The study of technical analysis involves comparing past price movements and using the learnings to attempt to anticipate and predict future price action.

What began as studying prices on paper “tape” and hand-drawing trend lines evolved into advanced computer software for analysis and a wide range of complex technical indicators.

Among those technical analysis tools is the MACD indicator, which can be used to generate a buy signal or a sell signal depending on market momentum. It also can help tell a trader when a cryptocurrency or other asset is overbought or oversold.

Read the following in-depth MACD crypto trading guide, complete with details on the tool’s definition, how MACD works, its calculation, and how to use it to trade crypto.

MACD Indicator Definition: What Is MACD In Crypto?

MACD stands for the Moving Average Convergence/Divergence indicator for short. It is a trend-following momentum indicator created by Gerald Appel in the late 1970s to analyze stock prices. However, the MACD indicator can be used reliably in commodities, forex, and cryptocurrencies.

The MACD is a popular technical analysis tool and as a result has become a cornerstone of an effective crypto trading strategy.

The tool is an unbounded oscillator consisting of an MACD line, a nine-period exponential moving average (EMA) acting as a signal line, and a histogram.

How Does The MACD Work? MACD Indicator Explained

The MACD line is the sum of a long-term EMA subtracted by a short-term EMA. The signal line is then plotted over the MACD line. When the two lines converge and diverge it can signal an asset is overbought or oversold, or that a trend change and reversal could be coming.

When the two lines crossover, it can act as a powerful trading signal that a change in momentum has potentially occurred.

MACD Formula: What Is MACD Indicator Calculation?

The formula for MACD is:

MACD = 12-Period EMA − 26-Period EMA

The MACD line is calculated by subtracting the 26-period EMA from the 12-period EMA.

Exponential moving averages give greater weight to recent price data.

The formula for EMAs is:

EMA = Closing price x multiplier + EMA (previous day) x (1-multiplier)

According to Investopedia, “the MACD has a positive value whenever the 12-period EMA is above the 26-period EMA and a negative value when the 12-period EMA is below the 26-period EMA.”

The MACD histogram formula is:

Histogram = MACD line – Signal line

The difference in these lines is represented visually using the histogram.

MACD Settings For Crypto Trading

Unfortunately, there are no special settings for the MACD to apply to crypto or other markets like there is for the Ichimoku and several other technical indicators. However, traders are always welcome to experiment. Be sure to backtest any trading strategies before using capital to trade.

How To Interpret MACD Signals And How To Read MACD Charts

Reading MACD cryptocurrency price charts can become second nature with some familiarity and practice using the tool.

Line crossovers can be used to generate a buy or sell signal. A bullish cross occurs when the MACD line crosses the signal line from below, while a bearish cross occurs when the MACD line crosses the signal line from above. MACD crosses can be a powerful signal to enter a position.

If the MACD line and signal line are rising together the momentum is bullish and if they are falling the momentum is bearish. If the lines are diverging, it suggests an asset is overbought or oversold. If the lines are beginning to converge it could lead to a crossover.

If the histogram lines are growing, a trend is gaining in strength. If the histogram lines are shortening, the trend could be weakening and a trader can anticipate a possible trend change.

What Is MACD Divergence? How To Use MACD To Trade Divergences

The MACD histogram is a visual tool that represents the difference between the MACD line and the signal line. The histogram grows as the speed of price movements increase in momentum and trends strengthen. When the histogram decreases, a trend, momentum, and the speed of price movements could be weakening.

