The concept of technical analysis takes a close look at past price movements and attempts to utilize this historical information to, with some degree of accuracy, predict future price movements and outcomes.

Digging deeper into this study, there are specific categories of focus which include chart patterns, Japanese candlestick formations, technical indicators, and much more. When combined, the practice can be further used for risk management and trend confirmation.

This crypto trading tutorial for beginners offers an in-depth guide to a particular candlestick pattern called the spinning top candlestick pattern. The guide will explain how to identify and how to trade the spinning top candlestick pattern.

What Is A Spinning Top Candlestick Pattern? All About The Japanese Candlestick Pattern

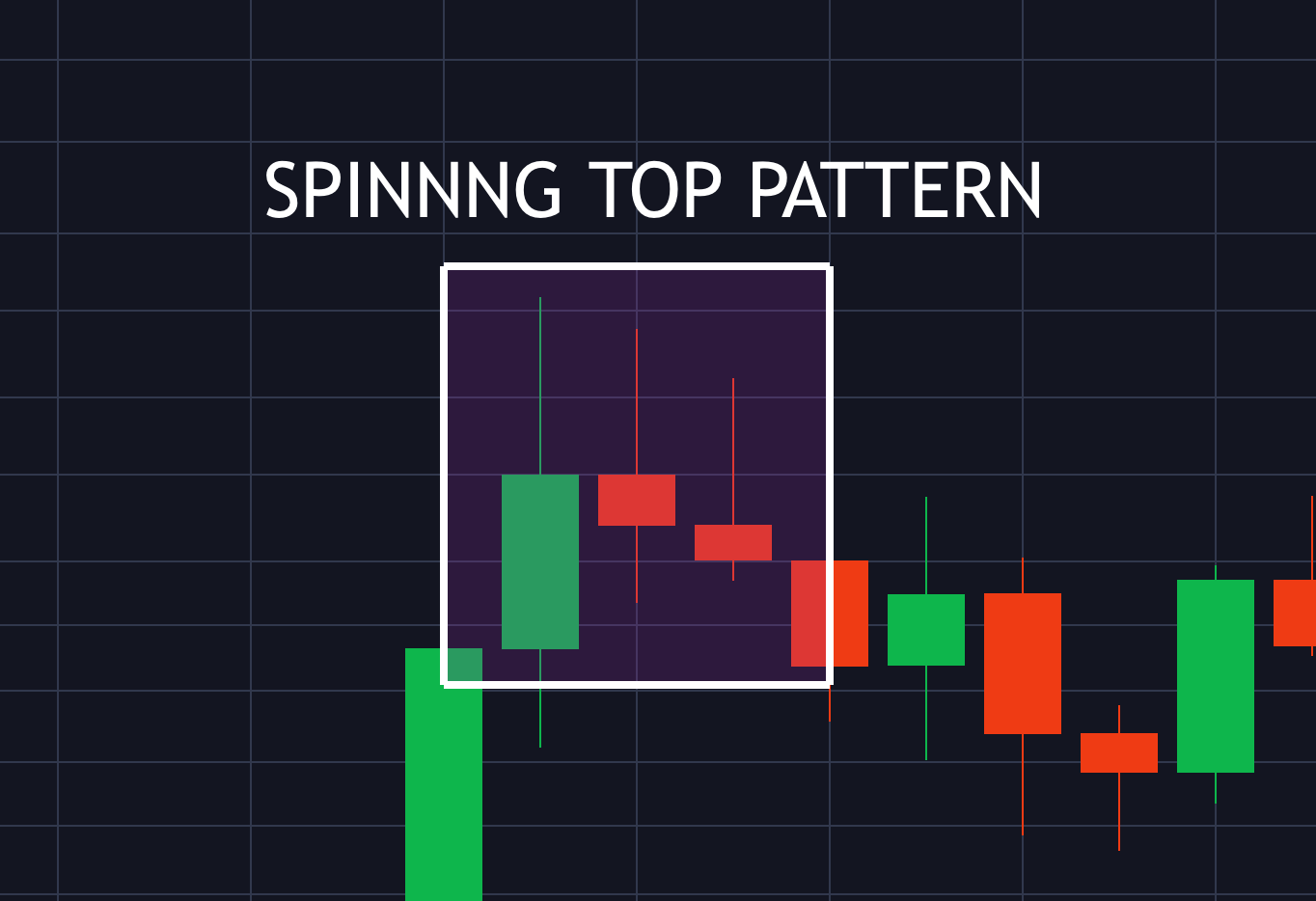

The spinning top candle pattern is a Japanese candlestick pattern that typically signals a possible trend reversal in the cryptocurrency market. It is characterized as having a short body with a long wick (or shadow) on the upper and lower sides of the candle’s real body. It appears as a signal that the prevailing trend could finish and price reverse.

Although the word “top” is in the name of the candlestick pattern, the spinning top formation is in reference to the shape of the pattern resembling the gyroscopic spinning toy of the same name. This means that a spinning top pattern forms at both the end of an uptrend (most common) or at the bottom of a downtrend (less frequent).

What Does A Spinning Top Candle Tell The Crypto Market?

A spinning top tells crypto traders that there is strong indecision and both sides of the market had powerful movements, but ultimately buyers and sellers were unable to choose a direction and ended up roughly where they began.

A spinning top forms when there is a potential price reversal in the making. The pattern is confirmed if there is bullish or bearish follow through on the next candles after the spinning top pattern appears. Always wait for confirmation before taking a position due to a spinning top candle appearing on a price chart, and set a stop-loss order above it in case the pattern fails. With patience, once the pattern has been established, it can provide a low risk-to-reward setup to profit from price action that moves sharply in the opposite price direction.

How To Identify The Spinning Top Candlestick Pattern?

A spinning top candle must have a short real body vertically centered between long upper and lower wicks. If it does not fit these conditions, be careful it is not some other candlestick formation, like a doji. Ideally, the upper and lower wicks are roughly the same length.

Spinning top candle patterns tend to form at the top or bottom of an impulsive move to the downside or upside and signal a possible trend reversal. Because the spinning top candle is a reversal signal, its signals aren’t as strong during sideways movement or consolidation.

