The cryptocurrency market is characterized by high volatility. A currency that is currently high may experience a significant drop the next day that you could not have anticipated. To avoid losing money when this happens, you can use a concept known as short selling, which allows you to profit from falling crypto prices even if you don’t own any.

Shorting Bitcoin can be a good option for investors who believe the currency will crash at some point in the future. With Bitcoin’s rising prominence in mainstream finance, the number of venues and methods for shorting the cryptocurrency has increased dramatically.

What is Shorting Cryptocurrency?

Shorting cryptocurrency is the process of selling it at a higher price to repurchase it at a lower price later, ideally when the price of a crypto asset is expected to fall. A trader opens a short position by borrowing a cryptocurrency and selling it at the current price on an exchange.

The trader then buys the digital currency and repay the capital borrowed at a later date. The trader will profit from the difference between the cost of buying and selling if the coin’s price has dropped.

Consider the following example:

- When the market value of Bitcoin is $60,000, you want to short one Bitcoin. As a result, you borrow one Bitcoin and sell it for $60,000 at market value.

- The value of one Bitcoin falls to $40,000.

- You purchase one Bitcoin for $40,000 and return it, along with any interest, to the broker from whom you borrowed it.

- You retain the difference between the sale and purchase prices, which equals $60,000 – $40,000 = $20,000 (less any interest).

Shorting cryptocurrency is the inverse of longing it; a trader should go short when they anticipate a currency’s value to fall and go long when they expect the coin’s value to rise.

Seven Ways to Short Crypto

Margin Trading

One of the best methods to short Bitcoin is to use a cryptocurrency margin trading platform. Margin trades allow investors to "borrow" money from a liquidity pool to make a trade, which is permitted by many exchanges and brokerages.

It’s important to keep in mind that margin entails borrowing money, which can either increase profits or aggravate losses.

Although there is a real possibility of profit when shorting a volatile asset like cryptocurrency, the amount of risk is substantially higher. In a conventional long position, the currency can only fall to zero, at which point you lose your initial investment. In a short position, the Bitcoin price, for instance, can increase indefinitely — as will your losses.

