Some Bitcoin whale wallets from around the time Satoshi Nakamoto was still online have recently become active. Miner wallets from those times and whale wallets from close to 11 years ago moved and took profit in September.

Meanwhile, Bitcoin remains lashed above the support mark of $65,000. On-chain tracker Whale Alert reports that on Saturday, September 28, a wallet address containing 150 BTC, approximately $9.8 million, became active. It expiates two different addresses’ transfers in just over 22 hours as over 75 BTC was transferred by the large wallet investor.

A week ago, more than $16 million in Bitcoin was on the move; wallet addresses belonging to a 2011 miner, the year Satoshi stopped posting in an online forum, started moving again. However, it is not perceivable if these old wallet addresses are cashing out or just relocating the location to other addresses.

https://twitter.com/lookonchain/status/1837031861819674881

As of now, Bitcoin was still clinging to recent gains, changing hands at $65,647. Over the week, BTC is up 3.81%, while in a month, it has risen 10.79%.

Bitcoin (BTC) Surges 3% This Week Amid Increased Institutional ETF Demand

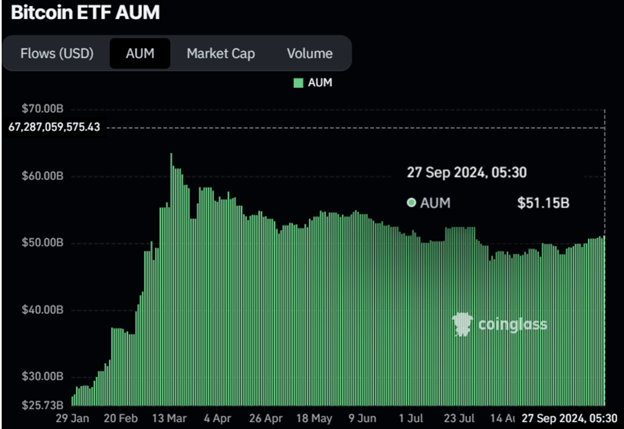

Bitcoin is up about 3% weekly after breaking above its upper range resistance of $64,700. The surge is buoyed by increased institutional buying of exchange-traded funds that saw more than $612 million in inflows this week.

Still, while some analysts believe the recent setup in macroeconomic circumstances could continue to favor risk assets like Bitcoin, others warn that this market might still be in a period of consolidation.

Currently, the sentiment is bullish at a technical level, and the next crucial resistance lies around $70,000. For this reason, Bitcoin surged this week on the back of strong institutional flows. According to data from Coinglass, US spot Bitcoin ETFs had seen four consecutive days of inflows, amounting to $612.60 million as of Thursday.

More importantly, the cumulative Bitcoin reserves across all 11 US spot Bitcoin ETFs grew from $50.53 billion to $51.15 billion—the highest since the end of July.

QCP Capital Report Indicates Positive Macroeconomic Trends for Risk Assets, Including Crypto

In a report this week, the following is how several macroeconomic events broker QCP Capital said could indicate a high and bullish sentiment from the class of risk assets, essentially Bitcoin and other cryptocurrencies.

The report also points out that the PBoC has been implementing policies to stir its flagging housing and anemic equity markets. Indeed, these have had an immediate effect, as witnessed by Chinese A50 futures closing 8% higher, while accordingly, Chinese and Hong Kong indices were up.

The report further notes that the yield spread between the 2-year and 10-year US Treasury notes has widened considerably in the past month by some 40 to 21 basis points. A wider yield spread indicates optimism about economic growth and is usually good for risk assets over a medium—to long-term horizon.

On the political front, in the US, Vice President Kamala Harris gave an address that was very supportive of artificial intelligence and digital assets. Indeed, several notable rallies occurred in AI-related cryptocurrencies after she spoke at the fundraiser. Also, the SEC’s approval of options trading, mostly known as BlackRock’s Spot BTC ETF, speaks to increased recognition and demand for digital assets as an asset class.

Movements in Dormant Wallets and Mt. Gox Funds

The recent movement of some of the wallets presumed to be ‘dormant,’ even those belonging to the now-defunct crypto exchange Mt. Gox, has raised some eyebrows in the crypto community.

According to the data provided by Arkham’s intelligence, Mt. Gox cleaned out four wallets on Wednesday after it took a deposit worth $370,000 in BTC from the Kraken exchange; this could be in preparation for the upcoming payout to creditors.

https://twitter.com/ArkhamIntel/status/1838893636622172226

Therefore, these repayments can create panic in the market, as creditors are expected to send their BTC to the centralized exchanges and offload inventory. The Mt. Gox wallet currently contains 44,899 BTC worth approximately $2.85 billion.

The data further reveals that a 13-year-old whale wallet, which has been dormant since mid-2011, moved 20 BTC valued at $1.27 million to the Bitstamp exchange on Tuesday. This is the wallet’s first transfer since its coins were received.

Meanwhile, another whale wallet with a balance of $77 million worth of BTC was also transferred to Kraken for five BTC. The wallet started mining in 2009, a month before Bitcoin went live. Three weeks ago, it stirred with three transactions that moved 10 BTC.

Another early Bitcoin whale, active for the first time in 15 years, made the headlines last week when it moved $16 million worth of BTC.

Considering such developments, investors are better off approaching such activities with caution. Early dormant wallet movements could trigger FUD; as such, wallets usually transfer their BTCs to centralized exchanges for liquidation.

Bitcoin Price Analysis

The price of Bitcoin recently broke out of its consolidation zone, ranging between $62,000 and $ 64,700, with a close over $65,000 on Thursday. Bitcoin traded a bit higher into Friday, sitting at roughly $64,900 but under resistance at $65,379 for the day.

