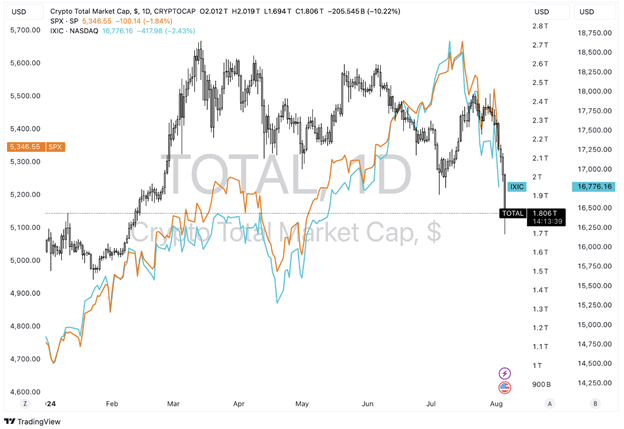

According to CoinGecko data, the cryptocurrency market capitalization has decreased by 15% over the past 24 hours, falling to $1.89 trillion as of Monday.

According to data from IntoTheBlock, Bitcoin experienced a significant correction, alongside declines in the S&P 500 and the Nasdaq Composite, despite having a negative 30-day correlation.

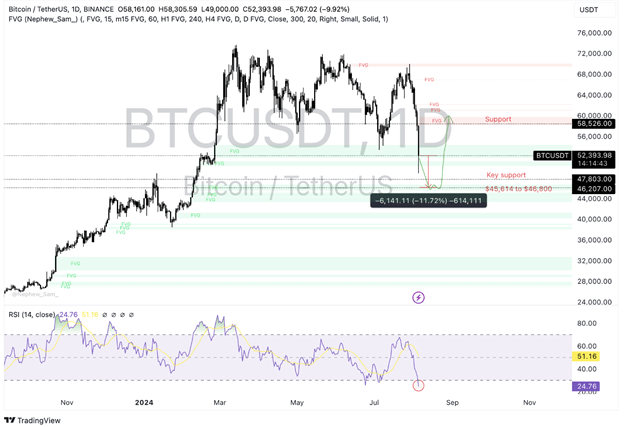

With forecasts that the most valuable cryptocurrency by market capitalization will face further drops, Bitcoin fell below $50,000.

Based on Coinglass data, one of the most notable liquidation occurrences since the collapse of the FTX exchange is that 24-hour liquidations in the crypto market have exceeded $1 billion.

Whether this ends the bull run for Bitcoin remains unknown among market players.

The chart below shows the fall in crypto market capitalization and corrections in the S&P 500 and Nasdaq Composite. Stock and risk assets, including Bitcoin and other cryptocurrencies, have suffered following the most recent US Federal Reserve meeting.

Declines since July 31 demonstrate a significant correlation between Bitcoin (BTC) and the S&P 500, as shown in the chart.

While bonds climb, global stock markets keep falling since recession concerns raise uncertainty among crypto traders. One of the most notable developments following the FTX fall was $1.06 billion in liquidations on the crypto market.

With its price falling below $50,000, the primary psychological support level for the most valuable cryptocurrency by market capitalization, Bitcoin has lost appeal. Targeting the liquidity in the Fair Value Gap (FVG), between $45,614 and $46,800, BTC could extend its losses by about 10%.

Before starting a comeback, Bitcoin can attain a liquidity level of $46,207.

The Relative Strength Index (RSI) indicator, currently reading 24.76, shows that BTC falls into the “oversold” range. Usually, an RSI of less than 30 signals an asset to buy. Based on this indicator, those waiting on the sidelines for Bitcoin should consider joining the trade.

Now functioning as resistance at $58,526, a daily candlestick close above the previous support level might undermine Bitcoin’s negative projection.

Bitcoin Falls Short of ‘New Gold’ Status, Claims Analyst

Declaring that it no longer holds in a recent tweet, Joe Weisenthal of Bloomberg questioned Bitcoin’s “store of value” premise.

