As a result of the constant growth in the crypto industry with the first emergence of Bitcoin and Ethereum, traders and investors have sought a better way of approaching the market to stay profitable, not overly worrying about the current state of the market. Some traders and investors have adopted chart patterns, using indicators such as the 3 bar play indicator, Relative Strength Index, Moving Averages, and others just to stay profitable and spot the best trading opportunities.

With many aspects of trading coming to the mainstream to cause disruptions in the strategies and approach, most traders and investors have gone as far as learning how to position themselves, finding the best entry and exit, building a better psychology as regards the market, and having the edge over the market has proved difficulty considering each market situation needs a different strategy of approach.

Regardless of these factors, a good trading strategy developed by a trader provides an advantage in the market, trades with better judgment, and aids in the identification of potential opportunities to build a more robust portfolio. As traders, investors, and institutional organizations look for ways to leverage the crypto space with razor-sharp trading strategies and other forms of trading to stay at their best, the crypto industry is a big place for many opportunities.

In this guide, you will learn how to use the 3 bar play trading pattern to identify bullish and bearish chart patterns, as well as how to make a clear application of the 3 bar play trading pattern with the help of a chart. Learning how to use the 3 bar pay pattern as a trader will provide you with more opportunities to spot trend reversals and trade better while implementing risk management procedures.

3 Bar Play – What Is It?

The 3 bar play trading pattern is a common trading chart pattern among cryptocurrency traders that is made up of three successive candlesticks or four candle sticks in most cases that usually appear in an uptrend or downtrend market for traders to spot a trend reversal in the direction of the chart.

Although the 3 bar play is known as the 3 bar play pattern, sometimes it consists of four candlesticks rather than the usual three candlesticks that the name of the chart pattern implies during its formation as a result of market price actions. The 3 bar play can appear in trend reversal (uptrend or downtrend) or continuation pattern depending on the location the 3 bar play trading pattern appears.

There are up to four different categories of 3 bar play patterns, but these different types are grouped into two types: the rising three (bullish 3 bar play pattern) and the falling three ( bearish 3 bar play pattern). These chart patterns are easy to find, be it in a trend reversal or continuation pattern that traders such as scalp traders (Scalpers) and day traders love to use for quick and profitable setups.

This 3 bar play pattern trading is mostly adopted by traders looking to implement their short-term trading strategy for a quick price movement to close the position at the closest profit target level.

How To Identify 3 Bar Play Pattern?

An intriguing part of using the 3 bar play pattern is how it is easy to spot most traders, making this chart pattern indispensable. Just like the three black crows, the 3 bar play pattern trading is a three candle pattern that provides a bullish or bearish signal when spotted by a trader in any market setup, be it bullish or bearish market.

To identify the bullish 3-bar play pattern, whether the market structure is bearish or bullish, you must have the following formation.

- A bullish candlestick has an unusually long candle body or a fully-bodied candlestick larger than the average-sized bar.

- The second candlestick is a bearish down candlestick with an opening price similar to (or less than) the closing price of the first candlestick.

- The third candlestick, also known as the trigger bar, is bullish, with an opening price that is the same as the closing price of the second candle and a closing price that is significantly higher than the closing price of the second candle.

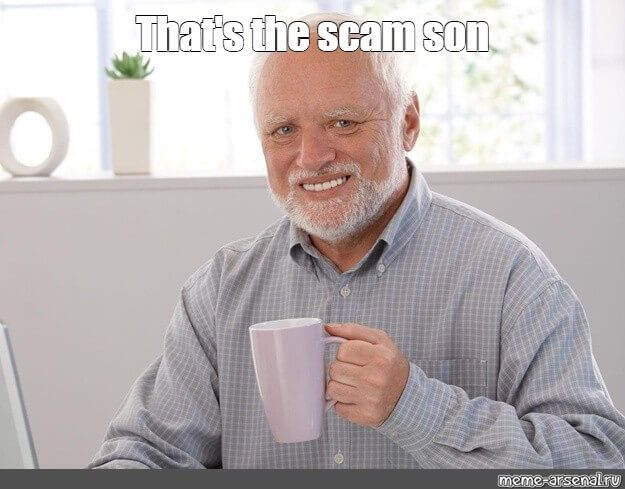

From the Image above, you can see the ETHUSD pair on the 5 minutes chart above; the 3 bar play pattern was formed in the middle of an uptrend indicating a bullish continuation to the upside. The first candle is a bullish candle indicating the uptrend is still open, followed by a second candle that is bearish in form, indicating some form of indecision regarding the price action in the market. This second candle is followed by a third candle that is bullish in appearance that rises above the middle candle indicating a 3 bar play pattern formation.