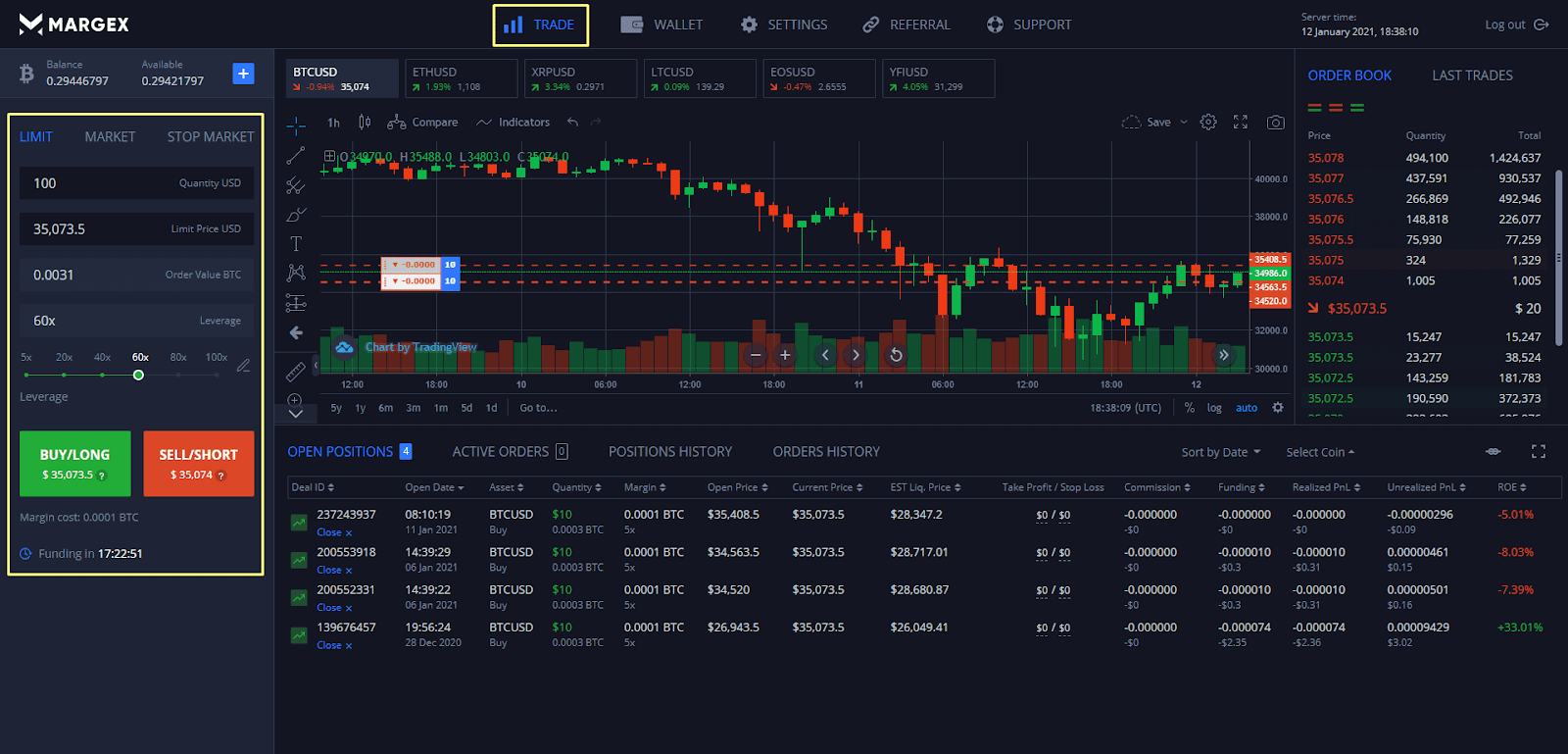

At this time, many Bitcoin exchanges allow margin trading, with Margex being one of the allowing users to short with up to x100 leverage.

Futures Market

A futures market exists for Bitcoin, just as it does for other assets. In a futures trade, a buyer agrees to purchase a security with a contract that defines when and at what price the security will be sold.

When you buy a futures contract, you’re hoping that the security’s price will grow, ensuring that you’ll be able to get a good deal on it later.

When you sell a futures contract, you’re indicating a negative attitude and a prediction that Bitcoin’s price will fall. You can short Bitcoin in this situation by buying contracts that gamble on the cryptocurrency’s price declining.

You can also short Bitcoin futures on a few exchanges. Margex allows short selling with up to 100x leverage which allows traders to maximize gains on the falling market. Margex is one of the high-leverage platforms available.

Prediction Markets

Prediction markets are another tool for shorting Bitcoin. Cryptocurrency prediction markets are comparable to those found in traditional markets. Investors might make a wager based on the outcome of an event.

As a result, you may forecast that Bitcoin will drop by a specific amount or percentage, and if someone takes you up on the bet, you’ll profit if it happens.

Short-Selling Crypto Assets

Though this technique might not be for everyone, individuals with the stomach for it can profit if their gamble against Bitcoin pricing pays off.

Sell tokens at a price you’re comfortable with, then wait for the price to decline before buying them back. Of course, if the price does not shift as you anticipate, you risk losing money or losing Bitcoin holdings.

Short-selling Bitcoin comes with a lot of fees and risks. For example, you’ll have to pay custody or Bitcoin wallet fees to keep the Bitcoin safe until the transaction takes place.

You’ll also have to deal with the volatility of Bitcoin’s price. You could lose a lot of money if the price goes up (rather than down, as you expected).

Certain exchanges also provide leverage for such transactions. The disadvantage of using leverage is that it has the potential to compound losses.

Using Crypto perpetuals

A contract for differences (perpetuals) is a financial technique that pays out money for settlement depending on price discrepancies between open and closing prices.

Bitcoin perpetuals, like Bitcoin futures, are simply predictions of the price of the cryptocurrency. Shorting Bitcoin is when you buy a perpetual that predicts the price of Bitcoin will fall.

As a result, you’re shorting Bitcoin.

If Bitcoin is trading at $40,000, for example, you could short sell it and close your position when the price reaches $35,000 so you make a $5,000 profit.

Perpetuals have a longer settlement period (since they don’t expire) than Bitcoin futures, which have predefined settlement dates. Bitcoin perpetuals also do not necessitate the cryptocurrency’s actual delivery.