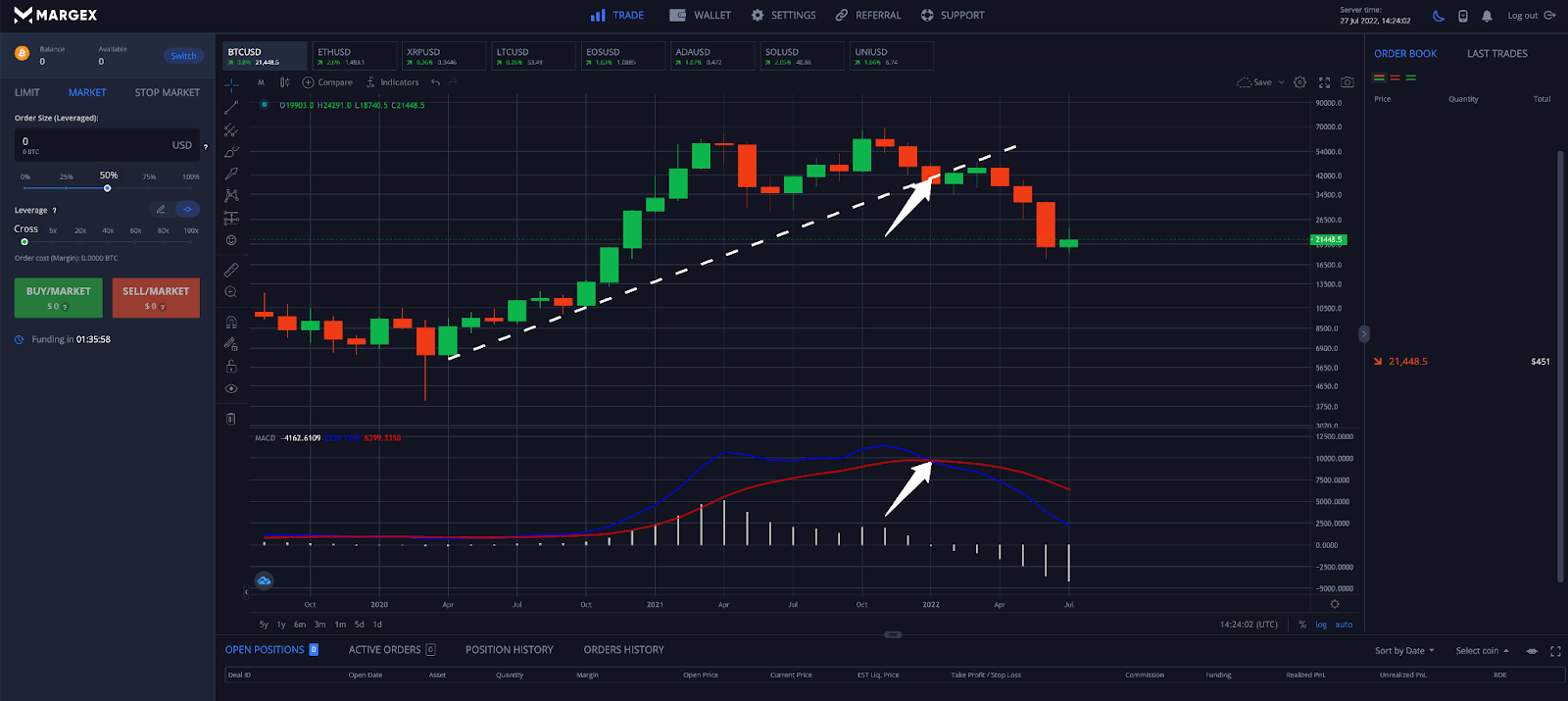

A divergence can appear on the histogram if price action doesn’t move in the same direction of the indicator. For example, a bearish divergence appears when price is making higher highs, while the MACD is making lower highs. A bullish divergence appears when price is making lower lows, while the MACD is making higher lows.

Divergences can be found by drawing trend lines across a series of swing highs or swing lows to better understand if any discrepancies between price and the technical indicator exist. Trading divergences can be tricky and isn’t recommended. Divergences are only confirmed in hindsight and can lead to traders being faked out or chopped up.

Reading MACD divergences, however, can tip a trader off about a potential trend change, allowing the trader to prepare accordingly and look for supporting signals and patterns that could confirm the setup.

Example Of How To Use MACD In The Crypto Market

Here is an example of how to use the MACD to trade cryptocurrencies like Bitcoin, Ethereum, Litecoin, XRP, and other altcoins.