Once the third candle is formed, the chart pattern for the 3 bar play is complete, and a trader could look to ope a long position signal with stop loss and take profit in mind. It would be good to confirm this formation with the help of other technical analysis tools, such as the Moving Average indicator.

From the above, the 8-day and 21-day Exponential Moving Average was used to spot a trend and confirm the trend after the 3 bar play pattern is identified either for a long or short position to be initiated.

Having the above in mind as regards the 3 bar play pattern, here is what you should look out for when identifying this chart pattern;

- Determine whether the 3-bar play chart formation is in an uptrend, downtrend, or continuation trend.

- To confirm the signal, use additional technical tools such as the moving average, relative strength index (RSI), and other momentum indicators.

- Once the third candle (also known as the momentum bar) rises above the second middle candlestick, enter a position.

- Set a stop-loss at the first candle’s lowest or highest level (depending on the market trend)

- Set a stop-loss order at the next Fibonacci retracement level.

3 Bar Play In Long

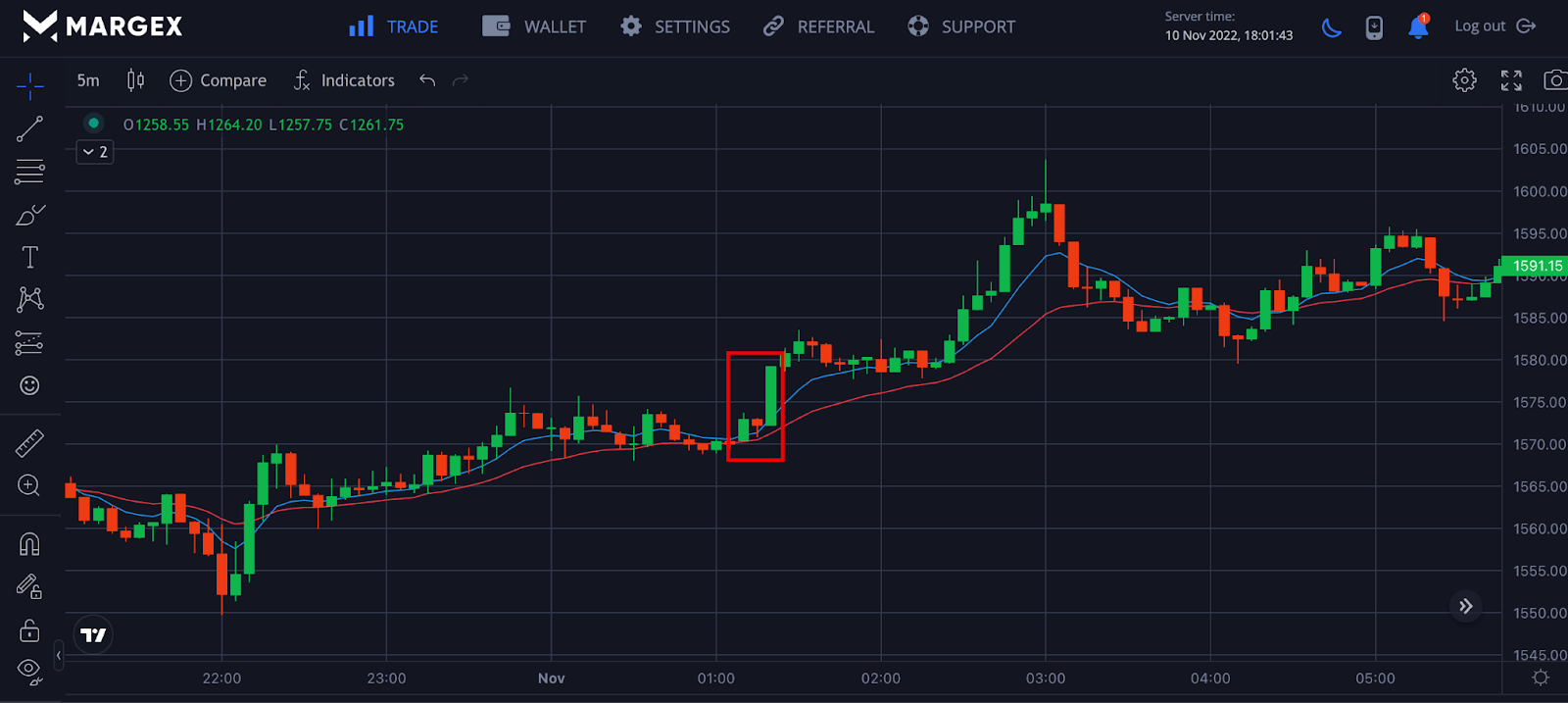

From the Image above, the price of ETHUSD formed a bullish 3 bar play pattern as the price of ETH rallied to the upside after the chart pattern was formed and was confirmed with the Exponential Moving Average indicator. After the third candle for the 3 bar play is formed, this signals to the trader that a trend reversal or continuation is in place to the direction of the trend. A trader could look to open a long position while observing all necessary risk management procedures.

