckoff profitable?

The Wyckoff method plays off the idea that accumulation and distribution, as well as markup and markdown trends, are controlled by a composite man pulling the strings behind the scenes. By outsmarting smart money, using Wyckoff theory can be profitable.