As a result, you won’t have to pay custody fees. Traders can enter into a contract based on Bitcoin’s performance, or its performance relative to fiat currency or another cryptocurrency in specific Bitcoin perpetuals marketplaces.

Factors to Consider While Shorting Crypto

Traders know that the price of the asset falls much faster than it grows, so in theory, bears should earn more than bulls, however shorting Bitcoin, like any other cryptocurrency strategy, carries a high level of risk. Here are a few things to think about when shorting Bitcoin:

Choose the right trading platform to short-sell

For you to short-sell crypto, you need to know the right and the best trading platform that allows this. A great example of a Crypto exchange that allows this is Margex. Margex is a cryptocurrency derivatives trading platform with a lot of flexibility, especially for traders that value privacy, reasonable fees, and a wide range of tried-and-true trading pairs. Both newbies and veterans in the derivatives trading field are likely to find their eternal home here, thanks to an advanced trading engine, rigorous security standards, and a very intuitive UI.

How to execute short-selling trade on Margex

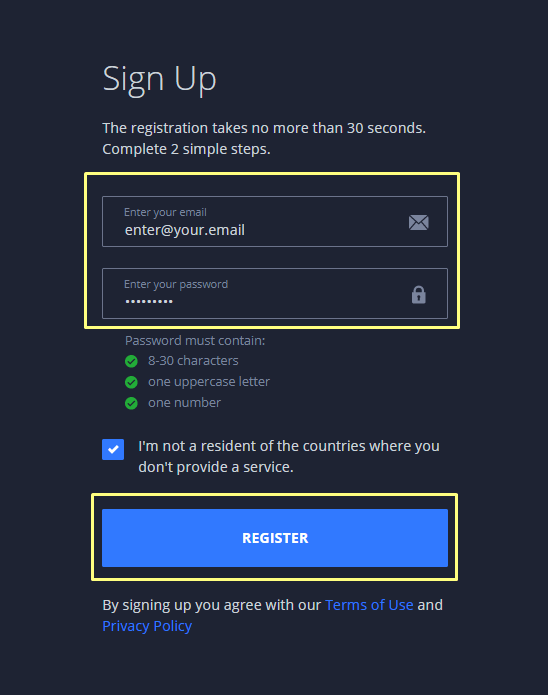

- Go to the registration page and fill out all of the necessary fields. Click the "Register" button. You will receive an email confirming your registration. To confirm your subscription, open the email and click the confirmation link