9) The Bitcoin “store of value” thesis is getting blown up right now.

Bitcoin doesn’t look like The New Gold. It looks like 3 tech stocks in a trenchcoat. pic.twitter.com/cY77hvXagL

— Joe Weisenthal (@TheStalwart) August 5, 2024

BTC Last Week Report

At the start of the previous week, Bitcoin (BTC) struggled to maintain its position above $70,000 and dipped to $50,000 by Aug. 5.

Mt. Gox has transferred Bitcoin to exchanges for creditor repayments. Meanwhile, the Federal Open Market Committee (FOMC) voted to maintain US interest rates unaltered.

Legislative news reports state that US Senator Cynthia Lummis proposed the Bitcoin Act in the Senate. Furthermore, Michael Saylor’s MicroStrategy revealed that there are 226,500 Bitcoins. These developments helped explain Bitcoin’s declining price trend this week.

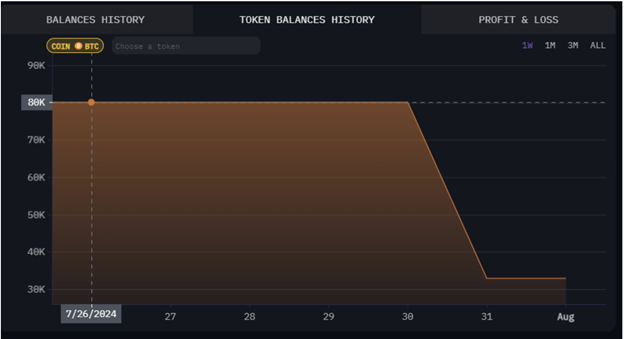

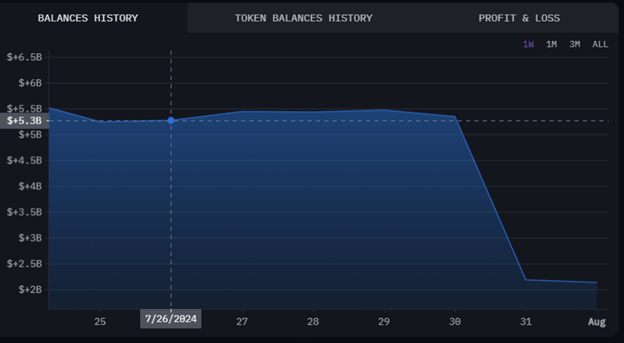

Data from Akram Intelligence shows that Mt. Gox’s token balance dropped from 80,000 to 33,000 BTC over the week. According to the token balance records, Mt. Gox’s holdings dropped from $5.3 billion to $2.1 billion from the start of the week.

BTC Transfers from Mt. Gox Linked to Market Fears and Bitcoin Price Decline

Recent Bitcoin (BTC) transfers from Mt. Gox to exchanges for creditor reimbursement could have caused Fear, Uncertainty, and Doubt (FUD) among traders, hence helping to lower the price of Bitcoin this week.

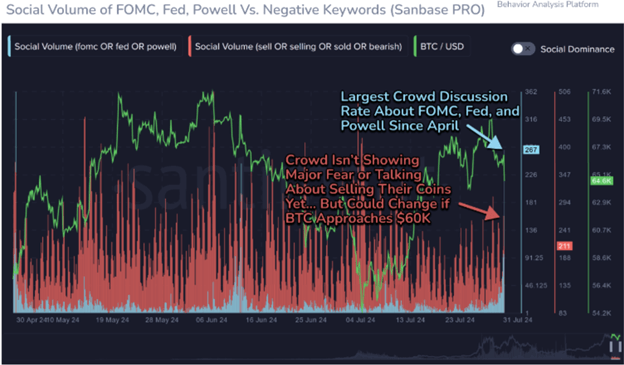

Keeping interest rates consistent at 5.25%-5.50%, the US Federal Reserve (Fed) met expectations on Wednesday in its FOMC meeting. Sentiment data, however, shows a first decline in crypto prices as traders had expected a first-time rate reduction starting on March 15, 2020.