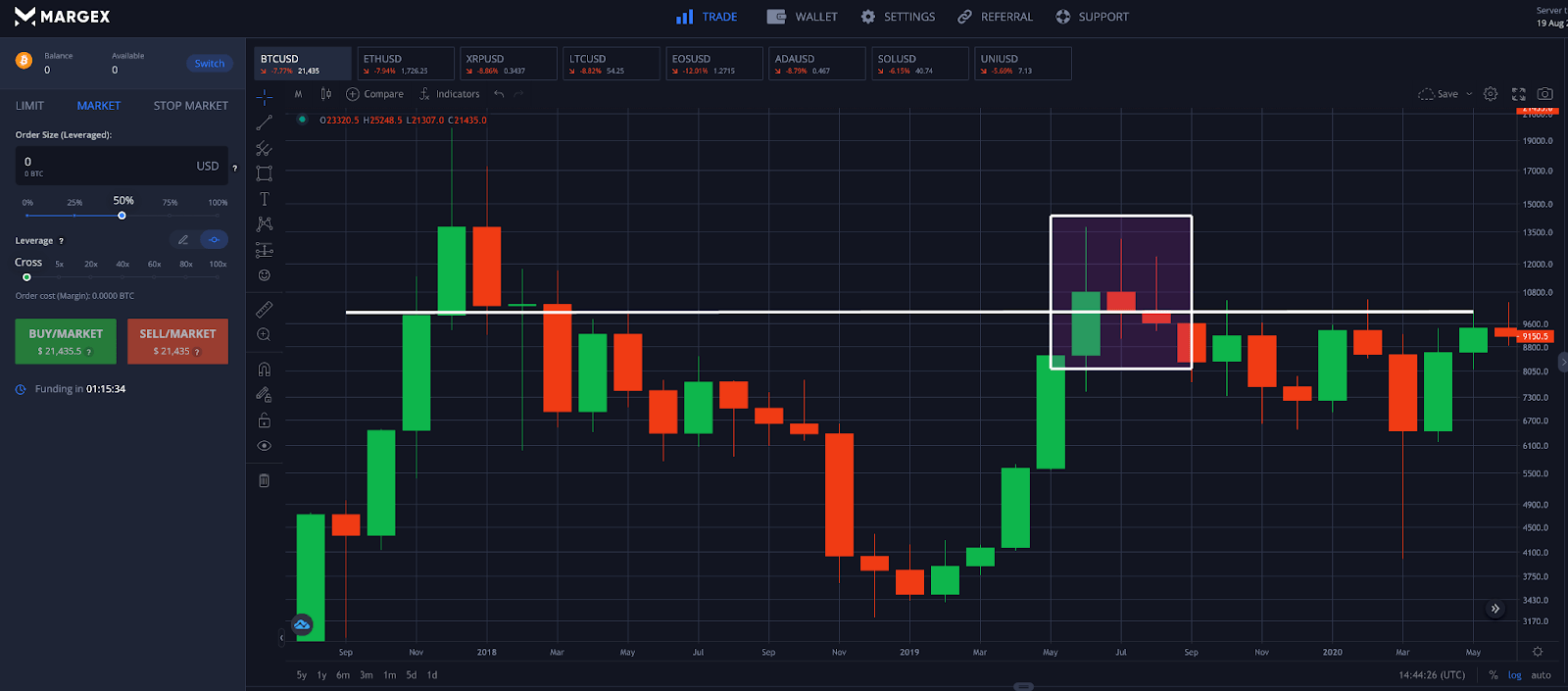

Crypto Market Spinning Top Candle Example

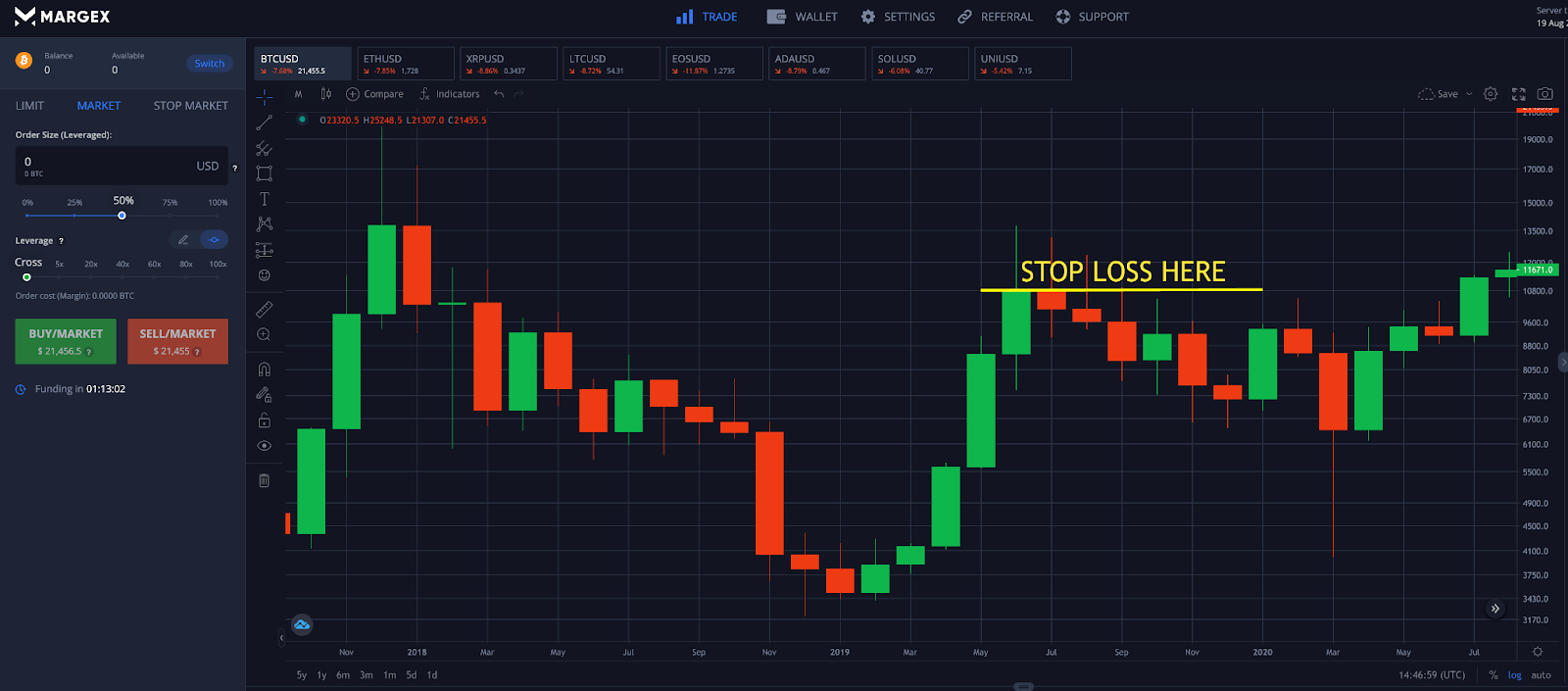

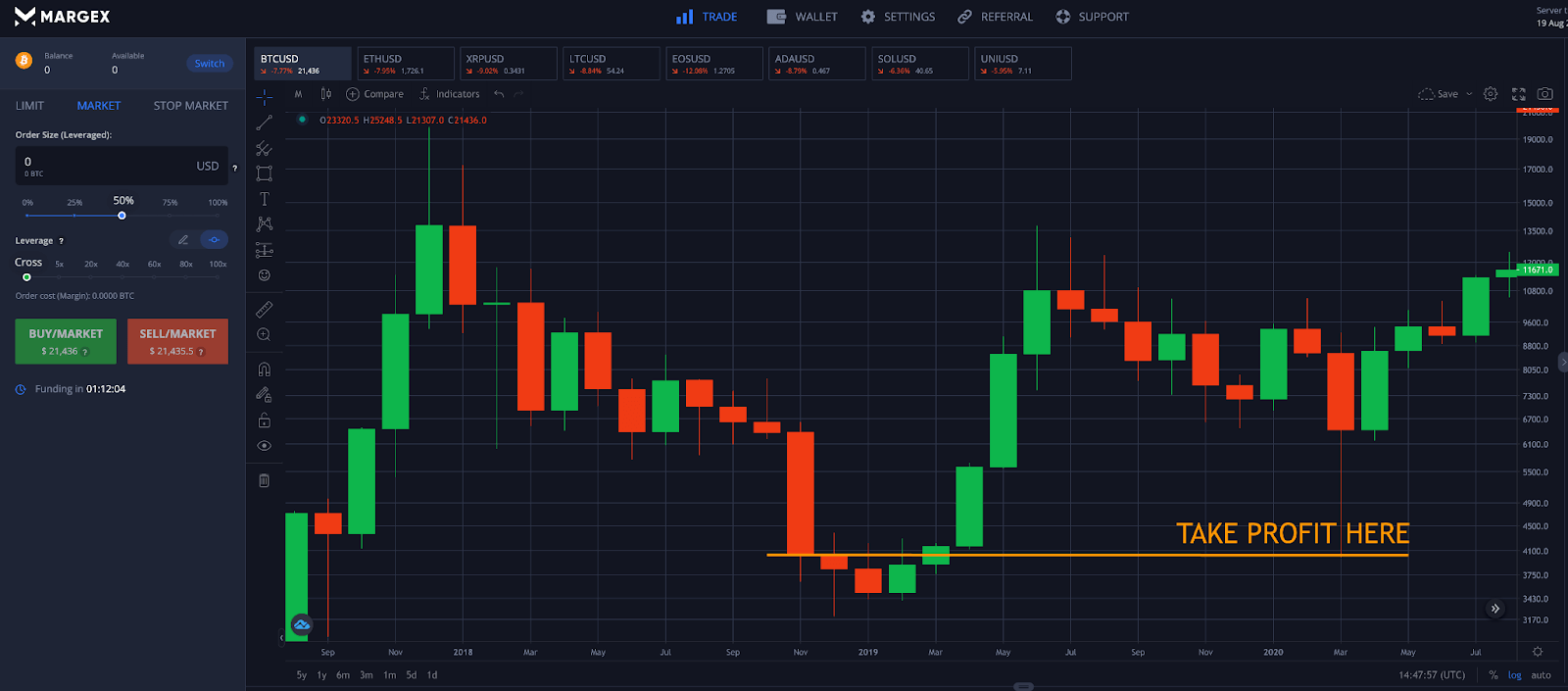

In the below real crypto market example, Bitcoin monthly formed a spinning top candle just as it retested previous resistance levels. The long wicks represent selling at the top of the trend. The spinning top candle formed after the last large green uptrend candle, before a downtrend began. The following red candles confirmed the reversal pattern.

Limitations Of The Spinning Top Technical Analysis Chart Pattern

The primary limitations of the spinning top candlestick pattern is that it can be easily confused for other candlestick patterns, namely the doji. In the next section we’ll explain the differences and similarities between a spinning top candlestick pattern and a doji candle pattern.