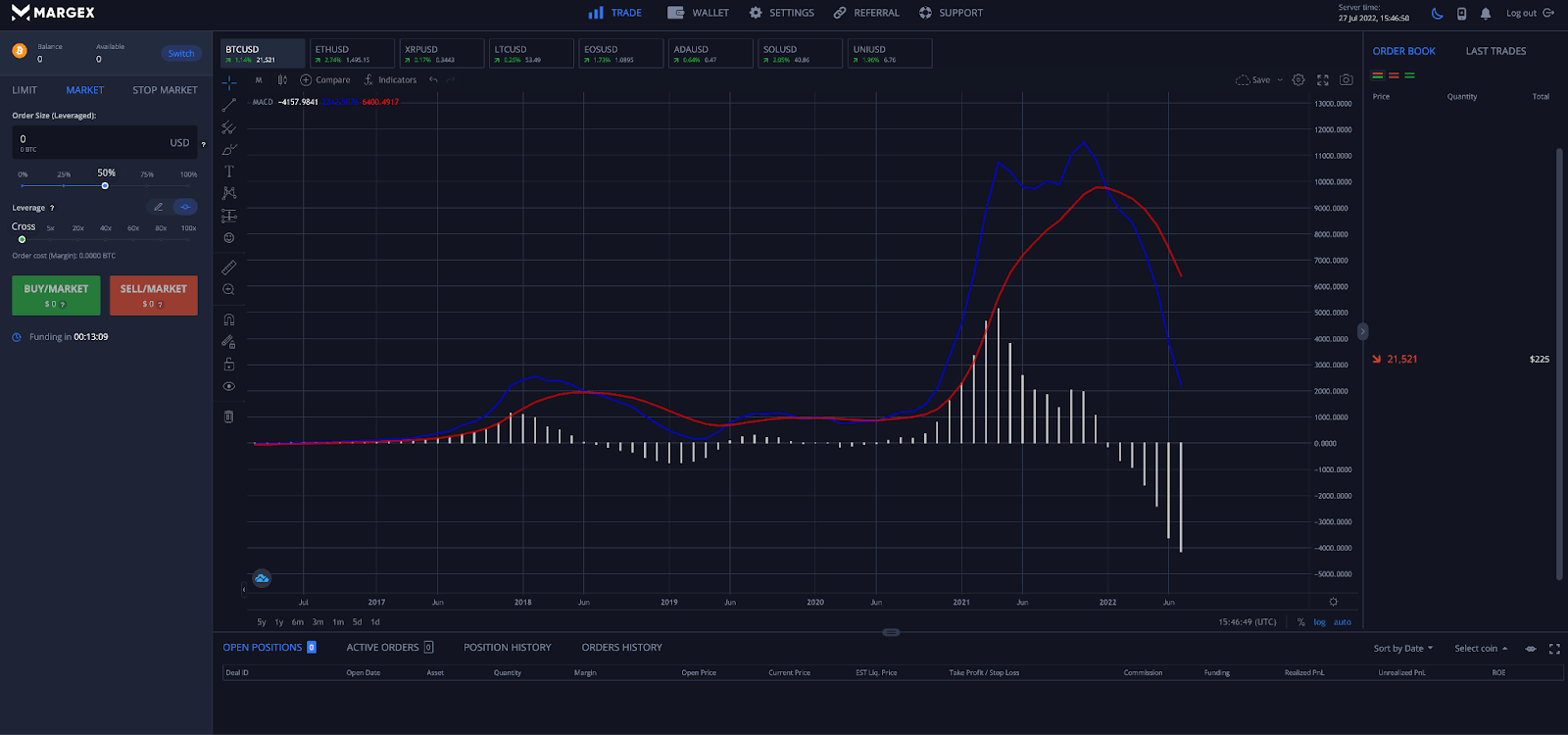

In the BTC example above, the MACD is converging at the zero line. Either the MACD will cross bearish and prices will fall, or the MACD will diverge from here and prices will soar higher with increasing momentum.

It is then important to consider the rest of the picture from a technical analysis standpoint. Bitcoin is also supported by a minor uptrend line (orange dashed line) and there is a possible bull flag. If price collapses below the trend line with a bearish crossover, more downside should be confirmed. If price pumps and the MACD diverges, significant upside could follow.