Although there will be an early sell-off, market stabilization is likely driven by active whale accumulation and rising audience hostility, allowing a notable return.

Senator Cynthia Lummis Introduces the Bitcoin Act

US Senator Cynthia Lummis will officially present the Bitcoin Act in the Senate on Wednesday. The act suggests creating a strategic Bitcoin reserve as a supplementary store of value, strengthening America’s balance sheet and guaranteeing open federal government control of Bitcoin assets.

The wait is over. This is our Louisiana Purchase moment.

Read the text for my BITCOIN Act below ⬇️⬇️https://t.co/mSYJVwn1wI

— Senator Cynthia Lummis (@SenLummis) July 31, 2024

“As families across Wyoming struggle to keep up with soaring inflation rates and our national debt reaches new and unprecedented heights, it is time for us to take bold steps to create a brighter future for generations by creating a strategic Bitcoin reserve,” said Lummis.

The bill seeks for the US to buy one million BTC over five years, indicating institutional interest and possible government support for Bitcoin and thus strengthening its legitimacy and appeal.

Michael Saylor’s MicroStrategy Acquires 226,500 Bitcoins for $36,821 Each

MicroStrategy Incorporated (MSTR), the largest corporate holder of Bitcoin and the first development business worldwide has revealed its financial figures for the June quarter.

Now holding 226,500 bitcoins, the company’s market value exceeds its cost basis by 70%. Since the beginning of Q2, MicroStrategy has bought 12,222 bitcoins at an average price of $65,342, raising its total bitcoin holdings to $8.3 billion, averaging $36,821 per Bitcoin. In July, the business also bought 169 Bitcoins for $11.4 million.

“We are extremely optimistic about the improved understanding of Bitcoin and the increasing support for the ecosystem from bipartisan politicians and institutions, as showcased at the Bitcoin 2024 Conference in Nashville.

“Furthermore, we are witnessing continued global adoption of our cloud-powered BI and AI software, achieving another quarter of double-digit growth in subscription revenue and billings,” said Phong Le, MicroStrategy’s President and Chief Executive Officer.

Bitcoin Falls as Morgan Stanley and Genesis Trading Drive Market Changes

Friday dropped Bitcoin (BTC) below $61,000. Morgan Stanley is currently working with its financial advisers and wants to let them provide Bitcoin ETFs to particular clients. Genesis Trading has also moved Bitcoin and Ethereum to other addresses, which fuels rumors about starting debt payback to creditors.

According to CNBC, Morgan Stanley is preparing to let its customers make Bitcoin ETF investments. The company will first present two Bitcoin ETFs: Fidelity’s Wise Origin Bitcoin Fund and BlackRock’s iShares Bitcoin Trust.

The company’s growing interest in the changing scene of cryptocurrency investment products and rising client demand for Bitcoin ETFs drive recent developments in response. The company intends to restrict access to these new investment products by setting qualifying criteria, such as a minimum net worth of $1.5 million and a high-risk tolerance.

Although Bitcoin’s future seems bright, the news was eclipsed by Genesis Trading’s recent $1.5 billion Ethereum and Bitcoin movement. Data from Arkham Intelligence shows that Genesis sent 166,000 ETH, worth $521 million, and 16,600 BTC, valued at $1.1 billion, to many addresses on Friday.

Following the corporation’s insolvency in the wake of the 2022 market collapse, this massive flow of money has made the crypto community conjecture about possible debt settlement-related initiatives.

Following the fall of FTX and Three Arrow Capital (3AC), Genesis Global stopped trading activities and the Gemini Earn program in 2022. Listing 100,000 creditors with liabilities projected between $1.2 billion and $11 billion, the firm filed for bankruptcy in January 2023.

This scenario reflects the latest activities of the closed exchange Mt. Gox, which started paying back its debt this month. Of the 142,000 BTC owing to creditors, Mt. Gox already delivered 59,000 BTC.