Because spinning top candles are fairly common candlestick patterns, they often lead to false signals, especially during sideways price action. The signal requires confirmation before taking action, which often can lead to late entries and missing a portion of the price movement.

There is also no telling that a trend is guaranteed to reverse based on the signal and work best when combined with chart patterns, if they appear at key support and resistance levels, or when used in conjunction with popular technical indicators like the Relative Strength Index, MACD, Bollinger Bands, Ichimoku, and more.

Spinning Top Candle Versus Doji Candle: What Are The Differences And Similarities?

Although spinning top candles and doji candles look very similar in construction, dojis can also be a neutral pattern and a pause prior to continuation, or a reversal pattern. Spinning top patterns are typically a reversal pattern only.

The biggest difference in understanding which type of candle you are looking at is if the closing price and opening price are extremely tight, then it is a doji. Both have a small real body, but doji candles have less price discrepancy between open and close. Also, spinning tops and a longer upper and lower shadow, which resembles a gyroscopic spinning top toy.

How To Trade The Spinning Top Candlestick Using Margex Trading Tools

Picking the right broker to trade with is critical to success. The innovative Margex margin trading platform offers built in technical analysis tools and popular trading indicators to help traders scan for common candlestick patterns and react accordingly.

Follow these 4 simple steps to trade the spinning top candle using Margex trading tools.

