Bitcoin hovered around $67,000 as the week closed on July 21, fueled by an “extremely explosive move” that paved the way for a potential 10% gain.

Data from CoinGlass shows that the top cryptocurrency kept its recovery during out-of-hours trading, showing a 10.4% week-to-date jump and a 6.6% climb for July. This rally brought great enthusiasm to the market.

Renowned trader Benjamin Cowen thought the next support would come from the 20-week simple moving average (SMA) at $ 65,650.

“Extremely explosive move by BTC off the lower trend line back above its BMSB,” Cowen posted on X.

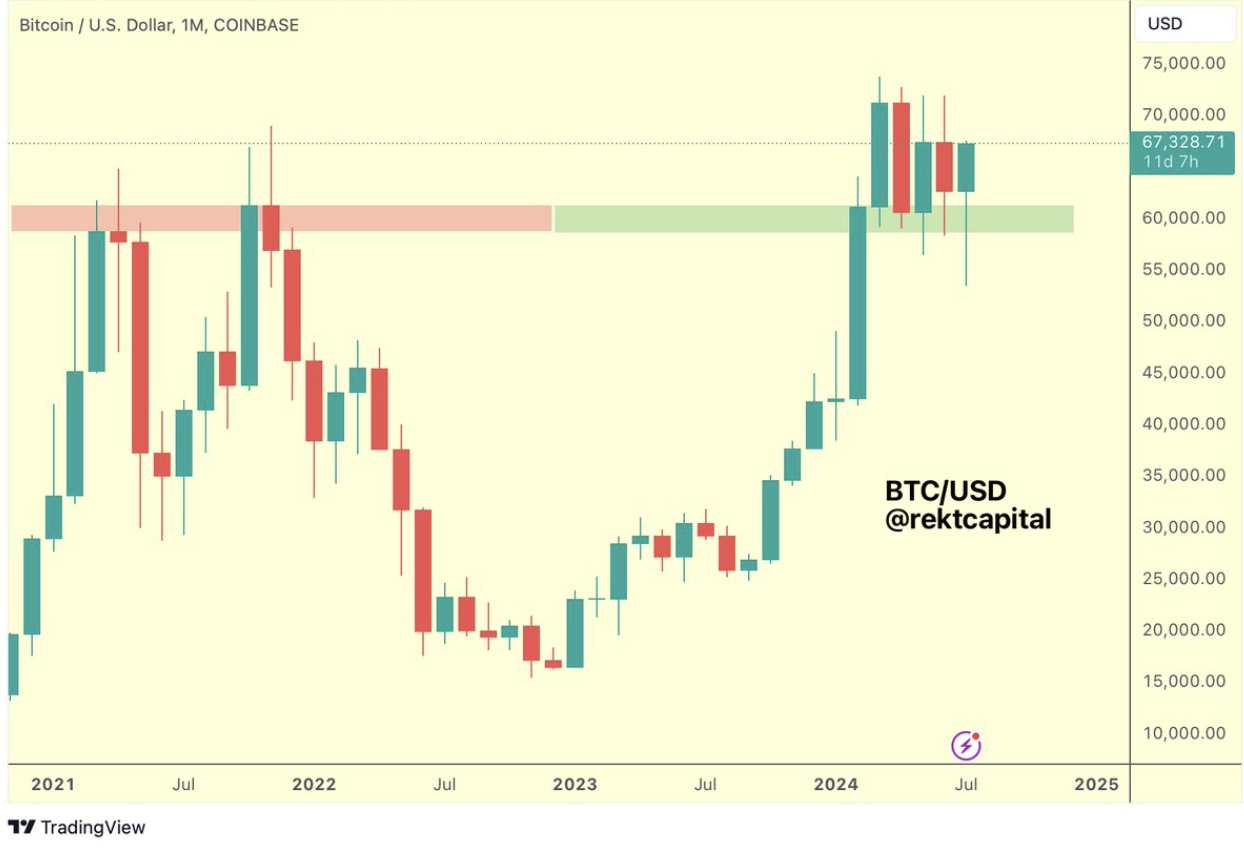

Cowen cited the Bitcoin bull market support zone, which spans the 21-week exponential moving average (EMA) and the 20-week SMA. Over the current bull market phase, BTC/USD has traded chiefly above this band. Rekt Capital, a trader and analyst, underlined the little effect of Bitcoin’s decline following March’s new all-time highs. He saw that BTC/USD has effectively retested its prior all-time high as support, maintaining its continuous resistance/support flip.