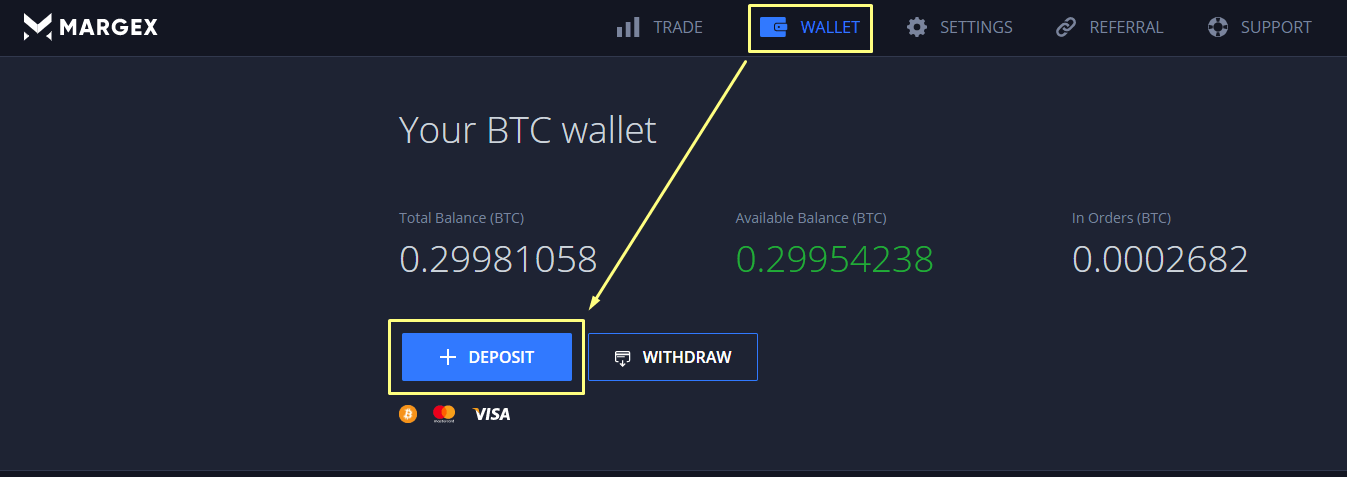

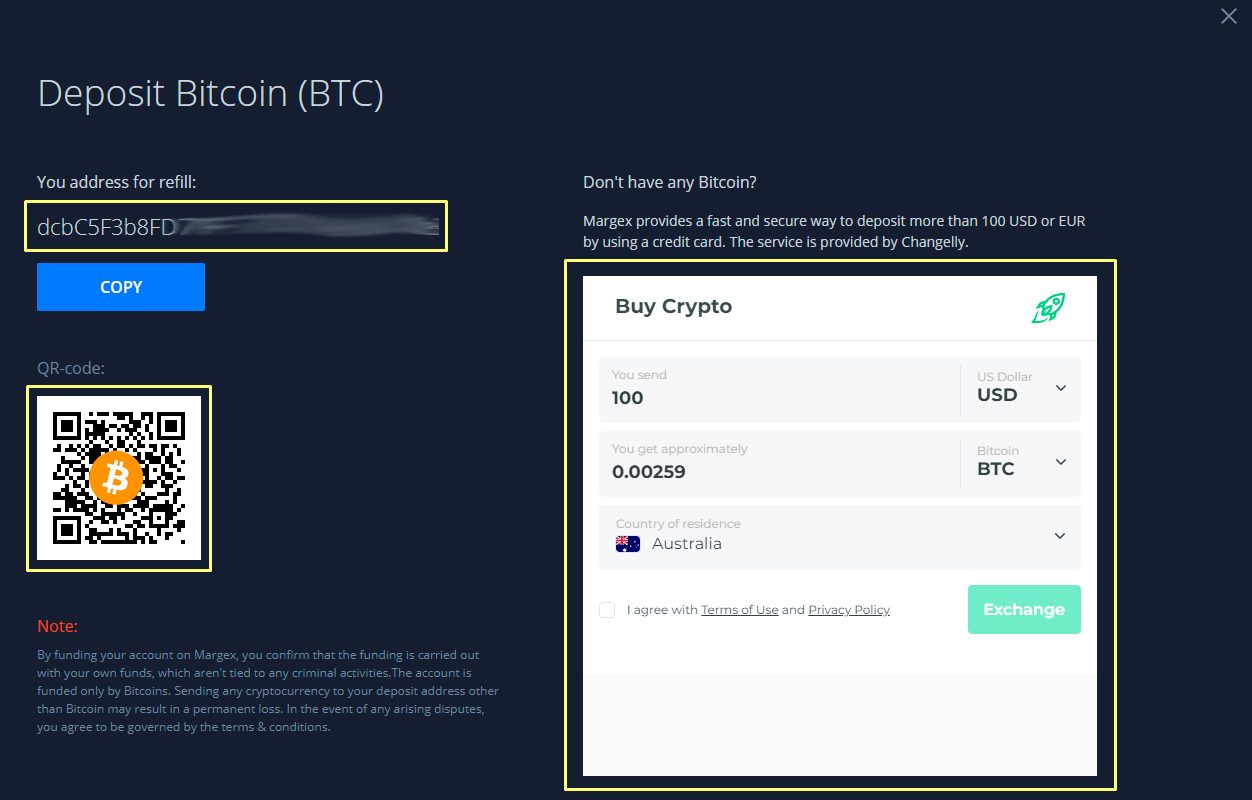

- To make a deposit, go to the "Wallet page" and select "+ Deposit".

- Choose one of the following alternatives for making a deposit:

- BTC or other crypto deposits directly to your Margex account Wallet from another cryptocurrency wallet.

- Changelly is a service that allows you to make payments using your bank card.

See "How to make a deposit" for a simple and easy-to-understand deposit lesson provided by Margex.

- Go to the "Trade" page to start trading.