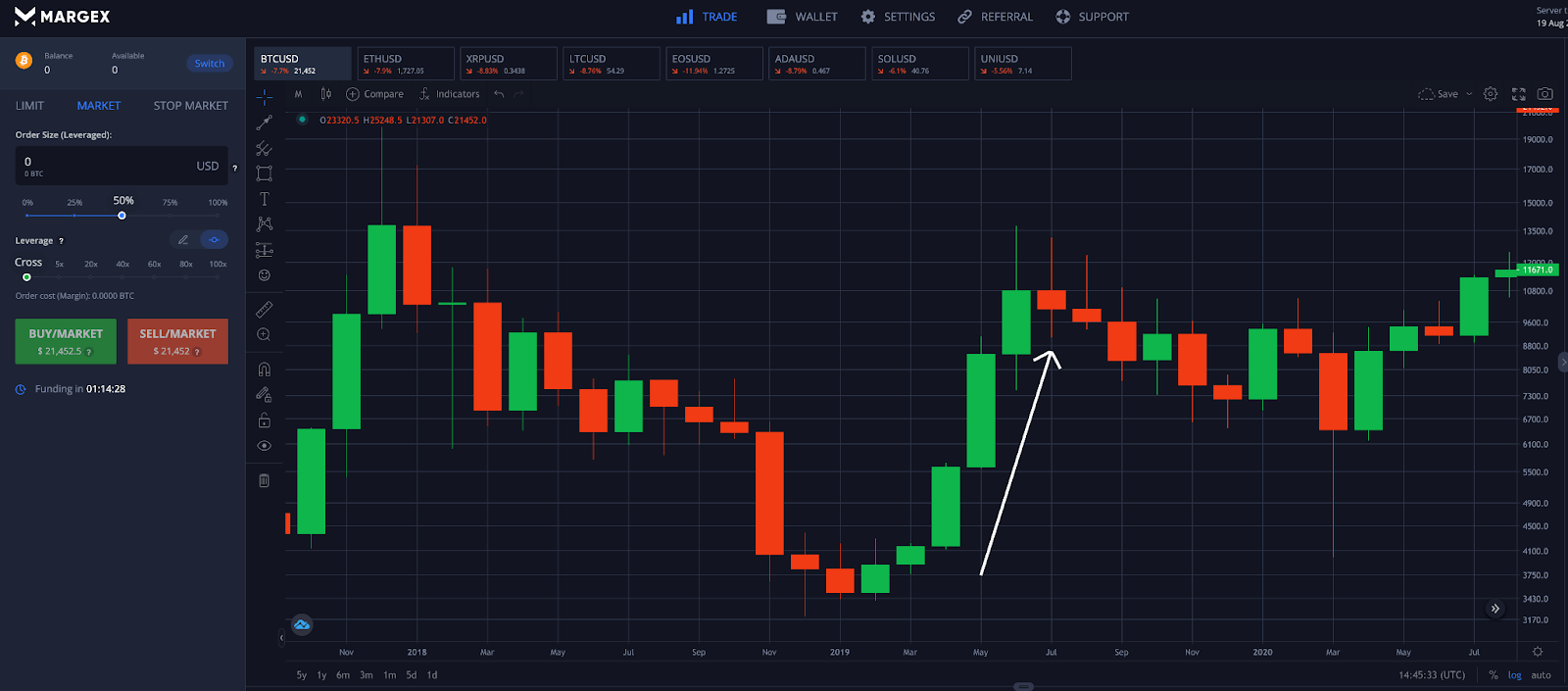

Step 1 – Open the Bitcoin (BTC) chart, and scan the price action for any spinning top candles. Be sure to focus on spinning top candles that form at the top or bottom of a strong trend, as these signals are more likely to confirm.