“Phenomenal retest of the old All-Time High resistance (red) as new major support (green),” he commented, sharing an explanatory chart.

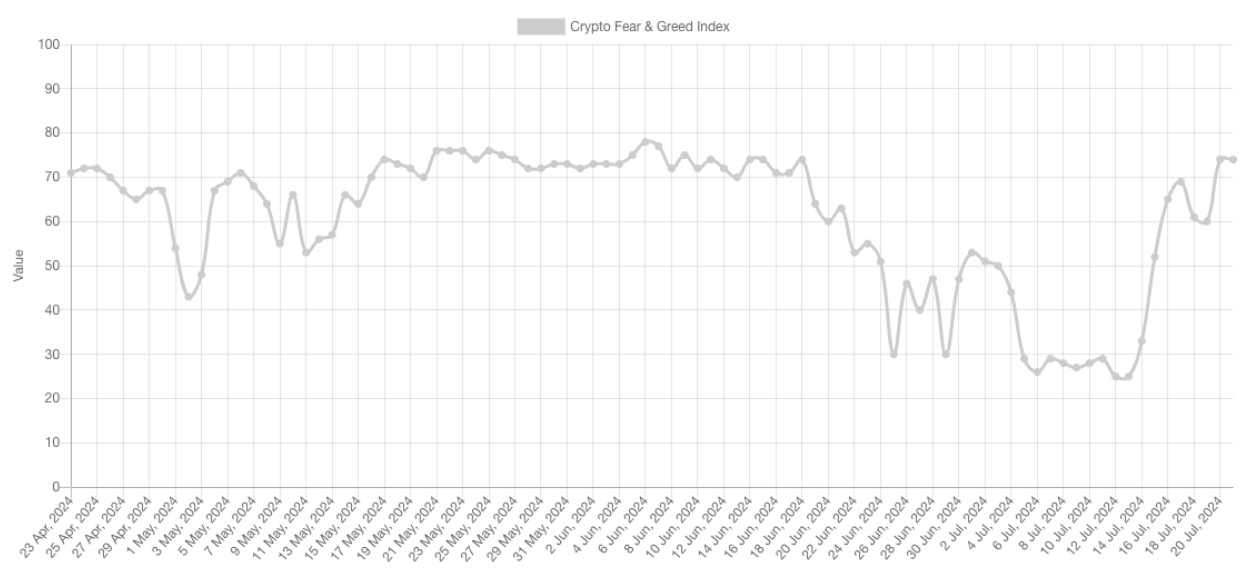

The Crypto Fear & Greed Index, which indicates the degree of the crypto recovery, reveals that the market mood reached its “greediest” level in almost a month. Slightly below “extreme greed,” this standard sentiment gauge integrating multiple components estimates an overall mood score for crypto markets at 74/100. Just a week before, the Index scored 25/100, showing the contrary condition of “extreme fear,” which described the market perception of the average trader at that period.

Dogecoin Shows Bullish Momentum on Weekend

Driven by the possibility of interest rate cuts in September and the possibility of a pro-crypto posture from former President Donald Trump, Dogecoin (DOGE) had a spike as of July 20. As the larger crypto market, including memecoins, is healing, many essential elements help to explain DOGE’s remarkable surge.

A significant factor behind Dogecoin’s recent performance is the growing possibility of US interest rate reduction. Up from 57.5% just a month ago, the likelihood of a 25 basis point decrease in September has skyrocketed to 94%). This expectation results from data showing US job growth below predicted levels, which has raised the expectation of reduced interest rates.

DOGE’s price increased 5.75% during the weekend, rising to $0.13, its highest monthly level. Dogecoin’s value has risen by more than 40% since July 13, the release date of the dismal job growth estimate.

Lower interest rates are usually reasonable for non-yielding investments like cryptocurrencies. For Dogecoin, this economic backdrop has generated a positive climate that stimulates investor interest and raises prices.

The possibility of a pro-crypto posture from Donald Trump should he win the forthcoming presidential elections adds to the buzz. Investors have been hopeful about Trump’s recent change of perspective on cryptocurrencies.

The crypto market is expected to benefit from his possible comeback to the White House, hence driving the notable increase in the price of Dogecoin.