3 Bar Play In Short

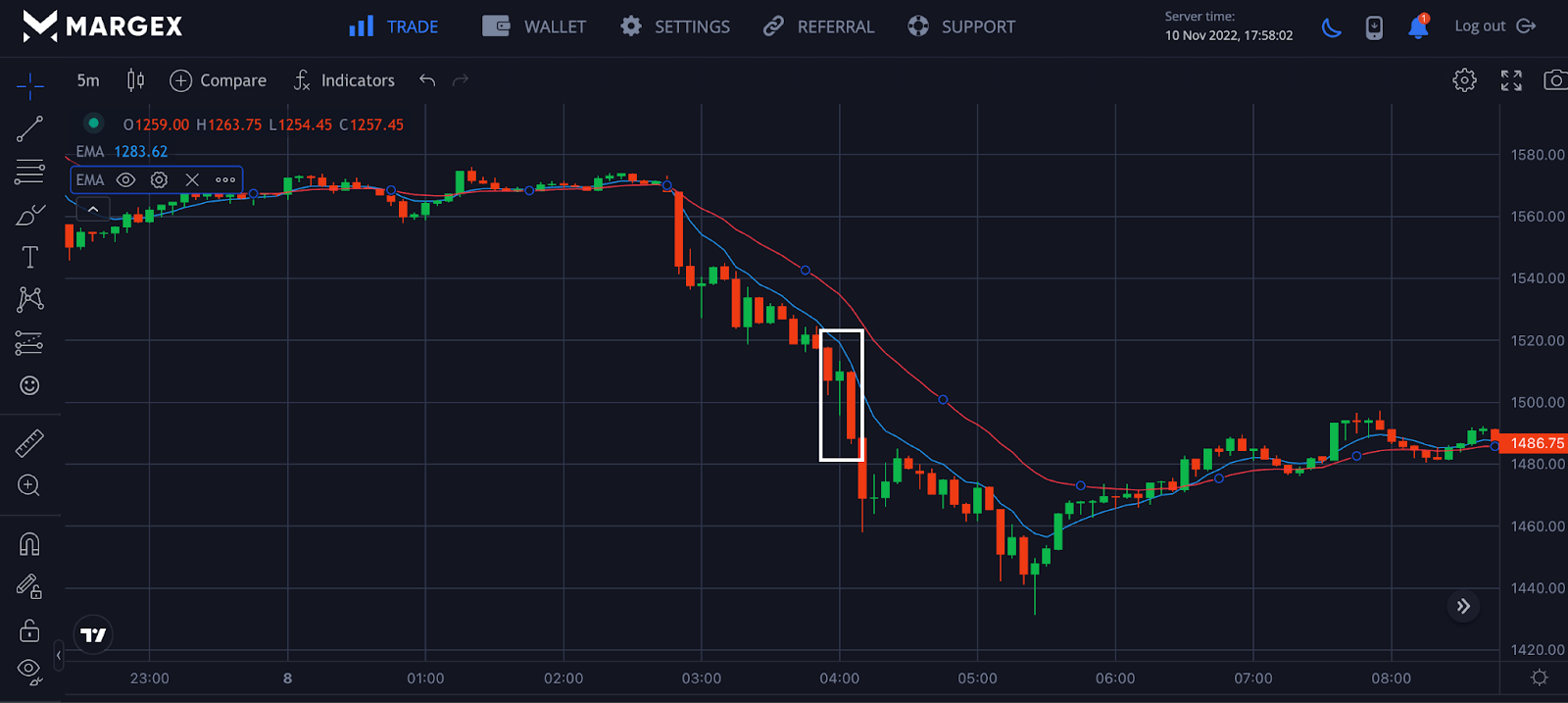

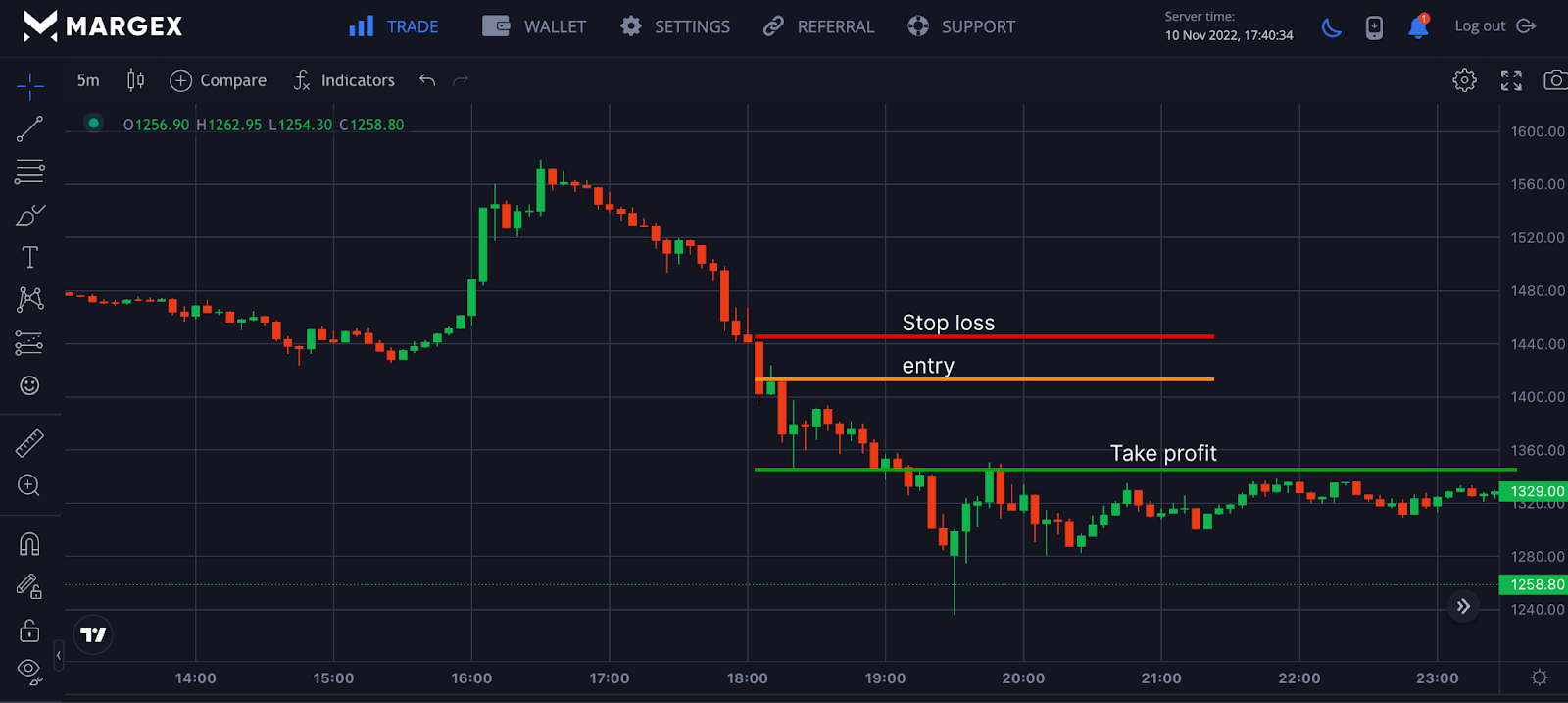

The Image above is a bearish 3 bar play for the ETHUSD pair; the 3 bar play pattern appeared in the middle of the trend, indicating trend continuation to the downside as the trader could look for a possible confirmation as regards this trend before opening a short position. You can use many technical analysis tools on the Margex platform free of charge to confirm that this trend is a bearish 3 bar play pattern before opening the position to help minimize the risk-to-reward ratio for this particular trade or any other one.