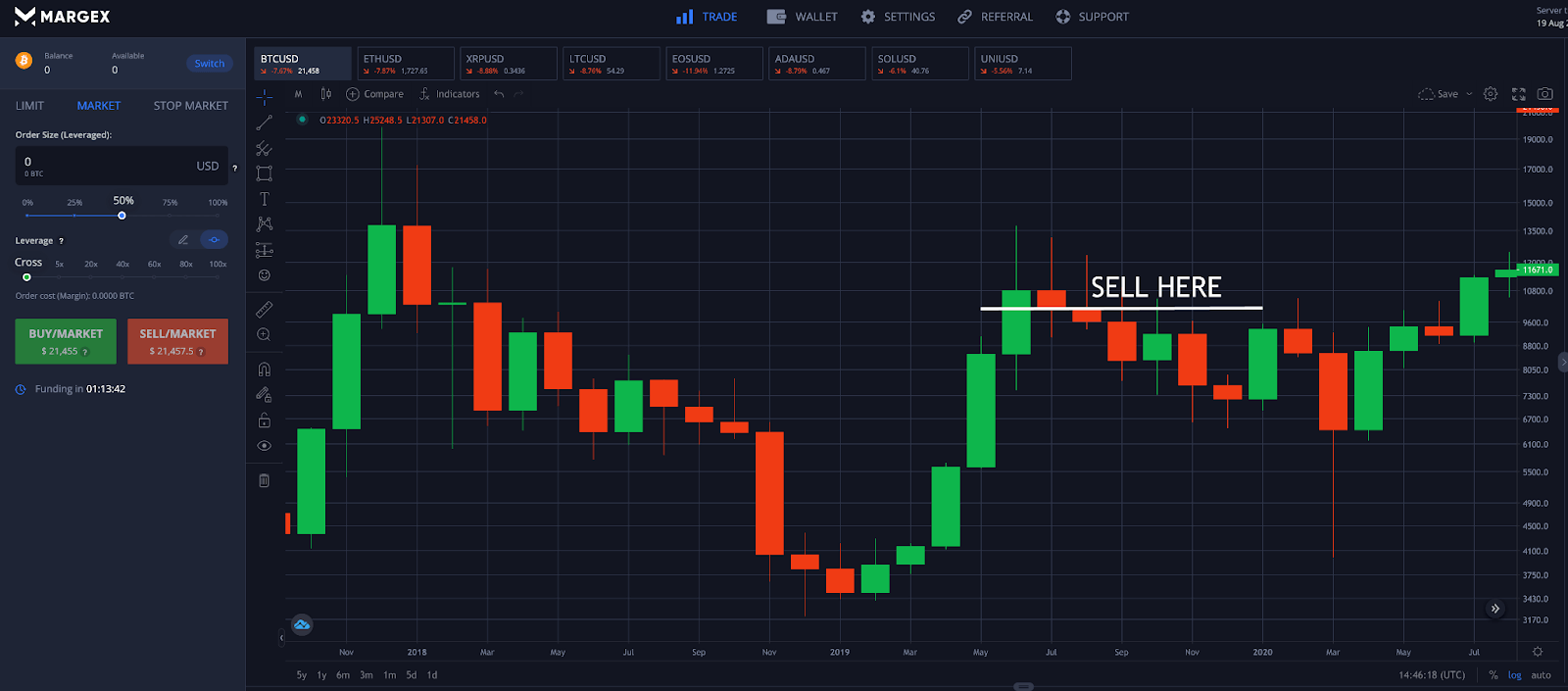

Step 2 – Wait for confirmation of the signal before taking a position. The pattern is valid once price moves in the opposite direction of the prevailing trend. At this point, place a buy or sell order depending on if you are a bear or bull.

Step 3 – Place a stop loss order above or below the real body of the spinning top candle. A looser stop loss strategy would entail placing the stop loss above the wick instead of the candle real body.

Step 4 – Plan ahead to take profit at key resistance or support zones, based on previous price action or Fibonacci retracement and extension levels. Congratulations, you have traded a spinning top candlestick pattern!

Spinning Top Candlestick Pattern FAQ: Commonly Asked Questions About The Spinning Top Candle

The spinning top candlestick pattern is a common candlestick pattern, but because of its close resemblance to the doji and strict conditions under which a spinning top candle is formed, there are often lingering questions that newcomers might have.

As such, we have prepared this spinning top candle pattern FAQ:

Are spinning top candles bullish or bearish?

Spinning top candlesticks can be both bullish or bearish. The word top in the name of the pattern can often confuse traders into thinking it is a topping pattern only. However, the pattern is named due to its close resemblance to the gyroscopic spinning top toy. It can appear at the very bottom of a trend before a reversal also.

What does a spinning top candle indicate?

A spinning top candlestick indicates strong indecision taking place in the market, and a huge battle between bulls and bears. The fight pushes prices in both directions, leaving a long wick behind on both ends, but ultimately closes with a small real body. The smaller real body is indicative of the ending balance of the trading session.

How do you use a spinning top candlestick to trade?

Using spinning top candles to trade must be confirmed with technical indicators, chart patterns, support and resistance, and much more. The spinning top candlestick isn’t always a pattern to trade on immediately upon its appearance. You must wait for confirmation in the opposite direction before taking a market entry.

What does a white or green spinning top candlestick mean?

A white or green spinning top candlestick simply means that bulls were able to have the slight upper-hand during the trading session. The color of the candlestick doesn’t matter quite as much as its appearance and what happens after it appears. Both color spinning tops can appear at the top or bottom of a downtrend and precede a reversal.

What does black or red spinning top indicate?

A black or red spinning top candlestick simply means that bears instead were able to gain the slight upper-hand during the trading session. The color of the candlestick doesn’t matter quite as much as its appearance and what happens after it appears. Both color spinning tops can appear at the top or bottom of a downtrend and precede a reversal.

What shape is a spinning top candle?

A spinning top candlestick – much like the name sounds – looks like the popular children’s toy that spins on an axis to maintain momentum after being twisted. Eventually, momentum runs out, and the top topples over. The pattern also indicates momentum running out of an uptrend or downtrend, and then reversing in the opposite direction, much like the toy example itself.