In that direction, a rally of around 7% may retest its July 29 high at $70,079 if Bitcoin can crack the daily resistance at $65,379 and close above it.

On the daily timeline, RSI has slightly declined but stays close to 65 and well above the midpoint. The key for more upside in Bitcoin’s rally is seen in an advance of the RSI above current levels. In that respect, if RSI keeps rising above the overbought threshold of 70, they can logically become cautious.

In the meantime, if Bitcoin breaks and closes below the consolidation zone nearby $62,000, it could go another 7% down from that line and actually retest the September 17 low at $57,610.

Ripple Keeps Advancing in the Creation of Stablecoins

Ripple is one of the leading players offering cross-border payment solutions and, where its stablecoin-also known as Ripple USD or RUSD, is being aggressively tested on the XRP Ledger and Ethereum blockchain.

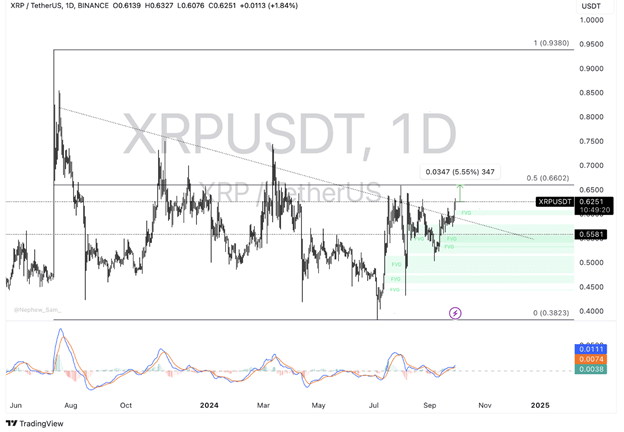

Meanwhile, XRP holders are closely watching the Securities and Exchange Commission’s possible appeal against the final judgment in the Ripple lawsuit. At the start of Sunday trading, XRP changed hands at $0.6251.

The cryptocurrency pair has been sliding along the bearish trend line since the middle of July but is still managing to stay above the crucial horizontal support line of $0.6200.

Interestingly, the MACD is painting green histogram bars, which represents positive hidden momentum in the trend of XRP’s price.

Analysts believe that XRP can further rally by 5.55%. The 50% Fibonacci retracement level, pegged at $0.6602, comprises a critical resistance for the altcoin, as that is where it dropped from the high of $0.9380 reached in July 2023 to a low of $0.3823 in July 2024.

The Fair Value Gap between $0.5972 and $0.6076 may also serve to support XRP, an area of imbalance where the token can look for liquidity in its climb back to $0.6602, the July 2024 high. In its efforts to reach $0.6602, previous resistance will likely be exerted via the August 7 high of $0.6434 this coming Sunday.

Pro-crypto attorney John Deaton, amici or friend of the court in the SEC vs. Ripple lawsuit, has been one of the most helpful in assisting XRP holders navigate any potential appeal by the U.S. financial regulator. According to Deaton, such an appeal would be a waste of taxpayer money, and added he believes SEC Chair Gary Gensler will do it anyway.

Ethereum Sees Price Increase Amid Surge in Transaction Fees

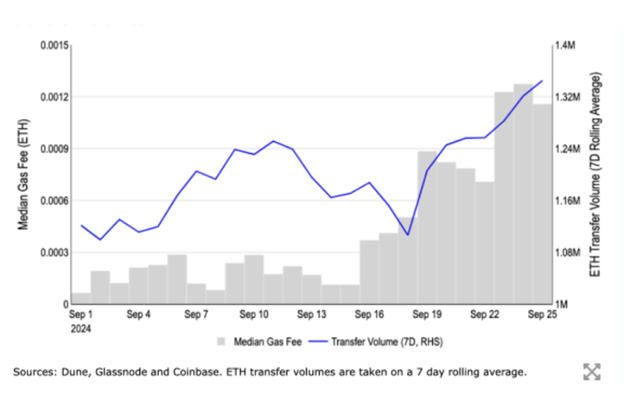

Ethereum (ETH) is trading at approximately $2,690 on Friday, reflecting a 2.2% increase following a dramatic 498% rise in transaction fees over the past ten days. The cryptocurrency is attempting to reclaim a critical support level of around $2,817.

Recent data from Coinbase reveals that Ethereum’s transaction fees have reached a seven-week high, driven by an uptick in on-chain activity on its blockchain.

On the ETF front, Ethereum-related funds experienced net outflows of $0.1 million on Thursday, marking the lowest outflow day recorded since their launch. However, BlackRock’s ETHA and Fidelity’s FETH have seen positive inflows, with $15.3 million and $15.9 million, respectively.

In contrast, Grayscale’s ETHE resumed its trend of negative outflows after two days of zero activity, posting a $36 million outflow.

In the last 24 hours, data from Coinglass indicates that ETH has seen liquidations totaling $18.85 million, with long positions accounting for $6.66 million and short positions for $12.19 million.

Over the past week, Ethereum has maintained trading above a key descending trendline that has suppressed prices since June. If ETH continues this upward trajectory, a significant rally could be anticipated in the coming months. Historical trends show that similar price patterns from August to November 2022 and July to October 2023 led to subsequent 94% and 164% rallies, respectively.

In the short term, ETH is working to hold above a resistance level of around $2,707. Should it overcome this resistance, reclaiming the $2,817 level is plausible. The Relative Strength Index (RSI) and the Awesome Oscillator (AO) are currently positioned above neutral levels, with the AO showing consecutive green bars, suggesting strong bullish momentum among investors.

A daily candlestick close below the $2,207 support level would invalidate the current bullish outlook.