Rules For The 3 Bar Play Pattern

It is very important to understand that trading the 3 bar play pattern, or 4 bar play pattern as some persons would call it, is not for newbies or beginner traders as it can be difficult getting the full potential of this strategy which most often requires extreme effort to learn and apply this strategy. The initial or first candle needs to be a full-bodied candle with the potential to move in the direction of the bar. The second candle is an indecision candle, followed by another fully-bodied candle to complete this pattern.

The potential for this chart pattern to pay off depends on applying the strategy with other technical analysis tools and patterns with tight stop loss and take profit. Sometimes the 3 bar play pattern is made up of 4 bars instead of the regular 3 bars and a time 5 bars; what counts is the application; if the chart pattern remains intact, then it can be applied to the trading strategy to be adopted. The pattern remains 3 bar play or 3 bar strategy even if the candlesticks are 4 bar or 5 bar.

With the above understanding, let’s look at the three key rules for identifying a 3 bar play pattern.

- The first bar or candle should be a full-bodied bar or candle with a lot of volume.

- The pullback bar, candlestick, or bar 2 (& 3), must be less than 50% of the first bar’s retracement and have relatively equal highs.

- A nice marubozu candle to new highs or lows should accompany the trigger bar (or expansion candle)

Possible Problems With 3 Bar Play Method

Day traders looking to apply technical analysis structures such as resistance or support need to be sure of these levels as this 3 bar play indicator can be flawed with no significant market level to decide on where the likely support and resistance are.

This pattern is formed after confirmation of the third candle formation, and in an extremely volatile market, this signal would be invalidated as the pattern would produce false signals due to the pattern formation after the third candle with stop loss usually hit or taken out of the trade.

3 Bar Play Indicators Trading

Margex is a Bitcoin-based derivative platform focused on assisting traders in trading with up to 100X in leverage size, and traders have the opportunity to stake tradable assets with the help of Margex’s unique staking feature that has set itself apart from other exchanges in the crypto industry. Users can trade and stake their assets with up to 13% APY with no lockup period of assets, and all staking rewards are sent to the staking balance daily with the help of the Margex automated system.

Let us see how we can trade the 3 bar play pattern on Margex using all the strategies as discussed.

Step 1: Find The 3 Bar Play Pattern

The first step to trading the 3 bar play pattern is finding and seeing how it can be applied. The pattern is made up of 3 candles, 4 candles or 5 candles, depending on the formation. It is called the 3 bar play because the first candle is a fully-bodied candle; this could be a bullish or bearish candle depending on the direction of the trend. Followed by indecision candles, this could be 1 to 2 candles as the middle candle, followed by the third candle being a full body candle or a marubuzo candle completing the formation.

A trader could look to open a position in the direction of the trend but needs more confirmation which can be gotten with the use of other technical analysis tools to help confirm the trend and formation of this strategy.

Step 2: Set Your Stop Loss

Set stop loss at the lower or higher point of the candlestick, depending on the direction of the trend. For a bullish 3 bar play pattern, set the stop loss at the lower end of the candlestick to allow room for proper risk management, while for a bearish 3 bar play pattern, the stop loss should be set at the higher end of the candlestick.

Step 3: Take Profit

This aspect of trading seems easy but could prove to be the toughest, as taking a profit has been challenging for most traders, including advanced traders. Always set your reward point to exit the market, which will prove key as you grow into a better trader.

Technical tools like the fibonacci retracement ratios are key to determining the next level or point you should be looking at taking profits.

Frequently Asked Question (FAQ) About How To Trade 3 Bar Play Pattern

Trading the 3 bar play pattern can be tough and challenging for newbies, including some advanced traders. Here are the commonly asked questions as regards trading this strategy.

What Is A Three-Bar Play Pattern?

The three-bar play pattern is a simple technical analysis strategy traders use to spot reversals based on 3 bar play signifying either a bullish or bearish trend. The first candle recognizes the chart pattern as a long candle body, followed by resting candles; these could be 1 or 2 candles, then the third candle with a full body. This pattern is a price action pattern used to signify reversal or short to long-term trends in the market.

Is It More For Bullish Or For Bearish Market Trend?

The 3 bar play can be bearish or bullish depending on the chart’s appearance; it could be at the beginning of a new trend or continuation. This is a strong signal chart pattern, and the price tends to go in the direction of the pattern when used accurately with other technical tools for more confirmation.

Does The 3 Bar Play Method Still Alive?

The 3 bar play method is still alive and used by day traders and intraday traders for short-term trading with great profit returns. When combined with other trading strategies, it can be very effective.