DOGE Price Surges as Trump Prepares for Bitcoin 2024 Keynote

After a failed assassination attempt on Trump, the momentum behind DOGE’s march grew even more strong, therefore enhancing Trump’s chances in the November election. Trump will give a keynote speech at the Bitcoin 2024 conference on July 27. In it, he is expected to discuss his ideas for crypto-friendly laws if he is reelected.

There is much conjecture that Trump would declare a Bitcoin strategic reserve strategy, similar to what El Salvador does regarding keeping Bitcoin on hand. The activity of DOGE’s future market mirrors its price increases today. On July 20, the two-week peak in unsettled DOGE futures contracts was $603.10 million.

Furthermore, compared to -0.546% two weeks ago, the financing rates for DOGE futures have turned positive—at 0.231% per week. This suggests that traders are ready to pay a premium for long positions, expressing higher confidence and a more positive view of DOGE’s price.

Rising open interest (OI) and low financing rates highlight the increasing activity in the Dogecoin market. DOGE keeps riding the positive mood created by macroeconomic events and political developments while traders and investors stay optimistic, presenting itself as a unique performer among cryptocurrencies.

Following a retest of the lower trendline in their rising wedge pattern, the July 20 gains in DOGE result from a technical comeback. Around $0.12, this trendline matches a noteworthy support level at the 50-4H exponential moving average (50-4H EMA).

Rising wedges are often seen as bearish reversals. They have two upward-sloping trendlines. Typically, the pattern breaks when the price falls below the lower trendline. Then, it might drop the distance between the two lines.

In an optimistic scenario, DOGE’s price could keep rising. It could reach the wedge’s tip at $0.14 before Trump’s July 27 speech.

Dogecoin Whales Pull Millions Out of Robinhood

On July 20, the Prominent cryptocurrency whale tracking tool Whale Alert revealed a noteworthy on-chain transaction between the well-known crypto exchange Robinhood and the meme coin Dogecoin.

Someone moved 800 million DOGE from Robinhood to unidentified wallets in the past 24 hours. This has generated attention and more research. People are trying to understand the reason for these large movements.

Two transactions of 400 million DOGE saw 800 million tokens, valued at roughly $100.54 million, transferred. Each transaction aimed at the unidentified “DEgDVF” wallet was worth almost $50.27 million. One of the biggest DOGE holders, the wallet “DEgDVF” contains 31 billion DOGE coins worth $4.17 billion.

Whale trades have a noteworthy effect on the market. One entity’s significant ownership makes the person among the most potent meme coin holders. Any choice to sell a significant amount of these holdings might influence the values of DOGE, SHIB, and other coins.

Significantly, the significant ownership of the addresses “DEgDVF” and “0x40B3” point to Robinhood as the likely owner of these wallets. The crypto exchange might have made this transfer strategically to move assets into cold storage.

The movement of significant numbers of DOGE and SHIB tokens has apparent effects on the market. The critical drop in the supply of these tokens on the Robinhood exchange helps lower selling pressure as the market progressively shows positive trends.

Dogecoin (DOGE) is trading at $0.1434 right now, 4.52% higher than 24 hours ago. On-chain data also shows that DOGE whales have stealthily accumulated millions of DOGE coins.

Dogecoin Breakout Sparks Altcoin Rally

“DOGE is breaking out and seems set for a significant upward movement,” pseudonymous crypto trader Shelby stated in a July 20 X post.

Shelby emphasized that previous Dogecoin price surges have often acted as a catalyst for other altcoins, citing the recent 37% increase in Floki (FLOKI) and a 3.89% rise in Shiba Inu, according to CoinMarketCap data. In parallel, crypto analysts Cheds and CryptoBoss highlighted a “strong base break” in Dogecoin’s price, asserting that it is currently “breaking out.”

The price spike in Dogecoin coincides with conjecture that the cryptocurrency could repeat its historical trajectory. It reached an all-time high of $0.73 in May 2021, a year after Bitcoin’s halving in 2020. Exactly one year after the last Bitcoin halving event, the token peaked on May 8, 2021.

Should this historical trend continue, by April 2025, Dogecoin might reach a fresh all-time high. However, applying technical studies is difficult since memecoins like Dogecoin are speculative.

Dogecoin recently attained a record high in Open Interest (OI) for July. According to CoinGlass statistics, OI, which gauges the total value of existing or unsettled Bitcoin futures contracts across exchanges, gushed by 19% to $647.19 million over four days.