Advantages And Disadvantages Of Using MACD

Like any tool, there are always upsides and downsides to using them. Some indicators give false positive signals, lag behind trend changes, or create other issues.

Here are some of the most common advantages and disadvantages of using the MACD indicator:

MACD Crypto Trading Pros

✔️Measures momentum

✔️Easy to read

✔️Follows the trend

✔️Clear buy or sell signals

MACD Crypto Trading Cons

❌Lagging indicator

❌False signals

❌No custom settings

How To Trade With MACD Indicator On Margex

The Margex trading platform offers built-in technical analysis tools that the pros rely on, like the RSI, Ichimoku, Bollinger Bands, Fibonacci tools, and the MACD. Here is a step-by-step guide on how to use the MACD to trade crypto with Margex.

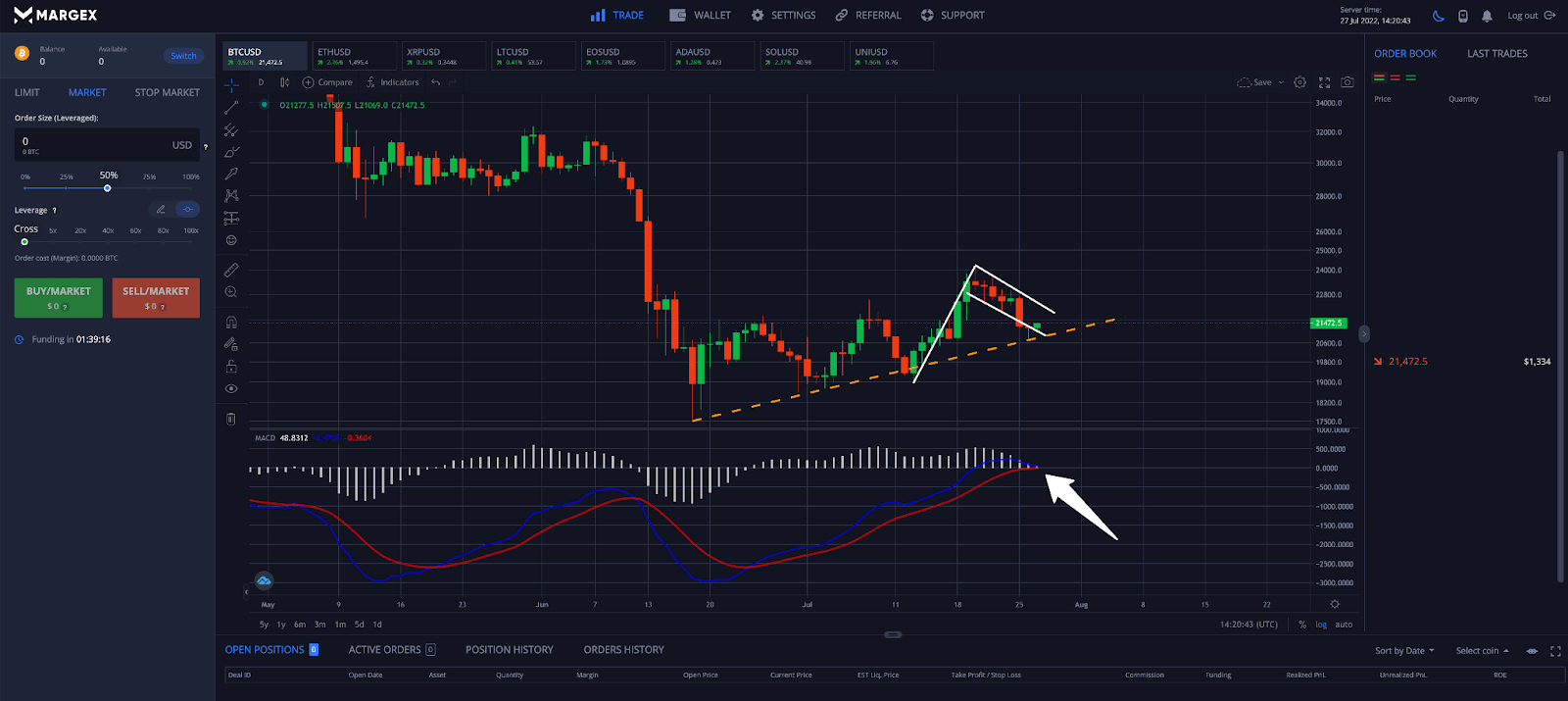

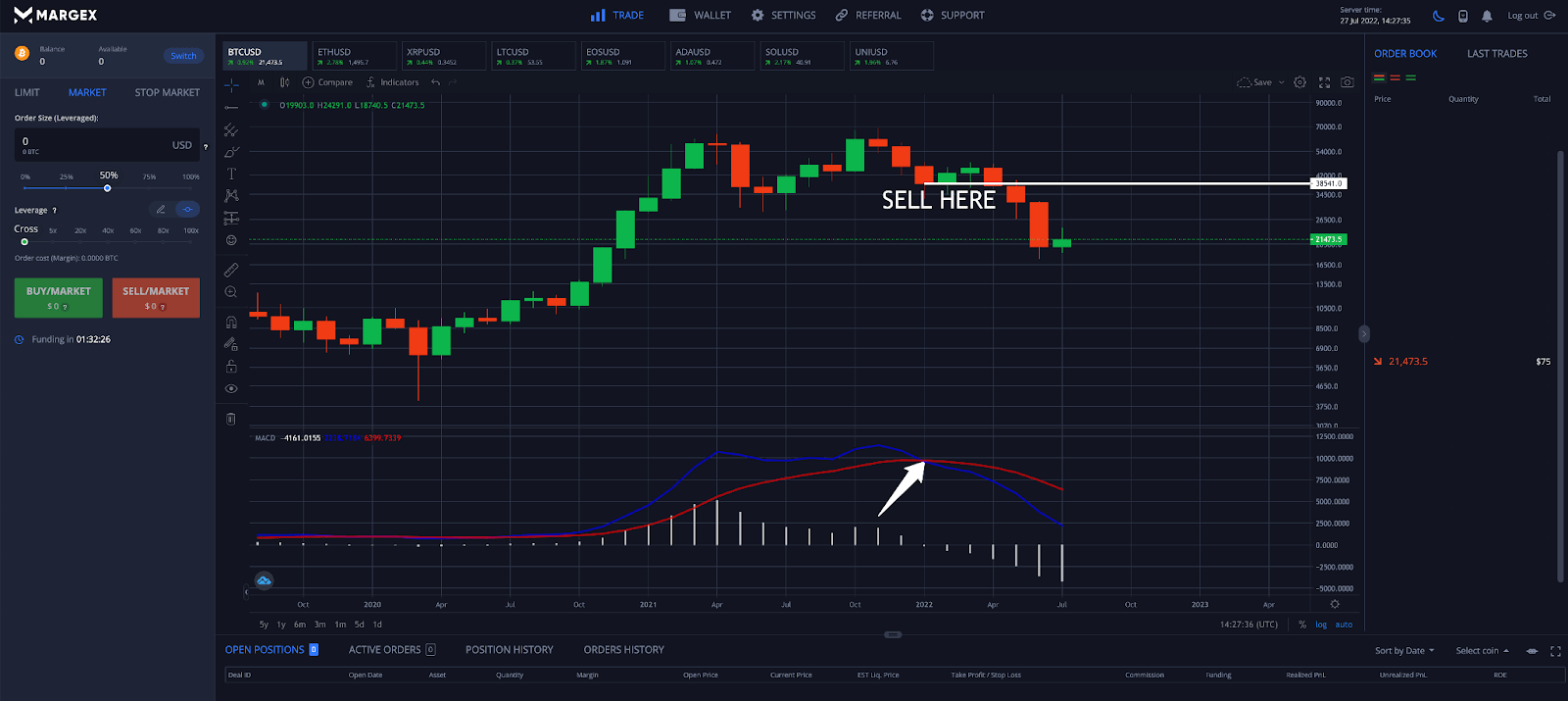

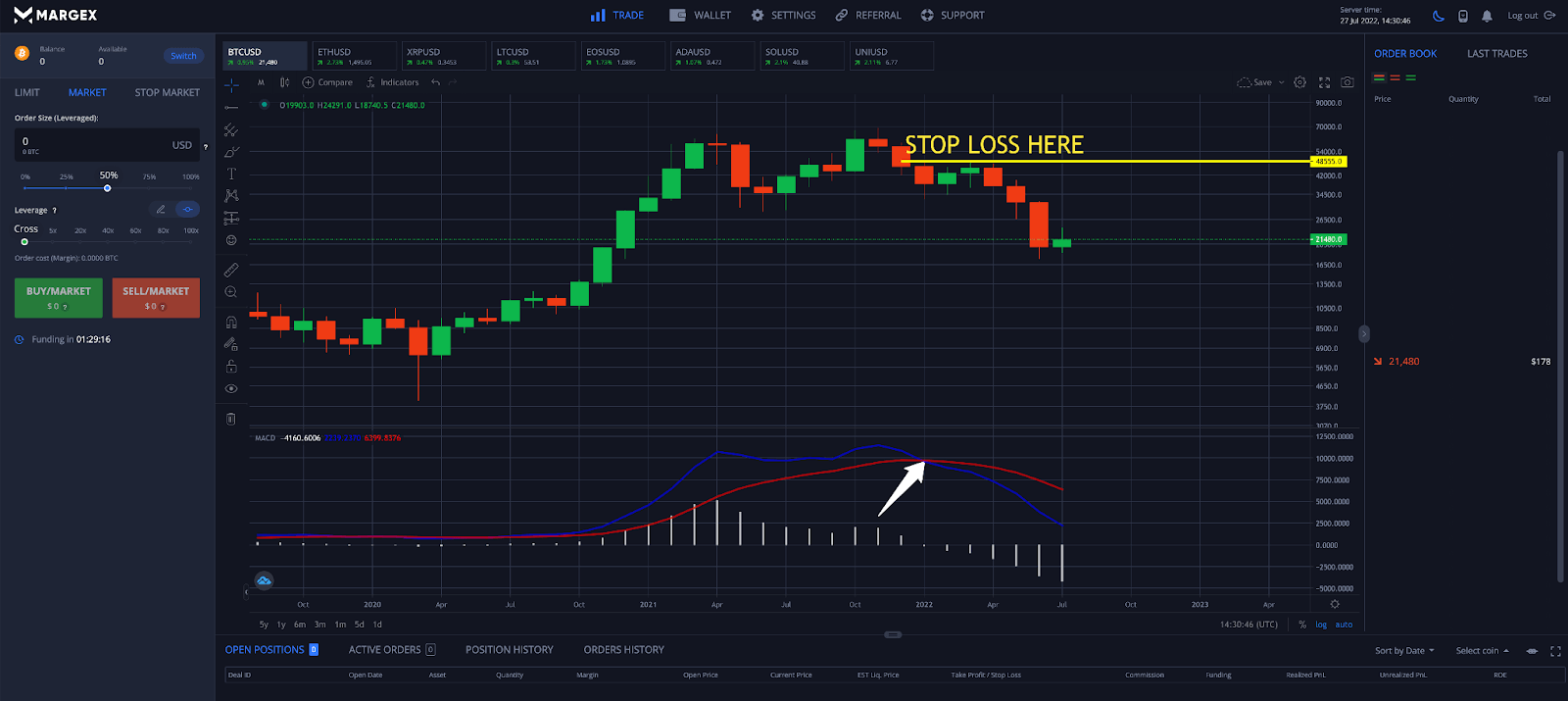

Step 1 – Turn on the MACD and highlight any bearish or bullish crossovers. Note: Crossovers are better signals if they appear as a trend line is breach (pictured).

Step 2 – Because this is a bearish crossover on weekly timeframes, it is a signal the uptrend is over and it is time to sell. A trade would be entered either after the two lines have crossed, thus commencing a new downtrend.

Step 3 – Place a stop loss order above the candle where the bearish crossover occurred. BTC dropped another 50% from where the sell order was placed and the stop loss was never triggered.