To make an order, select the desired order parameters such as the instrument to trade, order type, size, and leverage, then click SELL/SHORT.

Crypto price is volatile

The puns about Bitcoin’s price fluctuations have worn thin by now. They are, nonetheless, still relevant. The majority of ways to short Bitcoin rely on derivatives. These derivatives are dependent on Bitcoin pricing, which means that fluctuations in the cryptocurrency’s price have a great impact on investor gains and losses.

Bitcoin futures, for example, mimic spot price swings, implying that they cannot be utilized as an effective hedge against investment in actual Bitcoin. Similarly, due to the volatility of the underlying cryptocurrency’s price, options trading in Bitcoin can increase losses.

Traders with a high-risk appetite are naturally drawn to these fluctuations because they provide the possibility of significant profits. As a result, traders who are aware of changing trends and have experience in the industry profit from the currency’s volatility.

Knowledge of order types is a must

You should brush up on your knowledge of different order types before taking a short position in Bitcoin. They can assist you to limit your losses if the price does not move in the direction you predicted. When trading derivatives, stop-limit orders, for example, can assist you take-profit to secure your gains and stop-loss to minimize your losses

Some Advice on Shorting Crypto

1. Have a crypto trading strategy in place

Traders can employ a variety of analytical strategies while shorting crypto. These tactics differ depending on the type of analysis, time length, and risk tolerance. However, when traders first start out, they must decide whether to rely on technical or fundamental analytical tactics. Some traders use a combination of the two, especially if the information suggested by both strategies is similar.

Traders that use a technical analysis technique examine historical BTC price charts by looking at prior trends and employing technical indicators. The moving average indicators aid in converting bitcoin’s erratic price history into a straightforward trend line. The SMA (simple moving average), MACD (moving average convergence divergence), and Bollinger Bands are all examples of moving averages. The MACD is used to determine a trend’s strength and momentum, while Bollinger Bands are used to determine if an instrument is overbought or oversold.

2. Manage your risks

Set limitations on how much you invest in a specific digital currency and avoid trading with more money than you can afford to lose. Cryptocurrency trading involves higher risks than trading reputable stocks or bonds.

3. Diversify your cryptocurrency portfolio

It’s not a good idea to put all of your money into a single cryptocurrency. Spread your money among multiple digital currencies in the same way as you would with equities and shares.

Conclusion

Borrowing Bitcoin to sell on the market and then buying it back at a cheaper price is known as shorting. Traders do so in the hopes of making money from the price differential.

Shorting Bitcoin is a speculative and hedging strategy used by traders. Shorting Bitcoin can be done in a variety of ways. Selling through a trading platform or crypto exchange with the use of derivatives like perpetuals is a popular option.

Because short-selling entails risks, it’s critical to have a risk management strategy.

After you’ve launched your initial short-selling position, you should use news and analysis to keep up with any developments in the Bitcoin market.

FAQ

Can crypto be shorted?

Yes. You can trade against Bitcoin’s price by shorting it with derivatives such as perpetuals and futures. However, it is critical to evaluate the hazards connected with shorting, which are numerous. The loss is limited by the margin used in the trade.

What are some of the most common ways to short crypto pricing?

The most common method of shorting Bitcoin is through derivatives such as futures and options. Put options, for example, can be used to bet against the price of a cryptocurrency. Another option for shorting Bitcoin is to participate in prediction markets.

What are the risks of shorting crypto?

Shorting Bitcoin carries two major risks with the first of which is the price. Market volatility in the underlying value can make it difficult to precisely predict the underlying asset’s price movement. The second major risk is the absence of a global regulatory regime for Bitcoin.

Can I short crypto using leverage?

Most futures trading platforms and cryptocurrency exchanges, such as Binance, allow users to put bets on the price of Bitcoin falling using leverage. However, keep in mind that using leverage can compound both gains and losses. As a result, while using leverage, the risk is proportionally higher.

What does shorting in crypto mean?

Shorting crypto is the act of selling the cryptocurrency in the hopes that its value will fall and you will be able to repurchase it at a lower price. Traders can profit from the price disparity in the market.

Is shorting crypto a good idea?

The cryptocurrency market is extremely volatile, and short positions can offer attractive profit potential. With Margex exchange, you can maximize your shorting returns due to the 100X leverage provided.