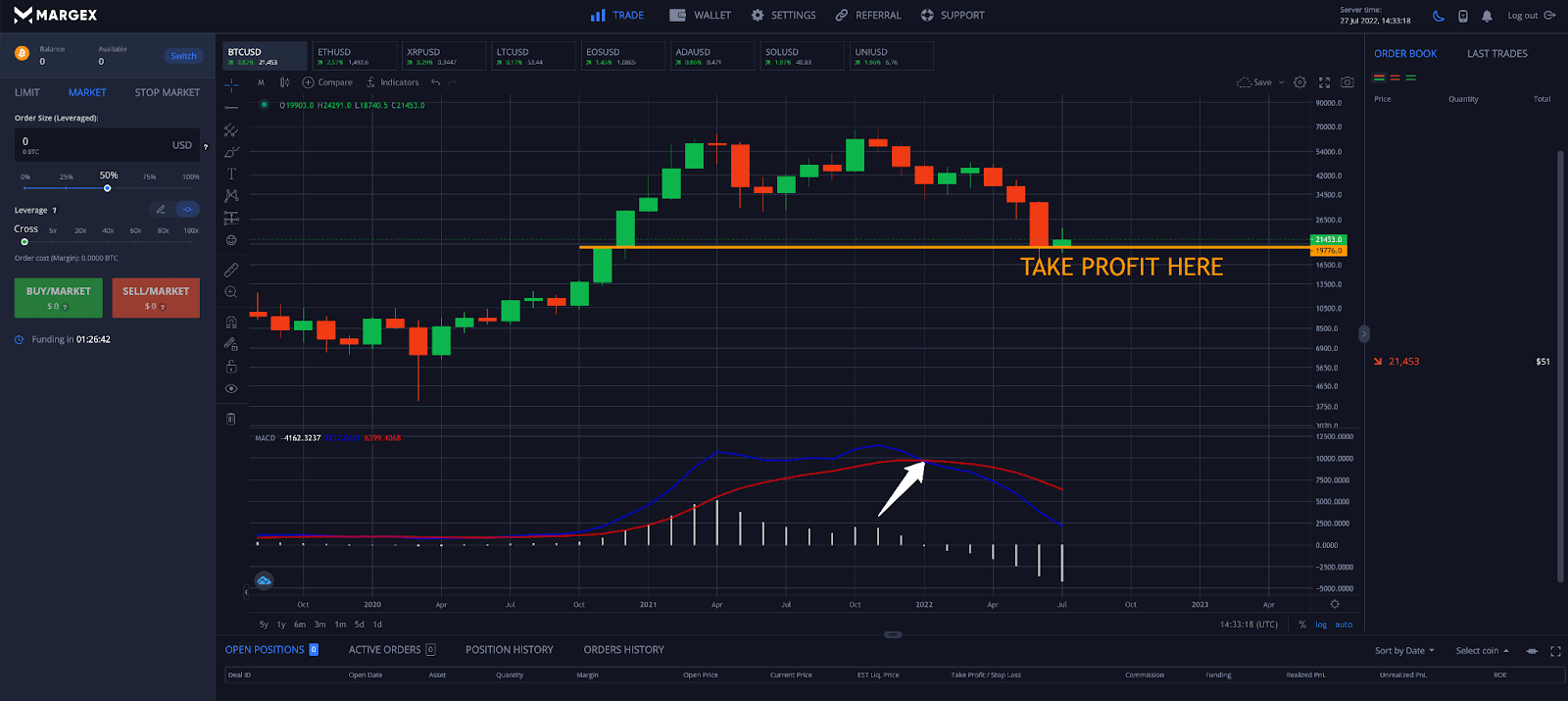

Step 4 – Traders should plan to take profit at key targets accordingly. Alternatively, a trader can wait for a bullish crossover to close any positions. However, because the MACD is a lagging indicator this isn’t recommended.

How To Avoid False MACD Signals: Understanding MACD Lagging Signals

The MACD is a trend-following momentum indicator. This means at times the trend will have changes prior to the MACD providing a crossover or signal. This has given the MACD a notorious reputation as a lagging indicator. Many argue that the MACD isn’t a great tool to trade with, while others swear by it in their toolset.

However, there are several ways to utilize the MACD effectively. The MACD is a great tool for spotting divergences. Positive divergences aren’t signals to actively trade on, but they can tell a trader a trend change might be coming and the trader can prepare accordingly.

The MACD also works well in conjunction with other technical indicators, such as the RSI, Stochastic, Bollinger Bands, and more. Traders can look for possible Japanese candlestick patterns or watch for MACD crossovers at support or resistance to further improve results of using the tool.

MACD Versus Relative Strength Index (RSI)

The RSI indicator and the MACD indicator are two of the most commonly used momentum indicators used by crypto traders. Although they both measure momentum and the velocity of a price movement, the way each tool provides signals is different.

The Relative Strength Index (RSI) indicates when an asset is overbought or oversold in relation to recent price action. The RSI takes the average gains and losses over 14-periods by default. Traders can experiment further with custom RSI settings.

The MACD is an unbounded oscillator while the RSI is range-bound between a scale of 0 to 100. A RSI reading of over 70 is considered overbought while a reading below 30 is considered oversold. Readings of below 50 are bearish while readings of above 50 are bullish. Because cryptocurrencies are speculative assets, they can remain overbought or oversold for extended periods of time compared to other assets.

The MACD measures the convergence or divergence between the MACD line and the signal line, while the RSI focuses on average price gains and losses during a timeframe. Because the two indicators work differently, they can generate mixed signals. However, when the two technical indicators are giving similar signals, traders have additional confirmation and a higher probability of a profitable trade setup.

FAQ

The MACD indicator (moving average convergence divergence) is an easy to read tool that provides potential buy and sell signals. However, using the MACD for crypto trading can be confusing for many.

We have created this MACD crypto trading FAQ to answer any remaining questions about the MACD indicator.

What is a MACD in crypto?

The MACD in crypto refers to a popular technical analysis tool and trend-following momentum oscillator that can be used to generate buy or sell signals, indicate when a market is bullish or bearish, and tell a trader when an asset is potentially oversold or overbought.

What does MACD mean?

MACD stands for moving average convergence/divergence and its signals are provided when the MACD line and signal line converge or diverge in either direction. Convergence can lead to crossovers and momentum changes, while divergence of the two lines can lead to trend continuation. This is not to be confused with a bearish or bullish divergence, which can signal a possible trend change.

Does MACD work with crypto?

The MACD is one of the best tools to use with cryptocurrencies like Bitcoin, Ethereum, and other altcoins offered by Margex. It offers effective signals that momentum has changed in the highly volatile asset class.

How to use the MACD indicator in crypto?

Using the MACD indicator in crypto involves looking for potential crossovers and changes in momentum. It also can be used to find bullish divergences and bearish divergences. The tool can also be used to tell when an asset is bullish or bearish, or oversold or overbought.

Is MACD crypto trading profitable?

The MACD can be a profitable technical trading indicator when used in conjunction with other indicators, support and resistance, chart patterns, Japanese candlestick patterns, and more. By itself, its signals can be unreliable and it has an infamous reputation for being a lagging indicator.

Is MACD a good indicator?

The MACD indicator isn’t one of the most popular indicators in technical analysis for nothing! The tool is great for hindsight comparisons and for finding potential setups before they occur. The key is using the MACD to look for potential divergences and then use the RSI or other tools and signals and wait for confirmation. The combination of the tools can increase the probability of success.

Which MACD is best?

For most intents and purposes, the regular MACD is best on default settings. However, when looking at large price movements over a longer timeframe, such as the entire price history of Bitcoin, using a logarithmic price chart in conjunction with the LMACD can work even better. The LMACD is the logarithmic version of the MACD and can give a better comparison between past price movements in terms of momentum.

Which is better, MACD or RSI?

For taking trades and entering positions, the RSI is a better technical indicator. However, for marking major momentum changes, there is no better tool than the MACD. Major momentum changes often happen in price before they occur on the MACD, giving the indicator a bad reputation as a lagging indicator. However, when used to prepare in advance for moves that are later confirmed by the RSI, the MACD and RSI can be a winning combination.